Crypto hedge funds have emerged as an influential subset of alternative investments, blending digital assets with sophisticated trading and risk‑management techniques. In an environment of rising institutional interest, these funds are shaping how professional managers approach crypto exposure, portfolio diversification, and strategy innovation.

For example, traditional hedge funds are increasingly allocating capital to crypto, and institutional frameworks now support specialized digital asset products. As adoption grows, understanding the latest statistics offers insight into market boundaries and investor confidence. Continue reading to explore detailed, data‑driven trends defining crypto hedge funds.

Editor’s Choice

- >400 crypto hedge funds are active worldwide.

- 55% of traditional hedge funds hold some crypto exposure.

- The average crypto hedge fund size is approximately $132 million.

- Only ~9% of crypto hedge funds exceed $1 billion AUM.

- Crypto hedge fund AUM is estimated at $82.4 billion in 2025.

- Institutional allocations to crypto are poised to increase, with 71% planning higher exposure.

- Over half of hedge funds now show interest in tokenisation and digital asset adoption.

Recent Developments

- As of 2025, >55% of hedge funds hold some exposure to crypto, marking growth from the prior year’s 47%.

- Regulatory improvements, especially in the US, are cited as a key factor driving institutional crypto allocations.

- Traditional managers now increasingly consider tokenisation to enhance liquidity and expand product offerings.

- Institutional surveys suggest 59% of investors plan to allocate over 5% of AUM to cryptocurrencies.

- Crypto hedge fund infrastructure has matured with new service providers and third‑party custodians supporting operations.

- Digital asset trading tools and on‑chain analytics are increasingly used for decision‑making.

- Advances in AI‑driven strategies are boosting performance and operational efficiency.

- M&A and fundraising in the crypto ecosystem hit record levels in Q2 and Q3 2025.

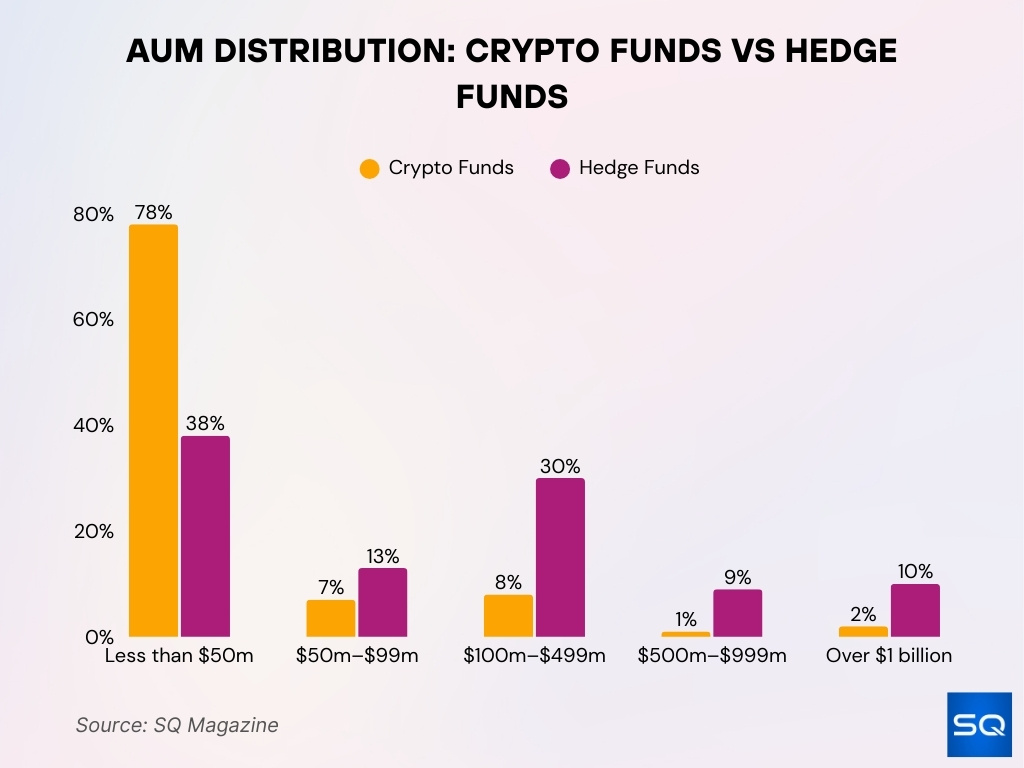

AUM Distribution: Crypto Funds vs Hedge Funds

- 78% of crypto funds manage under $50 million, versus 38% of hedge funds.

- Only 7% of crypto funds and 13% of hedge funds fall in the $50 million–$99 million bracket.

- 30% of hedge funds manage $100 million–$499 million, compared to just 8% of crypto funds.

- In the $500 million–$999 million range, 9% of hedge funds lead over 1% of crypto funds.

- 10% of hedge funds manage over $1 billion, while just 2% of crypto funds reach that tier.

Crypto Hedge Funds Statistics Overview

- 400+ active crypto hedge funds operate globally in 2025.

- Crypto hedge fund AUM is estimated at $136.2 billion in Q2 2025.

- The average individual crypto hedge fund manages about $132 million in assets.

- Around 9% of funds have AUM exceeding $1 billion.

- Funds under $25 million AUM represent approximately 27% of the market.

- North America accounts for an estimated 57% of total crypto hedge fund AUM.

- Institutional capital inflows into crypto hedge funds rose about 29% year‑over‑year.

- Crypto hedge funds represent a niche yet growing segment relative to the total hedge fund industry AUM.

Number of Active Crypto Hedge Funds Worldwide

- Over 400 active crypto hedge funds exist worldwide.

- 55% of traditional hedge funds now hold crypto exposure, up from 47% in 2024.

- Total crypto hedge fund AUM reached $136.2 billion in Q2 2025.

- The average crypto hedge fund size stands at $132 million AUM.

- 9% of crypto hedge funds exceed $1 billion in AUM.

- Crypto hedge funds in North America hold 57% of global AUM.

- Funds over $100 million AUM comprise 44% of the market.

- Average annual returns hit 36% for crypto hedge funds.

- Quantitative strategies account for 28% of crypto hedge funds.

- Institutional investors represent 56% of capital in crypto hedge funds.

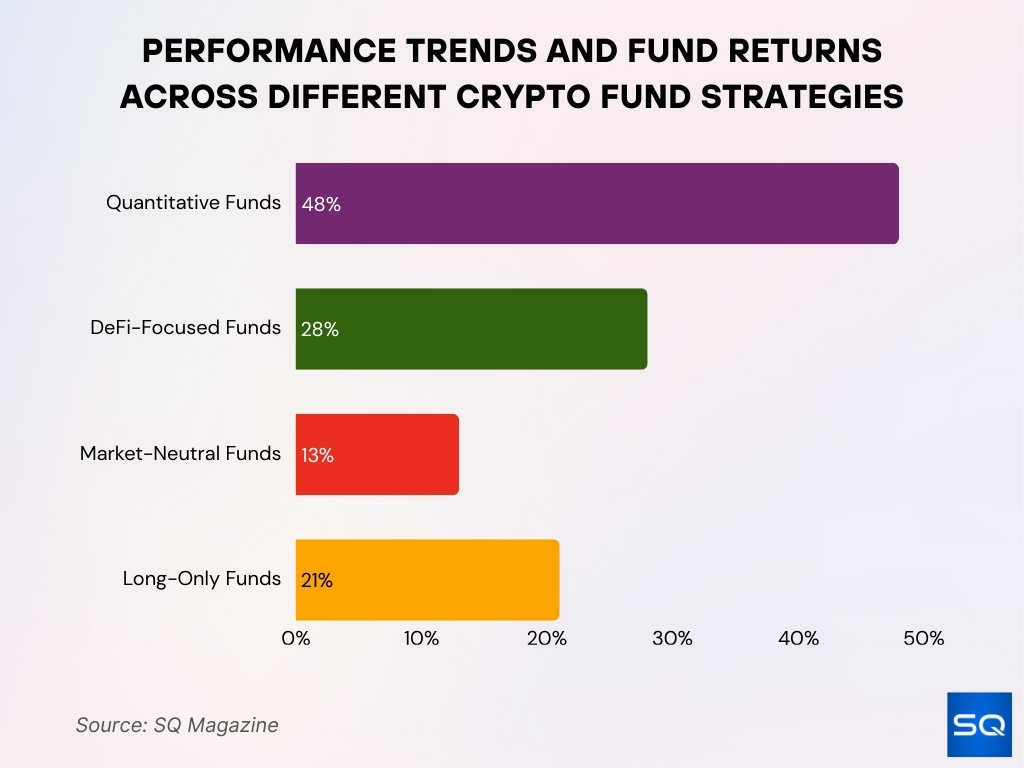

Fund Returns and Performance Measurement

- Crypto hedge funds averaged 36% annual returns in 2025 despite regulatory and macroeconomic headwinds.

- Quantitative funds led with 48% returns, boosted by AI-driven algorithmic trading strategies.

- DeFi-focused funds earned 28%, driven by staking, restaking, and decentralized lending.

- Market-neutral strategies delivered 13%, appealing to low-risk, conservative investors.

- Long-only crypto funds returned 21%, benefiting from bullish trends in Bitcoin and Ethereum.

- Average volatility hit 46%, much higher than traditional hedge fund benchmarks.

- Sharpe ratios averaged 1.6, reflecting stronger risk-adjusted performance.

- Monthly returns ranged from -18% to +52%, showing extreme variability in fund outcomes.

- High-frequency trading funds gained 22%, exploiting intraday volatility and inefficiencies.

- 83% of crypto hedge funds benchmark to BTC, while multi-asset funds use broader crypto indices.

Average Crypto Hedge Fund Size

- The average crypto hedge fund manages approximately $132 million in assets.

- This average reflects steady growth in fund capital since the early 2024 market data.

- Just 9% of funds hold over $1 billion AUM, showing limited large‑fund concentration.

- Funds holding between $100 million and $1 billion AUM make up a meaningful share of the market.

- Smaller funds (<$25 million AUM) still constitute over a quarter of all funds.

- Larger crypto hedge funds often attract institutional allocations and higher fee structures.

- Average fund sizes have expanded as regulatory clarity and infrastructure have improved.

- Differences in average size reflect strategy specialization and investor type (institutional vs retail).

Year‑on‑Year Growth of Crypto Hedge Funds

- Crypto hedge fund numbers grew year‑over‑year through 2025 as the asset class matured.

- Institutional interest increased notably, with 55% of traditional hedge funds now holding crypto.

- This adoption rate is up from 47% in 2024.

- Allocations remain modest on average but show expanding strategic commitment.

- An estimated 71% of funds with crypto exposure plan to increase allocations.

- Total crypto hedge fund AUM growth is supported by inflows and asset price appreciation.

- Growth momentum aligns with broader digital asset adoption in alternative portfolios.

- Year‑on‑year expansion highlights resilience despite market volatility.

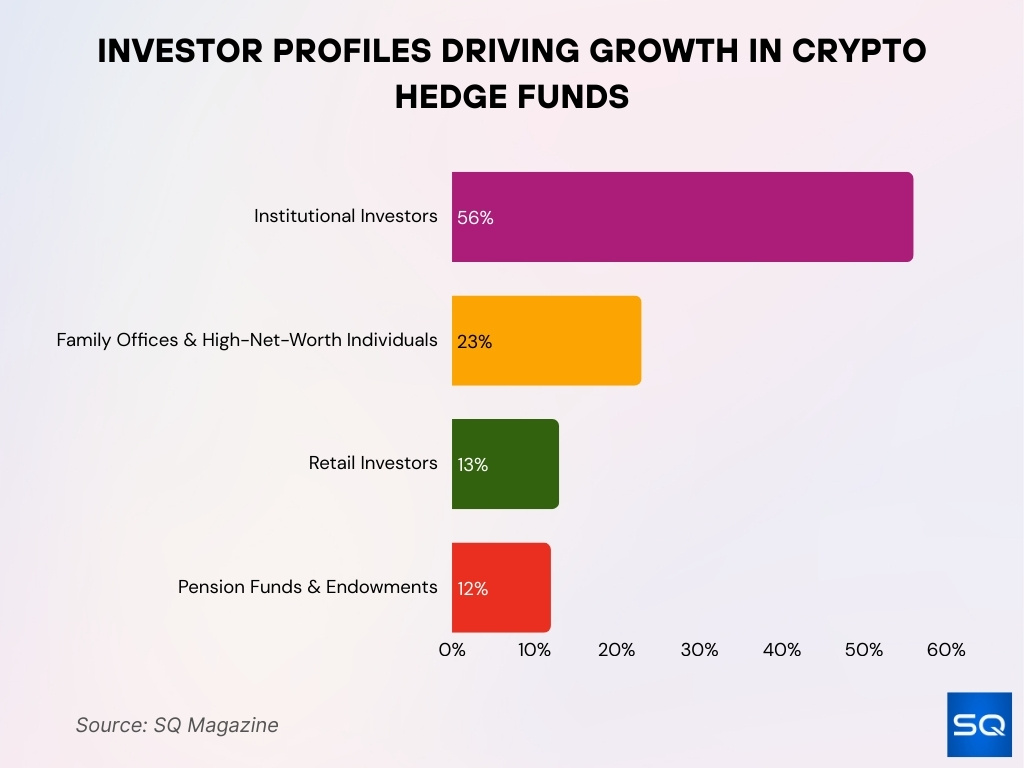

Institutional Adoption and Investor Demographics

- Institutional investors contribute 56% of total capital in crypto hedge funds, showing increased trust in the asset class.

- Family offices and high-net-worth individuals make up 23%, highlighting strong private wealth engagement.

- Retail investors represent just 13%, limited by access barriers and shifting regulations.

- 58% of institutions cite diversification as the top reason for investing in crypto hedge funds.

- Pension funds and endowments now provide 12% of institutional capital, reflecting growing conservative interest.

- 62% of crypto hedge funds are domiciled offshore, favoring tax-friendly and flexible legal environments.

- Average institutional ticket size is $11.4 million, showing deeper capital commitment.

- US institutions contribute 53%, followed by Europe at 31% and Asia at 16% of total crypto hedge fund capital.

- 47% of new 2025 capital came from institutions, confirming crypto’s mainstream investment appeal.

- Women now make up 17% of crypto hedge fund investors, showing gradual demographic expansion.

Crypto Hedge Fund Launches and Closures

- 262 new hedge funds launched in H1 2025 while 138 closed, netting +124 funds.

- Crypto hedge fund AUM grew around 20–25% year‑over‑year to approximately $136.2 billion by Q2 2025, reflecting both net inflows and market appreciation in the latest PwC/AIMA data.

- 82 fund liquidations occurred in Q3, the lowest quarterly rate in 20 years.

- Equity hedge strategies, including crypto hybrids, saw 60 new launches in Q2.

- Institutional allocations to crypto hedge funds reached 47% of new capital.

- 55% of hedge funds now hold crypto, up from 47%, driving hybrid launches.

- Crypto hedge fund closures limited to performance issues amid $71 billion inflows.

Risk‑Adjusted Performance Metrics (Sharpe, Sortino, Max Drawdown)

- Crypto hedge funds averaged a Sharpe ratio of 1.6 amid 46% volatility.

- Quantitative crypto strategies achieved Sharpe 1.58 and Sortino 2.03 in backtests.

- Bitcoin portfolios with 5% allocation showed a Sharpe ratio of 0.30 versus 0.17 for traditional portfolios.

- Bitcoin’s 10-year Sharpe ratio stood at 0.93–1.0, competitive with stocks.

- Average Sortino ratio for crypto hedge funds reached 3.2, focusing on downside risk.

- Crypto experienced potential drawdowns up to 70% over 12 months.

- 83% of crypto hedge funds benchmarked against BTC for risk metrics.

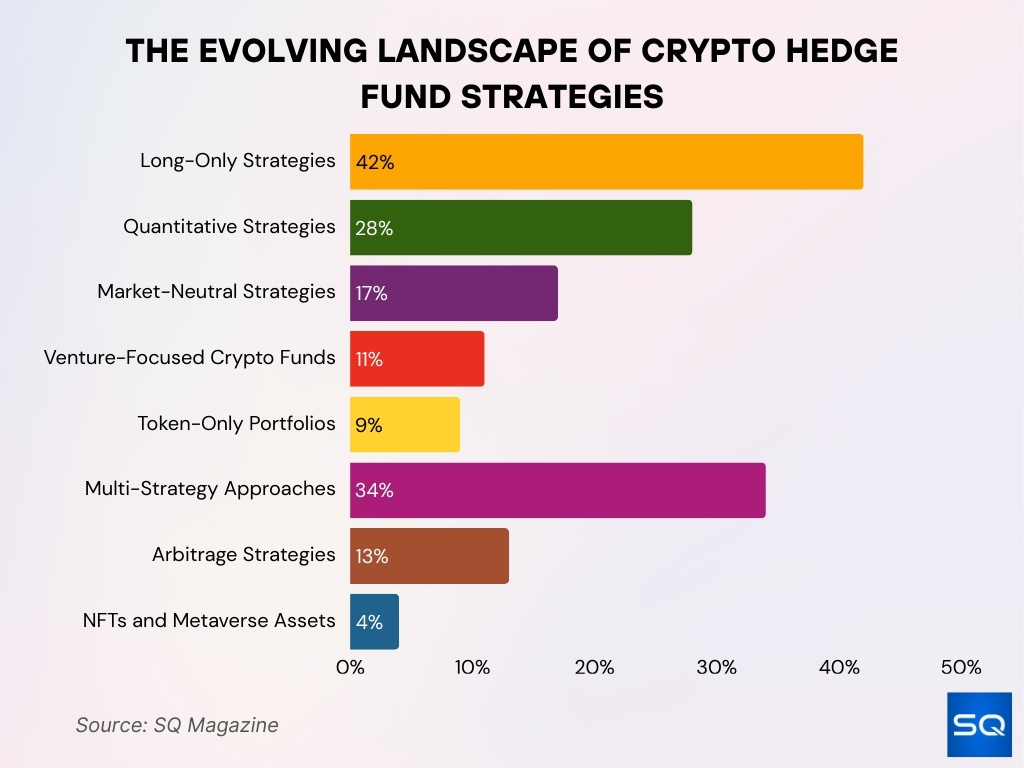

Crypto Investment Strategy Segmentation

- 42% of crypto hedge funds use long-only strategies, reflecting a strong belief in long-term sector growth.

- 28% of funds deploy quantitative strategies, powered by AI and real-time analytics.

- 17% use market-neutral approaches, aiming to minimize short-term volatility and directional risk.

- DeFi-focused funds expanded by 22% in 2025, driven by staking and yield farming on Ethereum and Layer-2s.

- 11% of funds are venture-focused, investing in early-stage infrastructure and Web3 projects.

- 9% manage token-only portfolios, avoiding traditional hedging or non-token assets.

- 34% adopt multi-strategy models, blending diverse methods for stronger risk-adjusted outcomes.

- 13% engage in arbitrage strategies, exploiting price gaps across exchanges and geographies.

- 4% of funds are exposed to NFTs and metaverse tokens, slightly down due to market consolidation.

- Token staking strategies grew by 24%, supported by passive income demand in PoS ecosystems.

Comparison with Traditional Hedge Fund Performance

- As of 2025, the traditional hedge fund industry’s HFR Cryptocurrency Index posted notable pressures, including an ‑8.0% loss in November 2025, reflecting crypto volatility.

- Traditional hedge funds across all strategies achieved an average of ~16.6% gain through the first three quarters of 2025, led by multi‑strategy firms.

- Traditional multi‑strategy hedge funds averaged ~19.3% returns by Q3 2025, often outperforming specialized crypto strategies.

- Some macro hedge funds achieved 30%+ annual returns in 2025, illustrating strong alpha potential in traditional markets.

- The broader hedge fund industry hit nearly $5 trillion AUM by Q3 2025, dwarfing crypto hedge funds’ collective capital base.

Directional and Long‑Only Strategy Statistics

- Directional long-only strategies represent 24% of crypto hedge funds.

- Long-only approaches focus on Bitcoin (86%) and Ethereum (80%) holdings.

- 19% of crypto hedge funds follow discretionary long-only strategies.

- Directional strategies captured 12% outperformance versus general crypto funds.

- Long-only mandates show the highest sensitivity to bull market trends.

- 55% hedge fund crypto exposure favors directional long-biased plays.

Quantitative and High‑Frequency Strategy Statistics

- Quantitative strategies account for 28% of crypto hedge funds.

- Quant funds achieved an average of 48% annual returns, led by AI models.

- 54% of crypto hedge funds deploy algorithmic trading systems.

- Arbitrage strategies used by 13% of funds average 16% annual returns.

- Funding arbitrage strategies maintain Sharpe ratios above 2.0 with low volatility.

- 62% active management strategies incorporate quant data analytics.

- HFT convertible arbitrage captured 0.3-0.8% consistent price gaps.

DeFi, Yield‑Farming, and On‑Chain Strategy Statistics

- 43% of hedge funds plan DeFi integration through tokenized assets and protocols.

- DeFi-focused crypto hedge funds manage $10–15 billion in dedicated AUM.

- Yield farming strategies deliver 20–30% APY on established stablecoin platforms.

- 47% of institutional allocators increased crypto exposure, including DeFi strategies.

- 33% of hedge funds expect DeFi disruption requiring operational adaptation.

- Stablecoin yield farming offers 5–15% reliable APY across lending protocols.

- Macro strategy funds show 67% highest interest in on-chain DeFi markets.

Use of Leverage in Crypto Hedge Funds

- Crypto-collateralized lending reached $73.59 billion all-time high in Q3.

- Lending expanded 38.5% quarter-over-quarter to support leveraged positions.

- Futures open interest hit $220.37 billion amid perpetual trading.

- CeFi borrows grew 37.11% QoQ to $24.37 billion outstanding.

- Total outstanding borrows increased 47.72% QoQ across CeFi and DeFi.

- Q2 lending market size expanded 27.44% to $53.09 billion in total.

- 55% hedge funds use crypto exposure, including leveraged derivatives.

- Gross leverage ratios exceed 3x equity in quant crypto strategies.

Spot vs Derivatives vs ETF Exposure Statistics

- 55% of traditional hedge funds hold crypto exposure, with 67% using derivatives.

- Hedge funds allocate an average of 7% AUM to crypto, 52% commit under 2%.

- Derivatives trading volume exceeds spot by 3-5x daily across major exchanges.

- Spot Bitcoin ETF AUM has reached $75 billion since 2024 approvals.

- 47% hedge fund crypto allocations favor futures and perpetuals over spot.

- Ethereum spot ETFs captured $15.2 billion in inflows post-approval.

- Perpetual futures open interest hit $220 billion peak versus $150 billion spot.

- 82% institutional crypto exposure via ETFs to avoid custody risks.

- Hedge funds hold $18 billion in spot crypto ETFs per HFR data.

- Derivatives comprise 71% active trading strategies in crypto hedge funds.

Regional Distribution of Crypto Hedge Funds

- North America hosts 57% of global crypto hedge fund AUM.

- 39% hedge funds with crypto exposure are located in North America.

- APAC crypto hedge funds comprise 21% of global exposure.

- 8% crypto hedge funds operate in Latin America, Africa, and other regions.

- U.S. funds manage $78 billion of $136 billion total crypto hedge AUM.

- Europe holds 29% of active crypto hedge funds by count.

- Asia-Pacific saw 15% YoY growth in crypto hedge fund launches.

- Cayman Islands domicile 62% of global crypto hedge funds.

- North America leads with 45% of new crypto hedge fund formations.

Frequently Asked Questions (FAQs)

As of 2025, there are over 400 active crypto hedge funds globally.

The average assets under management (AUM) for crypto hedge funds rose to $132 million in 2025.

Only about 9% of crypto hedge funds manage above $1 billion in AUM.

Conclusion

The crypto hedge fund landscape reflects a market advancing in sophistication and institutional integration. Leverage remains a double‑edged sword, offering expanded exposure while amplifying risk. Derivatives dominate strategic deployment, while spot and ETF exposures provide complementary anchors for diversified portfolios. Regional dynamics highlight North American leadership, meaningful activity in EMEA, and accelerating interest in APAC. As regulatory frameworks evolve and institutional infrastructure deepens, crypto hedge funds are poised to play a more central role in alternative investment strategies. Understanding these trends is essential for investors and allocators navigating the digital asset frontier.