Algorithmic stablecoins are a unique class of digital currencies designed to maintain a price peg, commonly to the U.S. dollar, through automated algorithms rather than direct collateral reserves. Their theoretical appeal lies in capital efficiency and decentralized stability mechanisms, making them attractive in decentralized finance (DeFi) and cross‑border settlement contexts.

Real‑world firms such as payment networks and blockchain protocols experiment with algorithmic designs to streamline settlement and liquidity. Yet past collapses like TerraUSD’s wipeout underscore the risks innovators still face while pushing this technology forward. Explore the statistics below to understand how this sector is evolving and what the numbers say about its future.

Editor’s Choice

- Almost all stablecoins today are tied to the U.S. dollar, with nearly 99% pegged to USD as of mid‑2025.

- The total stablecoin market cap surpassed $300 billion in 2025, reflecting growth from around $247 billion a year earlier.

- Visa reported $4.5 billion in annualized stablecoin settlement volumes in early 2026.

- Stablecoins accounted for ~30% of total crypto transaction volume in 2025.

- The U.S. Senate passed a stablecoin regulation bill linked to a 22% increase in market cap in 2025.

- Key DeFi metrics show algorithmic stablecoin collapses still shape risk perceptions.

Recent Developments

- Market capitalization for all stablecoins topped $300 billion by Q4 2025.

- Visa’s pilot with Circle’s stablecoin (USDC) hit $4.5 billion annualized settlement volume in early 2026, signaling mainstream payment integration efforts.

- The GENIUS Act passed the U.S. Senate in 2025, advancing formal rules for stablecoin issuance.

- Stablecoin transaction volumes reached over $4 trillion between January and July 2025.

- Regulatory clarity from MiCA in the EU and Hong Kong’s Stablecoin Bill emerged in 2025.

- Stablecoin usage in DeFi and trading now represents ~30% of crypto transactional volume.

- Traditional banks such as Goldman Sachs, UBS, and Citi explored launching stablecoin projects.

- BIS warned that stablecoins could pose financial stability risks without stronger oversight.

Overview of Algorithmic Stablecoins Statistics

- Algorithmic stablecoins market cap stands at $682.7 million, a niche segment amid total stablecoin dominance.

- Represents roughly 0.21% of the total stablecoin market cap of about $318 billion in early 2026.

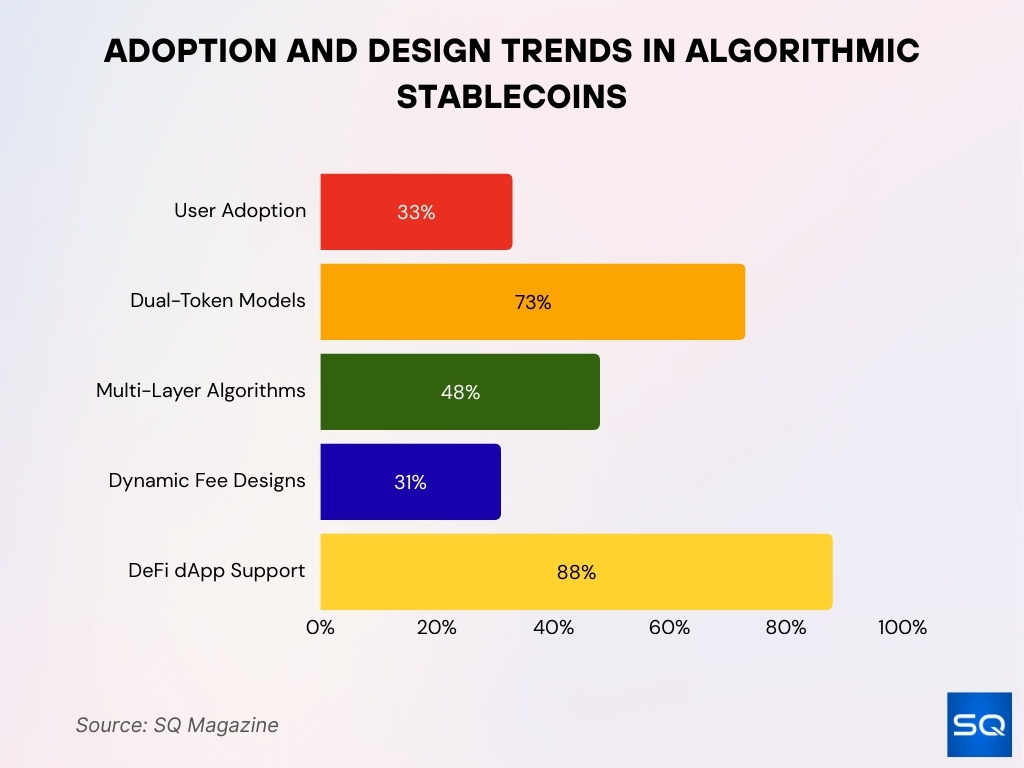

- 33% of crypto users now hold algorithmic stablecoins, up from prior years’ caution.

- 73% employ dual-token models like seigniorage shares for enhanced resilience.

- 48% of designs feature multi-layered algorithms to mitigate depegging risks.

- 31% of new algorithmic stablecoins integrate dynamic fee structures for supply control.

- 88% of DeFi dApps now support algorithmic stablecoins for liquidity provision.

Number of Algorithmic Stablecoins in the Market

- 21 algorithmic stablecoins are actively tracked on major platforms.

- Only 5 hold a significant market cap above $10 million.

- 16 smaller projects listed with niche or zero trading volume.

- Frax remains the leading hybrid algorithmic design in DeFi.

- 3 new algorithmic variants launched, emphasizing RWA integration.

- 73% of projects now use dual-token architecture for supply management.

- Developer deployments total 48 multi-layered stability systems.

- 31% adoption rate among Asian DeFi users versus 43% in North America.

- Regulatory compliance was achieved by 88% of surviving protocols.

- 62% of activity is concentrated in DeFi liquidity and lending markets.

On-Chain Transaction Volume for Algorithmic Stablecoins

- Q1 transactions total $6.1 billion.

- Daily on-chain volume averages $21 million.

- DeFi liquidity pools contribute 65% of activity.

- Automated market maker trades account for 42%.

- Wallet volatility index at 3.2x fiat-pegged coins.

- Cross-chain bridge inflows reach $1.8 billion quarterly.

- Reward incentives drive 78% correlation with volume.

- Governance participation boosts tx count by 29%.

- Peg mechanism upgrades spike volume 150%.

- Regulatory clarity projects 45% growth potential.

Leading Algorithmic Stablecoins by Market Capitalization

- USDD leads with a $544.6 million market cap.

- Celo Dollar (CUSD) at $35.56 million.

- Hive Dollar (HBD) holds $35.53 million.

- SUSD ranks with $27.49 million.

- Celo Euro (CEUR) is valued at $7.11 million.

- Djed (DJED) market cap $4.05 million.

- Fei USD (FEI) at $3.52 million.

- Liquid Loans USDL $4.50 million.

- Alchemix USD (ALUSD) $14.51 million.

Peg Stability and Price Volatility Metrics

- Average peg deviation 0.05% across top algorithmic stablecoins.

- Frax achieves 98.5% stability rate.

- AMPL rebasing maintains 93% price stability.

- Volatility index is 3.2x higher than fiat-backed peers.

- 35% experienced temporary volatility in corrections.

- Multi-layered designs reduce deviation by 48%.

- AI predictive models improve stability 16%.

- Collateralized peers at 99% stability rate.

- Stress event amplification 2.5x for algorithmic.

- Governance adjustments cut deviations 22%.

TerraUSD and Major Algorithmic Stablecoin Collapses

- TerraUSD (UST) collapse wiped out $40 billion in market value.

- LUNA token fell from $87 to under $0.00005.

- UST price dropped from $1 to $0.2 in days.

- The event caused $450 billion in total crypto market losses.

- $18 billion trader losses in May 2022 alone.

- Do Kwon was sentenced to 15 years in prison for fraud.

- Terraform Labs filed for bankruptcy in 2024.

- $19 million forfeiture ordered from Kwon.

- Triggered multiple crypto firm bankruptcies.

- $80 million SEC civil penalty paid by Kwon.

Algorithmic Stablecoin Trading Volume

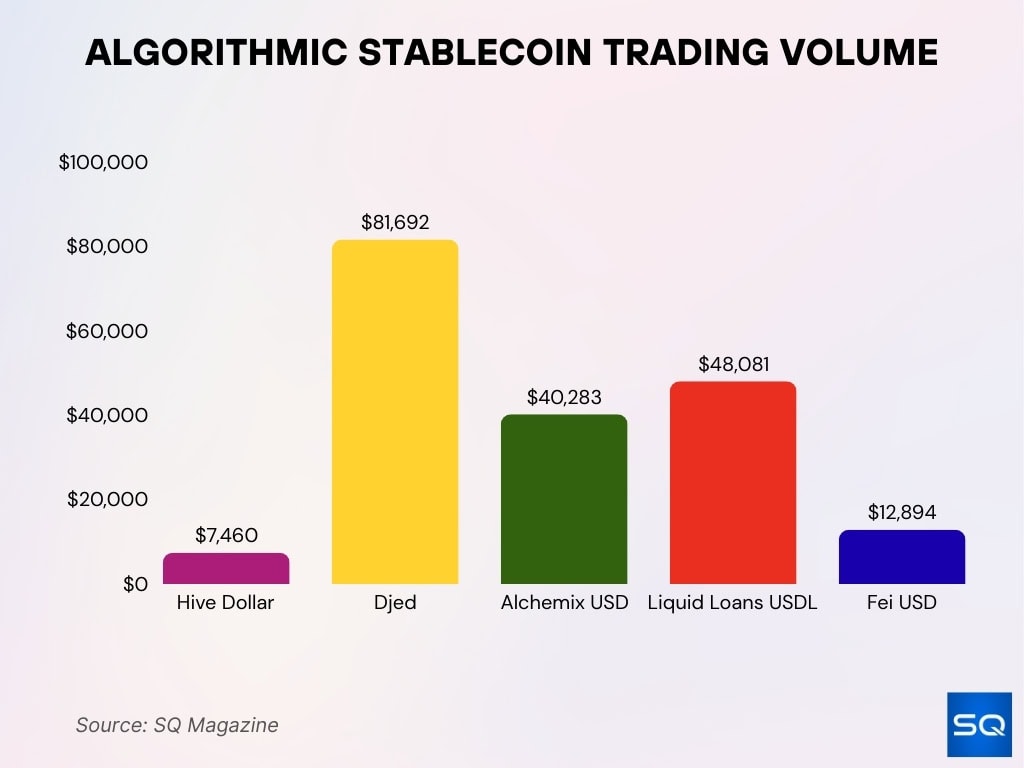

- Hive Dollar (HBD) volume $7,460.

- Djed (DJED) $81,692 daily volume.

- Alchemix USD (ALUSD) $40,283.

- Liquid Loans USDL $48,081.

- Fei USD (FEI) $12,894 24h trades.

Algorithmic Mechanism Types and Design Models

- 73% use dual-token models with bonds for supply shocks.

- 21% employ pure rebasing mechanisms, adjusting all wallets.

- 48% feature fractional-algorithmic partial collateral designs.

- 31% integrate hybrid collateral + algorithmic controls.

- 16% incorporate AI-driven dynamic supply adjustments.

- Seigniorage-style systems comprise 65% of active protocols.

- 42% combine AMMs with stabilization contracts.

- 88% incentivize arbitrage for peg maintenance.

- Multi-collateral hybrids reduce death spirals by 65%.

- 29% experimental designs use bonding curves.

Capital Efficiency Metrics of Algorithmic Stablecoins

- 0% upfront collateral required for pure algorithmic models.

- Hybrid designs average 75% reserve ratios.

- 3.2x capital efficiency over fully collateralized peers.

- Stress events drop efficiency by 85%.

- Fractional models balance at 40% collateral usage.

- Supply-to-reserve ratio varies 20-100% in hybrids.

- Liquidity depth correlates 92% with efficiency.

- DeFi LTV ratios reach 85% for algorithmic pairs.

- Peg breaks reduce metrics 65% sharply.

- Market participation boosts efficiency 2.5x.

Adoption of Algorithmic Stablecoins in DeFi

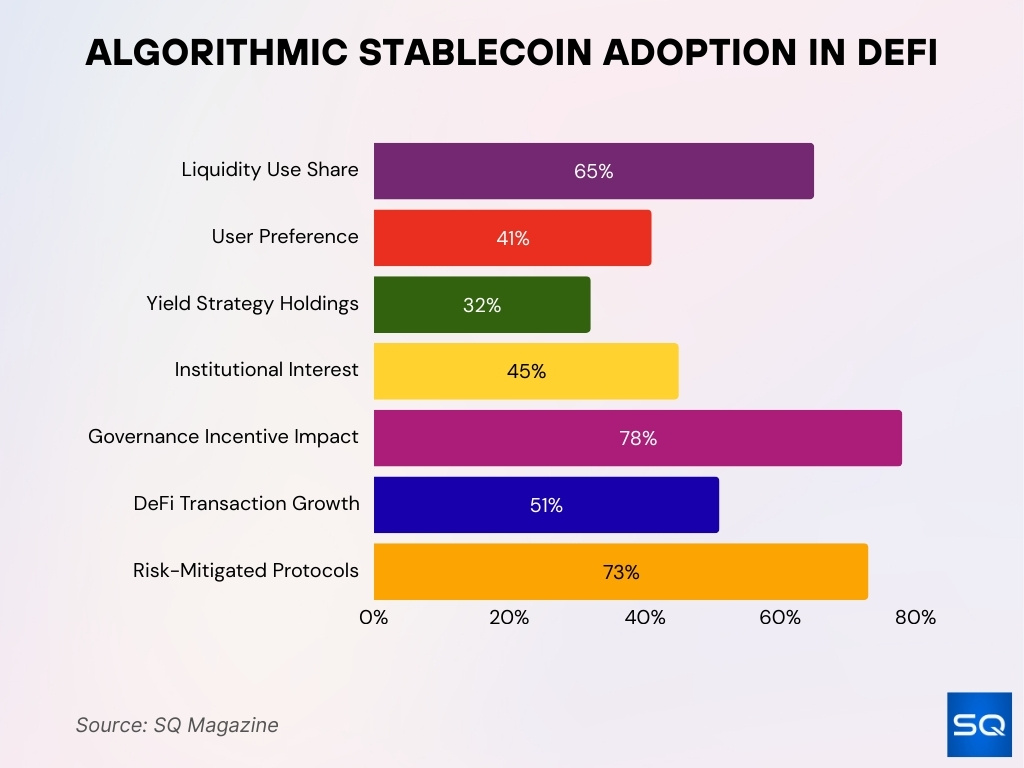

- Liquidity provision uses represent 65% of activity.

- 41% of users prefer algorithmic over collateralized stablecoins.

- Yield strategies account for 32% of holdings.

- 45% institutional DeFi interest in algorithmic lending.

- Governance incentives drive 78% adoption correlation.

- 51% transaction growth in DeFi integrations.

- Risk-mitigated structures are used by 73% of protocols.

Geographic Distribution of Algorithmic Stablecoin Usage

- MENA leads with 52.3% stablecoin transaction activity.

- CSAO region shows 48.8% share.

- Eastern Europe at 48.5% usage rate.

- Latin America records 48.1% stablecoin dominance.

- Eastern Asia 45.0% of transactions.

- Sub-Saharan Africa 43.2% adoption.

- Western Europe 42.8% activity.

- North America 37.9% balanced with Bitcoin.

- Asia and Europe 43% user preference for algorithmic.

- Latin America 30% users who hedge with algorithmic coins.

Institutional vs Retail Adoption of Algorithmic Stablecoins

- 33% of crypto users hold algorithmic stablecoins.

- Retail users comprise 95% of algorithmic holders.

- Institutions allocate <1% to algorithmic designs.

- 41% retail prefer algorithmic for DeFi yields.

- 85% institutions cite peg risks as barriers.

- Hybrid models attract 12% institutional testing.

- Retail spikes 150% during DeFi incentives.

- 78% retail view as high-risk speculative assets.

- Institutional stablecoin adoption at 0.5/10 scale.

- 52% hedge funds hold some virtual assets.

Regulatory Actions Targeting Algorithmic Stablecoins

- MiCA bans algorithmic stablecoins requiring 100% reserves.

- 78% EU stablecoins need reclassification under MiCA.

- 21% current projects meet full MiCA standards.

- GENIUS Act restricts issuance to regulated institutions.

- SEC enforcement against 3 algorithmic projects as securities.

- 10 anticipated MiCA enforcement actions in 2026.

- Hong Kong restricts unbacked algorithmic arrangements.

- 3 major stablecoins may exit the EU for non-compliance.

- ECB veto on large systemic algorithmic issuers.

- €500 million invested by exchanges in MiCA readiness.

Forecasts and Growth Projections for Algorithmic Stablecoins

- Projected market share remains under 5% by end-2026.

- Transactions grew 51% in 2025 with continued momentum.

- User holdings rose to 33% in 2025 from 28% prior.

- AI mechanisms forecast to cut volatility 65% by late 2026.

- Total stablecoins to hit the $1 trillion scale by 2030.

- Hybrid models to outpace pure algorithmic by 2x growth.

- Institutional cross-border use is up 45% annually.

- DeFi TVL for algorithmic is projected to be $5 billion.

- 16% CAGR through 2027 for resilient designs.

- 73% new projects will be hybrid by 2027.

Frequently Asked Questions (FAQs)

Hybrid/algorithmic stablecoins represent less than 5% of the total stablecoin market by value in 2025.

Approximately 99% of stablecoins worldwide are pegged to the U.S. dollar or dollar assets.

Visa’s stablecoin settlement run‑rate reached about $4.5 billion annually as of early 2026.

Conclusion

Algorithmic stablecoins continue to evolve within the broader stablecoin ecosystem. Despite representing a small market share relative to fiat‑backed alternatives and facing peg stability challenges historically, they have shown notable transactional growth and developer interest. Regulatory developments, hybrid protocol models, and increasing integration with DeFi indicate a maturing space that may carve distinct niches, especially where capital efficiency and decentralized mechanisms are valued.

As stablecoins overall scale and enter mainstream finance, algorithmic models could benefit from innovation focused on risk mitigation and regulatory alignment. The data suggests cautious but steady growth ahead, with broader market trends and institutional demand shaping their role in the years to come.