Cryptocurrency regulation has shifted from fragmented rules to structured frameworks as governments worldwide seek a balance between innovation and risk mitigation. During the past year, policymakers have enacted and proposed laws affecting everything from stablecoins to anti‑money‑laundering (AML) protocols, impacting market behavior, investor confidence, and corporate strategy.

These changes influence real‑world scenarios such as institutional trading desks restructuring compliance processes and payment firms integrating regulated stablecoins into digital settlement systems. The following section introduces key metrics that illustrate how regulatory trends are shaping digital asset markets today.

Editor’s Choice

- Over 70% of jurisdictions advanced stablecoin regulatory frameworks in 2025.

- Roughly 80% of jurisdictions saw financial institutions announce new digital asset initiatives after clarifying regulatory expectations.

- The U.S. passed the GENIUS Act, the first federal stablecoin regulatory law, in July 2025.

- Global crypto market capitalization reached an estimated $4 trillion in 2025.

- Central banks like Canada’s are pushing for strict liquid‑asset backing for stablecoins.

- UK crypto ownership declined from 12% to 8% in 2025 under regulatory pressure.

- Indonesia raised crypto transaction tax rates up to 1% for overseas trades in 2025.

Recent Developments

- MiCA compliance achieved by 65% of EU-based crypto businesses.

- 53 MiCA licenses granted across 27 EU countries.

- GENIUS Act passed Senate 68-30 and House 308-122.

- Canada requires stablecoins backed by high-quality liquid assets.

- UK FCA targets crypto regime finalization by Q2 2026.

- Pakistan Crypto Council established a multi-agency technical committee.

- Indonesia PMK 50/2025 eliminated VAT on crypto trades.

- FSB identified gaps with only 11 jurisdictions finalizing crypto frameworks.

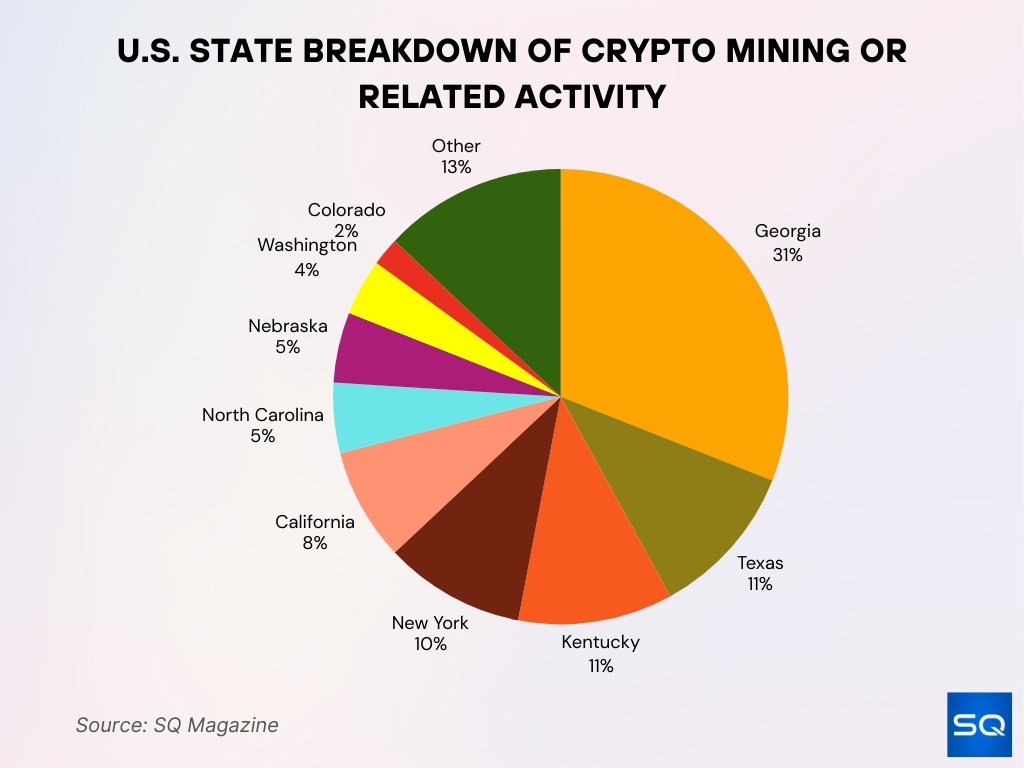

Crypto Mining Activity by U.S. State

- Georgia holds 31%, leading all U.S. states in crypto mining and related activity.

- Texas and Kentucky each have 11%, tied for second in crypto-related operations.

- New York accounts for 10%, remaining a major digital asset hub.

- California contributes 8%, reflecting its strong tech economy.

- North Carolina and Nebraska have 5% each, showing moderate mining activity.

- Washington holds 4%, playing a smaller but notable role.

- Colorado contributes 2%, indicating limited crypto infrastructure.

- Other U.S. states represent 13%, highlighting a fragmented nationwide presence.

Regulatory Clarity Versus Uncertainty in Crypto Markets

- 80% of jurisdictions saw institutional digital asset initiatives announced.

- 73% of policymakers advanced from drafts to defined crypto regulations.

- 55% of hedge funds gained digital asset exposure, up from 47% prior year.

- Unregulated VASPs showed 10x higher illicit activity than compliant platforms.

- 44% of cross-border investors faced legal issues from regulatory mismatches.

- Regulatory clarity boosted exchange listings by 61% in compliant markets.

- 62% FSB members aligned with crypto-asset frameworks, boosting confidence.

- Investor surveys ranked uncertainty as the top barrier for 50% of non-exposed funds.

- 43% countries enacted stablecoin rules, enhancing compliance confidence.

Classification of Crypto Assets and Legal Definitions

- U.S. GENIUS Act limits state regulation of stablecoins to issuers under $10 billion.

- 65% of EU-based crypto businesses achieved MiCA compliance by Q1.

- 53 MiCA licenses granted in the first six months across 30 EEA countries.

- The stablecoin market reached an all-time high of over $290 billion in Q4.

- 90% compliance rate for crypto firms in Germany, France, and the Netherlands under MiCA.

- Total staking rewards on MiCA-compliant platforms hit $5.0 billion in Q1.

- Regulatory-compliant staking providers control 85% of staking pools.

- 32% rise in AML compliance among DeFi protocols.

- Jurisdictions with detailed definitions saw licensing approvals in as few as 5 days.

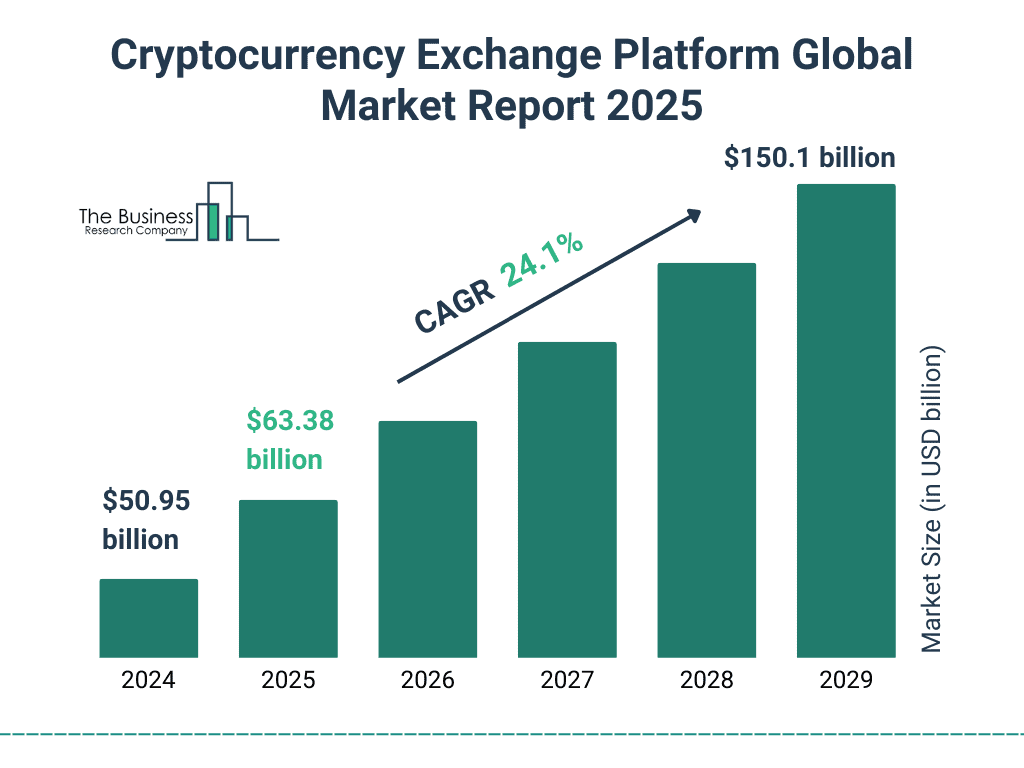

Cryptocurrency Exchange Platform Market Outlook

- Global market size projected to hit $150.1 billion by 2029, showing rapid expansion.

- CAGR stands at 24.1%, indicating strong, sustained growth through the forecast period.

- The market is expected to reach $63.38 billion in 2025, reflecting a major year-on-year increase.

Effects of Regulation on Cryptocurrency Market Volatility

- SEC enforcement actions triggered crypto market fluctuations of 15-20%.

- MiCA rules implementation drove +15% institutional inflow, reducing volatility.

- Assets with strong KYC/AML showed 31.4% volatility vs 73.8% for weak compliance during Oct 10-13.

- Bitcoin volatility dropped from 85 to 52 after the SEC regulatory shifts.

- CLARITY Act approval caused a +23% Bitcoin price surge with contained volatility.

- Stablecoin lending rates stabilized at 5.9% average post-MiCA, showing smoother volatility.

- Crypto lending platforms saw 24% lower liquidation rates under enhanced MiCA rules.

- Regulatory clarity reduced Bitcoin price drops to $5,000 from political uncertainties.

- MiCA correlated with 28% lending default rates decline improving market stability.

Influence of Regulatory News and Announcements on Crypto Prices

- GENIUS Act Senate passage drove a 68-30 vote with crypto stocks jumping 15%.

- Trump signing the GENIUS Act pushed ether prices to a yearly high with 20% gains.

- MiCA compliance boosted institutional crypto exposure by 30% in the EU.

- Hong Kong stablecoin rules announcement led Guotai Junan shares to a 300% spike.

- Regulatory uncertainty dropped the Fear & Greed Index to 10-15 extreme fear levels.

- GENIUS Act approval projected stablecoin market growth to $2 trillion.

- MiCA implementation increased EU crypto derivatives volumes by 28%.

- Enforcement news caused a 40% user decline on non-compliant exchanges.

- Stablecoin legislation correlated with $28 trillion annual transactions.

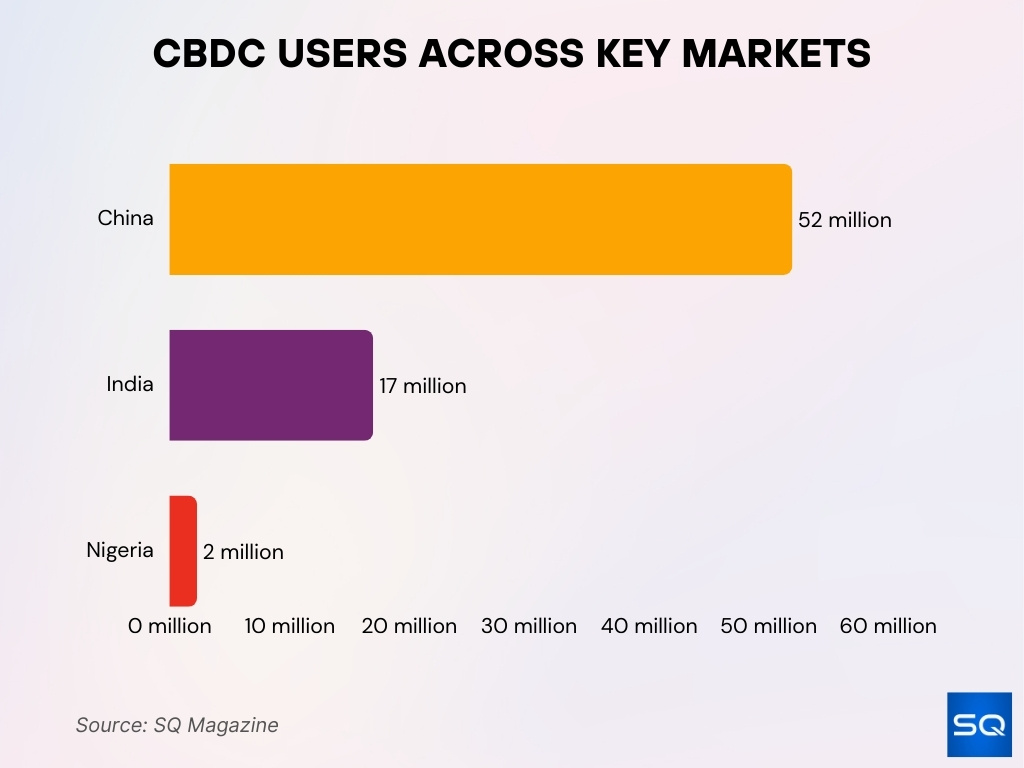

Central Bank Digital Currency Tracker

- 139 countries are exploring or piloting CBDCs, up 26% year-over-year as adoption accelerates.

- China’s digital yuan has 52 million users, with over $26 billion in transactions by mid-2025.

- EU’s digital euro is in the final pilot phase, with full rollout expected in early 2026.

- India’s CBDC pilot includes 17 million users, expanding via subsidies and public bank integration.

- Jamaica’s JAM-DEX reached 38% adoption among businesses, boosting rural financial inclusion.

- Nigeria’s eNaira has 2.3 million active users, reducing national cash usage by 14% in 2025.

- 47% of CBDCs now follow regulatory frameworks, prioritizing cybersecurity, data protection, and fraud prevention.

Regulatory Impact on Bitcoin Versus Altcoins

- Bitcoin ETFs amassed $149.7 billion AUM, representing 6.62% of BTC market cap.

- Altcoins showed 3x volatility versus Bitcoin after major regulatory announcements.

- BlackRock IBIT dominated with $87.2 billion (59.3% market share) in BTC ETFs.

- DeFi altcoins faced $10 billion+ losses from security breaches tied to regulations.

- Bitcoin commodity status drove $65 billion spot ETF AUM worldwide.

- Altcoin market cap hit $1.7 trillion (43.7% total crypto) with a 62.3% decline, then a recovery.

- 72% investors demanded stricter altcoin listing criteria post-scandals.

- Stablecoins comprised 30% on-chain volume despite altcoin regulatory hurdles.

- Utility tokens gained 44% more audited issuers under explicit definitions.

Effects of Stablecoin Regulation on Market Stability

- Total stablecoin market capitalization reached $251.7 billion mid-year.

- Tether USDT dominated with $112 billion supply, representing 68% of the market.

- Stablecoin supply surpassed $300 billion with 47% year-to-date growth.

- GENIUS Act mandated 1:1 reserves using cash or Treasuries for stability.

- MiCA required 30-60% reserves in bank deposits, reducing systemic risks.

- Regulated stablecoins showed 90% fewer exploits than unregulated variants.

- USDT processed a peak $1.01 trillion monthly on-chain volume.

- Stablecoins settled $772 billion in transactions on Ethereum and Tron.

- 12 countries endorsed centralized stablecoins for cross-border trade.

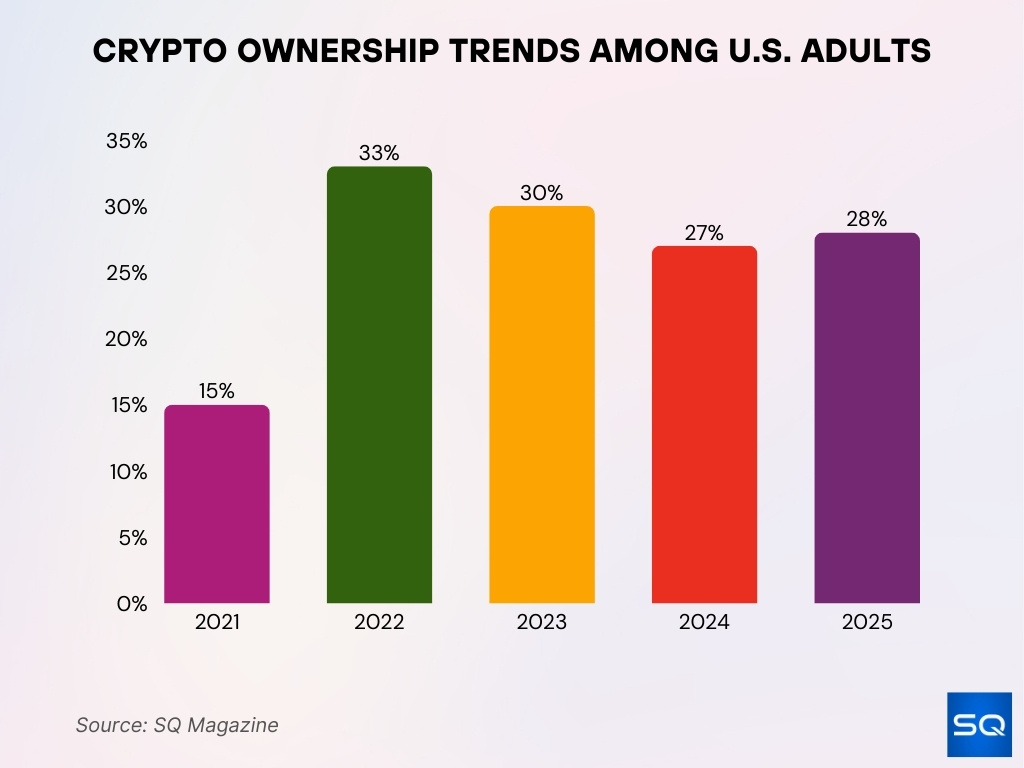

Crypto Ownership Trends Among U.S. Adults

- Ownership rose from 15% in 2021 to 33% in 2022, marking a peak in adoption.

- 2023 saw a slight dip to 30%, indicating shifting market sentiment.

- 2024 ownership was revised down to 27%, following updated data corrections.

- A rebound to 28% is projected for 2025, showing renewed interest among U.S. adults.

Impact of Regulations on DeFi Usage and Total Value Locked

- Total DeFi TVL reached $123.6 billion, up 41% year-over-year.

- Ethereum dominated with $78.1 billion TVL, representing 63% of the ecosystem.

- Institutional lending via compliant DeFi pools hit $9.3 billion.

- DeFi compliance costs ranged $120,000-$500,000 annually for exchanges.

- Smart contract audits averaged 3.2 per top protocol yearly.

- Formal verification tools usage rose 61% in DeFi development.

- SEC enforcement actions against DeFi dropped 48% focusing on fraud.

- DeFi lending outstanding loans grew 54.84% to $40.99 billion.

- 78% active protocols are integrated on-chain threat detectors.

Institutional Adoption Trends Under Evolving Regulations

- 59% of institutional investors planned >5% AUM allocations to crypto.

- 83% of institutions planned increased crypto allocations above 5%.

- 80% of jurisdictions saw financial institutions launch crypto initiatives.

- Q1 institutional crypto investments totaled $21.6 billion.

- 75% of institutions planned to expand crypto allocations strategically.

- Bitcoin ETFs attracted $115 billion in inflows, boosting institutional holdings.

- Tokenized RWAs reached $30 billion with institutional yield products.

- 5 crypto firms gained OCC national trust charters for custody.

- Spot Bitcoin ETFs saw $3.5 billion monthly inflows, hitting 12% BTC supply.

Retail Investor Participation Under Stricter Regulatory Regimes

- UK crypto ownership rose to 24% of adults, up 6% year-over-year.

- 9% of Brits (5 million) own cryptocurrency, with 6% holding Bitcoin.

- 38% of retail stakers use compliant staking pools for lower fees.

- 95% of brokers adopted stricter Reg BI transparency standards.

- 31% of retail investors use regulated fractional share trading.

- 53% increase in new brokerage accounts from zero-commission models.

- 49% of retail investors made data-driven decisions via reporting rules.

- 78% active protocols integrated compliance features for retail users.

- FCA issued 1,702 alerts improving retail protection compliance.

Impact of KYC and AML Rules on User Onboarding and Activity

- Anonymous crypto account creation dropped over 30% due to stricter KYC/AML rules.

- Average KYC verification time across platforms reached 3.5 minutes with AI tools.

- 90% of top centralized exchanges implemented automated transaction monitoring.

- Platforms without KYC were 10x more likely to enable illicit activities.

- 61% of users preferred platforms with robust compliance measures.

- 95% of the top 100 crypto platforms enforced 2FA with KYC processes.

- 81% of first-step verifications used selfie and photo ID matching.

- 90% of crypto platforms use AI-powered identity verification tools.

- 85 of 117 jurisdictions implemented the Travel Rule for virtual assets.

Regulatory Actions Against Illicit Crypto Use and Crime

- Illicit crypto volume dropped to 0.4% of the total $10.6 trillion transactions.

- Law enforcement seized a record $15 billion in Bitcoin from scam operations.

- Stolen crypto funds reached $2.17 billion mid-year, led by the ByBit hack.

- Stablecoins dominated 63% of laundering, surpassing Bitcoin’s 20% share.

- Crypto scams accounted for 54% of all crypto-related crimes.

- TRON illicit volume halved, dropping $6 billion with 49% sanctions links.

- $4.2 billion tied to crypto money laundering up 23% year-over-year.

- Exchanges post-sanctions saw an 82% average inflow drop within three months.

- Blockchain forensics market projected to hit $5.1 billion at 21.3% CAGR.

Effects of Travel Rule Enforcement on Cross-Border Transactions

- FATF Travel Rule implemented in 85 of 117 jurisdictions, up from 65 prior year.

- 99 jurisdictions have passed or are processing Travel Rule legislation globally.

- 73% of surveyed jurisdictions enacted Travel Rule, excluding VASP bans.

- 100% VASPs plan full compliance by year-end, with 85% targeting H1.

- EU TFR drove a 200x spike in Travel Rule protocol transaction volumes.

- 59% of Travel Rule jurisdictions have issued no enforcement actions yet.

- US Travel Rule threshold set at $3,000 for VASP cross-border transfers.

- Travel Rule fines reached $88,000 per violation in the Philippines enforcement.

- 50 jurisdictions took supervisory actions on Travel Rule compliance.

Compliance Costs and Operational Burdens for Crypto Firms

- Compliance spending reached 10-15% of operating costs at major exchanges.

- MiCA licensing fees ranged €33,000–€56,600 plus supervision charges.

- Upfront MiCA compliance costs hit €60,000+ for startups, including audits.

- Crypto KYC/AML annual compliance averaged $120,000-$500,000 per firm.

- 90% OECD tax authorities mandated crypto platform transaction reporting.

- 37% crypto firms consolidated operations due to multi-jurisdiction burdens.

- Compliance tech investment grew 61% focused on transaction monitoring.

- Venture capital prioritized compliant firms with $18-25 billion annual inflows.

Consumer Protection Rules and Reported Investor Losses

- Reported retail crypto losses dropped 23% in MiCA-regulated EU markets.

- $2.17 billion was stolen from services with the ByBit hack at $1.5 billion.

- US scam losses hit $9.3 billion, showing 46x growth since 2020.

- 30% countries are flagged high-risk for poor crypto consumer frameworks.

- 43% countries enacted stablecoin consumer protection redemption laws.

- 75% CASP T&Cs silent on insolvency protection for client assets.

- CASPs must resolve complaints within 2 months under EU standards.

- ESMA warned against misleading regulated vs unregulated product claims.

- 48% exchanges failed adequate KYC, increasing fraud exposure.

Frequently Asked Questions (FAQs)

Over 70% of jurisdictions made progress on stablecoin regulatory frameworks in 2025, according to a global crypto policy review.

About 80% of jurisdictions saw financial institutions announce new digital asset initiatives following clearer crypto regulation.

The global crypto market cap declined by 9% in Q1 2025, stabilizing near $2.62 trillion amid regulatory tightening.

UK adult crypto ownership fell from 12% to 8%, a 33% drop year‑over‑year during 2024–2025.

Conclusion

Cryptocurrency regulation has become a defining force shaping how digital assets function across global markets. Clearer rules have improved institutional participation, reduced illicit activity, and strengthened consumer protections, while also increasing costs and operational demands for crypto firms. For policymakers, businesses, and investors alike, the data shows that regulation no longer sits on the sidelines; it actively influences adoption, trust, and market stability. Exploring these statistics in detail helps clarify where crypto markets are heading and how regulatory decisions continue to shape their future.