The derivatives segment of the cryptocurrency market is now one of its most influential components. From institutional desks hedging exposure in futures to retail traders speculating on perpetuals, derivatives shape price discovery, liquidity, and leverage across the digital asset ecosystem. In the commodities market, firms use derivatives to lock in costs or revenues.

Similarly, in crypto, an asset manager might use a Bitcoin futures contract to hedge a large spot holding, while a retail trader might use a perpetual swap to amplify a short-term bet on Ethereum. This article explores the latest statistical trends in crypto derivatives, how much volume they represent, how they’ve grown, and where the opportunity (and risk) lies.

Editor’s Choice

- $24.6 billion. The average daily trading volume of crypto derivatives in 2025, up about 16% from the prior year.

- $42.5 billion. The notional open interest in BTC options on Deribit reached this level in May 2025.

- Derivatives account for ~75-80% of total crypto exchange trading volume in 2025.

- Open interest in Bitcoin futures across exchanges hit as high as $66 billion in mid-2025.

- Perpetual swap contracts represent around 78% of crypto derivatives trading volume in 2025.

- The average daily volume of crypto futures & options at CME Group in Q1 2025 was $11.3 billion (198K contracts).

- Altcoin options markets (for Solana, Cardano) grew by 35% and 28% respectively, in 2025.

Recent Developments

- In Q1 2025, CME’s crypto futures and options suite saw average daily volume (ADV) of 198 K contracts, representing $11.3 billion notional.

- The broader crypto derivatives market continues to outpace spot markets, one study notes spot volumes fell 16.6% in early 2025, while derivatives declined only ~5%.

- Major futures venue Binance recorded a monthly volume of $1.7 trillion in May 2025 for Bitcoin futures.

- Altcoin derivatives open interest (for ETH, SOL, XRP, DOGE) surged to a combined $60.2 billion at one point.

- The dominance of perpetual contracts increased, with funding rate dynamics signalling higher participation in short-term leveraged trading.

- Institutional and regulated product offerings are expanding, CME and others are advancing crypto derivatives, which historically were dominated by offshore venues.

- DeFi derivatives platforms (e.g., dYdX, Synthetix) reached open interest levels of $1.45 billion by mid-2025.

- Regulatory scrutiny in major jurisdictions (U.S., EU, Asia) is increasingly focused on derivatives trading concentration and systemic risk.

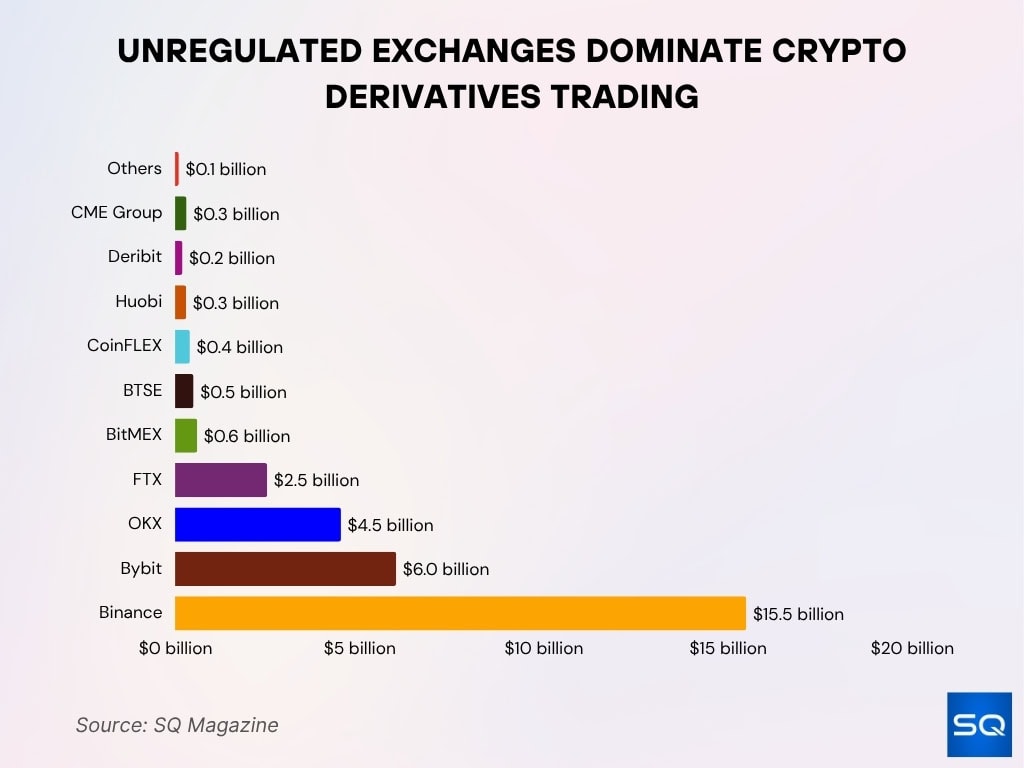

Unregulated Exchanges Dominate Crypto Derivatives Market

- Binance leads with $15.5 billion daily volume, far ahead of competitors.

- Bybit and OKX follow at $6.0 billion and $4.5 billion, respectively.

- FTX recorded $2.5 billion before its shutdown.

- CME Group (regulated) logs only $311 million daily, showing the imbalance.

- BitMEX: $0.6 billion; BTSE: $0.5 billion; CoinFLEX: $0.4 billion; Huobi: $0.3 billion; Deribit: $0.2 billion.

- About 97% of all crypto derivatives trading occurs on unregulated exchanges, raising oversight concerns.

Historical Growth of Crypto Derivatives

- In September 2023, monthly crypto derivatives volume hit $1.33 trillion, surpassing many spot markets.

- From 2024 to 2025, open interest in Bitcoin futures rose from ~$12 billion to ~$16.3 billion.

- Ethereum futures open interest climbed by 29% year-on-year in 2025.

- Futures product ADV at CME, Q4 2024 was 196K contracts ($10 billion notional), Q1 2025 jumped to 198K contracts ($11.3 billion notional).

- Perpetual contracts’ share of trading volume grew from ~70% in 2024 to around 78% in 2025.

- Altcoin options markets expanded notably, e.g., Solana options demand up 35%, Cardano up 28%.

- Decentralised derivatives venues saw meaningful growth (e.g., DeFi open interest in PDLPs).

- The composite open interest across major altcoins reached new all-time highs (e.g., $60.2 billion for ETH, SOL, etc.).

- Leverage structures and perpetual swap designs matured, enhancing capital efficiency and enabling deeper liquidity.

- Institutional adoption grew steadily, raising average contract sizes and lengthening holding periods compared to earlier retail-dominated cycles.

Trading Volume and Open Interest Statistics

- Daily crypto derivatives trading volume averaged $24.6 billion in 2025, up ~16% from 2024.

- Open interest in Bitcoin futures hit ~$16.3 billion, up from ~$12 billion in 2024.

- Ethereum futures open interest rose 29% in 2025, reflecting growing utility and speculation.

- Binance accounted for 33% of total crypto derivatives volume in 2025.

- Holding period for derivatives positions fell, ~81% of positions closed within 24 hours in 2025.

- On Deribit, Bitcoin options open interest reached $42.5 billion in May 2025.

- Across centralised derivative platforms, open interest in August 2025 was ~$187 billion.

- In Q1 2025, futures & options ADV at CME was $11.3 billion with open interest $21.8 billion.

- On Binance, Bitcoin futures open interest alone reached ~$13.6 billion in May 2025.

- Deep drawdowns in open interest (−20% to −25%) historically coincided with corrections of −7% to −21% in Bitcoin prices.

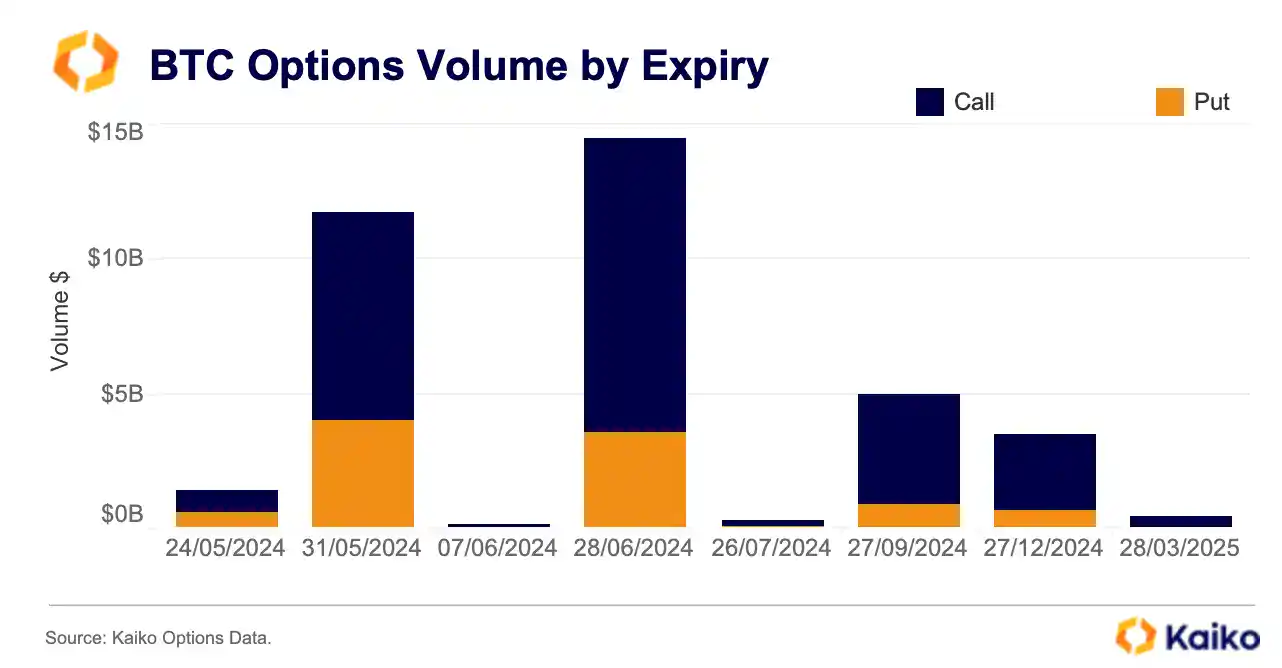

BTC Options Volume by Expiry

- June 28, 2024 leads with ~$15 billion total volume (Calls $9.5 billion, Puts $5.5 billion).

- May 31, 2024 follows with $11 billion total (Calls $6.5 billion, Puts $4.5 billion).

- September 27, 2024 and December 27, 2024 record ~$5 billion and ~$4 billion total volume, respectively.

- Short-dated expiries like May 24 and June 7 have under $2 billion and $0.2 billion, respectively.

- March 28, 2025 shows ~$0.5 billion, indicating limited long-term options activity.

Major Crypto Derivatives Products (Futures, Options, Perpetuals)

- Perpetual contracts (perps) remain the dominant product, accounting for ~78% of total crypto derivatives trading volume in 2025.

- The classic futures contracts on major assets like Bitcoin and Ethereum grew ~26% year-on-year.

- Options markets, once niche, are expanding, and altcoin options (e.g., for Solana and Cardano) grew 35% and 28% respectively, in demand.

- Regulated venues such as CME averaged ~198k contracts per day (futures + options) in Q1 2025, at $11.3 billion notional.

- Perpetuals offer 24/7 trading, no fixed expiry, and extremely high leverage (often up to 100×–125×) on some platforms, attracting both speculation and scrutiny.

- The growth of these distinct product types suggests diversifying strategies, hedging (futures/options), outright speculation (perps), and tokenised derivatives for yield seeking.

Perpetual Contracts and Open Interest Trends

- Open interest (OI) in perpetual futures for Bitcoin surged ~10% in one recent move, reaching ~$26.9 billion on offshore exchanges.

- One report cited a combined open interest for Bitcoin futures & perpetuals of ~$44.6 billion at a given time.

- In 2024 Q4, the top 10 centralised perpetual exchanges recorded $58.5 trillion in annual volume, more than double the 2023 level.

- The average holding period for derivatives positions collapsed further, with ~81% of positions closed within 24 hours in 2025.

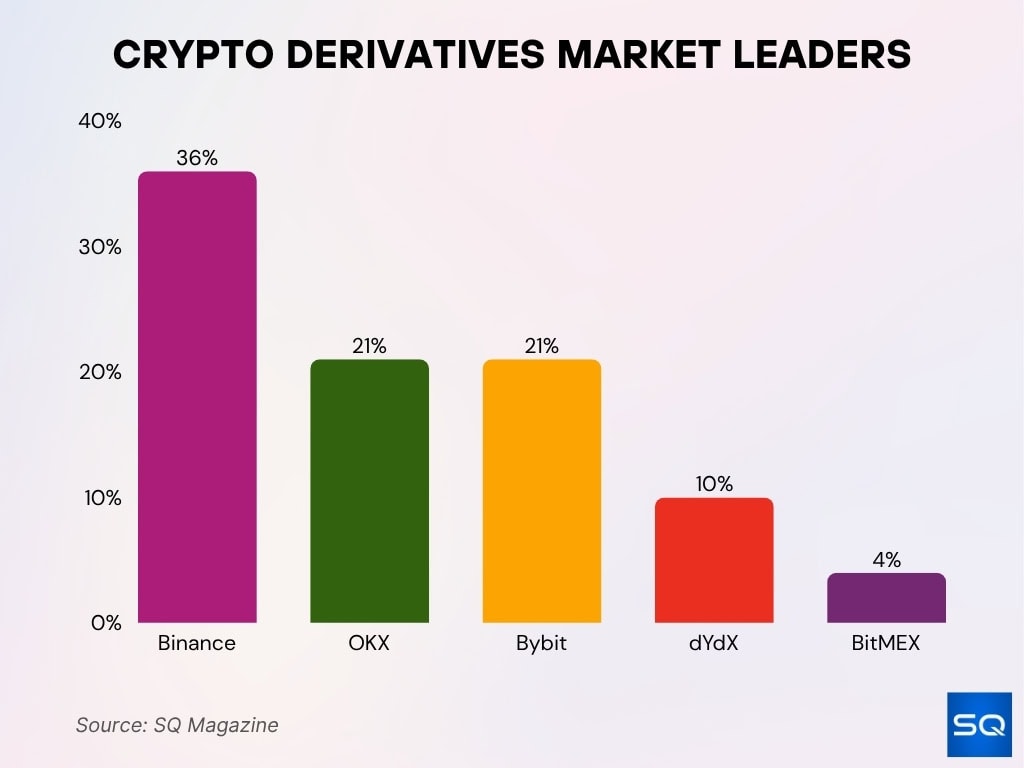

Leading Exchanges and Market Share

- Binance leads with a 36% market share, supported by deep liquidity and global reach.

- OKX and Bybit each hold about 21%, driven by efficient platforms and low fees.

- dYdX doubled its 2025 volume, now owning 10% of the DeFi derivatives market.

- FTX’s former share was absorbed by Bybit, Kraken, and OKX after its 2022 collapse.

- BitMEX maintains a 4% share, still appealing to high-leverage traders.

- Kraken and CME Group cater to institutions, with CME managing $2.6 billion in Bitcoin futures open interest by mid-2025.

- Huobi and Upbit dominate in Asia, combining for over 9% market share via local regulatory alignment.

Altcoin and DeFi Derivatives Growth

- Options demand for Solana options grew by ~35% and for Cardano by ~28% in 2025.

- DeFi derivatives platforms such as dYdX and Synthetix reached open interest around $1.45 billion by mid-2025.

- Institutional interest is shifting into alt and DeFi derivatives rather than only Bitcoin and Ethereum. One survey shows that ~42% of derivatives volume came from institutional players.

- Alt derivatives, including tokenised real-world assets, are gaining traction as traders seek yield exposure beyond the blue-chip tokens.

- The expansion of altcoin derivatives suggests diversification in trader behaviour and product innovation beyond the core BTC and ETH markets.

Institutional vs. Retail Activity

- In 2025, institutions reportedly account for ~42% of total crypto derivatives trading volume (including options).

- Retail trading still dominates high volatility altcoin derivatives; one source indicates retail comprises ~60-70% of alt options volume.

- Retail traders remain dominant in meme coins and quick speculation, while institutions focus on layer-1 infrastructure and DeFi blue chips.

- The regulated venue CME reported 198k contracts per day in Q1 2025, but its volume (~$11.3 billion) remains small compared to the unregulated global derivatives ecosystem.

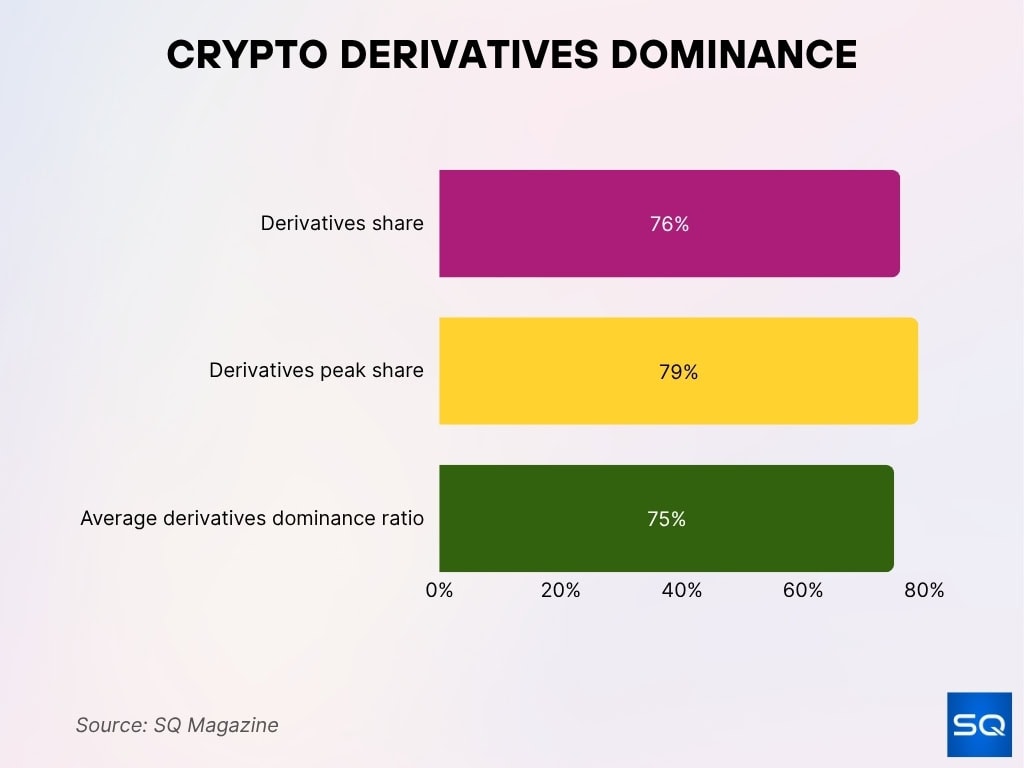

Derivatives Share of Total Crypto Market Volume

- By mid-2025, the derivatives segment represented approximately 76% of total cryptocurrency trading volume.

- At one point in June 2025, derivatives made up nearly 79% of the entire crypto market volume.

- The ratio was about 74.8%, illustrating the growing dominance of derivatives over spot markets.

- A report estimates that the global crypto derivatives market volume ranged between $20 trillion–$28 trillion by end-2024, underscoring its scale relative to spot.

- During periods of market stress, spot trading volume fell ~16.6% in early 2025, while derivatives trading volume contracted only ~5%.

- For the institutionally regulated venue CME Group, crypto derivatives volume in April 2025 jumped 129% to $8.9 billion, reflecting growth even within the regulated share.

- The rising share of derivatives implies that price discovery and liquidity increasingly live in derivative venues rather than spot exchanges.

Geographic Distribution of Derivatives Trading

- Top global derivatives platforms (e.g., Binance, OKX, Bybit) are consolidated outside the U.S., accounting for a large share of volume.

- Approximately 97% of total crypto derivatives volume is processed through unregulated exchanges, mostly offshore.

- For U.S. institutional access, CME accounted for only a fraction of volume, ~14% of total crypto futures volume in December 2024.

- In Q1 2025, the U.S. spot trading market for crypto declined significantly (-18.6%), while global volume patterns show strong derivatives activity.

- Asia, especially SE Asia & the Middle East, continues to be a strong derivatives trading region due to lighter regulation and high leverage appetite.

- The dominance of a few exchanges raises regulatory and market concentration concerns in major jurisdictions.

Margin, Leverage, and Liquidation Statistics

- On Sept. 22, 2025, approximately $1.5 billion in long derivatives positions were liquidated across major crypto exchanges in a single day.

- In a recent 24-hour period, over $1.36 billion in liquidations occurred, triggered by a rapid price drop and margin calls.

- The forced liquidation rate across key exchanges dropped around 13% in 2025 as margin monitoring and risk controls improved.

- Long traders accounted for nearly 90% of the liquidation volume during one major crash, with ~$1.14 billion in bullish bets wiped out while shorts made up ~$128 million.

- The share of positions closed within 24 hours rose to approximately 81% in 2025, pointing to shorter holding periods under high leverage.

- DeFi derivative platforms and perpetual futures exchanges raised insurance fund sizes to cover more than $670 million on major venues.

- September’s dataset showed “liquidation checks” and margin verifications spiked nearly 30% ahead of the crash event.

- Funding rates on perpetual contracts shifted negative ahead of a downturn; for example, ETH funding dropped to -0.0021, signalling traders paying to hold shorts.

- Leveraged exposure on major futures platforms declined modestly as traders reduced average leverage ahead of volatile periods.

Notable Developments in Crypto Derivatives

- The crypto derivatives market reached a record $8.94 trillion in monthly trading volume in 2025.

- Regulated exchanges with central clearing handled $9.8 billion in derivatives contracts in 2024, up 22% from 2023.

- The tokenised derivatives market value hit approximately $3.1 billion, driven by DeFi innovations in 2025.

- Decentralised derivatives platforms are growing at a projected 8.2% CAGR from 2025 to 2032.

- Over 97% of crypto derivatives volume is processed by unregulated exchanges, raising transparency calls.

- Central clearing and institutional risk controls expanded with 32 CFTC inspections in 2024, a 45% increase from 2023.

Technology and Decentralisation in Derivatives

- Decentralised derivatives via DeFi platforms are forecast to exceed 30% of total derivatives market volume by 2025-26.

- Blockchain-based derivatives platforms enable 24/7 trading and instant settlement with smart contract automation in 2025.

- Machine learning and LLM sentiment analysis tools have been integrated into derivatives risk frameworks, increasing predictive accuracy by over 20%.

- Smart contract perpetual futures represent over 78% of crypto derivatives trading volume in late 2025.

- Cross-chain interoperability advancements enable multi-chain derivatives trading across networks such as Ethereum, BSC, and Solana.

- Liquidity concentration increased on decentralised derivatives, with top DEX platforms controlling over 73% of the DEX market share.

- Smart contract risks like bugs and oracle failures account for approximately 10-15% of reported DeFi derivatives incidents in 2025.

- Enhanced margin monitoring, open interest tracking, and liquidation analysis tools now cover over 85% of derivatives platforms globally.

Future Outlook and Market Trends

- Institutional participation in crypto derivatives increased, contributing to a 140% rise in daily CME derivatives volumes year-on-year.

- More than 30% of derivatives volume is expected to shift to regulated venues in the U.S., EU, and Asia by late 2025.

- Platforms with advanced leverage risk controls and margin models attract over 60% more institutional capital.

- Tokenised collateral and synthetic derivatives markets have grown to over $33 billion, expanding exposure to traditional asset classes.

- AI integration and cross-chain interoperability have boosted product innovation and liquidity by approximately 25% in 2025.

- Regulatory fragmentation and systemic risks from high leverage remain challenges, with 45% of market participants citing these as concerns.

- Clearinghouse-style architectures are seeing pilot adoption, with 15% of major derivatives platforms integrating on-chain audit tools.

Frequently Asked Questions (FAQs)

~78%.

~42%.

198,000 contracts / $11.3 billion notional.

Over 30%

Conclusion

The crypto derivatives market is larger, more complex, and more integrated with traditional finance than ever before. From gargantuan liquidation events that highlight the risks of leverage, to regulatory shifts that aim to stabilise and legitimise the ecosystem, the next chapter is one of both opportunity and discipline. Technology and decentralisation are reshaping the landscape, but they also bring new demands for transparency, infrastructure, and oversight. For traders, investors, and institutions alike, the future of derivatives-based crypto exposure will depend not just on size but on structure, risk management, and regulatory alignment.