Central Bank Digital Currencies (CBDCs) are reshaping how countries envision money in the digital age. Today, CBDC development has transitioned from conceptual research to real‑world implementations, with countries testing digital money that could transform payments, cross‑border transactions, and financial inclusion. From public sector payments modernization to programmable digital government disbursements and enhanced retail efficiency, CBDCs are showing real impact in global finance. Explore how nations are adopting, piloting, and scaling CBDCs throughout this in‑depth statistical overview.

Editor’s Choice

- 143 countries are engaged in CBDC development efforts, representing 98% of global GDP.

- More than 70 countries are in pilot or development stages for CBDCs.

- China’s mBridge platform has processed over $55 billion in cross‑border digital currency transactions.

- India’s e‑rupee CBDC has attracted about 7 million retail users.

- e‑CNY transactions have surged past 3.4 billion, totaling roughly $2.4 trillion in value.

Recent Developments

- China’s cross‑border CBDC initiative mBridge saw transaction volume rise to $55 billion, a 2,500× increase from initial trials.

- China’s e‑CNY recorded 3.4 billion transactions, a more than 800% jump from prior years.

- India proposed linking BRICS CBDCs to facilitate trade and tourism payments in 2026.

- India’s digital rupee now serves ~7 million users within its ecosystem.

- Programmable CBDC pilots for direct benefit transfers have been implemented in India.

- BIS surveys continue to show a strong central bank focus on CBDC research and development through 2025.

- Singapore completed interbank transactions in live wholesale CBDC trials.

- Cross‑border collaborations between central banks have expanded, enabling interoperable payment trials.

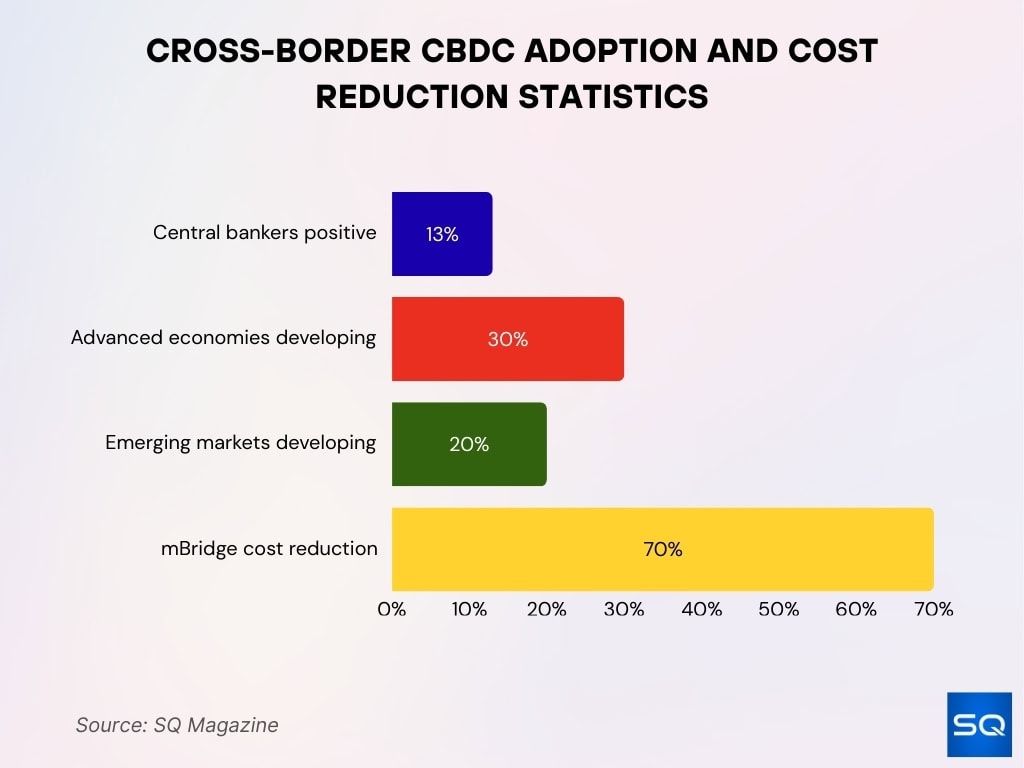

Cross-Border Usage Stats

- 13% of central bankers view CBDCs as highly promising for cross-border use.

- 30% advanced economy central banks are working on cross-border CBDCs.

- 20% emerging market central banks develop CBDCs for cross-border use.

- mBridge cuts costs by 70% vs traditional systems.

- mBridge processed $55.5 billion in 4,000+ transactions, a 2,500-fold increase since 2022.

- 27 countries test CBDCs for cross-border payments, including mBridge.

- Cross-border CBDC settlements $42 billion in 2025, 35% YoY increase.

- Cross-border retail payments to reach $320 trillion by 2032.

Countries Exploring CBDCs

- ~137 countries are evaluating CBDC issuance and frameworks, spanning advanced and emerging economies.

- 91% of surveyed central banks report active CBDC exploration.

- 143 jurisdictions engage in CBDC development projects worldwide.

- In Africa, ~75% of surveyed states are engaged in or planning CBDC activity.

- The Eurozone has CBDC research and pilot initiatives underway.

- The U.S. Federal Reserve is studying CBDCs but has not committed to issuance.

- Japan remains in experimental and consultation phases for a digital yen.

- Australia’s Project Acacia is testing digital currency models with major banks.

Live and Pilot CBDCs

- Four retail CBDCs fully live: Bahamas’ Sand Dollar, Nigeria’s eNaira, Jamaica’s Jam-Dex, and Zimbabwe’s ZiG.

- 70+ countries in pilot or development phases.

- 49 countries operate active CBDC pilot programs.

- Singapore completed live wholesale CBDC interbank lending trials.

- India’s e-rupee pilot reached 7 million users.

- ECB’s digital euro pilot planning targets launch post-2027.

- Eastern Caribbean’s DCash is preparing upgrades after relaunch.

- UAE’s Digital Dirham nearing launch in retail and wholesale forms.

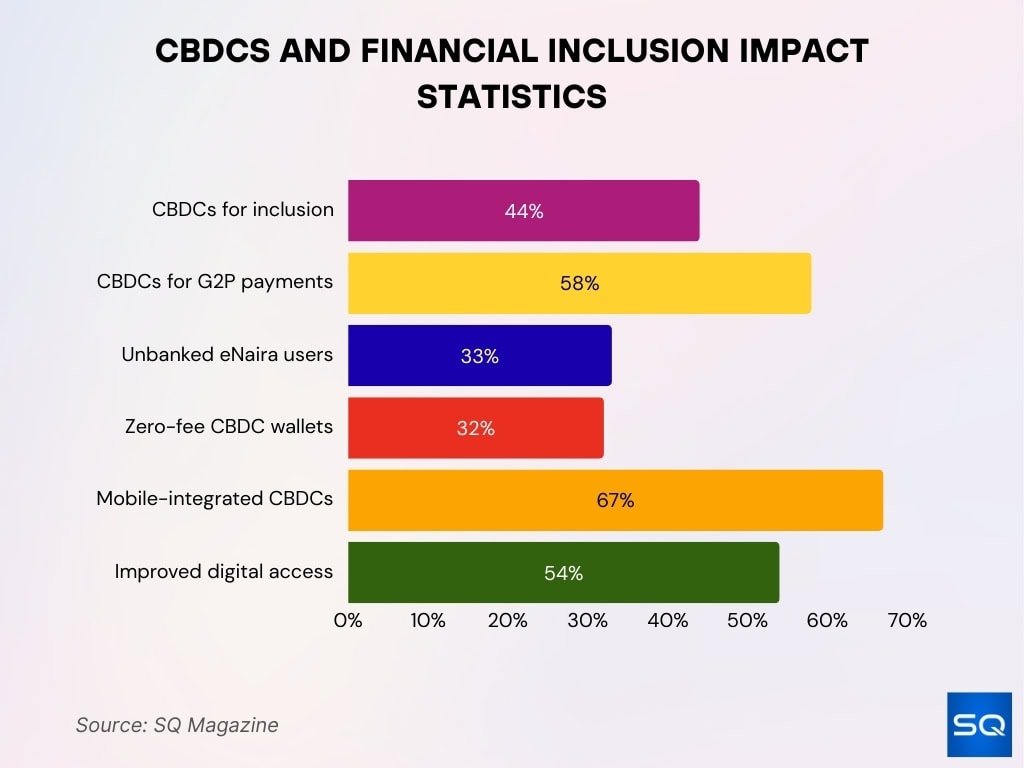

Financial Inclusion Metrics

- 44% of emerging economies deploy CBDCs to enhance financial inclusion through programmable payments.

- 58% of governments in developing nations use CBDCs for G2P payments.

- 33% of Nigeria’s eNaira users are previously unbanked.

- 32% of central banks provide zero-fee CBDC wallets for inclusion.

- 67% of countries integrate CBDCs with mobile banking for underserved areas.

- 54% of emerging markets report improved digital finance access.

Retail vs Wholesale CBDCs

- Retail CBDCs are designed for broad public use in day-to-day transactions.

- Wholesale CBDCs focus on large-value interbank operations, monetary policy, and settlement efficiency.

- 91% of surveyed central banks are exploring retail or wholesale CBDCs, with wholesale more advanced.

- 36 countries are active in retail CBDC pilots.

- 62 countries are piloting CBDCs for domestic retail payments.

- Wholesale CBDC issuance is more likely than retail by 2030, per the BIS survey.

- 62% of central banks cite financial inclusion as the primary motivation for retail CBDCs.

- 72 jurisdictions are in advanced CBDC stages, including wholesale projects.

Market Size and Circulation

- China’s e‑CNY CBDC has processed over 3.4 billion transactions totaling roughly ¥16.7 trillion ($2.4 trillion), an 800% increase from the 2023 figure.

- India’s CBDC (e‑rupee) circulation climbed to ₹1,016 crore (~$120 million) by March 2025, up from ₹234 crore a year earlier.

- Despite expansion, the digital rupee still represents a small fraction of total cash in circulation, reflecting early‑stage adoption.

- Global CBDC transaction projections forecast that annual volumes could exceed $213 billion by 2030, indicating continued long‑term growth.

- The Bahamas’ Sand Dollar, Nigeria’s eNaira, and Jamaica’s Jam‑Dex contribute to official CBDC circulation figures in their respective economies.

- In 2024, digital yuan pilots recorded ¥7 trillion (~$986 billion) transaction value across 17 Chinese provinces, nearly 4× the 2023 level.

- The aggregate value of CBDC transactions globally remains below 5% of global digital payment value, showing emerging scale.

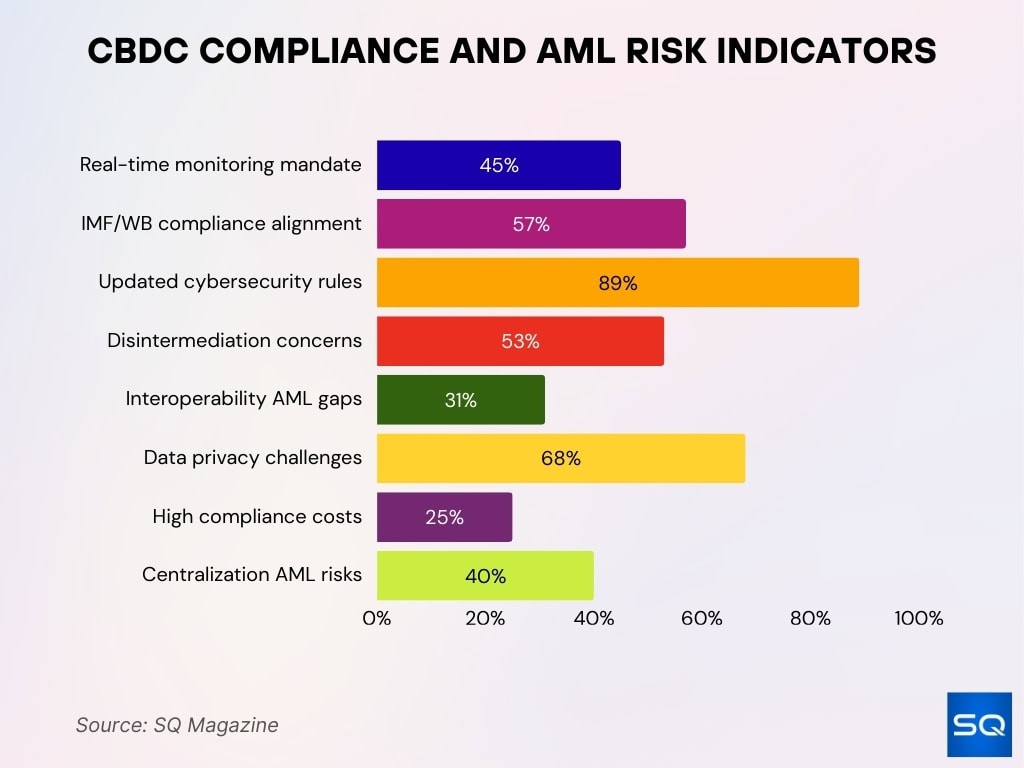

Compliance and AML Stats

- 48 countries align CBDC rules with global anti‑money‑laundering (AML) and counter‑terrorist financing (CFT) frameworks.

- 45% of CBDC regulations mandate real‑time monitoring of transactions to detect fraud.

- 57% of jurisdictions follow IMF/WB guidelines for digital currency issuance compliance.

- 42 countries use ISO 20022 messaging for consistent AML data exchange.

- 89% of countries with CBDC projects updated cybersecurity rules to meet international standards.

- 53% of regulators express concern over potential banking disintermediation risks due to CBDCs.

- 31% of jurisdictions cite cross‑border interoperability gaps as a barrier to AML effectiveness.

- 68% of central banks identify data privacy as a key compliance challenge.

- 25% of emerging markets cite high implementation costs as a compliance barrier.

- 40% of regulators worry that centralized control risks might weaken AML effectiveness if mismanaged.

Investment and Funding

- Central banks allocate billions annually in budgets for CBDC research and development.

- ECB digital euro setup costs are estimated at €4-5.77 billion.

- ECB development costs €1.3 billion until first issuance in 2029, annual ops €320 million.

- mBridge pilot settled US$22 million in real-value cross-border transactions.

- Bank of Italy estimates banks’ adoption costs at €6 billion over four years.

- IMF provides technical assistance and grants to emerging-market CBDC projects.

- Pilot programs funded from central bank innovation budgets.

- Major banks and tech firms co-invest in CBDC infrastructure research.

User Adoption and Active Wallet Numbers

- India’s e-rupee has had 7 million retail users since its launch.

- China’s e-CNY has billions of wallet instances.

- e-Rupee circulation ₹1,016 crore by March 2025.

- Global CBDC transactions are projected to reach 7.8 billion by 2031.

- eNaira 33% users previously unbanked.

- User activation rates are 20–40% in localized areas.

- 60% central banks accelerated CBDC initiatives.

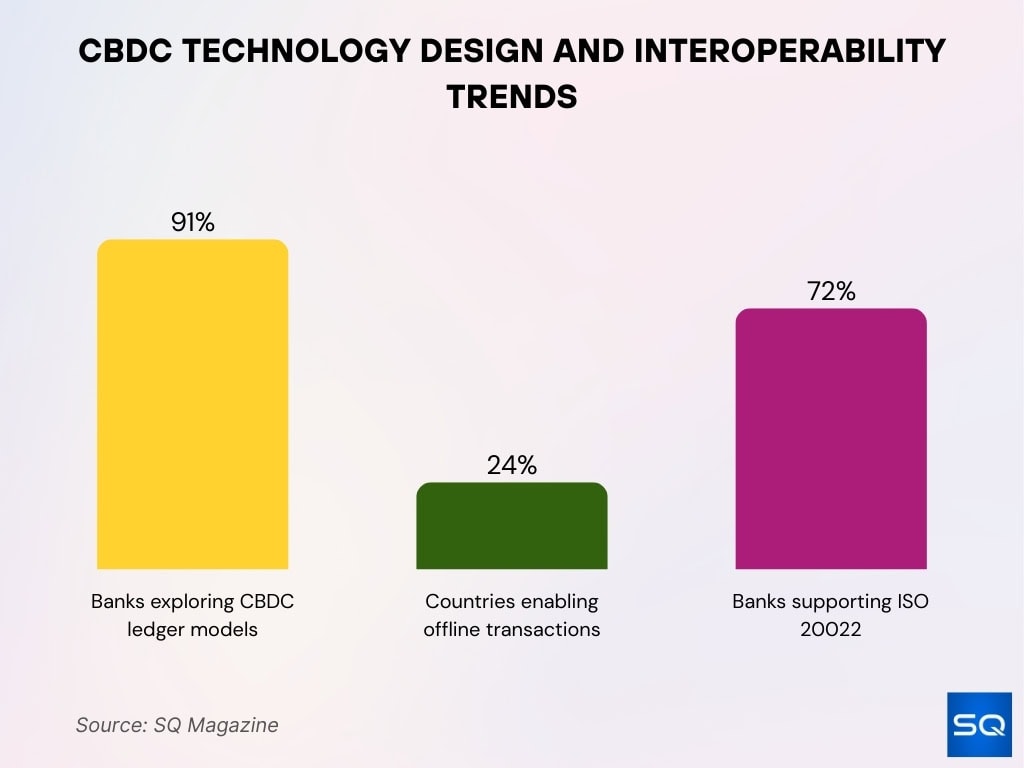

Technological Designs Overview

- 91% central banks explore retail or wholesale CBDCs with varied ledger models.

- 24% countries implement offline transaction capabilities.

- 72% central banks expect CBDC issuance, supporting ISO 20022 interoperability.

- Most designs include programmable money for conditional logic.

- CLT-based CBDCs use centralized databases like traditional banking.

- DLT-based CBDCs leverage blockchain for secure transactions.

- Hybrid models blend central bank and private intermediaries.

- Secure hardware modules protect digital wallets against attacks.

Use Cases by Sector

- 62 countries pilot CBDCs for retail payments.

- 27 countries test cross-border trade settlements via CBDCs.

- 44% emerging economies deploy programmable payments.

- 52% wholesale pilots target interbank settlement, 40% faster processing.

- $6.4 billion G2P payments via CBDCs in 2025.

- 24% countries implement offline transactions.

- 67% integrate CBDCs with mobile wallets for inclusion.

Regulatory Frameworks Count

- 90% of central banks studying CBDCs report that they are at some stage of regulatory planning or implementation.

- As of 2025, 48 countries align their CBDC regulations with FATF AML/CFT standards.

- 28 countries officially legislate CBDC interoperability standards, facilitating cross‑border usage.

- 22 European countries have drafted or implemented CBDC‑specific legal frameworks.

- 38% of developing countries link CBDC regulation with national digital identity programs.

- 9 of 10 G20 nations have advanced formal regulatory frameworks for CBDCs.

- 100% of Caribbean states using CBDCs have mandated anti‑money‑laundering protocols.

- 71% of CBDC‑developing central banks run regulatory sandboxes to test compliance requirements.

- 42 countries adopt ISO 20022 standards for CBDC transaction messaging compatibility.

- 35% of African nations with CBDC initiatives include specific cross‑border remittance rules.

Privacy and Security Stats

- 65% of countries implementing CBDC frameworks adopt privacy‑by‑design principles in their legal models.

- 72% of European CBDC regulations specifically address data privacy protections aligned with GDPR‑like standards.

- 68% of central banks listed data privacy as their top implementation concern.

- Offline payment design choices for CBDCs (e.g., digital euro) explicitly aim to balance privacy and accessibility.

- The ECB’s digital euro is designed with encryption and pseudonymization to protect user identity.

- 40% of regulators emphasize building robust security layers to mitigate systemic risks with digital currency systems.

- Security protocols for cross‑border CBDC platforms like mBridge explicitly incorporate jurisdiction‑specific compliance and governance rules.

- Offline CBDC payments research underscores integrity controls to prevent unauthorized access and double‑spending.

- Encryption and tokenization are core design elements in many CBDC prototypes to protect transaction confidentiality.

Top CBDC Projects

- Digital euro pilot starts 2027, issuance targeted 2029.

- mBridge processed $55 billion in 4,000+ transactions.

- China’s e-CNY reached $2 trillion in transactions.

- India’s e-rupee has 7 million active users.

- Live retail: Bahamas Sand Dollar, Nigeria eNaira, 10 million users, Jamaica Jam-Dex, Zimbabwe ZiG.

- Singapore wholesale trials completed interbank settlements.

- UAE Digital Dirham nearing retail/wholesale launch.

- Japan’s digital yen is in the experimental phase.

- Eastern Caribbean DCash upgrades post-relaunch.

Economic Impact Data

- CBDCs could cut cross-border remittance costs by up to 50% from 6.8% average.

- mBridge reduces cross-border costs by 70%.

- An optimal CBDC rate 0.8% yields a 27 basis points welfare gain.

- Wholesale CBDCs cut settlement from days to seconds.

- $50 billion annual savings in remittance fees for emerging markets.

- CBDC is cheaper by 50% than deposits reduces unbanked by 93%.

- Global remittances $508 billion in 2020, 6.8% fee average.

- 18 basis points of welfare gain in the euro area at 0.6% CBDC rate.

Frequently Asked Questions (FAQs)

About 91%–94% of central banks worldwide are currently studying or exploring central bank digital currencies.

Approximately 130–137 countries are engaged in CBDC exploration or development, representing about 98% of global GDP.

At least 6 to 7 central banks have launched retail CBDCs, including the Bahamas, Nigeria, China, Jamaica, the Eastern Caribbean, India, and Russia.

The China‑led mBridge CBDC platform has processed over $55 billion in cross‑border transactions.

Conclusion

Central bank digital currency initiatives are rapidly evolving from academic curiosity to measurable global economic forces. Countries are refining regulatory frameworks, aligning compliance standards, and embedding privacy and security into the design fabric of their CBDC systems. Leading projects like the digital euro, mBridge, and national pilots from China and India highlight how CBDCs can reshape payments, enhance financial access, and streamline settlement.

While adoption challenges and compliance risks persist, CBDCs are increasingly tied to financial strategy and monetary policy worldwide. As central banks continue pilot expansions and cross‑border collaborations, the landscape of digital money is poised to grow more robust, interoperable, and impactful.