Anti‑money laundering (AML) enforcement in crypto has become a battleground between innovation and regulation. Governments and watchdogs are issuing ever‑larger fines to crypto firms that fail to detect illicit flows. From global exchanges paying hundreds of millions to smaller platforms under scrutiny, the stakes have never been higher. In finance and traditional banking, AML fines act as a deterrent; in crypto, they are reshaping how companies build compliance from the ground up. Read on to uncover the latest data and enforcement trends.

Editor’s Choice

- In the first half of 2025, 139 regulatory penalties across sectors (including crypto) totaled $1.23 billion, a 417% rise over H1 2024’s $238.6 million.

- The average fine imposed on non‑compliant crypto businesses globally in early 2025 climbed to $3.8 million, up about 21% from 2024.

- OKX agreed to pay $504 million in penalties after pleading guilty to unlicensed money transmission and AML violations.

- Canada’s AML authority fined KuCoin’s operator C$19.6 million (≈ $14.09 million USD) for failing to register as a money services business and not filing suspicious transaction reports.

- The U.S. judge ordered BitMEX to pay $100 million for AML violations and also placed it on probation.

- The U.S. Treasury and DOJ froze over $26 million in crypto tied to Garantex and disrupted its infrastructure in 2025.

- TRM Labs estimates that $58.7 billion in illicit crypto flows occurred in 2023 (revised upward from prior estimates).

Recent Developments

- In August 2025, FinCEN issued Notice FIN‑2025‑NTC1 targeting crypto kiosks and intensified scrutiny of retail crypto services.

- In early 2025, the U.S. Secret Service, with partners in Germany and Finland, froze ~$26 million linked to Garantex and seized its domain infrastructure.

- India’s FIU‑IND issued notices to 25 offshore crypto exchanges for alleged non-compliance with the Prevention of Money Laundering Act (PMLA).

- Several crypto platforms are being pressured worldwide to register with local AML authorities or face legal and civil exposure.

- Regulatory bodies are applying traditional AML frameworks (e.g., KYC, suspicious transactions, reporting standards) more rigorously to crypto firms.

- More cross-border cooperation between enforcement agencies is evident, especially in actions involving mixed-jurisdiction targets.

- Crypto compliance technology vendors are getting pulled into enforcement debates, whether their tools are sufficient or even admissible in regulatory reviews.

- Exchanges are facing increasing demands for crypto‑native controls, e.g., wallet screening and traceability, not just traditional finance methods.

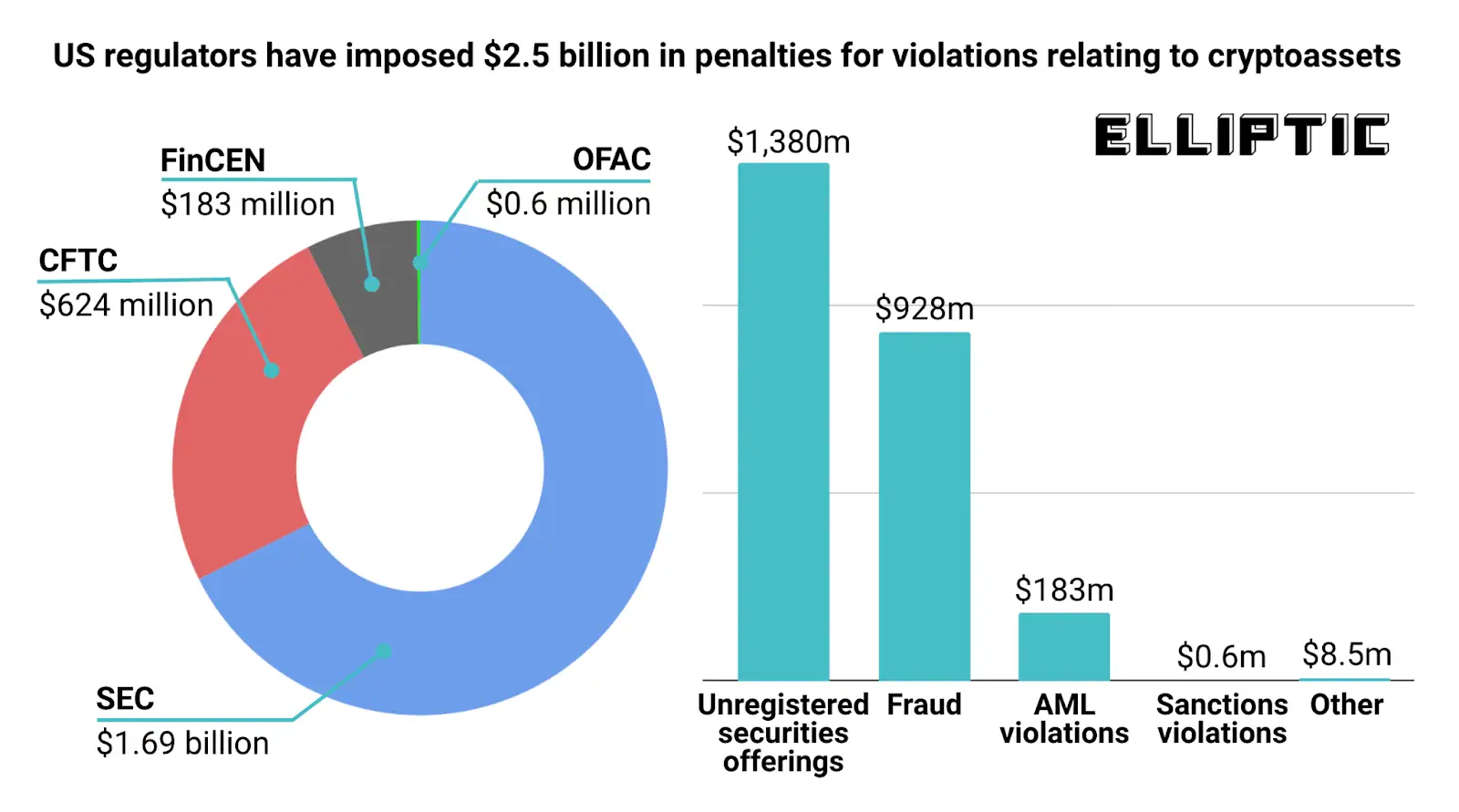

Key Statistics on US Crypto Regulatory Penalties

- US regulators imposed $2.5 billion in penalties related to cryptoasset violations.

- The SEC accounted for the largest share with $1.69 billion in fines, primarily for unregistered securities offerings.

- The CFTC issued $624 million in penalties, targeting fraud and market manipulation.

- FinCEN imposed $183 million in penalties, largely tied to AML violations.

- The OFAC issued only $0.6 million in penalties, focusing on sanctions violations.

- Unregistered securities offerings made up $1.38 billion, or over 55% of total penalties.

- Fraud-related fines totaled $928 million, representing a major area of enforcement.

- AML violations resulted in $183 million in fines, highlighting continued compliance gaps.

- Sanctions violations accounted for just $0.6 million, showing relatively low enforcement volume.

- Other violations contributed $8.5 million, reflecting minor infractions outside core categories.

Global Statistics on Crypto AML Fines and Penalties

- In 2025, total crypto exchange AML fines already surpassed $1 billion globally.

- The average AML penalty for crypto firms rose to $3.8 million in H1 2025.

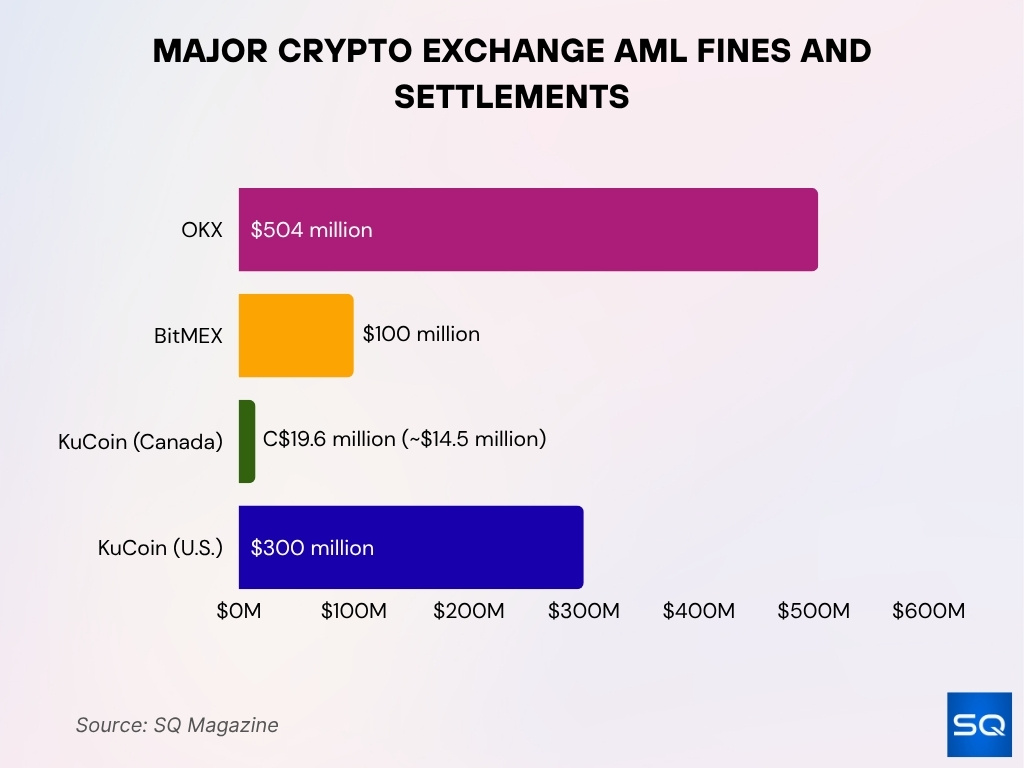

- OKX’s $504 million settlement represents one of the largest penalties ever levied in crypto for AML failures.

- BitMEX’s $100 million fine in 2025 marks continued U.S. resolve in prosecuting AML non-compliance.

- In Canada, KuCoin’s C$19.6 million penalty is the largest domestic crypto AML fine the agency has ever imposed.

- In 2024, several large crypto KYC/AML failures led to multistate and cross‑border settlements, laying the groundwork for 2025 actions.

- Regulatory fines across sectors (AML, sanctions, etc.) grew 417% in H1 2025 over H1 2024.

- Crypto firms are increasingly included in general regulatory penalty tallies as regulators see them less as fringe entities.

- The cost of non-compliance (fines, business disruption) is now a material risk for even well-established crypto platforms.

Regional Breakdown of Crypto AML Enforcement Actions

- In North America, enforcement is strongest; the U.S. and Canada both issued large penalties (e.g., BitMEX, KuCoin).

- In Canada, the FINTRAC penalty against KuCoin’s operator was C$19.6 million.

- In the U.S., DOJ, FinCEN, and Treasury are active in prosecuting and freezing crypto assets (e.g., the Garantex freeze).

- In Asia, authorities (e.g., India) issued notices to 25 offshore exchanges for AML non‑compliance.

- Latin America and Africa have seen fewer high-profile crypto AML fines thus far, but regulatory frameworks are under development.

- European countries are increasingly using existing financial crime tools to target crypto firms operating across borders.

- Some jurisdictions are hampered by unclear definitions, whether crypto firms count as “financial institutions” under domestic law.

- Exchanges that service users across multiple regions are most exposed to inconsistent enforcement regimes.

Major Crypto Exchange AML Fines and Settlements

- OKX pled guilty and agreed to ~$504 million in fines and forfeitures.

- BitMEX was fined $100 million by U.S. courts for violating AML obligations.

- KuCoin’s operator, Peken Global Limited, was hit with C$19.6 million (~$14.5 million) for failing to register, failing to file suspicious transaction reports, and neglecting large transaction reporting.

- KuCoin also agreed to exit the U.S. market in connection with criminal and civil resolutions (≈ $300 million total fines & forfeitures).

- Some smaller or regional crypto firms have reached multi‑million dollar consent orders behind the scenes (not always disclosed publicly).

- Exchanges sometimes pair fines with consent decrees, external compliance monitors, and mandated audits.

- Penalties often hinge on failures to file STRs, maintain adequate transaction monitoring, or enforce robust KYC on customers.

- Settlements may require the exchange to overhaul internal controls, hire third‑party compliance firms, and submit to ongoing reviews.

Criminal Charges and Legal Actions for Crypto AML Violations

- In July 2025, Rowland Marcus Andrade, founder and CEO of AML Bitcoin, was sentenced to seven years’ imprisonment for a multi‑million‑dollar fraud involving crypto and money laundering.

- In June 2025, Iurii Gugnin, founder of a crypto payments company, was charged with masterminding a $500 million money laundering scheme spanning multiple jurisdictions.

- Prosecutors indicted KuCoin’s founders for violations of the Bank Secrecy Act and unlicensed money transmission, tied to the alleged laundering of over $5 billion.

- The U.S. DOJ and SEC have pursued joint criminal and civil actions against crypto firms lacking AML controls, signaling increased blended enforcement.

- Courts in the U.S. have invoked the Racketeer Influenced and Corrupt Organizations (RICO) Act in crypto cases involving laundering and fraud.

- In the U.K., a Chinese national was admitted in September 2025 to laundering bitcoin tied to a £5 billion fraud, following asset seizures of 61,000 BTC.

- A crypto ATM operator in the U.K. was sentenced to four years in prison in 2025 for operating unregistered machines and handling criminal funds.

- Deferred prosecution agreements are becoming common; executives plead guilty to lesser charges in exchange for compliance reforms rather than full incarceration.

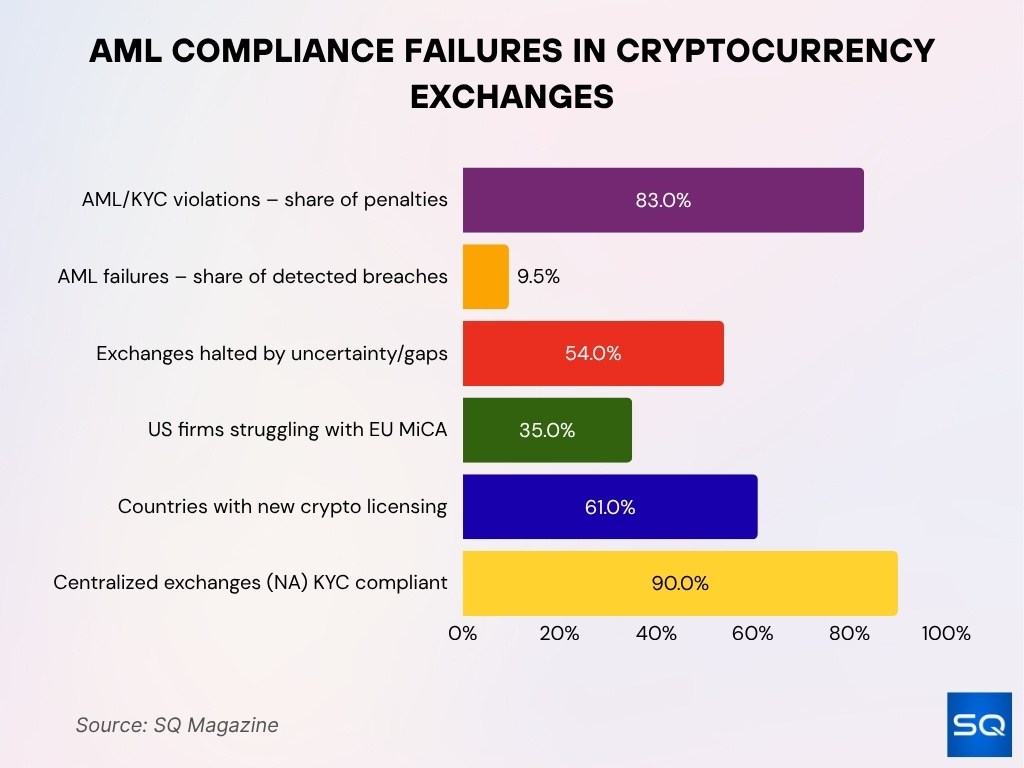

AML Compliance Failures in Cryptocurrency Exchanges

- As of 2025, 83% of crypto compliance penalties relate to AML / KYC violations.

- According to CoinLaw, AML compliance failures contribute 9.5% of detected crypto compliance breaches.

- 54% of global exchanges halted operations in at least one jurisdiction due to regulatory uncertainty or compliance gaps.

- 35% of U.S. crypto firms report struggles complying with EU MiCA in serving European customers.

- 90% of centralized exchanges in North America were reported to be fully KYC compliant in 2025.

- 61 countries have introduced licensing frameworks for crypto firms serving foreign markets, raising compliance barriers.

- Many exchanges outsource compliance to third‑party vendors, increasing third‑party risk and oversight scrutiny.

- Internal audit failures and a lack of continuous testing of AML systems are frequently cited in enforcement reviews.

- Some exchanges have weak controls over internal staff access or overrides, which regulators penalize.

Cross‑Border Crypto AML Enforcement Statistics

- 68% of cross‑border crypto transactions face compliance scrutiny due to mismatched AML and KYC rules.

- The SEC 2025 launched a Cross‑Border Task Force to target foreign firms interfering with U.S. markets.

- TRM Labs’ 2024 analysis found illicit crypto flows account for 0.4% of total crypto volume, a drop from 0.9% in 2023.

- In 2024, illicit crypto inflows reached $40.9 billion, a lower‑bound estimate over multiple chains.

- Over 60% of reviewed jurisdictions launched new crypto policies or regulations in 2024.

- In Europe, the implementation of MiCA triggered over €850 million in crypto‑sector fines in 2024.

- Cross‑border enforcement actions are rising via coordinated actions.

- Some jurisdictions now require crypto firms to register foreign operations or report them to home regulators.

- Sanctions‑driven cross‑border penalties, in countries dealing with sanctioned entities, are rising sharply.

Financial Impact of Crypto Money Laundering Incidents

- In 2024, crypto hacks, frauds, and thefts totaled $2.2 billion, up 17% from 2023.

- The average crypto hack in 2024 was about $14 million per incident.

- Global crypto transaction volume reached over $10.6 trillion in 2024, making illicit flows a smaller share.

- Illicit flows fell to $45 billion in 2024, down 24% year over year.

- AML‑related fines globally in 2024 exceeded $5.1 billion, a 39% jump from 2023 levels.

- The U.S. accounted for 47% of total crypto‑related fines in 2024 (~$2.4 billion).

- The Asia-Pacific region saw a 55% year‑on‑year rise in enforcement actions in 2024.

- The average penalty per crypto business increased by 21%, reaching $3.8 million in 2025.

- AML violations made up 60% of the top 10 crypto fines globally in 2024.

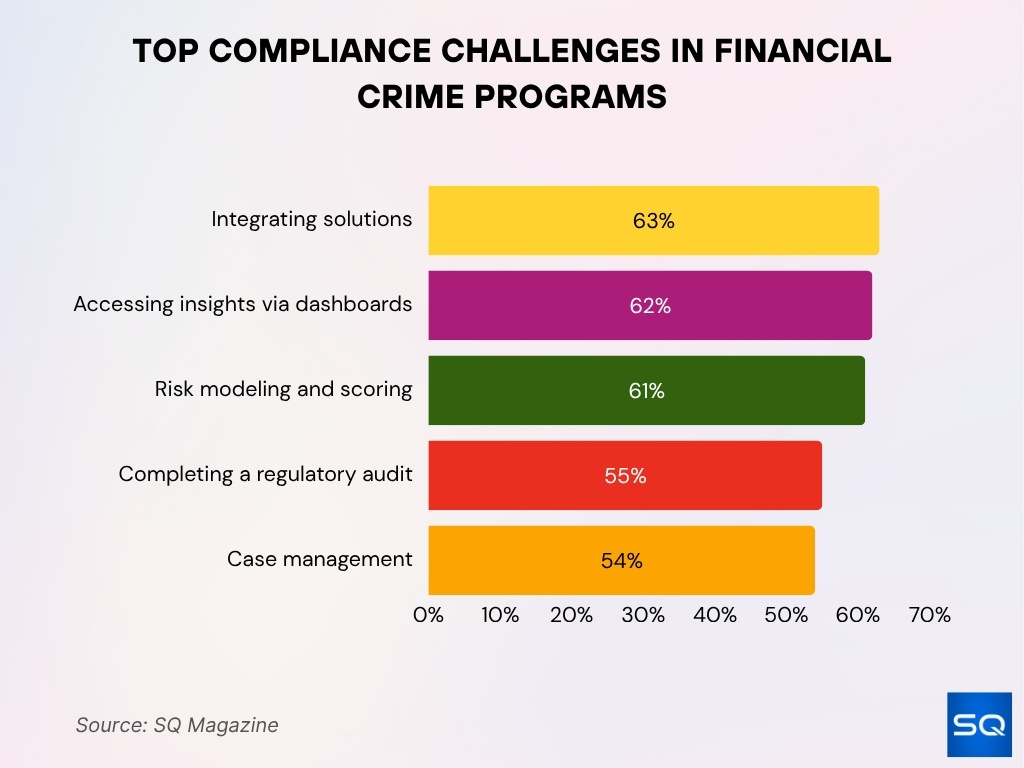

Top Compliance Challenges in Financial Crime Programs

- 63% of organizations cite integrating solutions as their biggest financial crime compliance challenge.

- 62% struggle with accessing insights via dashboards, limiting their ability to detect suspicious patterns.

- 61% face issues in risk modeling and scoring, affecting the accuracy of AML evaluations.

- 55% report difficulty in completing regulatory audits, which are often time-consuming and complex.

- 54% of firms identify case management as a key operational bottleneck in their compliance process.

Trends in Crypto AML Regulatory Enforcement

- Regulators are shifting from one‑off fines to sustained oversight, such as multi‑year compliance plans.

- There’s a rising trend of coordinated enforcement, with the U.S., EU, and Asia targeting cross-border crypto firms.

- In 2025, 88% of financial institutions plan to deploy AI/ML tools for AML, up from 62% in 2023.

- The RegTech market is projected to exceed $22 billion by mid‑2025, growing at approximately 23.5% CAGR.

- Blockchain-based AML/KYC procedures are gaining traction, with estimates that around 15% of such processes may run on-chain by 2025.

- Enforcement is more frequently targeting decentralized finance (DeFi) platforms and protocol developers.

- Regulators are imposing audit and system upgrade requirements as part of settlement orders.

- Some enforcement actions now penalize technology providers or analytic vendors linked to compliance failures.

- Monetary fines are being coupled with asset forfeitures, disgorgement, and operational restrictions.

Notable Crypto AML Enforcement Cases and Prosecutions

- Zhimin Qian (Yadi Zhang) pled guilty in the U.K. for laundering cryptocurrency linked to a £5 billion fraud.

- The Operation Destabilise campaign uncovered a global laundering ring tied to crypto platforms, and multiple actors received prison sentences.

- Tornado Cash developers were charged in the U.S. for laundering more than $1 billion through the mixer protocol.

- KuCoin executives faced U.S. indictments for violating the Bank Secrecy Act and operating an unlicensed money transmission.

- OKX’s $500 million guilty plea in 2025 is one of the biggest AML enforcement outcomes to date.

- BitMEX was fined $100 million for systemic AML violations in a U.S. court.

- Crypto arms of centralized exchanges (e.g., Binance, KuCoin) continue to face investigations globally under numerous jurisdictions.

- Some cases now emphasize protocol liability, when a protocol is allegedly used knowingly to enable laundering.

- Not all cases go to trial; many resolve via pleas or consent orders with compliance terms.

Technology and AI in Crypto AML Compliance

- AI / ML‑based AML models are rapidly adopted, and false positives have dropped by up to 40% in pilot deployments.

- Graph neural networks (GNNs) and network analytics now detect smurfing and structuring behaviors in blockchain workflows.

- Co-Investigator AI, an agentic framework, improves the speed and accuracy of drafting Suspicious Activity Reports (SARs).

- Privacy-preserving machine learning, such as homomorphic encryption, enables cross‑institution AML collaboration without exposing raw data.

- RegTech firms integrate real‑time transaction screening, sanctions filtering, and pattern recognition via APIs.

- Blockchain analytics tools now incorporate address risk scoring, clustering, and cross‑chain tracing.

- Some emerging technologies use smart contract rules to halt suspicious token movements in DeFi.

- AI is expanding into explainable compliance; models now produce audit trails to satisfy regulatory scrutiny.

- Tech is also used for behavioral profiling, detecting anomalous wallet activity, or address reuse patterns.

Frequently Asked Questions (FAQs)

In H1 2025, regulators imposed about $1.23 billion in penalties across sectors.

OKX agreed to pay nearly $505 million in fines and forfeitures.

Illicit flows made up about 0.4 % of global crypto transaction volume in 2024.

Fines increased by 417 % in H1 2025 versus H1 2024.

Conclusion

Crypto AML enforcement is entering a new era. We’re seeing larger fines, broader jurisdictional reach, and tighter regulatory expectations. Tech tools like AI, graph analytics, and privacy-preserving ML are no longer optional; they are core to meeting compliance standards. Exchanges and protocols must build AML into their DNA, not as an afterthought. The data shows that non‑compliance is no longer an occasional risk; it is a business-critical threat.