BONK Coin occupies a unique niche in the crypto world as one of the most followed Solana‑based meme tokens, drawing heavy retail interest and substantial trading activity today. Its journey reflects the broader dynamics of speculative markets and community‑driven tokenomics. In the real world, traders use BONK for short‑term trading arbitrage, while some NFT projects on Solana integrate BONK rewards to boost user engagement. As crypto markets evolve, data‑driven insights into BONK’s performance are essential for tracking sentiment, liquidity, and volatility. Continue reading to explore detailed BONK statistics.

Editor’s Choice

- BONK’s market cap hovered near $940 million in early January 2026, showing continued meme coin interest.

- BONK’s circulating supply stands at around 88 trillion tokens, nearly at its maximum.

- The token saw a 16% weekly price increase, outpacing some market averages.

- 24‑hour trading volume frequently exceeds $100 million, highlighting active liquidity.

- Recent ecosystem initiatives include token burn incentives tied to milestone achievements.

Recent Developments

- In January 2026, BONK’s ecosystem launched weekly trading competitions with ~$200,000 in rewards to boost engagement.

- A planned 1 trillion token burn activates once holder counts reach defined thresholds.

- BonkFun added zero creator fee launches to attract new traders.

- Institutional product exploration, including regulated financial instruments, remains under consideration.

- Market sentiment saw a memecoin rally with BONK peaking intraday around $0.0000147.

- Core protocol had no major codebase changes reported in early 2026.

- Community discussions highlighted liquidity and trading incentives as growth drivers.

- BONK continues to be referenced alongside other meme assets during speculative cycles.

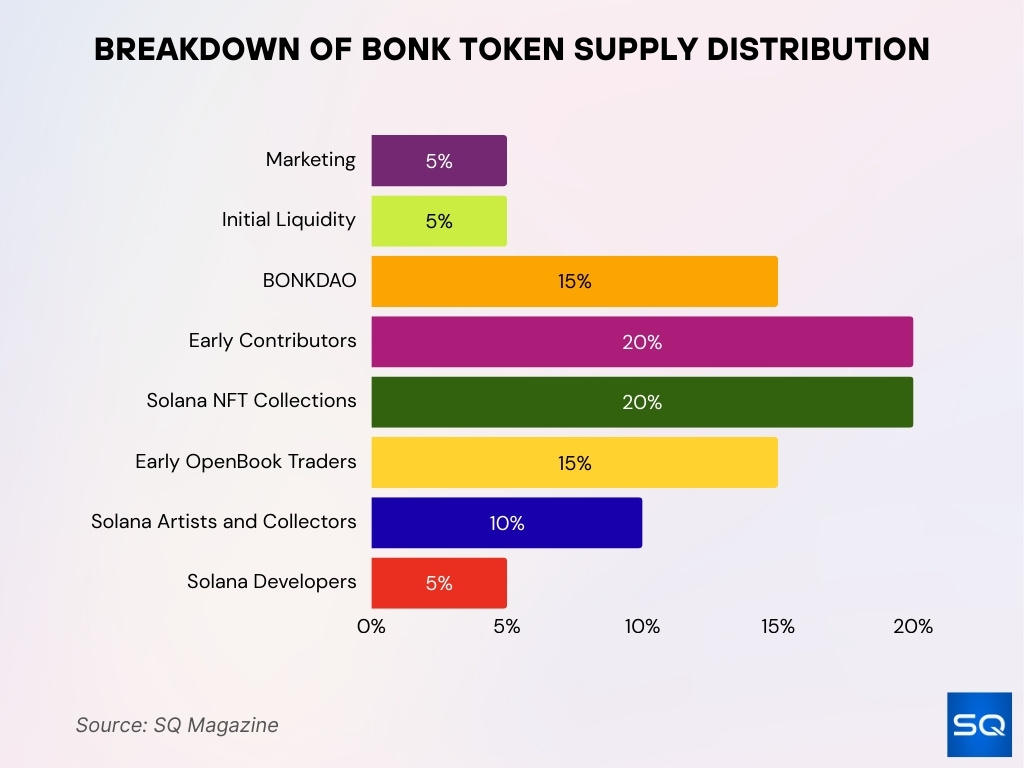

BONK Token Distribution

- Marketing receives 5% of BONK’s total supply for promotional efforts.

- Initial Liquidity is allocated 5% to enhance trading and price stability.

- BONKDAO holds 15% to manage governance and community decisions.

- Early Contributors own 20% as a reward for initial project support.

- 40 Solana NFT Collections share 20% to boost NFT ecosystem synergy.

- Early OpenBook Traders receive 15% to encourage platform adoption.

- Solana Artists and Collectors get 10% to fuel cultural engagement.

- Solana Developers receive 5% to drive ongoing innovation and growth.

BONK Market Capitalization

- BONK’s market capitalization was approximately $944 million per recent data.

- Some exchanges report market cap ranging from $757 million to ~$988 million, depending on the data source.

- In early 2026, BONK’s cap fluctuated but stayed within the upper hundreds of millions.

- Fully diluted valuation estimates place BONK near similar figures, reflecting near‑max supply.

- Relative meme coin rankings place BONK among the top 100–120 by market cap globally.

- Year‑over‑year comparisons illustrate a decline from mid‑2024 peaks as speculative sentiment shifted.

- Daily changes in cap often correlate with meme coin sector volatility.

- BONK’s cap contrasts with major tokens, emphasizing higher risk and community demand patterns.

Trading Volume and Liquidity

- BONK’s 24‑hour trading volume often exceeds $100 million, indicating substantial liquidity.

- Some data sources recorded volumes above $170 million on active days.

- Volume spikes frequently align with memecoin rallies or social media‑driven interest surges.

- Liquidity pools on Solana AMMs show consistent depth amid speculative trades.

- Relative volume ratios often outpace the broader cryptocurrency average during heightened activity.

- Some short‑term traders report rapid entry and exit flows, typical of meme coins.

- Market depth analytics show tight bid‑ask spreads during peak hours.

- Cross‑exchange volume variations highlight arbitrage opportunities between platforms.

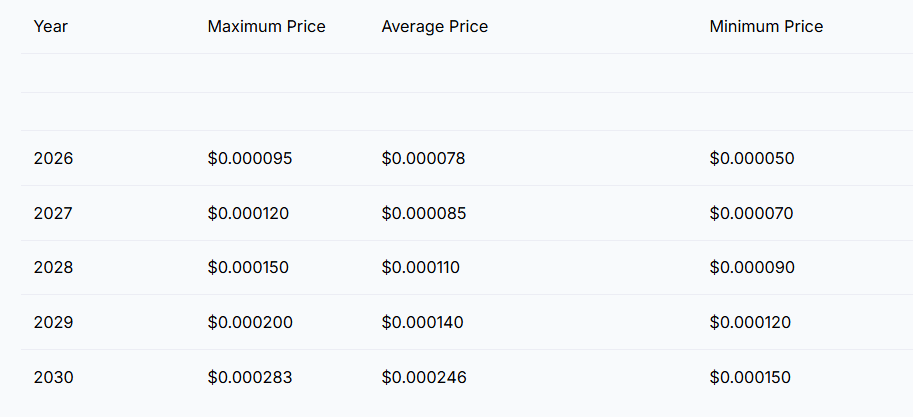

BONK Price Forecast Overview

- The maximum price outlook shows BONK rising from $0.000095 in 2026 to $0.000283 by 2030, highlighting strong long-term upside.

- Average price projection increases steadily from $0.000078 in 2026 to $0.000246 in 2030, signaling sustained adoption.

- Minimum price trend climbs from $0.000050 in 2026 to $0.000150 in 2030, reflecting stronger downside support.

- 2028 inflection point occurs as the average price surpasses $0.000110, indicating accelerated growth potential.

- Volatility outlook improves over time as rising minimum prices narrow the downside to upside range.

- Long-term sentiment remains bullish, with 2030 average prices over 3× higher than 2026 levels.

Volatility and ROI Statistics

- BONK’s price has exhibited wide intraday swings throughout early 2026, reflecting high volatility.

- Year‑to‑date price data shows fluctuations between approx $0.0000077 and $0.000012.

- Historical peaks indicate returns can be negative or positive double‑digit percentages weekly.

- Long‑term ROI since 2024’s ATH is negative, with the current price far below the peak.

- Short‑term trader ROI often shows rapid gains or losses based on sentiment shifts.

- Relative volatility tends to exceed that of major coin benchmarks like Bitcoin.

- Meme coin correlation patterns amplify ROI swings during market rallies.

- Comparisons with broader altcoin indices show more volatile behavior.

Inflation, Emission, and Token Burn Statistics

- BONK max supply capped at 88.87 trillion tokens with circulating supply near 88 trillion.

- Historical total burns exceed 2.47 trillion BONK (2.6% of supply), valued at $74.4 million.

- Scheduled 1 trillion BONK burn (1.24% supply) triggers at 1 million unique holders (currently 950,000).

- July 2025 burn of 500 billion BONK (0.5% supply) drove 158% price surge.

- BONK.fun allocates 50% revenue to burns; January generated $1.5 million in 11 days.

- Emission slowed as the circulating supply reaches 99% of the max limits.

- Burn events historically trigger 15–70% short-term price rallies.

- Unique holders approach the 1 million milestone for major burn activation.

- Cumulative burns include BURNmas 2024’s 1.69 trillion BONK ($53.5 million).

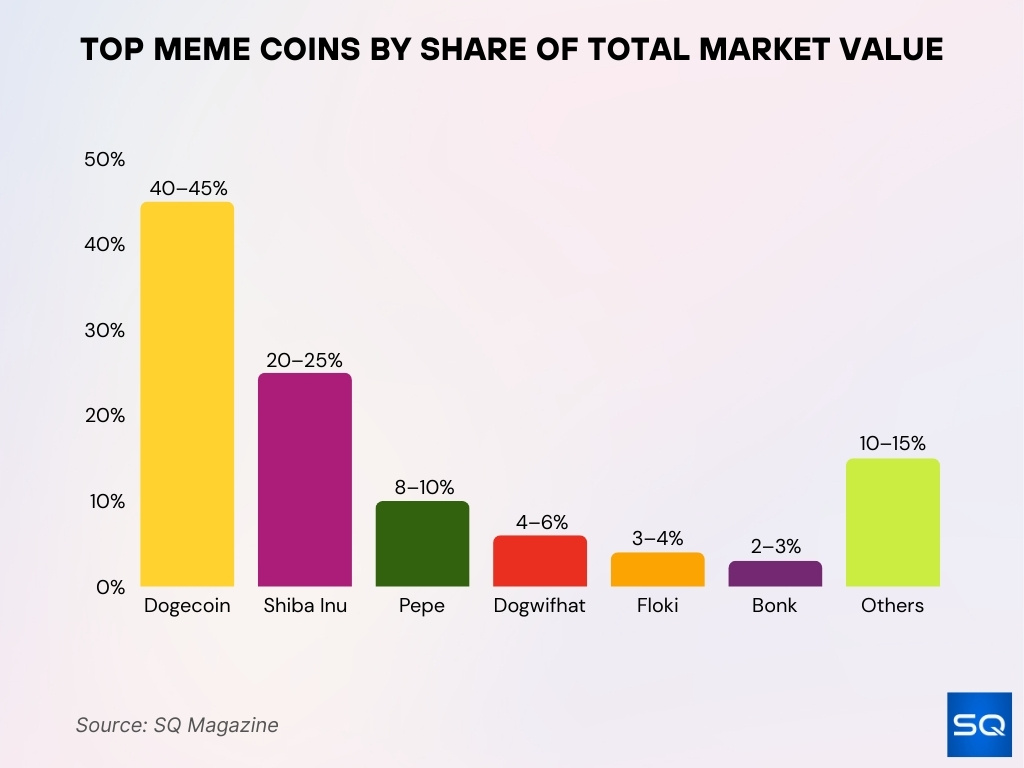

Dominance of Top Meme Coins in the Sector

- Dogecoin (DOGE) leads with roughly 40–45% of the large-cap meme coin market value, retaining the top position.

- Shiba Inu (SHIB) holds about a 20–25% share, firmly ranking as the second-largest meme asset.

- Pepe (PEPE) accounts for nearly 8–10% of leading meme coin capitalization due to strong viral momentum.

- Dogwifhat (WIF) captures around 4–6% of the top meme coin value, supported by a market cap above $1.5 billion.

- Floki (FLOKI) represents approximately 3–4% of the upper-tier meme sector with a market cap of over $1 billion.

- Bonk (BONK) controls roughly 2–3% of the large-cap meme coin market value as a key Solana-based meme token.

- Other emerging meme coins collectively make up about 10–15% of total sector capitalization.

Distribution and Wallet Metrics

- Circulating supply reaches 87.99 trillion BONK across 975,000 Solana addresses and 51,806 BNB holders.

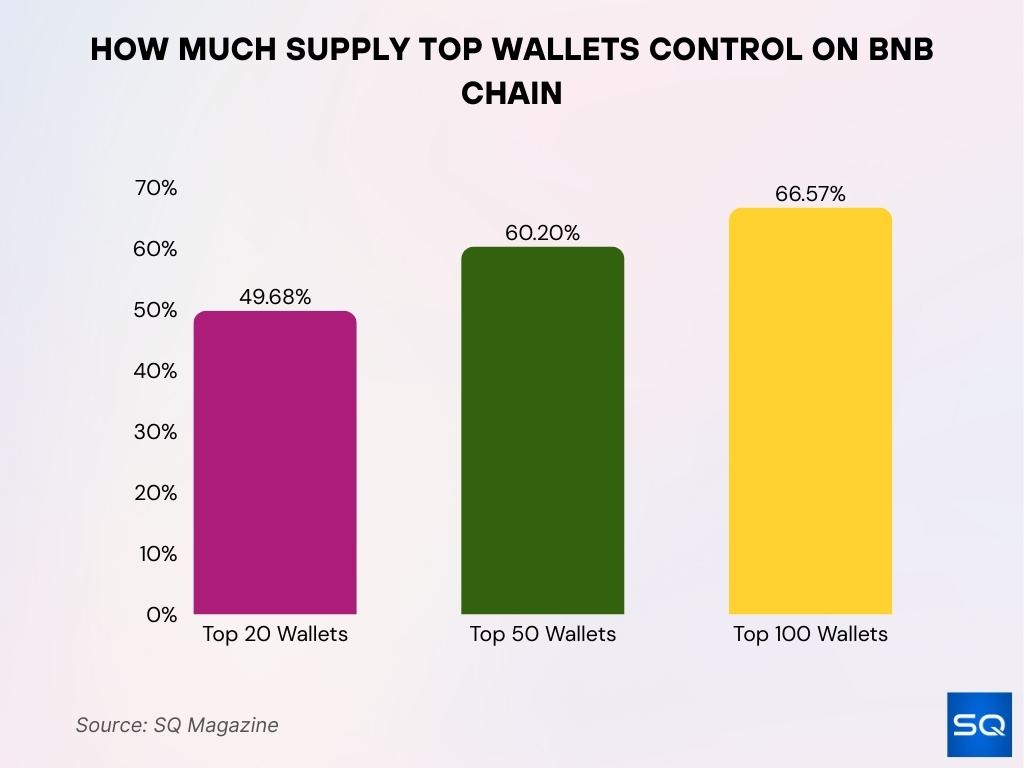

- Top 10 wallets control 41.03%, top 20 hold 49.68%, and top 100 possess 66.57% on BNB Chain.

- Largest BNB wallet holds 7% of BNB BONK supply, with concentration diluting from prior 41% top-10 levels.

- Exchange inflows hit $30 million vs $28 million outflows recently, signaling net deposits.

- Daily trading volume exceeds $300 million, with 24h peaks at $988 million on AMMs and exchanges.

- The initial airdrop distributed 50 trillion BONK to 297,000 wallets.

- Recent 24h trades: 2,114 on Coinbase with 1,307 buyers and 873 sellers.

- On-chain volume spiked to 2.9 trillion tokens during high-activity periods.

Holder Statistics and On-Chain Activity

- Holder count increased by roughly 11% year over year, signaling sustained interest beyond peak hype cycles.

- The top 100 wallets control approximately 38% of the circulating supply, a common pattern among meme-based assets.

- Wallets holding less than $1,000 worth of BONK account for over 92% of all addresses, underscoring retail dominance.

- Daily active addresses average 48,000–55,000, fluctuating with market volatility.

- On-chain transfer volume spikes often coincide with centralized exchange inflows, indicating short-term trading behavior.

- BONK ranks among the top five most transferred SPL tokens on Solana by transaction count.

- Whale wallet activity increases notably during double-digit price movement days, amplifying volatility.

- Long-dormant wallets (inactive for 6+ months) represent less than 9% of supply, suggesting high token velocity.

Wallet Distribution

- Top 20 wallets collectively hold 49.68% of the total token supply on BNB Chain, indicating high concentration among leading holders.

- Top 50 wallets control 60.20% of the circulating supply, showing increasing ownership consolidation beyond the largest addresses.

- Top 100 wallets possess 66.57% of the total supply, highlighting a strong dominance of large holders within the network.

Staking and Yield (if applicable)

- Bonk Rewards locking program offers dynamic yields from ecosystem revenue, not fixed APY.

- BONK/USDC Raydium pool APY ranges 7-15% based on trading fees and activity.

- BONK/SOL Jupiter-integrated pools deliver 10-22% estimated APY amid high volume.

- Longer Bonk Rewards locks (12 months) yield 1.5x higher multipliers vs 3-month.

- Liquidity providers face 20-30% impermanent loss risk from BONK volatility.

- Bonk Rewards TVL supports rewards from BonkBot, SVB, and BonkSwap revenues.

- Third-party DeFi platforms list BONK farming opportunities up to 25% APY.

- Ladder strategy across 3/6/12-month locks balances liquidity and max yields.

- Ecosystem rewards are distributed pro rata in USDC and BONK to lockers.

Transaction Metrics and Network Usage

- BONK records 470,000 active addresses with robust daily transaction velocity.

- 24-hour trading volume reaches $84.4 million, representing 11.19% of market cap.

- Peak 24-hour volume hit $988 million, 13-15% of Solana meme-coin activity.

- Solana network TPS leads at 290 TPS YoY (+34%), supporting BONK throughput.

- Daily token creations exceed 25,000 on Solana launchpads like letsBONK.fun.

- letsBONK.fun fees peaked at $352,793 daily, driving 600% revenue surge.

- Transaction failure rates under 1% on the high-throughput Solana network.

- Memecoin launchpad volumes hit $228 million three-month high.

- BONK platforms capture 53.2% daily locked SOL volume on Solana.

- Average tx fees are fractions of $0.001, enabling micro-trading strategies.

Exchanges Listing and Trading Pairs

- Binance leads with $126.6 million 24h volume on BONK/USDT (12.97% total).

- MEXC records $99.1 million (10.15%) on the BONK/USDT pair.

- Coinbase Exchange trades $73.2 million (7.49%) primarily in BONK/USD.

- P2B achieves $61.5 million (6.3%) volume on BONK/USDT.

- Upbit contributes $36.5 million (3.74%) on BONK/KRW.

- LBank volume hits $32 million (3.28%) for BONK/USDT.

- Bybit and Bitget add $23.5 million and $19 million on USDT pairs.

- KuCoin sees $5.4 million (0.55%) on BONK/USDT.

- Raydium and Jupiter DEX host BONK/SOL, BONK/USDC with rising liquidity.

Correlation With Bitcoin and Major Altcoins

- BONK maintains a 0.94 correlation coefficient with Bitcoin price movements.

- Positive correlation with the top 10 market cap coins at 0.695 index.

- Correlation with top 100 coins (ex-stablecoins) stands at 0.659.

- Strong linkage to Solana (0.82 CC), amplifying ecosystem rallies.

- Memecoin peers PEPE (0.73) and FLOKI (0.78) show strong positive ties.

- BONK surged 144% during Solana’s 29% rally, leveraging beta.

- High BTC correlation (0.94) despite memecoin independence in volatility.

- Ethereum correlation is weaker, with BONK diverging during Solana narratives.

- 48.18% volatility decline projected vs stable BTC/ETH growth.

Frequently Asked Questions (FAQs)

As of early 2026, BONK’s market cap is about $757 million to $1 billion, depending on the data source and exchange.

BONK’s price in 2026 is around $0.000008 to $0.000012 per token on major exchanges.

The circulating supply of BONK is approximately 88 trillion tokens, nearly at its max supply.

BONK accounts for roughly 13% to 15% of Solana meme‑coin trading volume in recent 24‑hour metrics.

Conclusion

BONK remains one of the most active and widely discussed meme tokens, exhibiting high transaction volumes, strong exchange presence, and distinctive supply dynamics compared with broader crypto assets. Market metrics show that while BONK’s price does not strictly follow Bitcoin or major altcoins, it thrives on community engagement and speculative momentum, producing both opportunity and risk for traders.

On‑chain data reflects robust usage but also highlights the volatile nature of meme‑coin trading. As the ecosystem matures, BONK’s ongoing burn mechanisms, expanding liquidity pools, and broad exchange access will likely shape its narrative. Whether BONK emerges from meme coin classification toward sustainable utility will depend on broader adoption, narrative shifts, and macro crypto conditions.