Sharps Technology is ramping up investor confidence with a bold $100 million stock buyback while deepening its position as one of Solana’s biggest digital asset treasuries.

Quick Summary – TLDR:

- Sharps Technology announced a $100 million share repurchase program to regain investor value and boost its stock performance.

- The move comes as the company strengthens its Solana digital asset treasury, now holding over 2.14 million SOL tokens.

- Sharps recently raised $400 million in private equity, making it a key player among Solana-focused treasury firms.

- Despite stock price volatility, the firm remains committed to its pharmaceutical business and will not dip into its crypto holdings for the buyback.

What Happened?

Sharps Technology has announced plans to buy back up to $100 million worth of its own stock through a mix of open market and negotiated deals. The Nasdaq-listed firm is also building one of the largest Solana digital asset treasuries (DAT) in the market. This dual strategy signals a bold pivot that merges traditional finance with crypto innovation.

🚨 Solana treasuries are starting to look like Wall Street playbooks.

— Satoshi Club (@esatoshiclub) October 2, 2025

Sharps Technology, already holding 2M $SOL (~$448M), unveiled plans for a $100M stock buyback.

In August, the firm pivoted from medical devices to crypto with a $400M Solana treasury strategy. pic.twitter.com/cMWcyYAeTr

Sharps Technology Goes All-In on Buyback Strategy

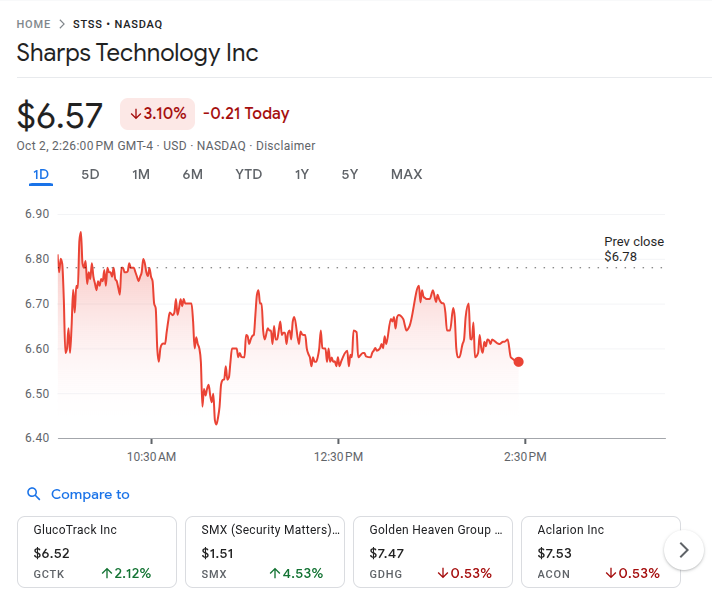

Sharps Technology (ticker: STSS), a medical device company turned digital asset strategist, is doubling down on its market position with a stock buyback plan worth more than half its market cap, which currently sits at around $180 million.

The company’s stock has had a bumpy ride. After a surge to $16 in August, shares have dropped to the $6.52 to $6.78 range, reflecting nearly a 99% decline year-to-date. With this new repurchase plan, Sharps aims to restore investor confidence and signal belief in its intrinsic value.

According to its statement, the repurchase will happen “in the open market and in negotiated transactions” depending on market conditions and other factors. No specific timeline has been provided.

Massive Investment Fuels Solana Push

This buyback announcement follows Sharps’ ambitious foray into the Solana blockchain ecosystem, where it has accumulated over 2.14 million SOL tokens valued around $448 million. That makes it the second-largest Solana treasury company, just behind Forward Technologies which holds more than 6.8 million SOL.

To support this strategy, Sharps executed a $400 million PIPE deal (Private Investment in Public Equity), with participants like Pantera Capital and ParaFi Capital. On top of that, it entered into a Controlled Equity Offering with Cantor Fitzgerald & Co. and Aegis Capital Corp., allowing sales of up to $236.6 million in common stock.

The firm also partnered with Crypto.com to manage its digital asset holdings using institutional-grade custody and OTC services.

Crypto Holdings Off-Limits for Buyback

Importantly, Sharps clarified that the buyback will not tap into its crypto treasury. The SOL holdings will be preserved, as part of a long-term staking and value-generation plan. The company believes in a “strong holder ethos”, a common trait among digital asset treasury companies, which aims to avoid panic selling and contagion.

Other DAT firms like DeFi Dev Corp. have taken similar routes, recently expanding their own repurchase programs to $100 million.

Currently, the broader Solana ecosystem is experiencing a revival. The SOL token has bounced back above $225, and the network is showing strength in DeFi usage, stablecoin liquidity, and staking rewards. Treasury companies are seen as a gateway for traditional investors to tap into these decentralized returns.

Pharma Roots Remain Intact

While diving deep into crypto, Sharps hasn’t abandoned its original identity. It continues to operate its pharmaceutical product business, which reached the revenue stage in August. This hybrid approach of maintaining core operations while venturing into Web3 finance sets Sharps apart from other DAT firms.

SQ Magazine Takeaway

I love a bold move, and Sharps Technology is making one. A $100 million buyback from a company valued at less than double that sends a huge message. They’re not just betting on Solana, they’re betting on themselves. The fact that they’re not selling any crypto to fund the buyback? That’s confidence. While stock volatility and the crypto market come with risk, Sharps is playing the long game. And in a space where so many just chase short-term hype, that’s worth watching.