Dogecoin enters the world of regulated finance with the launch of the TDOG ETF, offering mainstream investors direct DOGE access.

Quick Summary – TLDR:

- 21Shares launched TDOG, the first Dogecoin ETF on Nasdaq, giving investors 1:1 DOGE exposure without needing crypto wallets.

- TDOG is backed by the Dogecoin Foundation, positioning it as the only officially endorsed Dogecoin ETF on the market.

- Despite the launch, Dogecoin’s price continues to slide, with no immediate bullish reaction from the market.

- Technical analysts eye long-term breakout potential, though short-term downside volatility remains.

What Happened?

21Shares has officially rolled out its spot Dogecoin ETF, TDOG, on Nasdaq. The launch introduces a regulated way for investors to gain exposure to Dogecoin through traditional brokerage accounts, without needing to hold or secure digital wallets. The ETF arrives at a time when Dogecoin is trading near cycle lows, raising questions about timing and market appetite.

DOGE ETF Dashboard Update 🆓

— SoSoValue (@SoSoValueCrypto) January 23, 2026

The SoSoValue DOGE ETF dashboard now tracks the 21Shares Dogecoin ETF (TDOG), officially listed on NASDAQ. @21shares

Key Details:

– Ticker: TDOG

– Exchange: NASDAQ

– Mgmt Fee: 0.50%

– Supports cash/in-kind creation & redemption

US DOGE Spot ETF… pic.twitter.com/JqxAxNs6h7

21Shares Delivers First Foundation-Backed Dogecoin ETF

TDOG marks a significant development for Dogecoin’s legitimacy in traditional finance. The fund is fully backed and holds DOGE in a one-to-one ratio, using institutional-grade custody. This means every share of TDOG is physically supported by real Dogecoin, stored securely and managed professionally.

This isn’t the first Dogecoin ETF in the market, but it is the first and only one officially endorsed by the Dogecoin Foundation, the nonprofit that supports Dogecoin’s development and ecosystem. This endorsement adds a layer of credibility that other ETFs, like Grayscale’s GDOG and Bitwise’s BWOW, do not have.

Federico Brokate, Global Head of Business Development at 21Shares, emphasized Dogecoin’s unique position, saying the coin has “widespread community support” and an expanding role in real-world use cases. The firm calls TDOG a tool for investors who want regulated exposure to a cultural icon in crypto.

Strong Infrastructure, Weak Price Action

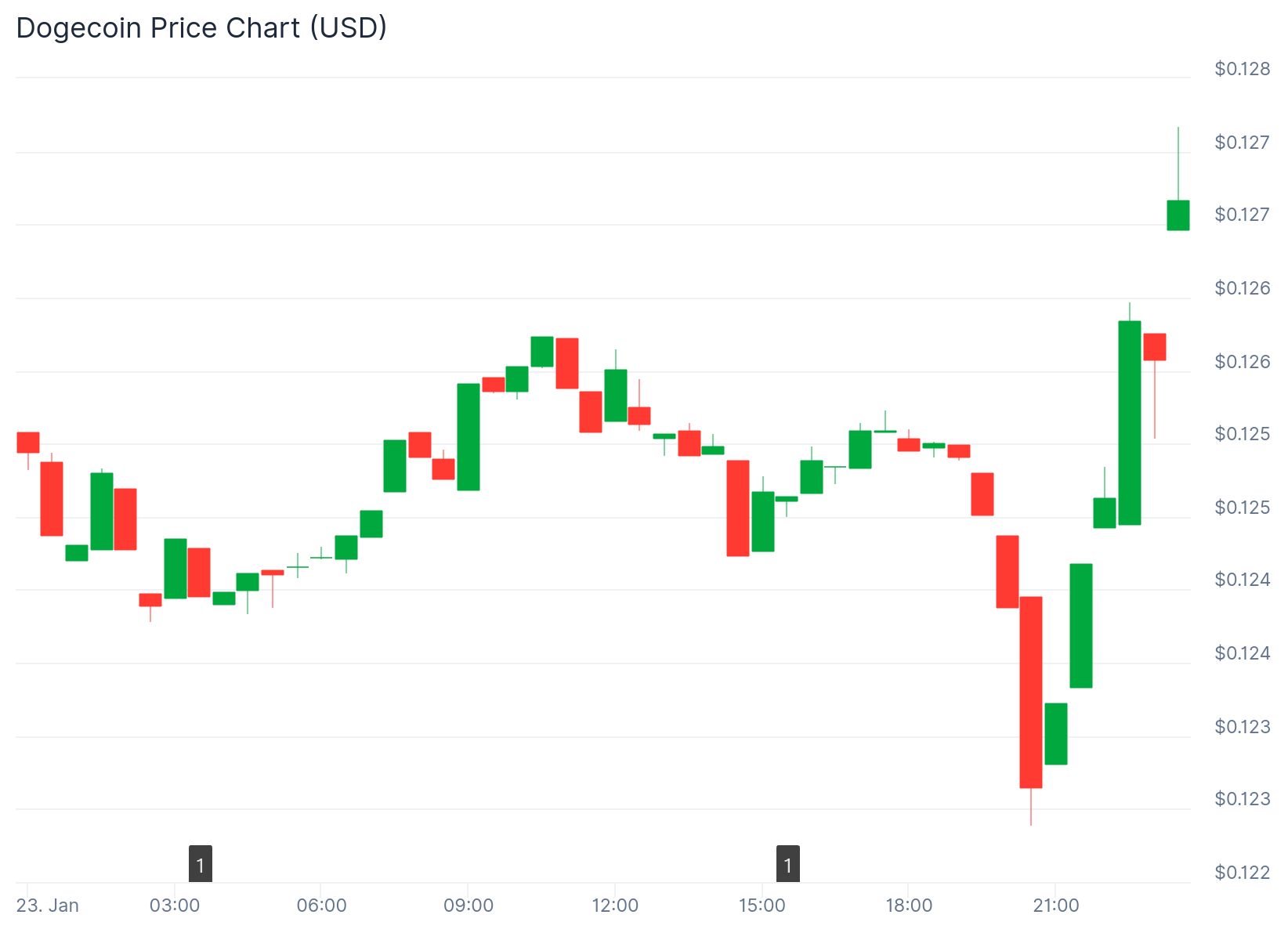

While TDOG adds to Dogecoin’s financial infrastructure, the market’s response has been muted. Dogecoin was trading at around $0.1249 on the day of the ETF’s launch, continuing a multi-month downtrend. It remains well below its October high of $0.28, showing no significant lift from the ETF announcement.

Despite the fanfare, DOGE has lost over 50% of its value from recent highs, and trading volumes have fallen compared to mid-2025. This points to reduced speculative interest even as institutional products become available.

Some analysts argue that the lack of price movement is a sign that the ETF’s launch had already been priced in, especially since the plan was made public as early as April 2025. They also see this as a shift in the market, where speculative hype no longer drives price as easily as before.

SQ Magazine Takeaway

Honestly, this launch is a big deal. It’s not just another crypto product. For the first time, you can buy into Dogecoin through a traditional ETF that’s not only regulated but also endorsed by the very foundation behind the coin. That’s huge for mainstream adoption. But let’s not ignore the elephant in the room. The market isn’t exactly throwing a party. Prices are slumping, and the hype that used to follow anything Dogecoin-related just isn’t there right now. Still, I see this as Dogecoin growing up. It’s shifting from being a meme to becoming a legit financial asset, and that’s a narrative worth watching.