The no-code platform landscape is no longer niche; it’s central to how modern businesses build digital tools. By making software development accessible to non‑technical teams, no‑code has reshaped workflows, accelerated product delivery, and reduced dependency on traditional programming. Today’s platforms power everything from internal tools at startups to customer‑facing apps at Fortune 500 companies, unlocking faster innovation and greater control.

From enabling business users to automate processes to helping enterprises scale customer solutions at speed, the impact spans industries and organizational sizes. Explore the full article to understand the latest no‑code platform trends and statistics shaping the future of software development.

Editor’s Choice

- 70% of new business applications are expected to be built using no‑code or low‑code technologies by 2026, reflecting rapid mainstream adoption.

- Around 77% of businesses reported using or planning to use low-code/no-code solutions.

- Gartner reports that over 75% of enterprise apps will be built on no‑code/low‑code tools by 2026.

- Developers outside IT are set to be 80% of no‑code users by the end of 2026, signalling democratization.

- SMEs account for a growing share of the market, driven by cost‑efficiency and ease of use.

Recent Developments

- Gartner’s forecast indicates a shift from less than 25% in 2020 to over 75% by 2026 for enterprise applications built on no‑code or low‑code platforms.

- By 2025, 70% of all new applications will be powered by no‑code/low‑code technologies.

- Platforms continue integrating AI automation to simplify app creation and predictive workflows.

- Increased funding and investment in no‑code startups reflect confidence in long‑term growth.

- Visual, drag‑and‑drop interfaces are becoming standard across leading platforms.

- Enterprise integration connectors are expanding, easing adoption alongside legacy systems.

- No‑code marketplaces now offer plugins and templates to jump‑start development.

- Industry‑specific no‑code solutions (e.g., healthcare, finance) are on the rise.

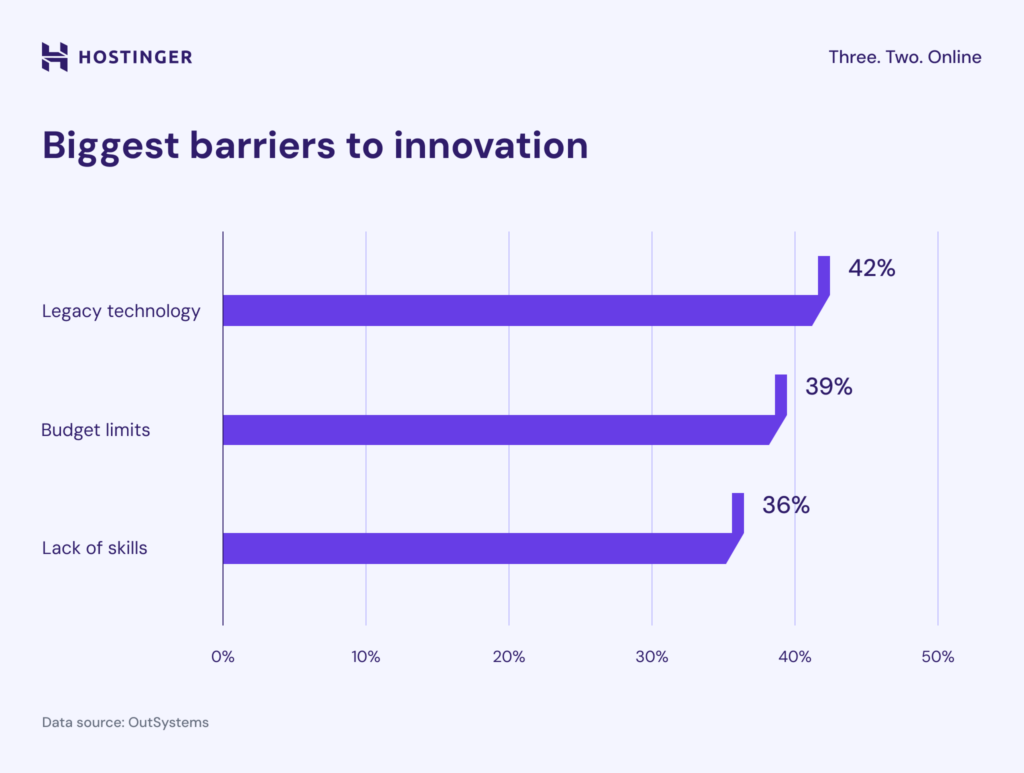

Biggest Barriers to Innovation

- Legacy technology remains the top obstacle, cited by 42% of organizations, as outdated systems slow modernization and integration efforts.

- Budget limits affect 39% of businesses, restricting investment in new tools, platforms, and digital transformation initiatives.

- Lack of skills is a major concern for 36% of companies, highlighting ongoing talent gaps in modern development and innovation capabilities.

App Development and Platform Usage

- Low-code development platform market reaches $28.75 billion.

- 500 million apps built using no-code platforms.

- 65% of all app development activity uses no-code/low-code.

- 70% of enterprise apps use low-code/no-code.

- 75% of new applications are built with low-code/no-code.

- 80% of low-code users are outside IT departments.

- No-code reduces development time by up to 90%.

- 70% cost savings on development projects with no-code.

- 362% average ROI for no-code implementations.

- Citizen developers outnumber professionals 4:1.

Business Impact and ROI Metrics

- Organizations achieve 362% average ROI from no-code implementations.

- 91.9% of no-code projects recover investment within the first year.

- Companies save up to $1.4 million annually using no-code platforms.

- Average firm avoids hiring 2 IT developers, saving $140,000-$300,000 yearly.

- Ricoh achieved 253% ROI in just 7 months with low-code.

- No-code reduces development costs by 70% versus traditional methods.

- Microsoft Power Platform delivers 206% ROI according to a Forrester study.

- No-code cuts maintenance costs by 80%, including updates.

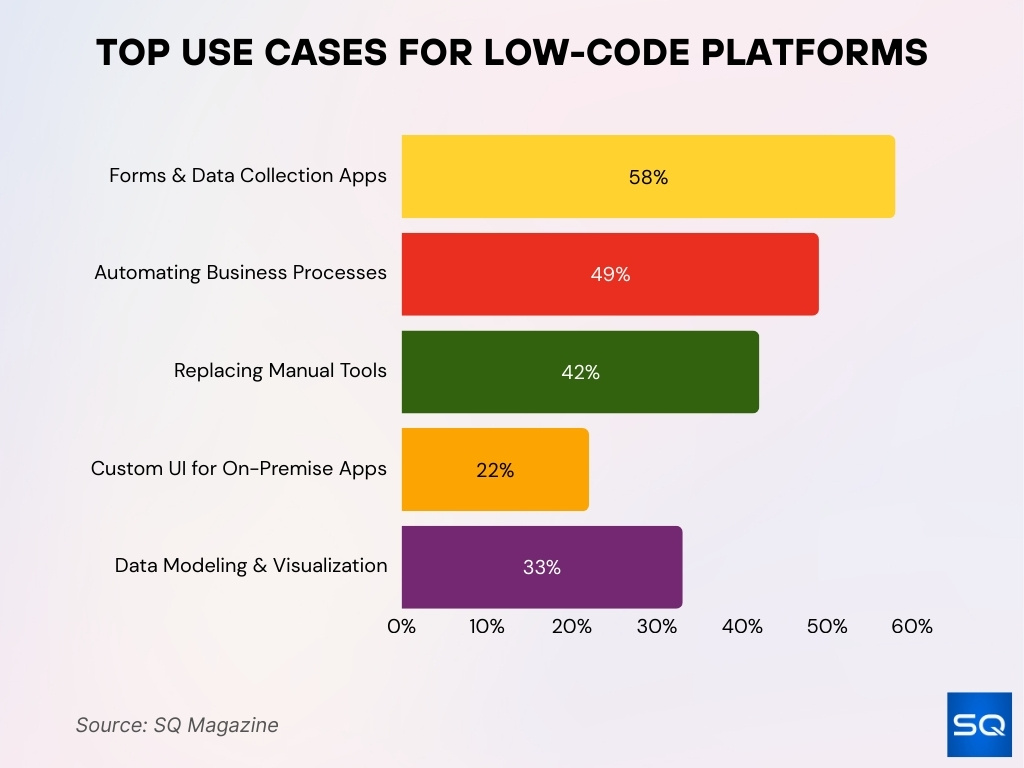

Top Use Cases for Low-Code Platforms

- Forms & data collection apps lead adoption, used by 58% of organizations to quickly build internal tools and capture business data.

- Automating business processes is a major use case for 49% of companies, helping reduce manual workflows and improve operational efficiency.

- Replacing manual tools is cited by 42% of organizations, showing how low-code platforms streamline legacy spreadsheets and disconnected systems.

- Data modeling & visualization is leveraged by 33% of users, enabling faster insights and easier reporting without heavy development effort.

- Custom UI for on-premise apps remains a niche use case at 22%, often supporting modernization of legacy enterprise systems.

Industry and Enterprise Trends

- 75% of new enterprise applications use low-code/no-code.

- 70% of new business apps leverage low-code platforms.

- 75% of large enterprises use at least 4 low-code tools.

- Banking/financial services holds 27% market share.

- 24.1% CAGR is the fastest in the education sector.

- Healthcare and retail exceed 20% CAGR growth.

- 87% of enterprise developers use low-code.

- Low-code accounts for 65% of app development activity.

- 50% of new apps are no-code in key industries.

- BFSI leads no-code AI with 20% share.

Technology Integration and Future Outlook

- The no-code AI platform market is valued at $8.6 billion.

- No-code AI grows at 31.13% CAGR to 2034.

- Alternative projection shows a $4.88 billion market size.

- Asia-Pacific expands at 31.46% CAGR.

- North America commands 41% global market share.

- 70% of no-code platforms integrate AI features.

- 80% of new apps are built by non-technical users.

- Low-code market exceeds $30 billion.

- 75% enterprises mix low-code/no-code with traditional.

- Predictive analytics leads the fastest-growing use cases.

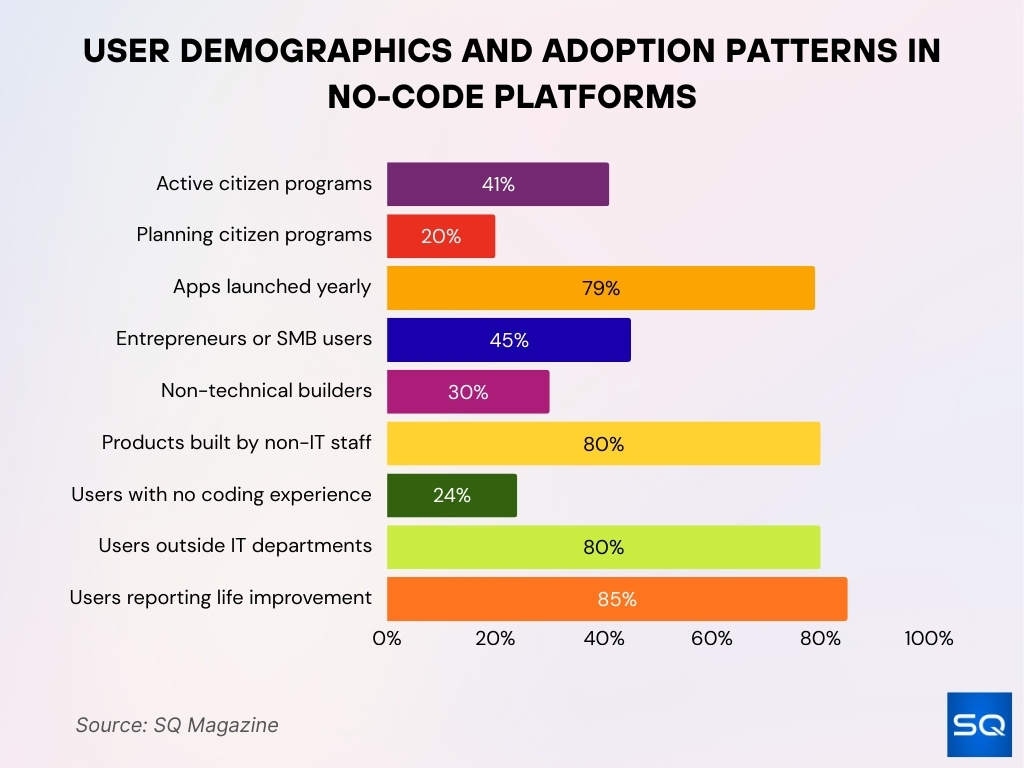

User Demographics and Adoption Patterns

- 41% of organizations actively run citizen development programs.

- 20% of companies evaluate or plan citizen development initiatives.

- 79% of businesses with citizen programs launch at least one app yearly.

- 45% of no-code users are entrepreneurs or small business owners.

- 30% of no-code builders are non-technical individuals.

- 80% of tech products are created by non-IT professionals.

- 24% of no-code users had zero prior coding experience.

- 80% of low-code users are outside formal IT departments.

- 85% of no-code users report life enhancement from tools.

Adoption by Business Size

- SMEs hold 57% of the low-code development platform market share.

- Large enterprises capture 57% no-code AI platform market share.

- SMEs represent 43% share in no-code AI platforms.

- SMEs grow at 38.6% CAGR in no-code AI adoption.

- SMEs expand at 30.53% CAGR in low-code platforms.

- Large enterprises account for 66.67% low-code revenues by 2035.

- 60% no-code market share driven by SMBs.

- SMEs achieve 36% CAGR from 2026 to 2029.

- 70% new SME apps use low-code by 2025.

- Large enterprises dominate with 57.8% share in 2025.

Citizen Developer Statistics

- 41% of businesses have active citizen development programs.

- 20% of organizations evaluate or plan citizen development.

- 79% of businesses complete one no-code app within the first year.

- Citizen developers outnumber professionals 4:1.

- Citizen developer platforms market reaches $15.6 billion.

- 65% of enterprises adopt citizen development models.

- 70% of organizations have active citizen developer programs.

- 80% of companies view citizen developers as critical.

- Nearly 60% of custom apps are built outside IT.

- 53% expect growth in non-IT apps.

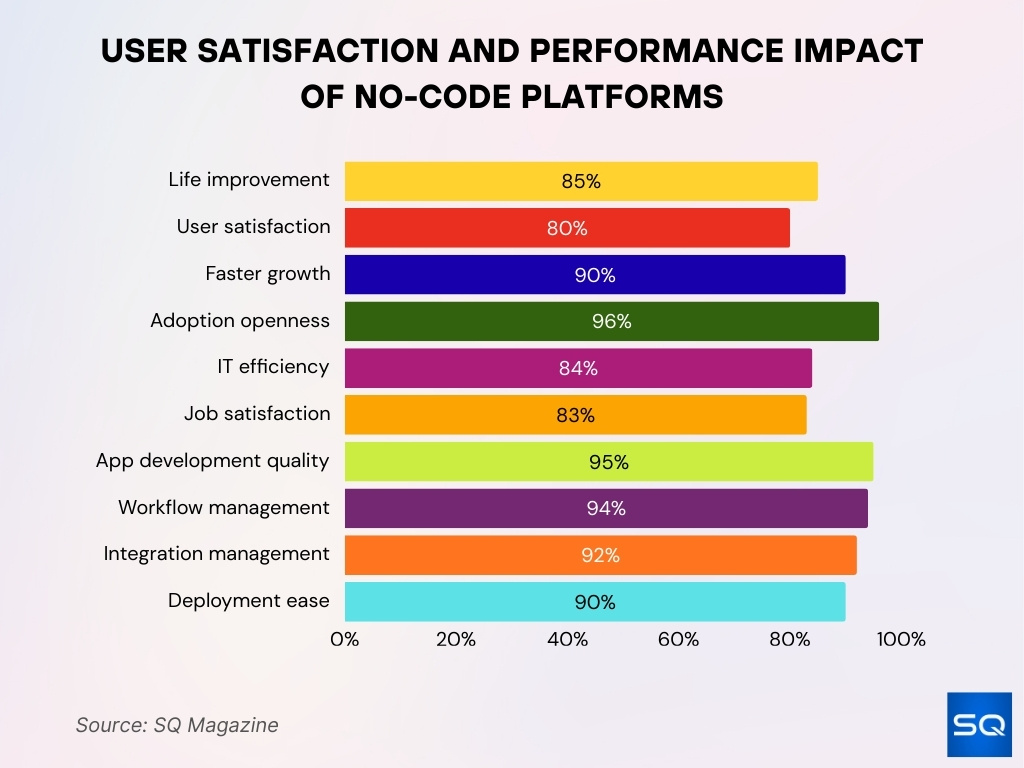

User Satisfaction & Performance Metrics

- 85% of no-code users report life enhancement.

- 80% user satisfaction with no-code platforms.

- 90% of no-code users see faster company growth.

- 96% non-users are open to adopting no-code.

- 84% enterprises adopt for IT efficiency.

- 83% report improved job satisfaction.

- 95% rate web/mobile app development highly.

- 94% value workflow management features.

- 92% appreciate integration management.

- 90% praise deployment management ease.

Cost Savings and Development Time

- No-code reduces development time by up to 90%.

- 70% cost savings on development projects.

- $187,000 average annual savings per organization.

- 10X faster app development with no-code tools.

- 60% reduction in enterprise development time.

- 362% average ROI for no-code projects.

- 91.9% projects recover investment in the first year.

- 253% ROI with 7-month payback.

Regional Market Growth

- The global no-code AI market is valued at $8.6 billion.

- North America holds 41% no-code AI market share.

- Asia-Pacific accounts for 23% market share.

- Europe represents 27% of no-code AI platforms.

- Middle East & Africa claims 9% market share.

- Asia-Pacific grows at 31.46% CAGR.

- North America leads the low-code market regionally.

- Low-code platform market hits $28.75 billion globally.

- Asia-Pacific fastest-growing no-code region.

- North America dominates with 39.6% share.

No-Code vs Traditional Development Trends

- 70% of new enterprise apps use no-code/low-code.

- 65% of application development is low-code/no-code.

- 10x faster development with no-code platforms.

- Development time reduced 50-90% vs traditional.

- 75% large enterprises use 4+ low-code tools.

- Citizen developers outnumber professionals 4:1.

- 80% low-code users are business technologists.

- 70% cost savings vs traditional coding.

- 43.5% developers save 50% time with low-code.

- No-code apps built in days vs months.

AI & No-Code Integration Statistics

- No-code AI market valued at $8.6 billion.

- Projected growth to $75.14 billion by 2034.

- 31.13% CAGR for no-code AI platforms.

- North America leads with 39.6% market share.

- Asia-Pacific fastest-growing at 31.46% CAGR.

- 67.20% market share held by platforms.

- 29.74% CAGR for the services segment.

- Global no-code AI reached $6.56 billion in 2025.

- 30.2% CAGR projected to 2033.

- 70% new enterprise apps use no-code/low-code with AI.

Frequently Asked Questions (FAQs)

75% of new applications are forecast to be created using low‑code or no‑code by 2026.

80% of platform users are expected to be non‑IT developers by the end of 2026.

Around 41% of businesses reported having active citizen development initiatives.

No‑code platforms can reduce application development time by up to 90% compared to traditional methods.

Conclusion

The no‑code platform ecosystem continues to grow rapidly across regions and industries, with substantial gains in market size, adoption, and user satisfaction. North America remains the most mature market, while Europe and Asia‑Pacific are expanding quickly as organizations invest in digital transformation. No‑code tools increasingly compete with traditional development by delivering faster, cost‑effective, and highly satisfying outcomes for users of all skill levels.

With AI integration propelling innovation and democratizing app creation, the future promises broader adoption and deeper business impact. As no‑code platforms evolve, they are becoming essential for companies of every size aiming to accelerate software delivery and innovation in 2026 and beyond.