Regulation of cryptocurrencies in China remains one of the most closely watched and tightly enforced frameworks in the world. Over the past few years, Beijing has repeatedly reaffirmed its ban on crypto trading and mining to preserve financial stability, control capital flows, and steer innovation toward state-backed digital solutions. These measures influence global markets, shape mining and investment behavior, and affect how international crypto firms approach China. Read on to see key statistics that illustrate the current regulatory environment.

Editor’s Choice

- In 2025, the People’s Bank of China (PBOC) reasserted that all crypto-related business remains illegal.

- Despite the ban, as of October 2025, China accounts for about 14 % of global Bitcoin mining hashrate, making it the world’s third-largest mining hub.

- Recent multi-agency enforcement efforts target not only trading and mining, but also stablecoins and real-world asset (RWA) tokenization.

- Courts in China have, at times, ruled that cryptocurrencies count as property, providing limited legal protection to individual holders.

- The 2025 global adoption rankings show that China is far behind leading crypto adoption countries, reflecting the domestic ban’s impact.

- Hong Kong, within China’s broader geopolitical sphere, has adopted a regulated approach to digital assets, creating a de facto two-tier system.

- The resurgence of mining in 2025, despite a formal ban, shows a gap between public policy and economic incentives.

Recent Developments

- China hosts 59 million crypto users, representing 8-10% of the global total.

- Underground Bitcoin mining reaches 14-20% of global hashrate.

- Chinese mining capacity surges to 145 EH/s, ranking third worldwide.

- PBOC convenes with 13 agencies to enforce virtual currency bans.

- China scores 0.6 on the 2025 global crypto regulation index, the worst ranking.

- Stablecoin usage declines sharply due to wallet blocks and restrictions.

- Canaan’s sales to China exceeded 50% in Q2 from mining demand.

- Digital yuan transactions surpass 14.2 trillion in cumulative volume.

- Yuan’s share of global payments falls to 0.88%, the lowest in two years.

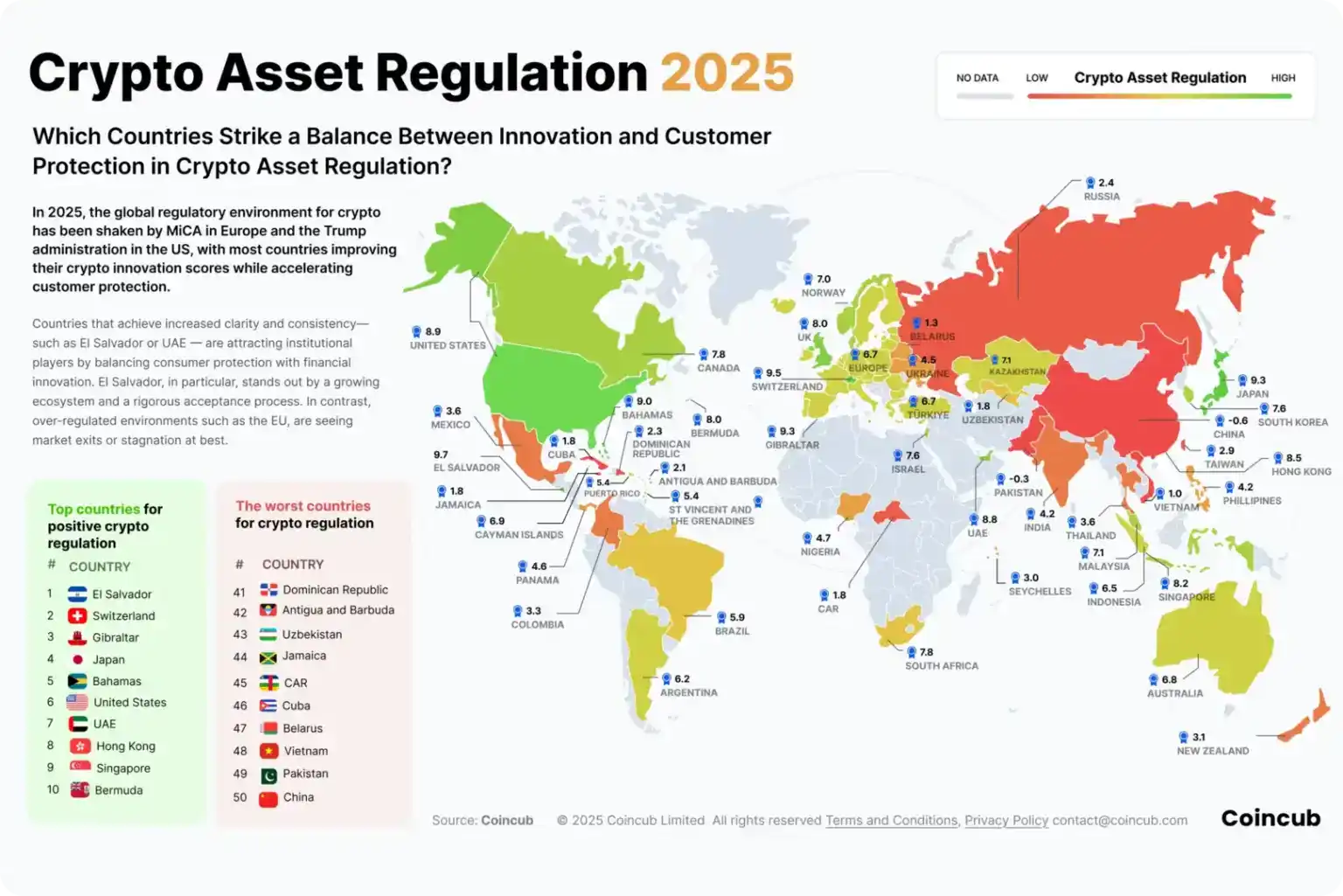

Crypto Asset Regulation Statistics

- El Salvador leads globally with a score of 9.7, praised for its balanced and welcoming crypto regulation.

- Switzerland and Gibraltar follow, combining strong investor protections with pro-innovation policies.

- Japan and The Bahamas also rank in the top 5 for having favorable crypto environments.

- United States earns a score of 8.9, reflecting improved regulatory clarity in recent years.

- Hong Kong scores 8.5 and Singapore 8.2, attracting institutions with innovation-friendly laws.

- China ranks lowest in 2025 with a score of 0.6 due to aggressive bans and restrictions.

- Pakistan scores –0.3, signaling one of the strictest crackdowns on crypto globally.

- Belarus (1.3), Uzbekistan (1.8), Cuba (1.8), and Vietnam (3.0) show weak or unclear frameworks.

- Dominican Republic and Antigua & Barbuda are in the bottom 10 due to restrictive or inconsistent policies.

Legal Status and Rulings

- China hosts 59 million crypto owners despite nationwide bans.

- Crypto cases in courts drop to 11 amid stricter enforcement.

- Penalties for crypto cases spike over 3,000%.

- 26% of Greater China ETF investors eye crypto exposure.

- Courts recognize crypto as property in civil disputes.

- Crypto transaction activity falls 22% post-ban.

- Blockchain services file over 4,000 with regulators.

- Courts deny protection in 100% of illegal trading claims.

- China ranks 0.6 on the global crypto legality index.

Cryptocurrency Ownership Statistics

- China records 59 million crypto owners despite bans.

- This equals 10% of global crypto users worldwide.

- Global crypto owners reach 580-861 million total.

- China ranks 2nd globally by user count after India.

- Ownership penetration drops to 4.15-5.5% of the population.

- 26% of Greater China ETF investors plan crypto exposure.

- Transaction activity declines 22% post-2021 restrictions.

- China is placed in the top 50 global adoption rankings.

- Underground P2P and VPN usage persists covertly.

Investor Demographics and Behavior Statistics

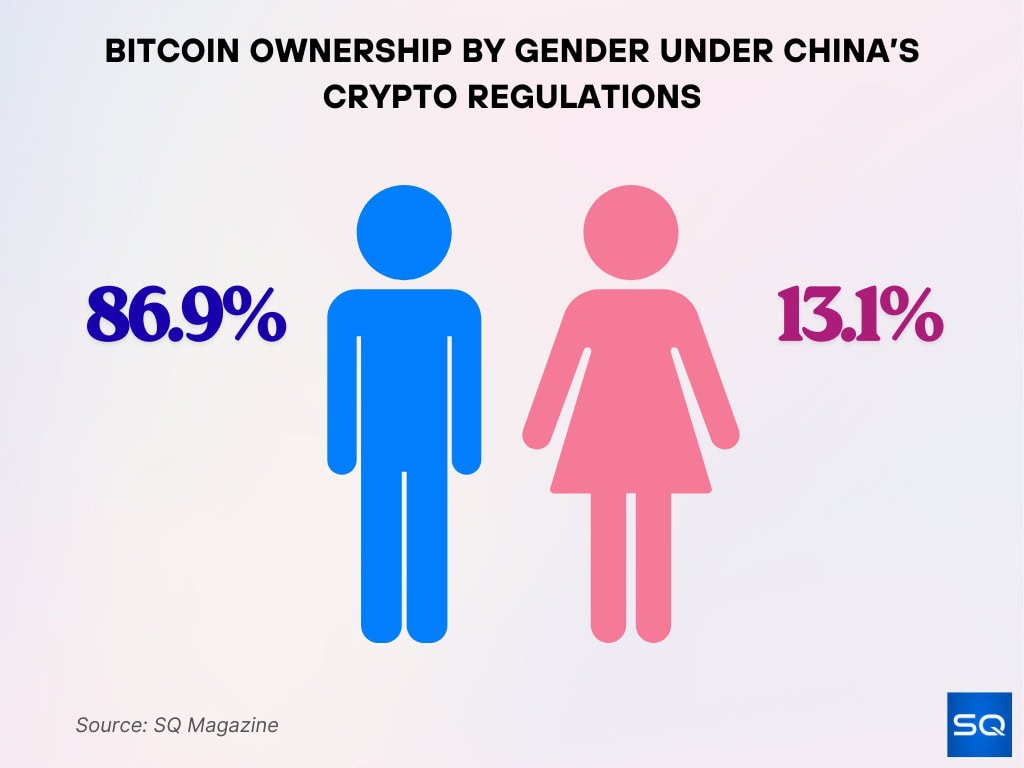

- 86.9% of Bitcoin holders are male, highlighting a strong gender dominance in crypto investing.

- Only 13.1% of Bitcoin holders are female, exposing a major gender gap in digital asset ownership.

Investor Demographics and Behavior

- China crypto users skew 86.9% male, 13.1% female.

- 25–34 age group comprises 31% of users.

- 26% of Greater China ETF investors seek crypto exposure.

- Illicit OTC crypto trading hits $75 billion.

- 61% male dominance persists globally among owners.

- 19% growth in first-time adopters worldwide.

- Millennials hold 40% of total crypto users.

- Gen Z represents 28% of global participants.

- 72% new users adopt via mobile-first platforms.

Impact of Bans on Markets

- Underground OTC crypto trading reaches $75 billion.

- Bitcoin drops 5-10% after PBOC ban reaffirmation.

- Crypto transaction activity falls 22% post-2021 ban.

- Global market cap dips to $2.93 trillion following crackdown.

- Chinese users contribute $86.4 billion in raw volume.

- Liquidations hit $750 million in long positions.

- Black market crypto surges to $23.7 billion.

- Hashrate temporarily declines due to mining shutdowns.

- Q1 centralized exchange volume records $5.4 trillion globally.

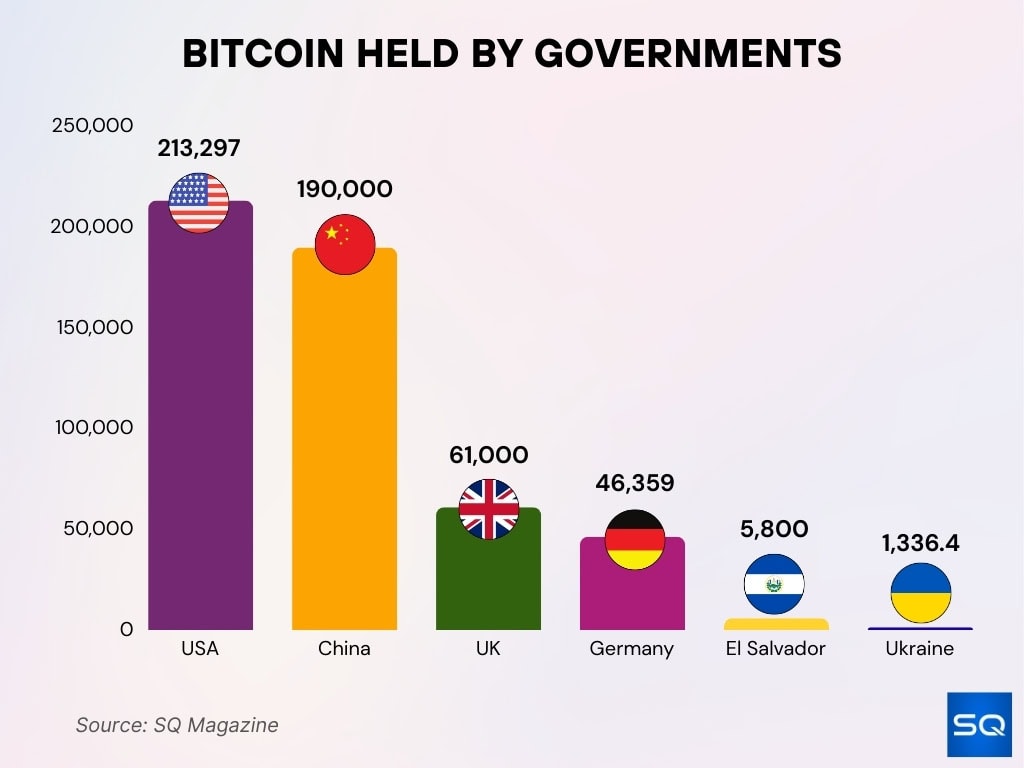

Bitcoin Held by Governments

- USA leads with 213,297 BTC, making it the largest government Bitcoin holder in the world.

- China holds 190,000 BTC, maintaining a strong crypto presence despite domestic bans.

- UK owns 61,000 BTC, placing it firmly among the top three state holders of Bitcoin.

- Germany holds 46,359 BTC, reflecting its calculated involvement in digital assets.

- El Salvador holds 5,800 BTC, underscoring its pioneering move to adopt Bitcoin as legal tender.

- Ukraine owns 1,336.4 BTC, marking a notable reserve amid ongoing financial challenges.

Mining Crackdown Trends

- China mining share rebounds to 14.06% global hashrate.

- Underground operations hit 145 EH/s, third worldwide.

- Pre-2021 dominance stood at 65-75% global hashrate.

- Q1 2025 share rises from 13.75% to 14.06%.

- Relocated miners boost North America by 30%.

- Chinese pools control 55% network despite bans.

- Canaan exports to China exceed 50% Q2 sales.

- Global hashrate redistributes post-crackdown exodus.

- Energy savings align with ban objectives.

CBDC Adoption Figures

- e-CNY cumulative transactions reach 14.2 trillion yuan.

- 225 million personal wallets opened on the app.

- 3.32 billion total transactions processed.

- Pilot covers 26 localities across 17 regions.

- User base hits 260 million wallets.

- Q1 active users grow 30% year-over-year.

- Covers 29 cities with expanding pilots.

- An international operations center was established in Shanghai.

- 70% support for CBDC among the population.

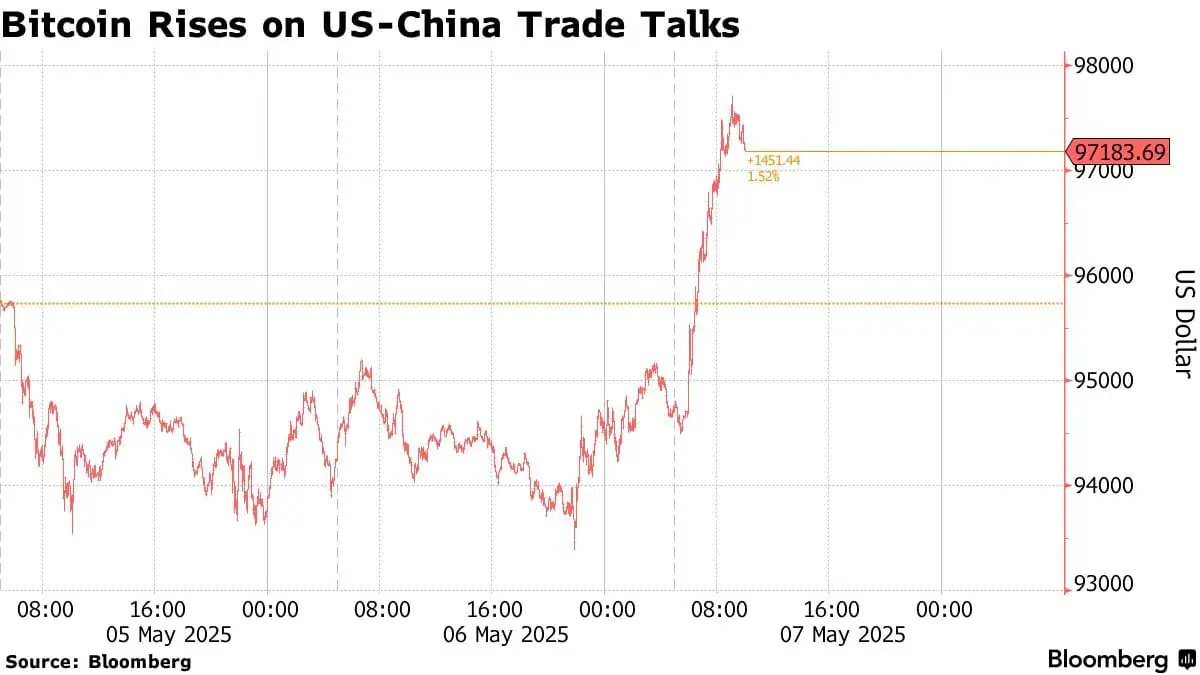

Bitcoin Surge During US-China Trade Talks

- Bitcoin hit $97,183.69 on 7 May 2025, driven by renewed optimism in US-China trade negotiations.

- Price surged by +$1,451.44 (+1.52%) in a single day, marking a strong bullish move.

- From 5–6 May 2025, Bitcoin ranged between $93,000 and $96,000, showing short-term sideways action.

- Breakout occurred on the morning of 7 May 2025, fueled by positive trade talk momentum.

- The spike shows how geopolitical news still heavily impacts Bitcoin’s short-term price movements.

Cross-Border Flows Data

- Asia-Pacific on-chain value peaks at $244 billion monthly.

- Regional inflows sustain above $185 billion monthly.

- APAC crypto volume grows 69% year-over-year.

- Chinese users drive $86.4 billion in transaction volume.

- Cross-border Bitcoin flows peak $2.6 trillion.

- Stablecoins comprise 50% of cross-border volume.

- APAC totals $2.36 trillion in annual crypto activity.

- Global cross-border payments hit $40 trillion.

- Chinese illicit flows contribute to $21.8 billion in laundering.

Illicit Activities Trends

- In 2024, wallets linked to illicit crypto activity received at least $40.9 billion globally.

- Of that total, approximately $10.8 billion flowed to entities categorized as direct illicit-actor organizations.

- Crypto hacks accounted for roughly $2.2 billion stolen worldwide in 2024.

- Criminal groups continue to exploit crypto for laundering, fraud, extortion, and ransomware payments.

- Stablecoins and mixer-based transactions now dominate many laundering routes.

- Although illicit crypto activity fell to about 0.4% of total volume in 2024, absolute values remain high.

- Illicit use now spans scams, DeFi exploits, darknet markets, and cross-chain transfers.

- Research has identified more than 1,100 illicit blockchain addresses tied to organized criminal campaigns.

Enforcement Actions and Penalties

- Crypto crime penalties surge 3,000% in court cases.

- Money laundering cases hit 3,032 individuals prosecuted.

- Crypto-related crimes reach 430.7 billion yuan ($59 billion).

- Local penalty revenues climb 65% to 378 billion yuan.

- Underground networks laundered $136 million seized.

- Illicit crypto volume drops to 0.4% of total.

- 13 agencies coordinate the PBOC enforcement meeting.

- Social media accounts shut down exceed 12 platforms.

- Global illicit seizures total $15 billion in bitcoin.

Blockchain vs Crypto Policy

- The blockchain market reaches $39.7 billion globally.

- China invests 400 billion yuan annually in blockchain.

- Over 100 enterprises offer blockchain applications.

- Healthcare adopts blockchain in 55% applications.

- 86% tech teams see blockchain benefits.

- Blockchain assets have exceeded $270 billion.

- 68% CEOs cite privacy as a key hurdle.

Public & Institutional Sentiment in Crypto

- 26% Greater China ETF investors seek crypto exposure.

- Institutional holdings have declined by over 70% since 2020.

- 59% familiar adults lack crypto security confidence.

- 40% owners doubt technology safety.

- 75% fraud victims skipped due diligence.

- 24% US leads global crypto fraud cases.

- 60% expect crypto value to rise under Trump.

- 46% believe Trump boosts US adoption.

- 80% investors see AI positive societal impact.

Macroeconomic and Financial Stability Considerations

- Illicit crypto volume totals $40.9 billion globally.

- Crypto laundering reaches $21.8 billion worldwide.

- China’s illicit flows hit $59 billion in crimes.

- Fraud losses surge 27% to $5.6 billion.

- Mixers launder $1.2 billion despite crackdowns.

- Regulatory costs climb 65% to 378 billion yuan.

- Stablecoin illicit use drops to 15% of volume.

- Crypto scams cause $3.7 billion in investor losses.

- Enforcement actions prosecuted 3,032 cases.

Frequently Asked Questions (FAQs)

China accounts for about 14% of the global Bitcoin mining hash rate as of October 2025.

China’s Bitcoin mining hash rate rose from 13.75% in Q1 2025 to 14.06% in the current quarter.

In November 2025, China’s central bank reaffirmed that virtual currencies are not legal tender and declared related business activities illegal.

Conclusion

Global cryptocurrency activity continues to present both innovation potential and significant regulatory challenges. Billions of dollars still move through illicit channels, while enforcement and compliance efforts intensify worldwide. China’s approach, banning private crypto while promoting blockchain and the digital yuan, reflects a broader strategy to balance technological progress with financial stability. For investors, institutions, and policymakers, the data underscores a clear reality: risk management and regulatory clarity now define the future of digital assets.