Banking chatbots have shifted from novelty to necessity. Once a fringe experiment, they now play a core role across customer service, onboarding, and fraud alerts in major banks worldwide. In real‑world banking, chatbots help millions of customers quickly check balances or transfer funds, while institutions use them to reduce wait times and scale support. In a separate scenario, banks deploy AI chatbots at scale to deflect routine service tasks and free human agents for complex inquiries. Read on to explore the latest adoption data and what it means for the banking sector.

Editor’s Choice

- 92% of North American banks will use AI‑powered chatbots by 2025.

- The top 10 U.S. commercial banks have active chatbots deployed as part of their customer service infrastructure.

- More than 98 million U.S. banking customers interacted with a bank chatbot in 2022, roughly 37% of the U.S. population.

- The global banking chatbot market value is over $2 billion in 2025.

- By 2025, many banks worldwide report having implemented AI in at least one core function, including chatbots.

- A 2025 survey found that 37% of respondents said they have never interacted with banking chatbots, signaling room for growth.

- Deployment of chatbots remains stronger for basic services (balance inquiries, transactions) than for complex tasks like loans or personalized advice.

Recent Developments

- A 2025 analysis shows banks are significantly increasing investments in AI and chatbot systems, spanning customer service, operations, and fraud detection.

- Many institutions report that chatbots now handle a majority of routine customer inquiries, reducing pressure on human call centers.

- AI solutions allowed banks to reduce downtime by 99%, improving the reliability of digital channels.

- Despite growth, roughly 37% of customers in a 2025 survey said they have never used a banking chatbot, showing adoption still lags among certain populations.

- The generational gap affects satisfaction; younger users (Millennials, Gen Z) report more positive chatbot experiences compared with older generations.

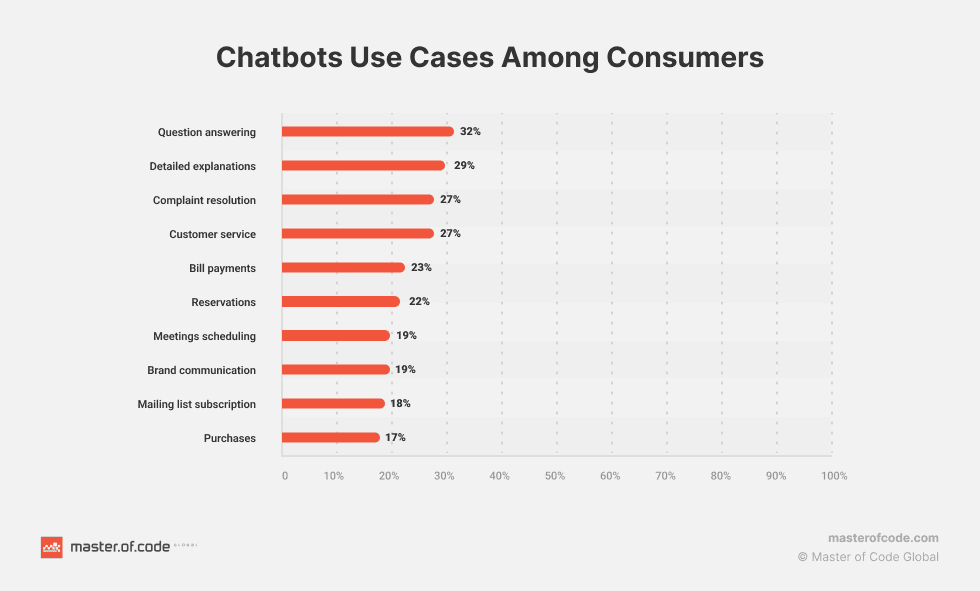

Top Chatbot Use Cases Among Consumers

- 32% use chatbots for question answering, the top use case.

- 29% rely on chatbots for detailed explanations.

- 27% use them for complaint resolution.

- 27% turn to chatbots for routine customer service.

- 23% handle bill payments through chatbots.

- 22% use chatbots to make reservations.

- 19% schedule meetings using chatbots.

- 19% engage in brand communication via chatbots.

- 18% use chatbots to subscribe to mailing lists.

- 17% complete purchases through chatbots.

Global Adoption Rates

- 92% of North American banks had adopted AI chatbots by 2025.

- By 2025, 73% of global banks will deploy at least one chatbot for customer operations.

- The global AI adoption rate among organizations reached 78% in 2025.

- AI in the banking market size was valued at approximately $34.58 billion in 2025.

- Chatbot-related AI spending contributed to a global banking AI market of over $2 billion in 2025.

- 46% of mid-sized banks worldwide adopted AI chatbots in 2025, up from 30% in 2022.

- In Southeast Asia, banking chatbot adoption has surged, reaching about 73% in 2025, in line with regional data on AI-powered banking chatbots.

- Banks in the Middle East and Africa had a chatbot adoption rate of about 59% in 2025.

- In 2025, 71% of financial institutions globally implemented chatbots for internal support functions.

- Fintech-led challenger banks reached a 100% adoption rate of chatbot support by 2025.

Regional Adoption Trends

- 88% of US Tier 1 banks integrated AI chatbots across platforms by 2025.

- 92% of North American banks use AI-powered chatbots in customer service in 2025.

- In Europe, UK banks lead with 85% chatbot adoption, and Germany at 78% in 2025.

- 92% of EU banks deploy AI, with the Nordic region at 81% for first-line support in 2025.

- Asian-Pacific banks show a 79% chatbot adoption rate in 2025.

- Southeast Asia banking chatbot adoption rises to 73% in 2025.

- Latin America sees 62% bank chatbot penetration, South America at 68% in 2025.

- Middle East and Africa banking chatbot usage stands at 59% in 2025.

- India handled over 250 million monthly banking chatbot interactions in 2025.

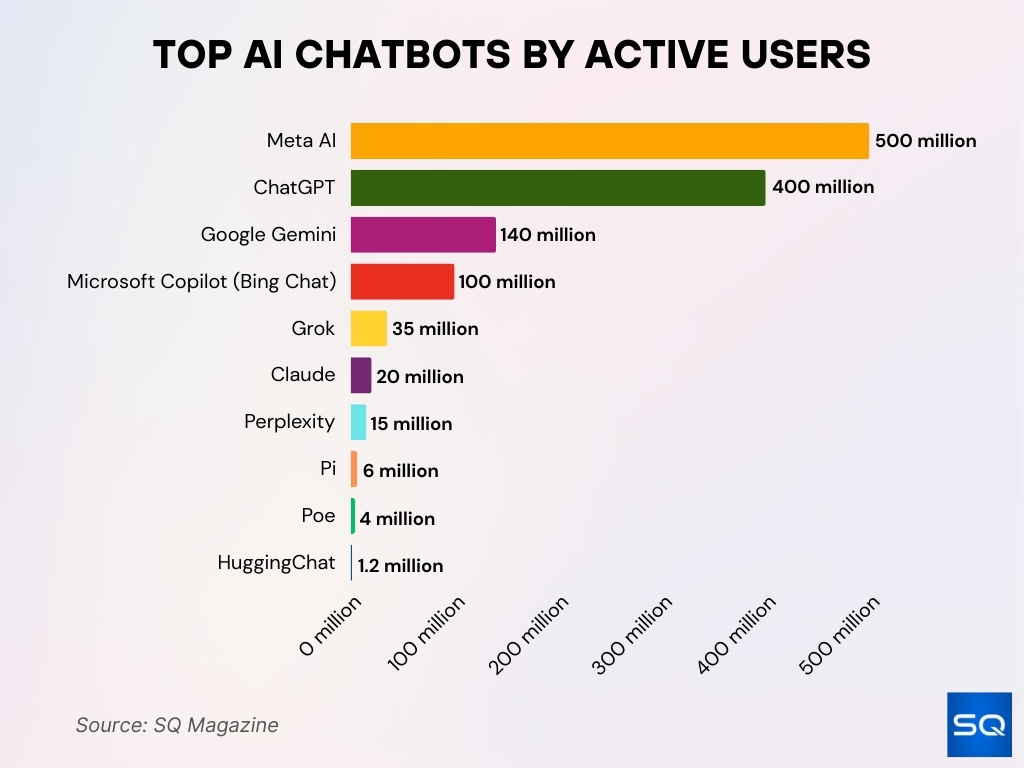

Top AI Chatbots by Active Users

- Meta AI leads with 500 million active users, the most globally.

- ChatGPT follows with 400 million active users across sectors.

- Google Gemini has 140 million active users, showing strong traction.

- Microsoft Copilot serves 100 million users via Microsoft 365.

- Grok by xAI has 35 million users, growing rapidly.

- Claude reaches 20 million users with a safety-focused approach.

- Perplexity powers 15 million users with AI-driven search.

- Pi from Inflection AI engages 6 million active users.

- Poe sees 4 million users accessing multi-model AI tools.

- HuggingChat attracts 1.2 million users in dev and research.

Market Size and Growth

- The global “chatbot for banking” market is valued at $3.37 billion in 2024, with a projected CAGR of 37.62% through 2032.

- The overall global chatbot market is expected to reach ≈ $9.56 billion in 2025.

- The banking‑chatbot segment alone in 2025 is valued at over $2 billion.

- The broader AI‑chatbot market may reach $46.64 billion by 2029, driven by BFSI use.

- Growth reflects demand for automated customer service, digital support, and 24/7 responsiveness.

- Large banks with $100 billion+ in assets are expected to have fully integrated AI strategies by 2025.

- Chatbot software dominates over service-based models in banking deployments.

- Banks aim to scale support without proportionally increasing headcount, leveraging chatbots to support that goal.

Customer Satisfaction Metrics

- A 2025 study found that service and system quality alone didn’t significantly influence satisfaction.

- Another report showed chatbot use improved the online customer experience, boosting satisfaction.

- Younger generations (Millennials, Gen Z) report more positive experiences than older users.

- 70% of users who tried chatbots return to use them again.

- Still, only 29% of customers say they’re satisfied with chatbots, with 78% needing human help afterward.

- Design, expectations, and customer context play critical roles in satisfaction levels.

- A 2024 study showed 74.4% R² between perceived usefulness/ease of use and continued adoption.

- “Behavioral intention” to use chatbots drops significantly when privacy or security concerns arise.

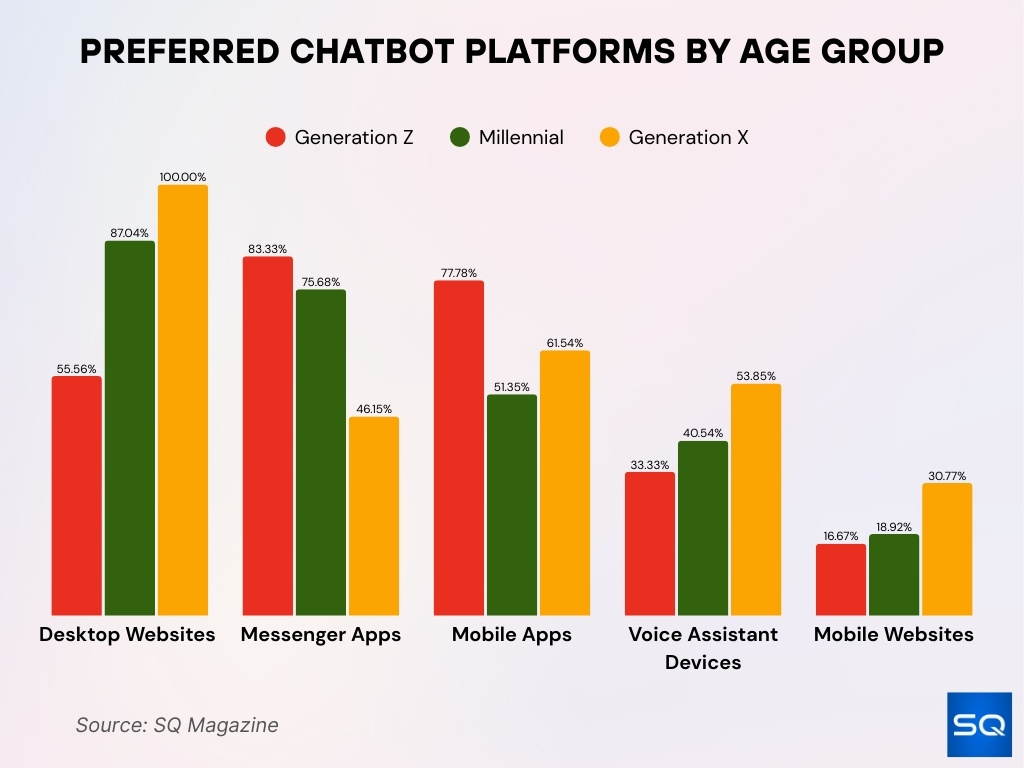

Preferred Chatbot Platforms by Age Group

- 83.81% prefer desktop websites, led by 100% of Gen X, 87.04% of Millennials, and 55.56% of Gen Z.

- 73.33% use messenger apps, with 83.33% of Gen Z leading, followed by 75.68% of Millennials and 46.15% of Gen X.

- 57.14% prefer mobile apps, with 77.78% of Gen Z, 51.35% of Millennials, and 61.54% of Gen X.

- 40.95% use voice assistants, preferred by 53.85% of Gen X, 40.54% of Millennials, and 33.33% of Gen Z.

- 20% choose mobile websites, with 30.77% of Gen X, 18.92% of Millennials, and 16.67% of Gen Z.

Cost Savings and Efficiency

- Chatbots can reduce call center costs by up to 70%.

- They reduce response times by ≈ 65% and lower abandonment rates by 50%.

- Global banking chatbot use could save $7.3 billion in 2025.

- Human agents focus on complex issues while bots manage routine tasks, improving team efficiency.

- Staff can shift to higher-value tasks like advisory or lending.

- Bots provide 24/7 support, eliminating the need for night-shift staffing.

- Fewer call centers means reduced real estate and training expenses.

- Bots ease service bottlenecks during high-volume times, improving throughput.

Operational Impact Statistics

- 75% of banks with over $100 billion in assets fully integrated AI across operations by 2025.

- Chatbots support fraud detection, with 59% of banks reporting real-time fraud alert capabilities in 2025.

- AI-driven KYC automation reduced onboarding times by 50% in many banks in 2025.

- Banks experienced 45% fewer service downtimes after AI migration initiatives in 2025.

- Scalability improvements enabled 99.9% uptime during peak traffic periods in AI-supported banks.

- Around 80% of banks offered 24/7 global customer support through AI chatbots in 2025.

- AI chatbots contributed to a 30-50% reduction in customer-facing staffing needs in 2025.

- The use of AI reduced incremental costs for entering new markets by up to 40% in 2025.

- Chatbots improved response consistency, reducing customer handling variability by 35% in 2025.

- Banks reported 13% average operational cost savings due to AI deployment in 2025.

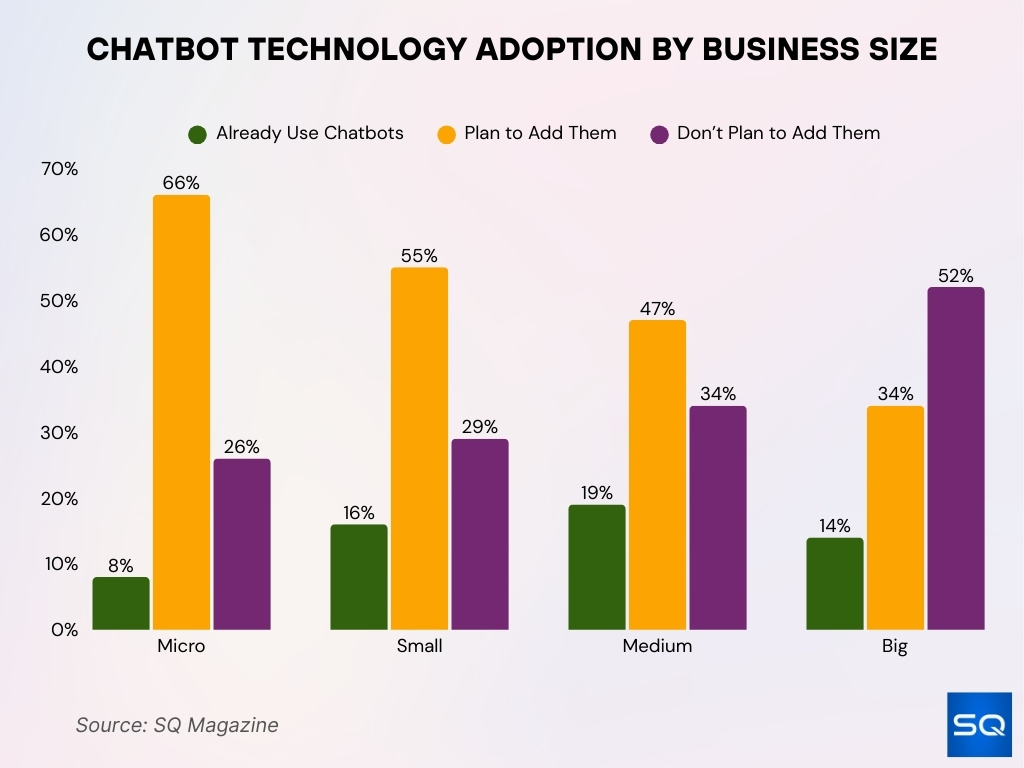

Chatbot Technology Adoption by Business Size

- 8% of micro businesses use chatbots, while 66% plan future adoption.

- 16% of small businesses have adopted chatbots, with 55% planning to.

- 19% of medium businesses lead in usage, and 47% plan to adopt.

- 14% of big businesses use chatbots, but 52% have no adoption plans.

Use Cases by Banking Sector

- 98% of retail banks actively use chatbots for customer service and onboarding in 2025.

- 78% of US credit unions deploy chatbots for member service and fraud alerts in 2025.

- 66% of banks offering mortgage services employ chatbots for pre-qualification and FAQs in 2025.

- Chatbots handle 87% of banking inquiries in under 60 seconds without escalation in 2025.

- 72% of commercial banks use AI chatbots in business accounts onboarding flows in 2025.

- 64% of banks will implement real-time fraud threat detection systems with chatbots in 2025.

- 62% of digital banking platforms support document uploads via AI chatbots in 2025.

- 74% of chatbot interactions achieve first-contact resolution in banking support in 2025.

Technology Advancements

- CAPRAG and RAG AI models enable contextual Q&A and automatic reporting in 73% of banks by 2025.

- Hybrid AI models combining vector and graph learning are used by 52% of financial institutions in 2025.

- 98% of banks plan to use generative AI tools, including chatbots, by the end of 2025.

- 75% of banking leaders have deployed or are rolling out generative AI tools in 2025.

- Voice input and command features are integrated in chatbots for banking tasks by 43% of banks in 2025.

- Multilingual chatbot support is offered by 48% of banks globally to improve accessibility in 2025.

- AI bots assist with onboarding, payments, and credit screening in 67% of banks by 2025.

- Real-time AI-powered fraud risk flagging based on pattern detection is active in 64% of banks in 2025.

- Chatbots with contextual memory manage multi-turn conversations effectively in 76% of banks in 2025.

- 70% of banking chatbots are integrated with CRM tools for deeper personalization in 2025.

Security and Compliance Stats

- Only 38% of banks use chatbots specifically for security, but this is rising.

- Use in fraud and compliance is expected to hit 95% by 2025.

- AI cut processing errors by 40%, enhancing accuracy.

- Audit preparation is 50% faster with AI-enhanced bots.

- Data privacy concerns remain a top inhibitor to full AI adoption.

- 76% of users are unclear about how their data is handled during bot interactions.

- Few users apply privacy-preserving behaviors when chatting with bots.

- Banks limit bots in high-risk areas like large transactions to manage liability.

Future Growth Projections

- AI chatbot market projected to reach $27.29 billion by 2030, growing at 23.3% annually from 2025.

- Generative AI spending in banking is forecasted to hit $85 billion by 2030 with a 55% CAGR starting in 2025.

- 75% of banks over $100 billion are expected to fully integrate AI strategies by the end of 2025.

- GenAI is expected to boost bank productivity by 20-30% through core operations expansion by 2028.

- Early AI adopters are projected to gain 30% higher lead conversion rates versus laggards by 2026.

- Agentic AI is forecasted to disrupt $23 trillion in low-yield consumer deposits by 2030.

- 95% of customer interactions are expected to be via AI chatbots as the default banking interface by 2030.

- RAG and NLU advancements are projected to enable complex task handling in 70% of banks by 2028.

Challenges & Barriers to Adoption

- 63% of banks report difficulty integrating chatbots with legacy core systems in 2025.

- 48% of banks need to retrain or replace chatbot AI models due to evolving expectations in 2025.

- Only 36% of banks have adequate in-house expertise to maintain chatbot AI in 2025.

- 59% of mid-sized banks face challenges in maintaining conversational consistency across platforms.

- 41% of chatbot systems struggle to detect customer intent accurately for complex queries.

- 52% of banks upgraded their infrastructure to support advanced chatbot features like voice in 2025.

- Vendor lock-in is a risk factor for 44% of banks using third-party chatbot providers in 2025.

- Smaller banks lack resources, with 34% exceeding chatbot project budgets by over 15%.

- Manual overrides remain common to reduce automation risks in 78% of financial institutions.

- Compliance and audit requirements complicate bot integration for 67% of banks in 2025.

Frequently Asked Questions (FAQs)

92% of North American banks use AI‑powered chatbots in 2025.

The banking‑chatbot segment is estimated at over $2 billion in 2025.

Some major U.S. banks report an average 13% reduction in operational costs after deploying AI (including chatbots) in 2025.

According to a 2025 survey, 74% of respondents preferred human agents over chatbots for simple, routine banking queries.

Conclusion

The evolution of banking chatbots is well underway. Through advanced AI models, modern chatbots now go beyond simple FAQs; they perform contextual understanding, support multilingual and voice interactions, and integrate with core banking workflows. At the same time, increased use of AI for security and compliance signals a shift toward deeper operational integration.

Yet, barriers remain, privacy concerns, regulatory compliance, technical limitations, and uneven adoption across institutions present real challenges. As AI infrastructure matures and regulators adapt, many banks are likely to broaden chatbot use, making efficient, automated, 24/7 banking a norm rather than a novelty. The numbers suggest clear momentum; the next few years will show whether chatbots truly become the standard interface for banking customers and operations.

Aisyah

Chatbots are clearly reshaping banking by boosting support efficiency without adding more staff.