Crypto payment gateways, platforms that let merchants accept cryptocurrency and convert it, or settle it, into fiat or stablecoins, are reshaping digital commerce. They are helping e‑commerce sites reduce cross‑border friction and enabling startups in Web3 to support on‑chain checkout. For example, a gaming company might let users pay in ETH or USDC directly at checkout, while a global freelancer platform could accept crypto payments from clients in multiple jurisdictions. Read on to see how metrics and trends are evolving in this space.

Editor’s Choice

- The global crypto payment gateway market is projected to reach $1.68 billion by 2025.

- The gateway market was valued at approximately $1.69 billion in prior years and is expected to grow with a CAGR of 18.9 %.

- The traditional payment gateway market (all payment types) is forecast to hit $47 billion in 2025.

- In 2025, 87 % of crypto transactions are processed via mobile devices.

- More than 659 million people globally are using cryptocurrency as of 2025, roughly 1 in 13.

- In some surveys, 32 % of small business owners report accepting crypto payments.

- Stablecoins now account for approximately 70 % of crypto payment volume.

Recent Developments

- Gateways are increasingly doubling as fiat off-ramps, letting merchants instantly convert crypto into local currency.

- Coinbase recently announced waived fees for PayPal’s stablecoin (PYUSD) to boost adoption in merchant payments.

- Stripe has reintroduced support for USDC in commerce and is exploring deeper crypto integrations.

- Square, Block, plans to enable Bitcoin payments via the Lightning network for its POS merchants by 2026.

- More gateways are emphasizing multi‑chain and cross‑chain ability, supporting Bitcoin, Ethereum, and Solana concurrently.

- The market sees growing M&A and consolidation, with smaller providers merging or being acquired.

- Growing regulatory clarity, e.g., MiCA in the EU, U.S. stablecoin bills, is encouraging providers to scale operations.

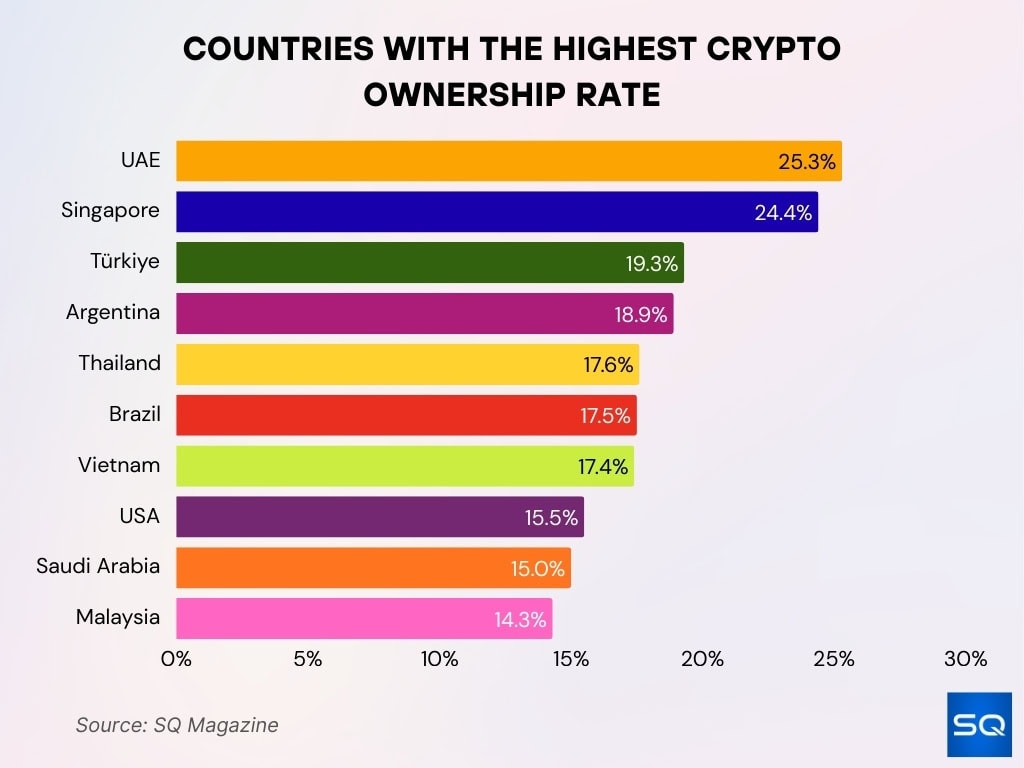

Top Countries by Crypto Ownership

- UAE leads globally with 25.3% ownership, the highest adoption rate.

- Singapore follows with 24.4%, confirming its status as a crypto hub.

- Türkiye shows 19.3%, reflecting strong retail participation.

- Argentina records 18.9%, driven by inflation-hedging demand.

- Thailand posts 17.6%, signaling robust Southeast Asian adoption.

- Brazil sits at 17.5%, underscoring Latin America’s growing interest.

- Vietnam reaches 17.4%, boosted by remittances and retail usage.

- USA stands at 15.5%, showing steady mainstream expansion.

- Saudi Arabia holds 15%, reflecting rising regional investments.

- Malaysia rounds out the top 10 with 14.3%, showing stable adoption in Asia.

Benefits of Using Crypto Payment Gateways

- Lower fees: Many crypto gateways charge ~1 %, often lower than credit card fees, ~2–3 %.

- Faster cross‑border settlement: Without correspondent banks or SWIFT delays.

- Access to new markets: Especially unbanked or underbanked populations in emerging economies.

- Reduced chargebacks: On-chain payments are irreversible by default.

- Transparency: All transactions are recorded on the blockchain, simplifying audit trails.

- Programmability: Payments can trigger smart contracts or conditional logic, e.g., escrow.

- Stablecoin settlement: Merchants can receive stablecoin to avoid volatility.

- Brand differentiation: Early adoption can position a business as crypto‑friendly.

- Partial decentralization: Non‑custodial models let merchants retain control over wallets.

Business Sectors Adopting Crypto Payment Gateways

- In 2024–2025, 78 % of Fortune 500 companies are either exploring or piloting crypto payments, especially for international B2B transfers.

- Among surveyed merchants, 46 % have already integrated cryptocurrency as a payment option.

- Bitcoin still leads in merchant usage, accounting for around 42 % of merchant crypto transactions in 2025.

- USDT, a stablecoin, makes up 30–35 % of merchant crypto payment volume in many markets.

- E‑commerce adoption of crypto grew ~38 % year-over-year, pushing the number of merchants accepting digital assets beyond 32,000.

- Sectors showing the highest uptake include: digital goods & entertainment, travel & lodging, gaming, donation & non‑profit, and cross-border remittances.

- Many B2B platforms are enabling crypto invoicing or settlement in stablecoins to bypass FX and banking delays.

- Some SaaS and subscription-based businesses are experimenting with recurring crypto billing using smart contracts.

- Payment gateways report that ~90 % of their merchant clients demand support for multi‑currency and multi‑chain tokens.

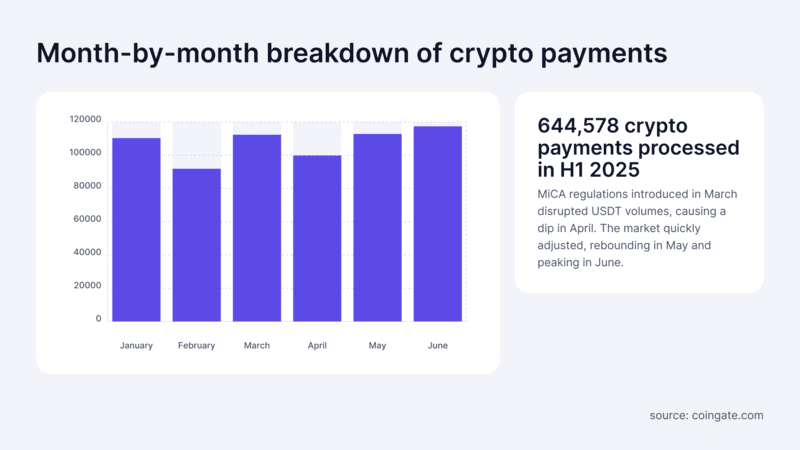

Monthly Crypto Payment Trends

- A total of 644,578 crypto payments were processed in the first half of 2025.

- January started strong with 110,000 payments.

- February dropped to 90,000 payments, the lowest point of H1.

- March rebounded with 111,000 payments before MiCA regulations took effect.

- April slipped to 99,000 payments as MiCA rules impacted USDT usage.

- May recovered with 111,000 payments, showing a swift market adjustment.

- June peaked at 118,000 payments, the highest in H1 2025.

Security in Crypto Payment Gateways

- Around 90 % of crypto gateways will enforce AML and KYC compliance in 2025.

- Blockchain-based payment systems are increasingly used for auditability, with 36 % of surveyed organizations saying blockchain is “crucial” for regulatory compliance and tracking flows.

- Newer designs combine permissioned blockchains, central bank digital currency components, and cryptographic controls to enhance security.

- Gateways deploy real-time fraud detection models, AI/ML, to detect abnormal patterns and mitigate double spends or address reuse attacks.

- Some platforms require multi-signature control or hardware security modules (HSMs) to protect private keys.

- Audit trails: immutable ledger records allow retroactive verification and dispute handling.

- Smart contract upgrades and patching risks are actively monitored, and protocol safety audits occur before deployment.

- In 2025, regulatory fines related to blockchain compliance spiked. In the first half of 2025, fines for financial institutions climbed 417 % year-over-year, amounting to $1.23 billion.

- To comply with custody rules, some gateways require third-party custodians to submit to regulatory inspections.

- Cryptographic proof systems, e.g., zero-knowledge proofs, are being tested to allow privacy-preserving verification without exposing user data.

Regulatory and Compliance Landscape for Crypto Payments

- As of 2025, about 30 countries globally have adopted clear regulatory frameworks for crypto payments.

- In 2025, regulatory penalties for noncompliance soared, global fines reached $1.23 billion in H1, up 417 % from H1 2024.

- In the U.S., the Crypto Task Force, by the SEC, continues to shape enforcement and regulatory interpretations.

- At the state level, U.S. crypto business policies expanded by ~25 % by 2025, easing licensing for gateways.

- The EU’s new AMLA, Anti‑Money Laundering Authority, has flagged crypto assets as a top money laundering threat in 2025, urging tighter controls.

- Only 40 of 138 assessed jurisdictions met FATF’s “largely compliant” standard for crypto regulation as of April 2025.

- In Britain, Coinbase’s payments arm was fined £3.5 million for failures in financial crime controls, signaling stricter oversight.

- European fintech licensing under MiCAR, Markets in Crypto‑Assets Regulation, is reshaping crypto gateway registration in the EU.

- Custody and third-party custodians are under increased regulatory scrutiny; 2025 guidance calls for regular audits of custodians.

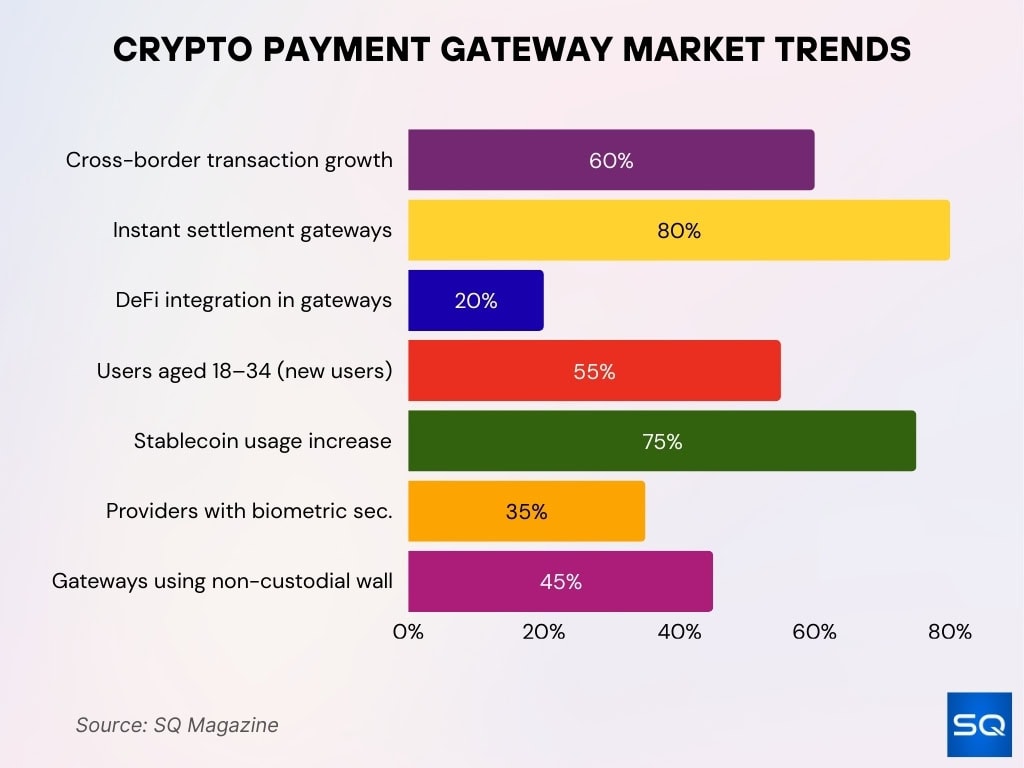

Key Crypto Payment Gateway Trends

- Cross-border transactions surged by 60% in 2025 as gateways cut currency conversion and banking fees.

- Nearly 80% of gateways enabled instant settlement, reducing fiat conversion time for businesses.

- DeFi integration expanded to 20% of gateways, offering decentralized finance payment options.

- Around 55% of new users were aged 18–34, with Gen Z and Millennials leading adoption.

- Stablecoin usage in transactions rose by 75% between 2024–2025 as businesses favored stable rails.

- About 35% of providers adopted biometric security to enhance transaction protection.

- Non-custodial wallet adoption reached 45%, highlighting demand for user-controlled assets.

Fees and Cost Structure of Crypto Payment Gateways

- Many crypto gateways charge 0.5 % to 1 % per transaction, which is generally lower than credit card rates of 2 %-3 %.

- Some platforms offer flat‑fee models or tiered pricing depending on volume or selected settlement currency.

- Gateways that support fiat settlement sometimes add a conversion spread, e.g., 0.2 %–0.5 %, when converting crypto to local currency.

- Providers often impose minimum fees, e.g. $0.10, for very small transactions to ensure cost coverage.

- Volume discounts: merchants processing high volume may negotiate fees as low as 0.2 %.

- Some gateways charge a monthly subscription or platform fee in addition to per‑transaction fees.

- Hidden costs: gas or network fees, blockchain transaction costs, are often passed to the merchant or buyer, depending on configuration.

- For white‑label gateway development, the build cost ranges from $20,000 to 100,000, depending on complexity, security, and compliance features.

- There may be costs for KYC/AML checks per merchant or per user onboarding, especially in stricter jurisdictions.

Payment Gateway Technology and Innovation

- Around 50% of crypto payment platforms explored or supported the Lightning Network, with ongoing adoption driven by Bitcoin fee volatility and speed.

- Gateways are increasingly offering SDKs, APIs, plugins, and modular architectures for seamless integration into merchant systems.

- Some platforms use AI/ML fraud detection and behavior analytics to dynamically flag suspicious transactions.

- Real-time monitoring dashboards allow merchants immediate insight into transaction flows, status, and anomalies.

- Multi‑chain routing: gateways route transactions through the optimal chain for cost and speed, e.g., choosing a chain or bridge, to reduce latency and fees.

- Some solutions employ zero‑knowledge proof techniques to verify compliance without exposing user data, helping privacy and regulatory adherence.

- Hybrid protocols are being researched, combining algorithmic stabilization, cross‑chain liquidity, and AI arbitrage for better price stability.

- Use of atomic swaps and adaptor signatures is growing to reduce counterparty risk in cross‑chain transfers.

- Smart contract upgradeability, with governance or timelocks, is now standard for many gateway infrastructures to allow modular improvements.

- Some gateways incorporate liquidity aggregation across DEXs, centralized exchanges, and fiat ramps to ensure best execution for conversion.

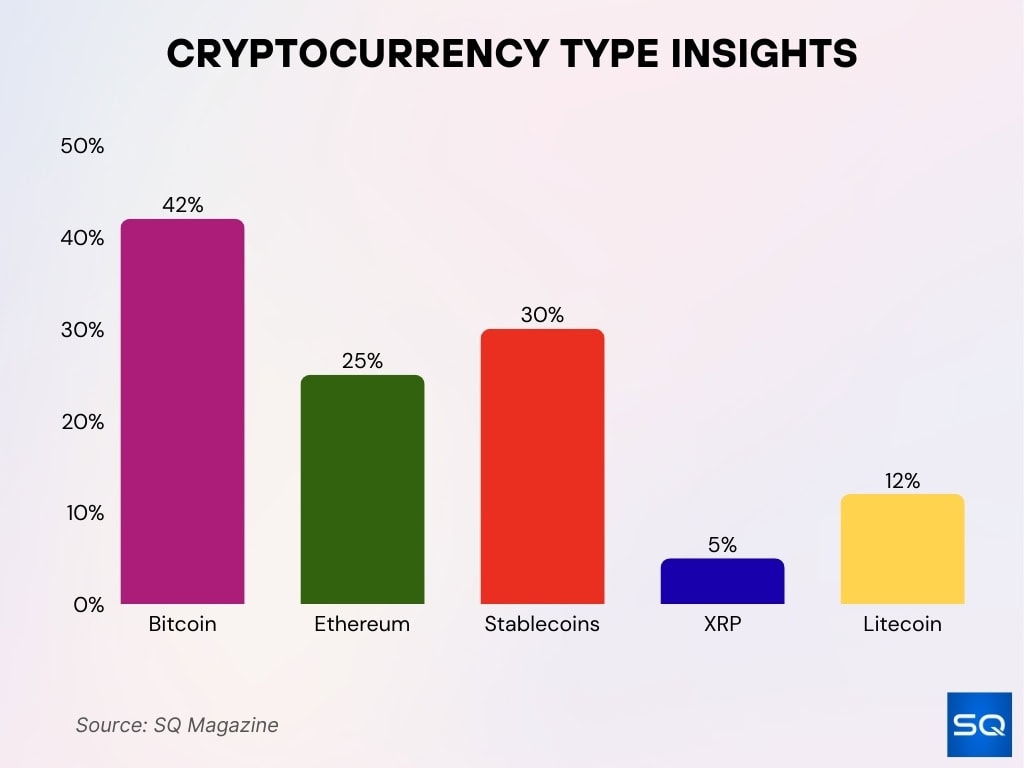

Cryptocurrency Usage Trends

- Bitcoin leads with 42% of crypto payments, remaining the top choice in gateways.

- Ethereum captures 25% of transactions, driven by DeFi and smart contract use cases.

- Stablecoins (USDT, USDC) account for 30% of volume, preferred for their price stability.

- Ripple’s XRP holds a 5% share, mainly in cross-border payment flows.

- Litecoin (LTC) saw a 12% rise in volume, offering faster and lower-fee transactions.

Role of Stablecoins in Crypto Payments

- In 2025, stablecoin transactions represent roughly 76 % of all crypto payment volume, driven by USDT, USDC, and FDUSD.

- 90 % of payments firms view stablecoins as already powering payments today.

- 86 % of surveyed firms say stablecoin infrastructure is ready for scale.

- In Latin America, 71 % of respondents use stablecoins for cross‑border payments.

- 48 % of firms cite faster settlement as a primary driver for stablecoin adoption.

- The GENIUS Act, passed in the U.S. in 2025, establishes requirements for stablecoins, e.g., full reserve backing, audits, and lending legal clarity.

- Some central banks and bank consortia are exploring regulated stablecoin alternatives, e.g. euro‑denominated stablecoin by European banks, for payments.

- J.P. Morgan forecasts stablecoin growth more conservatively and notes that only ~6 % of stablecoin demand currently ties to payments.

Layer 2 and Cross‑Chain Solutions in Crypto Gateways

- By 2025, Layer 2 networks, Polygon, Arbitrum, Base, Optimism, have become primary rails for stablecoin payments rather than just ETH scaling layers.

- On Base, USDC dominates, around 60 %, of payments, the rest in ETH.

- On Arbitrum, ETH’s share in payments dropped significantly; stablecoins now exceed 70 % of transactions on many L2s.

- Approximately 52 % of crypto payment providers support Lightning Network, a layer 2 approach for Bitcoin.

- Cross‑chain bridges and routers allow gateways to move assets across chains to optimize gas, liquidity, or settlement paths.

- Some architectures use adapter signatures and cross‑chain atomic swaps to maintain atomicity and trustlessness across chains.

- AI-driven arbitrage around these cross‑chain flows helps maintain peg and liquidity balance.

- Non‑EVM chain support, e.g., Solana, BSC, Cosmos, is essential in many gateways to capture broader usage.

- Gateways increasingly support multi‑chain settlement, letting merchants receive funds on a preferred chain or in fiat from any chain.

- Because gas fees on some chains are volatile, cross‑chain fallback logic, choosing cheaper rails, is now standard in many gateway systems.

Frequently Asked Questions (FAQs)

The crypto gateway segment is expected to grow from $1.69 billion to about $2.0 billion, implying a CAGR of ~18.9 %.

Stablecoin transactions represent approximately 76 % of all crypto payment volume in 2025.

Around 43 % of e‑commerce platforms have integrated crypto payment options in 2025.

About 50% of crypto payment providers will offer support for the Lightning Network by 2025.

Daily volumes using stablecoins could reach at least $250 billion within the next few years.

Conclusion

Crypto payment gateways have matured well beyond experimentation. Businesses now view them as strategic infrastructure rather than speculative add-ons. Stablecoins lead in usage, layer 2 and cross‑chain tech provide faster, cheaper settlement, and evolving regulation, like the U.S. GENIUS Act, gives firms pathways to compliant scaling.

The future depends on innovation, and AI risk engines, atomic cross‑chain swaps, and hybrid stablecoin-fiat systems will shape which gateways become dominant. For any merchant, adopting a well-designed crypto gateway today isn’t just about keeping up; it’s about futureproofing.