Blockchain is reshaping how money moves across global supply chains. In supply chain finance, distributed ledgers are boosting transparency, cutting costs, and speeding up transactions across industries. From automating invoice financing in logistics to reducing fraud in trade finance, blockchain’s real-world impact is evident across manufacturing and financial services. As firms grapple with digital transformation and efficiency demands, the data below highlights key trends and adoption numbers. Read on to explore the latest statistics and insights.

Editor’s Choice

- The blockchain in the supply chain market is projected to reach $3.7 billion in 2025.

- ~46% of North American supply chain firms plan to adopt blockchain solutions.

- ~63% of companies seek blockchain verification systems to enhance transparency.

- Blockchain cuts operational costs by up to 33% in supply chain finance.

- 82% of executives expect positive ROI from blockchain adoption within two years.

Recent Developments

- A 50% increase in blockchain platforms handling trade finance in the past year reflects the expansion of cross-border settlement tools.

- IBM launched an upgraded blockchain supply chain finance platform in 2024, featuring AI-based risk evaluation and real‑time monitoring.

- Asia-Pacific blockchain markets in SCF are growing at a ~59% CAGR through 2027.

- Real‑world asset tokenization continues to integrate into supply finance, bridging TradFi and decentralized ecosystems.

- Institutions like DTCC are using blockchain infrastructure to standardize mutual fund data across ledgers.

- Luxury brands expand blockchain product tracking systems, and over 70 million products have been registered on such networks.

- Tokenization and digital asset issuance are gaining traction in institutional finance, as seen in blockchain‑based debt issuances.

- U.S. fintech firms are moving traditional lending markets like mortgages on‑chain, illustrating broader blockchain finance integration.

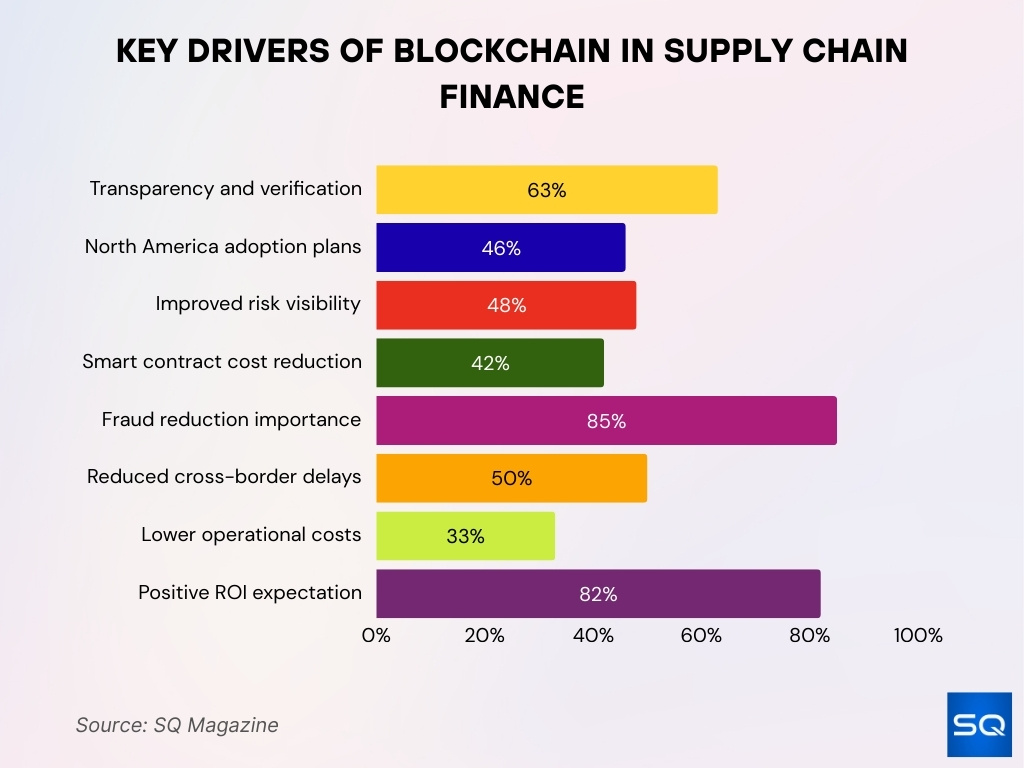

Key Drivers of Blockchain in Supply Chain Finance

- 63% of companies seek blockchain-based verification systems to boost transparency, traceability, and security.

- 46% of North American supply chain firms have integrated or plan to adopt blockchain solutions.

- 48% of companies report better risk visibility due to blockchain’s real-time transparency.

- Smart contracts lower administrative costs by up to 42%, especially in invoicing and settlements.

- 85% of supply chain finance firms consider blockchain essential for fraud reduction.

- 50% of trade finance companies pursue blockchain solutions to reduce cross-border delays.

- Blockchain implementation cuts operational costs by up to 33% by removing intermediaries.

- 82% of executives expect positive ROI from blockchain adoption within two years.

Blockchain Adoption in Supply Chain Finance

- ~46% of North American supply chain firms have integrated or will adopt blockchain SCF solutions.

- 15% of logistics providers now use blockchain to streamline supply chain finance workflows.

- 82% of executives believe blockchain adoption yields positive ROI within two years.

- Blockchain adoption CAGR in finance and logistics sits at ~53% through 2025.

- Private blockchain networks hold ~40% revenue share in sustainable supply chains due to secure permissions.

- Invoice financing within blockchain SCF represented ~28% of the market in 2024, with strong projected growth.

- Large enterprises captured ~73% market share in blockchain SCF in 2024.

- SMEs show ~38% CAGR adoption potential through 2034, indicating broader future uptake.

Barriers to Blockchain Adoption in Supply Chain Finance

- 60% of small businesses cite high implementation costs as a significant barrier.

- 30% of companies struggle with interoperability challenges between blockchain and existing systems.

- 45% of executives highlight data privacy and security issues as primary concerns.

- 76% of banks note regulatory compliance costs like AML and KYC as major hurdles.

- Lack of skilled blockchain personnel affects 58% of supply chain professionals.

- Scalability limits hinder 40% of high-volume transaction implementations.

- 50% of SMEs face ROI uncertainty, delaying digital transformation investments.

- Resistance to change impacts 35% of traditional finance and supply chain players.

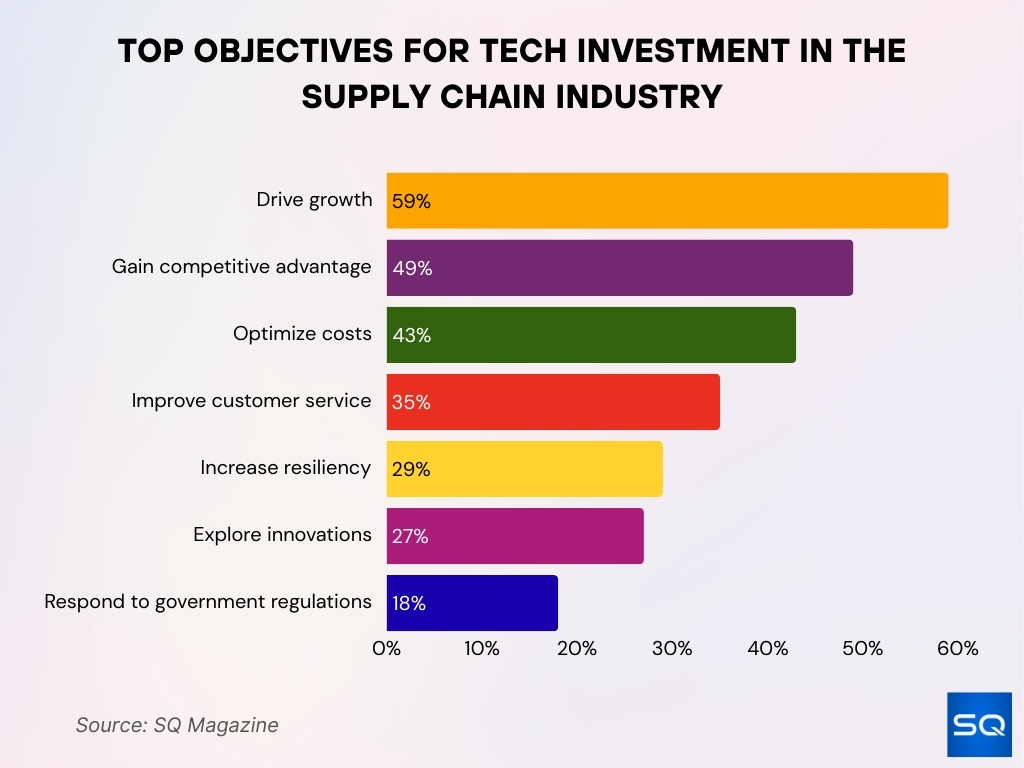

Top Objectives for Tech Investment in the Supply Chain Industry

- 59% invest in technology to drive growth, making expansion the primary objective across supply chains.

- 49% pursue tech to gain a competitive advantage, strengthening strategic market positioning.

- 43% focus on cost optimization, emphasizing efficiency and margin improvement.

- 35% prioritize customer service improvements, reflecting a shift toward consumer-centric logistics.

- 29% invest in increasing supply chain resiliency, aiming to reduce disruption risks.

- 27% explore innovation initiatives, staying ahead of emerging technologies and trends.

- 18% invest to meet government regulations, making compliance a secondary driver.

Blockchain Supply Chain Finance by Industry Vertical

- Logistics & transportation holds 29.58% market share due to early blockchain adoption for visibility.

- 15% of logistics providers use blockchain to streamline supply chain finance processes.

- Manufacturing firms achieve working capital optimization through blockchain SCF platforms.

- Healthcare supply chain management captures 26.2% of blockchain applications for traceability.

- The pharmaceutical sector could save $218 billion annually via blockchain fraud reduction.

- 46% of North American firms in various verticals adopt blockchain for efficiency.

Transaction Volumes in Blockchain Supply Chain Finance

- Transaction volumes are projected to double by 2028 as adoption deepens.

- Real‑time transparency reduces dispute‑related transaction rework by nearly 38%.

- Blockchain platforms improved invoice verification accuracy by ~38%, reducing errors and rejections.

- Cross‑border SCF transactions benefit from reduced settlement times, supporting higher throughput.

- Trade finance volumes on blockchain platforms have grown ~50% year‑over‑year.

- Supply chain invoices financed through blockchain accounted for ~28% of related market applications in 2024.

- Dynamic discounting and reverse factoring applications in SCF show double‑digit transaction growth through 2034.

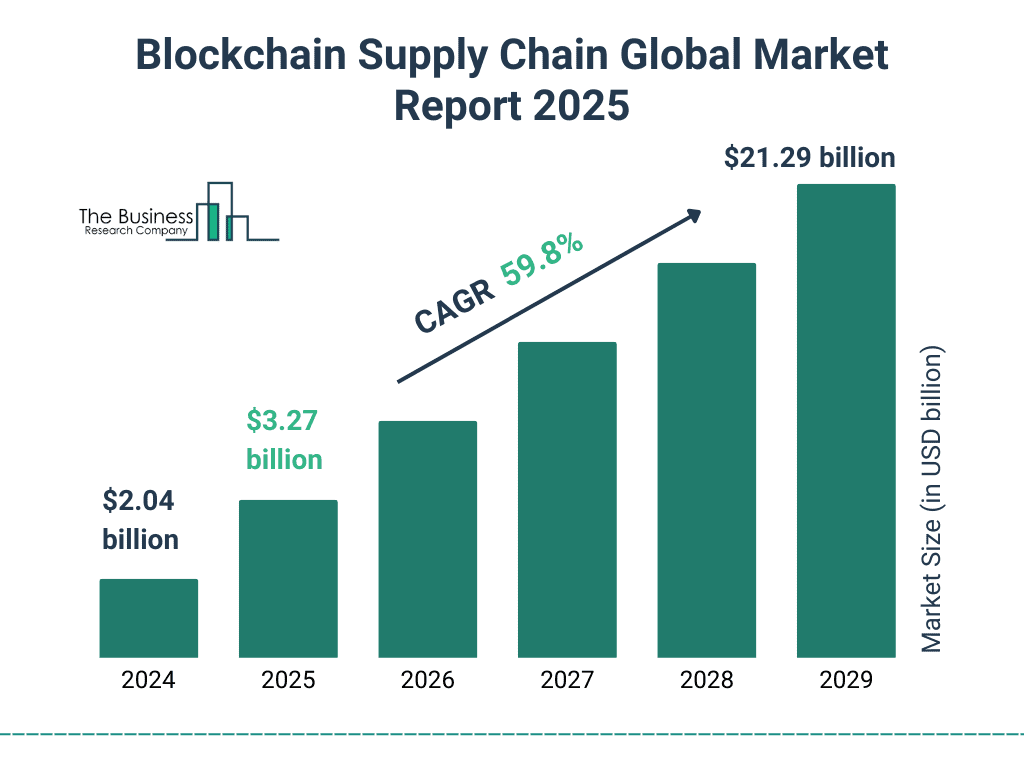

Blockchain Supply Chain Market Growth Outlook

- $21.29 billion projected market size by 2029, reflecting a rapid expansion phase.

- 59.8% CAGR forecast, signaling one of the fastest growth rates across enterprise blockchain use cases.

- $3.27 billion expected market value in 2025, marking strong early adoption momentum.

- Tenfold growth is anticipated from 2025 to 2029, with major acceleration between 2026 and 2028.

Cost Savings from Blockchain in Supply Chain Finance

- Blockchain can cut operational costs by up to 33% by reducing intermediaries and manual checks.

- Digital ledgers save an estimated $3.8 billion annually by reducing fraud and double financing.

- Smart contracts lower administrative costs by up to 42% for invoicing and settlement tasks.

- Trade finance processing times drop by an average of 81%, reducing labor and overhead.

- Blockchain dispute resolution tools cut dispute‑management costs by ~25%.

- 43% of banks report cost savings in compliance automation through blockchain use in 2025.

- Reduced paperwork and fraud deterrence translate to lower insurance and audit costs.

- Shared ledgers limit reconciliation expenses across partner networks.

Efficiency and Process Automation Improvements

- Smart contracts lower administrative costs by up to 42% in invoicing and settlements.

- Trade finance processing times have been reduced by an average of 81% through blockchain systems.

- 82% of executives expect positive ROI from blockchain within two years.

- Blockchain-integrated IoT adoption grows at 34% annually for real-time tracking.

- Transaction accuracy improved by 38% for blockchain-using firms.

- Smart contract usage grew by 55% enabling automated trade agreements.

- 45% of financial institutions report reduced operational bottlenecks via automation.

- Blockchain cuts supply chain costs by up to 37% eliminating intermediaries.

- 43% of banks report cost savings in compliance and regulatory automation.

- Invoice approval time reduced by up to 70% using smart contracts.

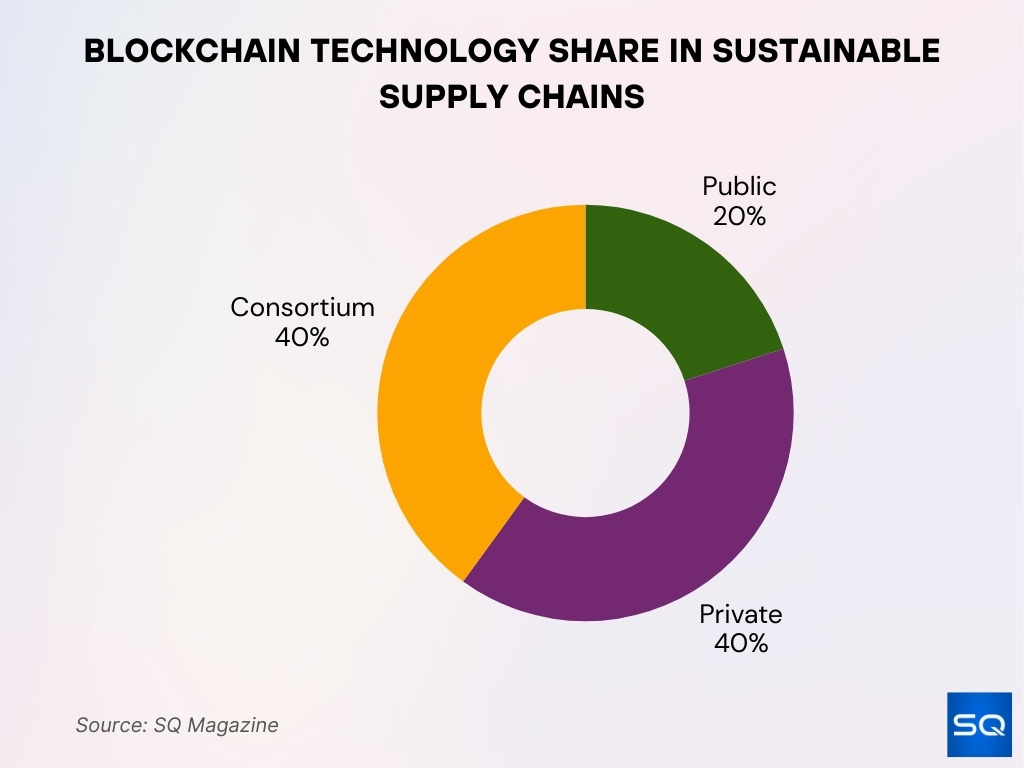

Blockchain Technology Share in Sustainable Supply Chains

- Private blockchain 40% share, leading adoption due to secure and permissioned network requirements.

- Consortium blockchain 40% share, driven by cross-organization collaboration for transparency and traceability.

- Public blockchain 20% share, reflecting smaller but growing use in open and decentralized supply chains.

Risk Management and Fraud Reduction with Blockchain

- 85% of supply chain finance firms consider blockchain essential for fraud reduction.

- 48% of companies report better risk visibility through blockchain transparency.

- Digital ledger technologies save businesses $3.8 billion yearly by preventing double financing.

- Blockchain reduces trade finance fraud risks like document forgery and money laundering.

- 38% transaction accuracy improvement cuts discrepancies, indicating potential fraud.

- Real-time audit trails enable faster discrepancy identification across transaction histories.

- 25% drop in dispute management costs through blockchain-based resolution.

Blockchain and Supply Chain Transparency

- 63% of companies seek blockchain verification systems to boost transparency and traceability.

- 78% of consumers expect brands to disclose supply chain information via transparent ledgers.

- 57% of organizations believe blockchain will enhance supply chain transparency significantly.

- 48% of companies report better visibility into transaction histories through blockchain.

- Blockchain traceability reduces disputes by up to 25% via shared verifiable records.

- 38% improvement in transaction accuracy supports reliable credit risk assessments.

- 75% of companies expected to adopt blockchain for supply chain visibility.

- Immutable ledgers cut reconciliation efforts between buyers and suppliers by 40%.

Blockchain Integration with Trade Finance and Letters of Credit

- Blockchain reduces LC settlement times from 10 days to 4 days on average.

- 58% shorter settlement times achieved using blockchain-based trade systems.

- Fraudulent transactions drop by 42% with blockchain in trade finance.

- 40% reduction in trade finance processing times via smart contracts.

- 37% operational cost decrease through blockchain LC integration.

- 49% improved compliance efficiency in blockchain trade environments.

- LC processing cut from weeks to hours, replacing paper workflows.

- 22% increase in bank blockchain deployment for trade finance.

- $3 billion saved in administrative costs by eliminating paper processes.

Smart Contracts in Supply Chain Finance

- Smart contract usage grew by ~55% increasing automation of trade agreements.

- ~22% growth recorded in supply chain applications, highlighting adoption.

- 85% of financial institutions are expected to adopt smart contracts.

- Large enterprises comprise ~60% of smart contract usage for efficiencies.

- ~40% growth in adoption by enterprises through scalable solutions.

- SMEs experienced a ~35% adoption increase for learner operations.

- Invoice approval time reduced by up to 70% using smart contracts.

- Process-cycle times reduced by ~40% for firms deploying smart contracts.

- Operational costs drop by ~30% average through smart contract adoption.

Frequently Asked Questions (FAQs)

63% of companies seek blockchain‑based verification systems to boost transparency and traceability.

~46% of North American supply chain firms have integrated or are planning blockchain solution adoption.

Over $11 billion in global investment for blockchain technology in supply chain applications is expected by 2025.

Conclusion

Blockchain’s impact on supply chain finance continues to grow as firms seek transparency, risk control, and efficiency gains. Across trade finance, smart contracts, and risk management, blockchain platforms are redefining how multinational firms, banks, and suppliers transact and verify data. From automation of letters of credit to immutable audit trails and real‑time monitoring, the data shows clear adoption momentum and practical advantages. As regulatory clarity and interoperability improve, expect broader integration across both the core supply chain and financial services ecosystems.