BlackRock has triggered new waves of speculation after moving over $135 million worth of Ethereum to Coinbase, even as crypto markets rally.

Quick Summary – TLDR:

- BlackRock transferred 44,140 ETH worth around $135.36 million to Coinbase Prime

- The selloff continues a month-long Ethereum unloading streak by BlackRock’s ETF wallet

- This comes despite a 7% surge in ETH price, which hit a multi-week high above $3,100

- Market analysts remain divided on whether this signals profit-taking or deeper sentiment shifts

What Happened?

BlackRock, the world’s largest asset manager, deposited 44,140 ETH to Coinbase Prime in five separate batches on December 3, reigniting discussions in the crypto world. This marks the latest move in a series of similar Ethereum sell-offs dating back over a month. Despite the recent crypto rally, BlackRock continues to offload large volumes of ETH, leaving investors puzzled about its strategy.

🚨 BREAKING:

— ardizor 🧙♂️ (@ardizor) December 3, 2025

BLACKROCK DUMPED 44,140 $ETH WORTH $135.3M TODAY

WHAT IS GOING ON?? pic.twitter.com/RtE2d9ugal

BlackRock’s ETH Selloff Raises Eyebrows

The crypto community was quick to notice the transaction thanks to on-chain data platform Lookonchain. The value of the transferred Ethereum was approximately $135.36 million, executed in four batches of 10,000 ETH and one final transfer of 4,140 ETH.

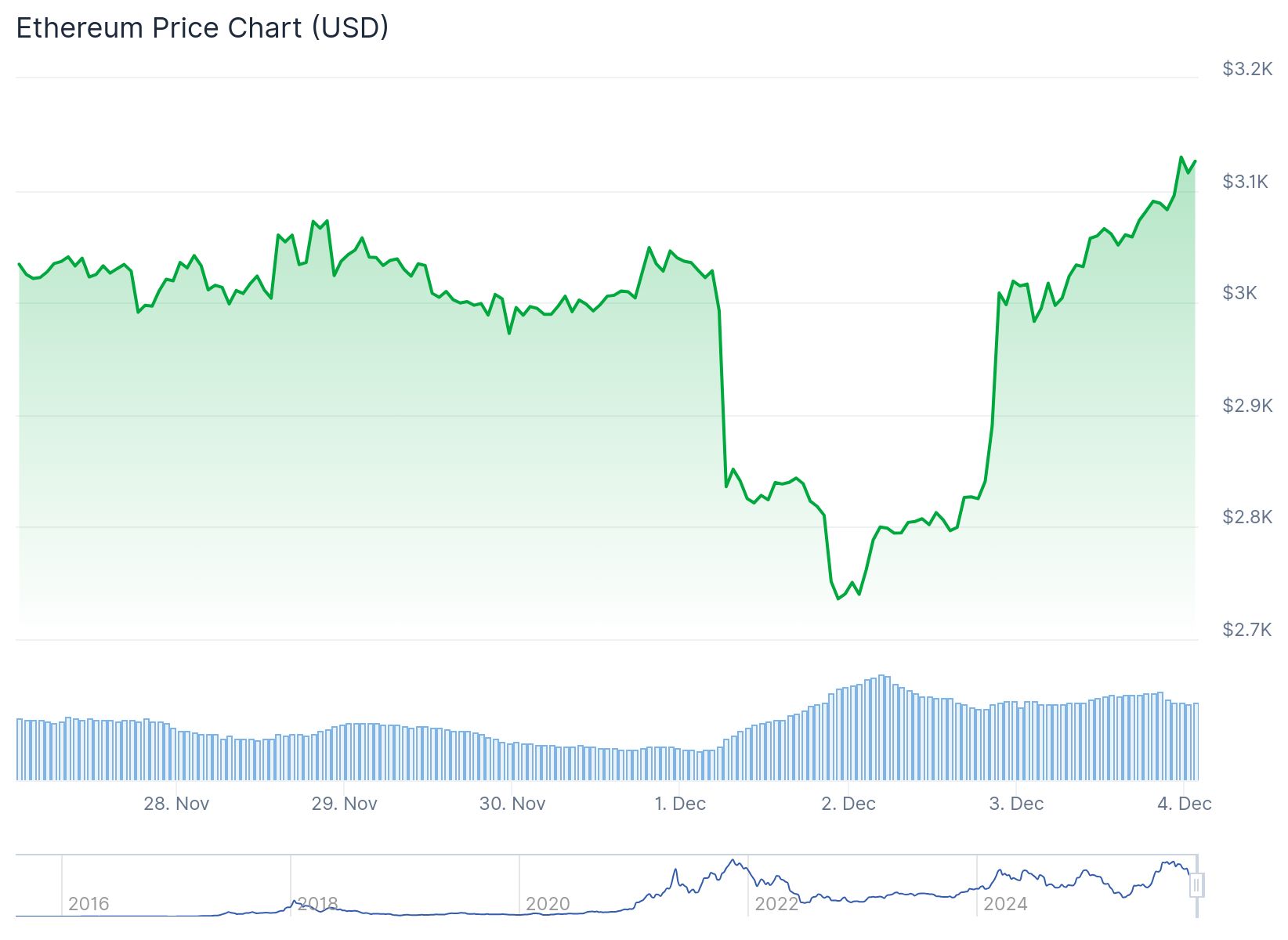

This aggressive move comes at a time when Ethereum surged over 7% in 24 hours, reclaiming a high of around $3,100. Instead of pausing amid the rally, BlackRock has continued to offload ETH, adding to the uncertainty about its motives.

Some speculate that this could be an ETF rebalancing or a profit-taking strategy, while others suspect a broader shift in institutional sentiment. BlackRock has not commented on the move, which further deepens the mystery.

Vanguard’s Entry and ETF Outflows

Interestingly, this selloff came just as Vanguard, the second-largest asset manager, began listing Ethereum ETFs, including the BlackRock Ethereum ETF (ETHA). However, BlackRock’s ETF was the only one to record significant outflows, with $88.7 million pulled, according to Farside Investors.

In contrast, Fidelity saw $50.7 million in inflows and Grayscale logged $28.1 million, highlighting a shift in investor preference away from BlackRock’s ETH exposure.

Such moves have sparked concerns that institutional sentiment toward Ethereum may be weakening, even in the face of bullish market signals.

Ethereum Fundamentals Remain Strong

Despite the heavy selling, Ethereum continues to build on its technological strengths. The Fusaka upgrade, rolled out the same day as BlackRock’s selloff, introduced PeerDAS, a feature that boosts data throughput by up to 8x and slashes Layer-2 blob fees by 30 to 80%. The upgrade aims to improve scalability, lower node hardware requirements, and make room for heavier apps like games and DeFi protocols.

This came after Ethereum’s recent 58% rally post-Pectra upgrade, though current market conditions are different. Trading volumes jumped 18% over the last 24 hours, signaling growing interest. However, if ETH loses the $3,000 support level, analysts warn the price could dip to $2,800.

SQ Magazine Takeaway

If you’re watching the crypto market and wondering what BlackRock is up to, you’re not alone. I find this move confusing too. Selling off massive chunks of ETH during a rally isn’t typical behavior unless there’s a deeper play at hand. Whether it’s ETF rebalancing, cashing out, or a signal of shifting sentiment, this shows how unpredictable the crypto landscape remains even for the biggest players. For retail investors, it’s a reminder to watch the whales but also trust your own strategy. This market is not for the faint-hearted.