Dropbox remains a foundational player in cloud storage, serving over 700 million registered users worldwide. Its evolving metrics reveal the sharp focus on monetization and efficiency. You’ll see how Dropbox’s paying user base, revenue, and regional income distribution shape its strategy. This article dives into those trends and invites you to explore the full picture as we break down the stats in detail.

Editor’s Choice

- Over 700 million registered users across more than 180 countries mark Dropbox’s global scale.

- 18.22 million paying users as of Q2 2024, up from 18.16 million in Q1.

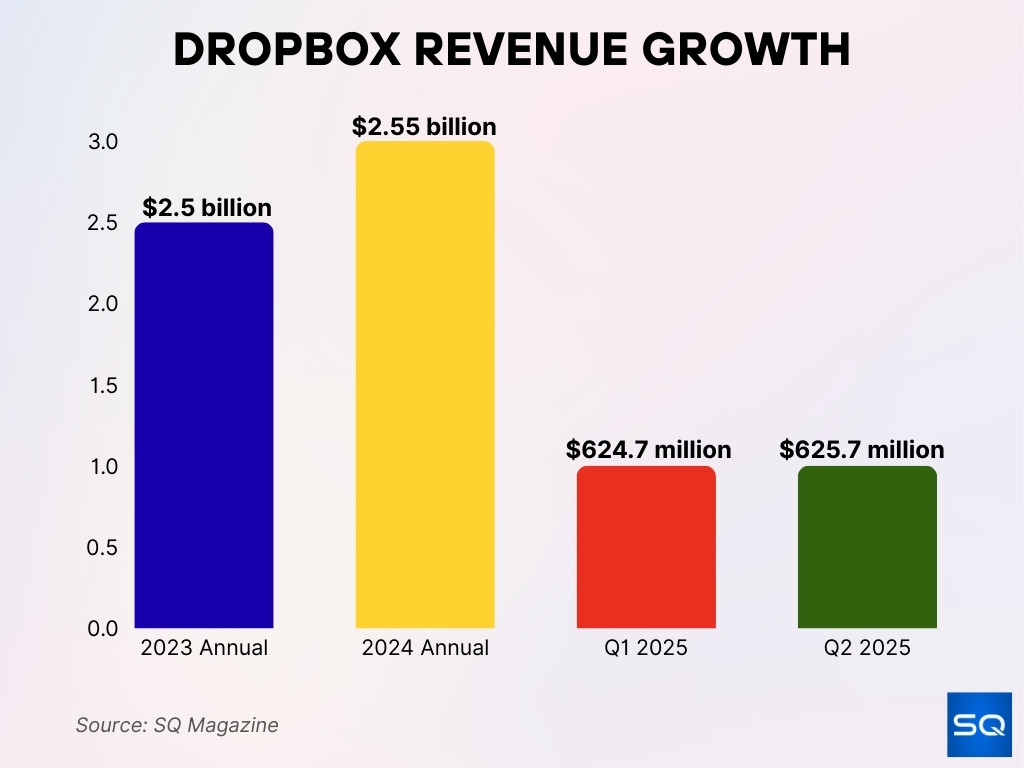

- 2023 annual revenue: $2.50 billion, rising 7.6% over 2022.

- 2024 revenue: $2.55 billion, up 1.86% from 2023.

- Q2 2025 trailing‑12‑month revenue: $2.53 billion, a slight 0.04% decline year‑over‑year.

- Q2 2025 quarterly revenue: $625.7 million, down around 1.4% year‑over‑year.

- Q2 2025 paying users: 18.13 million, a small sequential dip.

- Q2 2025 ARPU: $138.32, slightly below Q1’s $139.26.

Recent Developments

- In Q2 2025, revenue dipped 1.4% year‑over‑year to $626 million, constant‑currency decline was 1.3%.

- Annual Recurring Revenue (ARR) at end Q2 2025: $2.542 billion, down roughly 1.2% year‑over‑year.

- Paying users declined by about 34,000 sequentially, chiefly due to reduced investment in FormSwift.

- Full‑year guidance sees a projected 1.5% decline in paying users as Dropbox shifts focus from acquisition to monetization.

- CEO highlights the growth of Dash (AI‑powered universal search) and improved user engagement.

- Activist investor Half Moon Capital is pushing to end the dual‑class share structure amid concerns over slowing growth and paid‑user decline.

Paying User Statistics

- Q2 2025 paying users: 18.13 million, down slightly from 18.16 million in Q1.

- Q1 2025 record: 18.16 million, flat year‑over‑year.

- Paying users have climbed steadily from 6.5 million in 2015 to 18.22 million in Q2 2024.

- Growth trend by year: 2016 – 8.8 M, 2017 – 11 M, 2018 – 12.7 M, 2019 – 14.31 M, 2020 – 15.48 M, 2021 – 16.79 M, 2022 – 17.77 M, 2023 – 18.12 M.

- Recent growth has slowed significantly, showing signs of plateauing.

Revenue Statistics

- 2023 annual revenue: $2.50 billion, a 7.6% increase over 2022.

- 2024 annual revenue: $2.55 billion, up 1.86%.

- Trailing‑12‑month (TTM) revenue as of mid‑2025: $2.53 billion, a slight 0.04% decline.

- Q2 2025 revenue: $625.7 million, down ~1.4% year‑over‑year.

- Q1 2025 revenue: $624.7 million, down 1% from the prior year.

- Revenue softness linked to scaling back FormSwift contribution.

US Revenue & International Revenue

- 2023 US revenue: $1.42 billion, accounting for approximately 56.7% of total revenue.

- 2023 International revenue: $1.08 billion, or 43.3% of total.

- Q1 2024 US revenue: $358.3 million (56.76% share), Q2 2024: $361.7 million (57% share).

- Q1 2024 International: $273 million (43.24% share), Q2 2024: $265.2 million (42.99%).

- While Dropbox’s international revenue has increased in absolute terms, its percentage share of total revenue has gradually declined since 2018 as U.S. growth has outpaced international expansion.

Average Revenue Per Paying User

- In Q2 2025, the average revenue per paying user (ARPU) stood at $138.32, down from $139.93 in Q2 2024.

- ARPU declined slightly from $139.26 in Q1 2025 to $138.32 in Q2.

- Long‑term growth trend: ARPU rose from $113.54 in 2015 to $139.93 in 2024.

- ARPU by year: 2022 – $134.51, 2023 – $139.38, 2024 – $140.23.

- Growth since 2019: ARPU up 13.7%.

- The modest ARPU drop reflects strategic shifts such as FormSwift scaling down and Simple Plan rollout.

- Despite pressures, Dropbox maintains pricing leverage by incrementally increasing ARPU over the years. The recent dip is a short-term trend.

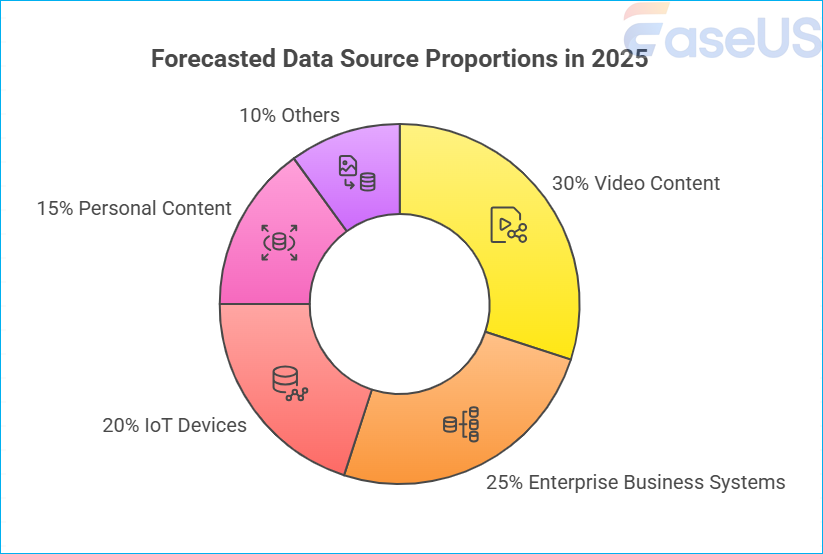

Forecasted Data Source Proportions

- 30% Video Content is projected to dominate as the largest data source.

- 25% Enterprise Business Systems will account for a quarter of the total data.

- 20% IoT Devices are expected to generate significant volumes of information.

- 15% Personal Content will continue to contribute a sizable share.

- 10% Others will make up the remaining data sources.

Market Share

- Dropbox accounts for around 2% of the file-sharing and collaboration tools market, though this varies by study and measurement scope.

- As of April 2025, average monthly site visits: Dropbox 137.2 million vs. Google Drive 2.4 billion.

- Dropbox is considered one of the most recognized personal cloud services globally, often grouped with major players like Google Drive, OneDrive, and iCloud in market coverage and user adoption.

- In file‑sharing tools used by companies, Dropbox counts 1,132,272 organizations, compared to 5.5 million using Google Drive.

- Dropbox competes in a crowded landscape, with over 115 competitor tools.

- The slight decline in paying users and revenue has triggered investor concern over Dropbox’s market position.

- Dropbox remains a recognizable brand but trails ecosystem-heavy platforms that integrate storage with productivity suites.

Growth Rate

- Paying user growth from Q2 2024 to Q2 2025, down by 90,000 (from 18.22M to 18.13M).

- Q1 2025 saw flat year-over-year, 18.16M paying users, but down 60,000 from Q4 2024.

- Earnings call guided for a ~1.5% decline in paying users for the full year.

- CAGR for paying subscribers from Q1 2019 to Q1 2025: 5.5%.

- ARR decreased ~1.2% YoY as of Q2 2025, and revenue fell 1.4% in Q2.

- Despite slowing user growth, operating margins improved (non-GAAP operating margin rose to 41.5%).

- Growth is flattening, and Dropbox has entered a mature phase, shifting from expansion to maintaining profitability.

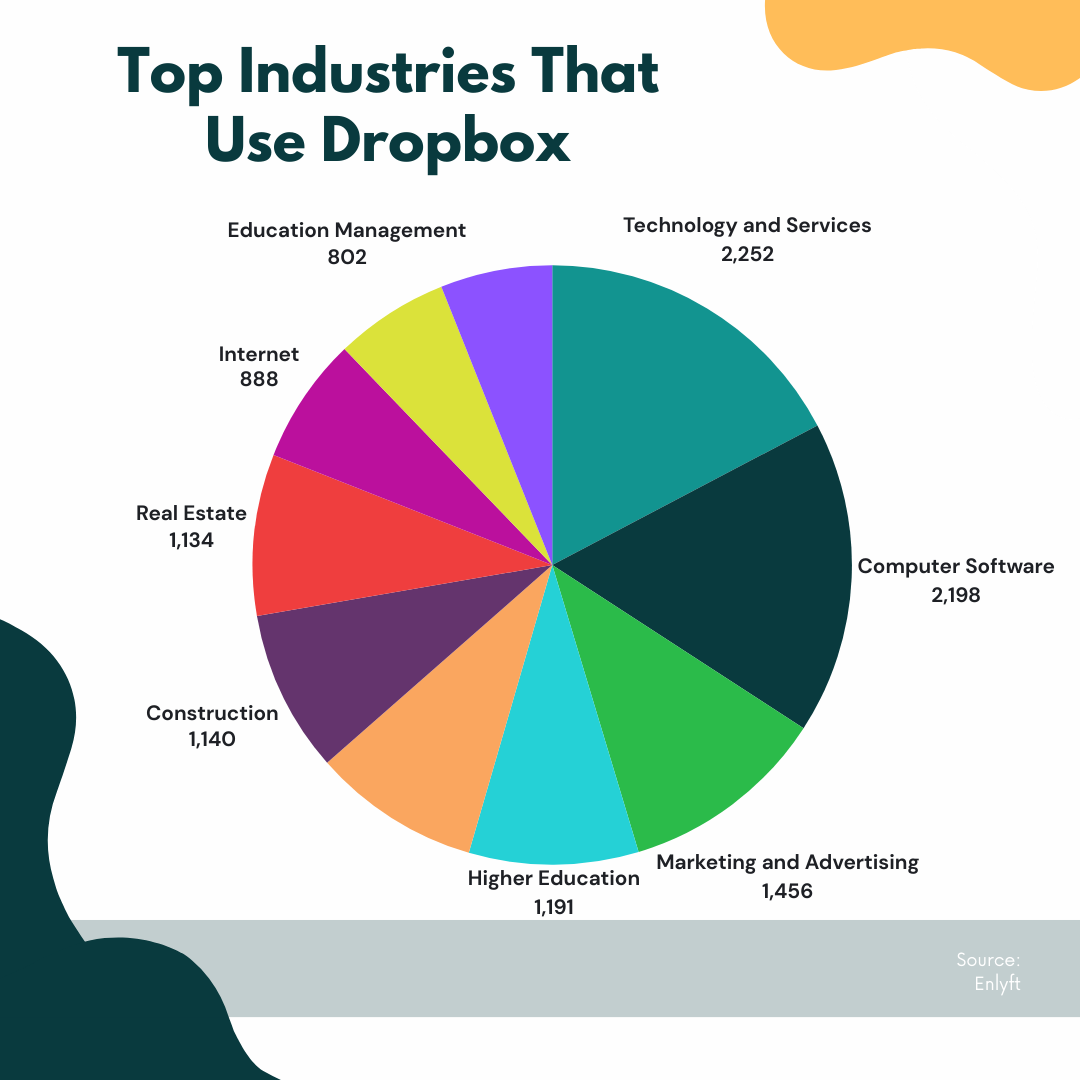

Top Industries That Use Dropbox

- Technology and Services leads with 2,252 companies using Dropbox.

- Computer Software follows closely with 2,198 companies adopting the platform.

- Marketing and Advertising accounts for 1,456 companies leveraging Dropbox.

- Higher Education has 1,191 institutions relying on Dropbox.

- Construction represents 1,140 companies utilizing the service.

- Real Estate contributes 1,134 companies as active users.

- The internet industry includes 888 companies making use of Dropbox.

- Education Management rounds out the list with 802 organizations.

Usage by Businesses

- 68% of Dropbox’s corporate users are based in the United States.

- Dropbox remains popular across sectors like higher education, marketing, nonprofits, construction, and real estate.

- Over 1.13 million businesses use Dropbox for document management.

- Many rely on Dropbox’s referral and freemium structure to debut usage in business contexts.

- Dropbox’s business plans offer HIPAA compliance, but Basic plans lack such enterprise features.

- Reports of decline, more companies now favor integrated productivity, storage platforms over standalone Dropbox.

- Dropbox’s development of AI‑powered tools like Dash may help business retention and appeal.

Personal Use Adoption

- As of 2025, an estimated 2.3 billion people globally use personal cloud storage platforms such as Dropbox, Google Drive, and iCloud.

- By 2025, 70% of global internet users will have at least one personal cloud account.

- In the U.S., over 80% of smartphone users back up images or contacts via personal cloud services.

- About 40% of U.S. families pay for storage upgrades of at least 200 GB.

- Among major personal cloud services, Dropbox remains widely used, though trailing giants like iCloud and Google Drive.

- Surveys suggest that individuals often use two to three cloud storage services concurrently, with Google Drive, iCloud, and Dropbox among the most common choices.

- Personal usage growth is robust, but Dropbox competes fiercely for consumer mindshare.

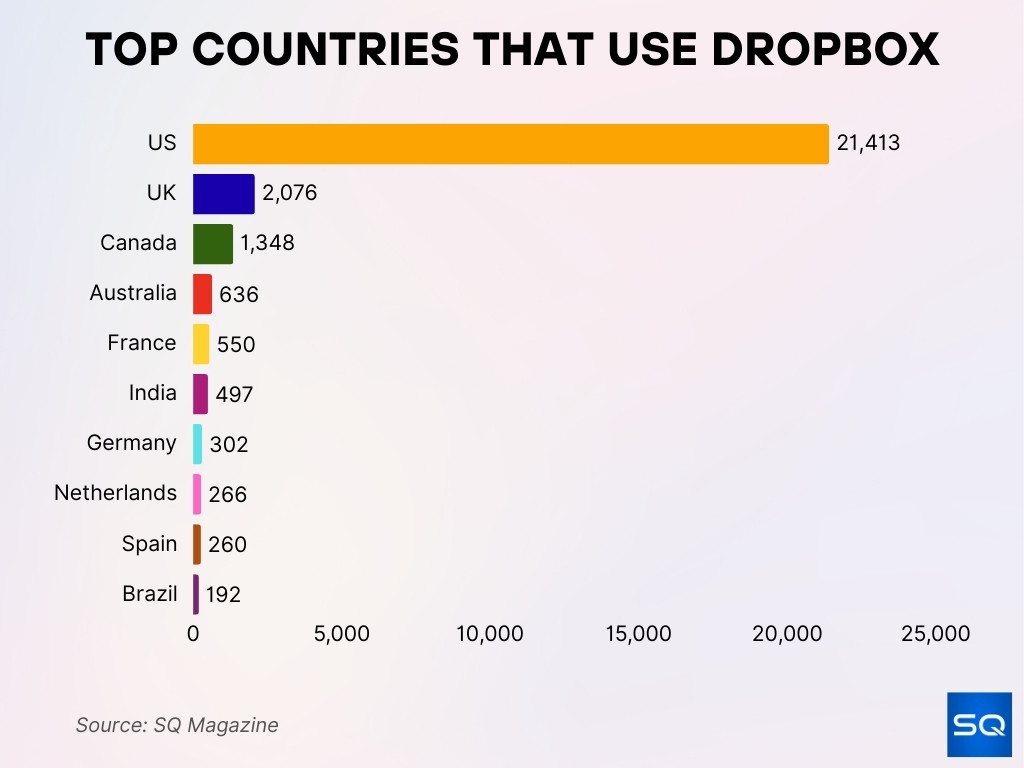

Top Countries That Use Dropbox

- United States leads with 21,413 companies, making up the majority share.

- United Kingdom follows with 2,076 companies using Dropbox.

- Canada has 1,348 companies adopting the platform.

- Australia accounts for 636 companies as active users.

- France contributes 550 companies to Dropbox’s base.

- India includes 497 companies utilizing Dropbox.

- Germany represents 302 companies using the service.

- Netherlands shows 266 companies relying on Dropbox.

- Spain has 260 companies among Dropbox users.

- Brazil rounds out the list with 192 companies.

Employee Count

- As of 2024, Dropbox employed 2,204 people.

- GAAP operating margin in Q2 2025 climbed to 26.9%, helped by reductions in headcount and employee costs.

- Acting on restructuring, Dropbox cut ~20% of its workforce in late 2024 and ~16% earlier in 2023.

- These workforce reductions contributed to improved margins and strong free cash flow (Q2 FCF was $258.5M).

- Dropbox continues to invest selectively in AI tools while maintaining a leaner cost structure.

Operating Expenses

- For the quarter ending June 30, 2025, Dropbox’s operating expenses were $457 million, marking a 9.9% year-over-year decline.

- Over the trailing twelve months through mid‑2025, operating expenses totaled $1.965 billion, a 5.35% increase year-over-year.

- In the full year 2024, operating expenses were $2.062 billion, up 5.05% from 2023.

- The drop in quarterly expenses reflects the reduction in headcount and streamlined overhead.

- Earlier reference, as of September 2023, Dropbox’s total operating expenses were $1.23 billion, up 9% from the prior year.

- These expense trends suggest disciplined cost management in 2025, despite modest growth challenges.

Storage Capacity

- Dropbox Basic (free) accounts include just 2 GB of storage.

- Users can earn up to an additional 16 GB via referrals, adding 500 MB per signup.

- Dropbox Plus plan offers 2 TB of storage, while the Professional/Essentials plans offer 3 TB.

- Business plans start at 9 TB for teams, depending on the plan.

- There’s a known soft limit; performance may degrade with over 300,000 files in a sync folder.

- In user reviews, Dropbox is praised for its intuitive syncing interface and strength in collaboration, though it’s no longer the most affordable choice.

File and Content Statistics

- Dropbox supports previews for more than 50 file formats, enhancing productivity.

- Syncing is efficient due to block‑level sync; only the changed file parts are re-uploaded.

- File versioning keeps past versions for up to 180 days, compared to 30 days in Google Drive.

- Dropbox’s Dash now includes advanced video and image search, speeding up content access.

- Dropbox retains a friendly folder structure (versus Google’s flat pool), supporting intuitive navigation.

- No specific total files stored data publicly available as of mid‑2025.

Referral Program Impact

- New users on Basic get 2 GB free storage, plus up to 16 GB via referrals.

- Each successful referral adds 500 MB of bonus storage.

- The program has been a key growth and engagement tool, particularly for consumer conversions.

- Dropbox Basic remains a popular entry point, with the referral system acting as a low-cost marketing lever.

Security and Compliance Statistics

- Dropbox experienced major data security incidents. In 2012, a breach exposed the emails and passwords of 68 million users.

- In May 2011, it faced FTC complaints around deduplication and employee data access via shared AES-256 keys.

- Dropbox improved access controls and reaffirmed data protection policies.

- As of mid‑2025, private encryption is not available on personal plans, but is coming to Dropbox Business.

- Generally, Dropbox remains secure for most users, but notable past breaches underscore ongoing vulnerabilities.

Platform Integrations

- Dropbox offers over 100 third‑party app integrations, including Microsoft Office 365 and Google Docs.

- Core tools include Dropbox Paper, Capture, Sign, plus DocSend and Dash for business workflows.

- Integrates with sector-specific apps for sales, HR, creatives, IT, and more, catering to wide enterprise needs.

- Its universal folder‑based model supports familiar UX across Windows, macOS, Linux, iOS, and Android.

- Dropbox excels at sync-first workflows, block-level syncing, fast previews, and seamless third-party plugin access.

Conclusion

Dropbox today anchors itself as a reliable, integration-focused cloud storage platform. Its shifting metrics, like a slight decline in paying users and revenue, highlight signs of maturity in a saturated market. Yet, impressive operating margins, strategic expense cuts, and innovations such as AI-powered Dash show a company seeking efficiency, not expansion at all costs. Security, while generally sound, bears the weight of past breaches, reinforcing the need for continued vigilance. Overall, Dropbox remains a household name for syncing, sharing, and collaborating, but it must keep evolving to stay competitive. Explore the full article for deeper insights and every statistic in context.