Crypto exchanges stand at the heart of the digital asset ecosystem, bridging fiat currencies and blockchain networks. They reflect both the maturation and volatility of the crypto industry, powering trillions in transactions, hosting global users, and navigating evolving regulation. In institutional finance, exchanges serve as gateways for asset managers to add crypto exposure. In retail markets, they power DeFi access and retail trading apps. Read on to uncover the key numbers defining crypto exchanges in 2025.

Editor’s Choice

- The global crypto exchange market is projected to be worth $71.35 billion in 2025.

- Binance commands a 39.8 % share of total spot trading volume among centralized exchanges (mid‑2025).

- In Q2 2025, CME’s crypto product suite saw a 140 % year-over-year rise in average daily notional volume.

- APAC recorded a 69 % increase year-over-year in on-chain crypto activity (12 months ending June 2025).

- The global crypto market capitalization in 2025 is estimated at $3.9 trillion.

- Spot trading represented 58.86 % of the exchange market in 2024, with derivatives rising faster.

Recent Developments

- Morgan Stanley plans to onboard crypto trading via E*Trade in 2026, illustrating traditional finance entering the exchange space.

- The U.S. and EU continue to codify stablecoin and crypto-asset legislation (e.g., MiCA in Europe), pushing exchanges toward stricter compliance.

- Global policy reviews in 2024–25 covered regulations in 24 jurisdictions, touching ~70 % of crypto exposure.

- Platforms emphasize regulatory compliance and user trust as competitive advantages in 2025.

- The EU’s market watchdog flagged concentration in trading, ~10 exchanges process ~90 % of volume, with Binance often near half.

- Some major exchanges experienced large declines in Q2 2025. For example, Crypto.com’s volume dropped ~61.4 % quarter-on-quarter.

- CME’s new spot-quoted futures contracts were launched in mid-2025 to offer capital-efficient exposure.

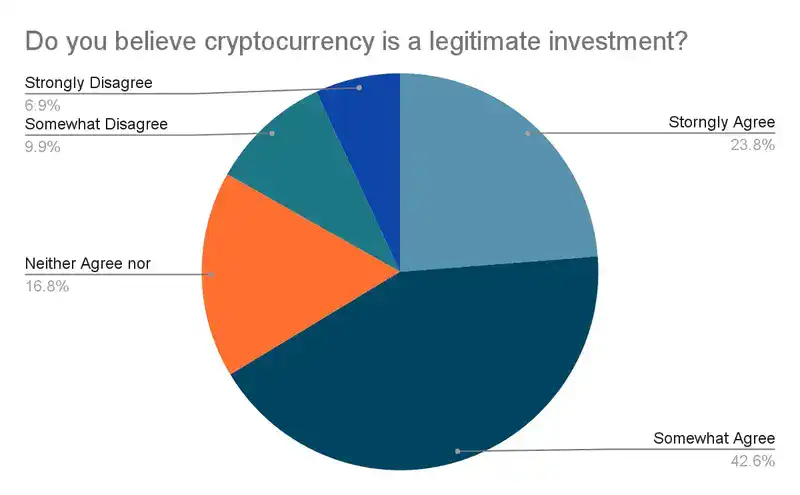

Public Perception of Cryptocurrency as an Investment

- 42.6% of respondents somewhat agree that cryptocurrency is a legitimate investment, making it the largest group.

- 23.8% strongly agree, meaning nearly one in four have high confidence in crypto as an investment.

- 16.8% neither agree nor disagree, reflecting caution or indecision toward crypto’s legitimacy.

- 9.9% somewhat disagree, showing skepticism among a smaller segment of respondents.

- 6.9% strongly disagree, representing a minority firmly rejecting crypto as a valid investment option.

Crypto Exchange Market Size

- Projections place the global crypto exchange market at $71.35 billion in 2025.

- The market is expected to grow to $260.17 billion by 2032, implying a CAGR of ~20.3 %.

- In 2024, the market was estimated at $24.75 billion, based on a CAGR of 19.29 % since 2019.

- Centralized exchanges accounted for 90.76 % of the 2024 exchange market by model.

- Spot trading accounted for 58.86 % of exchange revenue in 2024.

- Derivatives are expected to be the fastest-growing segment over 2024–2029.

- Fiat‑crypto exchanges dominated ~59.72 % of the market in 2024.

- Some alternate reports estimate 2025 exchange market revenue closer to $50–60 billion, depending on assumptions.

Number of Cryptocurrency Exchanges

- There is no universally agreed count, but estimates suggest hundreds to low thousands of active exchanges globally.

- Among those, dozens manage the lion’s share of volume, ~10 exchanges process ~90 % of trades.

- The number of centralized exchanges remains far smaller than that of decentralized ones (DEXs), though DEXs grow more quickly.

- Some exchanges have shut down or exited markets due to regulatory pressure, reducing active counts in strict jurisdictions.

- New localized exchanges launch in developing markets to serve underserved regions in Asia, Africa, and Latin America.

- Institutional-grade exchange software providers enable white-label launches, increasing the total number of “exchange instances.”

- Some exchanges operate only regionally to satisfy licensing or regulatory constraints, especially in the U.S., EU, or APAC.

- Overall, market concentration suggests fewer than 100 exchanges truly dominate global volume.

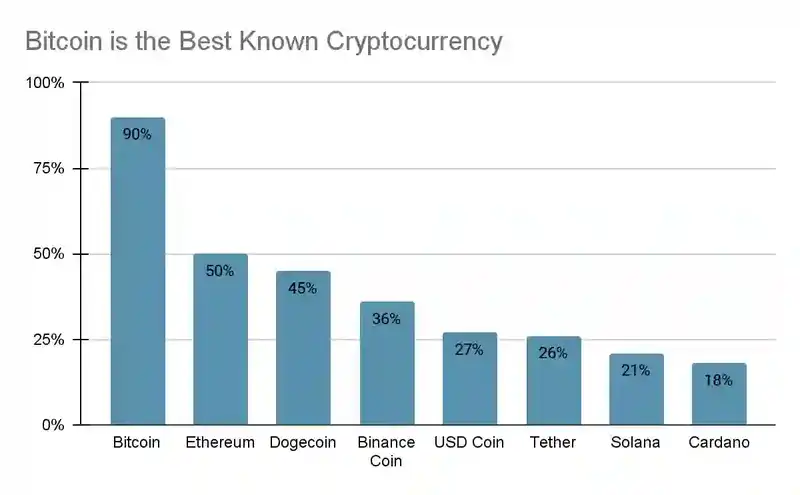

Most Recognized Cryptocurrencies

- Bitcoin leads with 90% awareness, making it the most widely recognized cryptocurrency.

- Ethereum ranks second with 50% awareness, about half the recognition of Bitcoin.

- Dogecoin follows at 45% awareness, showing strong visibility despite its meme-based origins.

- Binance Coin is known by 36% of respondents, placing it in the mid-tier range.

- USD Coin reaches 27% awareness, slightly ahead of Tether at 26%, highlighting stablecoin presence.

- Solana records 21% awareness, reflecting growing recognition in the market.

- Cardano closes the list with 18% awareness, still maintaining notable recognition among users.

Largest Exchanges by Registered Users

- Binance remains the largest by user count and volume, with tens of millions of users globally.

- Other large exchanges include Coinbase, OKX, MEXC, Gate, Bitget, Bybit, and Upbit, each with significant registered user bases.

- Coinbase peaked early in 2025 but has slipped in share while maintaining a robust U.S. user base.

- In July 2025, Coinbase’s spot trading share fell to ~5.8 %.

- MEXC held ~8.6 % of spot volume in July 2025, suggesting a large user footprint.

- Gate had ~7.8 % share in July 2025 among top exchanges.

- The remaining top‑10 exchanges held ~43.8 % in July 2025.

- Exchange platforms that offer derivatives or advanced products often retain higher user stickiness and registration growth.

Crypto Exchange User Demographics

- In the U.S., a survey of ~2,000 adults in early 2025 measured sentiment and adoption among average Americans.

- Younger age groups (18–34) continue to dominate crypto exchange usage versus older cohorts.

- Male users represent a higher share in many exchanges, though female adoption is increasing.

- Many users operate on mobile first, with mobile apps accounting for a large share of interface logins.

- Institutional users and retail users now coexist on many platforms, but institutions tend to trade larger volumes with higher frequency.

- Regions such as APAC and Latin America report higher penetration among younger, tech-savvy populations.

- Many new users originate from developing economies where crypto provides remittance, cross-border, or inflation hedging use cases.

- KYC/AML requirements filter out some demographic strata, particularly among privacy-focused users.

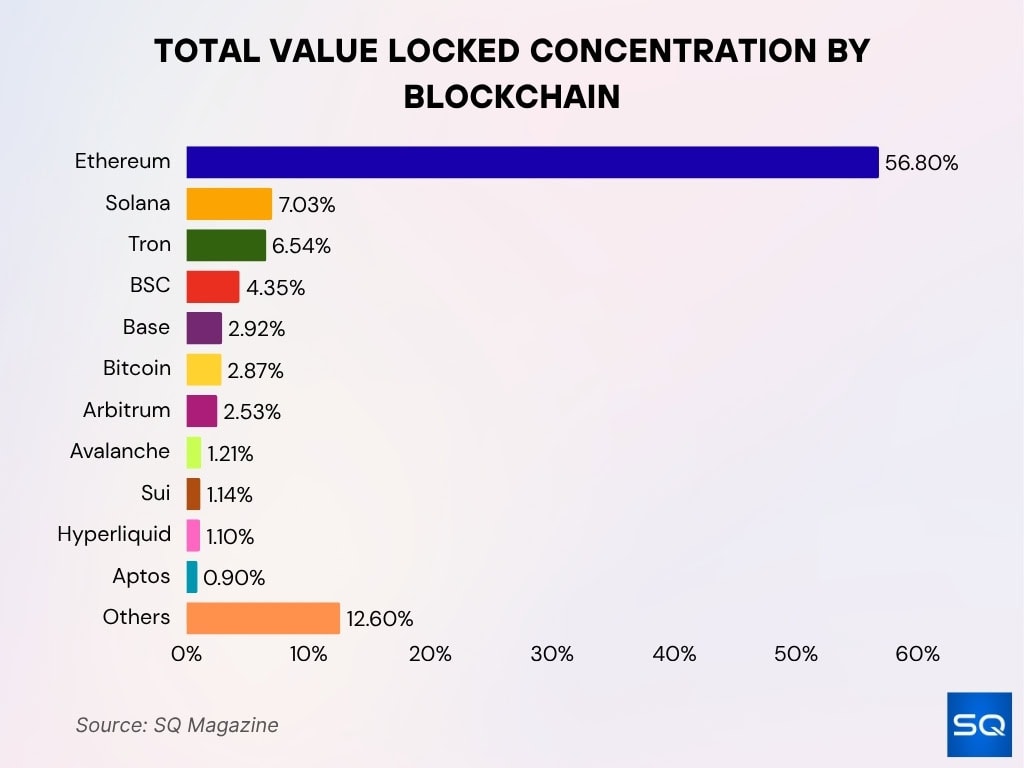

Blockchain Share of Total Value Locked (TVL)

- Ethereum leads decisively with 56.8% of TVL, cementing its dominance in decentralized finance.

- Solana ranks second with 7.03%, emerging as a strong alternative chain.

- Tron follows at 6.54%, maintaining a solid share of the DeFi market.

- BSC (Binance Smart Chain) holds 4.35%, continuing its role as a major DeFi network.

- Base contributes 2.92%, while Bitcoin accounts for 2.87%, showing moderate adoption in TVL.

- Arbitrum records 2.53%, underscoring growth among Ethereum Layer-2 solutions.

- Avalanche (1.21%), Sui (1.14%), Hyperliquid (1.1%), and Aptos (0.9%) capture smaller yet notable shares.

- Other blockchains collectively represent 12.6%, reflecting the fragmented nature of the wider ecosystem.

Exchange Market Share Breakdown (Spot, Derivatives, DEX)

- In July 2025, Binance held 39.8 % of the total spot trading share among CEXs.

- MEXC claimed 8.6 %, Gate 7.8 %, Bybit 7.2 %, Bitget 7.6 %, Upbit 6.3 %, and OKX 6.0 % in mid‑2025.

- Spot trading continues to dominate overall revenues; some forecasts say ~61.3 % of exchange revenue will derive from spot in 2025.

- Derivatives (futures, perpetuals, options) are the fastest-growing segment in many platforms.

- In Q2 2025, DEX perpetual trading volume hit $898 billion, with Hyperliquid capturing ~73 % share of that.

- In the same quarter, DEX spot volume reached $876.3 billion, up more than 25 % from the prior quarter.

- The DEX-to-CEX spot volume ratio reached ~0.23 in Q2 2025, indicating DEXs are gaining share.

- Centralized exchanges still handle the majority of derivatives volume, with CEXs being far more liquid for futures and options.

Crypto Exchange Fee Structures

- Most exchanges use maker-taker tiered pricing, where higher trading volume reduces fees.

- Typical ranges in 2025: 0.10 % to 0.40 % for many pairs, with special zero‑fee tiers on selected pairs.

- Binance’s baseline maker/taker is often 0.10 % / 0.10 %, with discounts when paying in BNB.

- Kraken Pro charges 0.16 % / 0.26 %, though tiered discounts may reduce that for high-volume traders.

- BYDFi offers a flat 0.10 % / 0.10 % structure, with additional voucher discounts.

- Many exchanges impose withdrawal, deposit, and network (gas) fees separately.

- Some exchanges hide “spread” or “convenience” fees; Gemini, for instance, charges a 1.49 % transaction fee + 1.00 % convenience markup.

- DEXs frequently use fixed or algorithmic protocol fees, which are distributed to liquidity providers rather than to a central operator.

Leading Crypto Exchanges by Trading Volume

- SuperEx leads with a massive $163.6 billion in 24-hour trading volume.

- Binance follows in second place with $15.4 billion, far behind SuperEx but still a major player.

- Other high-volume exchanges include: 4E ($3.52 billion), BiFinance ($3.32 billion), HTX ($2.99 billion), Darkex ($2.95 billion), Zedcex ($2.59 billion), Bybit ($2.47 billion), MEXC ($2.45 billion), and OKX ($2.30 billion).

Exchange Supported Cryptocurrencies

- Top centralized exchanges often list 500+ tokens/pairs, including major altcoins, stablecoins, and occasionally meme tokens.

- Platforms differentiate via support for new token launches, cross‑chain assets, and layered networks (e.g., Ethereum, Solana, BNB Chain).

- Exchanges often delist low-liquidity or noncompliant tokens due to regulatory or security risk.

- Some exchanges support synthetic assets, wrapped tokens, and tokenized real‑world assets (RWAs).

- DEXs typically allow permissionless listing, enabling many small or experimental tokens to appear quickly.

- Cross-chain bridges and wrapped assets increase the effective token universe across many platforms.

- Exchanges sometimes limit listings by jurisdiction to comply with local law, reducing token availability in restricted countries.

- Token listing fees, legitimacy audits, and market maker commitments shape which assets get listed.

Crypto Exchange Geographic Distribution

- Asia‑Pacific is projected to lead in 2025, with ~42.3 % share of the global exchange market.

- North America is forecasted to have ~31.1 % share in 2025, and is expected to be one of the fastest-growth regions.

- In 2024, some reports estimated the exchange platform market at $33.42 billion, rising to 2025 estimates like $37.23 billion.

- Other sources place the 2025 market at $48.41 billion, with a CAGR of 14.2% to 2032.

- Meanwhile, some industry data suggests growth from $43.8 billion in 2024 to $54.8 billion in 2025 (CAGR ~25.1%).

- The U.S. and India consistently rank among the top adopters in on-chain activity per capita analysis.

- In Q2 2025, combined spot + derivatives trading on CEXs hit $9.72 trillion in August, marking record volume.

- The global on-chain adoption index places India and the U.S. at the forefront of grassroots token usage.

Crypto Exchange Security Statistics

- In the first half of 2025, $2.47 billion was stolen in hacks/scams, after recoveries, net losses were ~$2.29 billion.

- More than 344 hacking or scam events were recorded through mid‑2025.

- Crypto security breaches in 2025 have already exceeded $2.17 billion, outpacing full-year totals from some prior years.

- Some exchanges maintain proof-of-reserves audits and publish third‑party cryptographic proofs to enhance trust.

- Cold storage and multi-signature architectures remain standard practice for high-capital portions of holdings.

- Security audits for smart contracts (on DEXs) can cost tens of thousands to hundreds of thousands of dollars.

- Some hackers exploited compromised infrastructure, like third-party wallet services, to facilitate attacks.

Exchange Platform Growth Rate

- Some projections estimate a CAGR of ~14.2% from 2025 through 2032 for the exchange market.

- Others estimate higher growth, 25.1% CAGR from 2024 to 2025 in the exchange platform sector.

- The crypto trading platform market was valued at $27 billion in 2024 and is expected to grow at ~12.6% CAGR between 2025 and 2034.

- Growth is fueled by increased demand for derivatives, institutional flows, and tokenization products.

- Retail investor share was about 43 % in 2024.

- Infrastructure investments (scalability, security, UI/UX) are increasing to support higher user volumes.

- Platform upgrades, such as multi-chain support and lower fees, help accelerate adoption.

- Market fragmentation is rising, with more niche or regional platforms emerging to capture specific user segments.

Notable Regulatory & Compliance Events

- In 2025, 90 % of centralized exchanges in North America are fully KYC‑compliant, up from 85 % in 2024.

- Globally, 99 jurisdictions have either passed or are implementing the FATF “Travel Rule” for crypto transfer traceability.

- The U.S. OCC issued a joint statement in July 2025, reinforcing crypto‑asset safekeeping and risk‑management standards for banks.

- Several major exchanges engaged with regulators proactively, cooperating with security audits and licensing under MiCA in Europe.

- Some jurisdictions tightened oversight; in Australia, AUSTRAC ordered Binance’s Australian arm to appoint an external auditor over AML concerns.

- The SEC’s Crypto Task Force continues to clarify when crypto assets qualify as securities.

- In early 2025, the SEC closed its investigation into Robinhood’s crypto arm with no action, signaling a shift in enforcement approach.

- Several exchanges are embedding compliance tools (on-chain monitoring, automated reporting) into their platforms to stay ahead of regulators.

Major Crypto Exchange IPOs

- In September 2025, Gemini priced its IPO and raised $425 million.

- Bullish, backed by Peter Thiel, conducted a large IPO in 2025, raising $1.1 billion.

- News reports suggest OKX is exploring a U.S. IPO after recent compliance settlements.

- In 2025, stablecoin issuer Circle also entered public markets, raising $1.05 billion via IPO.

- The surge in IPOs marks renewed investor confidence and a maturation of crypto exchanges into mainstream finance.

- Some firms, like eToro, also pursued IPOs. eToro completed its Nasdaq listing in 2025, reporting 40 million registered users.

Crypto Exchange Product Offerings

- Exchange platforms now commonly bundle services, spot trading, derivatives, staking, lending, yield farming, and tokenized assets.

- Many exchanges support staking/yield products as non‑trading revenue sources.

- Some exchanges have added NFT marketplaces, token launchpads, and cross‑chain swap portals.

- Institutional features include custody, margin, futures, options, OTC desks, and custom APIs.

- Exchanges are increasingly offering wrapped assets, cross-chain assets, and synthetic derivatives over multiple chains.

- Some platforms integrate compliance tooling (e.g., wallet screening, risk scoring) directly into the product stack.

- White‑label or modular exchange infrastructure is offered by providers, enabling regional or niche exchanges.

- Exchanges are experimenting with subscription models or premium tiers offering lower fees or advanced analytics.

Institutional vs. Retail Exchange Usage Trends

- In 2025, 59 % of surveyed institutional investors plan to allocate > 5 % of their AUM to digital assets.

- Over 75 % of institutional respondents expect to increase crypto allocations this year.

- Institutions tend to focus on Bitcoin, Ethereum, and large-cap assets; retail traders chase altcoins and momentum plays.

- Retail users, especially in the U.S., are concentrated on Bitcoin, Ethereum, and Dogecoin. ~28 % of American adults own crypto.

- About 70 % of crypto users trade via mobile apps, reflecting a retail-first interface.

- In rising markets, retail flow often dominates volume spikes, and institutions bring stability in downturns.

- Institutional traders use derivatives, custody, and algorithmic strategies; retail users lean toward spot and simpler trades.

- In surveys, retail sentiment remains more bullish than institutions, though institutions often drive large capital allocations.

Top Decentralized Exchanges Statistics

- DEX trading volume in 2025 rose ~37 %, averaging $412 billion monthly.

- Ethereum-based DEXs capture ~87 % of all DEX volume.

- DEX-to-CEX spot volume ratio in Q2 2025 was ~0.23, showing rising DEX adoption.

- Solana‑based DEXs now exceed $1.5 billion in daily trades.

- Cross‑chain DEXs and bridges see higher usage for arbitrage and liquidity shifts.

- Some DEX smart contract exploits and front-running risks push users toward “audited” pools.

- Protocol fees (usually ~0.05–0.3 %) accrue to liquidity providers rather than a centralized operator.

- DEX growth is especially strong in emerging markets where censorship resistance and non‑custodial access matter more.

Exchange Rankings by Consumer Sentiment

- In the 2025 Gemini “Global State of Crypto” survey of 7,205 respondents, sentiment favored U.S. and EU exchanges due to perceived regulatory safety.

- Over 70 % of survey respondents prefer mobile-first exchanges with an intuitive UX.

- Trust scores are increasingly tied to proof-of-reserve disclosures and audit transparency.

- Exchanges with lower fees, responsive support, and regulatory compliance tend to outrank those with frequent outages or negative press.

- In multiple polls, users rank Binance, Coinbase, and OKX among the top trusted exchanges internationally.

- Sentiment toward decentralized exchanges is mixed; users value autonomy but worry about hacks and interface complexity.

- Some sentiment indexes weigh media sentiment and social chatter; these models now feed into market forecasts.

Frequently Asked Questions (FAQs)

Approximately 39.8 % of global centralized exchange spot volume in July 2025.

Spot trading volume rose 53.7 % in July 2025 compared to the prior month.

The global crypto market cap in 2025 is over $3.9 trillion.

CoinMarketCap tracks about 254 spot exchanges as of the latest reports.

Conclusion

Crypto exchanges will continue evolving along multiple axes: regulation, security, product breadth, and user experience. The rise of IPOs and tighter oversight signals that exchanges are stepping into mainstream finance, while DEXs steadily claim more volume and trust. Institutional capital now complements retail dynamism, and consumer sentiment increasingly rewards transparency and compliance. For anyone navigating crypto’s infrastructure, these statistics offer a roadmap into where exchanges are headed next.