The billionaire class is expanding in both size and influence. The world now counts more ultra‑wealthy individuals than ever, their collective net worth far exceeding the global economic outputs of many nations. This growing concentration of wealth affects markets, politics, and social equity in measurable ways. From tech founders shaping global innovation to inherited fortunes shifting economic power, billionaire wealth trends matter across industries and borders. Read on to uncover the latest statistics shaping the billionaire wealth landscape today.

Editor’s Choice

- 3,028 billionaires were recorded worldwide in 2025, the first time surpassing the 3,000 mark.

- Billionaire wealth jumped over 16% in 2025, much faster than the five‑year average.

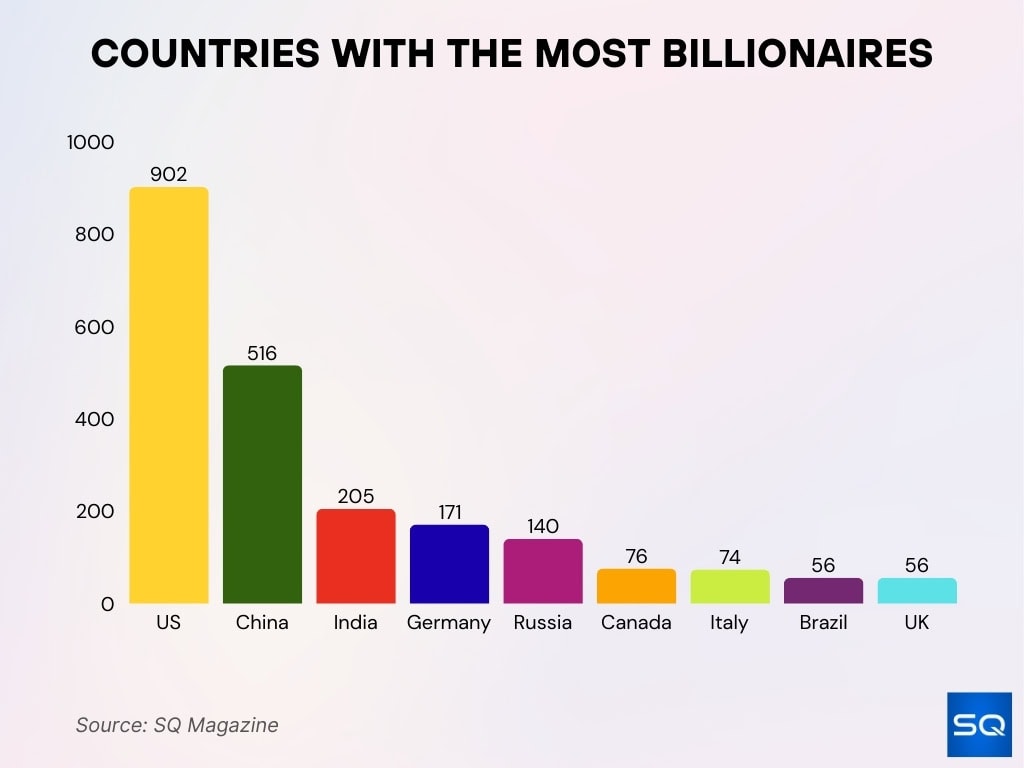

- The U.S. hosts 902 billionaires, the largest national count.

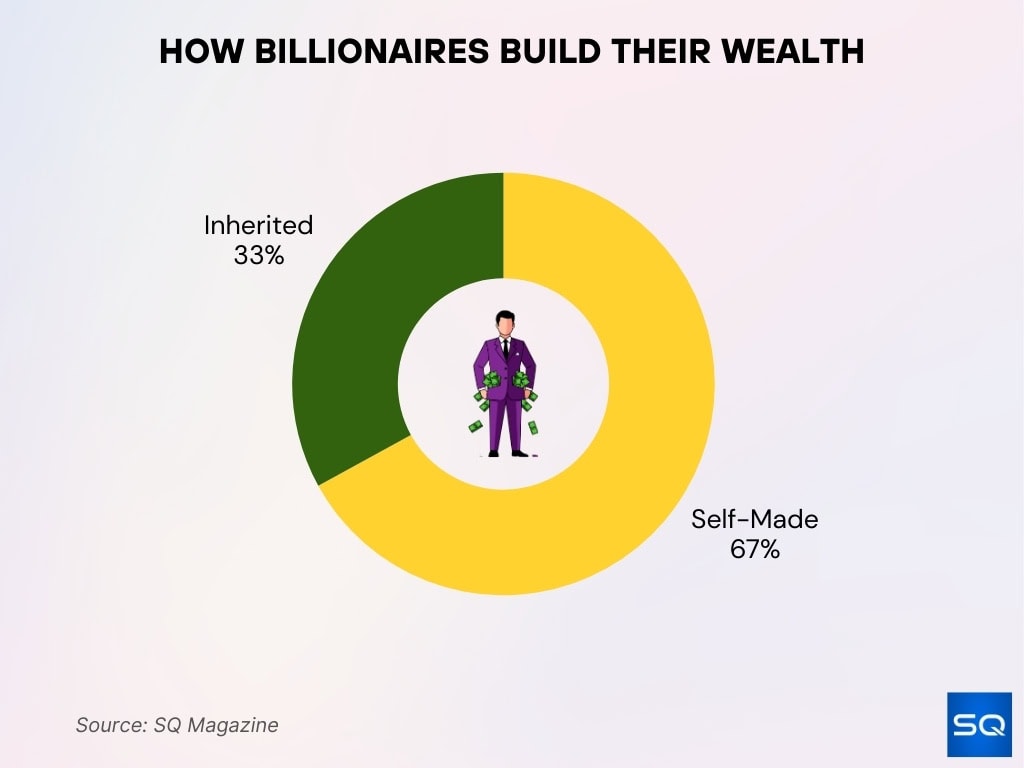

- About 67% of global billionaires are considered self‑made.

- A record 91 individuals became billionaires through inheritance in 2025.

- The combined wealth of the top 12 U.S. billionaires exceeds $2.7 trillion.

Recent Developments

- Billionaire fortunes worldwide hit a new historic peak in 2025.

- Global billionaire wealth grew 16% year‑over‑year in 2025.

- Economic policy shifts in major economies have favored wealth accumulation for the ultra‑rich.

- Debate over wealth taxes, such as California’s proposed “Billionaire Tax Act,” intensified.

- Billionaires are increasingly perceived as exerting political influence, with some reports noting they were 4,000 × more likely to hold office than average citizens.

- Protests linked to wealth inequality arose in multiple regions, reflecting social tensions.

- Discussions at forums like the World Economic Forum spotlighted the billionaire impact on global policy.

- Philanthropy pledges by billionaires continue, though critics question their reach versus overall influence.

Top Billionaires by Net Worth

- Elon Musk tops with a $600–700 billion net worth.

- Larry Page ranks second at $270 billion.

- Larry Ellison holds third with $247-253 billion.

- Sergey Brin at $251 billion.

- Jeff Bezos is fifth with $253 billion.

- Mark Zuckerberg is sixth at $233 billion.

- Bernard Arnault is seventh with $208 billion.

- The top 20 billionaires added a record $2.2 trillion in wealth in recent years.

Total Number of Billionaires

- 3,028 billionaires were listed globally in 2025, breaking previous records.

- According to some estimates, the population is near 2,900 – 3,500, depending on the data source.

- Annual growth rates of billionaire numbers ranged from about 8.8% to double‑digit figures.

- Billionaire population continues expanding despite economic uncertainty.

- Growth is driven by new wealth creation and generational inheritance.

- U.S. leads with the highest national concentration of ultra‑wealthy individuals.

Number of New Billionaires

- Inherited wealth created 91 new billionaire heirs in 2025, a record.

- Combined inherited billionaire wealth reached $297.8 billion in 2025.

- U.S. produced 87 new self-made billionaires worth $171.9 billion in 2025.

- Americas added 92 self-made new billionaires totaling $179.9 billion in 2025.

- Total new billionaires in one report cited as 247 added last year to reach 3,028.

- Global billionaires hit 3,028 in 2025 with about $18.3 trillion in combined wealth.

- UBS reported 287 new billionaires in 2025 worth $684.3 billion.

Wealth Inequality Trends

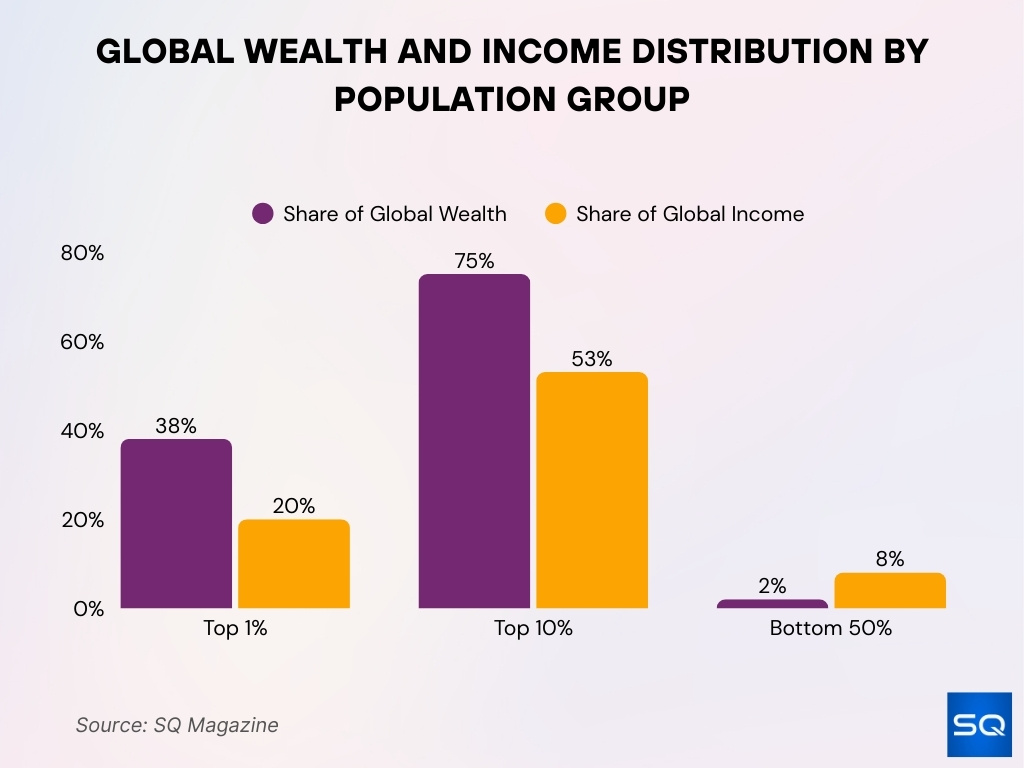

- Top 1% control 38% of global wealth and earn 20% of global income.

- Top 10% capture 75% of global wealth and 53% of global income.

- Bottom 50% hold just 2% of global wealth while earning 8% of global income.

- Billionaire wealth surged 16% in 2025, three times faster than the five-year average to $18.3 trillion.

- $2.5 trillion billionaire gains in 2025 equal the wealth of the bottom 4.1 billion people.

- Billionaires are 4,000 times more likely to hold political office than the average person.

- The number of billionaires topped 3,000 for the first time in 2025.

- $2.5 trillion 2025 gains could end extreme poverty 26 times over.

Billionaire Wealth Growth

- Global billionaire net worth grew over 16% in 2025 to record levels.

- Combined wealth reached an estimated $18.3 trillion in 2025 in some assessments.

- Billionaire wealth has increased 81% since 2020.

- Wealth expanded at three times the rate of the previous five‑year average.

- Billionaires’ average net worth is rising as numbers and total fortunes grow.

- U.S. billionaire wealth continues to lead global totals.

- Tech and finance sectors remain key drivers of net worth growth.

- In some regions, industrial and innovation‑based wealth grew fastest.

Wealth Concentration

- The top 20 billionaires control wealth exceeding many national economies.

- Richest 1% holds more than the bottom 95% of the global population.

- Billionaire wealth grew to $2.2 trillion in a recent record surge.

- U.S. billionaires numbered over 900 with soaring combined wealth.

- Inherited wealth hit a record $297.8 billion for 91 new heirs.

- New self-made billionaires totaled 196 worth $425 billion.

- Extreme top concentration: Musk alone at $600–700 billion.

- The global ultra-wealthy added 287 new billionaires worth $684.3 billion.

- Top 1% gains mirror poorest 4.1 billion people’s total wealth.

Sources of Billionaire Wealth

- 67% of billionaires are classified as self-made from entrepreneurship.

- 33% derive wealth primarily from inheritance.

- Inherited wealth reached a record $297.8 billion across 91 new heirs.

- 196 new self-made billionaires added $425 billion in wealth.

- Self-made billionaires dominate technology sectors overwhelmingly.

- 287 total new billionaires created, worth $684.3 billion combined.

- U.S. generated 87 self-made worth $171.9 billion.

- Americas added 92 self-made, totaling $179.9 billion.

- Inherited share expected to rise with $5.9 trillion transfers by 2040.

- Inheritance created 91 new billionaire heirs.

Self‑Made vs Inherited Wealth

- 67% of billionaires globally are self‑made as of 2025.

- 33% of billionaires inherited part or all of their wealth.

- In the U.S., about 70% of billionaires are self‑made.

- In Germany, only ~25% are self‑made, while most inherited wealth.

- Russia and China show ~97% self‑made billionaire shares.

- Female billionaires are more likely to inherit wealth than their male counterparts.

- Only ~28% of female billionaires are fully self‑made.

- Wealth transfer trends suggest inheritance will become more prominent over time.

Billionaires by Age

- 70-80% of billionaires are aged 50-79.

- Under 50 comprises just 10-12% of all billionaires.

- 21 billionaires under 30 worldwide, mostly inheritors.

- 1 in 5 U.S. billionaires is over 80-90 years old.

- 36 billionaires globally are over 90 years old.

- The average billionaire age reached 67.3 years, the oldest in 25 years.

- Global youngest: only 2 self-made under 30.

- 150 billionaires in their 80s, including Bloomberg.

- Tech billionaires are on average younger than 67 global norm.

- George Joseph oldest active billionaire at 103.

Billionaires by Country

- United States leads with 902 billionaires, holding the largest ultra-wealthy population.

- China ranks second with 516 billionaires, including Hong Kong and Macau.

- India is third with 205 billionaires, showing substantial growth.

- Germany is fourth with 171 billionaires from industrial strength.

- Russia holds 140 billionaires amid market fluctuations.

- Canada counts 76 billionaires in the top rankings.

- Italy has 74 billionaires tied to corporate wealth.

- Brazil records 56 billionaires in emerging markets.

- United Kingdom also has 56 billionaires.

Billionaire Wealth vs Global Population

- 3,028 billionaires worldwide versus an 8 billion global population.

- 15 centibillionaires (>$100 billion) control $2.4 trillion.

- Bottom 1,500 billionaires’ wealth < top 15 ultra-rich combined.

- Billionaires grew more slowly than the global population, but wealth concentrated faster.

- The top billionaires’ share of global GDP has risen steadily since 2020.

- 3,028 ultra-wealthy control more than the bottom 95% population combined.

Billionaires by Industry

- Technology leads with the highest number of billionaires globally.

- Finance & investments rank second with hundreds of billionaire fund managers.

- Manufacturing contributes significantly, especially in Germany (171).

- Real estate major wealth source in the U.S. (902) and China (516).

- Luxury goods drive wealth for families like Bernard Arnault ($208 billion).

- Energy produces billionaires mainly in Russia (140) and the Middle East.

- Media & entertainment grow with celebrity billionaires entering rankings.

- AI & biotech spawn new cohorts alongside tech dominance (Musk $483billion).

- The top 6 U.S. billionaires are all from the technology sector.

- Industrial sectors are strong in the Asia-Pacific in new billionaire creation.

Political & Economic Influence of Billionaires

- Billionaires are 4,000x more likely to hold political office than average citizens.

- 3,028 billionaires exert clout via $18.3 trillion wealth peak.

- Billionaire donations heavily shape elections and legislation globally.

- Wealth elites advise national economic and trade policymaking.

- Billionaires flock to Davos, influencing global policy discourse.

- $2.5 trillion 2025 gains amplify economic policy sway.

- Critics link billionaire power to policies favoring capital over labor.

- Influence grows alongside record wealth concentration.

- Top 1% political leverage deepens socioeconomic divides.

Wealth Share of Billionaires in Global GDP

- Total billionaire wealth represents 13-14% of global GDP.

- The top 20 billionaires control wealth matching mid-sized countries’ entire GDPs.

- Elon Musk‘s $600–700 billion surpasses Finland’s annual GDP.

- Mark Zuckerberg‘s $233 billion exceeds Algeria’s GDP.

- Jeff Bezos‘s $253 billion outpaces Hungary’s GDP.

- Billionaire GDP share projected to reach 20% by 2030.

- U.S. billionaires control $7.6 trillion, rivaling sovereign wealth funds.

Frequently Asked Questions (FAQs)

Billionaires are estimated to be 4,000 × more likely to hold political office than ordinary people.

The top 12 U.S. billionaires collectively had over $2.7 trillion.

The poorest 50% of people hold about 0.52% of global wealth, versus billions held by top billionaires.

Elon Musk’s estimated net worth is about $600–700 billion as of January 2026.

Conclusion

Billionaire wealth today remains highly concentrated across countries, industries, and economic influence. The U.S., China, and India dominate global billionaire counts, while the technology and finance sectors produce the most ultra‑wealthy individuals. Billionaires hold a growing share of global economic resources and influence both political processes and public discourse. This trend highlights both the opportunity for innovation and the challenges driving inequality and policy debates worldwide. As wealth continues to accumulate at the top, understanding these dynamics remains essential for informed discussion about economic growth, fairness, and global development.