Cryptocurrency cold wallets, offline storage devices that hold private keys without internet connectivity, are becoming core tools for securing digital assets. These wallets address the increasing incidence of hacks and thefts on exchanges and digital platforms, offering holders a way to protect long‑term value and institutional portfolios. In retail investing, cold wallets help individuals safeguard sizable holdings, while enterprises use them to meet compliance and risk‑management standards. Read on for detailed statistics shaping the cold wallet landscape this year.

Editor’s Choice

- Cold wallet ownership among retail investors increased by ~34% year‑over‑year in 2025.

- Institutional usage of cold wallets surged by ≈51% in 2025, reflecting enterprise security focus.

- Hardware wallets accounted for the largest segment of the cold wallet market in 2024, 2025.

- North America held ≈40% of global cold wallet revenue in 2024.

- Asia‑Pacific contributed about 23% of global cold wallet revenue in 2024, with rapid growth.

- Cold wallets made up approximately 22% of total crypto wallet usage in 2025.

Recent Developments

- Cold wallet ownership among retail investors rose by 34% year-over-year.

- Institutional cold wallet usage surged by 51%.

- Cold wallet cards expected to surpass 15 million users by year-end.

- Institutions like DAOs and hedge funds represent 35% of cold wallet card demand.

- Over $3.8 billion in crypto assets stored via hardware wallets as of Q2.

- Average transaction volume via cold wallets hit $5,000–$5,300, up 12–14% year-over-year.

- USB-connected hardware wallets hold 44.67% market share.

- The commercial segment accounts for 68.9% of hardware wallet revenue.

Public Sentiment on Crypto and Government Policy

- 60% of crypto-aware respondents expect crypto to rise under Trump, including 75% of owners vs 49% of non-owners.

- 46% believe the Trump administration will boost crypto adoption, with 59% of owners vs 36% of non-owners agreeing.

- 44% say government regulation threatens crypto’s decentralized nature (48% of owners vs 41% of non-owners).

- 28% support a national Bitcoin reserve, rising to 44% among owners vs 17% of non-owners.

- 25% back crypto tax credits or subsidies, including 39% of owners vs 15% of non-owners.

- Just 24% trust the government to regulate crypto effectively (28% of owners vs 20% of non-owners).

Retail vs Institutional Cold Wallet Adoption

- Retail cold wallet ownership grew 34% year-over-year.

- Institutional cold wallet usage surged 51% year-over-year.

- Hot wallets dominate, with 78% of crypto users preferring them over cold.

- Cold wallets represent 22% of total wallet usage.

- Retail users account for 82% of all crypto wallet holders.

- Institutional wallets number over 31 million units.

- 43% of institutional wallets are custodial for compliance.

- 65% of institutional investors plan to buy or hold crypto.

- The commercial segment holds 68.9% of hardware wallet revenue.

- Retail held 72.31% of the hardware wallet revenue share previously.

Cold Wallet Usage by Investor Profile

- 38.1% of crypto investors favor cold wallets as the primary self-custody option.

- Hot wallets hold 69–78% overall wallet share among frequent traders.

- Cold wallets represent 22% of total wallet usage.

- 34% YoY growth in cold wallet ownership among retail investors.

- 51% surge in institutional cold wallet usage.

- 82% of crypto wallet holders are retail users.

- Younger investors aged 25–34 dominate crypto ownership.

- 68.9% of hardware wallet revenue from the commercial segment.

- Average cold wallet transaction volume reached $5,300.

Global Crypto Cold Storage Wallet Market Highlights

- The cold wallet market was valued at $3.5 billion in 2024.

- It is projected to reach $12.2 billion by 2033.

- The market is set to grow at a 15.2% CAGR from 2026 to 2033.

- Growth is fueled by demand from North America, Europe, Asia-Pacific, the Middle East, and Latin America.

- Cold wallets are becoming essential as crypto adoption rises in institutional and retail sectors.

Cold Wallets vs Hot Wallets Statistics

- Hot wallets hold ~78% of all crypto wallets in 2025, with cold wallets making up ~22%.

- The hardware, cold wallet segment is forecast to grow at a ~30.76% CAGR through 2033.

- Hot wallets are still more convenient for DeFi and frequent transactions.

- Cold wallets dominate for offline self‑custody and long‑term holdings.

- Cold wallets have lower exposure to hacks than hot wallets due to offline key storage.

- Among hardware wallets in 2025, hot wallet‑connected devices still account for ~69% share of that segment.

- Cold storage solutions often integrate multi‑signature and vault features for extra security.

- Many users adopt a hybrid strategy, hot for active trading, cold for savings.

Self‑Custody vs Custodial Wallet Statistics

- 59% of global crypto wallet users rely on non‑custodial wallets vs 41% on custodial solutions.

- Self‑custodial wallets handle 68% of crypto transactions, with custodial providers managing the remaining 32%.

- The global non‑custodial wallet market is valued at about $3 billion, growing at around a 25% CAGR over recent years.

- Personal use accounts for over 80% of the total non‑custodial wallet user base.

- Active non‑custodial wallet users are estimated to have surpassed 50 million globally.

- Institutional‑grade custodial platforms offer insurance coverage up to around $320 million for cold‑stored assets.

- Self‑custodial and institutional‑grade solutions together support roughly 820 million non‑custodial wallets and 9 million multi‑sig deployments.

- Traditional custodial models faced about $2.17 billion in thefts, accelerating migration toward self‑custody and insured cold storage.

User Demographic Statistics (Retail, Institutional, Regional)

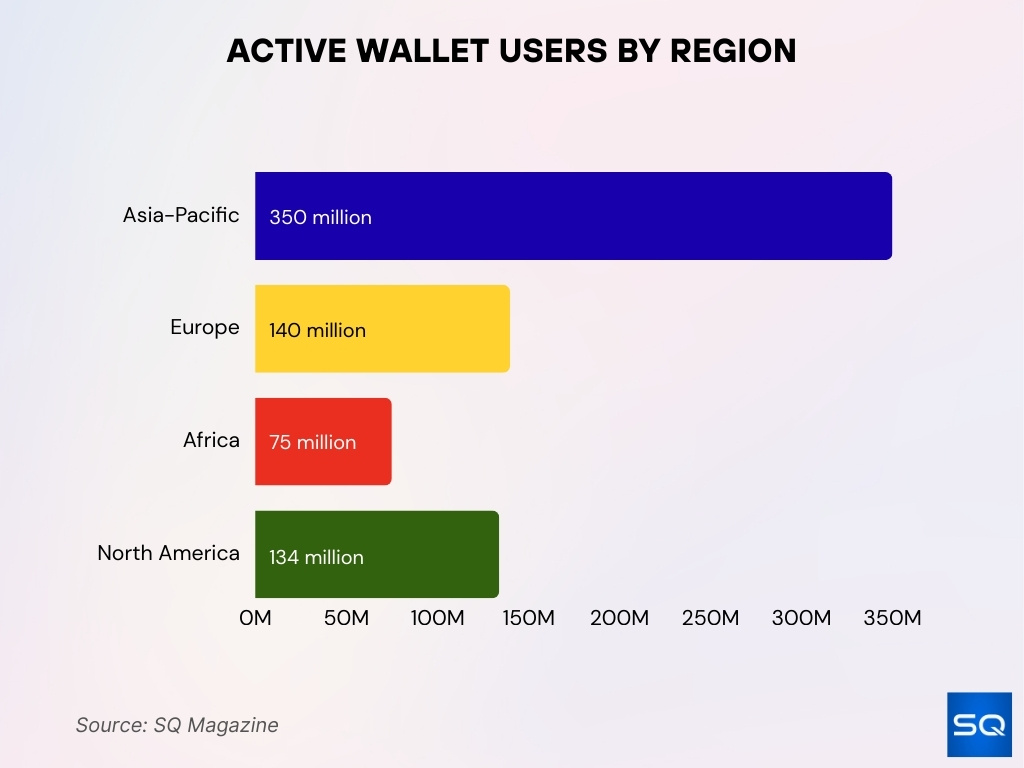

- Asia-Pacific leads with ~43% share or ~350 million of global crypto wallet users in 2025.

- Europe has ~140 million active wallet users in 2025, marking a ~12% YoY increase.

- Africa reached ~75 million users in 2025, nearly doubling in two years.

- North America holds ~134 million users, making up ~16% of the global total.

Cold Wallet Adoption Drivers and Barriers

- 34% YoY growth in retail cold wallet adoption driven by security concerns.

- Institutional adoption rose 40–50% year-over-year amid regulatory pressure.

- 78% of crypto users prefer hot wallets despite hack risks.

- 30% of users cite regulatory uncertainty as an adoption barrier.

- 68.9% hardware wallet revenue from commercial users seeking compliance.

- 69% of digital asset users prioritize wallets for secure transactions.

- Private key management challenges deter ~25% of new retail users.

Leading Cold Wallet Providers Market Share

- Ledger is estimated to hold about 34% of the global cryptocurrency hardware wallet market share.

- Trezor follows with roughly 28% market penetration among hardware wallet users.

- KeepKey maintains a single‑digit share within a group of major brands that dominate over 70% of hardware wallet sales.

- North America accounts for approximately 39–40% of global hardware wallet revenue.

- Europe captures close to 30% share of the worldwide hardware wallet market.

- Asia‑Pacific represents roughly 20–26% of hardware wallet revenues, with growth above 30% CAGR toward 2030.

- Commercial or enterprise end users generate about 68.88% of the hardware wallet market revenue.

- Crypto custody firm BitGo manages over $100 billion in assets under custody, up from $60 billion earlier in the year.

Geographic Distribution of Cold Wallets

- North America generated over 40% of global cold wallet revenue.

- Europe held around 30% of the total market share.

- Asia-Pacific contributed ~23%, with China, India, and South Korea driving rapid growth.

- Latin America and the Middle East & Africa each had under ~6% share but are expected to grow at similar CAGRs.

Cold Wallet Usage by Asset Type

- Roughly 60–70% of assets held in cold wallets are Bitcoin, reflecting its dominant role in long‑term storage.

- Ethereum typically accounts for about 15–25% of balances on multi‑asset cold wallets used by diversified investors.

- Institutional treasuries often keep over 80% of core BTC and ETH holdings in offline custody via qualified custodians.

- Some exchanges and brokers report holding 99.9% of client Bitcoin funds in cold storage for security.

- Multi‑asset hardware wallets now support 5,000+ different coins and tokens on a single device.

- Stablecoins and tokenized cash instruments increasingly feature in cold custody, with BTC spot ETFs alone managing more than $115 billion in underlying Bitcoin held with custodians.

- Cold storage wallets represent about 30% of primary wallet usage among security‑focused users and institutions, compared to ~69–78% for hot wallets.

Portfolio Allocation to Cold Storage

- Long-term investors allocate ≥70% of holdings to cold wallets for theft mitigation.

- Institutions designate up to 85% of digital assets to offline custody solutions.

- Retail holders place 50–65% of crypto portfolios in cold storage on average.

- Professional traders limit cold wallet holdings to 20–30% for core assets.

- 68.9% of hardware wallet revenue stems from institutional allocation strategies.

- High-net-worth users segment 75–90% of portfolios across multiple cold vaults.

- Diversified storage sees 82% of retail users employing multiple cold wallets.

- Automated cold vault solutions manage 15–25% of rebalanced holdings between hot and cold.

- Security-liquidity tradeoff drives 60% average cold allocation across investor profiles.

Key Security Incident Statistics Involving Cold Wallets

- Over $2.17 billion was stolen from crypto services by mid-year, surpassing all of 2024.

- Bybit hack resulted in $1.5 billion Ethereum loss from a cold wallet transfer.

- 121 security incidents tracked with $2.37 billion losses in the first half.

- Personal wallet compromises represent 23.35% of all stolen funds YTD.

- CertiK reports $2.47 billion stolen in H1 via hacks, exploits, and scams.

- Access-control exploits account for 59% of total crypto hack losses.

- 34 wallet compromise incidents caused $1.7 billion in H1 losses.

- SlowMist tallies $2.37 billion across 121 blockchain security incidents.

- Total 2025 crypto losses exceed $3.1 billion, with access flaws dominant.

Hacks, Thefts, and Exchange Failures Driving Cold Storage

- Mid‑year crypto crime reports show over $2.17 billion stolen from services, exceeding total 2024 losses and accelerating cold wallet demand.

- The Bybit exploit drained about 400,000 ETH (≈$1.5 billion) from a wallet environment associated with cold storage operations, marking the largest single exchange heist on record.

- Across 121 tracked incidents, total losses reached roughly $2.37 billion, with individual user wallets representing close to 23% of targets in some analyses.

- Reports show 2025 crypto hack losses surpassing $3.1 billion, with several centralized platforms temporarily halting withdrawals after breaches.

- July 2025 alone recorded a 27.2% month‑over‑month rise in hack losses to $142 million, followed by spikes in hardware wallet traffic and sales.

- Access‑control and key‑management failures account for roughly 59% of total hack losses, highlighting the perceived safety advantage of offline key storage.

Recovery Rates and Lost Access Incidents

- Surveys indicate around 24–30% of crypto users have lost access to funds at least once, with seed phrase or private‑key loss cited as the main cause.

- Estimates suggest 15–20% of all mined Bitcoin is lost or dormant, much of it due to inaccessible wallets and misplaced recovery data.

- Around 20–30% of self‑custodial wallet users report having no reliable backup of their seed phrase, raising permanent loss.

- Cold wallet users who maintain at least one physical backup (metal plates or duplicated phrases) report recovery success rates above 80%, versus sub‑50% for those without backups.

- Average cold wallet transaction volumes increased by roughly 12–14% year‑over‑year, signaling more active usage despite access concerns.

- Multi‑medium backup practices (metal, offline digital, and paper) are associated with recovery rates 20–30 percentage points higher than single paper backups alone.

- Surveys find that about 40–45% of hardware wallet owners use specialized steel or metal seed storage to protect recovery data from fire and physical damage.

User Error, Lost Keys, and Backup Practices

- 15% of wallet breaches involve seed-phrase or private-key compromise as the primary user error.

- 70% of stolen funds stem from private-key or seed-phrase mishandling incidents.

- Less than 50% of self-custody users feel confident in seed phrase recovery practices.

- Device loss or theft causes over 20% of self-custody wallet user errors.

- Asset mis-transfer errors occur at a 5-8% rate among multi-chain cold wallet users.

- 48% of exchange breaches are linked to phishing, often leading to improper seed handling.

- Metal or multi-copy backups reduce loss incidents by 60% compared to single paper copies.

- 35% of crypto users cite poor backup practices as the top self-reported cold wallet issue.

User Trust, Satisfaction, and Confidence in Cold Wallets

- 78% of cold wallet owners report higher trust in offline security versus hot wallets.

- 85% of users cite rising thefts as boosting confidence in cold storage protection.

- Cold wallet satisfaction scores average 4.2/5 despite usability challenges in surveys.

- 92% of users link device reputation and manufacturer support to overall confidence.

- 65% of consumers view cold wallets as core self-custody tools long-term.

- Simpler onboarding correlates with 25% higher satisfaction ratings among new users.

- 88% of institutional clients show elevated confidence with audit and insurance features.

- Community feedback identifies ease-of-use improvements as a priority for 72% of respondents.

Demographic Breakdown of Cold Wallet Users

- 25–34 age group represents 45% of cold wallet owners, blending hot/cold strategies.

- 35–44 cohort accounts for 28% of hardware wallet users, favoring long-term storage.

- U.S. users comprise 39% of global cold wallet adoption despite 4% world’s population.

- India shows 15–20% cold wallet penetration among 100+ million total crypto holders.

- Males represent 72% of cold wallet owners, with female adoption rising 12% YoY.

- High-value holders (>$10K) allocate 65% of portfolios to cold storage vs 25% for smaller accounts.

- Tech-savvy professionals show 82% preference for cold wallets over the general population’s 22%.

- Emerging markets exhibit a 10–15% cold adoption rate, rising with asset values above $5K.

- Older investors (45+) cite security as motivation for 55% cold wallet usage.

Enterprise and Institutional Cold Storage Solutions

- Institutions account for 68.9% of the hardware wallet market revenue through enterprise solutions.

- Institutional cold wallet adoption surged 51% year-over-year amid compliance needs.

- 43% of institutional wallets utilize custodial multi-signature cold storage setups.

- Crypto custody firms like BitGo manage over $100 billion in insured offline assets.

- 65% of institutions plan increased crypto allocations with dedicated cold vaults.

- Enterprise cold storage supports 99.9% offline reserves for major exchange treasuries.

- Redundancy features appear in 88% of institutional custody protocols for risk mitigation.

- Regulatory-compliant cold solutions capture 75% of new institutional custody demand.

Regulatory and Compliance Trends Affecting Cold Storage

- 43% of institutional wallets incorporate custodial compliance features for regulatory standards.

- U.S. and EU custody rules mandate audit trails in 88% of institutional cold storage protocols.

- Regulatory uncertainty impacts 30% of hardware wallet adoption decisions among enterprises.

- 65% of institutions seek certified cold vault services meeting AML/KYC requirements.

- Compliance reporting is integrated into 75% of regulated custodial cold solutions.

- MiCA framework influences 40% growth in EU-compliant cold storage providers.

- 68.9% hardware wallet revenue is tied to governance and compliance features.

- Audit readiness boosts institutional confidence in 82% of surveyed custody providers.

Cold Wallet Integration with DeFi and Web3

- 25% of DeFi users employ hybrid cold wallet solutions for secure offline signing.

- Multi-chain cold wallets support 5,000+ tokens, enabling broad DeFi participation.

- 40% growth in companion apps bridging cold wallets to Web3 dApps via QR/Bluetooth.

- NFT marketplace integrations see 35% of high-value transactions signed offline.

- 68% of advanced users demand multi-sig DeFi compatibility in hardware wallets.

- Bluetooth-enabled cold wallets capture 15% market share for Web3 connectivity.

- 82% of institutional DeFi allocations require compliant cold signing workflows.

- QR-based transaction protocols are adopted by 55% of modern cold wallet models.

Frequently Asked Questions (FAQs)

Cold wallets accounted for approximately 22 % of the overall cryptocurrency wallet market in 2025.

Hot wallets remained dominant, with about 78 % of all crypto wallet users opting for hot wallets in 2025.

More than 71 % of cryptocurrency users reported a preference for hardware wallets due to enhanced encryption and private key control.

Conclusion

Cryptocurrency cold wallets continue to evolve as a vital layer of digital asset security. Across individual and institutional segments, cold storage adoption is shaped by security priorities, regulatory shifts, and technological innovation. However, challenges like user errors, lost keys, and integration hurdles persist. As both DeFi and compliance ecosystems mature, cold wallets will play a growing role in safeguarding long‑term crypto holdings and meeting governance expectations. The data outlined here highlights clear trends toward robust offline custody while underscoring opportunities for improved usability and trust.