One of crypto’s most-watched investors just scooped up a massive amount of Lido DAO tokens, sending ripples through the DeFi world.

Quick Summary – TLDR:

- Arthur Hayes bought approximately 1.85 million LDO tokens, spending over $1 million.

- The move triggered a 6% price jump and 200% spike in trading volume.

- Lido’s fundamentals remain strong with $14.3 million in weekly revenue and 690% YoY development growth.

- Analysts view Hayes’ buy as a vote of confidence in Lido DAO and DeFi’s future.

What Happened?

Arthur Hayes, co-founder of BitMEX and a prominent name in crypto circles, made headlines with a bold investment in Lido DAO’s governance token, LDO. He purchased 1.85 million LDO tokens, worth approximately $1.03 million, according to blockchain analytics firm Onchain Lens. The purchase came through a direct transfer from Binance to a wallet linked to Hayes, and it didn’t go unnoticed by the market.

Just In: Arthur Hayes (@CryptoHayes) bought 1.85M $LDO worth $1.03M from #Binance.

— Onchain Lens (@OnchainLens) December 26, 2025

Address: 0x6cd66dbdfe289ab83d7311b668ada83a12447e21 pic.twitter.com/nYsyIMv0tN

Arthur Hayes’ Big Bet on Lido DAO

Hayes’ acquisition is being interpreted by analysts and traders as a strategic bet on DeFi’s next wave. This is one of his largest publicly visible token purchases since stepping down from BitMEX in 2021. He has recently been trimming his Ethereum holdings and reallocating capital into DeFi-native tokens such as PENDLE, ENA, and ETHFI.

- Hayes also bought $973,000 worth of PENDLE tokens around the same time.

- Earlier this week, he moved $609,000 into a mix of DeFi tokens, indicating a broader sector rotation.

In a recent statement, Hayes suggested that high-quality DeFi tokens could thrive under improving liquidity conditions. His move into LDO signals long-term faith in Lido DAO’s role in liquid staking and Ethereum’s future.

Lido DAO’s Fundamentals Strengthen the Case

Beyond Hayes’ involvement, Lido DAO’s protocol is showing signs of strong health. The network is the largest liquid staking provider, mainly serving Ethereum but also expanding to other chains.

- Lido recently reported a 690% year-over-year surge in development activity.

- It brings in around $14.3 million in weekly revenue, second only to Ethereum itself.

- Key upgrades like Curated Module v2 and triggerable withdrawals show ongoing innovation.

This technical growth, paired with financial strength, is drawing increasing attention from investors seeking yield and resilience in a shaky market. Lido’s integration with major DeFi platforms such as Aave, Curve, and MakerDAO adds further credibility to its ecosystem.

Price Movement and Technical Outlook

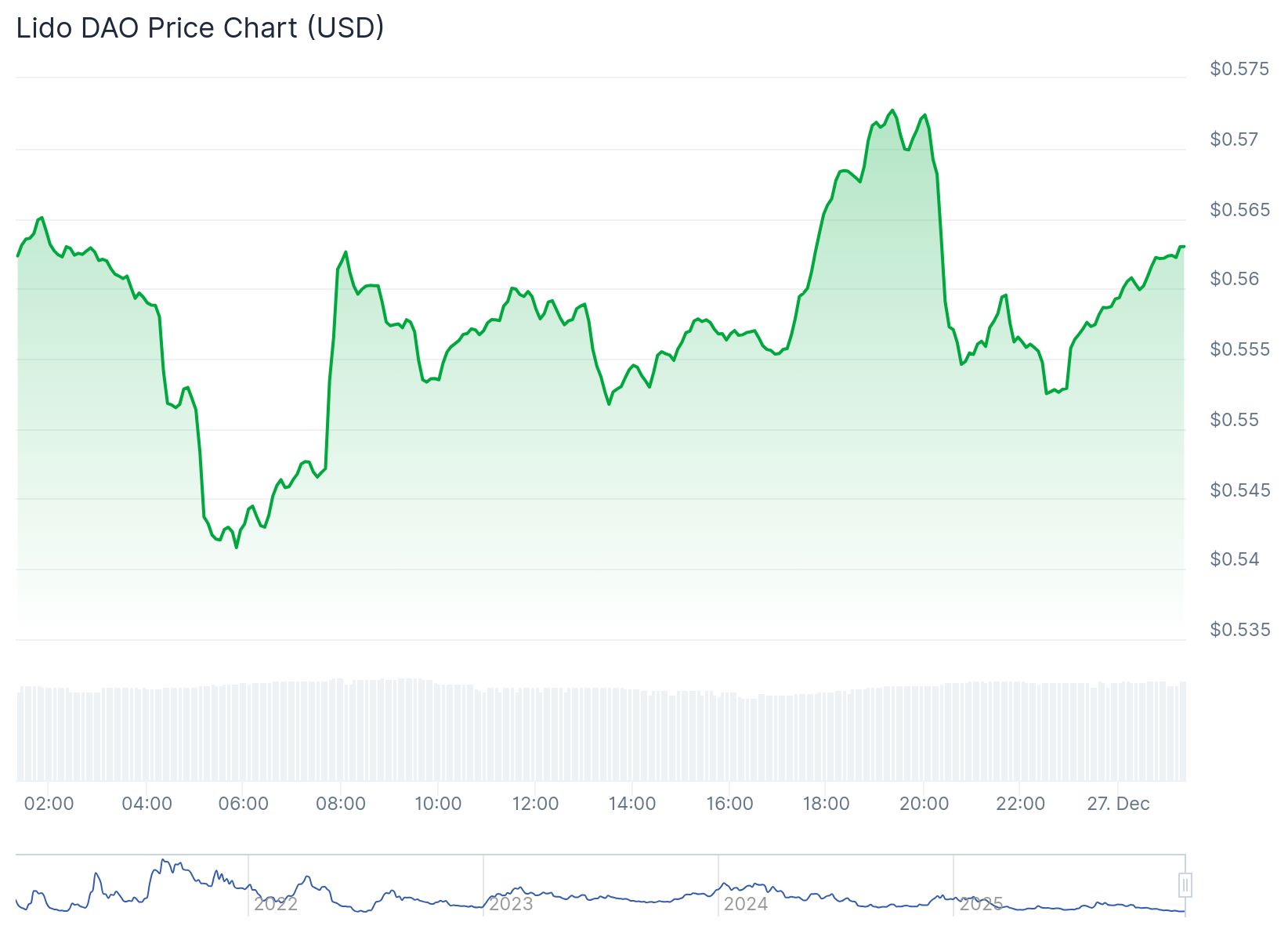

Following Hayes’ buy, LDO jumped around 6%, while trading volume more than doubled, climbing over 200% above its weekly average. Despite this short-term rally, LDO still faces a cautious technical outlook:

- The token sits above its 10-day EMA, but below the 20, 50, 100, and 200-day EMAs

- Support sits at $0.5546, with resistance levels at $0.7126, $0.9416, and $1.24

- RSI indicators are neutral, with the 14-day RSI at 45.65 and weekly RSI at 40.76

LDO’s price was last seen trading around $0.56, posting a 2% gain on the day and a 5.26% rebound over the past week, despite a 30-day loss nearing 14%.

Lido DAO Faces the Future with Renewed Momentum

The broader context matters too. The Safe Harbor Agreement, an initiative to protect over $26 billion in staked ETH via white-hat hacker coverage, is one of many steps Lido is taking to bolster protocol security and trust. As competition in liquid staking heats up, Lido’s ability to stay ahead on innovation and governance will be critical.

Experts believe that investor psychology shifts significantly when influential figures like Hayes make such moves, especially during uncertain times in the crypto market. While he hasn’t made a formal public statement about this LDO purchase, the market is clearly watching his every step.

SQ Magazine Takeaway

I think this move by Arthur Hayes sends a strong message. It is not just about buying into a token, but about showing trust in where DeFi is headed. Lido has the revenue, the dev power, and the market share. When someone like Hayes pivots from Ethereum to DeFi-specific assets, it’s a reminder that innovation in this space is alive and well. For me, it’s a bullish signal not just for LDO, but for smart, utility-focused DeFi projects overall.