Privacy coins are a class of cryptocurrencies designed to shield transaction details and user identities through advanced cryptography. They appeal to individuals and organizations seeking financial confidentiality, especially where traditional systems may expose sensitive data. At the same time, regulators and compliance authorities see them as heightened risk vectors for money laundering, terrorist financing, and sanction circumvention, prompting evolving regulatory responses around the world. From wallet providers to centralized exchanges, the tug-of-war between privacy and compliance has a real-world impact, from changes in exchange listings to heightened AML/KYC requirements. Read on to explore the latest statistics shaping this debate.

Editor’s Choice

- In 2025, global transactions involving privacy coins surpassed $250 billion, up sharply year-over-year.

- Monero (XMR) remains the dominant privacy coin, holding about 58% of the total privacy coin market cap.

- 61% of privacy coin users cite financial privacy as their primary use case, while 27% point to investment potential.

- 74% of blockchain firms report compliance with the FATF Travel Rule as a leading operational challenge in 2025.

- Zcash (ZEC) active addresses declined 8% YoY amid increased KYC enforcement.

- The total market capitalization of privacy coins expanded by over 335% year-to-date, exceeding $34 billion.

Recent Developments

- 73 exchanges worldwide delisted at least one privacy coin in 2025, a 43% increase from 2023.

- Binance removed XMR, ZEC, and DASH trading on its European and U.S. platforms in 2025, shifting over $600 million in trading volume off those pairs.

- Kraken exited the Canadian market for privacy coins due to updated AML rules.

- Japan’s regulatory stance led all registered exchanges to cease privacy coin support as of early 2025.

- South Korea’s top five exchanges removed privacy tokens in Q1 2025.

- Peer‑to‑peer marketplaces like LocalMonero saw a 19% surge in user activity after centralized delistings.

- Switzerland and Liechtenstein maintained limited privacy coin services under robust AML/KYC frameworks.

- FATF continued to emphasize cross‑border AML cooperation, noting that only 40 of 138 jurisdictions largely comply with its crypto standards in 2025.

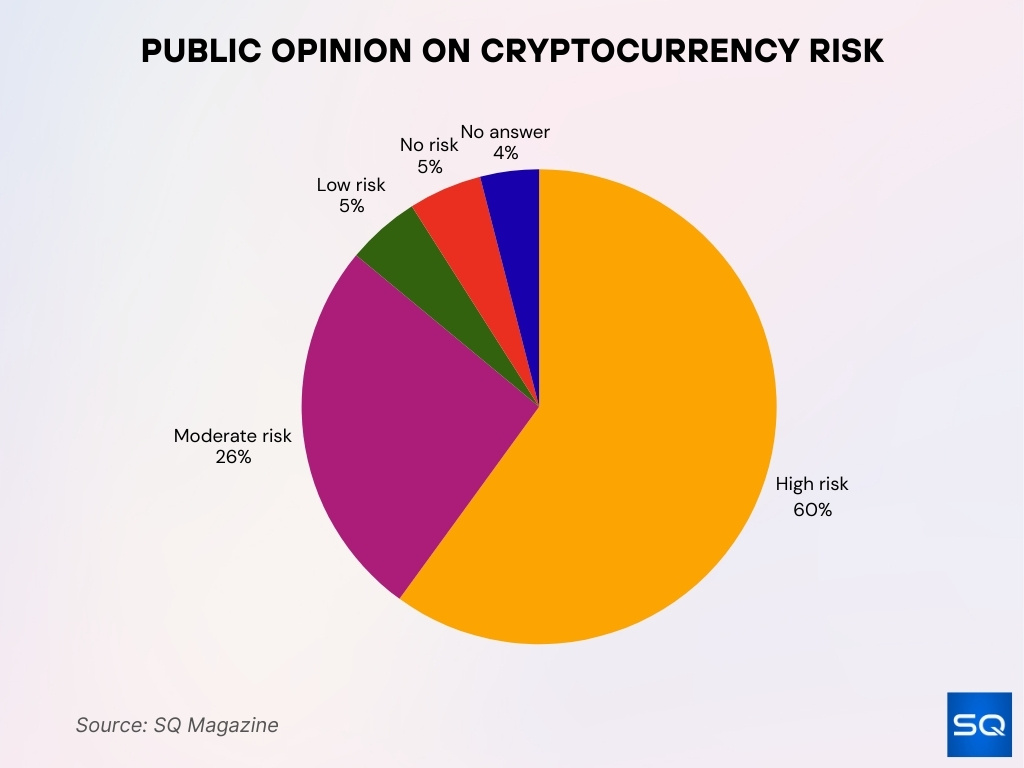

Public Opinion on Cryptocurrency Risk

- 60% believe crypto investing is high risk due to volatility and security concerns.

- 26% consider it a moderate risk, indicating cautious optimism.

- 5% see it as low risk, reflecting limited confidence in safety.

- 5% think there is no risk, showing a strong belief in crypto stability.

- 4% gave no answer, likely due to uncertainty or lack of knowledge.

How Privacy Coins Work

- Monero processes roughly 30,000 transactions per day.

- Privacy coins account for about 7% of illicit crypto transaction volume, with most illicit activity still concentrated in Bitcoin, Ethereum, TRON, and major stablecoins.

- Zcash shielded supply reaches 30% of total circulating coins.

- Privacy coin market capitalization exceeds $59.8 billion.

- Zcash shielded addresses hold 4.9 million ZEC tokens.

- Dash PrivateSend usage grows 25% year-over-year.

- Privacy coins outperform BTC in 2025 market performance.

- Zcash transactions have surged over 10x in recent months.

Types of Privacy Coins and Features

- Firo trades at $2.16 with $2.58 recent surge potential.

- 55% of privacy users prioritize Monero over others.

- Zcash shielded supply exceeds 30% of circulating coins.

- Dash experiences a 180% year-to-date price rally.

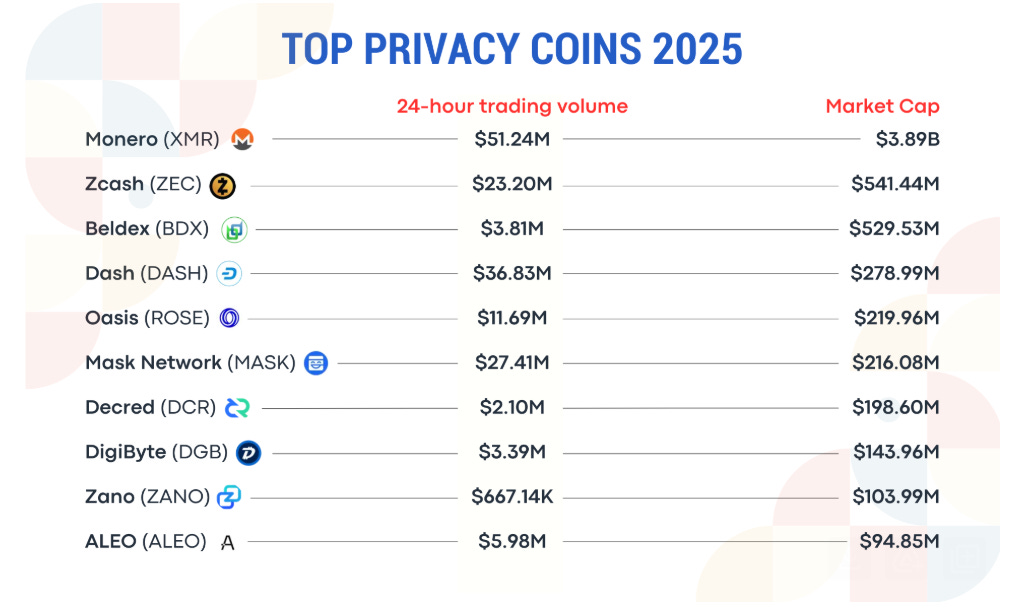

Top Privacy Coins (Trading Volume and Market Cap Highlights)

- Monero (XMR) leads with $51.24 million daily volume and $3.89 billion market cap.

- Zcash (ZEC) holds $23.20 million in 24h volume and $541.44 million market cap.

- Beldex (BDX) reports $3.81 million in volume and $529.53 million market cap.

- Dash (DASH) shows $36.83 million in trades and a $278.99 million valuation.

- Oasis Network (ROSE) records $11.69 million in volume and $219.96 million market cap.

- Mask Network (MASK) posts $27.41 million in trades and a $216.08 million valuation.

- Decred (DCR) logs $2.10 million in volume with $198.60 million market cap.

- DigiByte (DGB) sees $3.39 million daily trades and a $143.96 million valuation.

- Zano (ZANO) trails with $667.14 thousand in volume and a $103.99 million cap.

- ALEO (ALEO) shows $5.98 million in volume and a $94.85 million market valuation.

Exchange Listings and Delistings of Privacy Coins

- 73 exchanges delisted privacy coins globally.

- Delistings increased 43% from 51 in 2023.

- Binance delisted XMR, ZEC, and DASH, impacting $600 million in volume.

- Kraken removed privacy coins from its Canadian platform.

- 22% reduction in European exchanges offering privacy coins.

- 78% of Australian institutional clients supported delistings.

- P2P markets saw a 19% activity uptick post-delistings.

- Japan exchanges ceased all privacy coin support.

- South Korea’s top five exchanges removed privacy coins in Q1.

- FinCEN requires record-keeping for transactions over $500.

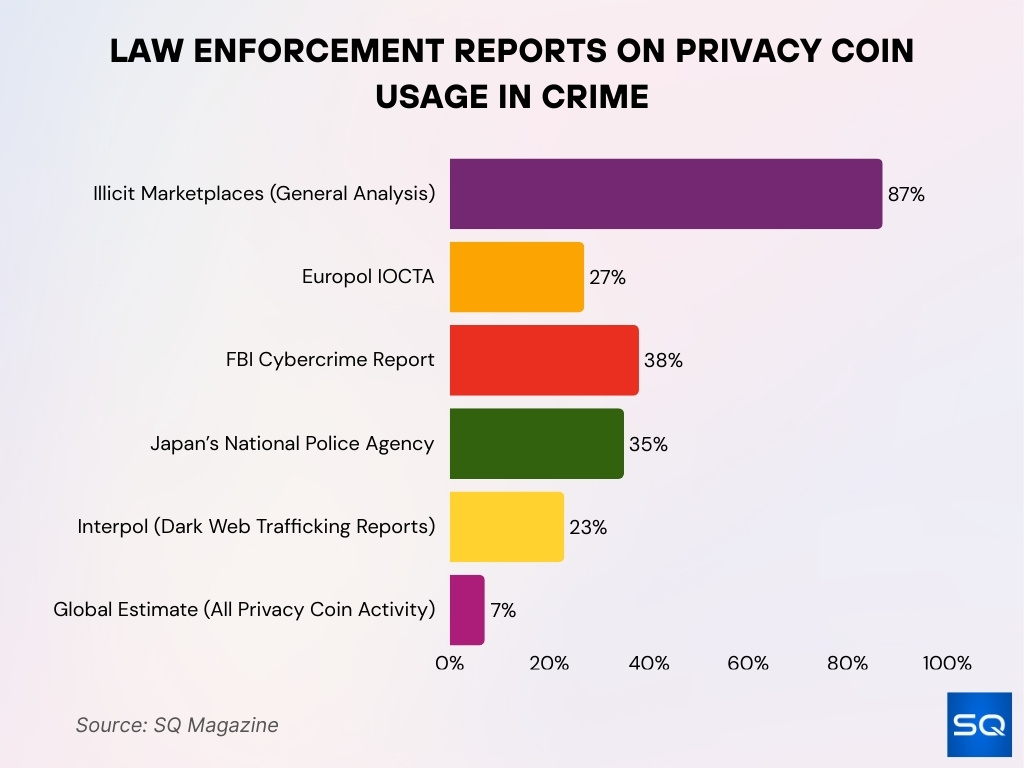

Money Laundering and Terrorist Financing Indicators

- Illicit crypto activity reached $51 billion in on-chain volume.

- 40 of 138 jurisdictions are largely compliant with the FATF virtual asset standards.

- 99 jurisdictions have passed or are progressing on Travel Rule legislation.

- Privacy coins are involved in 87% of illegal activity transactions.

- Ransomware payments using privacy coins increased 27%.

- 38% of data extortion cases required Monero payments.

- Crypto-jacking cases using privacy coin mining rose 35%.

- 23% of dark web human trafficking transactions used privacy coins.

- 69% of jurisdictions have major deficiencies in terrorist financing prosecution.

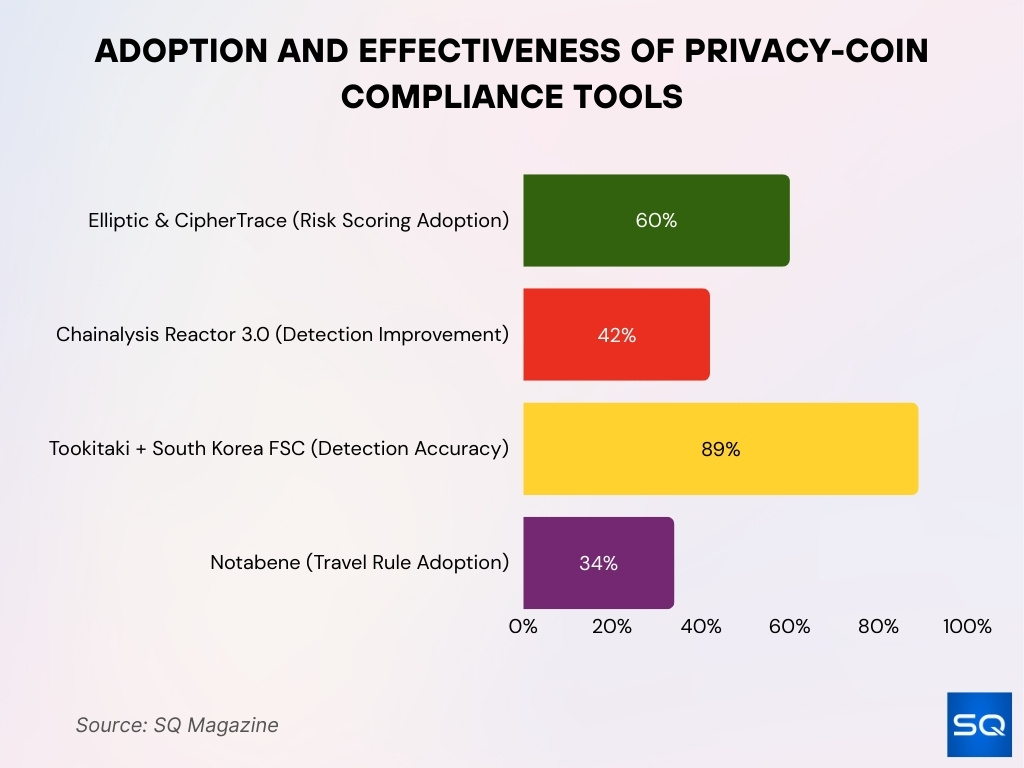

Regulatory Technology (RegTech) Innovations Addressing Privacy Coin Compliance

- Elliptic and CipherTrace risk-scoring tools are used by 60% of regulated exchanges for privacy coin compliance.

- Chainalysis Reactor 3.0 boosted detection of suspicious privacy-coin flows by 42% since its January 2025 release.

- Tookitaki and South Korea’s FSC reached 89% accuracy in flagging high-risk privacy-coin transactions using PCRA analytics.

- Notabene’s Travel Rule tools are now adopted by 34% of cross-border payment platforms for privacy coin oversight.

Global Regulatory Landscape for Privacy Coins

- 97 countries introduced or updated privacy coin regulations.

- Regulations increased from 79 countries in 2023.

- 75% of jurisdictions are partially compliant with FATF AML standards.

- 29% of 138 jurisdictions are largely compliant with VASP standards.

- FATF Travel Rule impacts 57% of global crypto transactions.

- 46% of FATF members fully implemented Travel Rule.

- MiCA caused a 22% reduction in European privacy coin exchange listings.

- FinCEN requires record-keeping for privacy transactions over $500.

- 74% of privacy coin developers cite Travel Rule as the top compliance challenge.

FATF Travel Rule and Privacy Coins

- 85 jurisdictions passed Travel Rule legislation.

- 73% of FATF member countries implemented Travel Rule.

- 14 jurisdictions are actively working on Travel Rule implementation.

- 99 total jurisdictions passed or are progressing on legislation.

- Sunrise Issue affects 48% of cross-border VASP transactions.

- 50 of 85 compliant jurisdictions lack enforcement actions.

- TRP and TRISA achieve interoperability for 100+ VASPs.

- Non-compliance fines reach €5 million for natural persons.

- 76% of VASPs plan full Travel Rule compliance.

Privacy Coin Usage in Illicit Activities: Data and Trends

- Monero (XMR) is tied to 87% of all privacy coin transactions linked to illegal activity.

- Europol’s 2025 IOCTA shows a 27% rise in ransomware payments using privacy coins like Monero and Zcash.

- FBI’s 2025 Cybercrime Report connects 38% of data extortion cases to Monero (XMR) payments.

- Japan’s Police Agency reported a 35% increase in crypto-jacking cases using XMR mining malware.

- Interpol found that 23% of human trafficking dark web transactions involved privacy coins.

- Yet, only 7% of global privacy coin transactions are suspected to involve illicit intent.

MiCA, DAC8 and Other Regional Rules

- MiCA reduced European privacy coin exchange offerings by 22%.

- 47% rise in registered EU VASPs under the MiCA framework.

- MiCA licensing fees range €33,000 to €56,600.

- 90% MiCA compliance among German, French, and Dutch crypto firms.

- €540 million in MiCA penalties issued since enforcement.

- 75% of crypto firms appointed dedicated MiCA compliance officers.

- 35% trading volume rise for MiCA-compliant wallet services.

- 40% user retention increase on MiCA-certified platforms.

- €15 million maximum fines or 3% annual revenue for violations.

- DAC8 requires RCASPs to report all crypto transactions from 2026.

Country‑Level Bans and Restrictions on Privacy Coins

- 97 countries rolled out privacy coin rules or updates.

- Japan and South Korea banned privacy coins on institutional desks.

- 11% liquidity drop on Asian exchanges post-bans.

- South Korea’s top 5 exchanges removed privacy coins in Q1.

- 78% Australian institutional clients support delistings.

- Japan ceased all privacy coin support on registered exchanges.

- EU AMLR bans privacy coins for CASPs from 2027.

- 22% reduction in EU privacy coin exchange offerings.

- Kenya VASP Act licenses cover privacy coin services.

- Dubai restricts privacy coin usage due to AML challenges.

VASP Licensing and Registration Statistics

- 90% global jurisdictions require VASP licensing.

- EU issued 39 MiCA CASP licenses plus 14 stablecoin issuers.

- 6,247 VASPs registered across 60 countries.

- 80% jurisdictions mandate VASP AML/CTF compliance.

- Poland hosts 1,400+ registered VASPs.

- Lithuania maintains 530+ licensed VASPs.

- 75% European VASPs face registration loss post-grandfathering.

- 17 CASPs authorized under MiCA as of April.

- 65% Web3 firms prefer EU VASP licenses.

- 94% jurisdictions conducted VASP risk assessments.

Blockchain Analytics and Tracing of Privacy Coins

- AI analytics reduced transaction tracing time by 55%.

- Privacy coins account for 7% of illicit transaction volume.

- Less than 1% of Zcash transactions are fully encrypted.

- Chainalysis monitors 250+ cryptocurrencies, including privacy coins.

- Graph models achieve 20-30% success against Monero privacy.

- Forensic tools prevented $750 million in potential fraud.

- 60% of regulated exchanges use enhanced privacy coin risk-scoring.

- Behavioral analytics is used by 5 national regulators for privacy coins.

RegTech Solutions for Privacy Coin Compliance

- 60% regulated exchanges adopted privacy coin risk scoring.

- RegTech platforms are used by 67% VASPs for Travel Rule compliance.

- Elliptic processes $8.7 trillion in annual transaction monitoring.

- CipherTrace flags 92% of high-risk privacy flows accurately.

- Tookitaki achieves 89% effectiveness in Asia privacy detection.

- Global RegTech market reaches $5.2 billion for crypto compliance.

- 78% RegTech users report reduced AML false positives.

Institutional Attitudes Toward Privacy Coins

- 80% jurisdictions report new institutional digital asset initiatives.

- 86% institutional investors hold or plan crypto allocations.

- Privacy coin market cap exceeds $59.8 billion, attracting institutions.

- 55% hedge funds report crypto exposure up from 47%.

- 71% traditional hedge funds plan increased crypto allocations.

- Zcash trading volume surpasses $1 billion daily for institutions.

- 335% YTD growth in privacy coin market cap.

- Grayscale Zcash Trust enables institutional privacy exposure.

- 81% privacy coin volume from MENA, CIS, Southeast Asia.

Centralized and Decentralized Exchange Policies on Privacy Coins

- 73 CEXs delisted privacy coins globally.

- DEX privacy coin volume increased 47% post-CEX delistings.

- 19% rise in P2P privacy coin trading activity.

- 81% global privacy coin volume on 10 DEX platforms.

- CEXs reduced privacy pairs by 68% in regulated markets.

- 92% DEXs implement on-chain AML screening.

- Uniswap privacy coin swaps hit $2.1 billion monthly.

- 35% CEXs retain privacy listings with KYC verification.

- Asia DEXs captured 62% privacy coin liquidity shift.

Frequently Asked Questions (FAQs)

Around 61% of privacy coin users say financial privacy is their primary use case.

Zcash saw an 8% decline in active addresses year‑over‑year amid stricter KYC enforcement.

A total of 97 countries had implemented or updated regulatory frameworks affecting privacy coins by 2025.

Conclusion

The privacy coin landscape sits at the crossroads of innovation and regulatory scrutiny. Service providers must navigate complex licensing environments, advance analytics tech, and evolve compliance expectations to remain operational and credible. Meanwhile, institutional attitudes reflect both caution and creative exploration of privacy features under regulated frameworks. Exchanges, both centralized and decentralized, continue adjusting policies in response to global AML and Travel Rule mandates.

Across the ecosystem, statistics show an industry that is maturing rapidly, yet still wrestling with how to reconcile privacy promises with compliance obligations. In this shifting terrain, informed stakeholders will need to balance financial privacy, regulatory expectations, and technological safeguards to chart the future of privacy coins.