Bitwise is getting closer to launching its Avalanche ETF as it reveals new details in an updated SEC filing, sending AVAX price nearly 7 percent higher.

Quick Summary – TLDR:

- Bitwise filed an amended S-1 form with the SEC for its Avalanche ETF, revealing the ticker “BAVA” and a 0.34% management fee.

- The fee will be waived for one month or until assets hit $500 million, whichever comes first.

- The ETF includes AVAX staking to generate additional yield and will trade on NYSE Arca if approved.

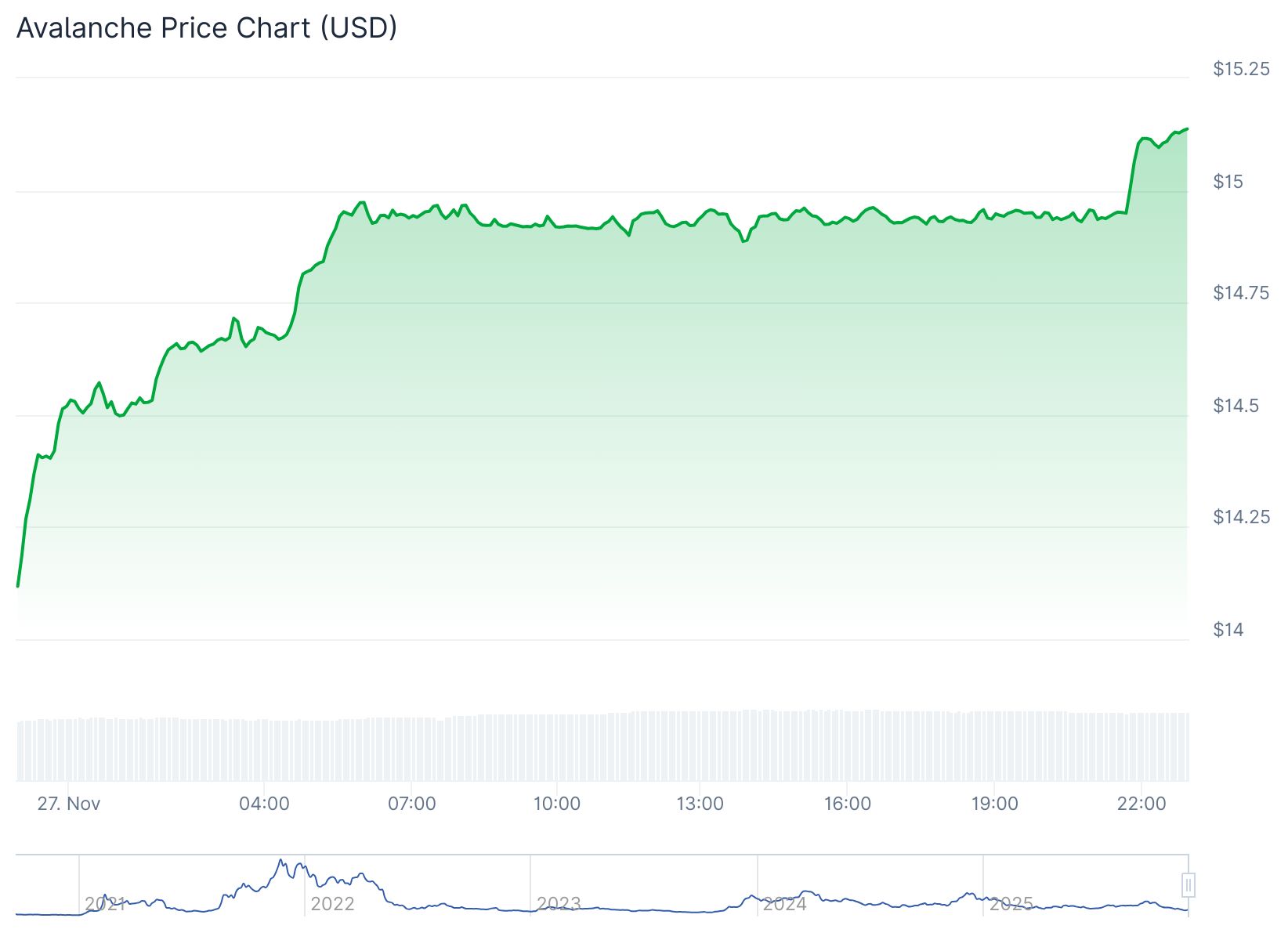

- AVAX surged nearly 7% following the announcement as investor optimism grew.

What Happened?

Bitwise Asset Management has taken a major step toward launching its Avalanche (AVAX) Exchange Traded Fund by submitting an amended filing with the U.S. Securities and Exchange Commission. The update includes new details about the fund’s structure, fee, and staking rewards. As a result, Avalanche’s token price spiked nearly 7%, reflecting fresh investor excitement.

JUST IN: BITWISE FILED AN S-1 AMENDMENT FOR ITS AVALANCHE ETF.

— The Moon Show (@TheMoonShow) November 27, 2025

MANAGEMENT FEE SET AT 0.34% AND THE TICKER WILL BE “BAVA.” pic.twitter.com/hEPpZAmmSM

Bitwise Unveils Key ETF Details

In the updated S-1 filing submitted on November 26, Bitwise announced that its Avalanche ETF will trade under the ticker “BAVA” on the NYSE Arca exchange, pending regulatory approval. The fund aims to give investors direct exposure to AVAX, the native token of the Avalanche blockchain, and generate extra income through staking.

The ETF will track AVAX pricing using the CME CF Avalanche-Dollar Reference Rate – New York Variant, a benchmark that aggregates market data from leading crypto exchanges and is managed by CF Benchmarks Ltd.

Coinbase Custody Trust Company has been selected to securely store the AVAX tokens, while BNY Mellon will handle the fund’s cash operations. Bitwise also confirmed that its investment arm will seed the fund with 100,000 shares worth $2.5 million, priced at $25 each.

Fee Waiver Strategy Targets Early Investors

The management fee is set at 0.34% annually, aligning with Bitwise’s structure for other altcoin ETFs like XRP and Dogecoin. However, the fee will be fully waived for one month or until the ETF reaches $500 million in assets under management, whichever comes first. This strategy is designed to attract early investors with lower entry costs.

ETF shares will be created and redeemed in blocks of 10,000, known as “Baskets,” exclusively through financial firms approved as Authorized Participants.

Despite the updates, Bitwise has not removed the delaying amendment in the SEC filing. This means the ETF will not become effective automatically and must wait for full regulatory approval.

AVAX Price Reacts to Filing News

The price of AVAX jumped 6.7% to nearly $15.13 shortly after the filing was made public. Although the token remains down about 26% over the past month, this price spike shows renewed confidence among investors.

AVAX currently trades below the important 50-day moving average of $18, which analysts say needs to be reclaimed for stronger bullish momentum. If the rally continues, the next targets could be $22 and $28. On the downside, holding above the $14 support level is seen as crucial to avoid a drop toward $12.

Growing Trend of Altcoin ETFs

Bitwise’s Avalanche ETF is not the only one in development. Grayscale and VanEck also submitted AVAX ETF filings earlier this year. Grayscale’s version is planned for Nasdaq, while VanEck’s application was registered in Delaware in March, signaling rising institutional interest in Avalanche-based financial products.

These developments reflect the broader trend of bringing alternative cryptocurrencies into mainstream investment portfolios through regulated products.

SQ Magazine Takeaway

Honestly, I think this is a big deal. Bitwise isn’t just putting out another crypto fund. They’re doing it with staking rewards built in, which is rare for ETFs. That means investors might not only ride the price of AVAX, but also earn extra returns. Plus, waiving fees early on shows they really want to attract serious money fast. If approved, this ETF could become a popular entry point for people who want exposure to Avalanche without the hassle of managing crypto wallets. The race for altcoin ETFs is heating up, and Bitwise is pushing hard to lead the pack.