Tesla’s performance today reflects a pivotal year for the electric vehicle (EV) powerhouse. Amid slowing global EV demand and rising competition, the company still hit production and delivery milestones while navigating profit pressures and shifting market dynamics. Tesla’s influence spans automotive manufacturing and renewable energy storage, altering how consumers and industries approach sustainable transportation and power solutions.

From utility fleets adopting massive battery systems to ride‑hailing pilots in major U.S. cities, Tesla’s footprint affects both consumer behavior and enterprise strategy. Explore the detailed statistics below to understand Tesla’s trajectory.

Editor’s Choice

- 497,099 vehicles delivered in Q3 2025, record quarterly deliveries.

- 447,450 vehicles produced in Q3 2025.

- 12.5 GWh of energy deployed in Q3 2025.

- ~1.61 million projected deliveries for full‑year 2025, below 2024.

- $95.6 billion estimated revenue for 12 months ending September 30, 2025.

- 37% year‑over‑year net income decline in Q3 2025.

- Tesla retains one of the largest Supercharger networks globally with approximately 7,900 stations.

Recent Developments

- Battery cell investments at German Gigafactory hit €950 million for local production ramp.

- Robotaxi service launched in Austin with 60 vehicles initially, expanding to 500 vehicles.

- Austin factory milestone: 500,000 vehicles produced since 2022 opening.

- Profit margins fell to 13.6% automotive gross margin amid tariffs and investments.

- Vandalism incidents surged 45% against Tesla vehicles in major U.S. cities.

- Model Y pricing slashed $5,000 to $39,990 in key U.S. markets.

- Q3 deliveries hit record 497,099 vehicles despite margin pressures.

- Shanghai Megafactory shipped the first Megapack, targeting 40 GWh capacity.

- Regulatory tariffs added $1,200 average cost per vehicle import.

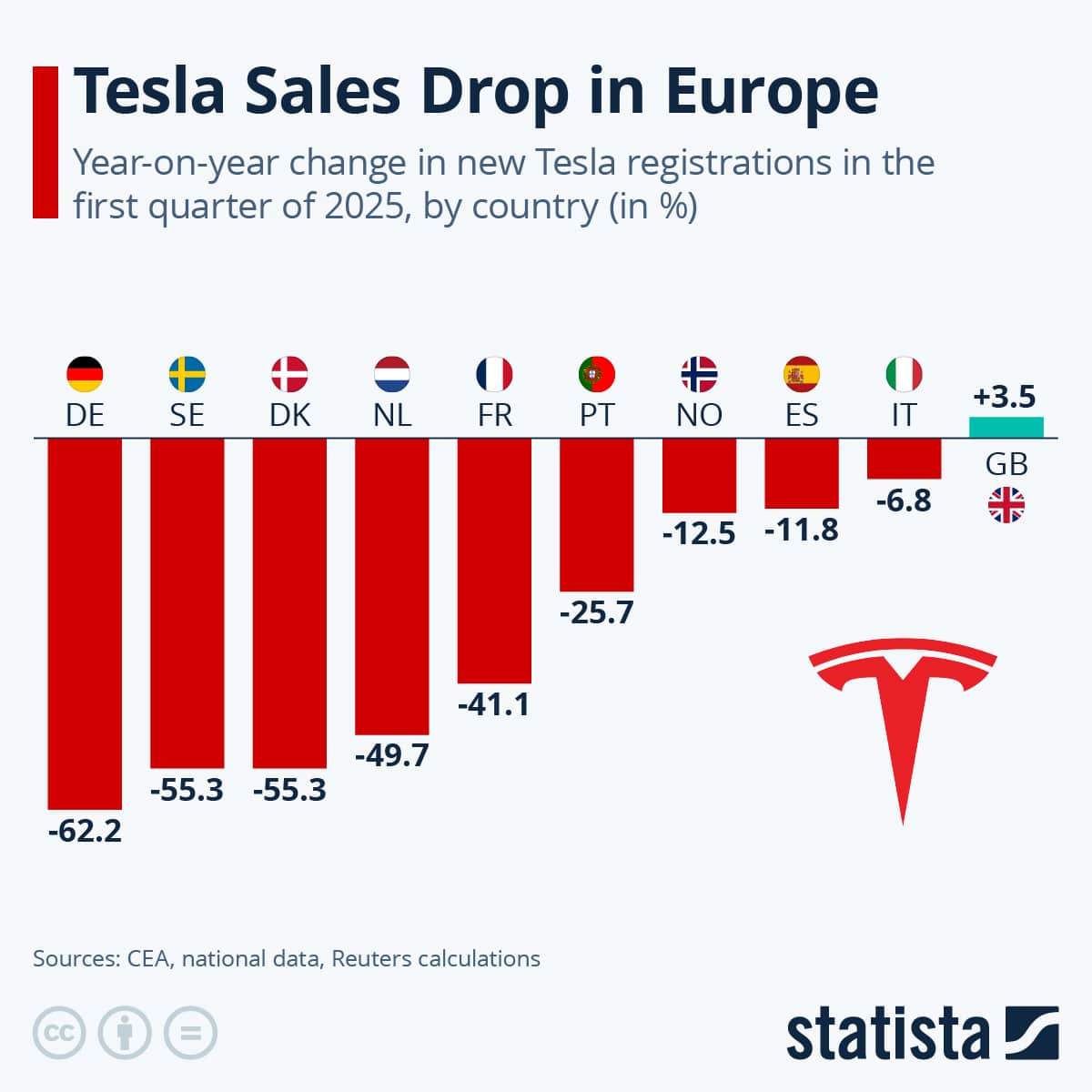

Tesla Sales Performance Across Europe

- Tesla registrations fell sharply across most European markets, highlighting a broad regional slowdown in early 2025.

- Germany recorded the steepest decline at –62.2%, marking Tesla’s largest year-on-year drop among major EU economies.

- Sweden and Denmark both saw registrations plunge by –55.3%, indicating weakened demand in traditionally strong EV markets.

- The Netherlands experienced a –49.7% decline, continuing its downward trend from late 2024.

- France posted a significant –41.1% drop, reflecting intensifying competition and subsidy shifts.

- Portugal’s sales fell by –25.7%, showing moderate but notable contraction compared with northern Europe.

- Norway declined by –12.5%, a relatively smaller drop in one of the world’s most EV-friendly markets.

- Spain and Italy reported milder declines of –11.8% and –6.8%, respectively, suggesting comparatively resilient demand.

- The United Kingdom stood out as the only growth market, with Tesla registrations rising by +3.5% year on year.

- Overall, the data shows widespread pressure on Tesla’s European sales, with only one market delivering positive growth in Q1 2025.

Tesla Overview and Key Facts

- Founded in 2003 by Martin Eberhard and Marc Tarpenning, Elon Musk led early funding starting in 2004.

- Tesla’s corporate mission focuses on accelerating the world’s transition to sustainable energy.

- Headquarters are located in Austin, Texas.

- As of 2025, Tesla operates six major manufacturing facilities across North America, Europe, and Asia.

- The company’s business spans electric vehicles, energy storage, and solar products.

- Tesla reported an estimated $95.6 billion in revenue over the trailing 12 months through September 30, 2025.

- Tesla vehicles and products are sold in 100+ markets globally.

- The company’s Supercharger network includes ~7,900 stations and 75,000+ connectors worldwide.

- CEO Elon Musk remains among the world’s wealthiest individuals, with major holdings tied to Tesla stock.

Vehicle Delivery Statistics

- Tesla delivered 497,099 vehicles in Q3 2025, the highest quarterly delivery figure to date.

- Q3 2025 deliveries were up from 384,122 in Q2 2025.

- Deliveries increased year‑over‑year from 462,890 in Q3 2024.

- Model 3/Y accounted for ~481,166 of the Q3 2025 deliveries.

- “Other models” (S, X, Cybertruck) comprised ~15,933 deliveries in Q3 2025.

- An estimated 1.61 million total deliveries by the end of 2025, about 10% below 2024.

- Deliveries in 2024 totaled ~1.79 million vehicles.

- Quarterly delivery trends show growth momentum in H2 2025 despite broader headwinds.

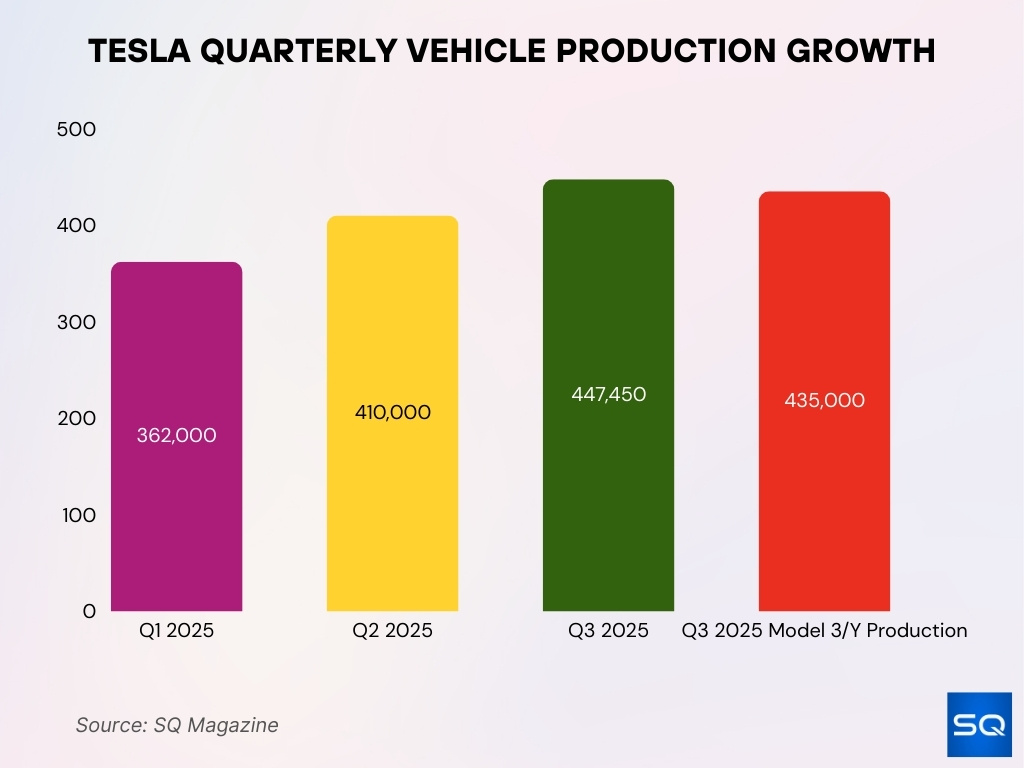

Vehicle Production Statistics

- Produced 447,450 vehicles in Q3 2025, a quarterly production record.

- In Q2 2025, production exceeded 410,000 units.

- Q1 2025 production was reported at approximately 362,000 units.

- Tesla’s production improved sequentially from Q1 to Q3 2025.

- Model 3/Y platforms accounted for ~435,000 of Q3 2025 production.

- Production capacity expansions continue at Gigafactories in Texas, Berlin, and Shanghai.

- Tesla’s manufacturing efficiency remains tied to vertical integration and in-house battery production.

- Despite competitive pressures, overall production outpaced deliveries in Q3 2025.

Revenue and Profit Statistics

- Tesla reported approximately $28.1 billion in revenue for Q3 2025, up approximately 12% year‑over‑year.

- Estimated $95.6 billion in trailing 12-month revenue through September 30, 2025.

- Full‑year 2024 revenue was roughly $97.7 billion.

- Q3 2025 GAAP net income was ~$1.4 billion, a 37% decline year‑over‑year.

- Operating income dipped roughly 40% compared with Q3 2024.

- Profit margins were pressured by declining regulatory credits and tariff costs.

- Energy storage deployment contributed materially to overall revenue growth.

- Profit volatility has been a focus for investors amid pricing adjustments and market shifts.

Market Capitalization and Valuation

- As of late 2025, Tesla’s market capitalization is approximately $1.60 trillion, making it one of the most valuable automakers globally.

- Tesla’s share price has reached highs not seen in nearly a year, trading above $480 per share amid optimism around autonomy testing.

- Analyst projections vary, with some forecasts suggesting Tesla’s valuation could reach $2 trillion by 2026.

- More bullish forecasts from some analysts see potential for a $3 trillion valuation, driven by advancements in FSD and robotaxi operations.

- In early 2025, Tesla’s market cap dipped below $1 trillion following weak European sales.

- Investors increasingly view Tesla’s future value as tied to autonomous technology and robotics rather than traditional vehicle sales alone.

- Despite fluctuations, Tesla’s valuation remains among the top tier of global automakers.

- Market sentiment often shifts with regulatory news around self‑driving features and broader economic conditions.

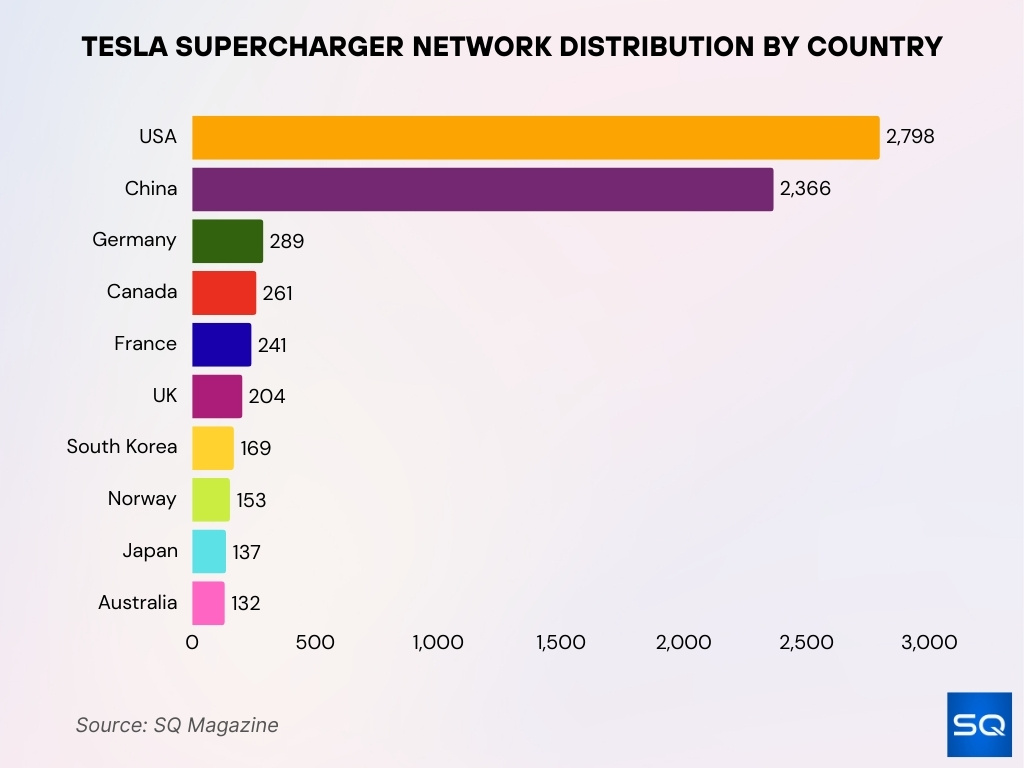

Tesla Supercharger Network Distribution by Country

- The United States hosts the largest Tesla Supercharger network, with 2,798 stations, reinforcing its role as Tesla’s primary infrastructure market.

- China ranks second with 2,366 Superchargers, reflecting Tesla’s aggressive expansion in the world’s largest EV market.

- Germany leads Europe, operating 289 Superchargers, making it Tesla’s most developed charging network on the continent.

- Canada follows closely with 261 stations, supporting long-distance EV travel across a geographically large market.

- France maintains 241 Superchargers, strengthening coverage in Western Europe’s core EV corridors.

- The United Kingdom operates 204 stations, enabling nationwide fast-charging access despite its smaller land area.

- South Korea has built out 169 Superchargers, highlighting Tesla’s growing footprint in advanced Asian EV markets.

- Norway, a global EV adoption leader, runs 153 stations, providing dense coverage relative to population size.

- Japan’s network totals 137 Superchargers, supporting urban-focused EV usage.

- Australia rounds out the list with 132 stations, underscoring the challenge of scaling fast-charging across vast distances.

Sales by Model (Model 3, Y, S, X, Cybertruck, Semi)

- The Model 3 and Model Y continue to dominate Tesla’s global deliveries, accounting for the majority of units sold in 2025.

- In early 2025, the Model 3 had significant U.S. sales, with nearly 190,000 units sold in 2024.

- Tesla’s Model Y became one of the top‑selling EVs in China, ranking among the most sold early in 2025.

- The Cybertruck saw cumulative sales of around 38,965 units by late 2024, although its 2025 performance has faced challenges.

- Earlier in 2025, Cybertruck sales reportedly declined significantly compared to previous quarters.

- Tesla’s luxury models, Model S and Model X, contribute a smaller portion of total sales but maintain premium demand.

- Commercial trucks like the Tesla Semi remain in pre‑volume production with limited deliveries as of 2025.

- Tesla continues to adjust pricing and incentives to sustain demand across different segments.

Pricing and Average Selling Price Trends

- Tesla Model Y Standard priced at $39,990, down from $44,990, to boost late-year sales.

- Tesla reduced Model Y prices by $5,000 in December amid falling US deliveries to 39,800 units.

- Average selling price dropped to $39,818 in Q4 2024, the largest sequential decline since Q1 2023.

- Vehicle revenue fell 12% YoY to $22.49 billion in Q2 due to price cuts and lower deliveries.

- Cybertruck top-tier Cyberbeast raised to $114,990, up $15,000 despite soft demand.

- Used Model 3 averages $23,800, down over 6% YoY; Model Y at $30,600, down 7.5%.

- Model 3 standard cut to $36,990, approximately $5,600 below the prior premium entry level.

- Cybertruck lease slashed 16% to $679/month effective, undercutting rivals like Silverado EV.

- Automotive gross margins hit a low of 13.59% in Q4 2024 from ASP declines and discounts.

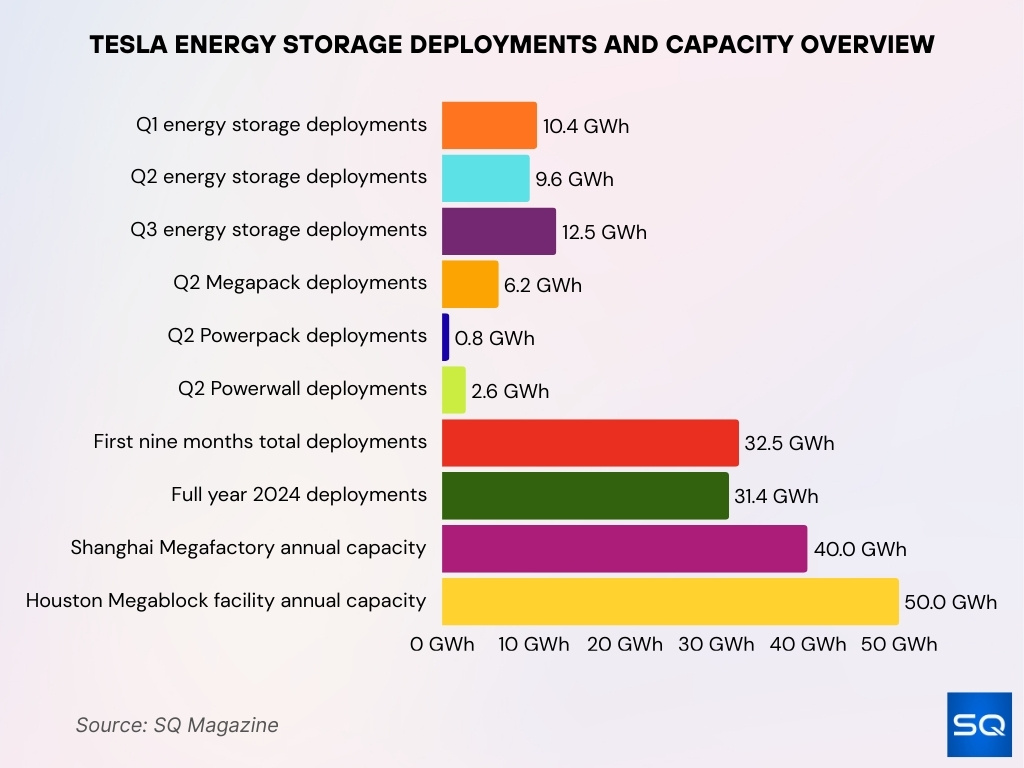

Energy Generation and Storage Statistics

- Energy storage deployments hit record 12.5 GWh in Q3.

- Q2 deployments reached 9.6 GWh, with Megapack at 6.2 GWh and Powerwall at 2.6 GWh.

- Q1 added 10.4 GWh of new installations, surging 156.6% over the prior-year quarter.

- First nine months totaled 32.5 GWh, exceeding the full-year 2024 figure of 31.4 GWh.

- Energy segment revenue grew 31% to $13.2 billion, the most profitable division.

- Q2 deployments broke down to 6.2 GWh Megapack, 0.8 GWh Powerpack, 2.6 GWh Powerwall.

- Shanghai Megafactory targets 40 GWh annual capacity, first Megapack shipped in March.

- Energy storage gross margins hit 25.2% in the recent quarter, topping automotive 16.6%.

- The Houston Megablock facility is scheduled to begin operations in 2026 with a planned output capacity of up to 50 GWh annually.

Autopilot and Full Self-Driving Usage Statistics

- Tesla owners drove 14.13 million miles per day using FSD (Supervised) in Q3, an all-time high.

- Cumulative FSD miles reached 6 billion by late October, up from 5.75 billion end of September.

- Q2 Autopilot recorded one crash per 6.69 million miles driven with technology engaged.

- Q1 Autopilot achieved one crash per 7.44 million miles, surpassing non-Autopilot 1.51 million.

- Model S/X FSD take rate hit 50-60%, fleet-wide adoption rose to 13-19%.

- Robotaxi fleet expanded to 1,655 vehicles in the Bay Area for supervised operations.

- FSD daily miles estimated at 12-13 million in October amid V14 rollout.

- Model 3/Y FSD adoption estimated 12-18%, driving data flywheel growth.

- Austin Robotaxi fleet targeted 500 vehicles but scaled to 60 with monitors.

Robotaxi and Autonomy Program Metrics

- Tesla has registered 1,655 vehicles for its Robotaxi program in California by late 2025.

- Registered drivers for the Robotaxi fleet number 798 as of late 2025.

- The Robotaxi service expanded rapidly from only 28 vehicles in August 2025.

- CEO Musk confirmed driverless Robotaxi testing without safety monitors, boosting investor confidence.

- Tesla’s competitive landscape includes Waymo’s 2,500+ autonomous vehicles operational in U.S. cities.

- Robotaxi rollout in Austin began mid‑2025 and expanded throughout the year.

- Regulatory approval for Robotaxi testing in Arizona and Nevada was received in late 2025.

- Tesla’s autonomy program remains in early commercial stages with further scaling planned for 2026.

Manufacturing Plants and Capacity

- Tesla operates 7 major factories globally, spanning North America, Europe, and Asia.

- Fremont Factory (California) remains one of Tesla’s largest plants, producing multiple models, including Model 3 and Model Y.

- Gigafactory Texas (Austin) produces Model Y and Cybertruck, and has hit a milestone of 500,000 vehicles built since opening.

- Gigafactory Shanghai reportedly has capacity for 750,000+ vehicles per year, making it a key export hub.

- Gigafactory Berlin in Germany supports Model Y production and local supply chains in Europe.

- Gigafactory Nevada focuses on battery packs, Powerwall, and semi-assembly, supporting U.S. energy and vehicle needs.

- Tesla has smaller facilities in New York (solar products) and other regions supporting service and production.

- Tesla’s planned Gigafactory Mexico aims for up to 1 million vehicles annually, though timing shifted toward 2026‑2027.

- Recent investments include expanding battery cell production in Germany to reach up to 8 GWh/year capacity.

Workforce and Employee Statistics

- Tesla employed tens of thousands globally across factories and facilities as of 2025.

- The Shanghai gigafactory workforce was approximately 20,000 employees in recent reports.

- Gigafactory Texas also lists about 20,000 staff historically.

- Tesla’s manufacturing development programs plan to onboard 1,000+ graduates in 2025.

- The company has recruited factory workers and operators to support its Robotaxi ride‑hailing operations in California and nationwide.

- Workforce levels have fluctuated with broader EV market dynamics and production shifts.

- Tesla’s total employment remains sizable compared to other EV makers, reflecting its manufacturing spread.

- Hiring focuses on production, engineering, AI operators, and service roles tied to new business units like autonomy.

Research and Development Spending

- Q3 R&D expenses hit a record $1.63 billion, up from $1.59 billion in Q2.

- Q4 R&D surged 16% YoY to $1.3 billion, focused on FSD and AI expansion.

- TTM R&D through March reached €4.46 billion ($4.8 billion), quarterly €1.3 billion.

- Full-year R&D projected over $6.5 billion, emphasizing autonomy and robotics.

- R&D intensity at 17.7% of revenue, triple traditional carmakers’ average.

- Q1 R&D allocated $1.22 billion amid Dojo supercomputer and battery advancements.

- Annual spend topped $4.5 billion in 2024, with 14% growth in autonomy tech.

- Engineering costs drove a 29% R&D increase from $3.97 billion prior year.

- R&D to operating expense ratio hit 43.8%, with 18% stock-based compensation.

Environmental Impact and Emissions Statistics

- Customers avoided 36.2 million metric tons of CO₂e emissions through EV driving.

- Global manufacturing used 85% renewable energy sources across all facilities.

- Battery recycling processed 50,000 tons, up 34% from the prior year’s throughput.

- Gigafactory Berlin achieved net water-neutral status with 100% wastewater reuse.

- Solar deployments offset 2.8 million metric tons CO₂e via Powerwall and Megapack.

- Lifecycle emissions for Model 3 averaged 45% lower than average ICE vehicles.

- Energy storage avoided 15.4 million metric tons of CO₂e through grid stabilization.

- Manufacturing embodied emissions dropped 12% via efficient production processes.

- 92% of Nevada Gigafactory’s energy from on-site solar and renewables.

Frequently Asked Questions (FAQs)

Tesla produced over 447,000 vehicles and delivered over 497,000 vehicles in Q3 2025, both reaching record quarterly levels.

Tesla deployed 9.6 GWh of energy storage in Q2 2025 and 12.5 GWh in Q3 2025.

Tesla’s stock was trading around $439–$440 per share toward the end of 2025.

Tesla has registered 1,655 vehicles and 798 drivers for its Robotaxi program in California as of late 2025.

Conclusion

Tesla’s performance reflects a company at the intersection of automotive production, energy innovation, and advanced autonomy. The firm achieved notable milestones in manufacturing output and battery capacity while navigating profitability pressures. Workforce expansion, R&D investment, and sustainability efforts underscore Tesla’s broad operational scope.

Emerging developments like Robotaxi deployment and renewable manufacturing strengthen Tesla’s long‑term potential despite market volatility. As Tesla evolves, its global influence on EV adoption, energy systems, and autonomous services remains significant, and the data shows a firm steadily shaping tomorrow’s mobility landscape.