Cloudflare continues to shape the way the internet works, from speeding up websites to protecting them from cyberattacks. The company’s edge network and security products power millions of web properties and serve as a backbone for global online infrastructure. Today, Cloudflare’s services are critical in industries such as online retail (ensuring fast, secure transactions) and media streaming (reducing outages and latency for large audiences). As you explore this article, you’ll find the latest data on Cloudflare’s growth, performance, customers, and financial standing.

Editor’s Choice

- Cloudflare’s third‑quarter 2025 revenue reached $562 million, up 31% year‑over‑year.

- Total paying customers exceeded 265,000 by mid‑2025, a 27% increase from a year earlier.

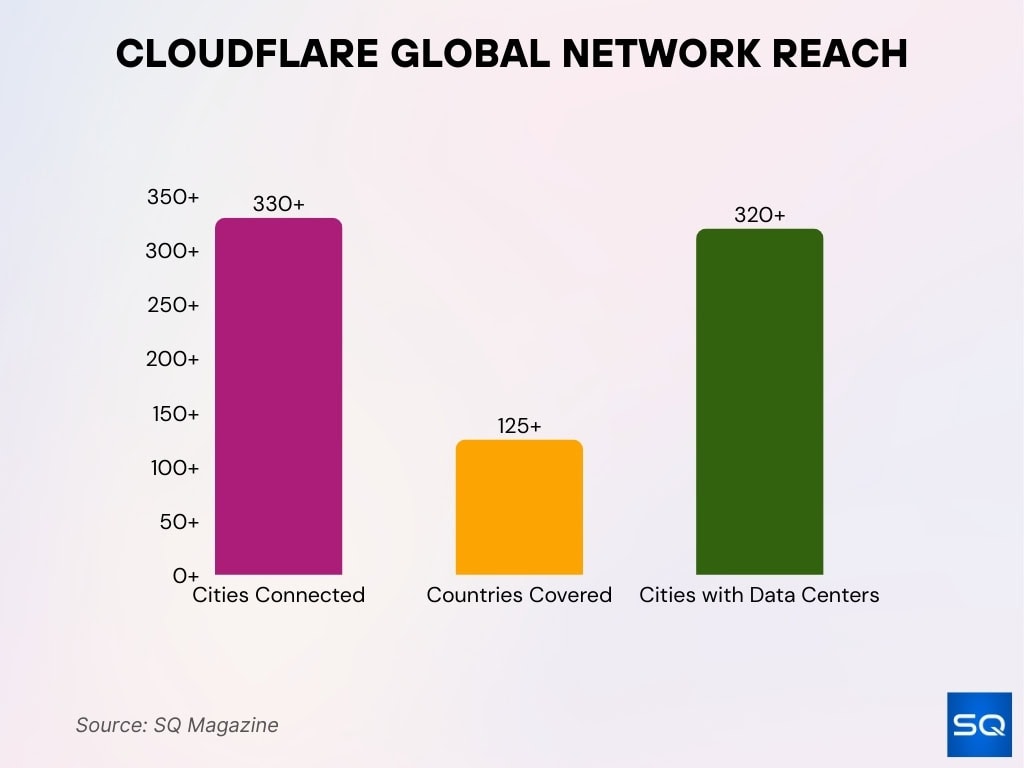

- Cloudflare’s global network spans 330+ cities in over 125 countries.

- More than 24 million active websites worldwide use Cloudflare services.

- Cloudflare’s CDN covers around 20–25% of all internet sites.

- Large enterprise customers (≥$100K ARR) grew over 22% year‑over‑year.

- The company blocked 416 billion AI bot requests from July through late 2025.

Recent Developments

- Cloudflare experienced major global outages multiple times in late 2025, disrupting sites like LinkedIn, Zoom, and Fortnite.

- Outages in December 2025 affected roughly 20% of all websites for a short period.

- The company apologized and committed to transparency following repeated service disruptions.

- Cloudflare launched the Content Independence Day initiative, automatically blocking AI bots unless sites opt in.

- Between July and December 2025, the initiative helped block over 416 billion AI bot scrape requests.

- New policies like Content Signals offer site owners more control over AI crawling and licensing.

- Cloudflare expanded partnerships for AI security and Zero Trust tooling throughout 2025.

- Gartner recognized Cloudflare’s SASE platform as a Visionary in 2025, highlighting its security roadmap.

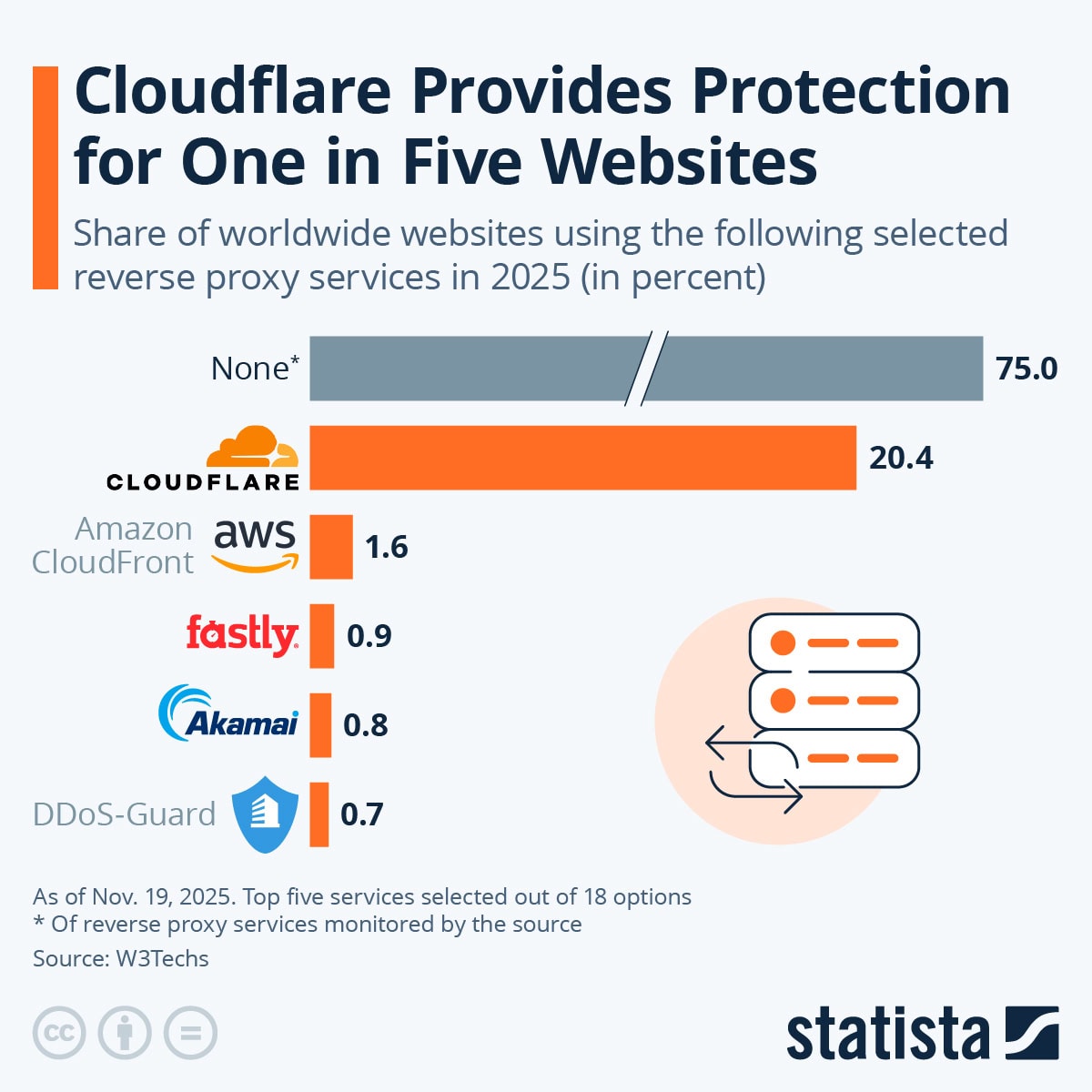

Reverse Proxy Usage Statistics

- 75% of websites globally do not use any reverse proxy service, highlighting the untapped market potential.

- Cloudflare leads the market, protecting 20.4% of all websites worldwide, 1 in every 5 sites.

- Amazon CloudFront powers reverse proxy services for 1.6% of global websites.

- Fastly is used by 0.9% of websites, focusing on high-performance edge delivery.

- Akamai, a long-standing CDN player, accounts for 0.8% of sites using reverse proxies.

- DDoS-Guard rounds out the top five, used by 0.7% of websites, especially in niche security-focused segments.

Cloudflare Revenue and Financial Performance

- Q3 2025 revenue was $562.0 million, a 31% increase compared to the prior year.

- GAAP gross profit in Q3 was $415.7 million (about 74% margin).

- Q3 non‑GAAP operating income reached 15.3% of revenue.

- Q1 2025 revenue totaled $479.1 million, up 27% year‑over‑year.

- Cloudflare anticipates ~$2.09 billion in total 2025 revenue, reflecting continued growth.

- Cash flow from operations in Q3 rose to $167.1 million.

- Free cash flow in Q3 was $75 million, or around 13% of revenue.

- Cloudflare’s U.S. revenue historically accounts for over half of its total income, underscoring its strong domestic market.

Cloudflare Customers and Paying Users

- Cloudflare reported 265,929 paying customers by the end of Q2 2025.

- That represents a 27% increase in paying customers over the prior year.

- The company saw 3,712 large enterprise customers spending $100,000+ annually.

- Customer retention was strong, at ~114%, indicating expansion within accounts.

- Cloudflare serves millions of internet properties, ~24 million sites globally.

- Around 17% of Fortune 1000 companies use Cloudflare’s network.

- The vast customer base includes small businesses to global enterprises, reflecting diversified demand.

Global Network Size and Data Centers

- Cloudflare’s network connects to more than 330 cities worldwide across over 125 countries, making it one of the largest CDN and edge networks.

- The platform maintains data center presence in 320+ major cities, supporting local traffic handling and lower latency.

- Roughly 20% of all global web traffic flows through Cloudflare’s network in 2025.

- Cloudflare peers with over 12,500 network operators globally, expanding reach and improving route efficiency.

- The network supports 4.3 trillion DNS queries per day, feeding threat detection and traffic insights.

- Cloudflare’s infrastructure enables local content delivery within regional ISPs, helping reduce backbone congestion.

- Cloudflare’s global presence helps support Zero Trust enforcement points near users, improving security without central bottlenecks.

Large Enterprise and High‑Value Customers

- By Q2 2025, Cloudflare reported 3,712 large customers paying $100,000+ annually, up 22% year over year.

- Large customers contributed 71% of Cloudflare’s total revenue in Q2 2025, up from 67% a year earlier.

- Cloudflare’s large customer segment has expanded about 2.8× since 2021, reflecting strong enterprise penetration.

- By mid‑2025, Cloudflare served roughly 266,000 paying customers overall, with large accounts representing about 1.4% of that base.

- As of late 2024, at least 173 Cloudflare customers generated over $1 million in annual spend, highlighting a growing ultra‑high‑value tier.

- Cloudflare’s active website footprint reached about 24.03 million in early 2025, supporting adoption among finance, e‑commerce, edtech, and media enterprises.

- Cloudflare’s large customer count grew ~29.5% year over year to 3,046 by Q2 2024, laying the base for the 3,700+ threshold reached in 2025.

- In 2025, Gartner recognized Cloudflare in the Magic Quadrant for Security Service Edge (SSE) for the third consecutive year, underscoring its enterprise security role.

- Cloudflare’s 2025 SASE recognition as a Visionary reflects strong enterprise demand for unified Zero Trust, SASE, and DNS‑resolver capabilities.

Performance and Latency Improvements

- Between November 2024 and March 2025, Cloudflare became the fastest network in 48% of the top 1000 networks by 95th percentile TCP connection time, up from 44% in September 2024.

- In early 2025, Cloudflare achieved a p95 TCP connect time of 116 ms, outperforming Fastly at 122 ms, Google at 124 ms, CloudFront at 127 ms, and Akamai at 153 ms.

- From 2021 to 2025, Cloudflare’s share of top networks where it ranked #1 by p95 TCP connect time rose from 33% to 48%, marking a 15 percentage point gain.

- Example measurements in Cloudflare’s CDN guide show that caching content closer to users can cut latency by about 1900 ms, improving load time from roughly 3000 ms to 1100 ms.

- Internal benchmarks highlight that QUIC and HTTP/3 handshakes can complete in 1 round-trip or less, compared with the 2–3 round-trip delays typical of legacy TCP+TLS flows, reducing connection setup delays.

- Third‑party comparisons in 2025 show Cloudflare often delivering 10–30% lower global response times than competing CDNs such as CloudFront and Akamai for many web workloads.

- Case examples report that fully cached pages on Cloudflare can drop time to first byte from around 300 ms to under 50 ms, while improving First Contentful Paint from about 2.4 s to 0.9 s.

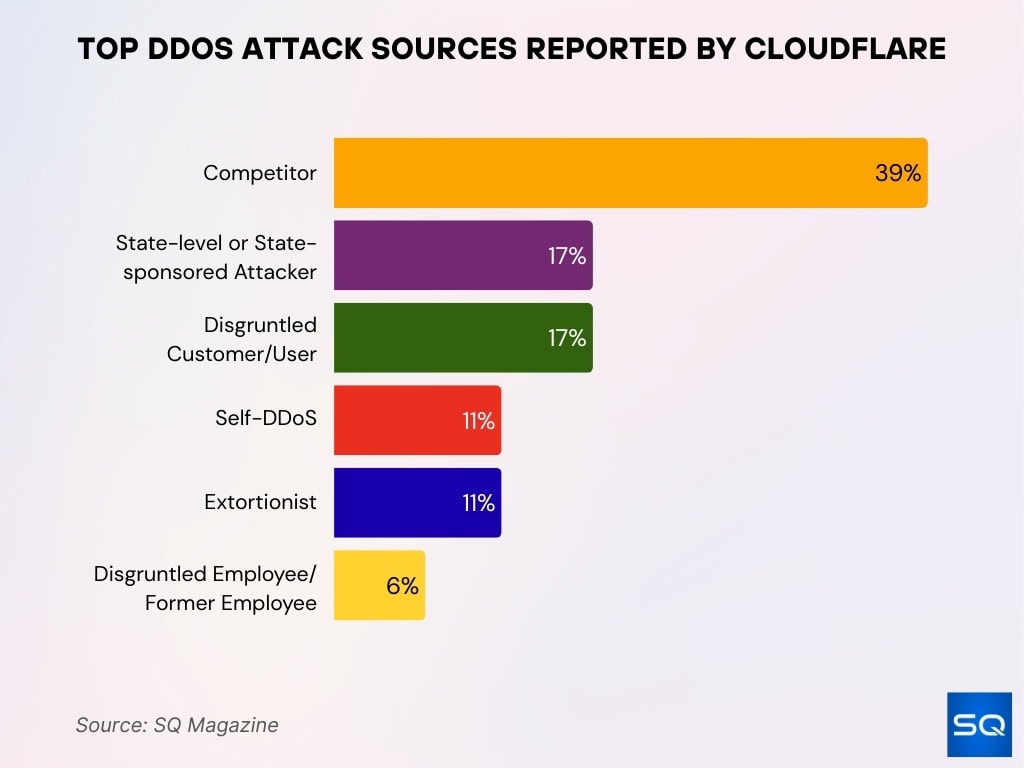

Top DDoS Attack Sources Reported by Cloudflare

- 39% of attacks were launched by a competitor, making it the leading threat source for Cloudflare customers.

- 17% originated from state-level or state-sponsored attackers, indicating rising involvement of nation-state actors in cyber disruptions.

- 17% of DDoS attacks were triggered by a disgruntled customer or user, reflecting emotional or retaliatory motivations.

- 11% were self-DDoS incidents, where organizations may have initiated attacks on themselves—either for testing or deceptive purposes.

- 11% came from extortionists, showing a strong financial incentive behind many DDoS campaigns.

- 6% of attacks were blamed on a disgruntled or former employee, highlighting the risk of internal threats within organizations.

Bandwidth Savings and Caching Efficiency

- In 2025, Cloudflare case studies show some sites reduce origin bandwidth by over 50% after enabling CDN caching and optimization tools.

- Typical Cloudflare deployments report average bandwidth reductions of around 60% and cuts of about 65% in total origin requests through intelligent caching.

- Well‑tuned Cloudflare cache configurations can raise cache hit rate from about 30% to 90%, dropping server load by roughly 90%.

- Example Cloudflare users report lowering Time to First Byte from roughly 500 ms to around 100 ms after boosting cache hit ratios and edge TTLs.

- CDN and caching use cases indicate that CDN‑served traffic can cut cloud egress‑related data transfer volumes by 60–80%, materially reducing bandwidth bills.

- Compression and minification of assets can shrink file sizes by roughly 50–70%, directly lowering bandwidth consumption on image and static asset delivery.

- Cloudflare customers frequently see page load times improve by about 50% when caching and optimization reduce repeated origin fetches and server processing.

- Cloudflare cache analytics guides recommend targeting cache hit ratios of at least 80%, which typically produces “obvious” bandwidth savings at the origin.

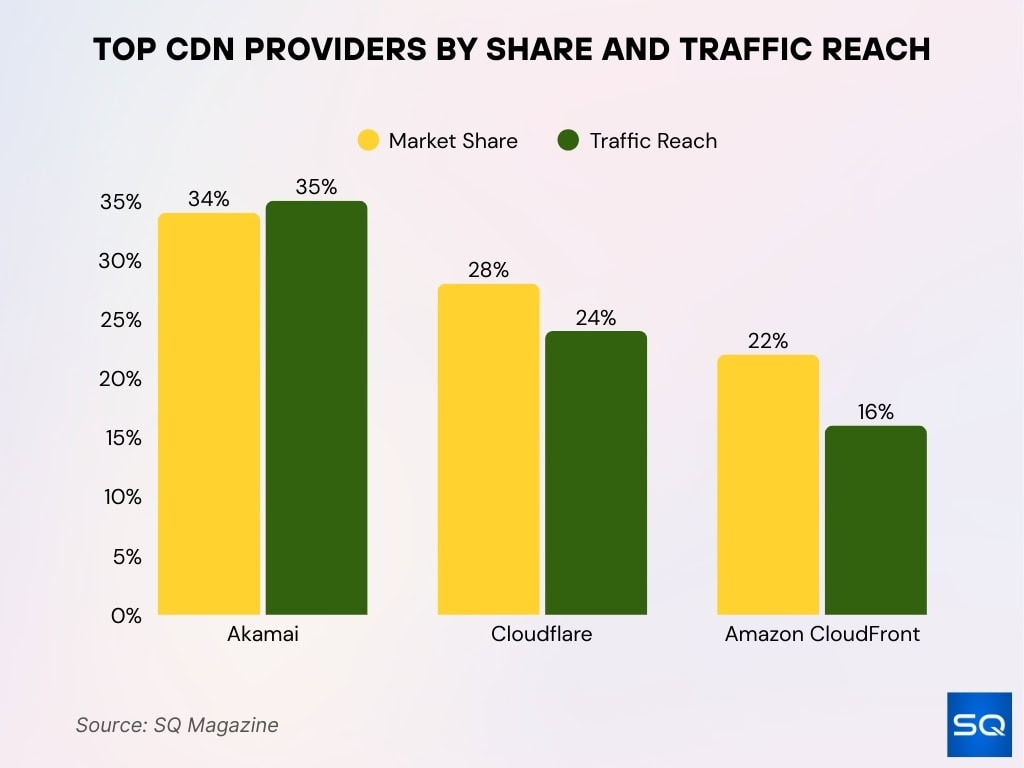

Comparative Statistics vs Other CDN and Security Providers

- Akamai leads the CDN market with about 34% share, while Cloudflare follows with 28% and Amazon CloudFront at 22%.

- By traffic reach, Akamai holds roughly 35% global CDN traffic, with Cloudflare at about 24% and CloudFront near 16%.

- The top five CDN vendors account for over 80% of worldwide CDN traffic volume.

- Global CDN market size reaches about $26.47 billion with double‑digit CAGR forecasts through 2030.

- Cloudflare averages around 28 ms global latency versus Akamai at 25 ms and CloudFront at 30 ms in one benchmark set.

- Cloudflare and Akamai each operate roughly 300+ PoPs, while some rivals range between 100–500 locations.

- SaaS‑style CDN services, where Cloudflare is strong, represent over 71.2% of the service share in the CDN market.

- IT and telecom customers drive about 30% of CDN vertical share, reflecting heavy security and performance demand.

Bot Management and Malicious Traffic Statistics

- Since July 1, 2025, Cloudflare has blocked over 416 billion AI bot scraping requests, averaging about 2.8 billion blocked requests per day over five months.

- Reports note that AI scraping attempts now account for an estimated 5–10% of total HTTP requests seen on some large Cloudflare‑protected properties.

- Early adopters of Cloudflare’s AI Labyrinth report reductions of over 80% in successful scraping attempts within the first 30 days of deployment.

- Cloudflare’s bot solutions documentation cites customers cutting malicious or unwanted automated traffic by 50–90% after enabling Bot Management or Super Bot Fight Mode.

- Organizations deploying Cloudflare bot defenses commonly see suspicious traffic volumes drop by around 60% and overall request rates fall by 20–40% as fake traffic gets filtered.

- Bot analytics dashboards expose cases where more than 30% of a site’s total traffic is automated, helping teams tune rules that block or challenge those requests.

- Customers combining Bot Management with rate limiting and challenges often reduce high‑risk endpoint hits by 70–95% during scraping or credential‑stuffing surges.

Zero Trust and Security Service Adoption

- 81% of organizations adopt or implement Zero Trust in 2025.

- Zero Trust security market reaches $38.37 billion in 2025.

- ZTNA market grows to $1.34 billion in 2025 at a 25.5% CAGR.

- SSE adoption surges as 79% plan implementation within 24 months in 2025.

- 72% of enterprises implement Zero Trust frameworks per the Gartner 2025 index.

- ZTNA market hits $7.34 billion by 2025 with a 17.4% CAGR.

- 60% of organizations adopt Zero Trust as a core strategy end of 2025.

- Zero Trust security is valued at $36.42 billion in 2025.

- 70% of new remote access users will use ZTNA over VPNs by 2025.

Cloudflare CDN Usage and Coverage

- Cloudflare operates a CDN in 330+ cities worldwide.

- Network spans 300+ active PoPs across 120+ countries.

- Powers 14.9 million live websites globally.

- Serves 20.5% of websites using servers.

- Holds 28% CDN market share behind Akamai.

- Handles an average of 6 trillion daily requests.

- Attracts 295,552 paying customers.

- Blocks 102 billion cyber threats daily.

- Generates $562 million Q3 revenue, up 30.7% YoY.

- Leads fastest network in 48% of top 1,000 networks.

DNS and Resolver Usage Statistics

- 1.1.1.1 resolver handles massive daily queries across the global network.

- DNSPerf ranks 1.1.1.1 fastest with a 6.95 ms average European response.

- .com domains capture over 60% of all 1.1.1.1 DNS queries.

- Resolver supports UDP, TCP, DoT, and DoH protocols with high privacy adoption.

- Cloudflare DNS holds 3.7% market share in resolution services.

- Outperforms Google DNS at 11.21 ms and Quad9 at 12.72 ms.

- Powers DNS for 25+ million monitored domains.

- Blocks threats via integrated DNS filtering in the security stack.

Cloudflare Workforce and Employee Statistics

- Cloudflare reports approximately 4,800 employees by the end of Q3, up 16% year over year.

- Company headcount rises from 4,263 in 2024, reflecting sustained double‑digit growth.

- Revenue per employee reaches about $441,340, highlighting strong productivity levels.

- Large customers paying over $100,000 annually grow to 4,009, deepening enterprise exposure per employee base.

- Cloudflare hires 214 new employees year to date while recording 171 net headcount growth in the latest external estimate.

- Engineering represents roughly 650 roles across 16 departments in one workforce breakdown snapshot.

- Global footprint spans about 18 locations, supporting 24/7 operations and customer coverage.

- Cloudflare plans to hire 1,111 interns in 2026, signaling continued investment in training and early‑career talent pipelines.

Frequently Asked Questions (FAQs)

Cloudflare was used by around 20.5% of all websites globally in 2025.

As of June 2025, Cloudflare had 265,929 paying customers, up 27% year‑over‑year.

Cloudflare powers over 24 million active websites worldwide.

Cloudflare anticipated $2.09 billion to $2.094 billion in total revenue for the full year 2025.

Conclusion

Cloudflare’s trajectory reflects its role as a critical internet infrastructure provider, with deep adoption across CDNs, DNS, security, and Zero Trust solutions. The company’s global network, broad usage, and security portfolio position it strongly in an expanding market driven by performance and protection demands. While competition remains fierce, Cloudflare’s integrated services and growth in high‑value offerings highlight its ongoing influence in how organizations deliver, secure, and scale digital experiences.