Cryptocurrency wallets serve as the essential interface between users and digital assets, enabling secure storage, transfers, and participation in blockchain networks. Unique crypto wallets are active globally, reflecting sustained adoption across retail investors, merchants, and institutions. These wallets power real-world use cases like cross‑border remittances for unbanked populations and merchant payment integrations where consumers pay with digital currencies at point‑of‑sale terminals. As this ecosystem grows, understanding wallet adoption trends becomes crucial for developers, businesses, and regulators alike. Read on to explore the most current statistics shaping the wallet landscape.

Editor’s Choice

- 820 million active crypto wallets worldwide in 2025.

- 78% of wallets are hot (internet‑connected) wallets.

- Cold wallets make up 22% of usage, up as security demands rise.

- 134 million wallet users in North America in 2025.

- Asia‑Pacific accounts for ~350 million wallets.

- Software wallet downloads exceed 520 million globally.

- Active stablecoin wallets jumped 53% YoY by early 2025.

Recent Developments

- The global crypto wallet market was valued at roughly $12.2 billion in 2025.

- Regulatory focus has sharpened, with major jurisdictions updating compliance frameworks, especially around stablecoins and custody.

- Wallet security concerns are increasing as crypto hacks surge, boosting interest in secure storage solutions.

- Consumer crypto reports indicate 28% of U.S. adults now own crypto.

- Wallet features expand beyond holding assets to include swap, staking, and DeFi access.

- Merchant adoption of crypto as payment shows growth from ~11k to ~16k businesses year‑over‑year.

- Institutional custody demand rises, particularly for insured cold storage offerings.

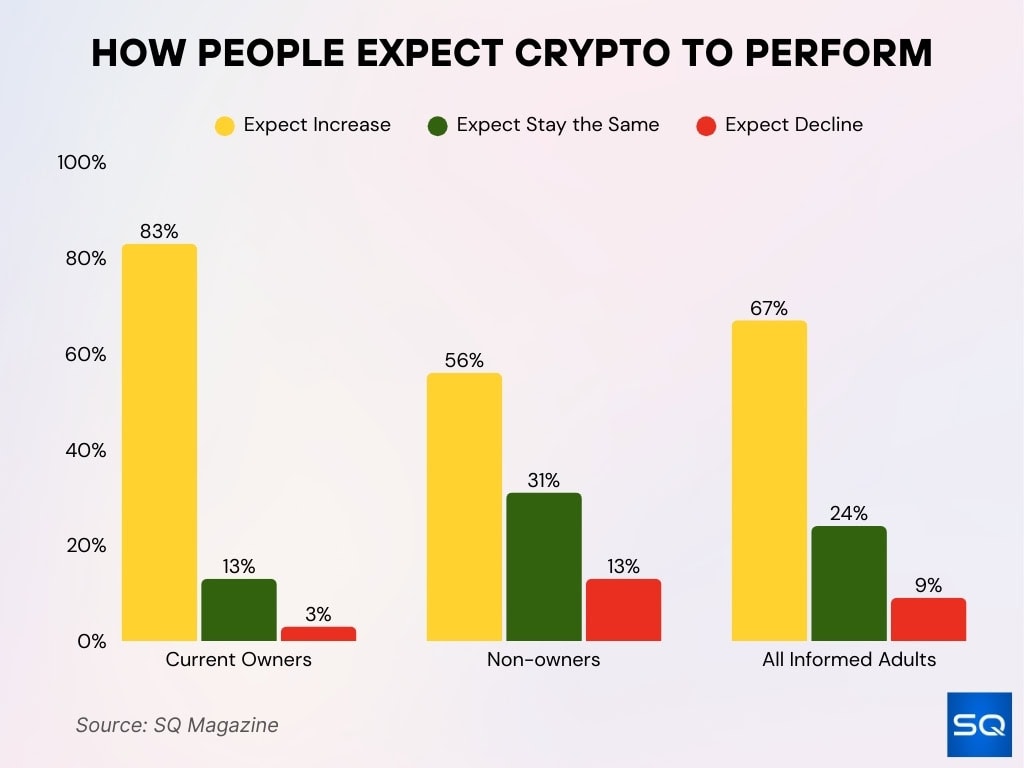

Crypto Market Sentiment

- 83% of current crypto owners expect the market to grow in 2025, reflecting strong investor optimism.

- Only 3% of current holders foresee a decline, while 13% think prices will stay flat.

- Among non-owners, 56% predict growth, 13% expect a decline, and 31% believe prices will be stable.

- Across all informed adults, 67% expect market growth, 24% expect no change, and 9% anticipate a decline.

- Overall sentiment is largely positive, especially among existing crypto investors.

Crypto Wallet Adoption at a Glance

- 820 million active wallets globally in 2025.

- Hot wallets dominate with 78% market share.

- Cold wallets account for 22% of usage.

- Software wallet downloads surpassed 520 million globally in 2025.

- Desktop wallet usage declined to ~9% of hot wallets.

- Active stablecoin wallets increased 53% YoY.

- Consumer adoption in the U.S. stands at 28% of adults.

Global Growth and Macro Adoption Trends

- Year‑over‑year global ownership dipped slightly from ~10.3% in 2023 to ~9.9% in 2025.

- The worldwide crypto market is projected to reach ~$7.98 trillion by 2030, with wallet usage underpinning that growth.

- Turkey’s internet population shows 25.6% crypto ownership.

- Developing economies like Brazil and South Africa see adoption rates approaching 20%.

- Regulatory clarity globally continues to influence adoption rates across regions.

- On‑chain adoption indexes highlight India and the U.S. as leading markets.

- Merchant acceptance of crypto payments is rising, with around ~16k merchants accepting digital assets.

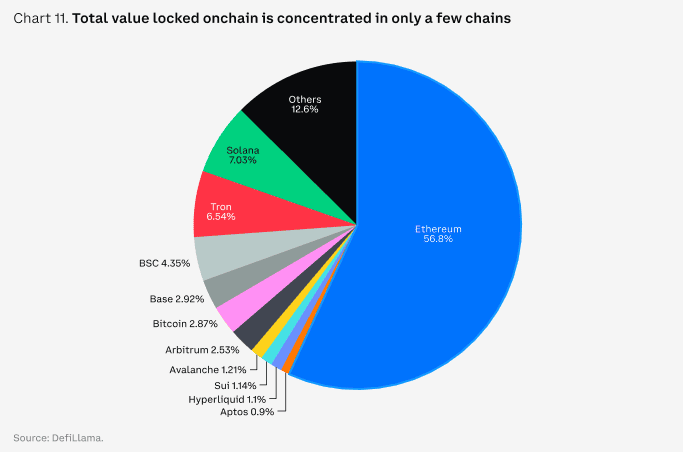

Blockchain Dominance in Total Value Locked (TVL)

- Ethereum leads with 56.8% of total TVL, cementing its position as the dominant DeFi chain.

- Solana holds 7.03% and Tron 6.54%, showing rising confidence in non-Ethereum alternatives.

- BSC captures 4.35%, while Base and Bitcoin follow with 2.92% and 2.87% respectively.

- Arbitrum accounts for 2.53% and Avalanche for 1.21%, reflecting steady Layer 2 and alt-layer growth.

- Sui (1.14%), Hyperliquid (1.1%), and Aptos (0.9%) indicate emerging adoption in newer ecosystems.

- Other chains represent 12.6%, showing that while Ethereum leads, DeFi value remains spread across networks.

Number of Active Crypto Wallets Worldwide

- 820 million active wallets traceable in 2025.

- Software wallets dominate the total with over 520 million downloads worldwide.

- Hot wallets represent ~78% of all wallets.

- Cold wallet adoption stands at ~22%.

- Desktop wallet share dropped to ~9% of hot usage.

- Independent reports suggest ~181 million monthly active wallet addresses.

- Hardware wallet shipments reached ~5.8 million units in 2024.

Regional Distribution of Wallet Users

- Asia‑Pacific leads globally with ~350 million wallet users, representing roughly 43% of all active crypto wallets in 2025.

- North America holds ~134 million wallets, making up about 16% of global users in 2025.

- Europe’s wallet user base expanded to ~140 million, with a 12% year‑over‑year increase.

- Latin America records ~92 million active wallets, driven by currency hedging and remittance demand.

- Africa’s wallet adoption jumped to ~75 million users, showing the fastest regional growth.

- Middle East wallet users reached ~29 million in 2025, reflecting gradual ecosystem development.

- Emerging markets frequently use crypto wallets for remittance and savings, versus investment alone.

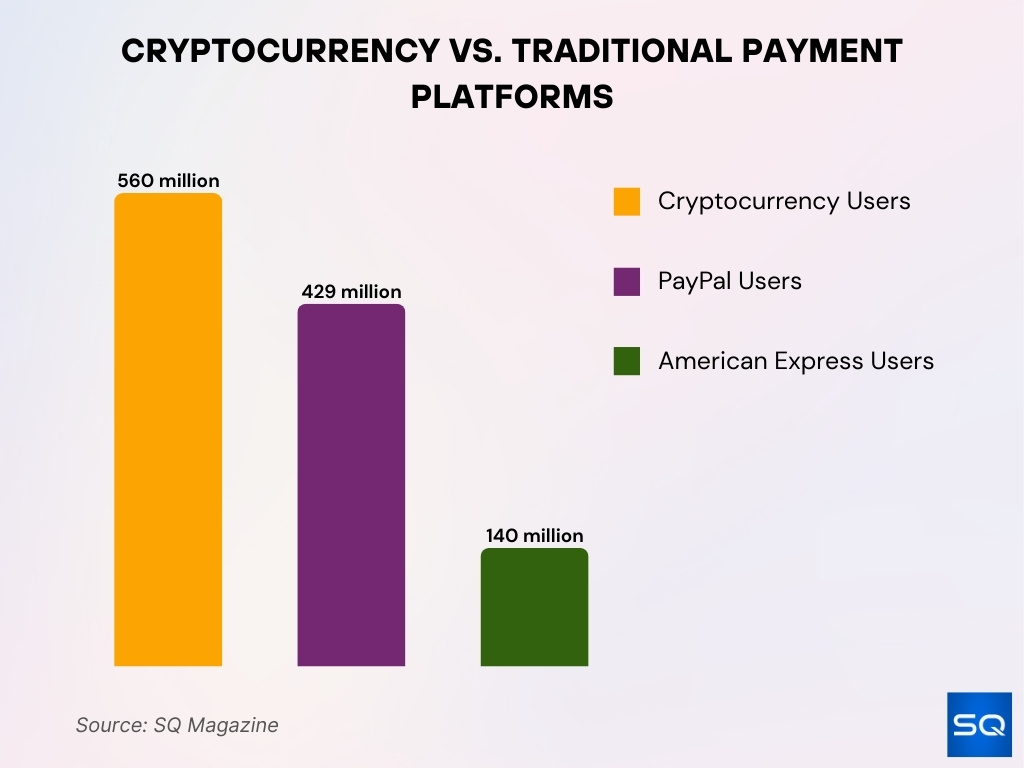

Cryptocurrency vs. Traditional Payment Platforms

- Cryptocurrency users hit 560 million, covering ~7% of the global population.

- PayPal remains strong with 429 million global users.

- American Express lags behind with only 140 million users.

- Crypto adoption has overtaken PayPal and AmEx, signaling a major move toward decentralized finance.

User Demographics and Behavior

- Crypto ownership is more prevalent among adults aged 25–34, the age group showing the highest engagement.

- Male users in the 25–34 bracket show higher adoption (16.2%) than females of the same age (8.7%).

- Ownership declines in older age groups, dropping to ~3.2% for men 65+.

- Countries like Turkey, Brazil, and South Africa report higher adoption rates compared to Japan and Germany.

- Wallet use is shifting from purely trading to payments, remittances, and savings behavior in certain regions.

- Frequent wallet users tend to hold multiple digital assets rather than single currencies.

- Young, educated users dominate remittance and stablecoin transactions.

- Demographic usage patterns influence wallet feature demand (mobile support, cross‑chain swaps).

Hot vs Cold Wallet Adoption

- Hot wallets continue to dominate overall, with about 78% of all wallets in 2025.

- Cold wallets represent ~22% of wallet usage, primarily among long‑term holders and institutions.

- Hardware wallet sales grew by ~31% in 2025 amid rising security concerns.

- Desktop wallets account for just ~9% of hot wallet usage, as mobile adoption rises.

- Market reports show the cold wallet segment projected to grow at a ~28% CAGR through the late 2020s.

- Software and mobile wallets remain the primary entry point for new users in 2025.

- Integration with exchanges and DeFi makes hot wallets more attractive for active traders.

- Cold wallets are increasingly used for institutional custody and long‑term storage.

Most Popular Crypto Narratives by Google Search

- DeFi tops the list with a Google Trends score of 75, leading all crypto narratives in search interest.

- RWA (Real World Assets) ranks second at 41, driven by rising interest in tokenized physical assets.

- Layer 2 solutions follow with a score of 27, showing demand for blockchain scalability.

- Meme Coins still trend with a solid 17 in search activity.

- Crypto AI gains moderate traction at 11, as AI-linked projects gain visibility.

- Play-to-Earn games decline in popularity with a low score of 7.

- DePIN ranks last with just 4, signaling limited mainstream attention for now.

Multi‐Signature and Enterprise Wallet Usage

- Enterprise-grade multi-signature wallets reached 9 million deployments, up 47% year-over-year.

- The multisignature wallets market is valued at $1.27 billion, projected to hit $4.37 billion by 2033.

- Institutional wallet ownership grew 51%, accounting for over 31 million crypto wallets.

- The commercial custodial wallets segment leads the crypto wallet market at $12.20 billion valuation.

- 52% of institutional wallets interact with smart contracts monthly for enhanced security.

- 43% of institutional wallets are custodial, supporting compliance and treasury integration.

- Hardware wallet sales tied to multisig are forecasted at $560 million amid enterprise demand.

- 59% of institutional crypto allocations now include self-custody multisig solutions.

- Multi-signature setups require 3-5 signatures for DAO treasury transactions to boost governance.

Mobile‐First and Cross‐Chain Wallet Ecosystems

- 72% of crypto users prefer mobile-first wallets for ease of use and real-time access.

- Android captures 61% of mobile wallet installs while iOS holds 36% market share.

- Software wallet downloads exceeded 520 million globally, with mobile dominating usage.

- MetaMask boasts 30 million monthly active users supporting 11 blockchains.

- Coinbase Wallet serves 11 million users as a top mobile self-custody option.

- Trust Wallet reaches 10.4 million users, boosted by cross-chain Binance integration.

- Cross-platform wallets syncing mobile and desktop grew 42% year-over-year.

- 84% of mobile wallet apps enable biometric authentication for enhanced security.

- Wallets with cross-chain swaps report 2.3x higher user retention rates.

Wallets Used for Payments, Remittance, and Commerce

- Crypto-powered remittances market valued at $27.87 billion with 25.3% CAGR to $68.59 billion by 2029.

- Blockchain remittances capture 3-5% of global remittance flows amid rapid adoption.

- 73% of merchants plan to accept crypto payments within two years.

- Stablecoins represent 30% of total crypto transaction volume for payments.

- 644,578 crypto payments recorded across H1 with 337% USDC growth.

- 65% of Latin America remittance users report faster crypto transfers.

- 76% Southeast Asia remittance users prefer crypto for speed and reliability.

- 43% e-commerce merchants now accept crypto to meet customer demand.

- 69% U.S. respondents prefer digital apps for sending remittances.

Stablecoin Usage in Wallet‑Based Transactions

- **Stablecoins accounted for 30% of total crypto transaction volume in early 2025, indicating their central role in on‑chain activity.

- Leading stablecoins like USDT and USDC make up over 90% of the fiat‑backed stablecoin market cap.

- Stablecoin transaction volume exceeded $4 trillion from January through July 2025, an 83% increase YoY.

- Stablecoins are widely pegged to the U.S. dollar, anchoring their appeal for global transactions.

- In certain markets, stablecoin usage has moved beyond trading to remittances and cross‑border value transfer needs.

- Regulatory clarity, like the U.S. GENIUS Act and MiCA in the EU, is encouraging broader stablecoin integration into payments infrastructure.

- Despite growth, stablecoin adoption for everyday payments remains emerging, with many use cases still tied to trading and DeFi.

- Some industry forecasts expect the stablecoin market cap to approach $2 trillion by 2028.

Wallet Activity, Retention, and Engagement

- Blockchain gaming wallets averaged ~4.66 million daily active wallets in Q3 2025.

- NFT wallets averaged ~410,000 daily active users in 2025, up about 9% YoY.

- Wallets interacting with NFT gaming assets increased by ~17% in early 2025.

- Secondary NFT market transactions accounted for ~52% of total NFT activity, showing engagement beyond initial minting.

- Cross‑chain wallet interactions continue to rise as users demand multichain capability.

- Web3 use indicates broader engagement, with an estimated over 560 million people using Web3 tools globally in 2025.

- Transaction frequency for certain wallet categories (DeFi, gaming, payments) is now a key adoption metric for ecosystem health.

- Mobile wallet retention remains a challenge, with specialized solutions emerging to improve user stickiness.

Security, Compliance, and Regulatory Influence

- The Web3 wallet security market is projected to grow at a ~23.7% CAGR from 2024 to 2033, reflecting rising security demand.

- Only ~13.9% of users rely on professional hardware wallets for enhanced security, underscoring a gap in strong self‑custody adoption.

- Popular private key storage methods include paper keys (34.7%) and encrypted digital storage (24.8%).

- Regulations like the U.S. GENIUS Act and EU MiCA framework aim to tighten compliance, reserve transparency, and protect consumers.

- AML, KYC, and sanctions compliance are increasingly required of wallet service providers and DeFi platforms.

- Auditability and reserve requirements for stablecoins enhance trust and reduce systemic risk.

- Security research highlights persistent threat vectors like phishing and wallet breaches, motivating improved protocols.

- Wallet extensions and browser wallets remain significant attack targets, prompting efforts in secure design.

Institutional and Enterprise Crypto Wallet Usage

- Institutional wallet ownership surged 51% year-over-year to over 31 million wallets.

- 43% of institutional wallets utilize custodial solutions for regulatory compliance.

- 61% of institutions deploy multi-signature wallets for enterprise digital asset security.

- Crypto custody industry reaches $3.28 billion, driven by TradFi entrants like BNY Mellon.

- 49% of institutions actively use stablecoins for treasury and payment operations.

- 59% of institutional investors plan 5%+ AUM allocation to digital assets.

- Digital asset AUM among institutions exceeds $235 billion with 22% VC growth.

- 6 in 10 F500 executives report active blockchain initiatives, including wallet integrations.

- 29% growth in crypto hedge funds adopting wallets for DeFi staking and yield.

Wallet Adoption for DeFi, NFTs, and Web3 Use Cases

- Daily active Web3 wallets reached 24.3 million dUAW for dApps, up 247% from early 2024.

- DeFi wallet usage hit 198 million users globally, representing 24% of total wallets.

- NFT-linked wallets total 294 million, with 61% gaming NFT interactions.

- Blockchain gaming daily active wallets averaged 4.8 million in April.

- 48% of all wallets interacted with at least one decentralized application.

- MetaMask reports 30 million monthly active users for Web3 dApp connections.

- Staking-enabled DeFi wallets grew to 92 million across protocols.

- Global Web3 dApp monthly active users are estimated at 5-10 million.

- 70% of emerging market internet users intend to use Web3 services.

Frequently Asked Questions (FAQs)

Cryptocurrency wallets represent roughly 7.4 % of global internet users in 2025.

About 11.02 % of the global population used cryptocurrency in 2025.

Approximately 28 % of American adults owned some form of cryptocurrency in 2025.

Around 46% of merchants accept cryptocurrency as a form of payment in 2025.

Conclusion

Crypto wallet adoption has shifted from basic storage tools to multifaceted engagement platforms that support stablecoins, DeFi, NFTs, and Web3 activities. Stablecoin transaction volumes are hitting record levels, and regulatory frameworks like the GENIUS Act and MiCA are shaping the landscape with clearer compliance requirements. Wallet security awareness is growing, even as active engagement in gaming, NFTs, and DeFi drives daily usage. Institutional wallets are maturing along with enterprise use cases, further expanding the ecosystem’s reach. As global adoption continues to broaden, wallets remain a foundational element in unlocking broader utility and mainstream participation in digital finance.