The crypto gaming sector continues to reshape both the gaming and blockchain industries. Fueled by blockchain’s promise of true digital ownership and economic participation, Web3 gaming is capturing attention from players, investors, and developers alike. In the U.S., major studios are experimenting with tokenized assets and play‑to‑earn models that reward real value for in‑game achievements, while global markets are seeing increased blockchain integration across genres. This article presents the most recent and authoritative data available on the growth, size, and adoption trends defining crypto gaming today.

Editor’s Choice

- Web3 gaming market expected to be worth between $32.33 billion and $39.65 billion in 2025, with continued growth projected through 2029.

- The global Web3 gaming market may reach over $117 billion by 2034.

- Play-to-earn NFT games market is forecasted to hit $6.37 billion by 2026.

- Blockchain gaming markets from different analyses show potential to reach between $310 billion and $1.17 trillion by 2032, 2033, depending on the definition.

- Some authoritative forecasts suggest CAGR growth above 50% for blockchain gaming from 2025 to 2032.

- In 2024, the blockchain gaming sector saw over $1.8 billion in recorded investment.

- Despite rapid growth, 97% of gaming token launches underperformed in 2025.

Recent Developments

- In 2024, over $1.8 billion flowed into blockchain gaming projects, showing increased investor interest versus prior years.

- Shifts toward functional tokens (instead of speculative launches) have marked crypto gaming token performance in late 2025.

- Most gaming token launches in 2025 underperformed market expectations, with reports indicating 97% failing to sustain value.

- Developers increasingly focus on integrating real asset ownership and interoperability across ecosystems.

- Major traditional gaming studios have announced blockchain gaming initiatives, increasing mainstream relevance (sector‑wide trend).

- Continued debates around token rewards and economic balance have shaped emergent game design strategies.

- Regulatory scrutiny on crypto game tokens has intensified across major markets, including the U.S. and the EU.

- Cross‑chain compatibility is drawing developer interest to support broader asset movement.

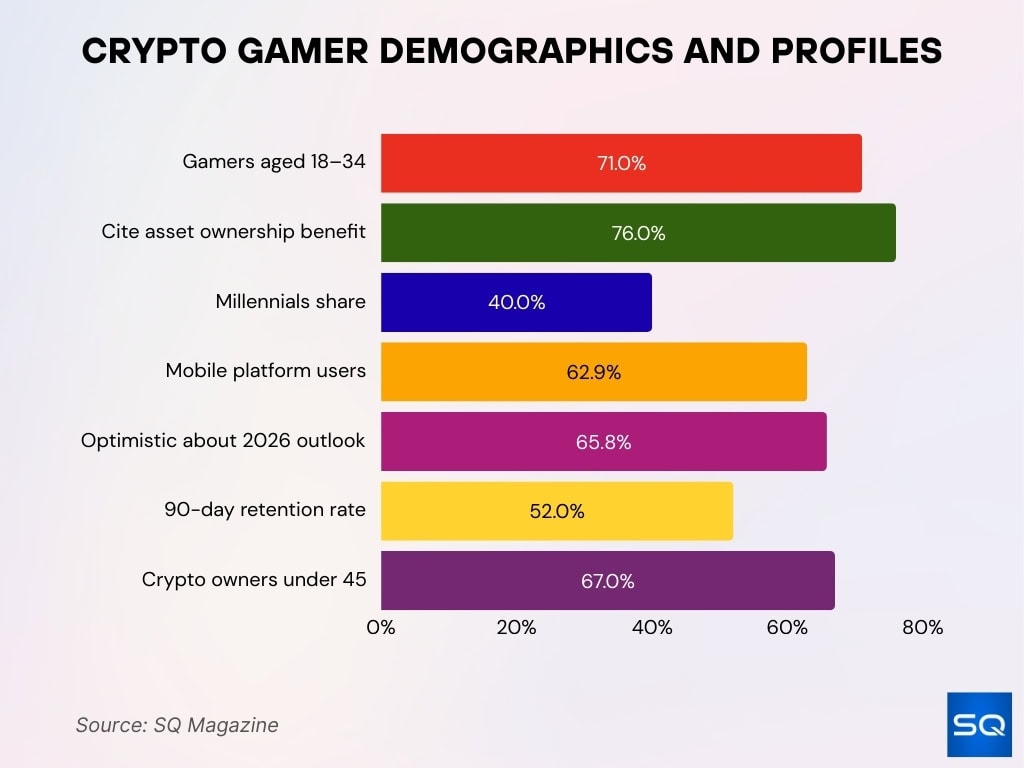

Crypto Gamer Demographics and Profiles

- The global gaming population reached 3.32 billion gamers in 2026.

- 71% of blockchain gamers aged 18 to 34 in 2026.

- 76% of blockchain gamers cite asset ownership as the primary advantage.

- 40% of Web3 gamers are millennials.

- 62.9% of Web3 gamers use mobile platforms.

- 65.8% of blockchain gamers are optimistic about the 2026 trajectory.

- 52% retention rate for blockchain gamers after 90 days.

- 67% of crypto owners are under age 45.

Web3 and Blockchain Gaming Market Growth

- Web3 games market projected to reach $44.75 billion in 2026 at 16.38% CAGR.

- Web3 gaming market valued at $36.19 billion in 2025, growing at 19.34% CAGR from 2026.

- NFT gaming market is expected to grow from $7.63 billion in 2026 at a 25.14% CAGR.

- The blockchain gaming solution market at $480 million in 2025 with a 21.7% CAGR.

- Web3 games market is expected to reach $44-52 billion by 2026 amid strong growth.

- The blockchain gaming market is growing at a 68.3% CAGR from 2026 to 2032.

- The gaming NFT market is expected to $5.694 billion in 2025 at a 31.92% CAGR.

- Web3 gaming at $28.31 billion in 2025 with an 18.1% CAGR to 2034.

Play to Earn Gaming Statistics

- The global Play-to-Earn NFT games market was valued at $4.58 billion in 2024 and expected to reach $6.37 billion in 2026.

- Some models estimate the Play to Earn games market size to be near $1.5 billion in 2026, rising to $8.1 billion by 2033.

- Play-to-Earn NFT games market is valued at $1.347 billion in 2026 with a 21.3% CAGR to 2035.

- P2E Game market projected at $4.5 billion in 2024, growing to $10.6 billion by 2033.

- Play-to-Earn NFT Games market is expected to hit $9.29 billion by 2035 from $1.99 billion in 2026.

- NFT Gaming market is expected to reach $0.54 trillion in 2025 at a 14.84% CAGR.

- Play to Earn Games market at $1.5 billion in 2024 with a 20.4% CAGR from 2026.

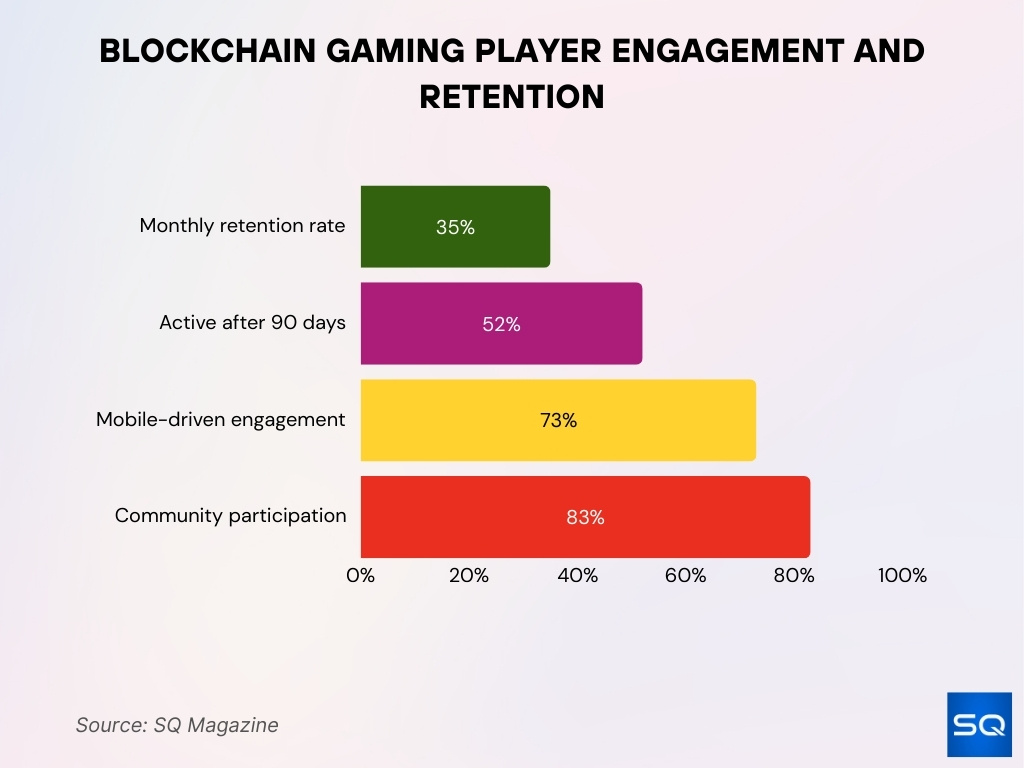

Player Engagement and Retention Metrics

- Blockchain gaming leads Web3 with a 35% monthly retention rate.

- 52% of blockchain gamers are active after 90 days.

- 73% of blockchain games on mobile drive engagement.

- 83% of blockchain gamers are in Discord or Telegram communities.

- Daily unique active wallets in blockchain gaming average 4.8 million.

- opBNB gaming active wallets reach 1.05 million on average.

- The average blockchain gamer spends 12-16 hours weekly.

- Daily dApp active wallets drop to 16 million in late 2025.

- Gaming dUAW declines from 5.8 million in early 2025 to 4.66 million in Q3.

GameFi Market Size and Growth

- The GameFi market is projected to be worth about $23.75 billion in 2025, expanding to $219 billion by 2034 at a CAGR of 28%.

- Another industry estimate places GameFi at roughly $23.75 billion in 2025 with continued strong long‑term expansion.

- In some models, the GameFi sector could grow from about $20.99 billion in 2025 to $156 billion by 2033.

- North America historically captured 40–45% of the global GameFi share in recent estimates.

- Polygon‑based GameFi applications accounted for about a 36% share (~$8.5 billion) of the market in 2025.

- Ronin‑based GameFi application value was around $5.5 billion in 2025 across games and trading activity.

- Growth forecasts commonly show ~28%+ CAGR across GameFi through the early 2030s.

Revenue and Monetization

- The global blockchain gaming market revenue is estimated at $24.4 billion in 2025, according to some forecasts.

- Play‑to‑earn (P2E) games generated ~62% of blockchain gaming revenue in 2025.

- The mobile segment holds about 55.2% share of blockchain gaming revenue, reflecting strong mobile monetization.

- Daily active wallet engagement (a revenue indicator) was ~4.66 million in Q3 2025.

- Despite macro slowdowns, some blockchain games report significant asset trading volumes tied to in‑game monetization.

- Wallet activity concentrations on leading chains (e.g., opBNB, Sei) tie directly to revenue capture in trading and rewards.

- High‑utility tokens linked to gaming ecosystems can drive revenue through asset sales and marketplace fees.

- Secondary market trading of gaming NFTs continues to form a crucial part of revenue streams.

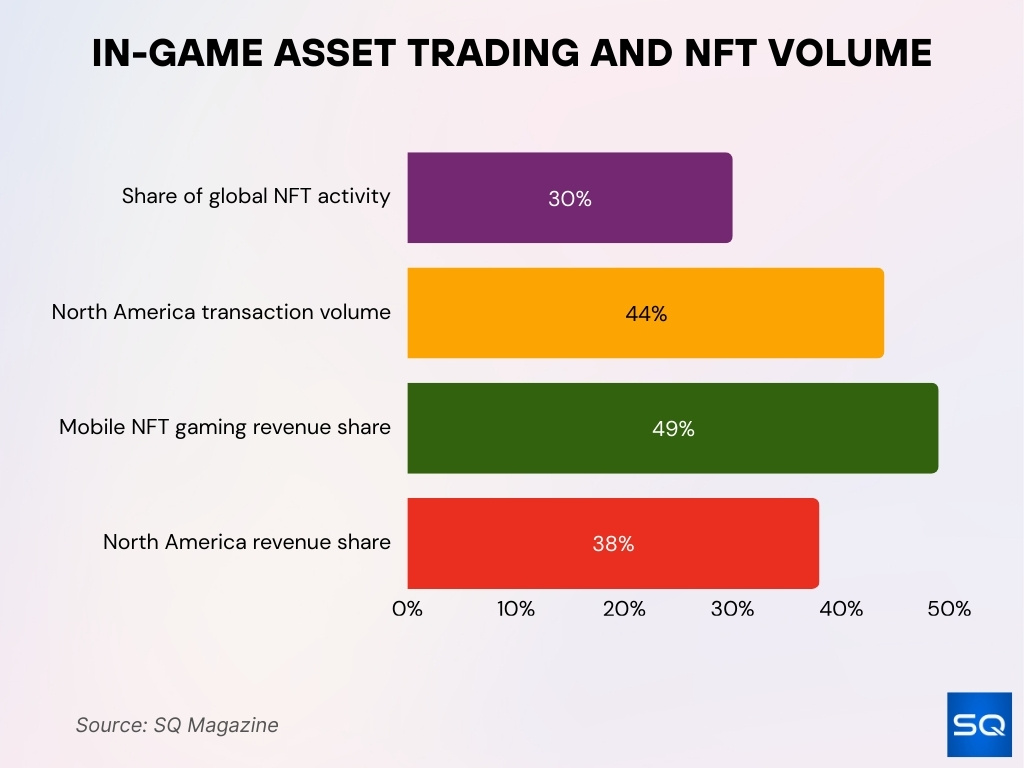

In-Game Asset Trading and NFT Volume

- Gaming NFTs comprise 30% of global NFT activities.

- North America accounts for 44% of NFT transaction volume.

- Mobile NFT gaming revenue is at 49% of the total.

- North America’s NFT gaming revenue is over 38% globally.

- NFT gaming market is projected at $7.63 billion.

- Global NFT market reaches $46 billion with gaming dominance.

- NFT gaming sales volume surges $85 million weekly.

- Gaming NFT supply totals 1.34 billion tokens.

User Base and Adoption

- Blockchain gaming reached ~5.8 million daily unique active wallets in Q1 2025 (active users proxy).

- Activity stabilized at ~4.66 million daily active wallets by Q3 2025 despite sector headwinds.

- Gaming remains the largest user segment in Web3 by active wallet count, surpassing sectors like DeFi.

- Some estimates suggest ~102 million blockchain gamers worldwide by 2025, up ~72% YoY.

- Roughly 54% of global blockchain games are mobile‑focused, aiding wider adoption.

- Asia‑Pacific holds the largest share of blockchain gaming adoption (approaching ~28.7%+).

- North America accounts for an estimated ~25–31% of global blockchain gaming users in 2025.

- 82% of U.S. blockchain gamers express interest in using crypto for in‑game purchases.

Crypto Gaming Transaction Volumes

- Web3 gaming on-chain transactions surpass 6 billion annually.

- NFT gaming sales revenue reaches $6.1 billion.

- Gaming NFT supply hits 1.34 billion tokens minted.

- Blockchain gaming daily trading volume averages $272 million.

- GameFi token trading volume surges to several million dollars daily.

- Polymarket gaming prediction volumes exceed $1.5 billion weekly.

- NFT gaming market is valued at $6.1 billion with high transaction activity.

- Bitcoin gaming transaction volumes show exponential growth.

- WAX blockchain gaming transactions lead at 687 million quarterly.

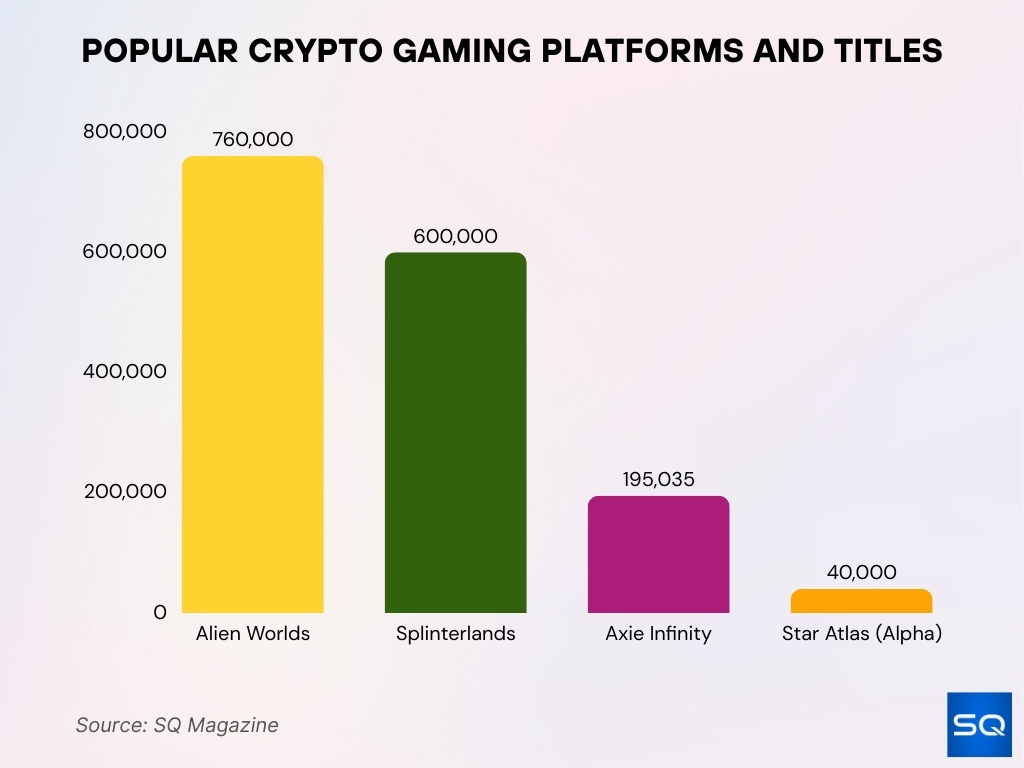

Popular Crypto Gaming Platforms and Titles

- Axie Infinity maintains 195,035 monthly active users.

- World of Dypians leads DappRadar with top engagement.

- Lumiterra MMORPG attracts high PvP player traffic.

- Alien Worlds ranks top with 760,000 monthly players.

- The Sandbox secures the top 5 NFT game position.

- Splinterlands boasts 600,000 monthly active users.

- Gods Unchained features in the best P2E lists.

- Star Atlas alpha testers exceed 40,000.

Crypto Gaming Token Market Statistics

- GameFi sector market cap stands at $7.8 billion.

- Total gaming tokens market cap reaches $7.66 billion.

- Web3 gaming tokens market value at $9.03 billion.

- GameFi coin market cap totals $384.56 million with $2.89 million volume.

- Immutable IMX gaming token market cap $450-490 million.

- Gala GALA circulating supply 46.983 billion tokens.

- GameFi tokens average 24h volume $14.9 million.

- Leading gaming tokens like BEAT have a $687.2 million market cap.

- Gaming tokens under $2 million market cap now 33 projects.

- Web3 gaming tokens down 69% YoY to $8.83 billion.

Venture Capital in Web3 Gaming

- Web3 gaming VC funding drops to $293 million in 2025.

- Crypto VC investments hit $25 billion in 2025.

- US crypto VC rebounds to $7.9 billion.

- LA gaming sector raises $2.1 billion across 180 deals.

- Web3 VC firms deploy $18.7 billion across 1,100 startups.

- Gaming VC check sizes average $4.2 million for seed.

- 32.6% of Web3 gaming studios face cash shortages.

- Large deals comprise 56% of total VC capital.

- Web3 gaming seed valuations at $34 million median.

Regulation and Compliance in Crypto Gaming

- 70% of major jurisdictions advance stablecoin rules.

- India’s Online Gaming Act 2025 is effective October 1.

- UKGC mandates KYC for crypto transactions over £2,000.

- SEC innovation exemption launches January 2026.

- KYC/AML mandatory for licensed crypto casinos.

- MiCA requires whitepapers for sales over €1 million.

- FCA stablecoin rules are effective January 1, 2026.

- FATF pushes stricter AML for crypto gambling.

- IAGR 2026 conference convenes gaming regulators October 19-22.

Security Incidents and Scam Statistics in Crypto Games

- Crypto scams cause $9.3 billion losses, prompting 2026 protections.

- $3.35 billion lost in Web3 hacks and scams in 2025.

- $2.5 billion crypto scam losses first half of 2025.

- December 2025 crypto hack losses drop 60% to $76 million.

- 90% gaming token launches fail post-2025.

- $50 million address poisoning scam in December 2025.

- Phishing attacks led to 248 incidents $722.9 million in losses in 2025.

- Bybit hack accounts $1.45 billion of 2025 losses.

- North Korean actors stole $2.02 billion through sophisticated attacks in 2025.

Future Trends and Forecasts in Crypto Gaming

- Blockchain gaming market grows at 35.4% CAGR to $36.15 billion by 2033.

- GameFi sector 29.5% CAGR from 2026 to 2033.

- Web3 gaming market reaches $88.57 billion by 2029 at 22.3% CAGR.

- Blockchain gaming solutions hit $1,504 million by 2032 at 21.7% CAGR.

- Stablecoins dominate 50%+ in-game transactions.

- NFT gaming market will expand significantly by 2030.

- 70% Web3 players adopt indie titles.

- GameFi market cap recovers post 68% 2025 drop.

- GTA 6 launch boosts GameFi inflows.

Frequently Asked Questions (FAQs)

The global blockchain gaming market is projected to reach $614.91 billion by 2030.

The Web3 gaming market is valued at approximately $28.31 billion in 2025.

The NFT gaming market is expected to reach $0.54 trillion in 2025.

Conclusion

The crypto gaming landscape continues to evolve from early speculative experiments to more durable applications that blend ownership, economic participation, and entertainment value. Market forecasts show substantial growth potential in NFTs, token economies, and decentralized gaming platforms, supported by ongoing innovation in play‑to‑own mechanics and cross‑chain interoperability. Regulatory frameworks and compliance initiatives are gaining traction globally, shaping how gaming tokens and assets are managed while aiming to protect players and investors.

Although funding landscapes and security incidents present challenges, the industry is gravitating toward utility‑driven models and long‑term sustainability. As blockchain gaming further integrates with mainstream gaming and digital asset trends, stakeholders, from developers to players and regulators, will shape a more mature, secure, and expansive ecosystem ahead.