The digital workplace is no longer a fringe concept; it’s embedded in how organizations operate and compete. From AI‑driven assistants to seamless hybrid models, workplace tech now dictates productivity, engagement, and growth. In healthcare, hospitals use digital dashboards to monitor staff workflows in real time, and in finance, firms adopt virtual collaboration environments for global teams to coordinate across time zones. Read on to explore the numbers shaping this evolving landscape.

Editor’s Choice

- The global digital workplace market is forecast to $59.4 billion in 2025.

- In 2024, global digital transformation spending hit $2.5 trillion.

- Only 1% of companies say they have reached full maturity in AI adoption.

- On average, workers will see 39% of their skill sets transformed or outdated in 2025–2030.

- Organizations are allocating about 7.5% of revenue to digital transformation efforts.

- 50% of digital workplace leaders will have a DEX strategy by 2026, up from ~30% in 2024.

- The success rate of digital transformation initiatives, only 48%.

Recent Developments

- Cisco is embedding AI agents into Webex for meeting summaries, task automation, and scheduling.

- Big tech companies plan to spend over $300 billion in 2025 on AI infrastructure and capabilities.

- In the U.S., remote work remains significant; 22.1% of workers continue to work from home as of mid‑2025.

- Nearly half of remote workers resist full returns to the office.

- Hyperscalers in the U.S. are expected to spend $1.2 trillion over the next few years on data infrastructure.

- AI and digital tools are now being adopted “under the radar”; about 50% of U.S. employees use AI secretly in their workflows.

- Office attendance in July 2025 saw a 10.7% increase year‑over‑year, the strongest since the pandemic began.

- In non‑tech industries, adoption of digital workspace tools is accelerating, driven by the need for agility and cost efficiencies.

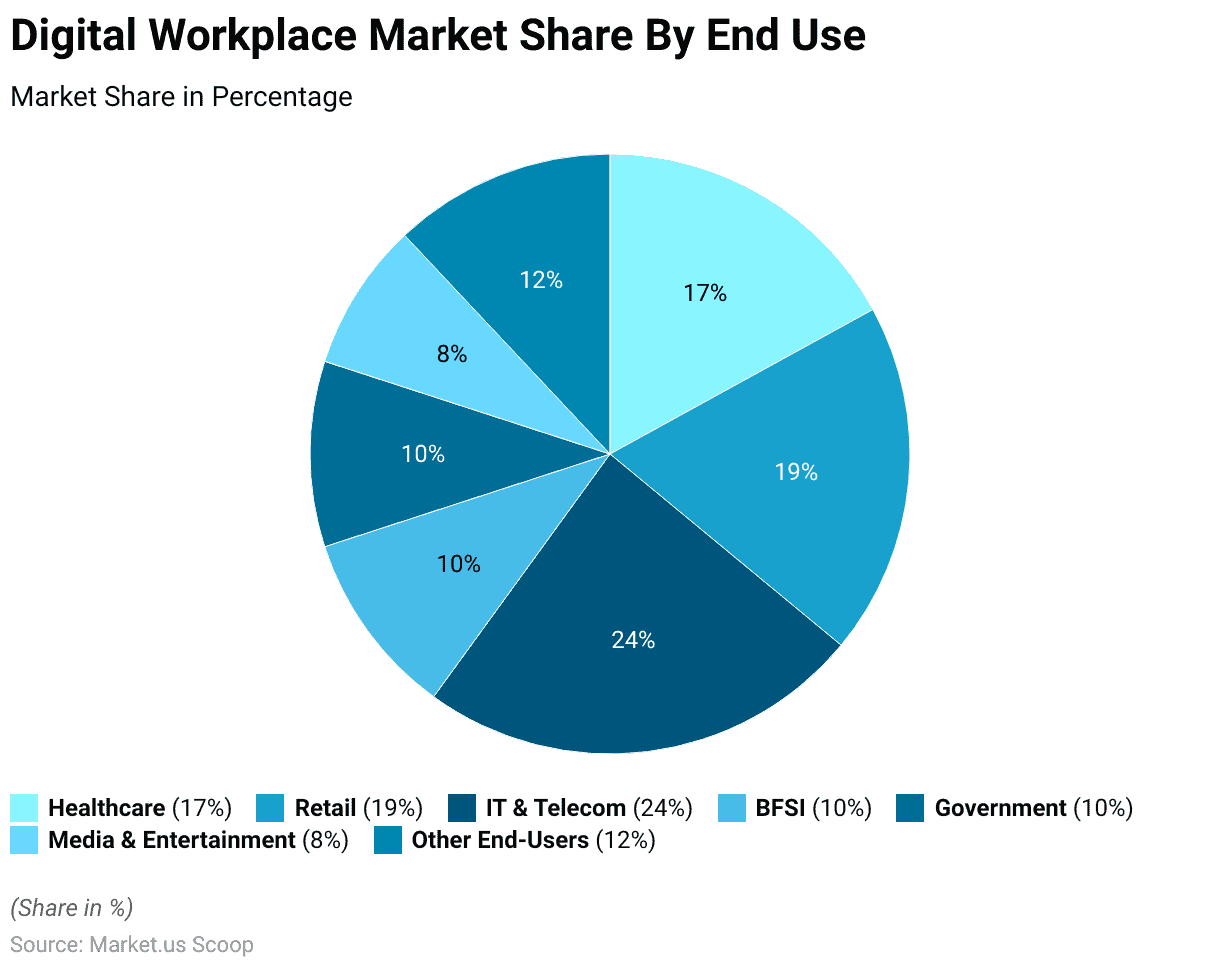

Digital Workplace Market Share by End Use

- IT & Telecom leads with a 24% market share, driven by strong adoption of cloud-based tools, automation, and secure communication systems.

- Retail follows with 19%, boosted by omnichannel operations, e-commerce integration, and real-time workforce analytics.

- Healthcare holds 17%, reflecting the rapid deployment of digital dashboards, telemedicine platforms, and connected patient data systems.

- Other end-users account for 12%, including sectors like education, logistics, and manufacturing, adopting hybrid digital workflows.

- BFSI represents 10%, with banks and insurers investing in compliance automation, secure transactions, and AI-powered employee tools.

- The government also captures 10%, focusing on cloud migration, digital document management, and citizen service platforms.

- Media & Entertainment takes 8%, supported by collaborative editing, virtual production, and digital asset management technologies.

Market Size

- The digital workplace market is projected to grow from $49.17 billion in 2024 to $58.93 billion in 2025.

- Another estimate places it at $59.42 billion in 2025.

- From 2025 to 2030, the market is expected to reach $166.27 billion, representing ~22.8% CAGR.

- The digital workplace is now seen less as “nice to have” and more as mission‑critical infrastructure for hybrid work.

- Many organizations now tie digital workplace investments to employee experience metrics (DEX).

Digital Transformation Spending

- In 2024, global spending on digital transformation was $2.5 trillion.

- That same market was valued at $1,070.43 billion in 2024, with projections to reach $4,617.78 billion by 2030.

- Digital transformation spending will exceed $700 billion by 2027.

- On average, organizations allocate 7.5% of revenue to these efforts.

- IT departments absorb ~5.4 percentage points of that allocation; the rest comes from business units.

- In 2022, worldwide digital transformation investment stood at $1.85 trillion.

- The United States typically accounts for ~35% of global DX spending and may cross the $1 trillion mark in 2025.

- Only 48% of transformation projects meet the success criteria.

- Qualitative hurdles like culture, leadership buy‑in, and metrics often derail those projects.

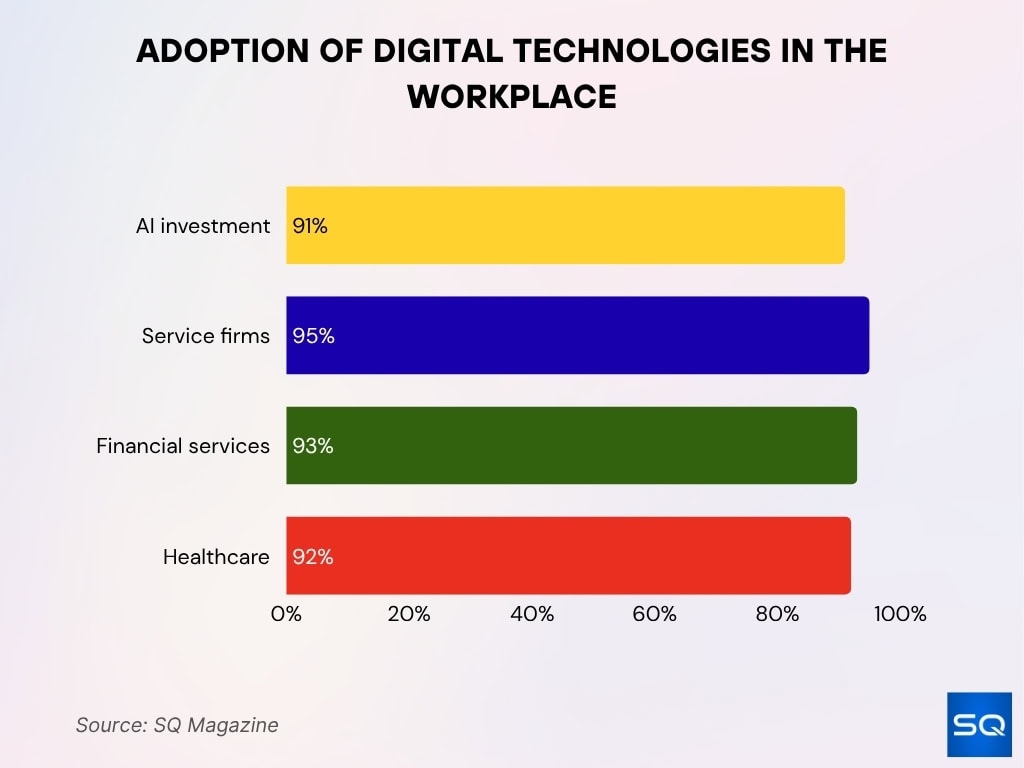

Adoption of Digital Technologies in the Workplace

- Around 91% of companies report they are investing in AI, with varying levels of maturity and implementation.

- Over 95% of service firms, 93% in financial services, and 92% in healthcare have digital‑first strategies.

- Adoption of collaboration tools (e.g., Microsoft 365, Slack, Teams) rose sharply in 2023–2025 across sectors.

- Use of cloud computing for work infrastructure has become nearly universal in midsize and larger firms.

- In hybrid setups, data analytics tools monitor workspace utilization and employee behavior.

- Private cloud solutions are regaining traction in digital workplace architectures.

- Many early-stage adopters are experimenting with digital twins of office spaces, sensor analytics, and smart building integrations.

Regional Growth and Adoption Patterns

- In 2024, North America held over 37% of the global digital workplace market.

- The U.S. is projected to grow at a 21.1% CAGR from 2025 to 2030 in digital workplace adoption.

- Europe’s adoption is moderate, with stronger uptake in Western nations.

- In 2024, large enterprises accounted for over 59% of the digital workplace revenue share.

- The solutions segment (software, platforms) comprised over 66% of total market revenue in 2024.

- The IT & telecommunications vertical was the largest sector by revenue share (~22%) in 2024.

- Regional disparity remains; many firms in emerging markets lag in adoption.

Commonly Adopted AI Use Cases in the Workplace

- 27% of white‑collar employees now report frequent use of AI at work.

- Firms indicate 5% to 40% adoption rates of AI in workplace systems.

- 35,445 AI‑related job roles were active in the U.S. in Q1 2025.

- 62% of employees aged 35–44 self-report high expertise with AI.

- Almost half of U.S. workers admit to using AI tools at work without notifying supervisors.

- AI roles are more likely to offer parental leave, remote work options, and other perks.

- 66% of U.S. adults say they would avoid applying to jobs that use AI in hiring decisions.

- 95% of initial candidate screening is expected to be handled by AI in 2025.

- Companies using AI in recruitment see up to 18% higher offer acceptance rates.

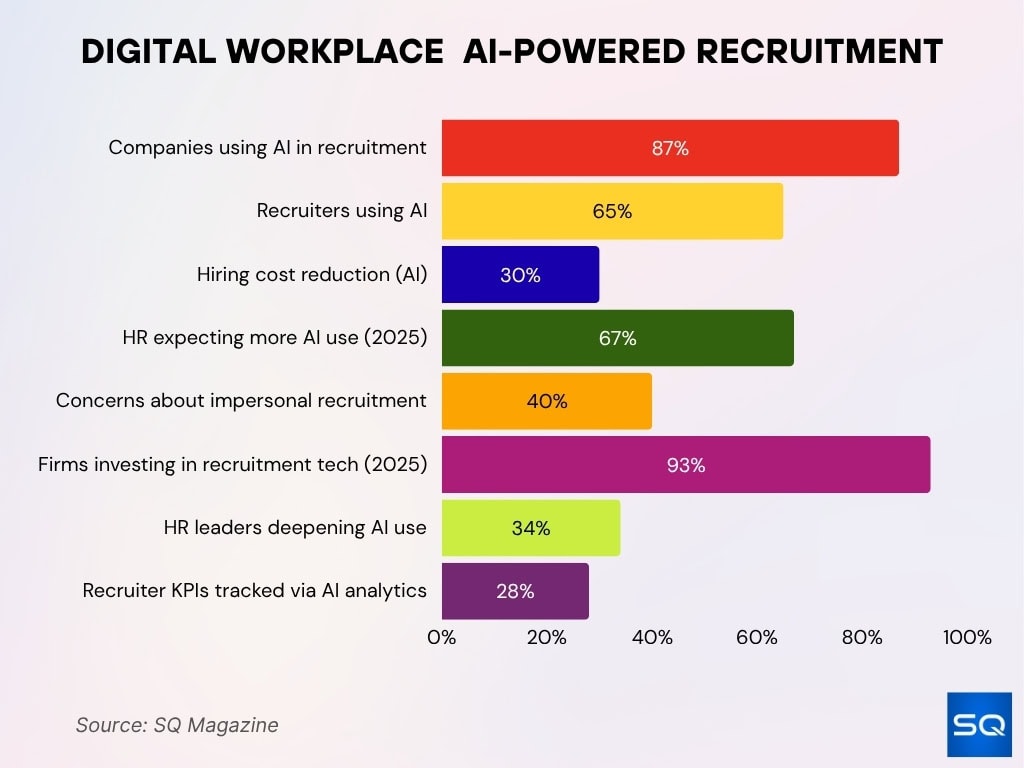

AI‑powered Recruitment and Onboarding

- 87% of companies now use AI‑driven tools in recruitment.

- Over 65% of recruiters have implemented AI to streamline processes.

- AI adoption in recruitment aims to reduce hiring costs by up to 30% per hire.

- 67% of HR professionals expect increased AI use as a top trend for 2025.

- 40% of TA specialists express concern about impersonal recruitment due to AI.

- 93% of firms are projected to invest in recruitment technology in 2025.

- Around 34% plan to deepen AI integration in hiring workflows.

- 28% of HR leaders monitor recruiter KPIs via analytics supported by AI.

Top Company Initiatives in Digital Workplace

- Organizations are prioritizing Digital Employee Experience (DEX) as a core initiative.

- Companies embed AI agents into collaboration suites.

- Shadow IT is rising; nearly 50% of U.S. workers use AI secretly.

- Firms apply sensor analytics and smart building tech to optimize space usage.

- Security and compliance enhancements are key pillars of digital workplace roadmaps.

- Companies include upskilling programs tied to digital tools literacy.

- Change management efforts are now standard in tech rollouts.

- New software rollouts must meet UX and accessibility standards.

Enhanced Cybersecurity and Compliance

- 83% of firms cite cybersecurity as a major challenge in digital workplaces.

- Zero-trust architecture is becoming the default security model.

- Multifactor authentication (MFA) adoption is nearly universal among Fortune 500 firms.

- Insider threat protection and user behavior analytics are standard.

- AI-driven anomaly detection is used to spot unusual patterns.

- Compliance platforms integrate with communication and storage tools.

- Many firms invest in privacy-by-design for all digital experiences.

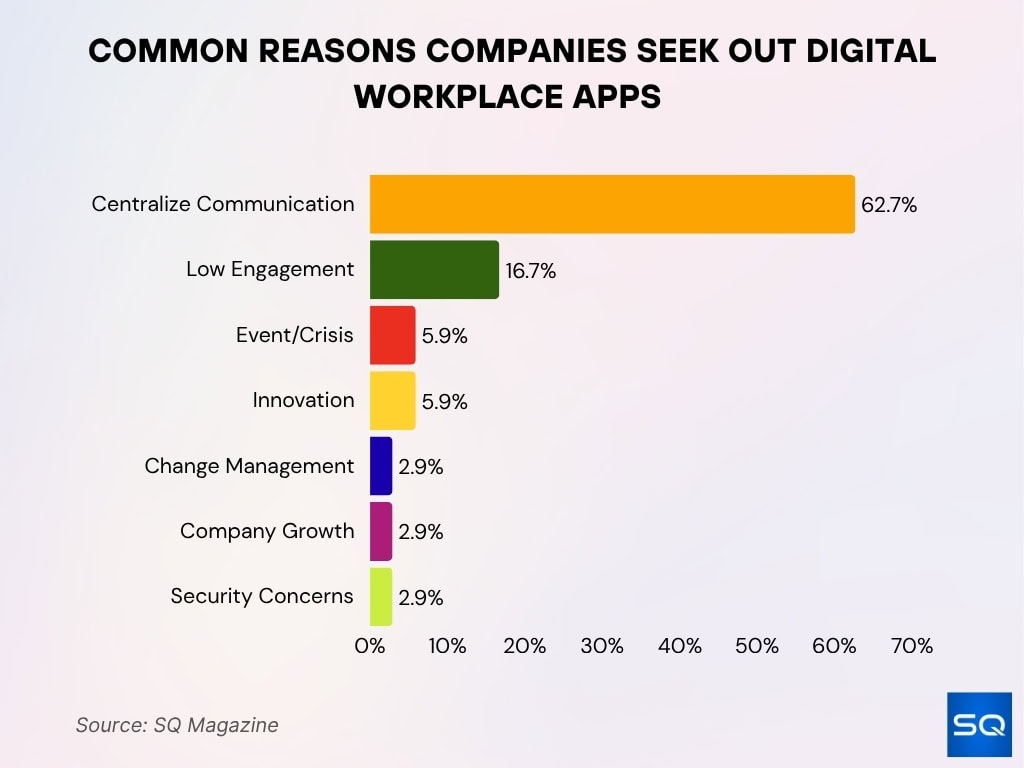

Common Reasons Companies Seek Out Digital Workplace Apps

- 62.7% of companies use digital workplace apps to centralize communication and connect dispersed teams for seamless collaboration.

- 16.7% adopt these tools to combat low employee engagement, improving participation and internal culture.

- 5.9% turn to digital workplace apps during an event or crisis to maintain business continuity and remote coordination.

- 5.9% leverage them to foster innovation, streamline workflows, and enable faster decision-making.

- 2.9% focus on change management, using digital platforms to guide organizational transitions smoothly.

- 2.9% invest in apps to support company growth, scaling operations as their workforce expands.

- 2.9% implement these solutions due to security concerns, enhancing data protection and compliance across digital systems.

Remote Work and Hybrid Work Statistics

- As of March 2025, 22.8% of U.S. employees worked remotely at least partly.

- ~24% of job postings were hybrid roles in Q2 2025.

- Among remote‑capable workers, ~50% operate hybrid, ~30% fully remote, ~20% on-site.

- 88% of U.S. employers allow some hybrid work option.

- Fully remote workers report higher engagement but lower overall life thriving (36%).

- Remote work accounted for ~29% of paid U.S. workdays in April 2025.

- 32.6 million Americans will work from home by 2025 (~22% of the total workforce).

- 65% of global workers predict remote work will grow significantly.

- 42.8% of advanced-degree holders teleworked in March 2025; only 9.1% of high school grads did.

Distributed Workforce Statistics

- Distributed work models report 43% higher employee engagement.

- Firms with strong digital strategies make decisions ~31% faster.

- Adoption: cloud tools ~91%, AI tools ~73%, mobile apps ~67%.

- Tech interruptions average 3.6 times/month per employee.

- That equals ~1.6 lost hours/month in productivity.

- IoT sensors are used in ~42% of digital workplaces.

- 50% of employees use AI tools without formal permission.

- Private cloud use is rising in sensitive industries.

Employee Experience and Well‑being

- Fully remote workers face more stress and isolation.

- Hybrid employees report “thriving” more often (42%).

- Tech issues cost ~$320,000/month for a 2,000‑employee firm.

- DEX initiatives link to higher retention and better satisfaction.

- 94% of employees use GenAI tools; 99% of C‑suite do.

- Leaders underestimate actual GenAI usage by ~3×.

- Most digital investments now tie to employee metrics.

- Tech outages lead to ~1.6 lost hours per person monthly.

Real‑time Feedback and Continuous Performance Management

- Over 50% of firms use real-time feedback platforms.

- Review cycles shift from annual to quarterly/monthly.

- Feedback tools drive 20–25% higher goal alignment.

- Ongoing feedback reduces perceived bias in reviews.

- Adoption is high in the tech and finance sectors.

- Barriers include resistance and analytic sophistication.

Upskilling and Reskilling in the Digital Workplace

- 69% of L&D leaders expect upskilling to be critical.

- 80% of tech leaders see upskilling as key to closing gaps.

- Micro‑learning and modular training are rising.

- Internal mobility is used for reskilling.

- ~58% of adopters use analytics to detect skill gaps.

- VR/AR tools are used in ~34% of immersive learning firms.

- ~73% of firms face talent shortages, prompting internal reskilling.

Frequently Asked Questions (FAQs)

It is estimated at $59.18 billion in 2025.

It is projected to grow at a 22.8% CAGR over that period.

Only about 48% of digital transformation projects meet success criteria.

The long‑term AI opportunity is valued at $4.4 trillion in added productivity potential.

Conclusion

The digital workplace blends flexibility, intelligence, and human focus. Remote, hybrid, and distributed models are now steady-state rather than experiments, shaping how teams organize, tools are adopted, and work is managed. But along with opportunity comes complexity; employee experience, cybersecurity, upskilling, and culture all demand care. If organizations can balance technology with empathy, they’ll lead the shift, not just follow it.