Decentralized finance (DeFi) and traditional banking sit on opposite ends of today’s financial spectrum, yet both shape how individuals and businesses manage money. DeFi ecosystem activity surged, while legacy banks continued to hold trillions in assets, reflecting persistent demand for regulated finance alongside rapid innovation in crypto‑native platforms. For businesses, DeFi offers programmable financial contracts and yield options; for banks, it presents opportunities to modernize payment rails and customer access. This article’s first part dives into the latest data on adoption, value metrics, accessibility, and cost structures in DeFi vs. traditional banking.

Editor’s Choice

- Forecasts suggest the global DeFi market could reach $110 billion by 2026, although projections vary significantly depending on the methodology used and the inclusion of assets such as NFTs and real-world tokenized assets.

- Global traditional banking assets are estimated to be around $370–410 trillion, depending on definitions (e.g., inclusion of off-balance sheet items and derivatives)

- DeFi transaction volume projected to exceed $3 trillion by 2026.

- Traditional banks’ net interest income reaches $7.24 trillion.

- Global crypto adoption is led by over 20 countries in DeFi activity.

- DeFi TVL on Ethereum alone surpasses $100 billion in projections.

Recent Developments

- DeFi’s total value locked (TVL) surpassed $90 billion by early 2025, reflecting sustained capital growth.

- Mainstream institutional interest in blockchain‑based finance is increasing, with efforts to merge on‑chain lending and traditional assets.

- Traditional banks in the U.S. saw asset growth and deregulation spur a $600 billion increase in market value in 2025.

- U.S. regulators permitted banks to act as crypto intermediaries, narrowing the gap between conventional finance and digital asset markets.

- The Federal Reserve’s FedNow instant payments network processed millions of payments with rising daily volumes in 2025.

- Ongoing Basel III regulation phases aim to update bank capital and liquidity standards through 2026.

- Traditional banks continue technology investments to remain competitive amid digital pressure.

User Adoption and Demographics

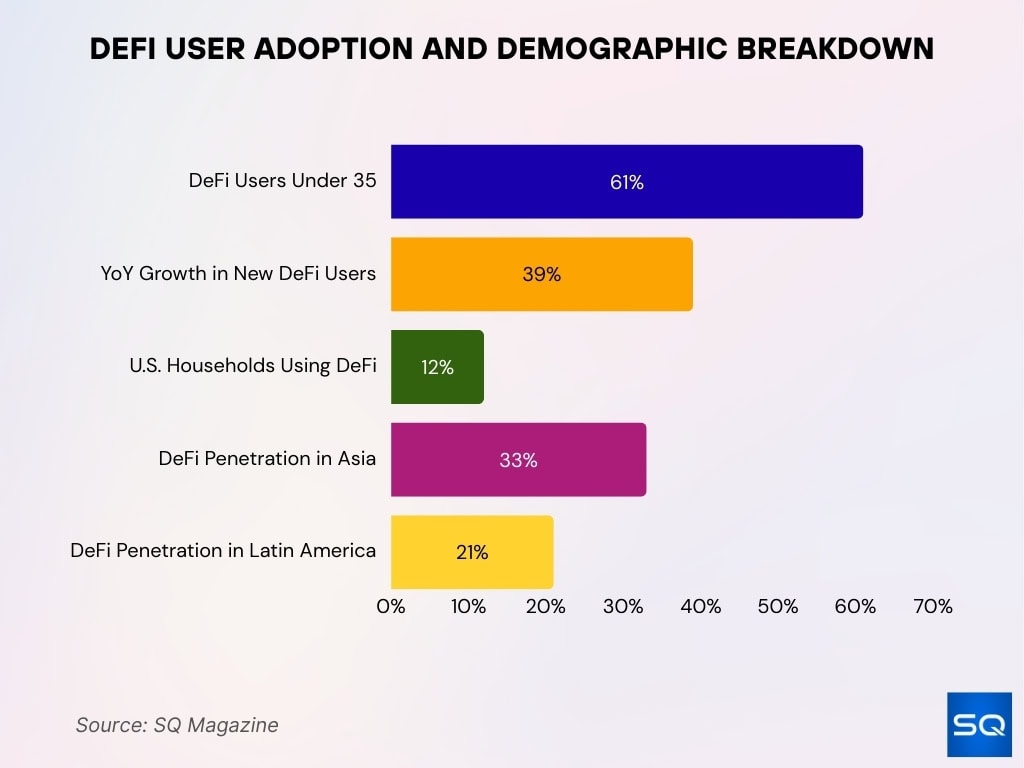

- 61% of DeFi users were under age 35, highlighting younger demographic adoption.

- Monthly active users on Ethereum DeFi apps reached 47 million.

- 39% YoY increase in first‑time DeFi users via mobile wallets reflects mobile‑driven growth.

- Around 12% of U.S. households used at least one DeFi application in 2025.

- DeFi penetration skews regional, 33% in Asia and 21% in Latin America.

- Traditional banking still dominates in North America and Europe, but DeFi activity remains comparatively modest in these regions.

Total Value Locked vs Bank Assets

- DeFi TVL stands at $140.645 billion.

- Global traditional banking net interest income reaches $7.33 trillion.

- As of late 2025, liquid‑staking platform Lido managed around $25–30 billion in total value locked, making it one of the largest DeFi protocols globally by TVL.

- In December 2025, lending protocol Aave was reported as the largest DeFi protocol by TVL, with around $50–55 billion locked across its markets, leading the sector’s lending category.

- Ethereum dominates DeFi TVL with approximately 60% share.

- U.S. banks’ total assets exceed $25 trillion across top institutions.

- ICBC holds the largest bank assets at $5.7 trillion.

- Global DeFi TVL projected to hit $500 billion.

- Ethereum TVL is currently $68.6 billion, eyed for 10x growth.

Accessibility and Financial Inclusion

- DeFi is active in 150+ countries worldwide.

- Moonpay supports fiat onramps in 160+ countries.

- 53% new DeFi wallets are from Southeast Asia and Africa.

- 77% Southeast Asia consumers use embedded finance.

- $1.2 billion saved in global remittance fees via DeFi.

- DeFi cross-border payments are finalized in 3.6 seconds on average.

- 71 countries see stablecoin volumes exceed local banking.

- 6.5 million DeFi wallets have been adopted globally.

- 12% Southeast Asians use digital currencies weekly.

Cost and Fee Structures

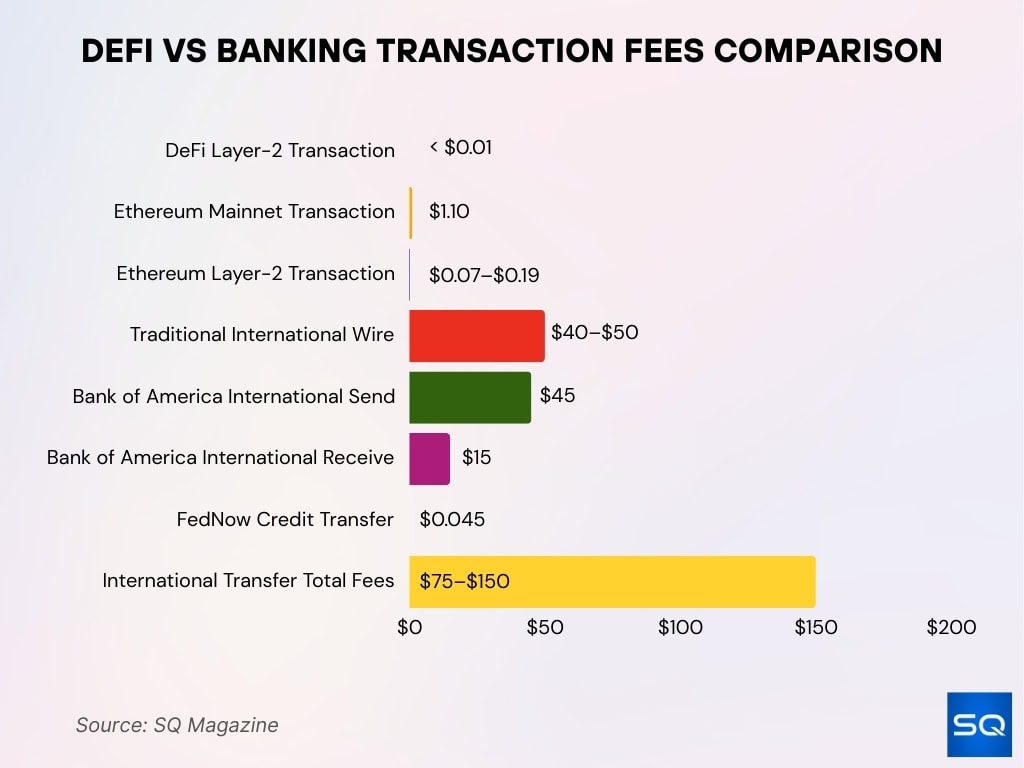

- DeFi Layer-2 average transaction fees under $0.01.

- Ethereum mainnet average fee $1.10, L2s $0.07-$0.19.

- Traditional international wire fees $40-$50 sender.

- Bank of America international sending fee $45, receiving $15.

- FedNow’s per-transaction fee is $0.045 credit transfer.

- International transfers total fees $75-150, including intermediaries.

- DeFi cross-border processing under 0.5-2% end-to-end.

Interest Rates and Yields

- DeFi lending and staking platforms averaged around 8.2% yield in 2025, significantly above many traditional products.

- The average global savings interest rate offered by traditional banks was roughly 2.1% in 2025, illustrating the gap with DeFi yields.

- Select DeFi protocols offered up to 14% yield on stablecoin lending in 2025.

- In contrast, 1‑year fixed deposits in U.S. banks hovered near 1.9% on average for the same period.

- DeFi liquidity pools pairing stablecoins and major crypto assets saw average APYs near 9.8%.

- Native asset staking (e.g., ETH, SOL) generated approximately 7.4% returns on average.

- Many traditional savings accounts still offered 0.01%–0.50% yields in large retail banks.

- After adjusting for inflation, effective traditional bank interest often fell below 1%.

Transaction Speed and Settlement Times

- DeFi transactions often settle in seconds or minutes, compared with days for many traditional banking systems.

- Blockchain‑based wallets and on‑chain interactions typically confirm transfers in under 2–5 minutes, depending on network congestion.

- Some Layer‑2 networks achieve throughput improvements, reducing cost and latency.

- In contrast, many international bank transfers still take 1–3 business days to finalize.

- Stablecoin rails remove traditional cut‑off times, enabling 24/7 settlement even on weekends.

- Traditional SWIFT cross‑border messages average settlement delays of several hours to days.

- Instant payment networks (e.g., FedNow) improved speed for domestic transactions but still operate within legacy rails.

- DeFi’s smart contracts automate execution, reducing manual reconciliation time further.

Savings, Deposits, and Staking Returns

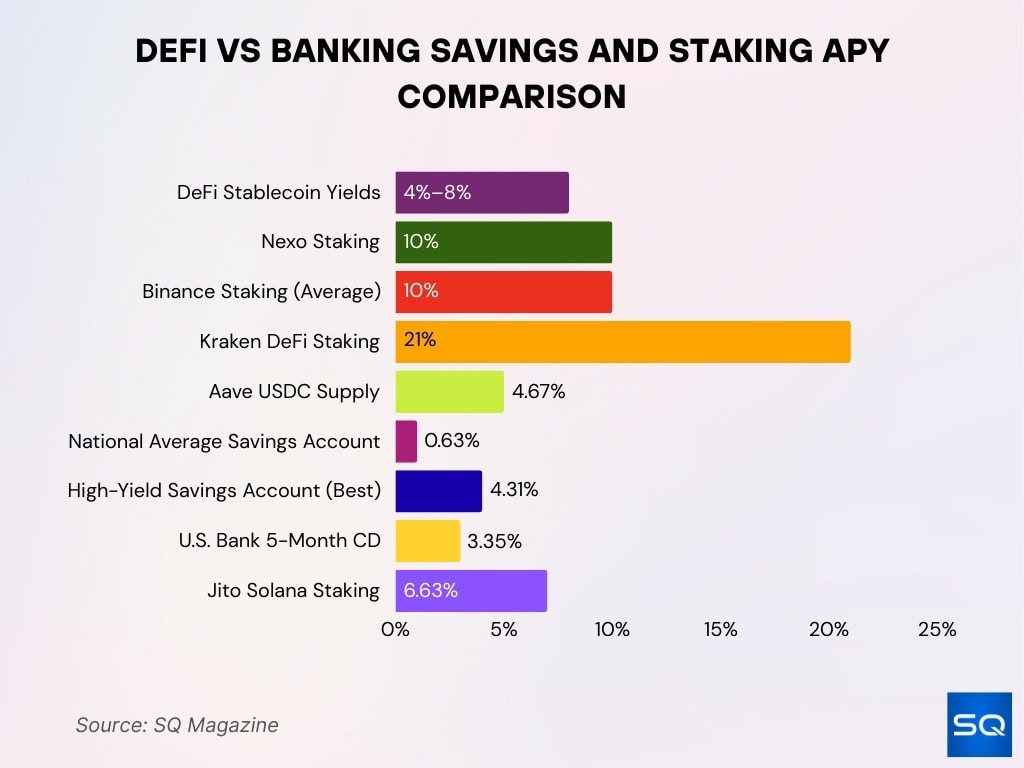

- DeFi stablecoin yields average 4-8% APY.

- Nexo offers staking APY up to 10%.

- Binance staking averages 10% APY across 60+ assets.

- Kraken DeFi staking reaches 21% APY.

- Aave USDC supply yields 4.67% APY.

- National average savings account 0.63% APY.

- Best high-yield savings up to 4.31% APY.

- U.S. Bank 5-month CD 3.35% APY.

- Jito Solana is staking 6.63% APY.

Operational Efficiency and Overheads

- DeFi platforms often operate with 60–70% lower overhead than legacy banks, thanks to automation and minimal staffing.

- On‑chain transaction median cost on some Layer‑2 networks is roughly $0.06 per transfer.

- Traditional wire transfers can cost about $9.40 per transaction when all operational expenses are included.

- Many DeFi smart contracts execute with no human intervention after deployment, boosting efficiency.

- DeFi protocols allocate over 80% of costs to core infrastructure and audits, not labor.

- Hybrid institutions integrating blockchain have reported ~42% reductions in operational overheads.

- Enhanced KYC/AML regimes forced many traditional banks to increase regulatory spend by over 60%.

- Stablecoin‑based global remittances cut fees and processing time, offering measurable savings over correspondent banking.

DeFi Lending vs Traditional Loans

- In H1 2025, DeFi lending protocols issued about $97 billion in loans.

- Traditional banks issued roughly $4.1 trillion in consumer loans over the same period.

- Average unsecured loan interest in DeFi was about 9.1%, higher than some bank rates but driven by different risk models.

- U.S. traditional lenders offered ~4.6% on average for personal loans in 2025.

- DeFi loan approvals can occur in under a second, thanks to code‑based risk checks.

- Traditional loans usually take 1–3 days for underwriting and approval.

- About 72% of DeFi loans are over‑collateralized, reducing credit risk without intermediary oversight.

- Around 14% of U.S. small businesses tapped DeFi channels for capital in 2025.

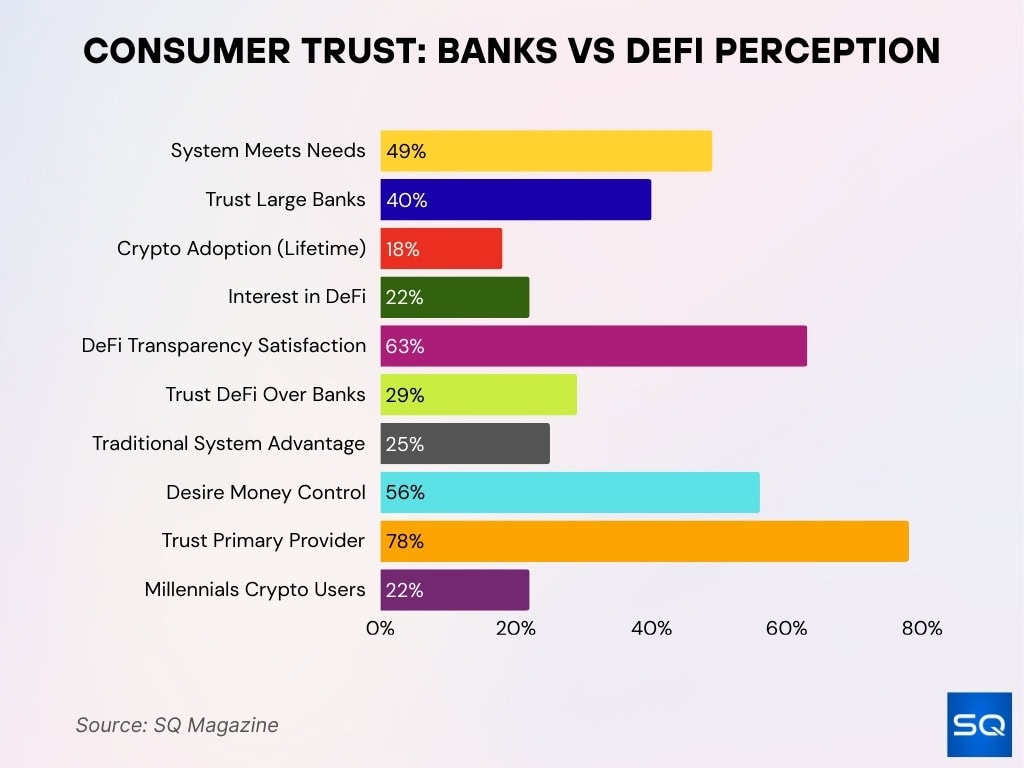

Consumer Trust and Risk Perception

- 49% Americans believe the financial system meets their needs.

- 40% have complete trust in large national banks.

- 18% Americans owned/used crypto lifetime.

- 22% interested in learning DeFi.

- 63% DeFi users have higher satisfaction with transparency.

- 29% U.S. adults trust DeFi more than banks for investments.

- 25% agree traditional system has advantages for ordinary people.

- 56% want full personal control over money.

- 78% trust primary financial provider.

- 22% Millennials owned crypto last 12 months.

DeFi Trading Volumes vs Bank Payment Volumes

- DEX 24h trading volume totals $11.7 billion.

- Weekly DEX trading volume averages $18.6 billion.

- Stablecoin transactions are projected $50 trillion yearly.

- Stablecoin supply reached $305 billion, with $47.6 trillion volume in 2025.

- Global payment volumes hit $36 trillion annually.

- B2B cross-border transactions exceed $42.7 trillion.

- FedNow transactions 5.14 million Jan-Aug 2025.

- RTP daily 1.18 million payments, $481 billion value.

- Platforms account for $36 trillion of global payments.

Security Incidents and Fraud Losses

- Traditional banking reported $2.8 billion in fraud losses in the U.S. alone in the same timeframe, showing that fraud risks persist across finance.

- 52% of DeFi breaches stemmed from smart contract vulnerabilities, underscoring code risk.

- About 19% of DeFi security incidents involved rug pulls, a scam unique to crypto ecosystems.

- 11 million phishing attacks targeted bank customers in early 2025, driving unauthorized access and account takeovers.

- 97% of traditional bank fraud cases involved account takeovers or unauthorized transactions.

- 87% of DeFi protocols were audited in 2025, yet vulnerabilities remain a key risk factor.

- DeFi hacks in 2025 represented roughly 1–2% of total TVL at peak, depending on the specific month and TVL baseline used, indicating that even a small share of assets at risk still equates to billions of dollars in losses.

- $418 million in DeFi funds were recovered by white‑hat hackers and bounty programs, mitigating some losses.

Smart Contract Risks vs Bank Operational Risks

- $2.17 billion stolen in DeFi hacks first half of 2025.

- Off-chain attacks 44% of total DeFi exploits.

- Compromised accounts 47% of DeFi hack losses.

- Only 20% hacked DeFi protocols have been audited.

- Banks lose $32 billion annually to fraud.

- 5 major DeFi hacks in December 2025, $20 million lost.

- Audited DeFi protocols 10.8% of total losses.

- 370% stolen funds flow to DeFi post-hack.

- 61% 2025 bridge hacks by North Korean Lazarus.

Environmental and Energy Use Metrics

- Ethereum PoS annual energy is 0.0026 TWh.

- Ethereum PoS per transaction: 0.02 kWh.

- PoS reduces Ethereum energy use by 99.95% vs PoW.

- Ethereum PoS emits 870 tonnes CO₂e/year.

- Banking finances account for 75% of the carbon footprint.

- Data centers consume 3-4% global electricity by 2030.

- Ethereum PoS consumes 99.988% less energy than PoW.

- Ethereum PoS 2,000x less energy than PoW.

- PoS blockchain uses 99% less energy than PoW systems.

Innovation Velocity and Product Diversity

- 15+ top DeFi protocols dominate lending, DEX, and staking.

- DeFi protocols manage $100+ billion institutional assets.

- 10+ DeFi trends, including RWA, AI yield, and DePIN.

- 6 key DeFi liquidity hubs: Aave, Uniswap, Lido, others.

- 44.13 billion DeFi market size with 46.8% CAGR.

- 6 major fintech trends: AI agents, embedded finance, and tokenization.

- 3 convergence innovations: predictive, BaaS, agentic AI.

- DeFi TVL growth is significant in lending, DEX 2025.

- 88% top banks adopt AI fintech.

Frequently Asked Questions (FAQs)

About 25 million new users were onboarded via Layer‑2 platforms in 2025.

First‑time DeFi users via mobile wallets increased by 39 % year‑over‑year in 2025.

About 84% of traditional bank users used centralized apps, but only 26% trusted them for investing.

Conclusion

As the financial landscape evolves, DeFi and traditional banking continue to diverge and sometimes converge across risk, regulation, trust, and innovation metrics. DeFi’s growth shows potential for novel financial products, faster settlement, and broader access, while traditional banks offer regulated safety, consumer protections, and mature operational frameworks. Both sectors face security and compliance hurdles, and each must innovate to meet consumer expectations and global economic demands. Understanding these data points equips readers with a perspective on where finance is heading, and why both systems matter in a world increasingly shaped by digital and regulated financial services.