Bitcoin and Ethereum continued to dominate the cryptocurrency landscape, shaping investor sentiment and blockchain innovation. Bitcoin remains the largest digital asset by market cap, while Ethereum drives decentralized apps and smart contracts. These two networks also serve as benchmarks for broader crypto risk appetite and institutional adoption. Whether it’s volatility, trading liquidity, or network activity, the data below reveals where each blockchain stands and what it could mean for digital finance. Read on for a detailed, up‑to‑date statistical comparison.

Editor’s Choice

- Bitcoin’s price hovered around $87,000–$93,000 in early 2026, reflecting consolidation after a turbulent 2025.

- Ethereum traded above $3,000 through the same period, showcasing divergent performance drivers.

- Bitcoin suffered an expected annual loss of ~6% in 2025, its first yearly decline since 2022.

- Stablecoin transaction volume on Ethereum reached $8 trillion in Q4 2025, underscoring its role as the dominant DeFi and settlement layer.

- Bitcoin and Ethereum options expiry events can still trigger dramatic short‑term swings, according to derivatives markets.

- Bitcoin ETFs saw a strong $457.3 million net inflow, signaling institutional interest even amid volatility.

Recent Developments

- Bitcoin is on track for a five‑day winning streak in early January 2026, showing renewed momentum.

- Crypto markets witnessed sizable sell‑off pressure in late 2025, with liquidations hitting $637 million or more across BTC and ETH.

- Bitcoin’s market leadership was reaffirmed after a record high above $126,000 in October 2025 before substantial retracements.

- Overall crypto market cap experienced shifts as price volatility and macro trends weighed on traders.

- Institutional flows into Bitcoin and Ethereum products remained material throughout 2025.

- Ethereum’s ecosystem continued growing via Layer 2 and DeFi innovations, impacting fee dynamics and developer engagement.

- Derivatives positioning indicated positive funding rates for both BTC and ETH through Q3–Q4 2025.

- Macro‑driven liquidity conditions, such as banking flows and repo activity, also bled into crypto price action.

- Volatility expectations rose around key financial events like derivatives expiries and macro announcements.

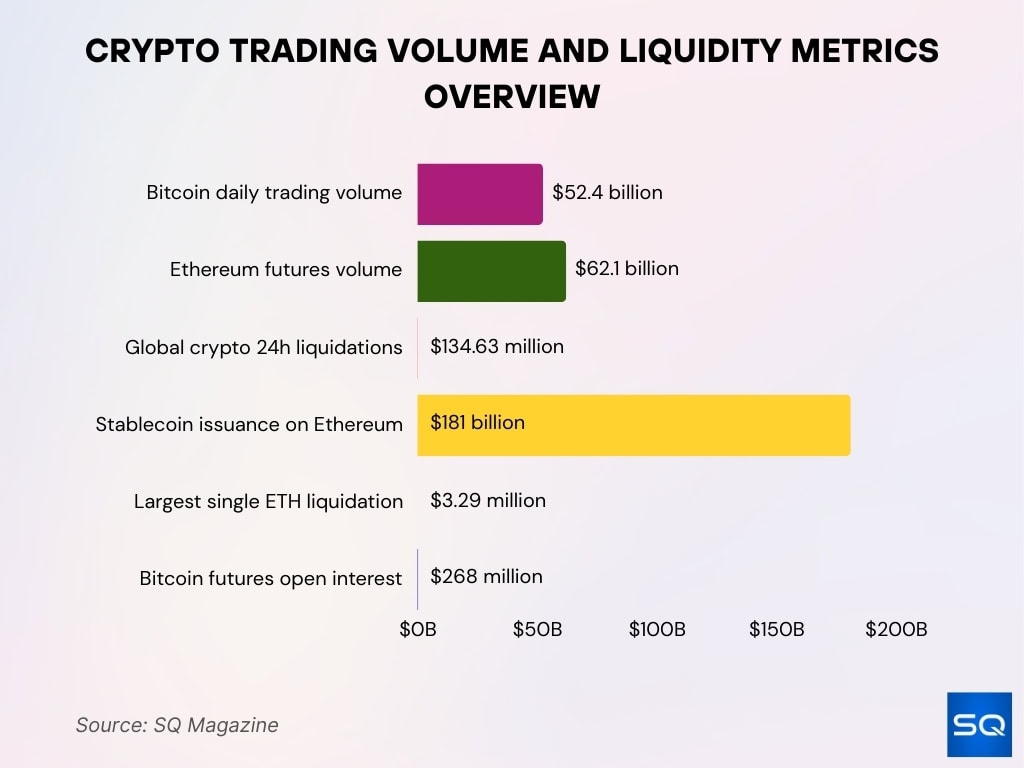

Trading Volume and Liquidity Comparison

- Bitcoin’s daily trading volume reaches $52.4 billion across major exchanges.

- Ethereum futures volume recently surpassed Bitcoin’s by 0.6% at $62.1 billion.

- Global crypto 24-hour liquidations total $134.63 million.

- Stablecoin issuance on Ethereum grew 43% to $181 billion in 2025.

- Ethereum holds 57% of the stablecoin market share.

- Largest single ETH liquidation order at $3.29 million recently.

- Bitcoin futures open interest shows March 2026 at $268 million.

Bitcoin vs. Ethereum Statistics Overview

- Bitcoin market cap stands at $1.821 trillion, outpacing Ethereum’s $382.51 billion by over 4.7x.

- Bitcoin dominance holds at 58.77% of the total crypto market cap.

- Ethereum commands 68% of the total DeFi TVL share.

- ETH/BTC trading ratio at 0.03437 BTC per ETH.

- Spot Bitcoin and Ethereum ETFs saw $645.8 million combined inflows on the first 2026 trading day.

- Ethereum stablecoin transfers hit $8 trillion in Q4 2025, a record high.

- Bitcoin network hashrate reaches 1,130.79 EH/s.

- Bitcoin ETFs projected to surpass $180 billion AUM in 2026.

- Bitcoin correlation to S&P 500 remains low, below 0.50.

- Ethereum holds 57% stablecoin market share.

Volatility Metrics for Bitcoin and Ethereum

- Bitcoin implied volatility is at 43%, down from prior peaks around 86%.

- Ethereum implied volatility stands at 60%, higher than Bitcoin’s 43%.

- Bitcoin 30-day ATM implied volatility is flat near 43% in late 2025.

- Ethereum 30-day ATM IV surged to 71% before stabilizing at 60%.

- $2.2 billion Ethereum options expiry set for early 2026.

- Ethereum saw $45.26 million in liquidations from short positions recently.

- ETH 3-month realized volatility hit 80% in 2025.

- BTC/ETH IV ratio at 1.95, showing ETH higher volatility pricing.

- Total crypto liquidations exceeded $155 million in a major 2025 event.

- Bitcoin long-term volatility declined to 43%, half its historical peak.

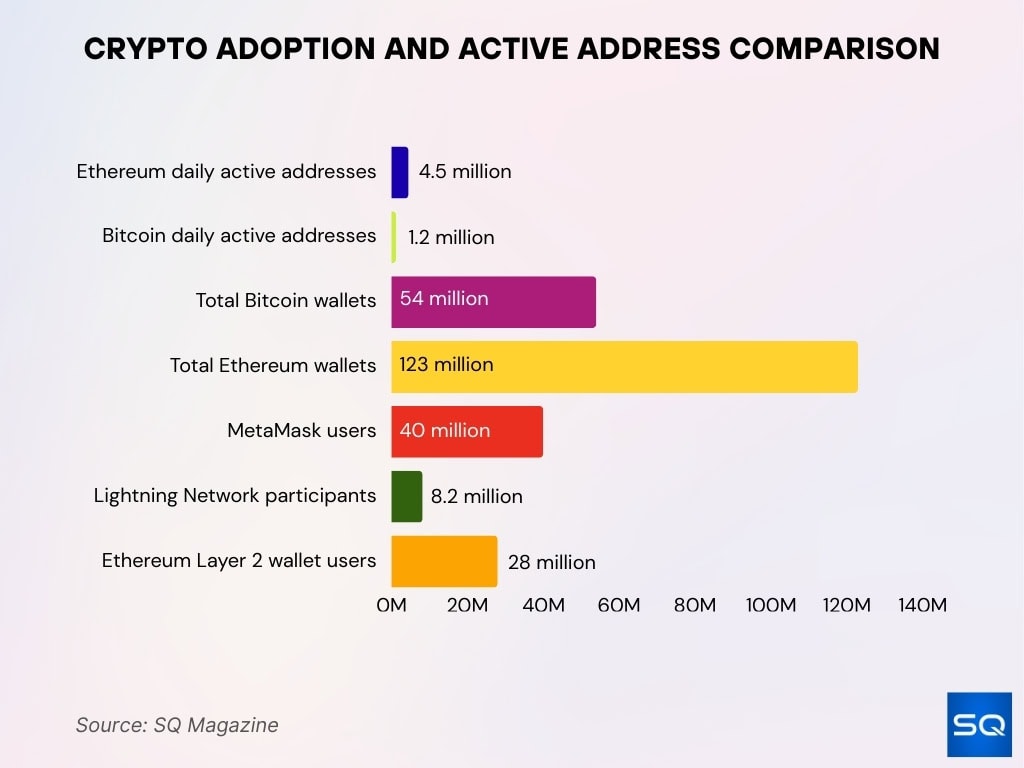

Adoption, Users, and Active Addresses

- Ethereum had over 4.5 million daily active addresses as of mid‑2025, outpacing Bitcoin by a significant margin.

- Bitcoin’s daily active addresses hovered around 1.2 million in the same period.

- Total Bitcoin wallets surpassed 54 million in 2025, up over 11% year‑on‑year.

- Ethereum wallet count reached 123 million, reflecting robust ecosystem growth.

- MetaMask installations exceeded 40 million users globally, underlining Ethereum’s retail adoption.

- Lightning Network participants surpassed 8.2 million, expanding Bitcoin’s off‑chain scaling.

- Layer 2 wallet adoption on Ethereum climbed to 28 million users, mainly across Arbitrum and Base.

- On Ethereum, addresses exhibited an average of 8.4 transactions per address versus 3.6 for Bitcoin.

Bitcoin vs. Ethereum Supply and Issuance

- Bitcoin’s maximum supply is capped at 21 million coins, and issuance shrinks roughly every four years through halvings.

- As of late 2025, about 19.79 million BTC were in circulation, leaving fewer than 1.21 million BTC yet to be mined.

- Ethereum’s supply is not capped; it adjusts based on network activity, fees burned, and issuance policy.

- Post‑Merge issuance for Ethereum fell by approximately 90% compared to its pre‑PoS levels.

- Unlike Bitcoin, which adds a fixed block reward, Ethereum burns a portion of fees under EIP‑1559, potentially resulting in net deflation during high usage periods.

- Bitcoin mining rewards stood at 3.125 BTC per block after the 2024 halving, with the next reduction expected in 2028.

- Daily issuance growth of ETH fluctuates sharply with demand, but has been subdued following major upgrades.

- Bitcoin’s predictable issuance schedule makes its supply highly transparent to investors relative to Ethereum’s dynamic approach.

Inflation, Halving, and Burn Dynamics

- Bitcoin’s annual inflation rate at 0.84% post-2024 halving.

- The current Bitcoin block reward is fixed at 3.125 BTC per block.

- Next Bitcoin halving scheduled for March 2028 at block 1,050,000.

- Ethereum net supply issuance is negative at -0.5% annually.

- Ethereum has burned 5.1 million ETH since the EIP-1559 launch.

- Bitcoin’s circulating supply totals 19.82 million BTC.

- Ethereum’s daily burn rate averaged 2,500 ETH recently.

- Post-halving, Bitcoin miner revenue is down 50% to $20 billion annualized.

- Ethereum deflationary periods burned 1.2 million ETH in the peak of 2025.

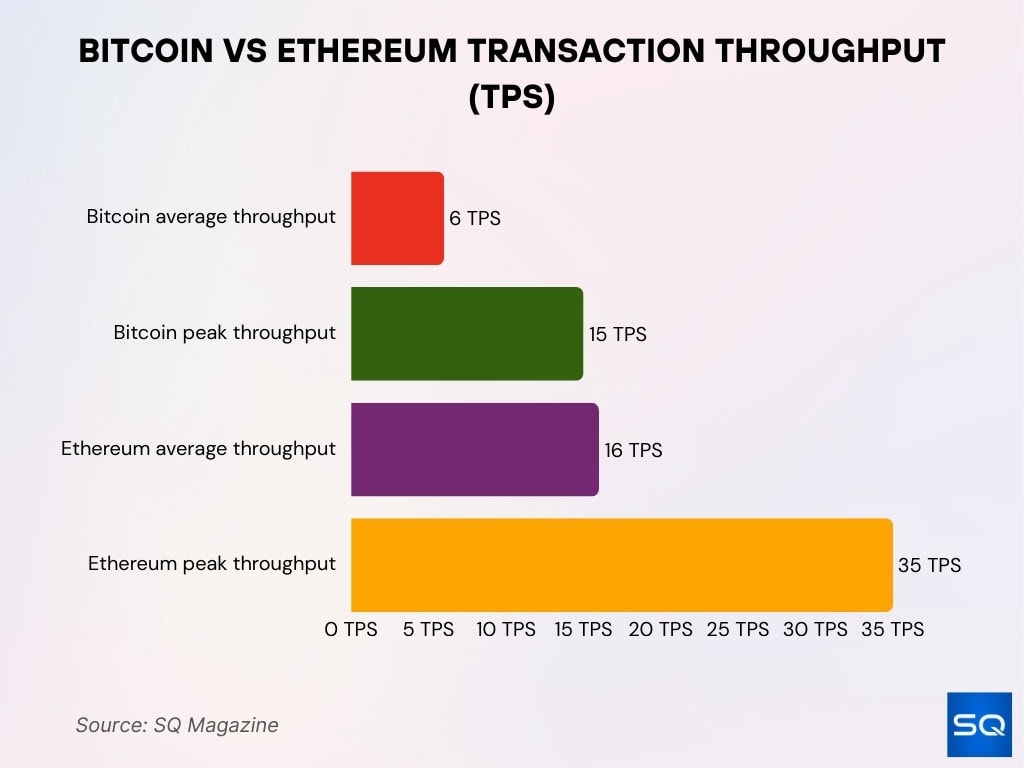

Transaction Speed and Throughput (TPS)

- Bitcoin’s mainnet handles an average of ~5–7 transactions per second (TPS) in early 2025–2026.

- During network peaks, Bitcoin TPS can briefly reach ~15 TPS before back‑pressure slows confirmations.

- Ethereum’s base layer typically processes ~12–20 TPS under proof‑of‑stake consensus.

- Peak Ethereum throughput can reach ~35 TPS during high activity periods before congestion.

- Bitcoin block times average ~10 minutes, slowing throughput by design.

- Ethereum block times average ~12 seconds, enabling faster confirmations.

- Layer‑2 solutions (e.g., Arbitrum, Optimism) regularly boost effective Ethereum TPS into the thousands by batching transactions off‑chain.

- Bitcoin’s Lightning Network enables near‑instant settlement and theoretically unlimited off‑chain transaction throughput.

- Despite these enhancements, both networks still lag behind traditional payments (e.g., Visa’s ~24,000 TPS).

Circulating Supply and Distribution Metrics

- Bitcoin’s circulating supply at 19.82 million BTC.

- Ethereum’s circulating supply reaches 120.45 million ETH.

- 54.2 million Bitcoin wallets hold at least $1 worth.

- 983,000 wallets control at least 1 BTC each.

- Ethereum’s unique addresses surpass 271 million.

- 1.58 million addresses hold 1 ETH or more.

- Top 100 Bitcoin wallets control 15% of the supply.

- Exchanges hold 2.3 million BTC or 12% of the circulating supply.

- Ethereum whales (1,000+ ETH) number 3,200 addresses.

- Lost Bitcoin is estimated at 3-4 million BTC or 15-20% of the supply.

Wallet, Holder, and Concentration Statistics

- 983,000 Bitcoin addresses hold 1+ BTC.

- Over 54 million wallets hold fractional Bitcoin.

- Ethereum unique addresses exceed 271 million.

- 1.58 million ETH addresses hold 1+ ETH.

- Top 100 Bitcoin wallets control 15% of the supply.

- Exchanges custody 2.3 million BTC or 12% circulating supply.

- Ethereum staking contracts hold 34 million ETH or 28% supply.

- 3,200 Ethereum whales (1,000+ ETH) exist.

- Top 10 ETH holders control 22% of the supply.

- Bitcoin HODL waves show 70% unmoved in 1+ year.

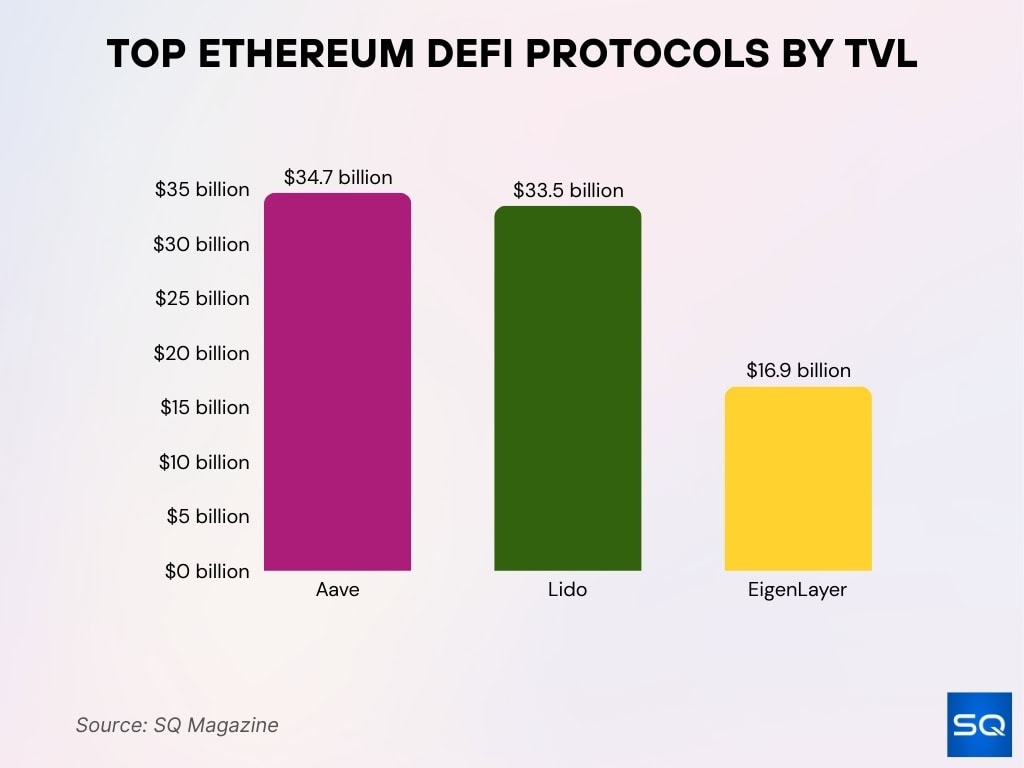

Bitcoin vs. Ethereum DeFi Ecosystem Statistics

- Top Ethereum DeFi protocols by TVL include Aave (~$34.7 billion), Lido (~$33.5 billion), and EigenLayer (~$16.9 billion).

- Ethereum dominates DeFi, with Total Value Locked (TVL) around $73.6 billion, accounting for ~67% of global TVL.

- Across all chains, total TVL neared $149 billion, showcasing Ethereum’s ecosystem scale.

- Ethereum’s DeFi activity continues to attract liquidity due to smart contracts and composability.

- Bitcoin’s DeFi presence remains relatively small due to limited scripting on its base layer.

- Layer‑2 rollups and cross‑chain bridges increasingly link Bitcoin liquidity to Ethereum DeFi.

- DeFi protocols on Ethereum often benefit from low fees and high throughput via rollups.

- DeFi activity growth is expected to persist into 2026 with broader institutional participation.

- Bitcoin’s role is more focused on collateral use cases through wrapped BTC in DeFi.

On‑Chain Activity and Transaction Counts

- Ethereum processes far more daily on‑chain transactions (~1.3 million) than Bitcoin (~300,000).

- This reflects Ethereum’s role as a smart‑contract and DeFi hub relative to Bitcoin’s value transfer focus.

- Over 4.5 million daily active Ethereum addresses show sustained network usage.

- Bitcoin’s active address count (about 1.2 million) has grown steadily but trails ETH.

- Average transactions per address were 8.4 for ETH versus 3.6 for BTC in 2025.

- Smart contract deployments on Ethereum exceeded 4.3 million in early 2025, up over 30% YoY.

- Bitcoin’s smart contract ecosystem remains limited, with a few million contracts via RSK and Stacks.

- Layer 2 networks collectively handled ~37% of wallet activity on Ethereum, reducing base‑layer congestion.

Transaction Fees and Cost Efficiency

- In 2025, Bitcoin’s average transaction fee was about $1.74, illustrating a more cost‑effective settlement than in earlier years.

- Ethereum’s average gas fee fell to around $0.38 thanks to widespread Layer‑2 adoption.

- Layer‑2 networks handled ~63% of Ethereum transactions, dramatically lowering L1 fees.

- On Arbitrum One, the average cost per transaction was about $0.03 in 2025.

- Bitcoin fees briefly spiked to $9.81 during BRC‑20 token minting surges in early 2025.

- Ethereum Layer‑1 gas fees stayed below $1 in roughly 90% of cases throughout 2025.

- Bitcoin’s Lightning Network offers near‑zero‑cost transfers (<$0.001) for many small transactions.

- Fee markets on both chains dynamically adjust with congestion, often rising sharply in bullish cycles.

- Median Bitcoin fee per byte, a measure of block cost efficiency, dropped to 7 satoshis in 2025.

Network Security and Hashrate vs. Staked ETH

- Bitcoin’s PoW security remains rooted in its massive hashrate, which is measured in exahashes per second, making attacks extremely costly.

- Higher hashrate increases difficulty for 51% attacks and reinforces PoW resistance.

- Ethereum now secures its network through proof‑of‑stake, with validators replacing miners.

- In 2025, Ethereum had over 1.03 million active validators, reflecting broad participation.

- Approximately 30–34 million ETH were staked by mid‑2025, roughly 28–30% of supply, enhancing stake‑based security.

- Ethereum’s staking rewards averaged ~4.8% APY in 2025, incentivizing validator growth.

- Bitcoin’s mining difficulty and hash power continued advancing, with difficulty around 85.1 T in 2025.

- Both PoW and PoS show zero successful 51% attacks in 2025, underscoring resilience.

- Bitcoin’s security budget tied to mining economics continues to evolve as subsidy rewards decline post‑halving.

Decentralization, Nodes, and Validators

- Bitcoin full nodes total 21,397 active globally.

- Ethereum validators reach 1.06 million unique.

- Lido controls 31% of the staked ETH supply.

- Bitcoin nodes are distributed across 102 countries.

- Ethereum total staked ETH hits 34.6 million or 29% supply.

- Top 5 validators hold 40% Ethereum stake.

- Bitcoin node count up 12% year-over-year.

- Ethereum average validator balance is 35 ETH.

- 15,200 Bitcoin reachable nodes online.

- Geographic node diversity: US 42%, Europe 28% for Bitcoin.

Energy Consumption and Environmental Impact

- Bitcoin consumes 173 TWh annually, 0.78% global electricity.

- Ethereum PoS uses 0.0026 TWh per year post-Merge.

- Bitcoin’s carbon emissions are at 65 megatons of CO2 yearly.

- Ethereum emissions dropped to 870 tonnes CO2e annually.

- Bitcoin’s renewable energy mix reaches 54% in mining.

- Per Bitcoin transaction, energy is 1,335 kWh.

- Ethereum PoS per transaction 0.03 kWh.

- Bitcoin fossil fuels account for 48% energy sources.

- Ethereum energy cut 99.95% after the Merge to PoS.

- Bitcoin network rivals the Netherlands’ 111 TWh consumption.

Frequently Asked Questions (FAQs)

Bitcoin traded near $88,000–$93,000 while Ethereum held above $3,000.

Approximately 30% of the Ethereum supply is staked as of late 2025.

Ethereum’s DeFi Total Value Locked (TVL) peaked near $92.7 billion during 2025, but ended the year around $73.6 billion, reflecting market volatility.

Conclusion

Bitcoin and Ethereum stand as complementary pillars in the crypto landscape. Bitcoin retains its position as the most secure and energy‑intensive proof‑of‑work asset with slower throughput and higher operational cost, but unrivaled network security and global brand recognition. Ethereum’s shift to proof‑of‑stake dramatically reduced energy use and amplified throughput, fees fell with Layer‑2 adoption, and its DeFi ecosystem dominates blockchain financial activity.

These statistical contrasts reveal why investors and developers alike may choose one or both networks depending on priorities, security, cost, sustainability, or decentralized finance engagement. The data across performance, security, energy, and ecosystem scale provides a nuanced view of how Bitcoin and Ethereum are shaping digital finance’s future.