Cryptocurrency use continues to evolve today, reshaping how individuals interact with financial systems across the globe. From urban professionals in New York and Berlin to remittance users in Lagos and Manila, crypto adoption is spreading fast, shaped by socio-economic needs, regulation, and technological access. As regulatory clarity improves and infrastructure matures, digital assets are no longer niche instruments; they’re becoming part of mainstream financial behaviors. This article offers a data-rich look at who is using crypto, how, and why, revealing the patterns and profiles that define today’s crypto economy.

Editor’s Choice

- India and the U.S. lead in global crypto adoption, with grassroots usage expanding rapidly in emerging markets.

- 23% of upper-income U.S. adults have used crypto, compared to 14% of lower-income adults.

- Over 91.8% of crypto investors in Gemini’s 2025 report had household incomes below £100,000.

- In 2025, 50.1% of crypto investors have no university or advanced degree, highlighting broad appeal.

- Crypto adoption among Asian (28%) and Black/Hispanic (20%) adults in the U.S. surpasses that of white adults (14%).

- Crypto use for remittances and inflation hedging is expanding in regions like Latin America and Southeast Asia.

Recent Developments

- As of early 2025, the global number of crypto users reached 861 million, up from 562 million in 2024.

- India ranked #1 globally for crypto adoption in 2025, with the U.S. at #2.

- Global crypto market cap surpassed $2.5 trillion in Q1 2025.

- Stablecoins now account for roughly 30% of on‑chain crypto transaction volume, driven by savings, payments, and remittances.

- Crypto ownership in the U.K. rose from 18% in 2024 to 24% in 2025.

- Retail adoption rose significantly, with retail transactions increasing 125% year-over-year.

- On-chain value received in Japan grew 120% between 2024 and 2025.

- The U.S. SEC approved additional Bitcoin ETFs in 2025, increasing institutional access.

- Over 21% of U.S. adults now report having used digital assets.

- The Philippines and Nigeria saw increased regulatory clarity, fueling adoption.

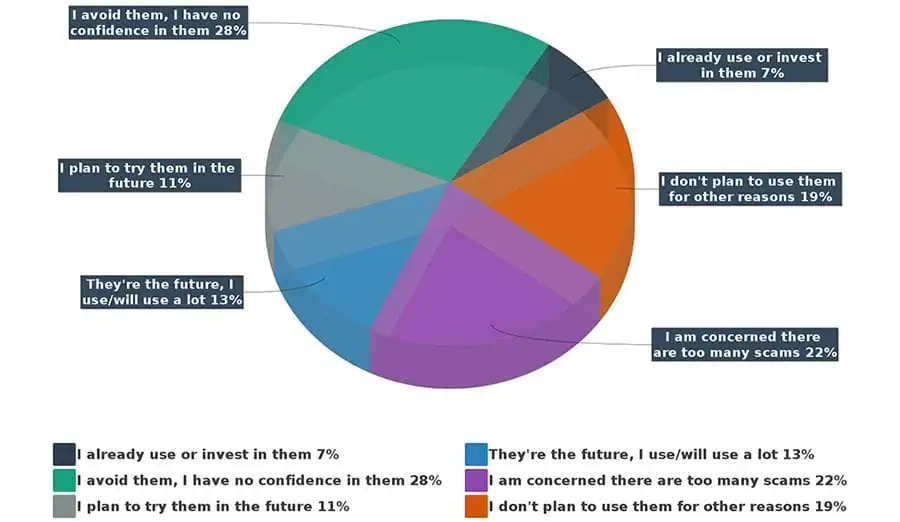

Public Sentiment Toward Cryptocurrency Usage

- 28% avoid crypto due to a lack of confidence.

- 22% worry about scams and stay away.

- 19% have other personal reasons for not using crypto.

- 13% see crypto as the future and plan heavy use.

- 11% intend to try crypto later.

- 7% currently use or invest in crypto.

Global Crypto User Distribution

- Asia remains the largest regional hub, with 326.8 million crypto users in 2025.

- North America follows with 72.2 million users, heavily concentrated in the U.S. and Canada.

- Latin America reached approximately 55 million users, led by Brazil and Argentina.

- Africa crossed 40 million users, with strong activity in Nigeria, Kenya, and South Africa.

- Europe is estimated to host over 100 million crypto users in 2025, with markets like France and the U.K. showing double‑digit ownership rates.

- The Middle East and North Africa (MENA) region hosts over 30 million crypto users.

- Southeast Asia is a high-growth zone, particularly the Philippines, Indonesia, and Vietnam.

- Russia, Ukraine, and Central Asia collectively reached over 20 million users, despite regulatory volatility.

- In Australia and Oceania, crypto ownership climbed to nearly 17% of adults.

- Institutional adoption continues to drive volume, though grassroots usage dominates in emerging regions.

Age-Based Demographics of Crypto Users

- 60% of global crypto users are under 35, with Gen Z and Millennials leading adoption.

- In the U.S., 28% of adults aged 18–29 have invested in crypto, compared to just 8% of those 65+.

- The average age of crypto holders globally is 34 years old.

- Gen Z investors often enter with small amounts, typically under $1,000.

- Younger users are more likely to use crypto for payments, not just investment.

- Millennials represent 45% of all crypto investors globally.

- Gen X adoption is rising, particularly among financially literate urban professionals.

- Baby Boomer adoption remains below 5%, reflecting trust and usability gaps.

- The gender gap is narrower among Gen Z users, with increasing female participation.

- Older users tend to prefer Bitcoin and Ethereum, while younger users explore NFTs and DeFi.

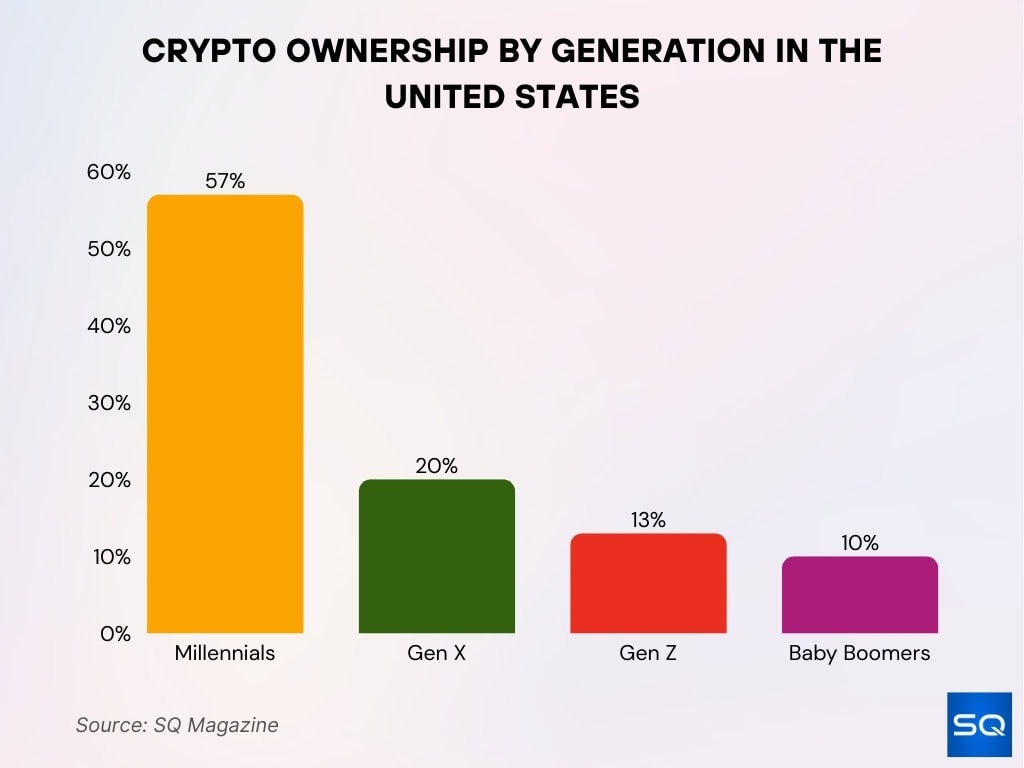

Crypto Ownership by Generation in the United States

- 57% of US crypto owners are Millennials, the largest group.

- 20% of crypto ownership belongs to Gen X.

- 13% of US crypto owners are Gen Z.

- 10% of crypto ownership comes from Baby Boomers.

Income Levels Among Crypto Investors

- 23% of adults in upper-income households in the U.S. have used cryptocurrency, compared to 18% of middle-income and 14% of lower-income.

- 76% of U.S. crypto investors in 2025 reported a positive impact from using crypto.

- Crypto holdings remain skewed toward higher-income individuals, though the gap is narrowing.

- Among active checking account users, higher income and male users dominate crypto account ownership.

- 91.8% of current or former crypto investors report a household income under £100,000.

- Upper-income Americans report 19% crypto ownership, above national averages.

- 51% of lower-income users have exited crypto entirely, compared to 36% of upper-income users.

- Income impacts both adoption and retention rates, with higher earners more likely to hold over time.

Education Level of Crypto Users

- 50.1% of crypto investors report having no university or advanced degree.

- Higher education sometimes correlates negatively with crypto investment intentions.

- Only 29% of adults globally meet digital financial literacy thresholds.

- 55% of crypto holders don’t know that crypto isn’t legal tender in their country.

- In some OECD countries, crypto ownership remains below 4%, despite higher education levels.

- One survey found that 50% of investors have a bachelor’s degree, and 28% have advanced degrees.

- Crypto investors show a bimodal education profile, with both under-educated and highly educated segments.

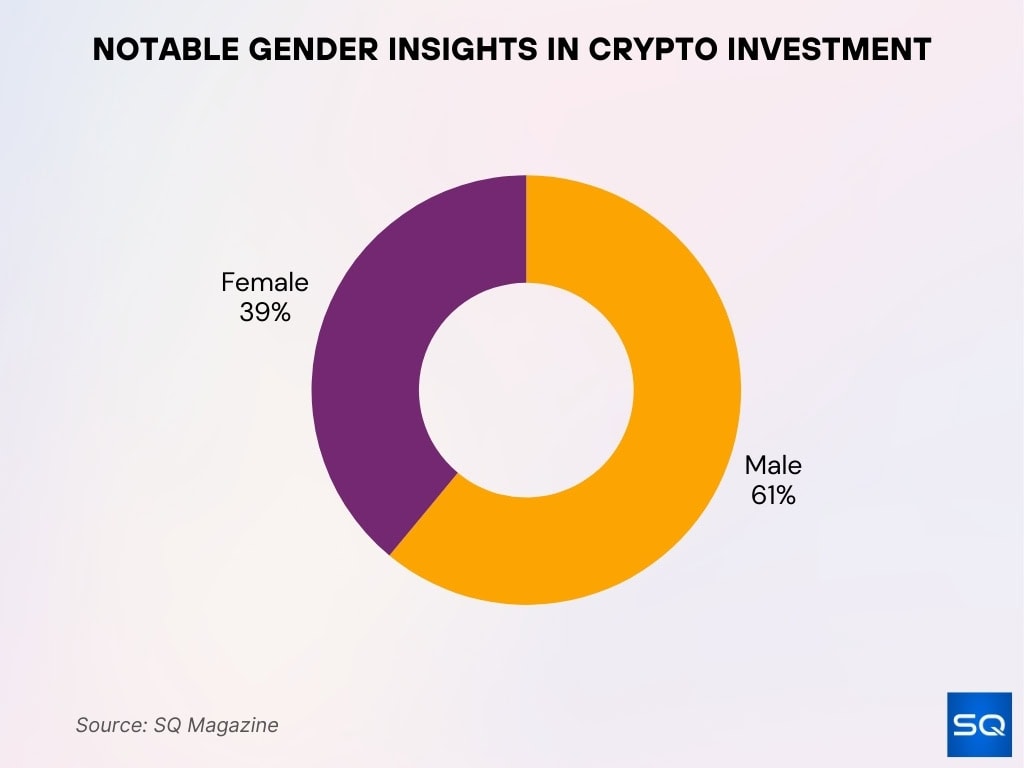

Notable Gender Insights in Crypto Investment

- 61% of crypto investors are male, showing strong male dominance.

- 39% of crypto investors are female, reflecting growing female participation.

Occupation and Industry Representation

- 67% of U.S. crypto owners are male vs 31% female, making men over twice as likely to hold accounts.

- Technology workers comprise 14% of crypto holders, the largest industry segment.

- Construction professionals represent 12% of U.S. crypto owners, exceeding finance at 7%.

- 24% of global crypto users work in technology, followed by 21% freelancers/gig workers.

- Finance/banking professionals account for 11% of worldwide crypto users.

- 67% of crypto owners are under 45, aligning with early- to mid-career professionals.

- 26% of crypto-owning households earn under $75K, including blue-collar sectors like manufacturing (7%).

- Institutions allocated $21.6 billion to crypto in Q1 2025, showing high-income overrepresentation.

Racial and Ethnic Demographics

- 28% of Asian adults in the U.S. report having used crypto.

- About 20% of Black and Hispanic adults report crypto use, compared to 14% of White adults.

- Black and Hispanic consumers are 2x more likely to use crypto for payments than White users.

- Non-citizen U.S. residents have a higher crypto payment rate than citizens, around 5.4% in 2022 vs 1.3% for citizens.

- Over 65% of remittance users in Latin America prefer crypto for faster cross-border transfers.

- Only 15% of crypto users are aged 55 or older, indicating older adults are underrepresented.

- Women account for 31% of crypto holders, but face awareness and participation gaps compared to men.

- Crypto adoption often reflects economic and social factors like financial access more than just knowledge or interest.

- Crypto use among immigrants is driven by remittance needs, with around 60% of unbanked adults relying on crypto for financial independence.

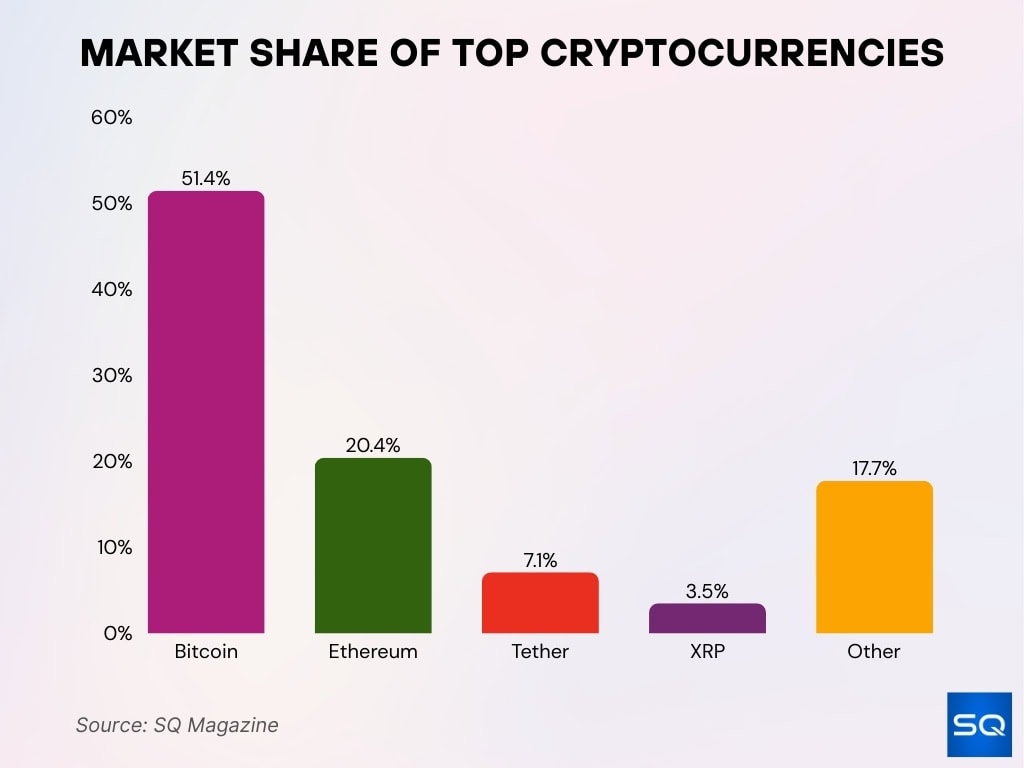

Market Share of Top Cryptocurrencies

- 51.4% of the total market cap belongs to Bitcoin.

- 20.4% of the market is held by Ethereum.

- 7.1% of the market cap comes from Tether.

- 3.5% of the total share is contributed by XRP.

- 17.7% of the market is made up of all other cryptocurrencies combined.

Adoption Rates by Region

- India and the United States top global adoption rankings in 2025.

- Global users grew from 420 million in 2023 to 562 million in 2024, then to 861 million in 2025.

- Asia leads with 326.8 million users, followed by North America at 72.2 million.

- Crypto ownership rose from 21% to 24% across surveyed countries in one year.

- The U.K. jumped from 18% to 24%, France from 18% to 21%.

- Emerging markets use crypto for remittance and financial access, not just speculation.

- Retail transactions increased 125% year-over-year, showing growing daily utility.

Top Countries Leading Adoption

- India ranks #1 in Chainalysis 2025 Global Crypto Adoption Index, followed by the United States at #2.

- Pakistan (#3), Vietnam (#4), and Brazil (#5) complete the top five in global rankings.

- Nigeria (#6), Indonesia (#7), Ukraine (#8), and the Philippines (#9) rank in the top ten.

- Emerging markets dominate the top 20, with APAC showing 69% on-chain value growth in 2025.

- South Asia led regional growth at an 80% increase in transaction volume, Jan-Jul 2025.

- Japan’s on-chain value surged 120% year-over-year to June 2025.

- APAC crypto transaction volume hit $2.36 trillion in 2025, up 69% from the prior year.

- US crypto activity rose 50% Jan-Jul 2025 vs 2024, reaching over $1 trillion.

Urban vs. Rural & Socio-economic Distribution

- Studies show urban crypto adoption is about 3x higher than rural due to infrastructure gaps.

- Around 80% of crypto users live in urban/metropolitan areas globally in 2025.

- Tech-savvy urban youth with limited banking access account for 45% of new adopters.

- Crypto adoption correlates strongly with urban digital infrastructure, present in 70% of global cities.

- In emerging markets, urban middle-class households represent 47% of crypto users, e.g., Brazil.

- High smartphone penetration in cities, often above 85%, supports crypto usage.

- Rural adoption is underreported, with only 20-25% of crypto wallets tied to rural IPs.

Motivations for Crypto Investment

- 46% of Millennials cite wealth building as the top motivation for crypto investment.

- 51% of emerging market users seek inflation protection through cryptocurrency holdings.

- 31% of investors are driven by positive price movements as the primary adoption factor.

- 37% of low-income users view crypto primarily as a remittance tool.

- 46% globally see crypto as an inflation hedge, up from 29% earlier in 2025.

- 42% of Gen Z are motivated by innovation and tech curiosity in crypto.

- 22% cite institutional adoption as a key driver for entering the cryptocurrency market.

- 35% of younger users are influenced by peers and social media communities.

Usage Patterns: Long-Term Holding vs Trading / Speculation

- 72% of the Bitcoin supply is unmoved for over 6 months, showing strong HODLing in emerging markets.

- 55-60% of retail holders resist selling during volatility, preferring long-term savings.

- 69% of U.S. owners report net gains from holding since purchase, vs 10% net losses.

- Institutions control 24% of Bitcoin, treating it as a diversified asset class for the long term.

- Cross-border stablecoin volume hit $18.7 trillion in 2025, key for remittances over trading.

- Lower-income users (59% under $25K) favor holding over active trading strategies.

- Short-term traders faced $15 billion in liquidations in one day amid 2025 volatility peaks.

- 73% of holders plan to continue or expand positions long-term into 2025.

- Gen Z/Millennials (68% of new HODLers) blend holding with staking for stability.

Impact of Regulation and Local Policies on Demographics

- Regulatory clarity boosted U.S. crypto adoption to 28% of adults in 2025, up from 27% in 2024.

- Countries with clear licensing saw 49% North America vs 42% prior year.

- GENIUS Act stablecoin rules grew supply to $280 billion by Sep 2025, broadening retail access.

- 14 stablecoins are fully regulated under MiCA, increasing institutional demographic participation.

- Japan’s strict rules enabled 31,000 retailers to accept crypto, expanding the user base.

- Nigeria’s sandbox issued 19 licenses, accelerating adoption despite prior restrictions.

- Policy instability reduced cautious users by 40% in uncertain markets.

Implications for Financial Inclusion & Access to Banking via Crypto

- Around 1 billion unbanked globally can access financial tools via crypto and mobile phones.

- 30% of urban populations without bank accounts use crypto as an alternative financial access.

- Crypto remittances cost as low as 1% vs traditional fees of 6.5%, saving billions annually.

- Stablecoins represent 30% of on-chain crypto volume, primarily used as digital savings and transfers.

- Crypto usage in underserved regions offers access to global finance previously unavailable to 63% of low-income users.

- Data on rural crypto adoption is limited, with estimates showing only 20-25% wallet activity linked to rural areas.

- Supportive national policies correlate with up to 40% higher financial inclusion via crypto.

- Crypto could help reduce global banking gaps that currently leave 1.7 billion adults unbanked.

- Digital payments usage among lower-income groups remains under 50% globally despite mobile access.

Frequently Asked Questions (FAQs)

14% of U.S. adults reported owning cryptocurrency in mid‑2025.

Approximately 861 million people globally are estimated to own cryptocurrency in 2025.

One major estimate puts the global crypto adoption rate near 10% of the world population in 2025, aligning with around 861 million users.

The 2025 report lists 241,700 crypto millionaires globally.

Conclusion

The landscape of cryptocurrency reveals a global market that is both diverse and rapidly evolving. Countries like India, the United States, Pakistan, Vietnam, and Brazil lead adoption, while emerging economies such as Nigeria, Indonesia, the Philippines, and Ukraine show strong grassroots engagement. Patterns of use vary; in many regions, crypto serves as a savings or remittance tool, while in others it remains an investable asset class blending trading and long-term holding.

Regulatory frameworks and local policies strongly influence who adopts crypto and how. Importantly, for millions, especially in underbanked or developing regions, crypto now offers a pathway toward financial inclusion. As adoption grows, present-day demographics may shift further, opening access to global financial systems for previously underserved communities.