Coinbase Wallet has grown from a niche self‑custody app to a mainstream gateway for decentralized finance, Web3, and NFT activity. Today, it distinguishes itself as one of the most widely used non‑custodial wallets globally, supporting millions of users interacting with crypto ecosystems without relying on centralized custody. Beyond simple storage, Coinbase Wallet now plays a visible role in mobile wallet rankings and powers new user engagement across DeFi and NFT protocols. The data below shows how this wallet’s scale, usage patterns, and ecosystem impact continue to evolve.

Editor’s Choice

- ~3.2 million monthly active users on Coinbase Wallet in 2025.

- ~120 million total monthly Coinbase platform users across all products in 2025.

- 8.7 million monthly transacting users on Coinbase overall.

- $237 billion in quarterly trading volume was reported in the most recent high‑activity period.

- Coinbase holds 12%+ of all Bitcoin and roughly 11% of staked Ether via its services.

- Coinbase joined the S&P 500 index in 2025.

Recent Developments

- Coinbase Wallet reached ~3.2 million monthly active users in 2025, reflecting sustained interest in self‑custody solutions.

- Coinbase became a member of the S&P 500 in May 2025, increasing institutional visibility.

- The company completed a major acquisition in 2025 valued at ~$2.9 billion, expanding its derivatives exposure.

- A disclosed cyber incident in 2025 affected less than 1% of transacting users.

- Estimated remediation costs for that incident ranged between $180 million and $400 million.

- Strategic partnerships expanded wallet access through mobile and device‑level integrations.

- Regulatory scrutiny remained elevated as user metrics and disclosures received closer review.

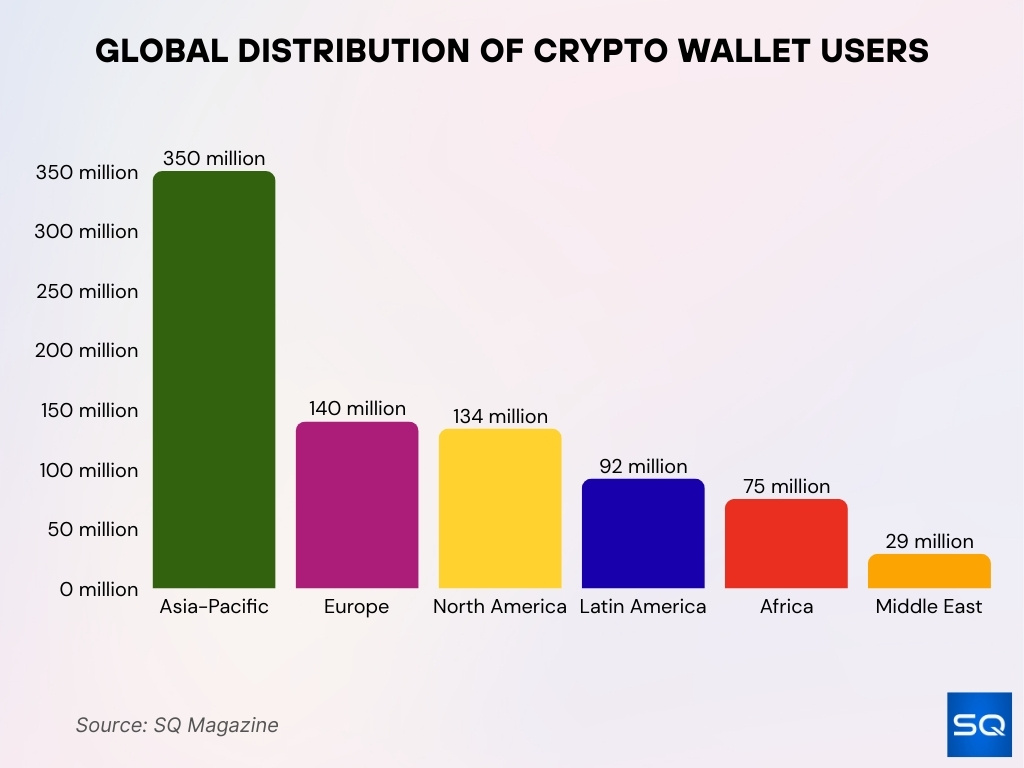

Geographic Distribution of Users

- Asia-Pacific leads with 350 million active crypto wallet users.

- North America holds 134 million wallet users.

- Europe hosts 140 million crypto wallet users.

- Latin America reached 92 million active wallet users.

- Africa expanded to 75 million crypto wallet users.

- Middle East reports 29 million active wallets.

- U.S. accounts for 68.6% of Coinbase users.

Coinbase Wallet Statistics: User Base and Monthly Active Users

- Coinbase Wallet recorded ~3.2 million monthly active users in 2025.

- Wallet MAUs represent roughly 2.7% of Coinbase’s total monthly user base.

- The broader Coinbase platform reported ~120 million monthly users across products.

- Monthly transacting users on the Coinbase platform stood at ~8.7 million.

- Wallet growth has trailed exchange growth, reflecting different risk and usage profiles.

- Engagement remains higher among users interacting with DeFi, NFTs, and swaps.

- Industry benchmarks suggest crypto wallet activation rates typically fall between ~5% and 10%.

App Downloads and Installation Trends

- Coinbase mobile apps averaged ~10,000 daily downloads recently.

- Coinbase Wallet reports 3.2 million monthly active users.

- The crypto wallet market is valued at $14.01 billion.

- Self-custody wallets accounted for 68% of crypto transactions.

- Global crypto wallet users exceed 300-400 million worldwide.

- Crypto wallet market grows at 24% CAGR.

- Android holds ~61% of mobile wallet installs.

- Emerging markets lead in crypto wallet adoption rates.

- Retail self-custody satisfaction reaches 63%.

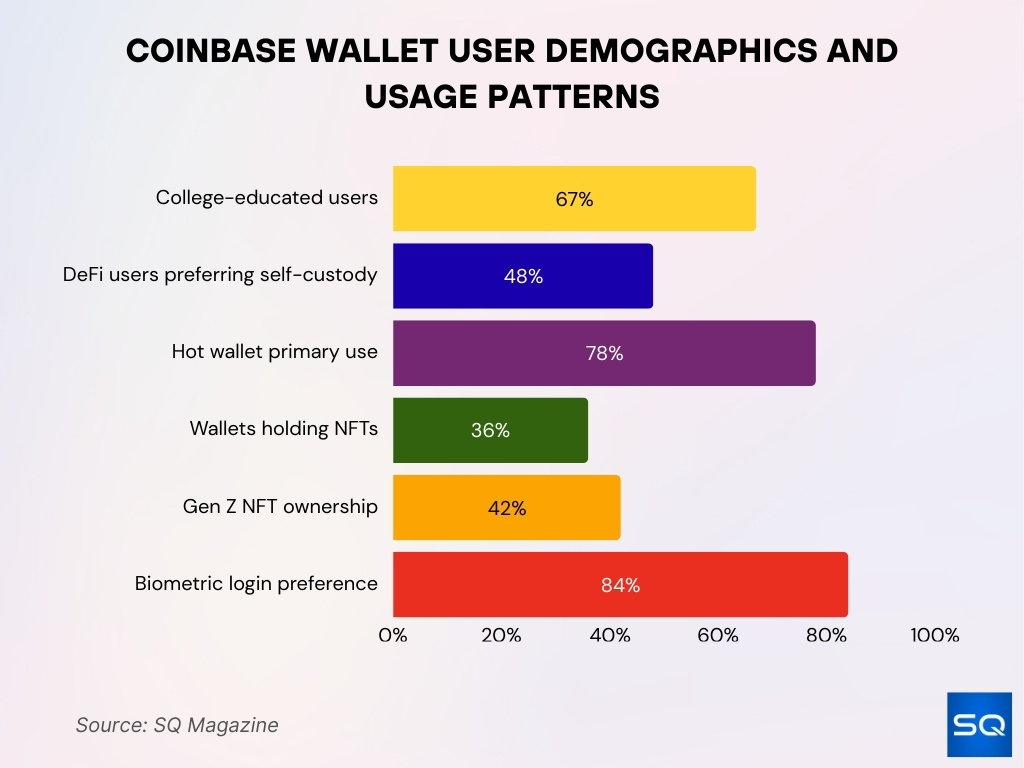

User Demographics and Behavior

- Wallet users aged 18–34 represent the majority.

- 67% of users hold college degrees or higher.

- 48% of DeFi users prioritize self-custody wallets.

- 78% use hot wallets as primary storage.

- 36% of wallets contain NFTs.

- 42% Gen Z surge in NFT wallet ownership.

- 84% mobile users value biometric login.

Assets Under Custody and AUM

- Institutional assets under custody hit $245 billion.

- Coinbase holds over 12% of the circulating Bitcoin.

- Coinbase controls 11.42% of all staked Ether.

- Coinbase manages 16% of the global crypto market cap.

- Stablecoin revenue contributed $355 million in Q3.

- Institutional trading volume at $194 billion quarterly.

- Coinbase supports 420+ assets for custody.

- Bitcoin holdings total 884,000 BTC worth $82 billion.

Transaction Volume and On-Chain Activity

- Global crypto trading volume hit $425 billion quarterly.

- Coinbase’s monthly transacting users reached 8.7 million.

- Stablecoin transfer volumes surged 690% year-over-year.

- Q3 consumer trading volume rebounded to $59 billion.

- Institutional trading volume totaled $194 billion quarterly.

- Retail trading volume processed $43 billion in Q2.

- Stablecoin transaction revenue contributed $355 million.

- DeFi TVL stands at $129 billion.

- NFT sales volume reached $2.8 billion in H1.

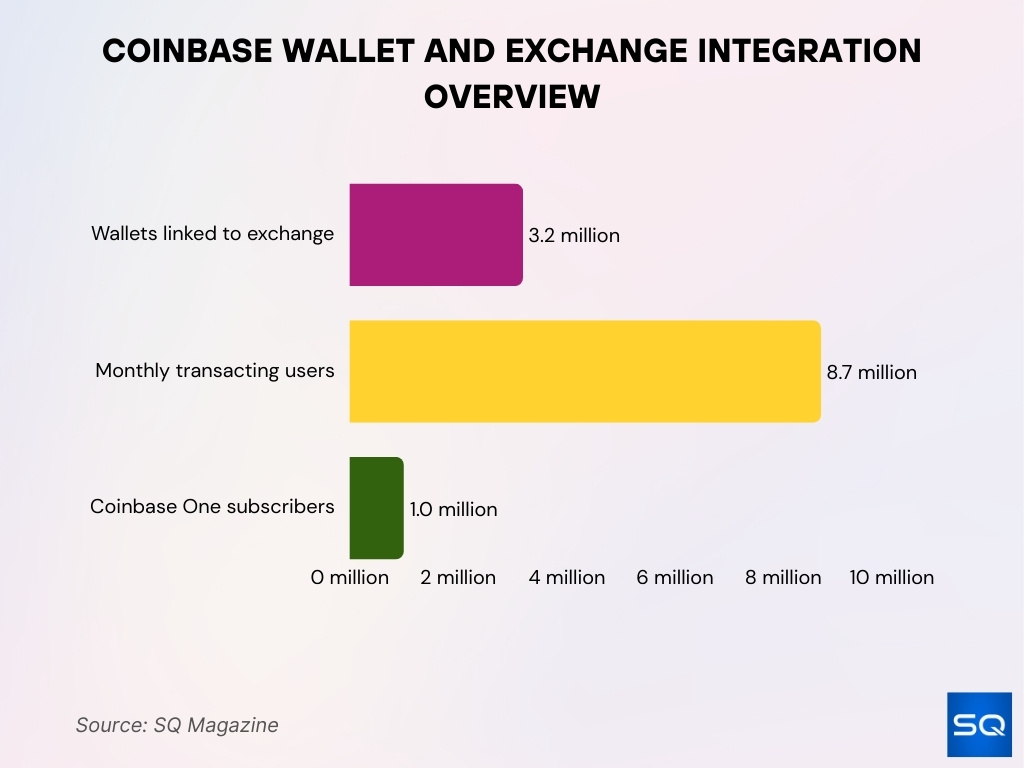

Integration with Coinbase Exchange

- 3.2 million monthly active wallet users link to the exchange.

- 8.7 million monthly transacting users across platforms.

- 1 million Coinbase One subscribers for premium features.

- 20% growth in the combined user base year-over-year.

- Supports 270+ cryptocurrencies across wallet and exchange.

- Stablecoin revenue shares 22% of total company revenue.

- $237 billion quarterly trading volume reported.

- 93% YoY increase in net income to $2.86 billion.

DeFi Usage and DApp Interactions

- 198 million wallets are active in DeFi globally.

- 48% of wallets interacted with at least one dApp.

- 294 million wallets linked to NFTs.

- 61% NFT interactions from gaming sectors.

- 92 million staking-enabled DeFi wallets.

- Average DeFi wallet supports 5.4 tokens.

- An average DeFi wallet interacts with 2.3 chains.

- DeFi TVL totals $129 billion across protocols.

- 42% Gen Z surge in NFT wallet ownership.

NFT Activity and Web3 Engagement

- 294 million wallets linked to NFTs globally.

- NFT market size projected at $60.82 billion.

- NFT sales volume reached $2.8 billion in H1.

- Ethereum dominates 62% of NFT contracts.

- Gaming NFTs represent 38% of transaction volume.

- 33% Web3-familiar users own wallets.

- NFT market cap estimated at $5.6 billion.

- Base network grew active NFT wallets by 1,280%.

- The global NFT industry was valued at $43.08 billion in the prior year.

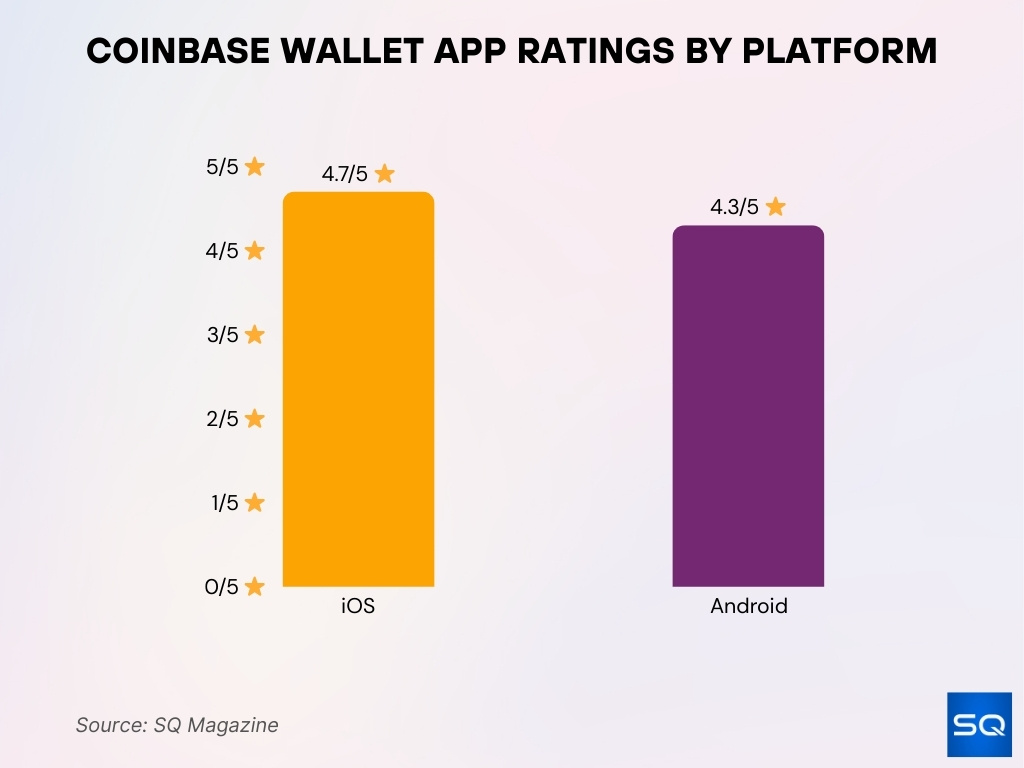

Device, Platform, and OS Usage

- Mobile devices drive over 90% of Coinbase Wallet usage.

- Android captures ~54% of global wallet installs.

- 100 million+ total mobile app downloads.

- 3.2 million monthly active mobile wallet users.

- Coinbase ranks as one of the top 50 finance apps on the App Store.

- 120 million monthly mobile platform visits.

- Mobile-first users show higher retention rates.

Revenue Impact and Monetization Metrics

- Total Q3 revenue reached $1.869 billion.

- Subscription and services revenue at $698.1 million in Q1.

- Coinbase One surpassed 1 million paying subscribers.

- 22% of revenue from stablecoins.

- Transaction revenue accounted for 59% of the total.

- Adjusted EBITDA stood at $930 million in Q1.

- Net income increased 93% YoY to $2.86 billion.

Security, Risk, and Incident Statistics

- 98% of Coinbase customer assets are in cold storage.

- Less than 1% of transacting users were affected by the 2025 breach.

- 69,461 customers were impacted in the 2025 data incident.

- Global crypto scams stole $17 billion in 2025.

- Phishing accounts for 36% of data breaches.

- Wallet drainer scams caused $500 million in losses.

- 78% wallets are hot wallets vulnerable to exploits.

- 22% cold wallet usage among institutions.

- Infostealers harvested 1.8 billion credentials.

Compliance, Regulation, and Reporting Metrics

- Coinbase holds 40+ US state money transmitter licenses.

- Secured MiCA license from Luxembourg CSSF.

- Fined €21.5 million by the Irish Central Bank for AML failures.

- €176 billion in unmonitored transactions in a 12-month period.

- 2,700 suspicious transaction reports were filed late.

- $355 million costs from the 2025 security incident response.

- KYC required for all trading, staking, and fund transfers.

- Registered as MSB with FinCEN for custodial services.

Feature Usage (Staking, Swaps, Bridges)

- 3.2 million monthly active users for staking, swaps, and bridges.

- Ethereum staking totals 36 million ETH (~$118 billion).

- 30% of the total ETH supply is staked globally.

- cbETH collateral supports loans up to $1 million USDC.

- Swaps compare rates across 75+ DEXes.

- Bridge supports Polygon, Base, Arbitrum, and Optimism.

- Bridge fees average $6.20 per transaction.

- Swaps slippage set to 3% default.

- Daily active addresses surged 112% YoY to 1.1 million.

Frequently Asked Questions (FAQs)

The latest reported quarterly trading volume for Coinbase was ~$237 billion.

Coinbase Wallet supported 270+ cryptocurrencies across multiple blockchains by late 2025.

Roughly 93% of verified Coinbase users were not trading monthly, implying only about 7% monthly engagement as an estimate.

Conclusion

Coinbase Wallet’s outlook reflects a broader shift toward self‑custody, on‑chain utility, and diversified crypto participation. While the wallet itself does not generate most company revenue directly, it plays a central role in enabling DeFi access, swaps, NFTs, and cross‑chain activity. Security investments, regulatory navigation, and mobile‑first design continue to shape adoption patterns. Together, these statistics show how Coinbase Wallet functions less as a standalone app and more as an infrastructure layer for the next phase of crypto usage.