Board games are enjoying a resurgence as social entertainment and strategic art converge. The global market continues to expand, driven by new hybrids, cafés, and an appetite for offline connection. In corporate team‑building, companies now host board game nights to strengthen collaboration. In education, schools and museums adopt game-based learning modules to teach history, math, or logic. Read on to explore the key stats that define the state of board gaming today.

Editor’s Choice

- The playing cards & board games sector is expected to grow from $22.03 billion in 2025.

- On Kickstarter, only ~41.98% of projects reach their funding goal.

- North America held ~41.68% of the board games market share in 2024, making it the largest regional market at that time.

- The Tekken: The Board Game campaign reached its goal of ~€50,000 in just 35 minutes and ultimately raised ~€350,000 (~700% of goal).

- The strategy & war genre accounted for 24% of the global board game market share in 2024.

Recent Developments

- AI-enhanced gameplay, narrative content, and companion apps are emerging as differentiators; publishers expect AI to reshape how rules and expansions evolve.

- Hybrid games (physical components with digital integration) are increasingly common in new launches.

- Board game cafés and experiential venues are opening in key cities, blending social gathering with play.

- Crowdfunding campaigns now include stretch goals tied to augmented reality or app tie-ins.

- The holiday season remains a peak window, with search trends for “family board games” and “board games for kids” spiking in Nov–Dec 2024.

- Some publishers report supply chain disruptions and rising material costs, squeezing margins.

- Tariffs and import regulations are pressuring small publishers in the U.S., with ~23% indicating possible closure due to cost burdens.

- Immersive adaptations, e.g., life‑size Monopoly, are launching as entertainment attractions in cities like Charlotte in 2025.

Board Game Spending Statistics

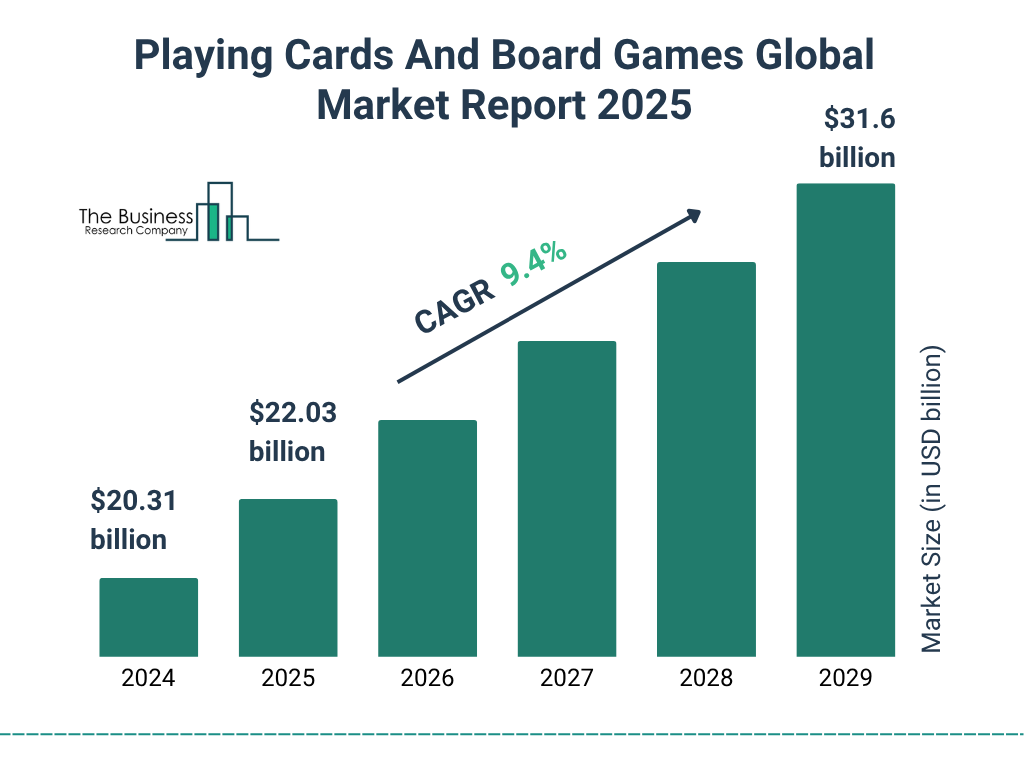

- The global playing cards & board games market is projected to grow to $22.03 billion in 2025, marking a healthy upward trend.

- The market is expected to hit $31.6 billion by 2029, reflecting a strong CAGR of 9.4%.

- Estimated values in between suggest growth to ~$24.1 billion in 2026, ~$26.4 billion in 2027, and ~$28.8 billion in 2028.

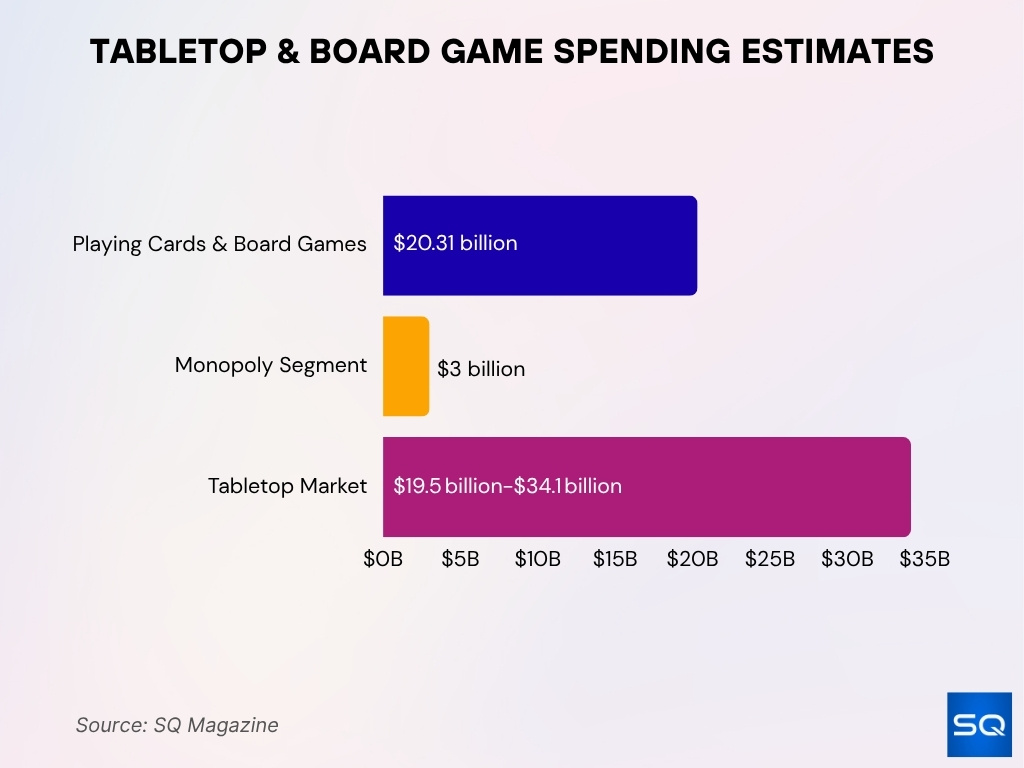

- Separately, the broader tabletop games market in 2025 is forecasted to range between $19.5 billion and $34.1 billion.

- The Monopoly franchise alone reportedly generates about $3 billion annually, highlighting the impact of iconic titles.

Regional Board Game Market Analysis

- In 2024, North America held ~41.68% of the global board games market share.

- Asia Pacific is second in size and growing; its CAGR is forecast to be near 6% over 2025–2034.

- Europe’s board game market is also expanding, with ~5.7% CAGR expected over the coming years.

- The U.S. gaming consumer base contributes over 60.5% of North America’s board game revenue.

- Emerging markets in Latin America and Southeast Asia are driving niche demand, especially in tabletop cafés.

- German-speaking Europe remains a key innovation hub, e.g., Eurogame design.

- E‑commerce adoption in developing regions is enabling cross-border board game sales.

- Cultural preferences differ; North America favors social and party games, while Europe leans more heavily toward strategic and thematic designs.

Annual Board Game Purchase Trends

- 2024 to 2025 shows continued growth, the playing cards & board games market rose from $20.31 billion to $22.03 billion (8.4% growth).

- Grand View Research projects revenue growth from $21.45 billion in 2025 to $31.93 billion in 2030.

- Rain checks, board game sales tend to peak in Q4 (holiday shopping).

- Many buyers purchase 2–3 games per year on average in mature markets.

- The average spend per buyer in the U.S. has risen 5–7% year over year.

- Bundled expansions and deluxe editions account for a rising share of purchases.

Board Game Spending Statistics

- A baseline, $20.31 billion in revenue for playing cards & board games.

- In 2025, the broader “tabletop” market projection is between $19.5 billion and $34.1 billion.

- The monopoly segment alone reportedly generated ~$3 billion.

- Specialty/hobby retailers continue to capture a premium portion of revenue.

- Online distribution channels are expanding faster in revenue share than brick‑and‑mortar.

- Higher-tier, deluxe, collector’s edition games now represent a significant share of total spend in mature markets.

- Accessory products, dice, organizers, and sleeves are rising as “micro‑spend” add-ons.

Distribution & Sales Channels

- In 2024, the offline segment (specialty stores, toy stores, big-box retailers) held the largest revenue share for playing cards & board games.

- However, online sales are the fastest-growing channel, fueled by e‑commerce convenience and global reach.

- Grand View Research reports that offline still dominates in 2024, but projects that digital will steadily close the gap by 2030.

- Specialty game stores still command a premium niche; many customers visit to try games, attend demo events, or get expert advice.

- Big-box retailers and mass merchants drive volume; titles with mass appeal often use these channels for reach.

- Direct-to-consumer models, via publisher websites, are rising, giving publishers higher margins.

- Subscription boxes or “game of the month” services contribute a small but growing distribution slice.

- Cross-border marketplaces, e.g., Amazon, BoardGameGeek store, enable indie publishers to reach buyers globally.

- Hybrid distribution, retail + app-based fulfillment, sometimes lets a retailer service local backers of crowdfunded games.

Popular Board Game Types & Genres

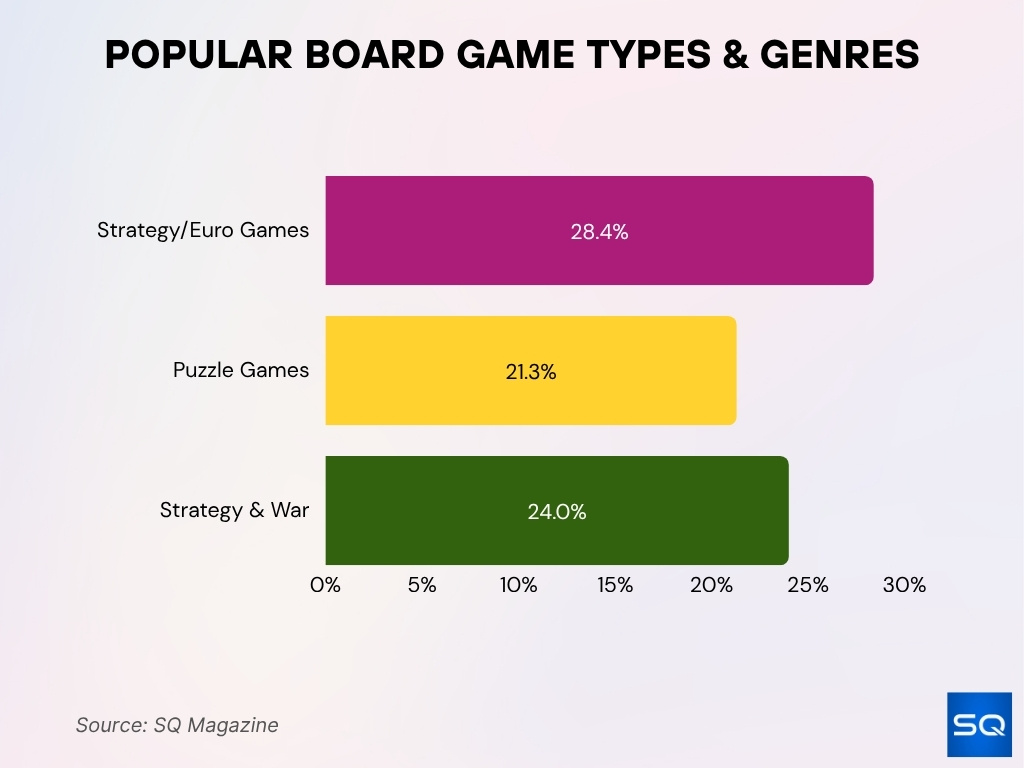

- Strategy / Euro games remain a leading genre; Mordor Intelligence estimates that strategy/Euro titles held 28.4% of market share in 2024.

- Puzzle and abstract games often serve as entry points. Future Market Insights projects a 21.3% share for puzzle games in 2025.

- The strategy & war genre accounted for 24% of the global board game market share in 2024.

- Cooperative and legacy-style games show strong growth, with a projected CAGR of ~12.1% through 2030.

- Fantasy and thematic games remain popular, leveraging intellectual property (movies, books) to attract players.

- Deduction and social games, e.g., hidden roles, are consistent sellers in party game segments.

- Solo and two-player games continue rising, especially designs optimized for small groups or solo play.

- Hybrid mechanics combining digital elements, apps, and AR with physical components are increasingly used.

- Niche genres like dexterity, engine building, and asymmetric play are seeing more experimentation.

- In many catalogs, “gateway” games, low complexity, approachable, help recruit new players.

Digital Integration and Hybrid Board Games

- The hybrid board games market is expected to reach about $1.2 billion by 2025.

- Hybrid systems include companion apps, AR/VR overlays, digital setup, or variable content updates.

- The research prototype DungeonMaker demonstrates physical board projection and material response under play.

- Many modern games ship “app‑assisted” editions to help with bookkeeping, events, or hidden information.

- Some publishers release digitally updatable rules or scenario packs tied to apps.

- Digital integration helps reduce rule complexity barriers by automating setup and scoring.

- However, some purist customers resist over-automation, preferring a “pen and paper” experience.

- Licensing between video game IPs and board game formats is a growing pathway.

- As digital infrastructure, e.g., AR-capable phones, becomes ubiquitous, more hybrid designs become feasible.

Board Game Demographics by Age Group

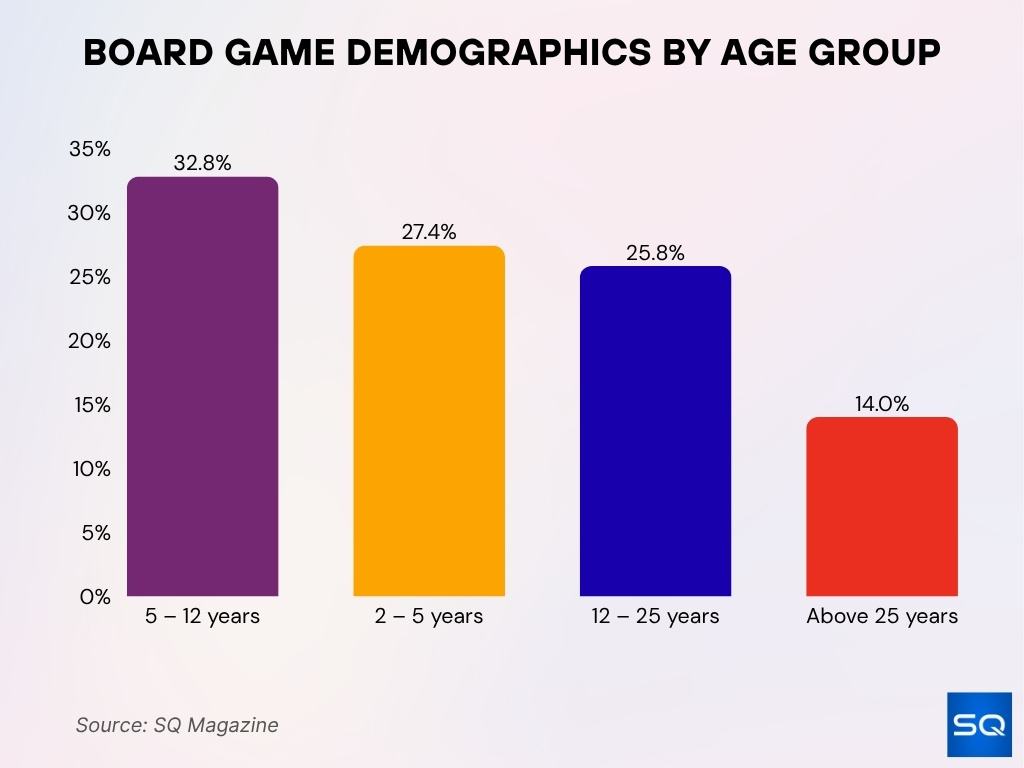

- The 5–12 years age group holds the largest market share at 32.8%, showing strong engagement from older children.

- Kids aged 2–5 years account for 27.4%, reflecting the popularity of preschool-friendly board games.

- The 12–25 years demographic makes up 25.8% of the global market, highlighting sustained interest among teens and young adults.

- Adults above 25 years represent 14.0% of the board game market, showing emerging growth among older players and families.

- Overall, children under 12 make up over 60% of total board game consumption, underscoring the industry’s youth-driven appeal.

Impact of Board Game Cafes

- The board game cafe market was valued at $1,268.94 million in 2024.

- It is projected to reach $2,495.12 million by 2032 with a CAGR of ~10.14%.

- Cafes often charge a cover or hourly fee for game library access; this model helps offset inventory costs.

- These venues serve as discovery points, and many customers try games in cafés before buying copies.

- Cafes help build local gaming communities via tournaments, meetups, and demo nights.

- Some joint café‑retail stores sell games on-site, boosting direct conversion.

- Cafés also increase dwell time, supporting food & beverage revenue in addition to game play.

- Chains like Draughts, The Uncommons, and Snakes & Lattes illustrate the format’s reach.

- In competitive city markets, cafés differentiate via curated libraries, rare titles, or themed events.

Most Popular Board Games (Top Sellers)

- Wyrmspan, from Stonemaier Games, recorded the largest single‑day sales in that publisher’s history after its 2024 release.

- The Tekken: The Board Game crowdfunding campaign exceeded €350,000 (700% of its goal) after hitting its target in ~35 minutes.

- Major evergreen titles like Monopoly still produce consistent revenue; some reports estimate Monopoly sold $~3 billion in 2024.

- Titles tied to popular IPs or media franchises often top charts due to built-in audiences.

- High‑component collector editions, miniatures, and deluxe boxes have become bestsellers in hobby segments.

- Legacy games, Pandemic Legacy, Gloomhaven, etc., continue to wash through secondary markets.

- Cooperative blockbuster hits, e.g., Ark Nova, Gloomhaven, draw sustained attention on Kickstarter and retail.

- Some Kickstarter campaigns generate more revenue than traditional retail launches.

- Reprints and “designer classics”, Catan, Carcassonne, and Ticket to Ride, retain consistent sales.

Board Game Crowdfunding Insights

- In 2024, Kickstarter’s dollars raised for tabletop campaigns declined by ~2.7% year over year.

- As of early 2025, the Gamefound platform has hosted over $85 million in tabletop campaign funding.

- In 2024, Gamefound was home to 6 of the top 10 most-funded tabletop campaigns, boosting its reputation.

- The global crowdfunding market is projected to grow from $17.72 billion in 2024 to $20.34 billion in 2025, a 14.8% jump.

- Many board game creators report unfulfilled orders or delays caused by manufacturing or trade disruptions.

- Crowdfunding platforms are increasingly integrating late pledge (post-campaign funding) and subscription models to extend project life.

- Some campaigns now include digital tie‑ins, stretch goal apps, or AR content to attract more backers beyond physical game features.

Sustainability Trends in Board Games

- In 2024, many publishers began switching to FSC-certified paper, soy-based inks, and recycled components to reduce environmental impact.

- The studio All About Games Consulting reports more demand from publishers for sustainability‑led manufacturing guidance in 2024.

- Serious educational games, e.g., Circul8, have been created to help players understand the circular economy and resource cycles.

- Environmental-themed games are used to raise awareness of climate change challenges among players.

- Some campaigns offer “green” pledges (offset carbon, plant a tree) tied to game shipments.

- Minimalist component design (less plastic, no inserts) is trending to reduce waste.

- Use of print-on-demand or lower initial print runs can reduce overproduction.

- Removable or reusable packaging is being introduced to cut single‑use waste.

- Some publishers are partnering with local manufacturing to shorten shipping footprints.

Leading Board Game Manufacturers & Brands

- Asmodee is often cited as controlling ~18% of the global board game share in 2024.

- Hasbro continues as a major legacy publisher (Monopoly, Clue, etc.), and has raised its revenue forecast in 2025 on strength from its game units.

- Games Workshop (Warhammer) reported $526 million in revenue in FY 2024, nearly doubling since 2020.

- Cartamundi, a major playing-card and board game manufacturing group, recorded ~€648 million in revenue in 2022.

- Many smaller publishers are being consolidated, and acquisition activity by larger firms is ongoing.

- In the U.S., the top game companies include Hasbro, Mattel, Ravensburger, Gamewright, and CMON, among others.

- Some manufacturers are vertically integrated (production, distribution, IP) to control costs and margins.

- Independent and niche publishers are still plentiful, though many struggle with scale and logistics.

- Manufacturing firms in Asia remain key to scale, and many Western publishers face pressure from tariffs or disruption.

Frequently Asked Questions (FAQs)

It is forecast to grow at about a 5.6% CAGR over 2025–2035.

North America held roughly 41.68 % of the global board games market in 2024.

It is projected to grow by $5.17 billion from 2025 to 2029.

About 41.98% of Kickstarter projects reach their funding goal.

Conclusion

The world of board games remains vibrant, shaped by funding innovations, experimental mechanics, and deeper social purpose. Crowdfunding still plays a central role, while evolving pressures push creators toward sustainability and hybrid models. Everywhere, from cafés to classrooms to mental health clinics, games are proving their value beyond fun. As you explore more data below, you’ll find the full article dives into how these trends interconnect and what lies ahead for an industry reinventing itself.