Open banking, where banks open up secure access to customer financial data to approved third parties, has shifted from a niche fintech concept to mainstream infrastructure. We see growing global adoption, rising transaction volumes, and expanding regulatory coverage that together push open banking into everyday banking and commerce. For example, businesses now use open banking to simplify payments and cash‑flow management, while consumers rely on it for budgeting tools or faster loan approval. This article explores the latest statistics behind that shift.

Editor’s Choice

- As of 2025, over 40 countries have moved from open banking to broader open finance frameworks.

- In the UK, active open banking users hit 13.3 million in March 2025, a record high.

- For the first time in 2025, 1 in 5 UK consumers and small businesses with online accounts used open banking in the prior month.

- The global user base of open banking services reportedly surpassed 470 million in 2025.

- Open banking payments in the UK reached 29.89 million transactions in July 2025 alone.

Recent Developments

- As of late 2024, 43 countries globally expanded from open banking into open finance, enabling data sharing beyond just bank transactions, e.g., mortgages, pensions, and investments.

- Regulatory activity has accelerated; by 2025, dozens of new open banking or open finance regulations rolled out across major markets in Europe, the UK, Brazil, and Australia.

- In the Asia-Pacific region, a 2025 report highlighted progress across 16 jurisdictions, showing increased regulatory clarity and fintech‑regulator collaboration.

- In the UK, 2025 saw a leap in adoption, from 13.3 M active users in March to 15.16 M users by July, equating to nearly one‑third of all UK adults.

- Growing consumer appetite for digital payment channels globally, in 2024, 42% of adults worldwide made a digital payment to a merchant, up from 35% in 2021, underlining a favorable macro environment for open banking.

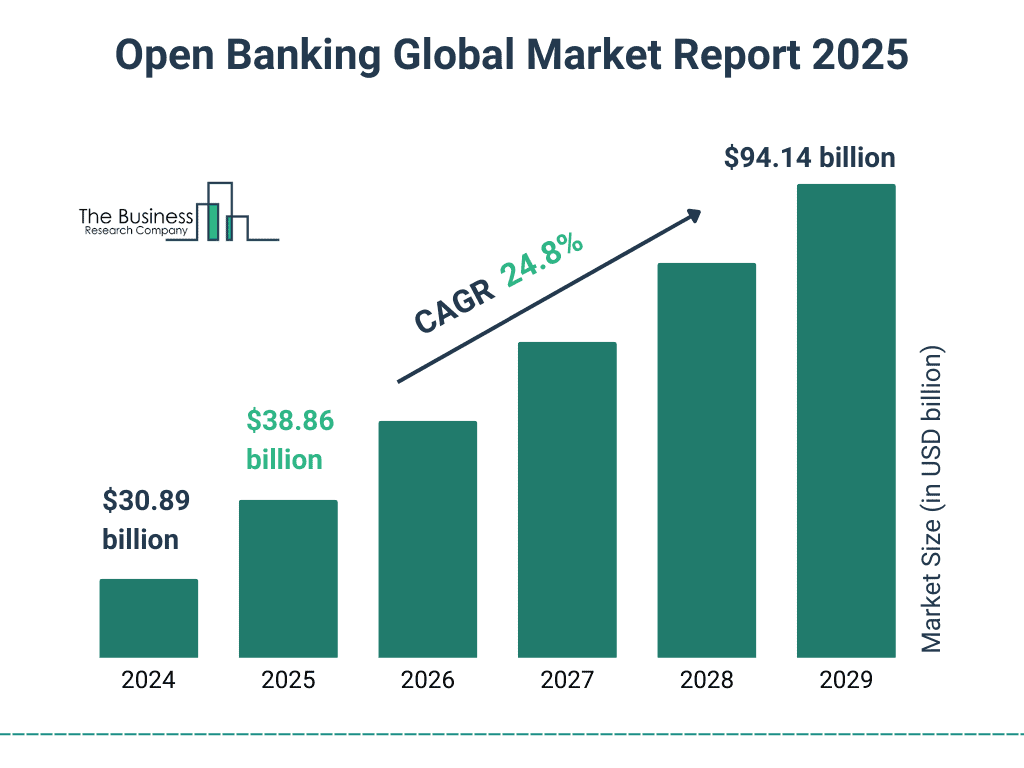

Open Banking Market Size Projections

- 2025 forecast rises to $38.86 billion, showing strong year-over-year expansion.

- CAGR expected at 24.8%, reflecting fast adoption of API-driven financial services.

- 2026 projection surpasses $48 billion, continuing double-digit annual growth.

- 2028 market size is expected to reach ~$75 billion, indicating mainstream global adoption.

- 2029 outlook estimates $94.14 billion, more than tripling from 2024 levels.

Open Banking Transaction Volumes

- In July 2025, the UK recorded 29.89 million open banking-enabled transactions, a new monthly high.

- Open banking payments accounted for 31 million transactions in the UK in March 2025, about 1 in 13 of all Faster Payments.

- The UK saw 70% year-on-year growth in open banking payments between 2024 and 2025.

- Variable Recurring Payments (VRPs) made up 13% of total open banking payments in the UK by March 2025.

- The UK had over 15 million active open banking users as of July 2025.

- More than 11 million open banking transactions were processed monthly by September 2025 in the UK.

- Globally, open banking transactions surpassed 120 billion annually in 2025.

Regional Adoption Breakdown

- Over 78 countries implemented open banking regulations globally by early 2025.

- Europe held the largest share at 36.4% of global open banking revenue in 2024.

- 94% of licensed banks in Europe comply with PSD2 for open banking in 2025.

- Asia-Pacific saw 44% YoY growth in open banking accounts in 2025.

- Brazil led LATAM with 9.8 million open banking users in 2025.

- 52% of US banks offered data-sharing APIs in 2025.

- North America is projected 21.4% CAGR for open banking through 2027.

- 551 TPPs operated across Europe in Q1 2025.

- India and Singapore showed over 80% YoY API call increases in APAC.

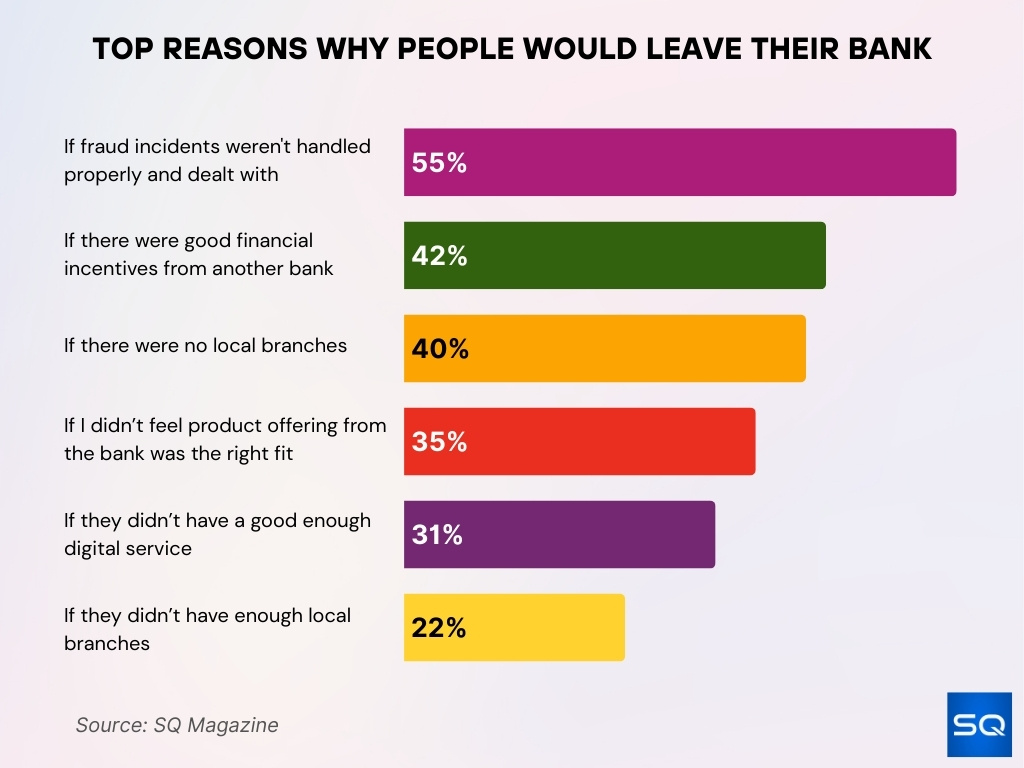

Top Reasons Why People Would Leave Their Bank

- 55% would leave if fraud isn’t properly handled, showing trust and security are top priorities.

- 42% would switch for better financial incentives, driven by competitive offers and perks.

- 40% would leave if their bank had no local branches, proving physical presence still matters.

- 35% would switch if products don’t meet their needs, stressing the need for personalized services.

- 31% would leave due to poor digital services, highlighting the importance of seamless digital banking.

- 22% would switch due to insufficient branch availability, reinforcing the role of in-person access.

Country-Level Open Banking Leaders

- The UK had 15.16 million open banking users as of July 2025, about one in three adults.

- Active UK open banking users reached 13.3 million in March 2025, a 40% YoY increase.

- Brazil reported a 45% increase in active consents in 2024 compared to 2023, reaching 61.9 million.

- Brazil nearly doubled its API calls from 51.9 billion in 2023 to 102 billion in 2024.

- Payment Initiation API calls in Brazil grew by 194%, hitting 159 million in 2024.

- Over 132 million global users benefit from open finance as of 2025.

- About 32 countries lead in open finance maturity globally in 2025.

- Brazil’s open finance ecosystem processed over 96 billion API calls monthly in 2025.

- UK open banking ecosystem reached 2 billion API calls in July 2025.

Adoption by Banks and Financial Institutions

- 95% of UK banks will participate in the national open banking initiative in 2025.

- 94% of licensed European banks comply with PSD2 open banking APIs in 2025.

- 87% of global Tier-1 banks implemented open banking capabilities in 2025.

- 52% of US banks offer data-sharing APIs through open banking in 2025.

- Over 80% of Brazilian banks support PISP functionality in Open Finance 2025.

- 60% of US regional banks will enable at least one open banking data API in 2025.

- Community banks in the US increased open banking participation by 31% YoY in 2025.

- 90+ accredited data recipients participate in Australia’s open banking in 2025.

- Major Asian banks like DBS provide over 20 open APIs each in 2025.

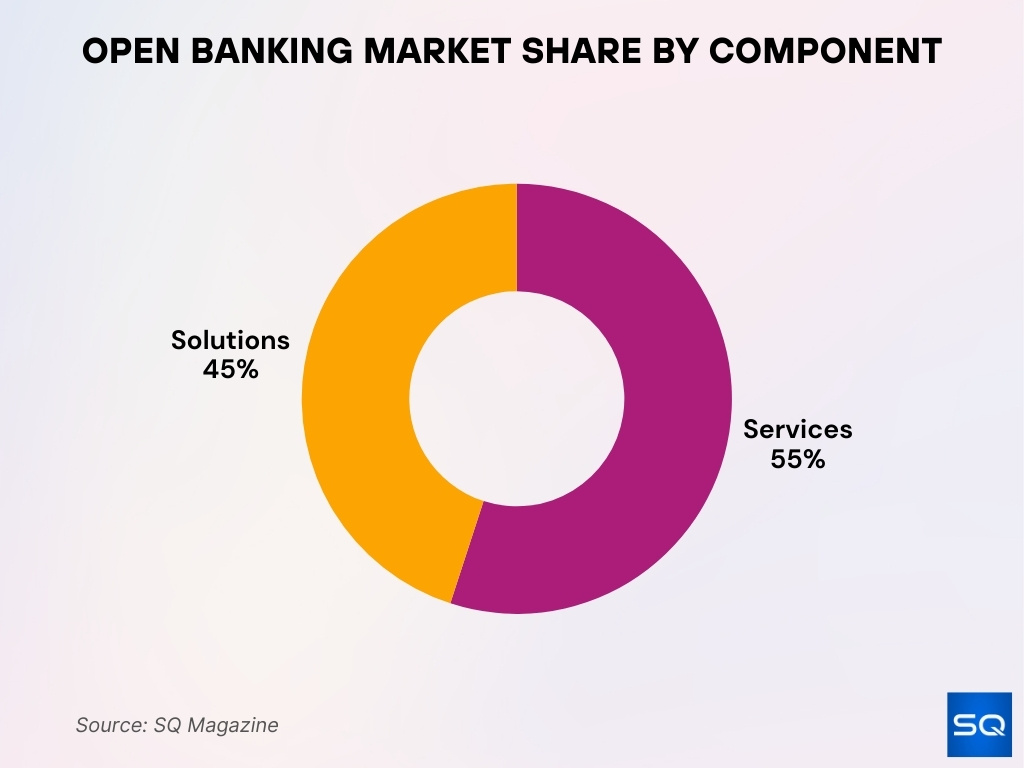

Open Banking Market Share by Component

- Services lead with 55% market share, driven by demand for API management and banking-as-a-service.

- Solutions hold 45% of the market, reflecting strong interest in compliance, analytics, and integration tools.

Third-Party Provider and Fintech Participation

- As of March 2025, the UK had 145 live third-party providers (TPPs) and 406 agents.

- Global open banking users surpassed 470 million in 2025.

- In the US, nearly 52% of adults used at least one open banking-enabled service in 2025.

- Open banking users globally could reach approximately 645 million by 2029.

- Global open banking API call volume increased by 427% in 2025 relative to previous baselines.

- Many fintechs use open banking data for value-added services like credit scoring and embedded finance in 2025.

- API adoption favors larger banks, leaving fintech participation higher in markets with open legacy banks.

- Fintechs are shifting from compliance to commerce-driven open banking with monetization models in 2025.

- Over 22 million open banking payments were made monthly in the UK in 2025.

- UK open banking ecosystem generated 2 billion API calls in a landmark month in 2025.

Consumer Adoption and Usage Frequency

- Open banking services in the UK reached 15.16 million users by July 2025, nearly one in three adults.

- About 18.4% of people with online current accounts were active open banking users in March 2025.

- March 2025 saw 31 million open banking payments in the UK, roughly 1 in 13 Faster Payments.

- Open banking payments made up 7.0% of all UK Faster Payments by March 2025.

- Over 22.1 million open banking payments were made monthly in the UK in 2025.

- Variable Recurring Payments (VRPs) grew to 13% of total open banking payments by March 2025.

- Over 70% of UK adults who are digitally active use at least one fintech service as of 2025.

- Open banking usage in the UK grew by 34% year-on-year as of July 2025.

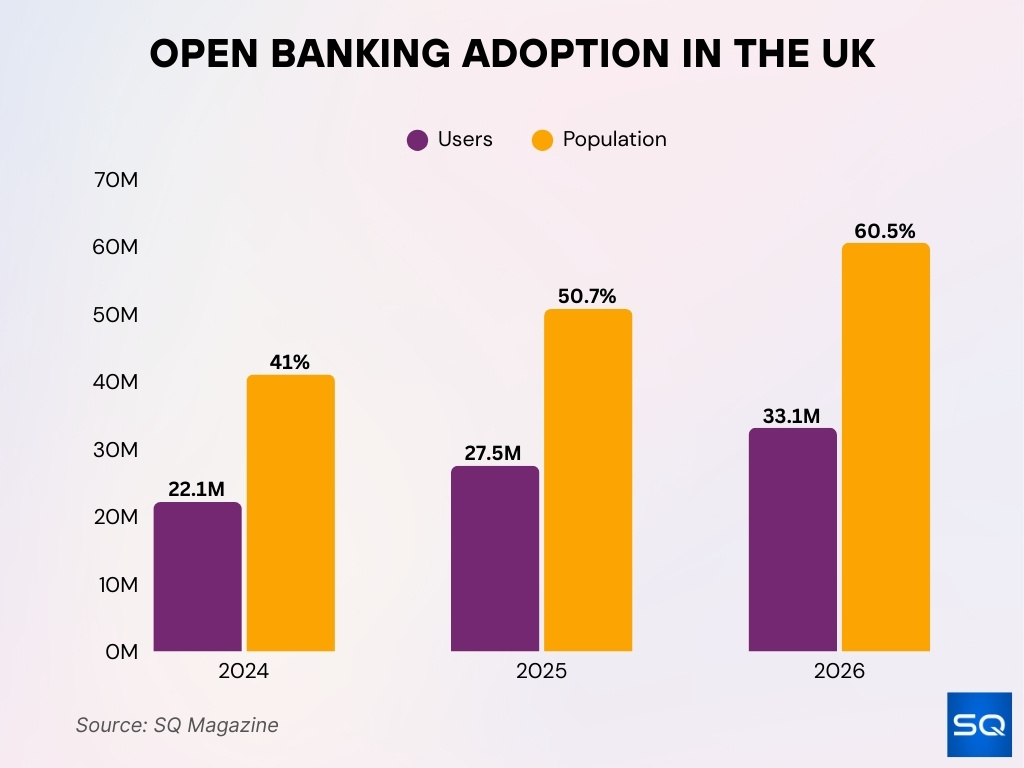

Open Banking Adoption in the UK

- 22.1 million UK users in 2024, equal to 41.0% of the adult population using open banking.

- 27.5 million users projected in 2025, reaching 50.7% adoption and crossing the halfway mark.

- 33.1 million users expected by 2026, covering 60.5% of UK adults with strong mainstream adoption.

Barriers to Open Banking Adoption

- 57% of global respondents remain unfamiliar with open banking in 2025.

- 41% of North American users cite lack of understanding as a key adoption barrier in 2025.

- 32% of mid-sized banks globally lack infrastructure for secure open APIs in 2025.

- 58% of consumers express concerns over data security in open banking platforms in 2025.

- Integration costs for smaller banks average $320K–$500K, limiting open banking participation in 2025.

- 28% of fintech developers report data latency issues hindering real-time open banking services in 2025.

- 62% of French consumers refuse data sharing without stronger privacy guarantees in 2025.

- 12% of TPP support tickets stem from inconsistent API schemas in open banking ecosystems in 2025.

- 84% of financial institutions plan to increase investment in consumer education on open banking security by 2025.

Frequently Asked Questions (FAQs)

18.4% (i.e., about 1 in 5) were active users.

15.16 million users, roughly one in three UK adults.

Over 78 countries worldwide had implemented some form of open banking regulatory framework by early 2025.

More than 470 million people worldwide.

Conclusion

Open banking has crossed a threshold; hundreds of millions of users around the world, including over 15 million in the UK alone, rely on open banking for payments, account access, and financial services. Fintech firms and banks increasingly build services around APIs, enabling anything from personal finance tools to embedded credit. Yet growth is uneven, and technical, regulatory, and trust‑related challenges still limit adoption in many regions.

Nevertheless, with continued improvements in data security, regulatory clarity, and user education, open banking stands poised to expand further. The shift toward open finance (covering investments, insurance, and broader financial data) may accelerate this trend. As barriers fall, open banking is set to reshape how people and businesses interact with money, making finance more accessible, transparent, and user‑oriented.