Ripple is gearing up for a major crypto market play, combining a billion-dollar XRP buy with a high-stakes acquisition to build the largest XRP-focused treasury yet.

Quick Summary – TLDR:

- Ripple is raising $1 billion to buy XRP and create a new digital asset treasury (DAT).

- The fundraising will be done via a SPAC, with Ripple also contributing its own XRP.

- This move follows Ripple’s $1 billion acquisition of GTreasury to expand its treasury solutions.

- Experts predict the plan could trigger long-term price growth and new investor confidence in XRP.

What Happened?

Ripple Labs is reportedly leading an ambitious effort to raise $1 billion to buy its own XRP tokens. The funds will be used to establish a dedicated XRP treasury, a digital asset pool designed to boost liquidity and build long-term strategic value. This move comes alongside Ripple’s recent $1 billion acquisition of GTreasury, a fintech company specializing in treasury management software, signaling Ripple’s broader push into the corporate finance space.

Ripple Labs is leading an effort to raise at least $1 billion to accumulate XRP, the digital token linked to the company https://t.co/1nKnOW3Mb3

— Bloomberg (@business) October 17, 2025

Ripple’s XRP Treasury Play

According to sources close to the matter, Ripple is structuring the fundraise through a special purpose acquisition company (SPAC) and will also contribute XRP from its own holdings. The company already holds over 4.5 billion XRP directly, with another 37 billion locked in escrow, released monthly under Ripple’s on-ledger program. The $1 billion buy could potentially add another 427 million tokens to Ripple’s reserve.

- Ripple’s market report confirms its sizable XRP stake and escrow strategy.

- The total circulating supply of XRP is over 59 billion.

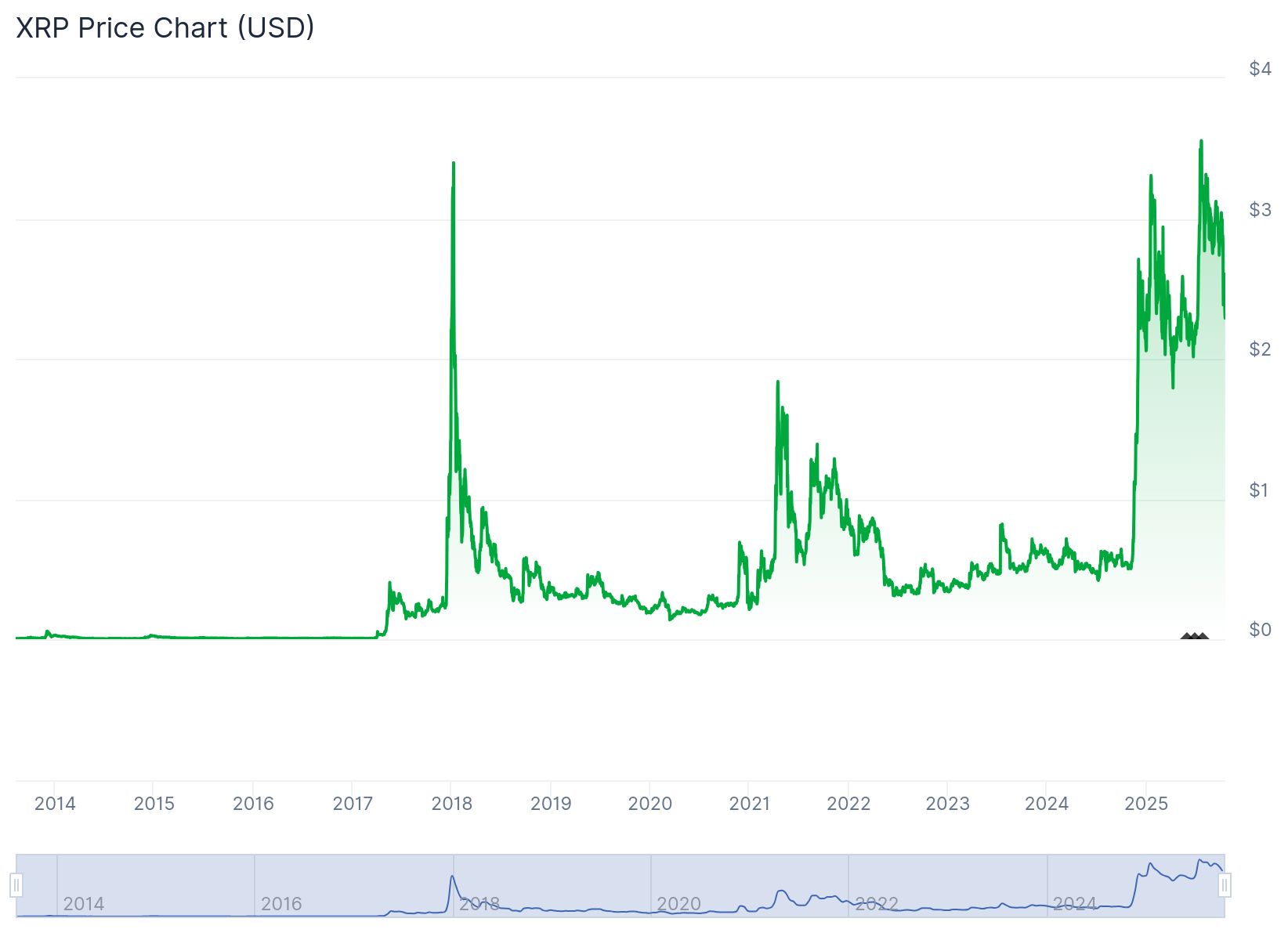

- At the time of the report, XRP was trading around $2.35. For real-time updates on the ripple price, you can check live charts and market trends..

If finalized, this would create the largest digital asset treasury focused solely on XRP, dwarfing other efforts like Trident Digital’s $500 million initiative, Webus’ $300 million plan, and VivoPower’s $100 million allocation.

Acquisition of GTreasury: Strengthening the Infrastructure

Ripple also confirmed the acquisition of GTreasury, a Chicago-based treasury management company. The deal aims to open up Ripple’s access to the multi-trillion dollar corporate treasury market, allowing it to offer digital asset management solutions to some of the world’s largest companies.

- GTreasury specializes in corporate treasury software and real-time global payment systems.

- Ripple aims to tap into the global repo market and cross-border transactions.

- This acquisition aligns with Ripple’s broader strategy to blend crypto with enterprise finance.

What a $10B XRP Treasury Could Mean for Prices?

To understand the market implications, a speculative analysis by Google Gemini looked at what would happen if Ripple expanded the treasury to $10 billion. At that scale, Ripple’s purchase would represent 7.1% of XRP’s entire market value, dramatically impacting liquidity and potentially driving the price up due to scarcity.

Gemini predicted:

- A sharp rise in XRP price due to reduced supply and increased demand.

- A psychological boost in investor confidence, leading to more institutional interest.

- A projected price range of $45 to $75 per token, assuming a $10B treasury strategy.

- A resulting market cap of around $4.5 trillion if prices hit the upper range.

The pace of purchases would also matter. A gradual accumulation could lead to steady price growth, while aggressive buying could trigger volatile price swings.

SQ Magazine Takeaway

I think Ripple is going all-in to cement XRP as a serious contender in the crypto treasury world. A billion-dollar token buy is a loud statement in itself, but combining it with the GTreasury acquisition shows Ripple is playing a long game. They’re not just stockpiling crypto, they’re also building the financial infrastructure to manage and deploy it. If they execute well, this could reshape how large companies treat digital assets, with XRP taking a front-row seat. It’s one of the boldest strategic moves we’ve seen from Ripple in a long time.