In a world where cloud environments pulse with terabytes of real-time data, knowing when something goes wrong, or even better, before it goes wrong, is priceless. That’s exactly where Amazon CloudWatch comes into play. Whether it’s a spike in EC2 CPU usage at 2:00 AM or a lagging Lambda function in your production app, CloudWatch captures every metric, log, and event that matters.

As AWS continues to lead the public cloud market in 2025, CloudWatch remains one of its most essential operational tools, helping businesses of all sizes monitor, automate, and scale their systems with confidence. In this data-rich report, we explore the latest AWS CloudWatch statistics for 2025, from built-in metrics to cost analysis and usage patterns, all backed by fresh insights and factual precision.

Editor’s Choice

- 89% of AWS customers use CloudWatch as their default monitoring service in 2025.

- 73% of enterprise CloudWatch users now rely on custom metrics for application-level observability.

- 92% of EC2 instances have detailed monitoring enabled by default.

- 65% of CloudWatch log ingestion is now linked to serverless architectures in 2025.

- 40% of customers reported using CloudWatch Contributor Insights to analyze high-cardinality data.

- 25% drop in average MTTR (mean time to recovery) was reported by teams that integrated CloudWatch with automated remediation.

- 61% of AWS budgets dedicated to monitoring are now allocated to CloudWatch Logs and Metrics.

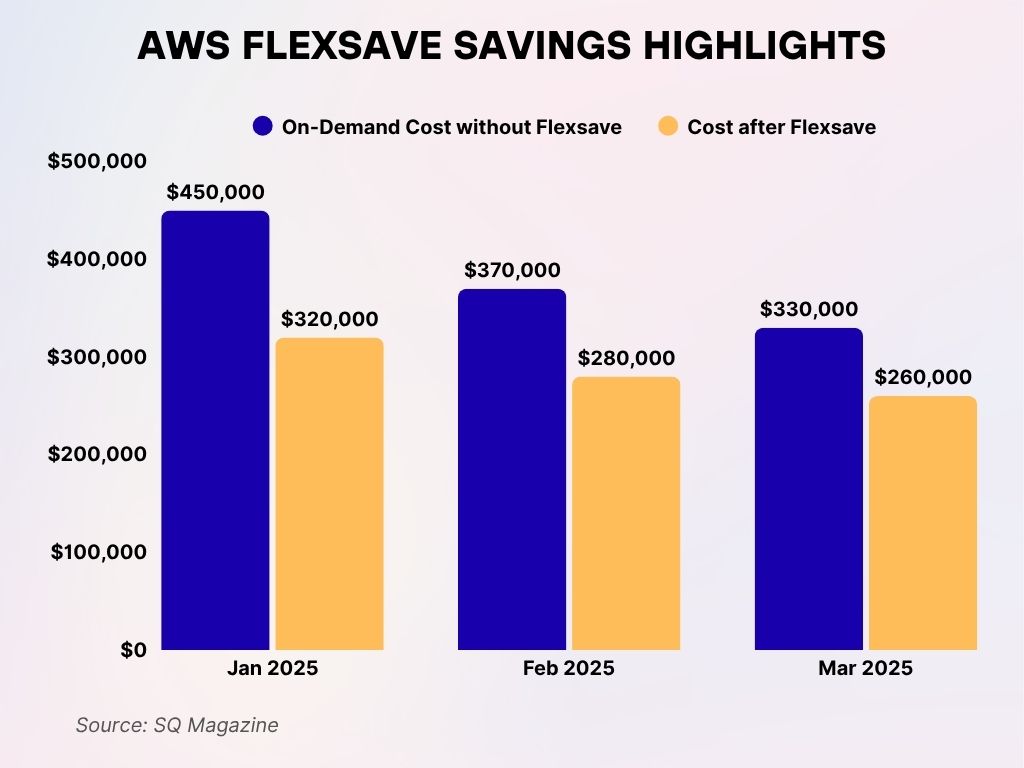

AWS Flexsave Savings Highlights

- In January 2025, the on-demand cost without Flexsave was $450,000, but with Flexsave, it dropped to $320,000.

- In February 2025, Flexsave reduced the cost from $370,000 to $280,000, delivering substantial monthly savings.

- In March 2025, AWS users saved $69,792, as the Flexsave plan cut costs from $330,000 to $260,000.

- The all-time effective savings rate reached 23%, translating into a lifetime savings of $2,819,381 on Flexsave-covered workloads.

Types of AWS CloudWatch Metrics

- Standard metrics are enabled by default across over 80 AWS services in 2025.

- Custom metrics saw a 23% increase in adoption YoY, driven by container and microservice monitoring needs.

- AWS CloudWatch now supports over 1,000 distinct metric types, categorized by namespace.

- High-resolution metrics (sub-minute granularity) usage has surged by 41% in the last 12 months.

- 30% of CloudWatch users employ a mix of both custom and built-in metrics for complete observability.

- CloudWatch’s anomaly detection feature now supports over 20 statistical models per metric stream.

- 14 regions now support enhanced metric delivery latency of under 5 seconds.

Amazon CloudWatch Built-in Metrics

- Over 100 million built-in metrics are collected across AWS services every hour.

- EC2, Lambda, RDS, and API Gateway remain the top 4 services contributing to metric volume.

- CloudWatch Logs Insights usage has increased by 37% for built-in metric analytics.

- Auto scaling groups now generate an average of 15 metrics per instance in active mode.

- Each Amazon RDS instance emits up to 58 default metrics.

- AWS Lambda functions emit 8 default metrics, with cold start data now exposed in near real-time.

- CloudWatch Synthetics scripts now auto-generate 6 performance metrics per canary.

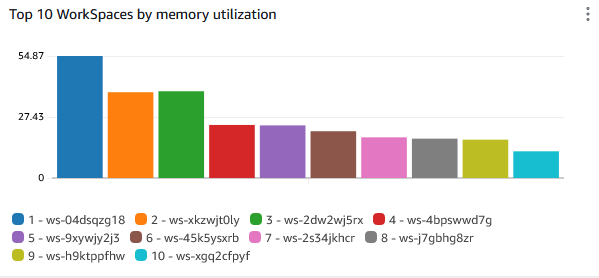

Top 10 AWS WorkSpaces by Memory Utilization

- ws-04dsqzg18 leads all WorkSpaces with a memory utilization of 54.87%, indicating high resource usage.

- ws-xkzwjt0ly and ws-2dw2wj5rx follow closely with utilization levels around 27–30%.

- Mid-tier WorkSpaces like ws-4bpswwd7g, ws-9xywyj2j3, and ws-45k5ysxrb show utilization in the 20–27% range.

- ws-2s34jkhrc and ws-j7gghg8zr are in the lower half, reflecting moderate memory usage.

- The least utilized WorkSpaces are ws-h9ktppfhw and ws-xgq2cfpyf, both below 20% memory utilization.

Metrics & Statistics Types

- CloudWatch tracks 6 core statistic types: Sum, Average, Minimum, Maximum, SampleCount, and p99.

- p90 and p95 percentiles are most used for application performance benchmarks in 2025.

- Custom dashboards now support up to 500 metric widgets, a 66% increase from the previous limit.

- 60% of CloudWatch alarms now use composite metrics to reduce alert fatigue.

- Metric math expressions usage grew by 48%, especially for anomaly filtering.

- Extended statistics, including percentile-based data, are available for all custom metrics.

- CloudWatch supports up to 10 dimensions per metric, allowing for deeper contextual monitoring.

- Baseline comparisons using historical metric data are now native in dashboard visualizations.

- Over 200 million custom statistics calculations are processed daily by CloudWatch analytics.

- Alarm state changes based on statistical thresholds make up 70% of notification triggers.

Metrics by Namespace & Service

- CloudWatch organizes data across more than 90 service namespaces, including AWS/EC2, AWS/Lambda, AWS/EBS, and AWS/ApiGateway.

- AWS/Lambda remains the most queried namespace, with over 31% of all CloudWatch metric queries.

- AWS/EC2 produces, on average, 12 default metrics per instance at 5-minute intervals.

- AWS/ECS namespace metrics usage grew by 45% due to containerized application growth.

- AWS/ELB namespace metrics now power over 18 billion automated alarm conditions annually.

- Custom namespace adoption is up by 22% year-over-year, driven by hybrid monitoring scenarios.

- AWS/CloudFront metrics now include edge location-level data across 450+ PoPs globally.

- Amazon Kinesis namespace emits over 100 metrics per stream for real-time analytics.

- AWS/RDS metrics are commonly used for IOPS and latency alerts, with a 26% growth in dashboard use.

- AWS/S3 added 6 new metric dimensions in 2025, including ReplicationLatency and ObjectLockStatus.

- AWS/OpenSearchService emits detailed index and shard-level metrics across 15 dimensions.

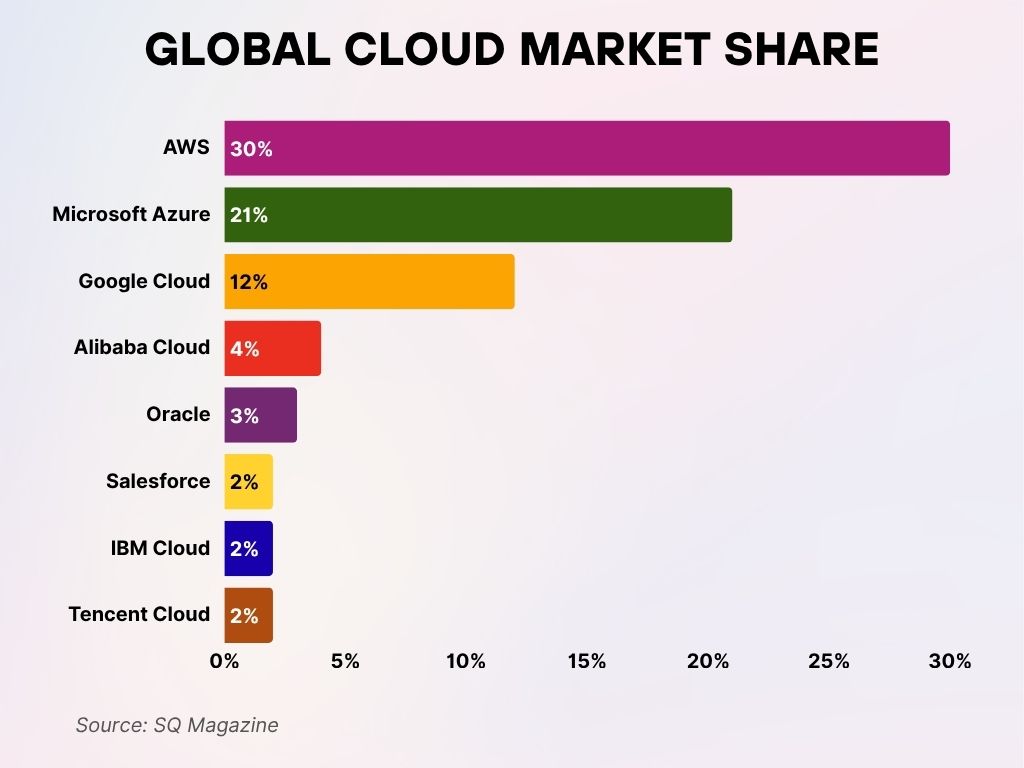

Global Cloud Market Share

- AWS leads the cloud market with a 30% share, maintaining its dominant global position.

- Microsoft Azure holds the second spot with a 21% share of the global cloud infrastructure market.

- Google Cloud ranks third, capturing 12% of the total market.

- Alibaba Cloud commands a 4% share, maintaining its presence in Asia and emerging markets.

- Oracle follows with a 3% market share, supported by growth in enterprise cloud services.

- Salesforce, IBM Cloud, and Tencent Cloud each hold a 2% market share.

Usage Metrics & API Operation Counts

- The GetMetricData API is now responsible for over 55% of the total CloudWatch API call volume.

- PutMetricData calls have increased by 33%, reflecting the rise in observability tooling integration.

- CloudWatch handles more than 1.2 trillion API requests per month as of mid-2025.

- CloudWatch Alarms account for 11% of API usage, driven by automated infrastructure response.

- Usage metrics for billing, such as EstimatedCharges, are now used by 72% of AWS accounts.

- Average CloudWatch usage per account exceeds 2.5 million datapoints/day, up 18% YoY.

- 90% of CloudWatch API traffic originates from other AWS services, not direct user calls.

- API throttling alerts for PutMetricData rose by 21%, indicating scaling gaps in some architectures.

- GetMetricStatistics has seen a decline of 15%, with customers shifting to GetMetricData for efficiency.

- Cross-account usage metrics adoption has doubled, now implemented in 41% of enterprise AWS orgs.

Log Data & Ingestion Metrics

- CloudWatch Logs ingests over 5 petabytes of data daily in 2025.

- Log group count has grown by 29%, averaging 850 groups per account.

- Log stream creation rate is up 34%, fueled by container and Lambda usage.

- The CloudWatch Logs Insights service processes more than 600 billion log events each week.

- 30% of all ingested logs are parsed using custom extraction filters.

- Vended logs, such as Route53 and VPC Flow Logs, represent 22% of all log data volume.

- Retention policies under 30 days are applied to 58% of log groups to manage costs.

- Data protection features, like log masking and redaction, are now used by over 63% of accounts.

- Log archive transitions to S3 via lifecycle policies surged 39% in the past year.

- Log metric filters are now defined on over 70% of high-throughput log groups.

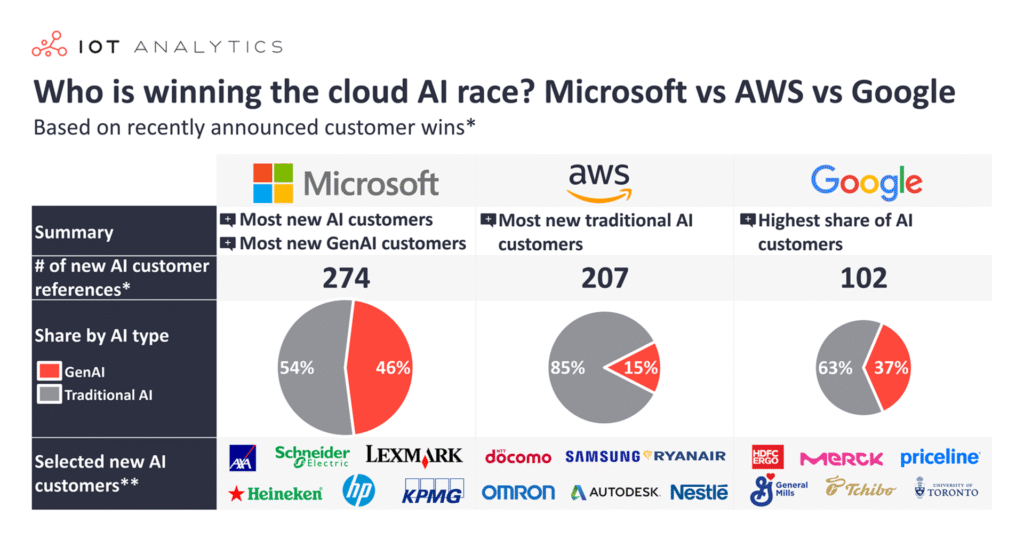

Cloud AI Race: Microsoft vs AWS vs Google

- Microsoft leads with 274 new AI customers, including the most new GenAI customers (46%) and traditional AI (54%) clients.

- AWS added 207 new AI customers, with the highest share (85%) focused on traditional AI and only 15% on GenAI.

- Google recorded 102 new AI customer references, with the highest overall AI customer share ratio: 63% traditional AI and 37% GenAI.

- Notable new AI customers include AXA, HP, Samsung, Nestlé, Merck, General Mills, and the University of Toronto.

- Microsoft stands out in total volume and GenAI adoption, AWS dominates in traditional AI, and Google excels in AI customer focus ratio.

Detailed EBS Performance via CloudWatch Agent

- With the CloudWatch Agent, EBS metrics include VolumeQueueLength, Throughput, and BurstBalance with 1-second granularity.

- Detailed monitoring for EBS is active on 62% of provisioned IOPS volumes.

- CloudWatch Agent allows over 25 new disk-level metrics for EBS, up from 16 last year.

- Median EBS VolumeReadOps for high-performance workloads exceeds 3,500 IOPS per volume.

- BurstBalance alarms help reduce unexpected latency spikes and are used on 48% of EBS GP3 volumes.

- CloudWatch Agent memory and disk space metrics are deployed in 71% of hybrid environments.

- Amazon EC2 + EBS monitoring pairs through the agent account for 40% of composite alarms in 2025.

- EBS latency (VolumeTotalReadTime) is under 1ms in 95% of monitored volumes.

- Agent-based metric collection is now used by 55% of performance-sensitive EC2 workloads.

- Multi-volume dashboards with shared agent data are up 31% YoY among DevOps teams.

Metric Query & Visualization Tools

- CloudWatch Dashboards now support up to 100 cross-region metrics per view.

- 64% of AWS accounts use CloudWatch Embedded Metric Format (EMF) for structured custom logs.

- CloudWatch Metrics Explorer saw a 46% increase in usage due to improved tag-based filtering.

- Managed Grafana for CloudWatch is used by 28% of enterprise accounts for advanced visualizations.

- AWS Console Dashboards support real-time rendering of metrics with refresh rates under 5 seconds.

- CloudWatch Logs Insights integrates with CloudWatch Dashboards in all commercial regions.

- Alarm heatmaps were introduced in 2025 to visualize incident frequency across environments.

- CloudWatch Contributor Insights is used by 33% of organizations for top-N analysis of log metrics.

- Dashboard export to PDF and email snapshots adoption increased by 39% YoY.

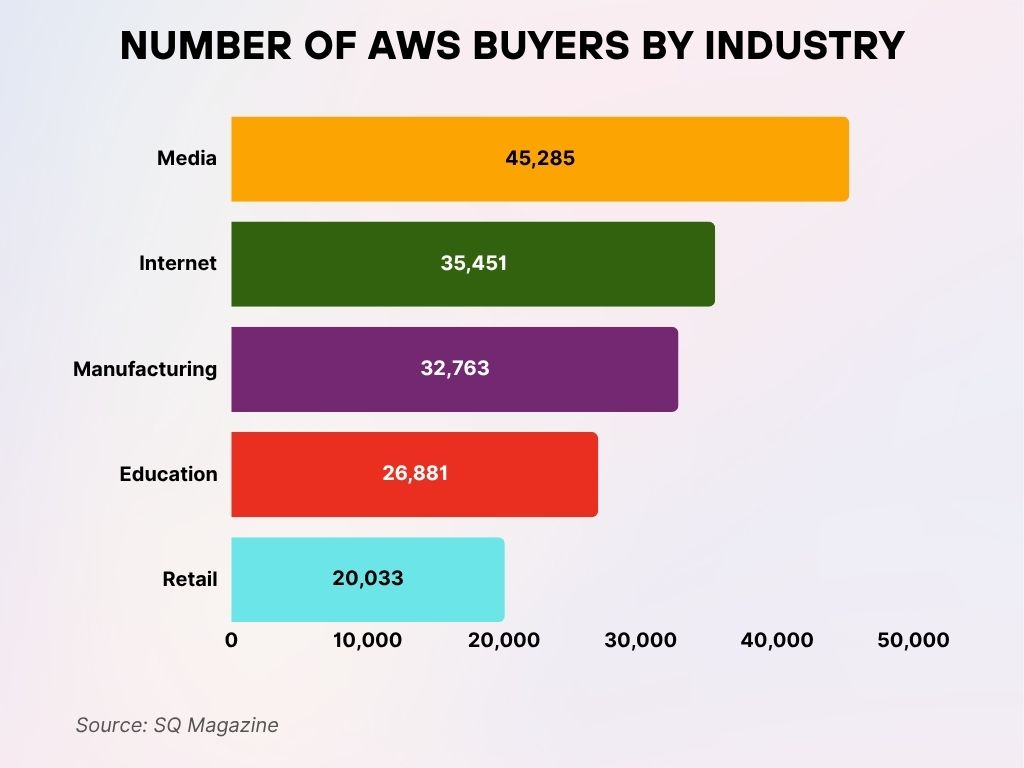

Number of AWS Buyers by Industry

- The Media industry leads with 45,285 total AWS buyers, reflecting strong cloud adoption in content and entertainment sectors.

- The Internet sector follows closely with 35,451 buyers, driven by digital-native businesses and online platforms.

- Manufacturing companies account for 32,763 AWS buyers, indicating growing interest in cloud-powered industrial solutions.

- The Education industry has 26,881 buyers, highlighting increased reliance on AWS for e-learning and academic infrastructure.

- Retail organizations make up 20,033 buyers, leveraging cloud services for e-commerce, logistics, and customer experience.

Retention, Resolution & Granularity

- Default metric retention is 15 months, with 60-second granularity retained for 63 days.

- High-resolution metrics with 1-second granularity can be retained for up to 3 hours.

- Extended data retention settings are configured by 22% of accounts, especially for compliance workloads.

- Alarms based on 10-second intervals now account for 12% of total active alarms.

- Logs retention settings vary widely: 44% of users opt for 90 days or less, 21% choose 365+ days.

- Metric stream delivery latency for near-real-time processing is under 2 seconds in 11 regions.

- Granularity overrides policies are configured in 35% of accounts for specific application profiles.

- Metric math expressions are increasingly used for normalizing resolution differences in multi-source dashboards.

- Retention costs for extended logs and high-resolution metrics have increased by 17% on average in 2025.

Cost & Usage Analysis

- CloudWatch Logs make up 38% of the average CloudWatch bill in 2025.

- The average monthly spend on CloudWatch per enterprise account is $1,200.

- Data ingestion costs are responsible for 51% of billing spikes in high-volume workloads.

- Free tier usage remains active in 92% of AWS accounts, mostly for small-to-medium workloads.

- Metric storage beyond 15 months results in a 7.8x cost multiplier per GB.

- Custom metrics pricing is now the second largest cost driver after logs, accounting for 31% of monthly spend.

- Dashboard API usage can now be monitored via Billing reports, a new 2025 addition.

- Cost Explorer tagging for CloudWatch components increased by 55%, aiding detailed chargeback analysis.

- Cross-account metric sharing contributes to 12% of consolidated billing discrepancies.

- Savings plans for monitoring tools are now used by 16% of enterprise AWS customers.

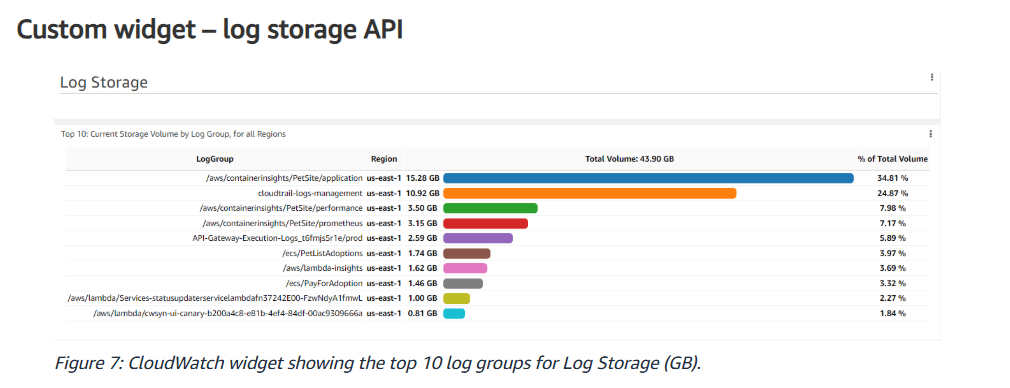

Top 10 AWS CloudWatch Log Groups by Storage (GB)

- The /aws/containerinsights/PetSite/application log group used the most storage at 15.28 GB, accounting for 34.81% of the total log volume.

- cloudtrail-logs-management followed with 10.92 GB, making up 24.87% of all stored logs.

- /aws/containerinsights/PetSite/performance consumed 3.50 GB, or 7.98% of the total.

- /aws/containerinsights/PetSite/prometheus stored 3.15 GB, contributing 7.17% to the overall volume.

- API-Gateway-Execution-Logs_cf6mj5riej/prod held 2.58 GB, which is 5.89% of the total log volume.

- The /aws/PetSite/adoptions log group used 1.65 GB, representing 3.79% of log storage.

- /aws/lambda-insights contributed 1.62 GB, or 3.69% of total volume.

- /aws/PayForAdoption accounted for 1.46 GB, making up 3.32% of storage.

- The log group /aws/lambda/Services-statusupdater… held 1.00 GB, equal to 2.27% of the total.

- /aws/lambda/cwsyn-ui-canary… stored the least among the top 10, with 0.81 GB and 1.84% of the total.

Recent Trends & Developments

- CloudWatch Logs Data Protection gained native PII redaction support in early 2025.

- AWS added 6 new metric namespaces in Q1 2025, including AWS/Bedrock and AWS/SupplyChain.

- Cross-account observability is now enabled in 58% of AWS Organizations.

- AI-driven alarm recommendation is being tested across 5 preview regions, starting in Q2 2025.

- CloudWatch RUM (Real User Monitoring) usage has tripled, now serving 2.4 billion sessions/month.

- Observability Access Manager launched in mid-2025 to streamline permissions and metric sharing.

- The launch of Metric Streams to Amazon OpenSearch increased streaming-based monitoring by 44%.

- Application Signals, a new preview feature, helps correlate metrics across multi-tier applications.

- Regional redundancy for dashboards is being rolled out gradually, with full availability expected by Q4 2025.

Conclusion

AWS CloudWatch continues to cement its role as the heartbeat monitor of the AWS ecosystem. In 2025, its capabilities have expanded far beyond simple metric tracking, becoming a core enabler of real-time decision-making, cost governance, compliance, and performance optimization. Whether it’s an AI-powered alert or a high-resolution insight at scale, CloudWatch’s evolution shows how essential proactive observability has become for every modern cloud strategy.