The digital dollar USD Coin (USDC) now stands as one of the most prominent stablecoins by market size and adoption. USDC supports trading, payments, and institutional liquidity flows, and its performance offers a revealing snapshot of how stablecoins are shaping modern finance. In real‑world finance, firms use USDC for cross-border transfers and fast settlements. In decentralized finance (DeFi), USDC supplies liquidity for lending, borrowing, and yield generation. This article explores up‑to-date statistics on USDC’s market cap, supply trends, and recent developments to help readers understand its significance today.

Editor’s Choice

- ≈ $76.0 billion, the approximate current market capitalization of USDC.

- ≈ 76.0 billion tokens, approximate circulating supply of USDC as of late 2025.

- Peg maintained near $1.00, USDC continues to trade close to its target value of one U.S. dollar.

- Fully reserved backing, USDC remains backed 100% by liquid cash or cash-equivalent assets.

- Resilient through macro shock, despite prior stress events in the banking system, USDC’s reserve‑backing model and transparency helped it maintain stability.

- Strong backing in money‑market instruments, USDC reserves include short-term U.S. Treasury securities, repos, and cash equivalents, contributing to overall liquidity and safety.

Recent Developments

- The number of active stablecoins nearly doubled from 136 at the start of 2024 to 259 by June 2025.

- USDC’s market capitalization reached approximately $76 billion by late 2025.

- Over 500 million USDC transactions were recorded on Ethereum alone in 2025.

- Circle reported $658 million in reserve income for USDC in Q2 2025, a 53% year-over-year increase.

- USDC maintains 100% backing with cash and U.S. Treasury equivalents, confirmed by monthly independent audits.

- The total stablecoin market cap exceeded $230 billion in mid-2025, with USDC among the top stablecoins by capitalization.

- Monthly stablecoin trading volumes are averaging around $1.48 trillion, up 27% year-over-year.

- USDC active wallets have surpassed 5.2 million, with strong activity in North America and Asia.

- Circle has published monthly reserve attestation reports for 41 consecutive months, increasing trust and transparency.

- USDC’s share of the stablecoin market was about 24.3% in early 2025, showing a 3% growth year-over-year.

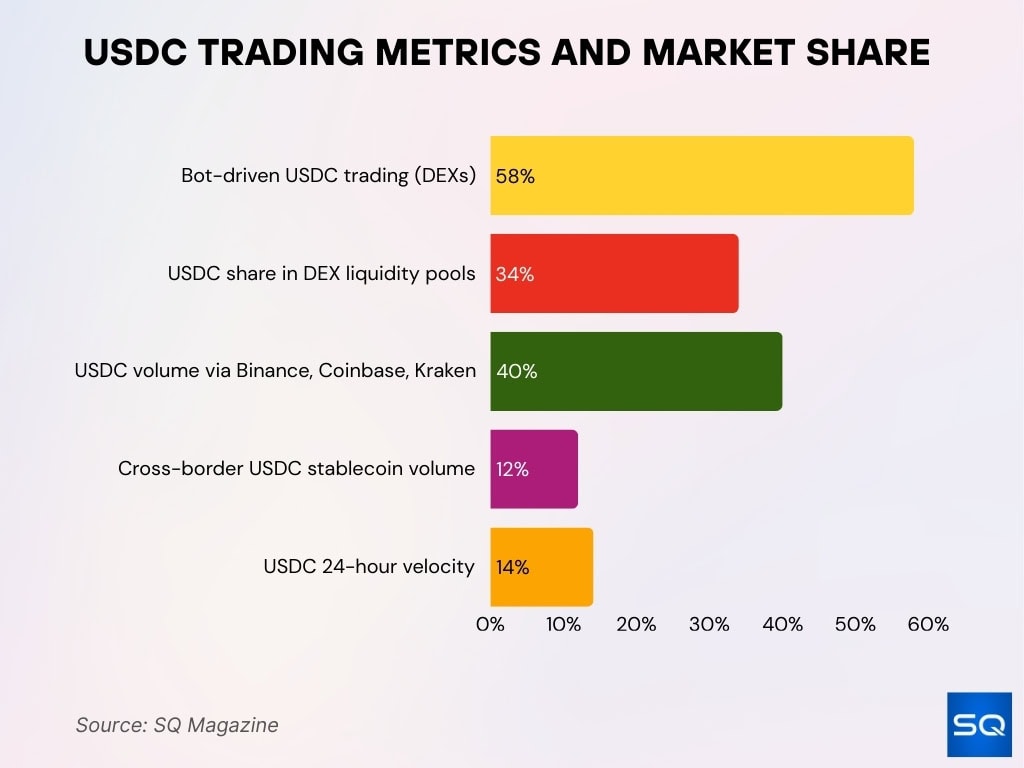

USD Coin Trading Volume Statistics

- 58% of USDC trading is algorithmic or bot-driven, especially on DEXs like Uniswap and Curve.

- 34%+ of DEX liquidity pools across top chains include USDC, making it the leading stablecoin pair.

- 40%+ of centralized USDC trading volume is handled by Binance, Coinbase, and Kraken in 2025.

- 12% of all stablecoin volume in 2025 comes from cross-border USDC swaps, showing strong global usage.

- 14.1% is USDC’s 24-hour velocity, meaning a high portion of its circulating supply moves daily.

USDC Market Capitalization

- USDC market cap stands at $76.02 billion as of November 28, 2025.

- Current 24-hour trading volume for USDC reaches $10.5 billion.

- USDC holds the #7 rank among all cryptocurrencies by market capitalization.

- Fully diluted valuation (FDV) matches market cap at $76.05 billion with full circulation.

- USDC’s market cap reflects a 37.7% increase from $53.3 billion in January to $73.4 billion by September 2025.

- Recent data shows the USDC market cap at $76.05 billion with 76.04 billion tokens in circulating supply.

- 24-hour volume spiked to $12.4 billion on November 17, 2025.

- USDC’s market cap dipped 2.71% to $73.5 billion in late November amid a stablecoin market decline.

- USDC accounts for about 25% of the total stablecoin market cap in late 2025.

Circulating Supply Trends

- The current USDC circulating supply is approximately 76.0 billion tokens.

- Multiple data sources consistently report the USDC supply near 76 billion tokens.

- USDC supply grew from single-digit billions in 2020 to tens of billions by 2025.

- Increased supply aligns with growing demand from exchanges and institutional users.

- No fixed maximum supply exists; total supply adjusts dynamically to demand changes.

- USDC supply is fully redeemable 1:1 for USD, reflecting dollar-pegged liquidity demand.

- Circulating supply growth underscores USDC’s key role in fiat on/off ramps and DeFi usage.

- Rising circulating supply signals stablecoins’ normalization in portfolios and payment systems.

- USDC’s supply growth rate accelerated by over 150% from 2023 to 2025.

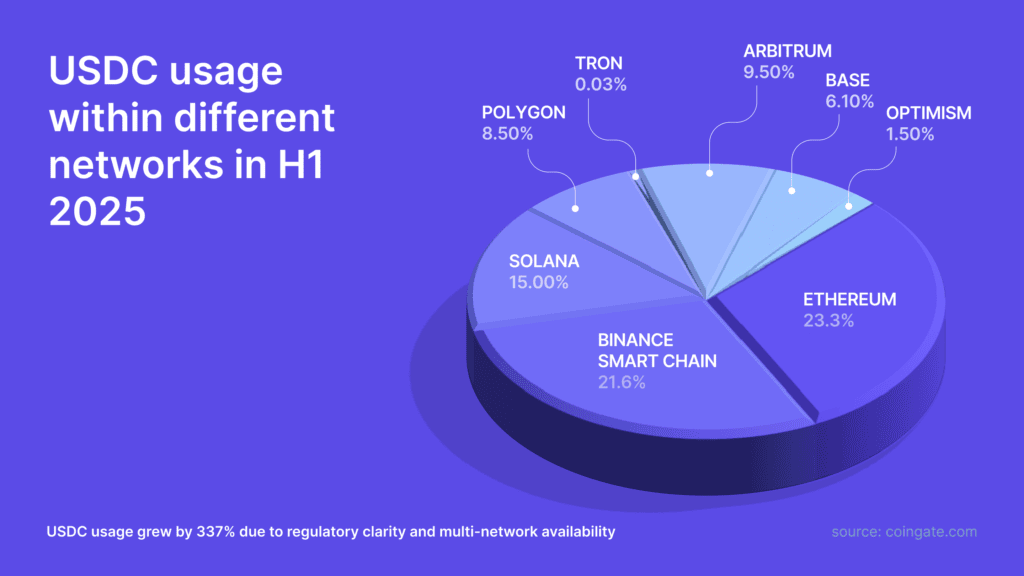

USDC Network Usage Highlights

- 23.3% of total USDC usage occurs on Ethereum.

- 21.6% of USDC activity takes place on Binance Smart Chain.

- 15.0% of usage share is captured by Solana.

- 9.5% of USDC transactions are hosted on Arbitrum.

- 8.5% of total usage comes from Polygon.

- 6.1% of the USDC network share now runs on Base.

- 1.5% of overall activity is supported by Optimism.

- 0.03% of USDC adoption is seen on Tron.

Price Stability Performance

- Throughout 2025, USD Coin (USDC) has largely maintained its dollar peg, with the 2025 first‑quarter data reporting a trading range between $0.9994 and $1.0006.

- Over the same period, the average annual deviation from the $1.00 peg was just ≈ 0.05%, placing USDC among the most stable major stablecoins.

- In March 2025, amid heightened market volatility, USDC briefly dipped to $0.9987, but it recovered within roughly 11 minutes, underscoring resilience under stress.

- Daily historical data from late 2025 shows USDC price consistently hovering around $1.0000, with minor daily fluctuations within a few basis points.

- Over the past 12 months, USDC’s 52‑week trading range stayed narrow (roughly $0.9936 to $1.0028), indicating low volatility compared with typical cryptocurrencies.

- On major exchanges, USDC’s 24‑hour price variation seldom exceeds ±0.02%, reflecting strong liquidity and market confidence.

- Industry analysts note that, despite macroeconomic headwinds in 2025, USDC’s peg stability remains a key competitive advantage over algorithmic or crypto-collateralized stablecoins.

USDC Cash Reserves Breakdown

- USDC reserves total $76.1 billion as of November 20, 2025, fully backing the circulating supply.

- 87% of USDC reserves held in Circle Reserve Fund as of September 30, 2025.

- 93% of reserves consist of cash, overnight repos, and U.S. Treasuries per recent composition data.

- 43.3% of reserves allocated to U.S. Treasury Repurchase Agreements for liquidity.

- 29.3% invested in U.S. Treasury Securities, adding stability to the portfolio.

- 12.8% maintained as cash at regulated financial institutions for immediate redemptions.

- Circle reported $658 million reserve income in Q2 2025, up 53% year-over-year.

- Q3 2025 reserve income reached $711 million, a 60% increase from the prior year.

- Monthly third‑party attestations confirm USDC reserves are maintained at 100% or slightly above outstanding tokens.

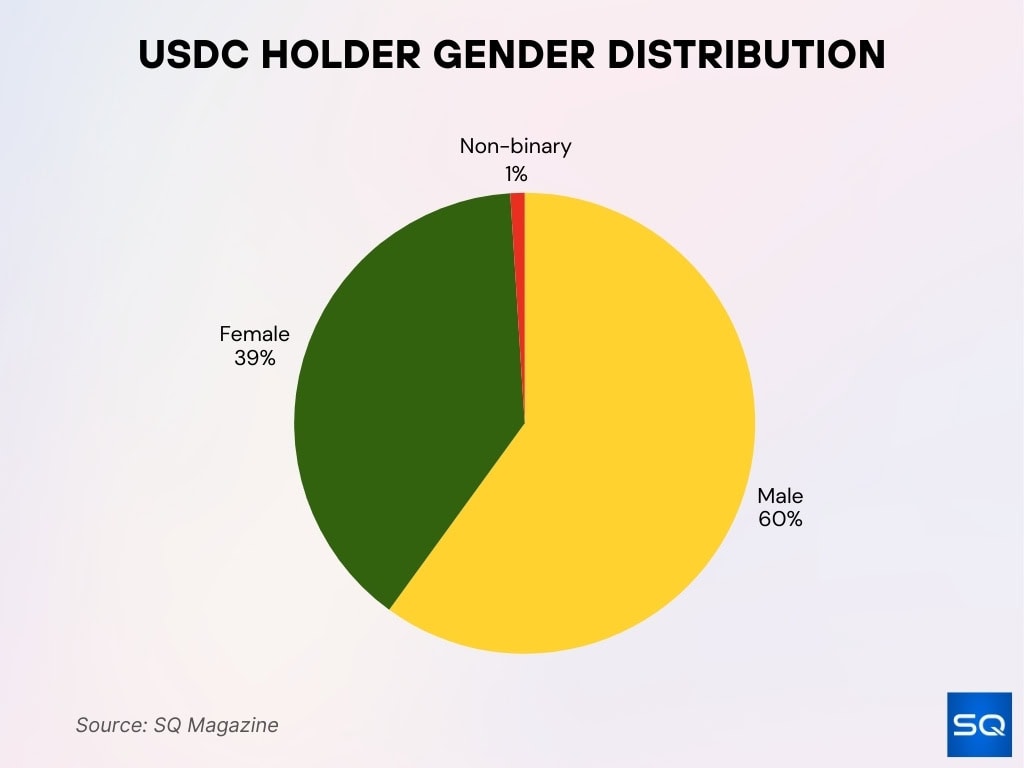

User Demographics and Growth Metrics

- 60% of USDC holders are male, 39% female, and 1% non-binary.

- 87 million unique USDC wallet addresses existed globally as of Q1 2025.

- 38% year-over-year growth in active USDC addresses occurred in 2024.

- $1,920 is the average balance per USDC wallet, higher in B2B and institutional segments.

- 48% of USDC holders fall between the ages of 25 and 39.

- 72% of retail users use USDC weekly or more often.

- 43% growth in USDC adoption among freelancers and gig workers was recorded in 2024.

- 36% of crypto-active Americans hold USDC, with the highest concentration in California, Texas, and Florida.

USDC Burn and Mint Trends

- As of March 26, 2025, the issuer reported over $60 billion in USDC in circulation, indicating continuing new issuance (minting) to meet demand.

- Comparison of reserve attestations in February 2025 shows reserve assets of $55.01 billion backing a circulating supply of approximately 54.95 billion, suggesting minimal excess issuance beyond backing.

- By September 2025, the increase in deposits from stablecoin holders had grown by $29.5 billion compared to December 2024, a 67.6% increase.

- In the same period, the issuer increased convertible debt drastically, up 266.2%, potentially reflecting broader corporate financing adjustments related to backing operations.

- Stablecoins overall processed over $8.9 trillion in on‑chain volume in H1 2025, and USDC’s supply growth supported increased transactional demand.

Wallets and Exchanges Supporting USDC

- Over 280 crypto exchanges support USDC trading as of March 2025.

- 87 million unique wallet addresses hold USDC globally in Q1 2025.

- 2.43 million daily active USDC addresses reported in late 2025.

- Coinbase, Binance, and Kraken account for over 40% of centralized USDC volume.

- 2.1 million new USDC wallets created in February 2025 across major chains.

- USDC is available in 195 countries with banking integrations in 37 nations.

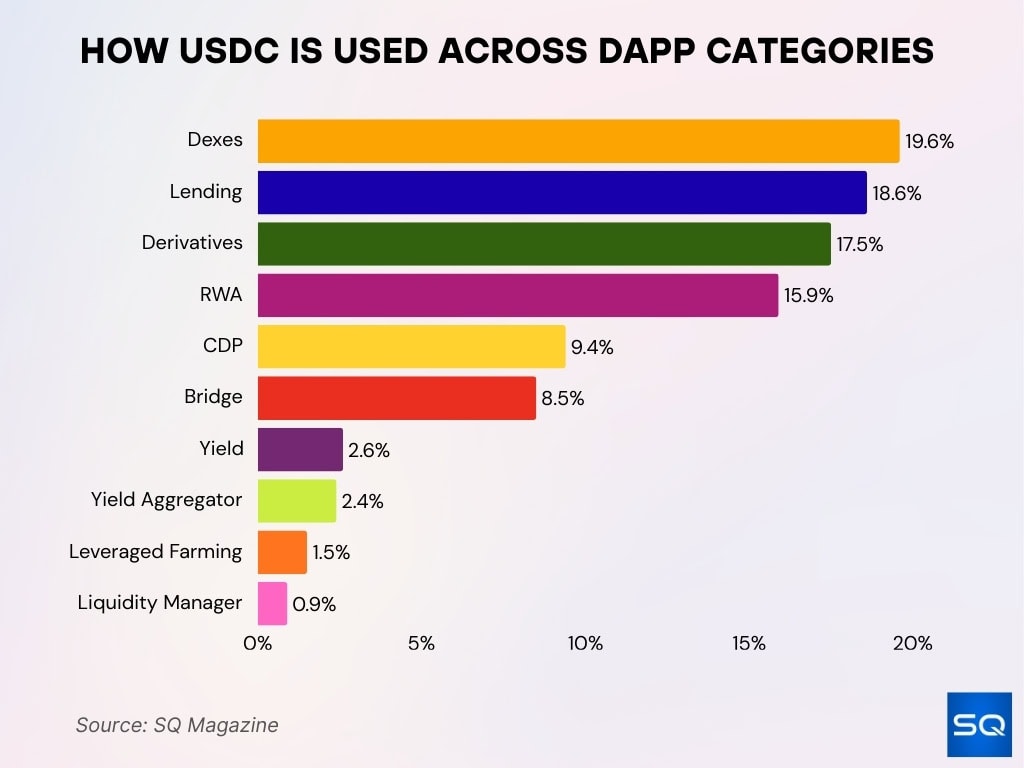

How USDC Is Used Across dApp Categories

- 19.6% of USDC is used on decentralized exchanges (DEXs).

- 18.6% of USDC activity happens on lending platforms.

- 17.5% of usage is tied to derivatives protocols.

- 15.9% of circulating USDC is used in real-world asset (RWA) apps.

- 9.4% is allocated to collateralized debt positions (CDPs).

- 8.5% of USDC is used by bridges for cross-chain transfers.

- 2.6% goes to yield protocols in DeFi.

- 2.4% of usage is driven by yield aggregators.

- 1.5% is used in leveraged farming applications.

- 0.9% of USDC supports liquidity management tools.

Major Use Cases and Adoption

- USDC circulation grew 78% year-over-year, outpacing other major stablecoins in 2025.

- 87 million unique wallet addresses hold USDC globally as of Q1 2025.

- 500 million USDC transactions processed on Ethereum alone in 2025.

- 80% of North American fintech apps offering stablecoin payments support USDC.

- Cross-border aid distributed $140 million in USDC to Ukraine and Gaza (2023-2024).

- 36% of U.S. crypto-active users hold USDC, the highest in California and Texas.

- DeFi lending protocols show $40.99 billion in outstanding USDC-collateralized loans in Q3 2025.

- 72% of retail USDC holders use it weekly for payments and trading.

- 17,000+ nonprofits accept USDC donations via platforms like GivingBlock.

USDC on Leading Blockchains

- As of late 2025, USDC is natively supported on 29 blockchain networks, enabling broad interoperability.

- About 64% of circulating USDC resides on Ethereum.

- BNB Chain accounts for roughly 7.4% of USDC in circulation.

- Ethereum hosted over 36.2 billion USDC tokens, while Solana hosted around 10 billion.

- USDC’s native presence on many networks simplifies on‑ramp/off‑ramp infrastructure.

- This multichain footprint strengthens USDC’s role as a global digital dollar.

Geographic Distribution of Usage

- The United States and India rank as the top two countries for cryptocurrency adoption in 2025.

- Stablecoins account for about 30% of all on-chain crypto transaction volume in 2025.

- South Asia, led by India and Pakistan, saw an 80% surge in crypto adoption through mid-2025.

- US crypto transaction volume surged approximately 50% between January and July 2025.

- Cross-border payments using USDC and other stablecoins contributed to over $8.9 trillion in on-chain volume in H1 2025.

Institutional Adoption and Partnerships

- 84% of firms are already using or are interested in using stablecoins.

- 59% expect to allocate over 5% of AUM to digital assets or stablecoin‑linked products by 2026.

- Corporate treasuries and fintech firms use USDC for global payments and treasury management.

- Regulated stablecoins like USDC are seen as viable alternatives to money‑market funds.

- A 2025 rollout added support from banks like Standard Chartered and Deutsche Bank.

- The total stablecoin market cap climbed to just over $300 billion in early October 2025.

- Future projections suggest potential growth to $500–$750 billion.

Comparison with Other Stablecoins

- Total stablecoin market cap reached around $300–305 billion in late 2025, with USDT and USDC together accounting for roughly 85–90% of that total.

- As of late November 2025, USDT holds about 60% of the stablecoin market while USDC captures roughly 25%.

- USDC circulation grew 78% year-over-year, outpacing other major stablecoins in 2025.

- 84% of Q3 2025 new stablecoin supply came from USDT, USDC, and USDe combined.

- USDT market cap expanded 25% from $140B to $175 billion through Q3 2025.

- Ethereum hosts 55.3% of the total stablecoin supply, with USDC at ~29% of its stablecoin market.

- USDC market cap rose from $53.3 billion in January to $73.4B by September 2025.

- The top five stablecoins (USDT, USDC, DAI, BUSD, TUSD) control 90% of the total stablecoin market cap.

- Combined USDT-USDC market share dipped to 83.6% from 91.6% early 2024 amid competition.

USDC Regulatory Developments

- GENIUS Act was signed into law on July 18, 2025, establishing a federal framework for payment stablecoins like USDC.

- GENIUS Act mandates 1:1 reserves in USD, Treasuries, and low-risk assets for compliant issuers.

- Circle holds 50-state money transmitter licenses plus federal compliance ahead of GENIUS Act requirements.

- USDC issuer Circle raised $1.05 billion in its June 2025 IPO, showcasing regulatory readiness.

- OCC oversees nonbank stablecoin issuers under the GENIUS Act federal licensing regime.

- Stablecoin issuers exceeding $10 billion market cap must transition to federal oversight within 360 days.

Frequently Asked Questions (FAQs)

About $61.7 billion for USDC.

About $7.16 billion in 24‑hour trading volume.

Approximately 99% of stablecoins in circulation are pegged to the U.S. dollar.

USDC is backed by a fully liquid reserve and is redeemable 1:1 for USD, supported by publicly disclosed cash and cash‑equivalent assets.

Conclusion

USDC today stands not just as a stablecoin, but as a foundational component of a maturing digital‑asset ecosystem. Its broad blockchain support, transparent reserve backing, and increasing institutional use place it at the center of the push toward tokenized money and programmable finance. As stablecoin legislation takes shape and as global adoption rises, USDC’s blend of liquidity, compliance, and interoperability gives it strong potential to remain a leading digital dollar. For anyone tracking the evolution of money on‑chain, these statistics offer a compelling view of how USDC may shape the future of payments, settlements, and asset flows.