U.S. households face record levels of debt, a trend with broad implications for consumer spending, financial stability, and public policy. As both mortgage and non‑mortgage debts climb, decisions by borrowers and lenders increasingly shape economic dynamics. Real‑world impacts already emerge: rising mortgage balances affect housing affordability and home‑buying behavior, while growing credit‑card and student‑loan burdens influence consumer spending patterns. Read on to explore key figures and insights in full detail.

Editor’s Choice

- Total U.S. household debt reached $18.59 trillion in the third quarter of 2025.

- In the same period, debt rose by $197 billion, a 1% increase quarter over quarter.

- Mortgage balances alone climbed by $137 billion, totaling roughly $13.07 trillion.

- Credit‑card balances increased by $24 billion, reaching $1.23 trillion.

- Student loan debt rose by $15 billion, totaling $1.65 trillion.

- As of 2025, household debt service payments, that is, debt payments as a share of disposable income, stood at about 11.2%, roughly in line with long-term averages.

- Mortgage debt remains the dominant component, representing about 70% of total household debt.

Recent Developments

- Between Q2 and Q3 of 2025, total household debt rose to $18.59 trillion, a new high.

- On a year-over-year basis, total borrowing rose by approximately $642 billion.

- Mortgage debt continues to lead growth, with the third quarter increase driven primarily by home loans.

- Credit‑card balances hit $1.23 trillion, up $24 billion, suggesting consumers continue to rely on revolving credit.

- Student‑loan balances rose $15 billion during the quarter, reaching $1.65 trillion.

- Auto loan balances held roughly steady at $1.66 trillion.

- Non‑mortgage consumer credit, including credit cards, auto loans, and student loans, saw modest but steady growth through the first half of 2025.

- At the same time, household net worth rose. In Q2 2025, households added $7.1 trillion in net worth, reflecting gains in equity and asset values.

- Debt relative to national GDP has moderated. As of early 2025, household debt stood at about 68–68.3% of GDP, down from roughly 69.4% at the end of 2024.

- Observers note that while debt levels are high, the composition and broader balance-sheet context, including rising assets, offer a more nuanced view than raw debt totals might suggest.

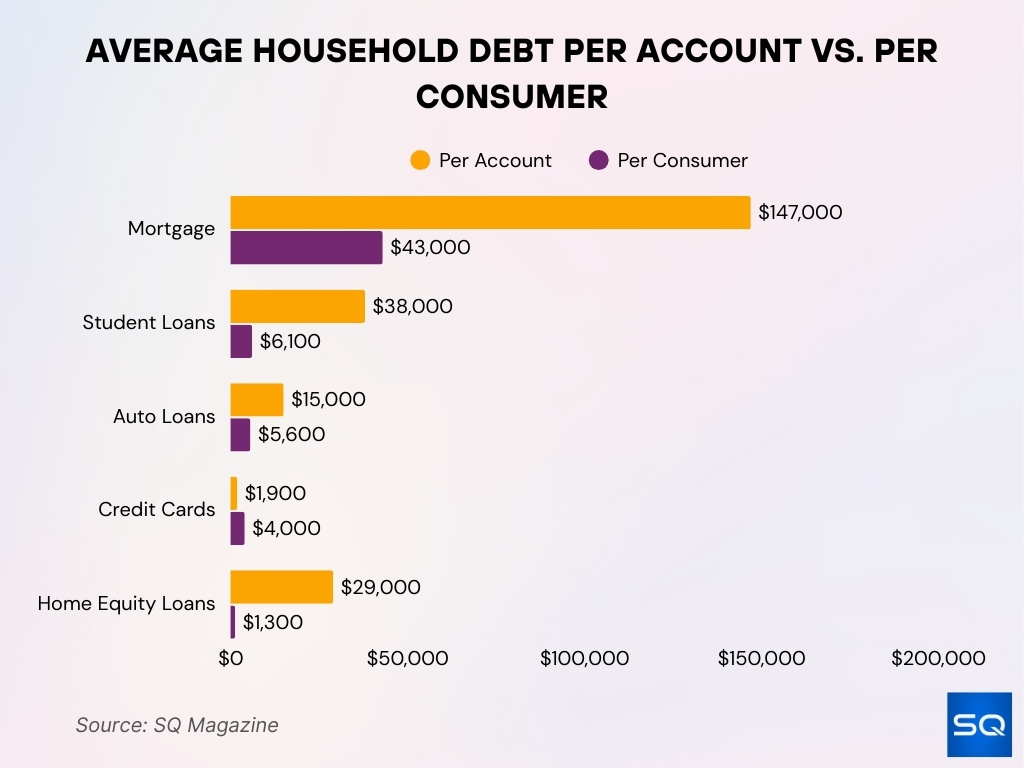

Average Household Debt: Per Account vs. Per Consumer

- Mortgages average $147,000 per account and $43,000 per consumer.

- Student loans total $38,000 per account and $6,100 per consumer.

- Auto loans average $15,000 per account and $5,600 per consumer.

- Credit card balances are $1,900 per account and $4,000 per consumer.

- Home equity loans average $29,000 per account and $1,300 per consumer.

Delinquency Rates

- As of Q3 2025, about 4.49% of all outstanding household debt was reported in some stage of delinquency.

- That 4.49% represents a slight rise from 4.41% in Q2 2025.

- The transition rate into “serious delinquency”, defined as 90 or more days past due, rose to 3.03% in Q3 2025, up from 1.68% in Q3 2024.

- For student loans specifically, about 9–10% of aggregate balances were 90+ days delinquent or in default by mid‑to‑late 2025, up from the high‑single‑digit range earlier in the year, reflecting stress as pandemic‑era relief fully rolled off.

- According to a recent analysis, credit‑card and auto‑loan delinquency trends have diverged, while mortgage delinquency remains relatively stable; non‑mortgage delinquency, especially credit cards, has seen increases.

- Overall delinquency rates on consumer loans at U.S. commercial banks stood at 2.72% in Q3 2025 (seasonally adjusted), only slightly lower than recent quarters.

- Some auto‑loan delinquency metrics remain stubborn, with new delinquencies near the high‑single‑digit range and 90‑day delinquencies around 5% of balances, underscoring persistent strain in this segment.

Household Debt Burden Relative to Income / Disposable Income

- In Q2 2025, average American household debt-service payments consumed 11.2% of disposable personal income.

- The household debt payments to disposable personal income ratio dropped to 11.25% in Q1 2025.

- Total household debt reached $18.59 trillion relative to $23.03 trillion disposable personal income.

- Debt-to-income ratio stood at approximately 81% in September 2025.

- Household debt to GDP decreased to 68.3% in Q1 2025.

- Mortgages represented approximately 70% of total household debt.

- Household debt accounted for 61.4% of nominal GDP in Q2 2025.

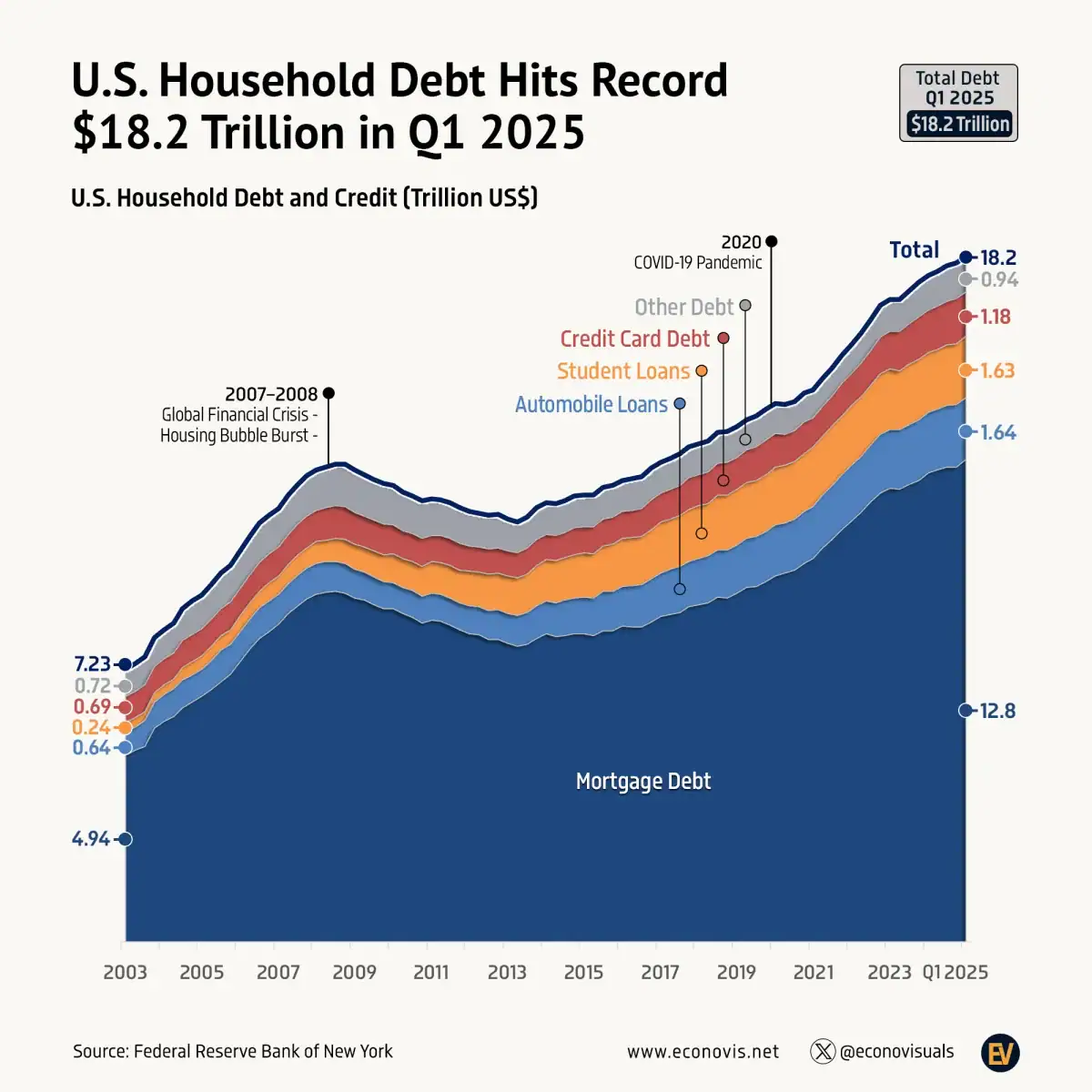

U.S. Household Debt Breakdown

- Total household debt reached $18.2 trillion in Q1 2025, the highest on record.

- Mortgage debt accounts for $12.8 trillion, the largest share of household borrowing.

- Automobile loans stand at $1.64 trillion, driven by higher car prices and financing costs.

- Student loans total $1.63 trillion, heavily impacting younger households.

- Credit card debt hit $1.18 trillion, reflecting increased revolving credit use.

- Other debt amounts to $0.94 trillion, including categories like personal loans.

Debt by Age Group

- Households aged 40-49 carried $4.76 trillion in total debt.

- Households aged 30-39 held $3.89 trillion in total debt.

- Generation X average debt reached $158,105.

- Millennials’ average debt stood at $132,280.

- Baby boomers’ average debt totaled $92,619.

- Generation Z’s average debt was $34,328.

- Households aged 18-29 averaged $19,962 per capita debt.

- Households aged 50-59 carried $4.02 trillion in total debt.

- Silent Generation average debt was measured $38,460.

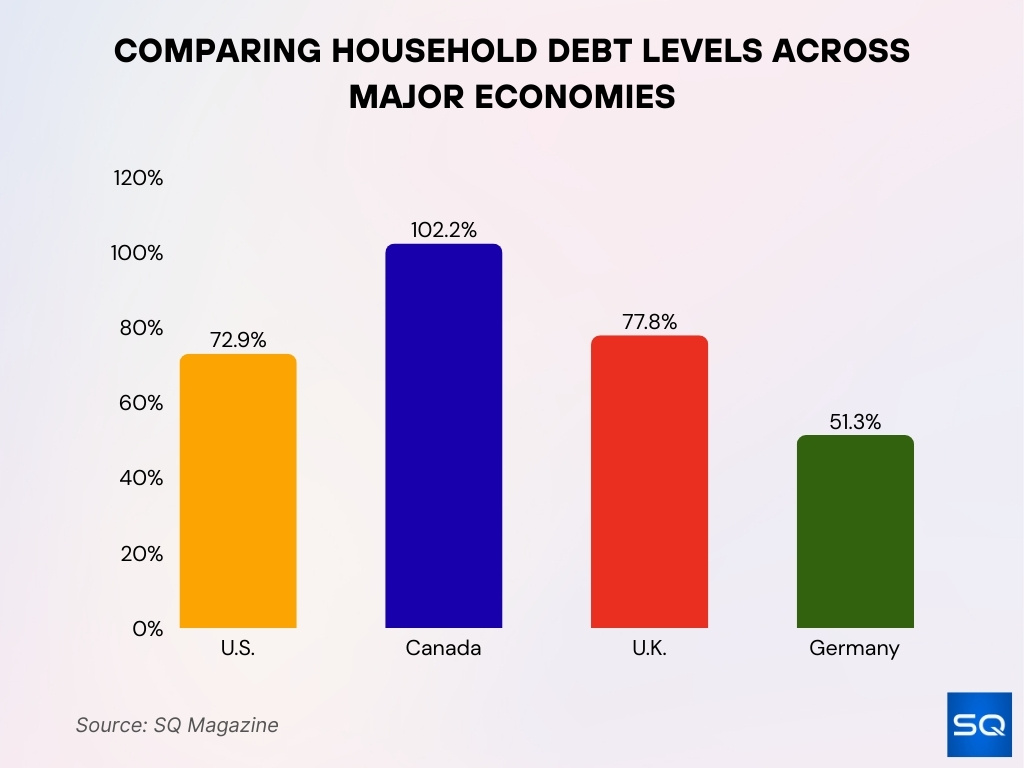

International Comparisons of Household Debt

- U.S. household debt equals 72.9% of GDP. This places it in the mid-range compared to other advanced economies.

- Canada’s household debt stands at 102.2% of GDP. It ranks among the highest globally, indicating heavier consumer leverage.

- The U.K. has household debt at 77.8% of GDP. This is above the U.S. level, reflecting strong credit reliance.

- Germany’s household debt is only 51.3% of GDP. It remains the most conservative among the countries listed.

Implications for Economic Stability & Consumer Spending

- Household net worth rose $7.1 trillion to $176.3 trillion in Q2 2025.

- Household debt grew at a 3.8% annual rate amid rising assets in Q2 2025.

- Real consumer spending projected to grow 2.1% despite debt pressures.

- Durable goods spending is expected to increase 2.9% before slowing.

- Nondurables spending is forecasted at a 2.3% growth rate.

- Services spending is projected to rise 1.9% with mortgage stability.

- Total household debt hit $18.59 trillion while spending remained resilient.

- Mortgages comprised 70% of debt supporting predictable payments.

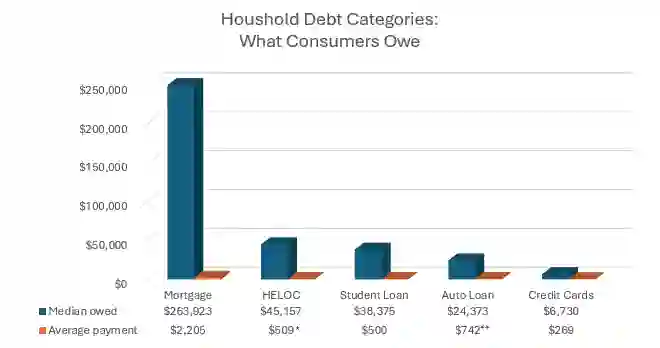

Household Debt Categories: What Consumers Owe

- Mortgages carry a median balance of $263,923 with an average monthly payment of $2,205.

- HELOC balances average $45,157 with monthly payments around $509.

- Student loans hold a median balance of $38,375 with an average monthly payment of $500.

- Auto loans show a median balance of $24,373 with a high monthly payment of $742.

- Credit card debt has a median of $6,730 with an average monthly payment of $269.

Policy Responses & Regulatory Environment

- Nonfinancial sector debt to GDP hit its lowest level in two decades at 142%.

- Private non-financial sector debt service ratio fell to 14.3% in Q1.

- Aggregate delinquency rates rose to 4.3% of outstanding debt in Q1.

- Overall delinquency rate increased to 4.49% in Q3.

- Credit card delinquency transition rates are elevated among younger borrowers.

- FDIC updated regulatory thresholds for community banks, effective in 2026.

- OCC requested data on debanking activities from the nine largest banks.

- Student loan delinquencies spiked after pandemic reporting resumption.

Frequently Asked Questions (FAQs)

Total household debt reached $18.59 trillion in Q3 2025.

Debt increased by $197 billion (≈ 1%) in Q3 2025 relative to Q2 2025.

About 4.49% of all outstanding household debt was reported in some stage of delinquency in Q3 2025.

Conclusion

The dominance of long-term mortgage debt helps cushion macro‑risk, but rising non‑mortgage liabilities and renewed delinquencies, especially among lower-income borrowers, underscore growing vulnerability. As policymakers deliberate regulatory adjustments and relief mechanisms, the coming quarters will test whether household financial health can weather tighter credit conditions and economic uncertainty. The data so far offer a mixed but critical snapshot, and underscore why monitoring household debt remains essential for understanding U.S. economic resilience.