Asset tokenization is transforming how real‑world and financial assets are issued, traded, and managed. From fractional real estate ownership to tokenized treasuries, the shift opens new investment pathways for both institutional and retail participants. For instance, in real‑estate markets, developers now offer tokenized shares to smaller investors who previously lacked access. Meanwhile, in the bond market, token issuance is enabling faster settlement and broader distribution. Read on to explore detailed statistics, trends, and implications.

Editor’s Choice

- Permissioned blockchains comprised approximately 51% of the tokenized RWA market, largely driven by institutional adoption.

- Institutional investors accounted for nearly 70% of the asset tokenization market in 2024.

- Real-world asset tokenization grew by 308% over the three years leading up to 2025.

- High-net-worth investors are expected to allocate 8.6% of their portfolios to tokenized assets by 2026.

- A survey found that 55% of HNW investors plan to allocate to tokenized assets within one to two years.

Recent Developments

- About 63% of custodians already offer tokenized asset services, and another ~30% plan to add them within two years.

- Around 15% of asset managers currently offer tokenized fund products, while another 41% plan launches.

- Analysts cite “democratizing financial market access” as a key driver of tokenization for retail and emerging-market investors.

- Commodities tokens on public chains are expanding at a 50.10% CAGR, though they still hold a smaller market share.

- IOSCO noted that interest in tokenization is rising, but actual adoption remains limited.

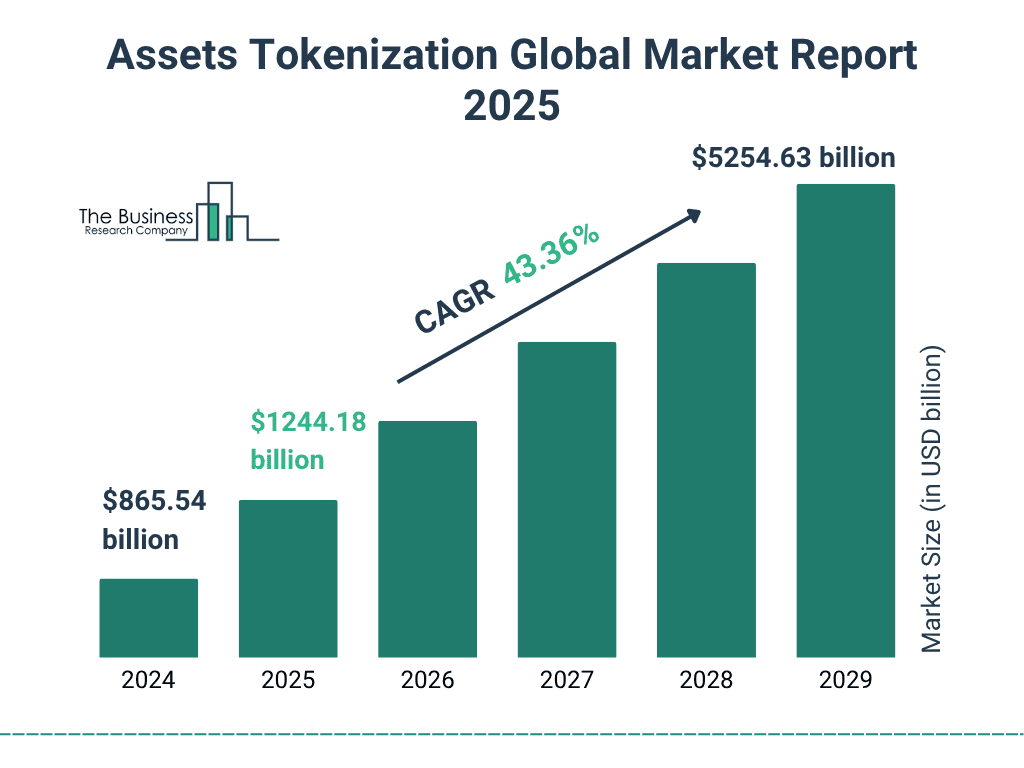

Global Asset Tokenization Market Size

- $865.54 billion was the global asset tokenization market size in 2024.

- The market is projected to hit $1,244.18 billion by 2025.

- It is expected to surge to $5,254.63 billion by 2029.

- The market is growing at a CAGR of 43.36%, signaling rapid adoption.

Institutional vs. Retail Participation

- Institutional investors held nearly 70% of the asset tokenization market in 2024.

- Retail participation is expected to grow at ~52.00% CAGR through 2030.

- Institutional investors are projected to allocate 5.6% of their portfolios to tokenized assets by 2026.

- High-net-worth investors expect to allocate 8.6% of their portfolios to tokenized assets by 2026.

- Institutional adoption remains strongest among custodians (63% offering services) and moderate among asset managers (15% offering services).

- Retail investors benefit from fractional ownership, with tokenization lowering minimums and broadening access.

Tokenization by Platform Type (Permissioned vs. Permissionless)

- Permissioned blockchains held 51% of the asset tokenization market in 2024.

- Institutional investors were responsible for nearly 70% of capital deployment in tokenized assets in 2024.

- Tokenized real estate represented over 30% of the total RWA market share in 2024, with most assets issued on permissioned blockchains.

- Permissionless platforms offer 24×7 market access, attracting global traders despite regulatory hurdles.

- Middleware services, including compliance and orchestration layers, accounted for nearly 60% of revenue in the tokenization stack in 2024.

- Legal and compliance middleware is growing at a 49.40% CAGR through 2030.

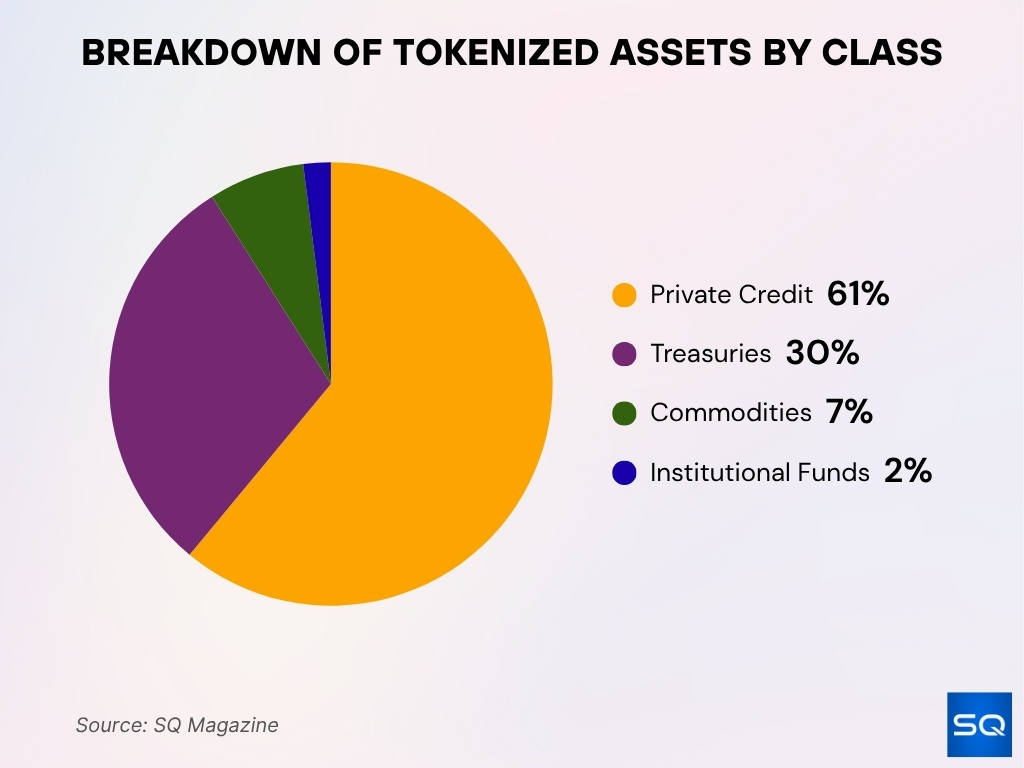

Asset Classes in Tokenization

- Private credit leads with 61% of tokenized assets as of April 2025.

- Treasuries account for 30%, reflecting strong institutional interest.

- Commodities represent 7% of the tokenized asset market.

- Institutional funds make up the remaining 2% share.

Leading Platforms and Service Providers

- The “Top 10 Tokenization Platforms of 2025” list features firms enabling digital‑issuance, fund servicing, custody, and secondary trading of tokenized assets.

- Platforms like Franklin Templeton and Ondo Finance have issued over $4 billion in tokenized assets, with a significant share in tokenized Treasuries.

- Marketplace and platform‑middleware vendors accounted for nearly 60% of 2024 revenue in the tokenization industry.

- Compliance and legal‑tech services tied to tokenization are growing fastest, with a projected CAGR of ~49.40% through 2030.

- Platforms that combine legal wrappers, custodial services, and blockchain rails are winning “tier‑1” banking mandates.

- The number of tokenization platforms worldwide increased by about 75% in 2023.

- Among service providers, competition is rising between specialist platforms and incumbent fintech/asset‑management firms integrating tokenization modules.

Regulatory Developments and Compliance Trends

- Tokenisation adoption remains limited, with 67% of firms citing regulatory uncertainty as a major barrier in 2025.

- The IOSCO final report on tokenisation was published in November 2025, addressing regulatory issues comprehensively.

- Tokenisation projects among financial institutions are expected to grow by 48.5% annually over the next five years amid evolving policies.

- Regulatory uncertainty, technology risk, and infrastructure limitations top the barriers for 72% of institutional investors.

- The FCA’s 2025 pro-growth strategy supports fund tokenisation, aiming to accelerate adoption in asset management sectors.

- MiCA and similar frameworks bring clearer guidance, reducing regulatory ambiguity for over 55% of token issuers.

- Around 85% of token issuers now integrate legal wrappers, KYC/AML, custody oversight, and audits to comply with securities laws.

- The regulatory perspective shifted, with 60% of authorities viewing tokenised assets as eligible under existing securities frameworks.

- Regulatory sandboxes for tokenisation increased by 38% globally in 2025 to facilitate innovation under compliant conditions.

- Cross-border regulatory fragmentation remains a challenge, impacting 45% of tokenisation platforms dealing with multi-jurisdictional compliance.

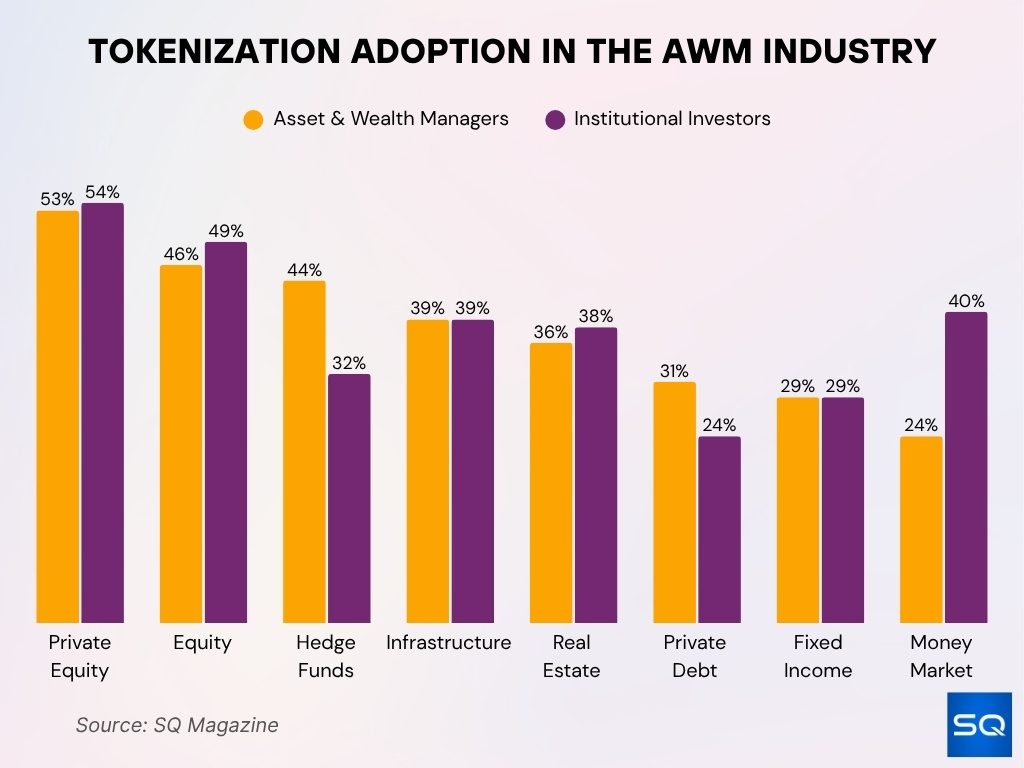

Tokenization Adoption in the Asset & Wealth Management (AWM) Industry

- 53% of asset & wealth managers and 54% of institutional investors are engaged in private equity tokenization.

- Equities are tokenized by 46% of asset managers and 49% of institutional investors.

- Hedge funds attract 44% of asset managers vs 32% of institutional investors.

- Infrastructure tokenization sees 39% adoption from both groups equally.

- Real estate tokenization is planned by 36% of asset managers and 38% of institutional investors.

- Private debt has lower traction with 31% of asset managers and 24% of institutional investors.

- Fixed income tokenization stands at 29% for both groups.

- Money market tokenization is stronger among institutional investors (40%) than asset managers (24%).

Key Market Drivers for Asset Tokenization

- Fractional ownership enabled by tokenization allows smaller-ticket investors to access previously out-of-reach assets, increasing retail participation by 37% in 2025.

- Blockchain-based settlement reduces transaction settlement times by up to 85% compared to traditional methods.

- Tokenization enhances liquidity by enabling 24/7 trading, increasing the liquidity of illiquid assets by an estimated 30-40%.

- 57% of institutional investors plan to increase allocations to tokenized assets in the next several years.

- Regulatory clarity across jurisdictions contributes to an over 50% rise in issuer confidence and deal flow in tokenized markets.

- Platform interoperability and integrated custody solutions have improved commercial feasibility, resulting in a 42% growth in platform adoption.

- Asset managers using tokenization report 28% cost reductions and improved transparency in alternative asset strategies.

- Investor interest in tokenized ESG assets, such as carbon credits, has increased by over 30%, as digital infrastructure enables better access and traceability.

- Blockchain-driven operational savings for banks and financial institutions are projected at over $27 billion annually by 2030 through tokenization.

Major Barriers and Security Risks

- Regulatory uncertainty is cited as the top barrier by 73% of financial institutions in 2025.

- Secondary-market liquidity remains limited, with many tokens seeing daily trade volumes below 5% of issued supply.

- 68% of token holders depend on issuer custody structures as the underlying asset remains off-chain.

- Valuation transparency issues affect 62% of tokenized real-world assets due to audit complexities.

- 54% of tokenization projects face interoperability challenges between blockchain protocols and legacy systems.

- Smart contract vulnerabilities and cybersecurity risks are reported by 49% of projects as critical concerns.

- Market adoption inertia persists, with 44% of tokenization initiatives still in pilot or niche phases.

- Certain asset types, like residential real estate, face tokenisation barriers cited by 39% of institutional investors.

- Custody and investor protection regulations are evolving, with 75% of token issuers integrating comprehensive oversight mechanisms.

- Blockchain and tokenization technologies inherit operational risks that contribute to 35% of reported failures or exploits.

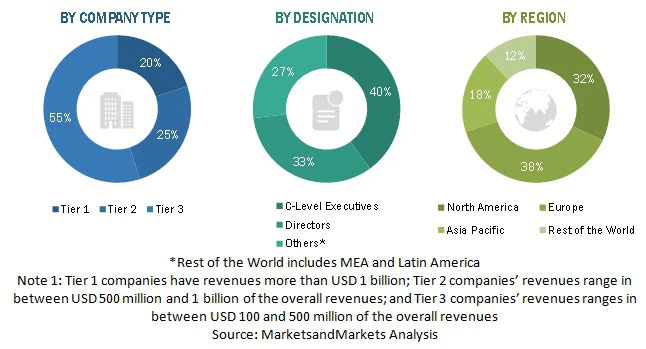

Market Insights by Company Tier, Role, and Region

- 55% of companies are Tier 1 with revenues over $1 billion.

- 25% are Tier 2 firms earning $500M–$1B, while 20% are Tier 3 with $100M–$500M in revenue.

- 40% of respondents are C-Level Executives, showing top-level involvement.

- 33% hold Director roles, while 27% are in Other positions.

- North America leads regionally with 38%, followed by Europe at 32%, Asia Pacific at 18%, and RoW (MEA & LATAM) at 12%.

Tokenization of Real Estate Statistics

- As of 2025, tokenized real estate assets already surpassed $10 billion in value.

- Analysts estimate tokenized real estate could reach $1 trillion by 2035 with approximately 8.5% penetration.

- Another forecast suggests tokenized real estate could hit $3 trillion by 2030, representing about 15% of real estate AUM.

- In a 2023 survey, 80% of HNW investors and 67% of institutional investors were either investing in or planning to invest in tokenized assets, with real estate cited as a top asset class.

- Real estate firms, as of June 2024, 12% had implemented tokenization, and another 46% were piloting.

- The number of tokenization platforms globally grew by ~75% in 2023, with ~38% based in the U.S. and ~37% focused on real estate assets.

Debt Instruments Statistics

- Tokenized real-world assets, including debt instruments, reached approximately $24 billion in 2025.

- Debt instruments such as corporate bonds and government securities accounted for 61% of tokenized asset volumes in 2025.

- Tokenization alters the ledger format while retaining the original legal status of debt securities.

- Issuers launched over 60 tokenized bonds globally, totaling around $8 billion in value.

- Tokenized sovereign and corporate bonds enable instant digital settlement and fractional ownership models.

- Liquidity remains a challenge, with trading volumes of tokenized debt often below 5% daily turnover.

- Custody and valuation transparency issues affect 62% of tokenized debt instruments.

- Institutional adoption is growing, with 57% of asset managers planning allocations in 2025.

Investment Funds Statistics

- Surveys show 76% of firms intend to invest in tokenized assets by 2026.

- Tokenized investment funds replicate conventional funds as “digital twins” on-chain.

- Regulatory frameworks for tokenized funds are evolving in major jurisdictions globally.

- Tokenized fund platforms grew by 85% in assets under management since December 2024.

- Institutional investors allocate an estimated 5.6% of portfolios to tokenized assets by 2026.

- Most tokenized fund initiatives remain private or semi-private rather than fully retail-focused.

Equities & Public Securities

- Institutions and B2B participants drive tokenized equity activity, while retail accounts for under 15% of the market.

- Analysts project tokenized equities to surpass $1 trillion as institutional adoption expands.

- Issuers emphasize regulatory compliance, shareholder rights, and accurate ledger representation in 85% of tokenized equity issuances.

- Tokenized equities continue to lag behind debt and real estate, with trading volumes at about 30% of those sectors.

- Secondary markets for tokenized equities show daily liquidity below 7% of outstanding tokens.

- Voting rights and dividend distribution remain hurdles affecting 65% of token holders in tokenized equity models.

- The tokenized equities market recorded a 566% volume increase within the Solana ecosystem in one month in 2025.

Commodities Statistics

- Analysts estimate tokenized oil at ~$500 million, silver at ~$200 million, agricultural commodities at ~$150 million, industrial metals at ~$75 million, and carbon credits at ~$50 million.

- Tokenized real-world assets surpassed $24 billion in 2025.

- Commodity-backed tokens continue to increase, with institutional interest rising significantly.

- Fractional ownership of commodities via tokenization is growing ~30% annually.

- Cross-border investor access to tokenized commodities increased by ~45% by 2025.

Frequently Asked Questions (FAQs)

Approximately 45.46%.

Roughly $24 billion, up 308% over three years.

About $7.4 billion, with an 80% year‑to‑date increase.

Around $1.9 billion, with commodities expected to expand at about 50.10% CAGR through 2030.

Conclusion

Asset tokenization is entering a new phase where institutional momentum, platform maturity, and regulatory evolution are aligning. From real estate and debt instruments to funds, equities, and commodities, tokenization is being tested across asset classes. Still, for the model to scale, liquidity, legal clarity, and investor access must progress at the same pace. For U.S. investors seeking a foothold in this transformation, the data in this article reveals both opportunity and caution. This comprehensive set of statistics offers a grounded view of where tokenized assets stand today and where the market is heading next.