BitPay has emerged as one of the pivotal payment platforms bridging traditional commerce and cryptocurrencies. As consumers and merchants increasingly seek alternatives to credit cards and bank transfers, BitPay’s growth reflects a broader shift toward crypto‑enabled transactions in everyday life. From global online marketplaces to small businesses accepting crypto in brick-and-mortar stores, BitPay’s influence spans multiple industries and continues to grow. Keep reading to explore the latest data behind this trend.

Editor’s Choice

- BitPay processed over 600,000 crypto transactions in 2024, signaling a major uptick in real-world spending via crypto wallets.

- BitPay Wallet downloads surpassed 12.4 million globally by 2025.

- In 2025, usage of stablecoin payments through BitPay’s “USDC Payment Mode” rose by 35%.

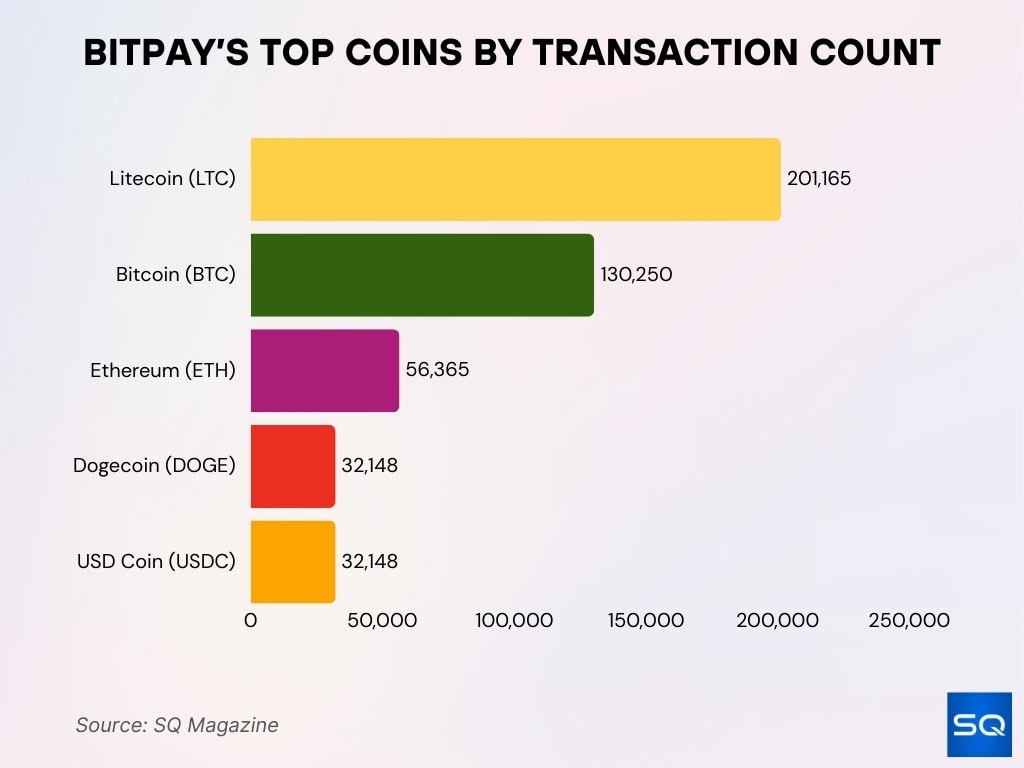

- Litecoin led with 201,165 transactions on BitPay in 2024, making it the most popular crypto for payments that year.

- Bitcoin (BTC) remained vital with 130,250 transactions, showing sustained demand despite market volatility.

- Ethereum (ETH) accounted for 56,365 transactions, confirming its role among commonly used cryptos for payments.

- Both Dogecoin (DOGE) and USD Coin (USDC) recorded 32,148 transactions each, underlining the growing acceptance of altcoins and stablecoins.

Recent Developments

- In 2024, BitPay reported that crypto spending across various industries surged, with some sectors experiencing a 324% increase in crypto-based payments during the first quarter.

- By the end of 2024, BitPay had processed more than 600,000 crypto transactions, reflecting increased adoption across both merchants and consumers.

- In August 2025, BitPay expanded support to include Solana (SOL), SPL tokens, and additional stablecoins in its Wallet and payments platform.

- BitPay continues to operate with a lean team. As of 2025, it maintains roughly 144 employees, focusing on product improvement rather than aggressive headcount growth.

- The platform reiterated its commitment to low fees in 2025, continuing to pitch ~1% transaction fees compared with higher costs in traditional payment systems.

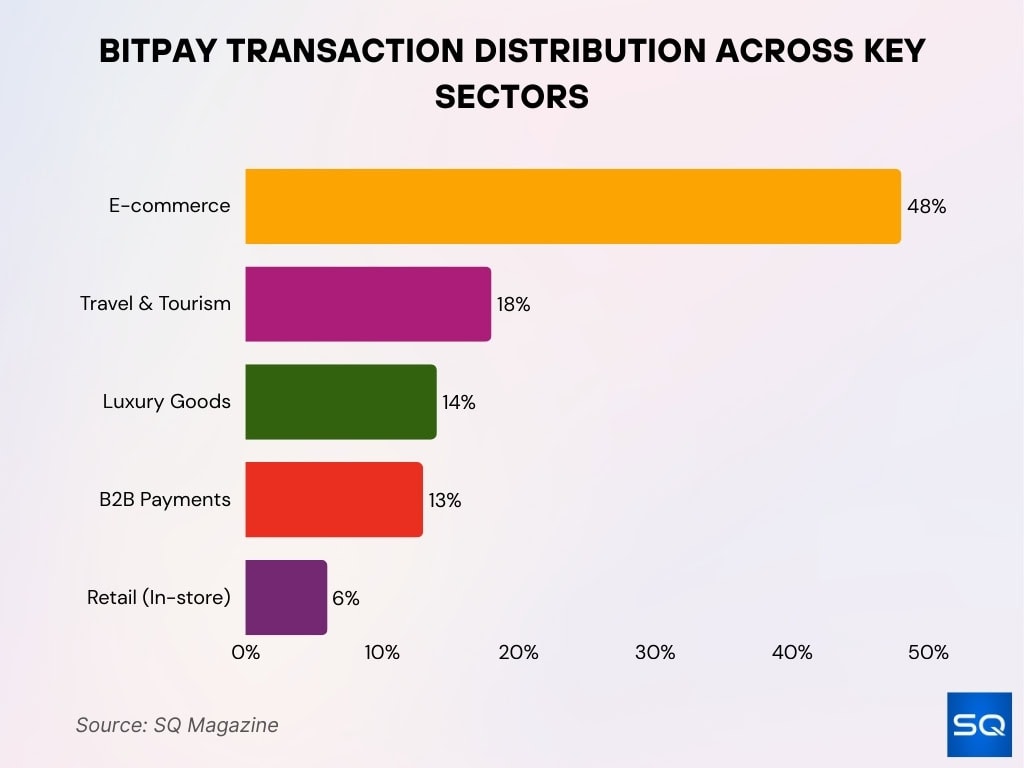

Industry and Sector Distribution of BitPay Payments

- E-commerce drove 48% of BitPay transactions in 2025, highlighting strong crypto use by online retailers.

- Travel and tourism contributed 18% of total crypto payments, driven by hotel and flight bookings.

- Luxury goods made up 14% of volume, fueled by crypto purchases of jewelry and designer items.

- B2B payments accounted for 13%, showing growing enterprise use of crypto for global settlements.

- The gaming sector saw a 16% rise in crypto transactions through BitPay platforms.

- Charities received $134 million in crypto donations, with 29% YTD growth in 2025.

- Retail (in-store) crypto payments stood at 6%, signaling slow but steady physical adoption.

BitPay Merchant Adoption Statistics

- BitPay processed over 600,000 transactions in 2024, showing rising merchant adoption.

- In 2025, stablecoins accounted for a significant and growing share of BitPay’s transaction volume.

- About 46% of merchants surveyed in 2025 had integrated cryptocurrency payment options.

- Bitcoin made up approximately 42% of crypto transactions processed by merchants in 2025.

- Stablecoins like Tether (USDT) represented between 30% and 35% of merchant crypto payment volume in some markets.

BitPay User Growth Statistics

- BitPay Wallet achieved over 12.4 million global downloads by 2025.

- Stablecoin payments on BitPay surged by 35% in 2025, boosting user confidence.

- Global crypto ownership reached approximately 560 million users in 2025, expanding BitPay’s potential base.

- BitPay reported a 17% increase in daily active users due to enhanced wallet features.

- 58% of BitPay users are based in the U.S., with 28% in Europe.

- Support for 38+ cryptocurrencies in BitPay Wallet widened its user appeal beyond Bitcoin holders.

- 25% surge in BitPay Prepaid Card activations reflected growing daily crypto spending.

- Crypto ownership adoption hit about 9.9% of global internet users in 2025.

BitPay’s Top Coins by Transaction Count

- Litecoin (LTC) leads with 201,165 transactions, making it the most used crypto on BitPay for payments.

- Bitcoin (BTC) follows with 130,250 transactions, showing strong continued usage despite volatility.

- Ethereum (ETH) logged 56,365 transactions, maintaining a steady role in crypto payments.

- Dogecoin (DOGE) and USD Coin (USDC) each reached 32,148 transactions, reflecting growing relevance in daily crypto spending.

Bitcoin vs Altcoin Usage on BitPay

- Around 36% of BitPay customers used altcoins or non-BTC cryptocurrencies in 2025.

- Ethereum maintained a steady presence with 56,365 transactions, ranking top three on BitPay.

- BitPay added support for 22 new cryptocurrencies in 2025, expanding altcoin accessibility.

- Litecoin and Dogecoin together represented about 1.8% of transactions, mainly used for micro and retail payments.

- Ethereum stablecoins comprised 5.4% of total transactions, reflecting demand for price stability.

- Altcoin transactions grew by 11% during Bitcoin downturns, showing diversification.

Stablecoin Usage and Growth on BitPay

- Stablecoins made up about 40% of BitPay’s payment volume in 2025, up from 30% in 2024.

- BitPay’s USDC Payment Mode usage rose 35% in 2025, driving stablecoin growth.

- Stablecoins are used for retail purchases, vendor payments, affiliate payouts, and large transactions.

- 95% of stablecoin transactions on BitPay occur on the Ethereum network and Layer-2 solutions.

- USDC and other pegged tokens are increasingly preferred for bill payments and merchant settlements.

- BitPay processed over 600,000 stablecoin transactions annually, mainly USDT and USDC.

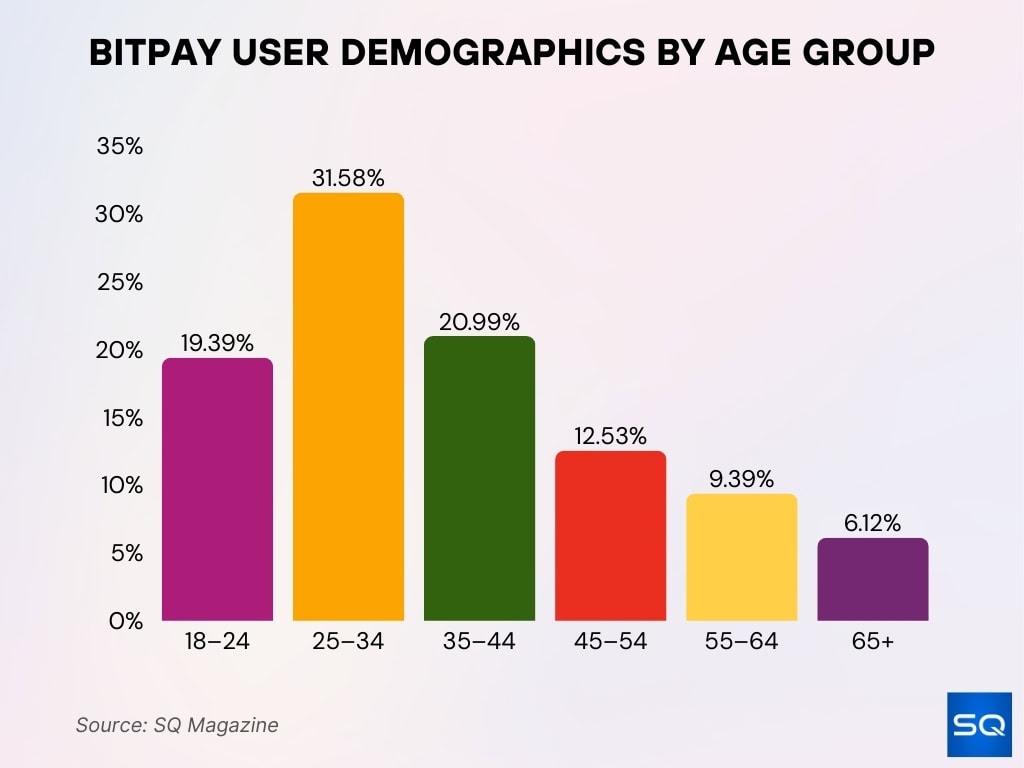

BitPay User Demographics by Age Group

- 25–34 age group leads with 31.58% of BitPay visitors, showing the highest engagement from young professionals.

- 35–44 users make up 20.99%, reflecting strong mid-career interest in crypto payments.

- 18–24 segment holds 19.39%, indicating growing adoption among younger users.

- 45–54 users account for 12.53%, showing moderate use by older professionals.

- 55–64 group contributes 9.39%, while 65+ seniors represent the smallest share at 6.12%.

Top Cryptocurrencies Used on BitPay

- Litecoin (LTC) led with about 201,165 transactions, topping transaction frequency in 2024-2025.

- Bitcoin (BTC) followed with 130,250 payments, securing second place on BitPay.

- Ethereum (ETH) ranked third with 56,356 payments by transaction count.

- Dogecoin (DOGE) recorded 32,148 payments, popular for smaller retail transactions.

- USD Coin (USDC) and Tether (USDT) topped transaction volume for high-value payments.

- Bitcoin (BTC) had 63,093 payments, dominant in business-level transfers.

- Over 50% of sales volume came from BTC, with USDT, LTC, USDC, and ETH growing.

BitPay Wallet Usage and Adoption Statistics

- BitPay Wallet surpassed 12.4 million global downloads as of 2025.

- Wallet supported 38+ cryptocurrencies, including Solana, boosting multi-chain adoption.

- 17% increase in daily active users driven by streamlined design and enhanced features.

- 25% surge in BitPay Prepaid Card activations linked to wallet-based daily spending.

- Self-custody model attracted users prioritizing private key control and security.

- Global crypto ownership hit 560 million users in 2025, expanding wallet potential.

- QR code payments jumped 24% via wallet for in-store crypto transactions.

- Wallet-enabled swapping, bill pay, and crypto-to-fiat conversions for active users.

- Adoption aligns with 22% growth in overall BitPay transactions in 2025.

BitPay’s Crypto Processing Volume Highlights

- 334,486 crypto transactions were processed by BitPay in the last 6 months, underscoring its global payment dominance.

- 60,204 transactions were handled in the past 30 days, showing steady monthly crypto payment activity.

BitPay Card and Prepaid Card Usage Statistics

- BitPay Prepaid Card activations surged by 25% in 2025, signaling growing user adoption.

- Card spending via BitPay increased to approximately $600 million in total transactions in 2025.

- Around 20% of BitPay users use the card for travel and accommodation expenses.

- 15% of card spending is on entertainment and digital services via BitPay.

- BitPay Card supports more than a dozen popular cryptocurrencies, including stablecoins.

- The card enables fee-free domestic spending anywhere Visa is accepted.

- BitPay Card daily spending limits max out at $10,000, with $25,000 monthly limits.

- The card facilitates seamless crypto-to-fiat conversion for everyday and online purchases.

- Use of the BitPay Card correlates with a 22% increase in wallet transaction volume.

Geographic Distribution of BitPay Users and Merchants

- BitPay reached 130,000 merchants globally in 2025.

- Approximately 58% of BitPay users are in the U.S., with around 28% in Europe.

- BitPay supports merchants and users in over 100 countries and territories worldwide.

- The platform supports 100+ cryptocurrencies, covering over 90% of the global crypto market cap.

- North America holds about 38% of the global crypto payment gateway market share as of 2024.

In‑store vs Online Crypto Payment Statistics via BitPay

- E-commerce accounted for 48% of BitPay transactions in 2025.

- Travel and tourism represented 18% of total BitPay payments.

- Luxury goods made up 14% of BitPay payment volume.

- B2B payments comprised 13% of BitPay’s 2025 transactions.

- Retail in-store payments accounted for 6% of total transactions.

- Gaming sector crypto transactions grew 16% via BitPay.

- 1 in 5 BitPay transactions involved luxury goods purchases.

- Average transaction size reached $390 across channels.

- BitPay processed 3.8 million transactions total in 2025.

BitPay B2B Payments and Invoicing Statistics

- B2B payments accounted for 13% of total BitPay transactions in 2025.

- B2B crypto payments grew 14% year-over-year in 2025.

- BitPay Send enables global mass payouts for vendors, affiliates, and employees.

- BitPay Invoice Tool processed 26% more invoices in 2025 for efficient tracking.

- Stablecoins facilitate vendor payments and contract payouts with value stability.

- BitPay offers instant crypto-to-fiat settlement, reducing volatility exposure.

- 1% transaction fees make BitPay competitive vs traditional payment processors.

- Supports payouts in 38+ cryptocurrencies for multinational business flexibility.

- B2B usage is driven by cross-border settlement efficiency and lower costs.

Cross‑border and International Payment Statistics via BitPay

- BitPay supports global payouts to over 225 countries for cross-border remittances.

- Crypto payment gateway market valued at $1.68 billion in 2025, growing at 13.6% CAGR.

- B2B crypto payments grew 14% driven by cross-border settlement efficiency.

- Stablecoins enable stable value transfers, reducing volatility in international payouts.

- BitPay processed 3.8 million transactions supporting global commerce in 2025.

- North America holds a 40% market share in crypto gateways, leading adoption.

- Asia-Pacific crypto gateway share is at 25% with the fastest regional growth.

- BitPay Send offers lower fees than traditional remittance solutions globally.

- Latin America gateways grew 35% year-over-year through 2025.

BitPay Checkout Conversion and Payment Success Rates

- BitPay records a 99.98% payment success rate in 2025.

- Standard transaction fees average around 0.47%, often lower than traditional payments.

- BitPay supports over 100 cryptocurrencies, increasing payment success despite network congestion.

- 99.97% transaction completion rate minimizes failed or declined payments.

- Stablecoin and multi-asset support boost merchant acceptance and checkout conversion rates.

- BitPay processes over 3.8 million transactions yearly with high reliability.

- The average transaction size rose to $390, reflecting diverse purchase types.

Frequently Asked Questions (FAQs)

About 130,000 merchants worldwide use BitPay in 2025.

In 2025, Bitcoin (BTC) accounted for about 84% of all BitPay transactions on the platform.

BitPay added 22 new cryptocurrencies to its supported asset list in 2025.

Conclusion

BitPay’s data shows clear momentum, from widespread geographic distribution and growing merchant adoption, to rising use of stablecoins and multi‑asset support, to robust checkout reliability and increasing cross‑border business payments. The mix of retail, luxury, travel, and B2B usage underlines BitPay’s versatility as a crypto payments platform. As global businesses, vendors, and consumers evolve, BitPay continues to offer a practical bridge between traditional finance and cryptocurrency payments. For merchants, enterprises, or individuals exploring crypto-based payments, BitPay presents a mature, scalable solution, and the statistics speak for themselves.