Bitcoin and Solana stand at distinct heights in the cryptocurrency world. Bitcoin continues to serve as digital gold with deep institutional backing, while Solana pushes the limits of scalability and low-cost transactions. Bitcoin’s network security and store-of-value narrative contrast sharply with Solana’s developer-driven ecosystem powering DeFi, NFTs, and gaming. This comparison has real-world impact, from portfolio allocations at major asset managers to blockchain solutions powering consumer apps. Explore this article to understand how statistics shape the narrative in the Bitcoin vs. Solana debate.

Editor’s Choice

- Bitcoin price ~ $118,000+ in mid‑2025, marking strong performance year‑to‑date.

- Solana price ~ $235.69 as of September 2025.

- Solana TPS ~ up to 4,700 transactions per second.

- Bitcoin market cap ~ $1.65 trillion in late 2025.

- Solana market cap ~ ~$138.75 billion.

- Solana transaction cost < $0.00025 on average.

- Bitcoin average fee is ~ $17+ and volatile.

Recent Developments

- Bitcoin hit a new record above $118,000 in 2025 with bullish flows into ETFs.

- Spot Solana ETF launched in the U.S., attracting $420 million in its first week.

- Institutional interest in BTC ETFs remains strong, with 68% of institutional investors planning investments.

- 86% of institutional allocators plan digital asset exposure in 2025.

- Regulatory clarity in 2025 improved access to digital asset investment products.

- Solana’s partnerships with major trading platforms increased institutional attention.

- Bitcoin saw increased ETF net inflows in 2025, with $51 billion total by mid‑year.

- Broader crypto adoption sentiment in the U.S. continues to rise in 2025.

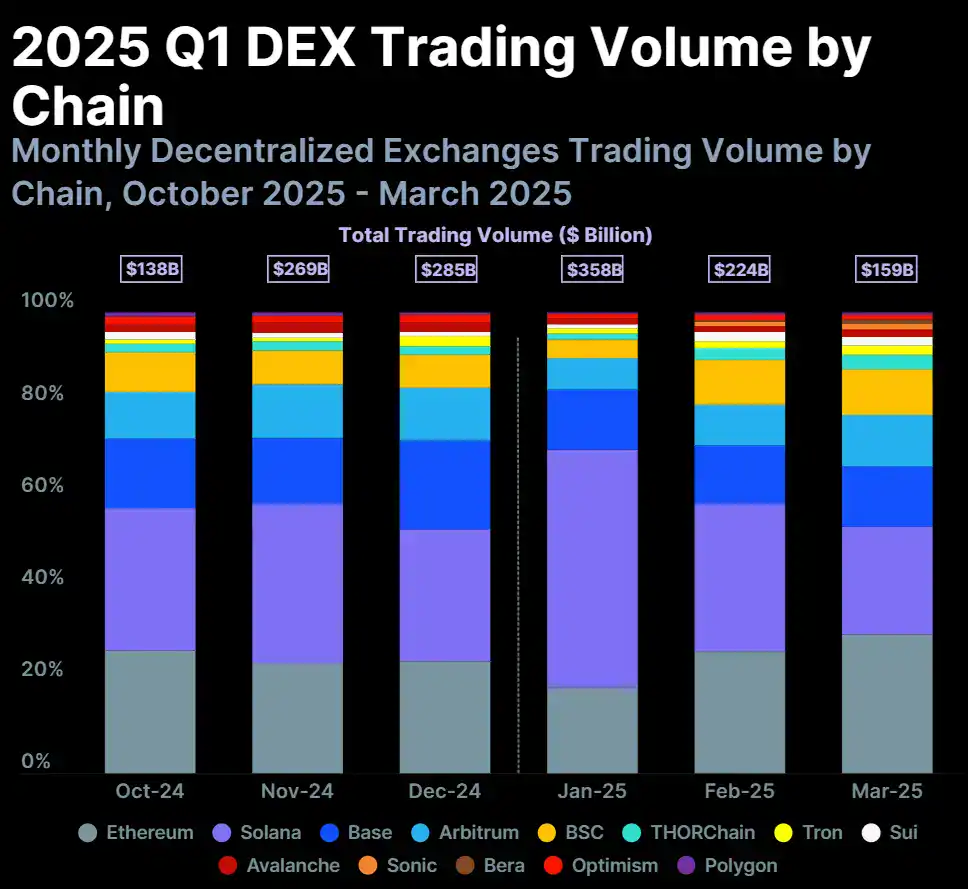

DEX Trading Volume by Chain

- January 2025 recorded the peak DEX volume at $358 billion, the highest across all chains.

- December 2024 saw $285 billion, and November 2024 had $269 billion, reflecting strong pre-2025 momentum.

- Solana and Ethereum led the market consistently, each commanding a significant share of DEX trading.

- Arbitrum and Base showed steady growth, highlighting increased Layer 2 adoption.

- THORChain, Avalanche, Sonic, and Sui maintained minor yet stable volume contributions, showing niche use cases.

- DEX volume dropped to $224 billion in February and $159 billion in March, signaling a post-January cooldown.

- October 2024 had the lowest trading volume at $138 billion, followed by a rapid surge in activity.

Bitcoin vs. Solana Statistics Overview

- Bitcoin’s total market capitalization remains ~12x larger than Solana’s.

- Solana’s market cap is near $138.75 billion, reflecting DeFi and ecosystem growth.

- BTC dominance in global crypto remains ~65% of total market cap.

- Solana ranks among the top 10 by market cap in 2025.

- Bitcoin’s network age (since 2009) is far older than Solana’s (launched 2020).

- Bitcoin’s first‑mover status underpins its valuation and institutional preference.

- Solana’s ecosystem has expanded with apps in gaming, NFTs, and DeFi.

- High network throughput makes Solana competitive for real‑time applications.

Price Performance and Volatility Comparison

- Bitcoin was trading above $118,000 as of mid‑2025.

- Solana’s SOL price was ~$235.69 in September 2025.

- Bitcoin exhibited lower relative volatility compared with many altcoins in 2025.

- Solana price movement shows wider short‑term swings due to ecosystem news.

- SOL forecast models hint at potential upside toward $500 by year‑end (conditional).

- Daily Bitcoin price fluctuation patterns reflect macroeconomic forces and sentiment shifts.

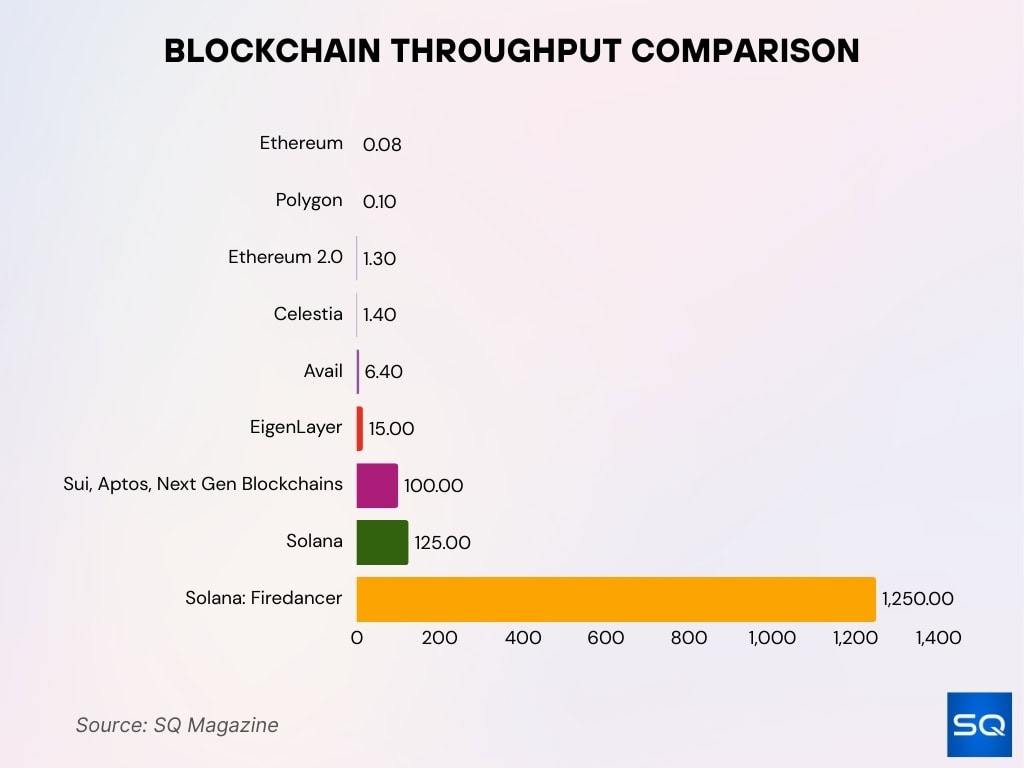

Blockchain Throughput Comparison

- Ethereum processes just 0.08 transactions, making it the least scalable in the group.

- Polygon slightly improves with 0.1 transactions, offering limited gains over Ethereum.

- Ethereum 2.0 boosts throughput to 1.3, showing moderate scalability progress.

- Celestia reaches 1.4 transactions, narrowly surpassing Ethereum 2.0 in early modular chain adoption.

- Avail delivers 6.4 transactions, reflecting stronger throughput for data-availability layers.

- EigenLayer supports 15 transactions, marking a substantial leap in scalability.

- Sui and Aptos handle 100 transactions, showcasing next-gen blockchain performance.

- Solana achieves 125 transactions, ranking among the fastest general-purpose chains.

- Solana: Firedancer leads with a blazing 1,250 transactions, over 10x faster than standard Solana.

Transaction Fees and Cost Efficiency

- Solana’s average transaction fee stays extremely low, often below $0.00025 in 2025, supporting microtransaction use cases.

- Bitcoin’s average on‑chain fee jumped to around $17.34, driven by network congestion and ordinal inscription usage.

- Solana’s fee cost per million transactions remains under $250, while Bitcoin’s exceeds $17 million for the same throughput.

- Fee volatility on the Bitcoin network increased about 24% year‑over‑year, complicating budgeting for high‑traffic dApps.

- Over 97% of Solana transactions cost less than $0.001, making it far more predictable for developers and users.

- Bitcoin’s Lightning Network aims to lower fees on micropayments, but only around 22% of wallets actively use it.

- NFT minting remains cost‑efficient on Solana (~$0.04) compared to Bitcoin’s $45–$85 using Ordinals.

- Token transfers remain more economical on Solana, whereas Bitcoin’s layer‑2 or token layers still incur variable multi‑dollar fees.

Supply, Issuance, and Inflation Rates

- Bitcoin’s total supply remains capped at 21 million coins, a fundamental part of its fixed‑supply design.

- After the April 2024 halving, Bitcoin’s inflation rate fell below 1%, compressing new issuance further.

- Bitcoin’s strict halving schedule reduces miner rewards every ~4 years, with the next event expected in 2028.

- Solana’s current circulating supply is approximately 445 million SOL in 2025.

- Solana governance uses a disinflationary issuance model where the annual inflation rate shrinks by ~15% each year.

- Current SOL inflation sits near ~4.18%, trending toward a terminal rate of 1.5%, balancing issuance and scarcity.

- Proposed inflation tweaks seek to accelerate disinflation to 30% annually, potentially reducing future issuance faster.

- Bitcoin’s capped supply contrasts with Solana’s controlled inflation, creating different scarcity and reward dynamics.

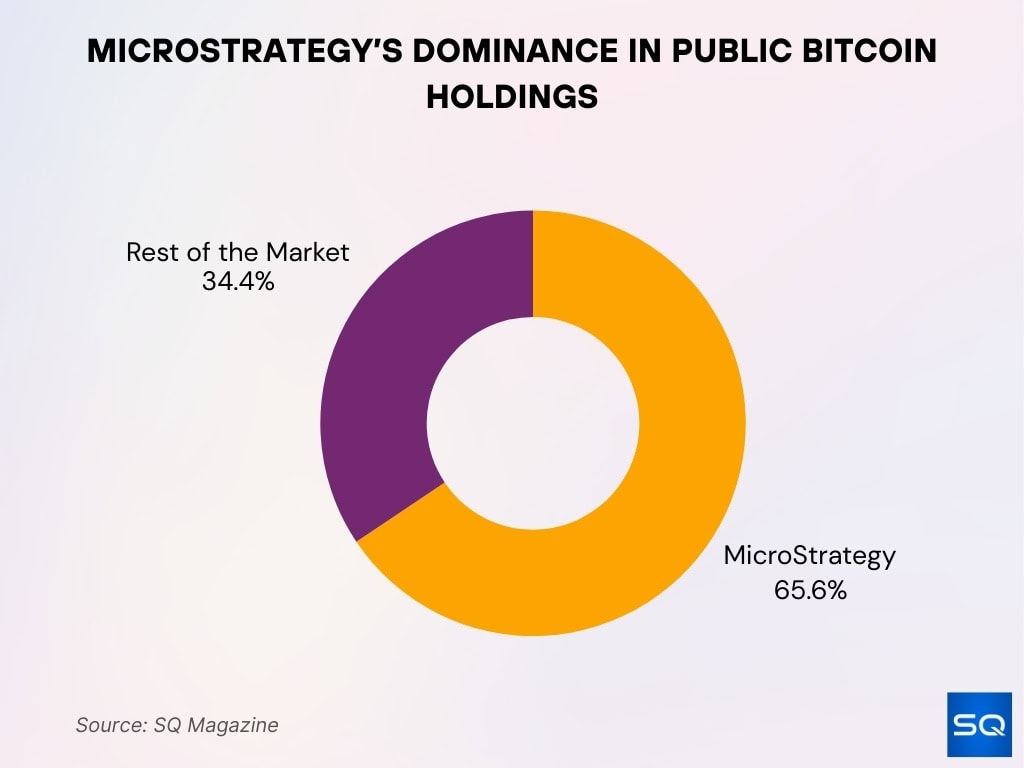

MicroStrategy’s Dominance in Public Bitcoin Holdings

- MicroStrategy holds 65.6% of all Bitcoin owned by public companies, leading the corporate BTC landscape.

- All other public companies combined hold just 34.4%, highlighting extreme BTC concentration.

- This reflects MicroStrategy’s aggressive accumulation and unwavering long-term bullish strategy on Bitcoin.

Adoption, Users, and Active Wallets

- Nearly 820 million unique cryptocurrency wallets exist globally in 2025, reflecting broad digital asset adoption.

- North America has ~134 million wallet users, part of a region with growing crypto participation.

- Security.org’s 2025 survey shows increased U.S. crypto awareness and usage, though the specific BTC/SOL share isn’t isolated.

- Global crypto adoption reaches nearly 9.9% of internet users in 2025, equating to ~559 million people owning crypto.

- Anecdotal blockchain data suggests over 54 million wallet addresses hold Bitcoin, although full‑coin holders remain rarer.

- Active decentralized application (dApp) users, particularly on high‑speed chains like Solana, continue trending upward.

- Mobile crypto wallet users grew ~20% year‑over‑year, reflecting expanding active engagement.

- Surveys show 73% of U.S. crypto holders plan to continue investing in 2025, with prominent interest in established assets like BTC.

Network Security and Consensus Mechanisms

- Bitcoin’s network hash rate reaches 1.150B TH/s (1.150 ZH/s).

- Bitcoin maintains 18,500 reachable full nodes globally.

- Bitcoin hash rate peaks at 1.442 ZH/s on September 20.

- Solana’s active validators drop to 800 from 2,500 over three years.

- United States controls 44% of Bitcoin’s global hash rate.

- Frankendancer client holds 20.9% of Solana stake across 207 validators.

- Bitcoin nodes total 24,536 reachable worldwide.

- Firedancer’s full deployment targets over 1 million TPS.

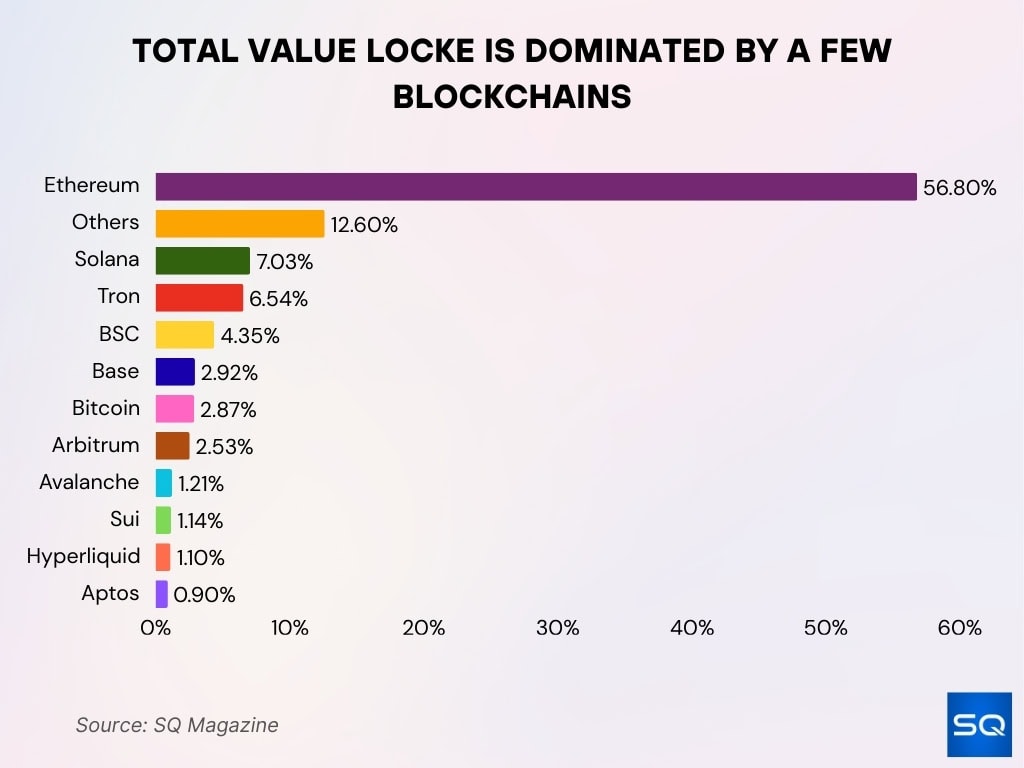

Total Value Locked (TVL) Is Dominated by a Few Blockchains

- Ethereum leads with 56.8% of total TVL, reaffirming its DeFi dominance.

- Solana holds 7.03%, remaining a strong Layer 1 contender.

- Tron follows with 6.54%, driven by high user activity and stablecoin use.

- BSC captures 4.35%, sustaining its role as a low-cost DeFi alternative.

- Base holds 2.92%, showing fast adoption as Coinbase’s Layer 2.

- Bitcoin contributes 2.87%, despite lacking native smart contract capabilities.

- Arbitrum claims 2.53%, highlighting its scalable Ethereum Layer 2 footprint.

- Avalanche (1.21%), Sui (1.14%), Hyperliquid (1.1%), and Aptos (0.9%) show steady but modest growth.

- Other blockchains collectively make up 12.6%, reflecting a fragmented niche market.

Energy Consumption and Environmental Impact

- Bitcoin’s annual energy consumption in 2025 is estimated at ~141 TWh, similar to that of a mid‑sized country.

- In contrast, Solana consumes a tiny fraction (~0.0023 TWh annually), thanks to PoH+PoS design.

- A single Bitcoin transaction consumes ~707 kWh, whereas Solana uses ~0.0019 kWh per transaction.

- Bitcoin network emissions reach approximately 73 million metric tons of CO₂ equivalent per year.

- Solana’s emissions remain under 50,000 metric tons CO₂e annually, reflecting its efficiency.

- Over 57% of Bitcoin mining energy now comes from renewables, reducing its fossil fuel footprint.

- Solana has pursued carbon‑neutral commitments through validator incentives and efficiency work.

- Network energy demand and sustainability remain key discussion points in 2025 policy and investment debates.

DeFi and Web3 Ecosystem Metrics (BTC vs. Solana)

- Solana DeFi TVL reaches $12.257 billion.

- Bitcoin DeFi TVL surges to $6.36 billion.

- Global DeFi TVL hits $237 billion in Q3.

- Solana DeFi TVL grows 32.7% to $11.5 billion in Q3.

- Bitcoin DeFi TVL climbs to nearly $10 billion by mid-year.

- Solana records $1.05 trillion cumulative DEX volume in H1.

- Solana hosts 400 unique DeFi dApps.

- Solana active addresses hit 22.24 million in August.

- Global DeFi TVL exceeds $150 billion in July.

- Solana DeFi TVL peaks at $12.2 billion.

NFT and Gaming Activity on Bitcoin vs. Solana

- Solana hosts over 28 million NFTs in 2025, with daily trading volumes averaging $13.2 million.

- Bitcoin’s Ordinals protocol recorded more than 80 million inscriptions by early 2025, though many are collectible tokens rather than active NFT trades.

- Solana’s NFT holders number ~2.1 million unique addresses, second only to Ethereum in ecosystem scale.

- Solana NFT marketplaces such as Magic Eden and Tensor handle over 60 % of cross‑chain NFT trades, highlighting network dominance.

- Average Solana NFT minting fees remain around $0.04, making large‑scale gaming asset issuance feasible.

- Bitcoin’s NFT infrastructure primarily relies on inscriptions and lacks native marketplace integration, limiting active use.

- Solana gaming‑focused collections and gaming dApps are expanding rapidly as creators adopt lower‑fee NFT minting options.

- Ethereum still leads overall NFT volume, but Solana’s share in gaming and micro‑NFT markets continues to grow.

Institutional Adoption and Investment Products

- The broader U.S. Bitcoin ETF market grew ~45 % to $103 billion AUM, showing rising institutional interest in regulated BTC exposure.

- Solana’s institutional products, including spot staking‑linked ETFs, have drawn significant capital, with some launches like BSOL gathering hundreds of millions of dollars in debut week inflows.

- Record global crypto ETF inflows reached $5.95 billion in a single week, led by Bitcoin with $3.55 billion, while Solana also contributed notable sums.

- Bank of America now allows wealth advisors to recommend crypto ETPs, marking wider institutional access to both Bitcoin and Solana investments.

- Many institutional investors prefer regulated ETF vehicles for digital asset exposure versus direct custody, raising BTC’s profile.

- Solana institutional adoption includes over $1.72 billion in treasuries held by public firms in 2025.

- Surveys indicate ~59 % of institutional allocators plan to hold digital assets as part of client portfolios, up from previous years.

- Corporate holdings and treasury accumulation highlight a maturing landscape for both BTC and SOL as strategic balance sheet assets.

Derivatives and Options Market Statistics

- Bitcoin’s derivatives market reached all‑time highs in 2025, with options open interest near $50.27 billion and ~454,000 active contracts.

- Derivatives usage reflects both hedging and speculative strategies, with clustering around common strikes like the $100,000 level.

- Solana and other altcoin derivatives volumes grew significantly in 2025, with options volume up nearly 27 % for SOL.

- DeFi derivatives platforms saw a ~43 % increase in global trading volumes, demonstrating expanding use cases for leverage and structured products.

- Perpetual futures and swaps remain dominant for crypto derivatives, offering flexible exposure absent delivery obligations.

- Emerging Solana derivatives on DEXs and cross‑chain venues reflect growing liquidity and user engagement.

- Regional markets, especially Asia‑Pacific, contribute ~48 % of global crypto derivatives activity due to supportive regulation.

- Rising institutional options strategy adoption highlights increasing sophistication in portfolio risk management.

Risk, Drawdowns, and Volatility Metrics

- Bitcoin’s annualized volatility drops to 41%.

- Solana volatility stands at 62%.

- Bitcoin drawdown reaches 30% from $110,000 to under $75,000.

- Bitcoin-S&P 500 correlation hits 0.88 over 20-day average.

- Bitcoin price slides 5% below $90,000 amid risk aversion.

- Bitcoin falls from $104,288 with a potential 30% crash to $74,000.

- Bitcoin-S&P 500 correlation rises to 0.5 on a 30-60 day basis.

- Bitcoin Q1 volatility features a peak near $109,000, then below $90,000.

- 52% of institutions use VaR models for crypto risk metrics.

- Bitcoin volatility hits 2-year low in narrow trading range.

Frequently Asked Questions (FAQs)

Bitcoin was trading around $93,515 in early December 2025.

Global crypto ETFs attracted a record $5.95 billion in a single week in 2025.

Solana can process roughly 2,000–65,000 TPS, while Bitcoin averages about 7 TPS.

Conclusion

Bitcoin’s dominant market cap, deep derivatives markets, and growing institutional use affirm its role as a core digital asset. Solana’s rapid DeFi expansion, low fees, and vibrant NFT and gaming ecosystems highlight its appeal for high‑throughput decentralized applications. Both chains face risks from volatility and macro conditions, yet the data points to continued ecosystem specialization. As investors and developers navigate this landscape, understanding these metrics offers clearer insight into where each network’s strengths will matter most.