The landscape of cryptocurrency exchanges continues to evolve rapidly. Two of the largest platforms, Binance and Coinbase, remain central players, not only facilitating trading but shaping market dynamics, regulatory approaches, and institutional participation. The statistics below highlight their scale, user base, and how they stack up against each other today. Read on to explore an in-depth comparison of their metrics and industry impact.

Editor’s Choice

- ≈ 280 million registered users for Binance globally as of mid‑2025.

- ≈ 120 million total monthly users on Coinbase in 2025.

- 8.7 million monthly transacting users (MTUs) on Coinbase as of Q2 2025.

- More than 500 cryptocurrencies are listed on Binance with over 1,500 trading pairs.

- Coinbase held about $404 billion in digital assets under custody at the end of 2024.

- In early 2025, Binance expanded from 250 million to roughly 280 million users, a growth of ~30% in about 18 months.

Recent Developments

- In January 2025, Binance announced it reached 250 million registered users, continuing a trajectory of fast growth.

- By July 2025, Binance’s count rose to 280 million registered users, marking one of the fastest user acquisition rates in the industry.

- On Coinbase’s side, 2025 saw 120 million total monthly users, up from 96 million in 2024, a roughly 25% increase year‑on‑year.

- Coinbase reported 8.7 million monthly transacting users (MTUs) in Q2 2025, indicating a substantial active user base despite a broader monthly user pool.

- Coinbase’s trailing twelve‑month revenue (mid‑2025) reached $6.71 billion.

- Binance maintained full collateralization across major cryptocurrencies like BTC, USDT, and ETH as of May 2025, a key commitment to fund safety.

- The rapid growth of Binance’s user base, especially across emerging markets, suggests expanding global adoption beyond traditional Western strongholds.

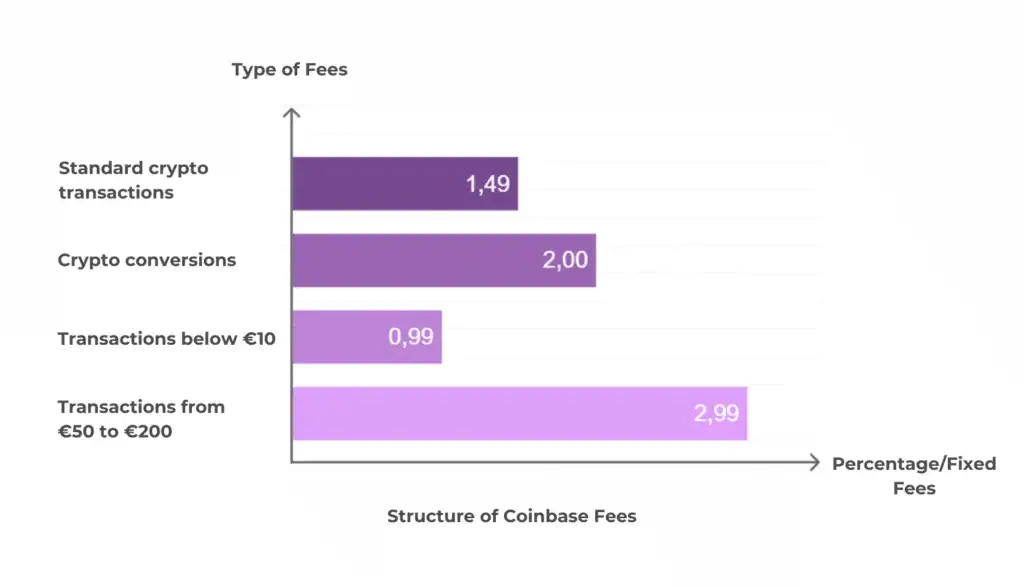

Coinbase Fee Structure Overview

- €1.49 fixed fee applies to standard crypto transactions on Coinbase. This is the default charge for typical buys or sells.

- €2.00 flat fee is applied to all crypto conversion transactions. This makes conversions slightly more expensive than standard trades.

- €0.99 reduced fee is charged for small transactions under €10. This incentivizes micro-transactions on the platform.

- €2.99 fixed fee is the highest, applied to transactions between €50 and €200. This tiered pricing hits mid-sized trades hardest.

User Base and Demographics

- Binance counts over 280 million registered users globally as of mid‑2025.

- In early 2025, the platform had around 250 million users, implying roughly 30% growth over a short period (18 months).

- Demographically, earlier Binance research indicated that about 32.14% of users are aged 25–34, with 21.55% aged 35–44, showing a predominantly millennial base.

- Roughly 70.7% of Binance users are male, while 29.3% are female.

- For Coinbase, estimates suggest around 120 million total monthly users in 2025.

- Among those, 8.7 million monthly transacting users (MTUs) in Q2 2025, users who actually trade or transact crypto.

- Coinbase’s “verified users” metric was about 108 million in 2024.

- Coinbase’s user base growth from 2024 to 2025 suggests rising mainstream interest in crypto investing and asset management.

Number of Supported Cryptocurrencies

- Binance offers more than 500 cryptocurrencies as of 2025.

- It supports over 1,500 trading pairs, enabling a broad array of spot and cross-asset trades.

- This variety positions Binance as one of the most comprehensive exchanges globally in terms of crypto listing breadth.

- Coinbase supports over 270 cryptocurrencies as of mid‑2025.

- The lower number on Coinbase reflects a conservative approach aimed at regulatory compliance and easier user onboarding.

- Both exchanges continue adding new tokens, but Binance’s pace and breadth remain unmatched in the industry.

- The contrast in supported assets underscores their differing strategies: Binance aims for maximal market coverage, and Coinbase emphasizes regulated, mainstream access.

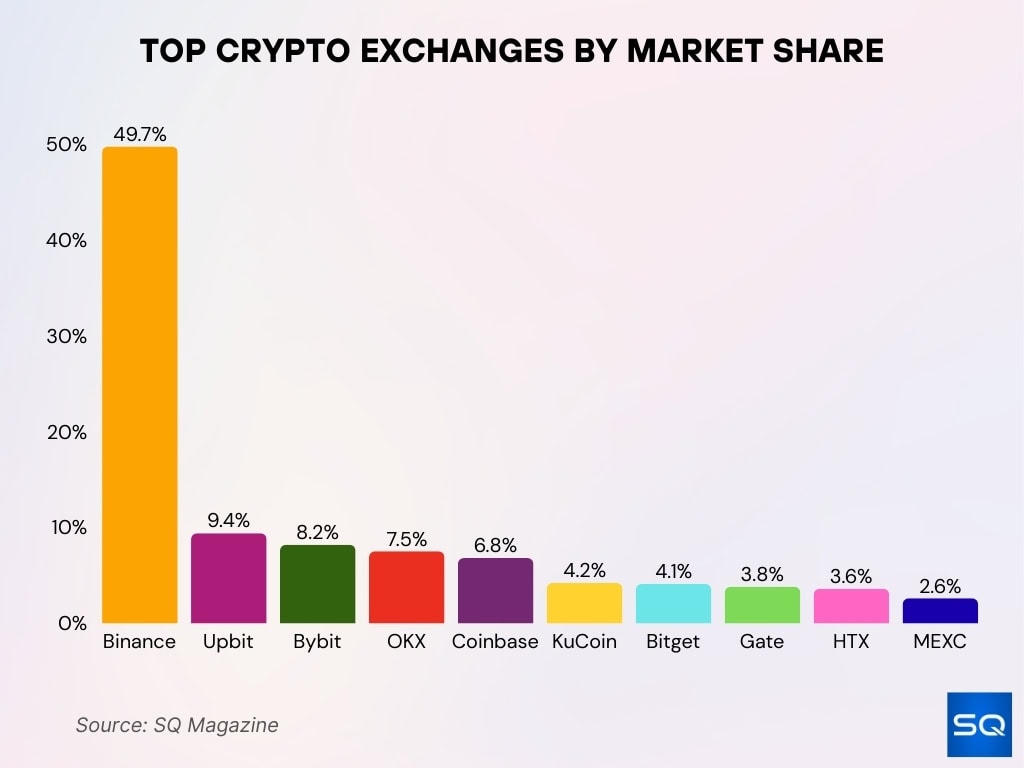

Top Crypto Exchanges by Market Share

- Binance leads with 49.7%, dominating nearly half of global crypto exchange volume.

- Upbit holds 9.4%, driven by strong South Korean trading activity.

- Bybit captures 8.2%, gaining ground through its derivatives-focused model.

- OKX has 7.5%, supported by a strong user base across Asia.

- Coinbase holds 6.8%, remaining the largest crypto exchange in the US.

- KuCoin secures 4.2%, favored by altcoin traders and international users.

- Bitget commands 4.1%, growing fast in copy trading and futures markets.

- Gate.io holds 3.8%, known for early listings of new crypto tokens.

- HTX (Huobi) retains 3.6%, despite headwinds from global regulatory issues.

- MEXC rounds out with 2.6%, showing niche appeal among altcoin-focused users.

Supported Fiat Currencies and Payment Methods

- As of 2025, Binance supports over 100 fiat currencies for its P2P trading and global on‑ramp/off‑ramp services.

- Binance offers multiple deposit and withdrawal methods: bank transfers, credit/debit cards, crypto deposits, and peer‑to‑peer (P2P) payments, depending on region.

- For U.S. users, Binance operates via a separate platform, Binance.US, which supports a narrower selection of assets and may have more limited fiat options.

- Coinbase supports fiat on‑ramps via bank transfers and cards, and in select regions, it allows PayPal and stablecoin‑backed purchases.

- Coinbase’s fee structure for fiat-based purchases in the U.S. uses a 3.99% surcharge on credit card buys, while Binance.US charges around 1.8% for similar transactions.

- For spot trades, Binance’s maker/taker fees start at 0.10%, falling even lower for high-volume users or BNB token holders.

- On Coinbase’s standard retail platform, transaction fees run around 0.60%, but users on Coinbase Advanced see reduced rates (as low as ~0.15%), improving cost competitiveness.

- Binance maintains a global presence with multilingual support and broad fiat accessibility across more than 150 countries, a strength for users outside traditional crypto‑heavy markets.

Derivatives and Margin Trading Statistics

- Binance supports margin trading, futures, and options, offering leverage up to 125× for major assets in 2025.

- Maker fees for Binance derivatives can be as low as 0.02%, with taker fees around 0.04–0.05%.

- Binance continues to lead in total derivatives trading volume globally.

- Coinbase does not offer margin trading or high‑leverage derivatives for retail users on its main platform.

- For institutional and advanced clients, Coinbase may offer derivatives access in certain jurisdictions.

- Binance’s large selection of trading pairs and high leverage capabilities attract more experienced or speculative traders.

- Coinbase’s conservative approach tends to favor long‑term investors and risk‑averse users.

- Binance remains the preferred exchange by margin and futures volume metrics in 2025.

Top Cryptocurrency Exchanges by Trading Volume

- Binance leads with $8.98 billion, far ahead of all competitors in daily volume.

- Bybit ranks second at $2.36 billion, reflecting dominance in derivatives trading.

- OKX, Upbit, and IndoEx each report around $2.2 billion, indicating tight competition.

- SuperEx follows at $2.19 billion, showing rapid momentum in the exchange space.

- Coinbase Exchange reports $1.88 billion, remaining the top US-based crypto platform.

- Bitrue sees $1.86 billion in trading volume, just ahead of BitForex at $1.56 billion.

- MEXC and WhiteBIT post $1.55 billion and $1.5 billion, maintaining consistent activity.

- CoinW ($1.4 billion), Bitget ($1.37 billion), and Bithumb ($1.33 billion) follow closely.

- HTX (Huobi) records $1.28 billion, holding on despite regulatory challenges.

- Bullish, Kraken, OrangeX, Gate.io, and BitMart each report just over $1.02–$1.07 billion in trading volume.

Staking, Yield, and Rewards Statistics

- Coinbase offers staking for major proof-of-stake assets with some reward rates advertised as high as 15% APY.

- In 2024, Coinbase distributed over $450 million in staking rewards.

- Coinbase reports $0 in losses from staking.

- Binance offers a more expansive yield ecosystem: Simple Earn, Advanced Earn, dual-investment, and on‑chain yield products.

- Binance supports staking across a wide range of crypto assets.

- Binance attracts crypto users seeking diversified yield strategies.

- Coinbase remains a solid choice for stable yield and simpler interfaces.

- Both exchanges are actively marketing their yield/staking offerings in 2025.

Geographic Reach and Jurisdiction Coverage

- Binance operates in over 100 countries across Africa, America, Asia, Europe, and the Middle East.

- Binance serves about 280 million total registered users globally as of mid‑2025, reflecting strong double‑digit growth from the 250 million milestone in early 2025.

- India leads with 103 million Binance users.

- Nigeria has 22 million Binance users.

- United States accounts for 55 million Binance users or 12% of the global base.

- Coinbase operates in over 100 countries.

- Coinbase serves 120 million users mainly in the U.S., Canada, and Western Europe.

- Binance is restricted in 9 countries, including Canada, the Netherlands, and Iran.

- Coinbase is restricted in 15+ countries, like Cuba, Iran, Russia, and Syria.

- Binance holds 45% users from emerging markets.

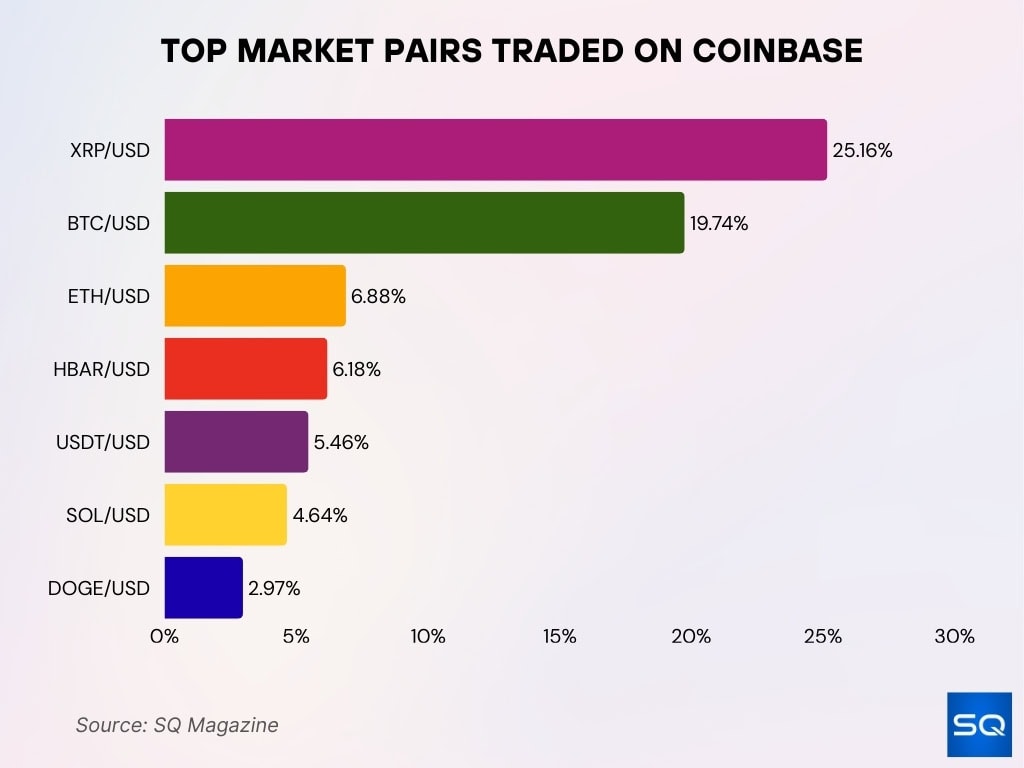

Top Market Pairs Traded on Coinbase

- XRP/USD leads with 25.16%, showing the highest trading volume driven by Ripple demand.

- BTC/USD holds 19.74%, confirming Bitcoin’s consistent popularity on the platform.

- ETH/USD accounts for 6.88%, keeping Ethereum among Coinbase’s top traded assets.

- HBAR/USD contributes 6.18%, signaling strong interest in Hedera.

- USDT/USD makes up 5.46%, highlighting Tether’s stablecoin conversion role.

- SOL/USD captures 4.64%, reflecting steady activity in Solana trading.

- DOGE/USD holds 2.97%, supported by ongoing community-driven Dogecoin interest.

Regulatory Status and Licensing Statistics

- Binance holds 21 global licenses and registrations.

- Coinbase secures MiCA license serving 27 EU states.

- SEC dismisses lawsuit against Binance in May 2025.

- SEC drops Coinbase case under Trump administration.

- Binance operates in 21 licensed jurisdictions worldwide.

- Coinbase consolidates 6 prior EU licenses into MiCA.

- Binance recovers $30 million+ in illicit activities via compliance.

- Coinbase becomes the first U.S. exchange with MiCA approval.

- Binance secures DASP and BSP licenses in El Salvador.

Security Incidents and Fund Safety Statistics

- Binance claims it remains “one of the most secure and audited platforms” in 2025.

- No system can eliminate user-level vulnerabilities like phishing.

- In 2025, hackers stole nearly $2.1 billion in crypto globally, targeting users directly.

- Coinbase experienced a breach through customer support outsourcing, exposing personal data.

- The attackers did not obtain login credentials or private keys.

- Coinbase estimates remediation costs between $180 million–$400 million.

- User retention in 2025 stood at 62% for Coinbase and 59% for Binance.

- Binance promotes security via audits, SAFU fund transparency, and incident disclosure.

Mobile App and Platform Performance Metrics

- Coinbase’s mobile apps hold 4.7★ (iOS) and 4.5★ (Android), while Binance’s apps score 4.4★ (iOS) and 4.2★ (Android).

- Coinbase leads in support responsiveness with an average response time of 4.8 hours versus Binance’s 9.6 hours.

- Coinbase’s Web3 wallet recorded ~3.2 million monthly active users in 2025.

- Coinbase mobile app downloads averaged ~15,000 per day in 2025.

- Coinbase’s 2025 retention rate stood at 62%, Binance’s at 59%.

- Binance added localized support in 25 languages.

- Binance introduced an AI-powered chat support system with a 32% improvement in resolution time.

- Binance’s broader feature set may pose usability challenges for newer users.

Customer Satisfaction and Trust Scores

- Coinbase NPS stands at 46.

- Binance NPS measures 39.

- Coinbase app averages 4.7★ on iOS.

- Binance app scores 4.4★ on iOS.

- Coinbase Web3 wallet satisfaction reaches 92%.

- Coinbase user retention rate hits 62%.

- Binance user retention stands at 59%.

- Coinbase support response averages 4.8 hours.

- Binance support response takes 9.6 hours.

- Binance rated #1 in Asia for UI improvements.

Institutional Usage and Volume Statistics

- Up to 74–76% of institutional investors indicated plans to increase their crypto exposure over the next 12 months.

- 59% of surveyed firms plan to allocate at least 5% of AUM to crypto.

- Binance reported $8.98 billion in total trading volume.

- Coinbase’s trading volume stood at $1.88 billion.

- Coinbase’s 2024 net income reached approximately $2.5 billion.

- Coinbase appeals to institutions for custody, compliance, and research tools.

- Institutions are interested in stablecoins, tokenized assets, and DeFi.

- Binance dominates in raw volume, and Coinbase leads in regulated institutional services.

Frequently Asked Questions (FAQs)

Over 280 million registered users.

About $16.29 billion daily trading volume.

Roughly 38% of global centralized‑exchange trading volume.

517 coins.

Conclusion

The comparison between Binance and Coinbase reveals a clear contrast in strategy, strengths, and target user base. Binance remains the powerhouse of global crypto, offering unmatched volume, broad features, and deep market access. Coinbase, meanwhile, positions itself as the safer, more regulated choice, appealing to users and institutions that value compliance, user experience, and predictable service. Security incidents, app performance metrics, user satisfaction scores, and institutional interest all reflect this divide. As always, the “right” exchange depends on what you value: breadth and flexibility, or stability and trust.