BlackRock has transferred a combined $273 million in Bitcoin and Ethereum to Coinbase Prime, raising eyebrows across the crypto industry.

Quick Summary – TLDR:

- BlackRock moved 2,019 BTC ($182M) and 29,928 ETH ($91M) to Coinbase Prime.

- The transaction signals continued institutional activity in crypto markets.

- This comes as BlackRock’s Bitcoin and Ethereum ETFs saw major outflows last week.

- Despite outflows, Bitcoin bounced back above $90,000, boosting overall market sentiment.

What Happened?

On Monday, BlackRock moved $182 million worth of Bitcoin and $91 million in Ethereum to Coinbase Prime, according to blockchain data from Arkham Intelligence. These significant transactions are now fueling speculation about the firm’s next steps, especially amid recent ETF outflows and volatile market swings.

🚨 BREAKING

— Wimar.X (@DefiWimar) December 22, 2025

BLACKROCK JUST DUMPED 2,019 $BTC WORTH OVER $180 MILLION, AND 29,928 $ETH WORTH $91 MILLION.

THEY SOLD WHEN $BTC HIT $90K.

SOMEONE REALLY DOESN’T WANT BITCOIN ANY HIGHER… pic.twitter.com/JEAGfCeQES

A Closer Look at the Transfers

The transfers involved 2,019 BTC and 29,928 ETH, with a separate Ethereum transaction of 19,928 ETH worth $60.79 million also recorded recently. All assets were deposited into Coinbase Prime, which is the exchange’s institutional platform for custody and trading.

While the reason behind these transfers remains unconfirmed, such large on-chain movements from institutional giants like BlackRock often precede bigger strategic plays or portfolio adjustments.

Key points:

- The total amount moved was $273 million.

- Coinbase Prime is often used by institutions for secure crypto storage and trades.

- No additional transfers from these wallets have been recorded yet.

ETF Outflows Paint a Bigger Picture

These crypto transfers come on the heels of a rough week for crypto ETFs. Data from Farside Investors shows:

- BlackRock’s Bitcoin ETFs saw $240 million in net outflows.

- Its Ethereum funds experienced $558 million in outflows with no positive flow days.

- In total, crypto investment products lost $952 million in capital last week.

This marked the end of a four-week inflow streak, indicating a possible shift in market sentiment or investor behavior.

Market Reacts: Bitcoin Rebounds, Sentiment Improves

Despite the negative flow data, the crypto market rebounded sharply:

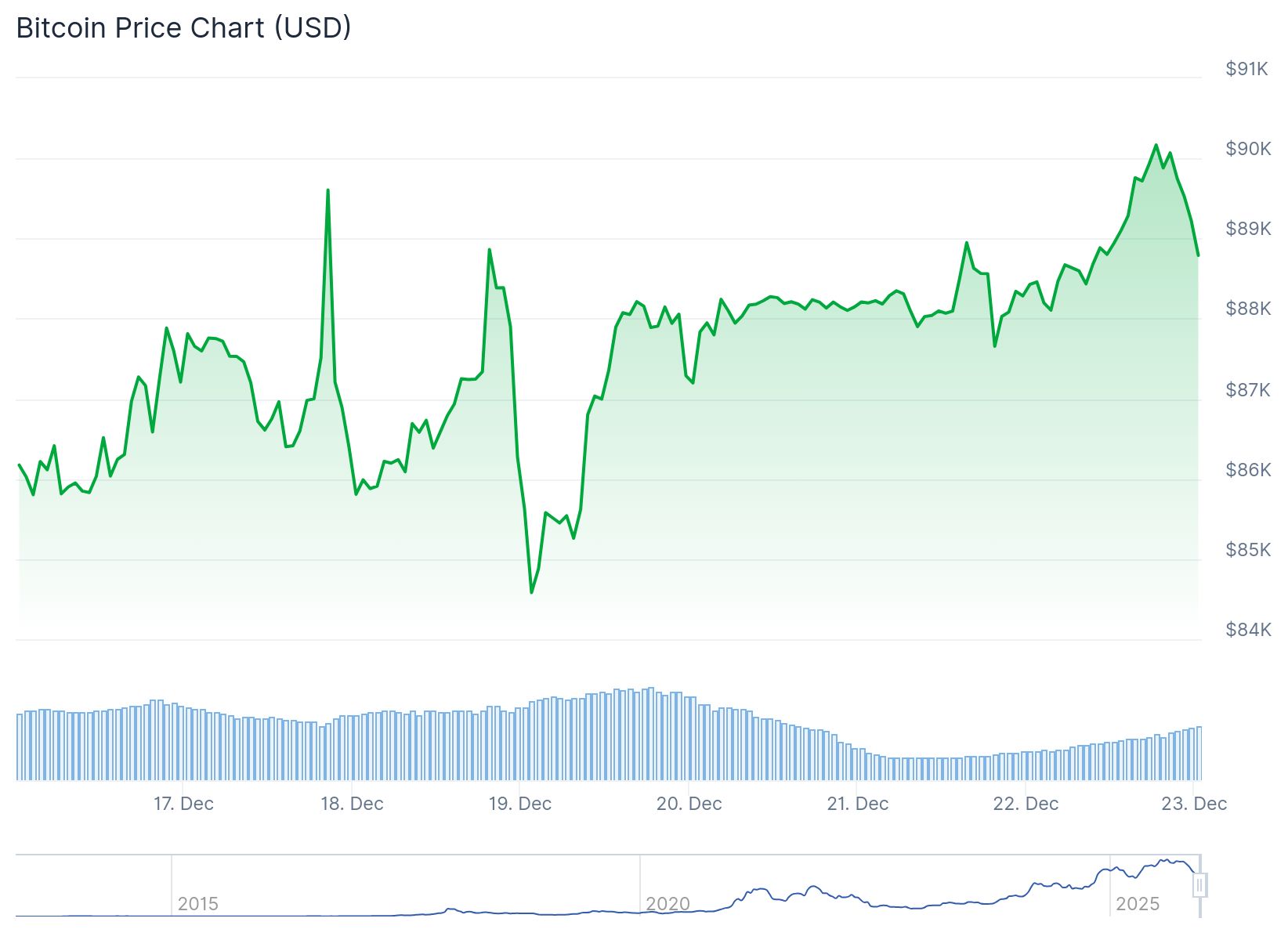

- Bitcoin dipped below $85,000 late last week but climbed back above $90,000.

- The overall crypto market cap rose 1.5% in 24 hours, reaching $3.1 trillion, per CoinGecko.

These price movements helped restore some optimism, even as large institutional transfers continue to dominate headlines.

SQ Magazine Takeaway

If you’re watching the crypto market closely, moves like this from BlackRock are huge signals. It’s not every day that a major financial firm shifts nearly $300 million in crypto. While ETF outflows suggest some investors are pulling back, these wallet transfers hint that BlackRock isn’t done with crypto just yet. Honestly, it feels like they’re playing chess while the rest of us are playing checkers. I’d keep a close eye on what Coinbase Prime does next, because something bigger could be brewing.