Shares of Eric Trump’s American Bitcoin Corp plunged 50 percent Tuesday, defying a broader crypto recovery and shocking investors.

Quick Summary – TLDR:

- American Bitcoin Corp (ABTC) shares crashed over 50 percent in one day, dropping to as low as $1.75.

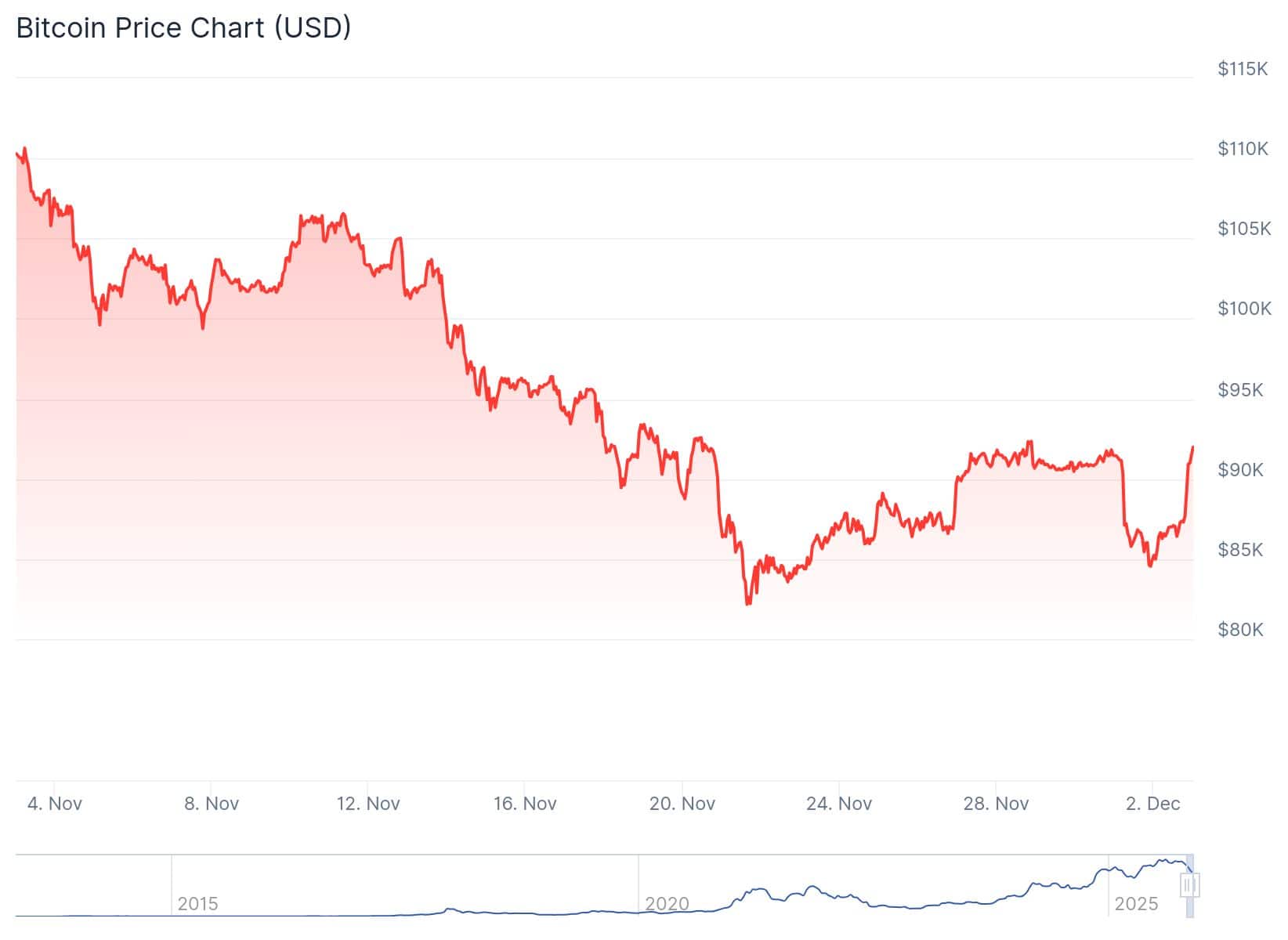

- The drop came despite a Bitcoin rally, which saw BTC climb above $90,000.

- The stock has now lost over 78 percent since its September peak of $9.31.

- Analysts cite panic selling, valuation concerns, and technical patterns for the collapse.

What Happened?

American Bitcoin Corp, the crypto mining and treasury company co-founded by Eric and Donald Trump Jr., saw its stock collapse more than 50 percent in Tuesday trading. This steep decline brought the stock to its lowest level since May, raising alarms across the digital asset sector.

The crash occurred even as Bitcoin and other altcoins rebounded strongly, confusing investors who usually expect mining firms to benefit from rising crypto prices.

Stock Price For Crypto Firm American Bitcoin—Founded By Trump’s Son—Plummets 40%https://t.co/P71M1sNpNr pic.twitter.com/JJKRZPztFF

— Forbes (@Forbes) December 2, 2025

ABTC Tanks While Bitcoin Soars

The timing of the crash could not have been more surprising. Bitcoin, which had been declining since mid-October, reversed course Tuesday and gained more than 4.5 percent, crossing the key $90,000 resistance level.

In contrast, ABTC dropped to an intraday low of $1.75, wiping out billions in market value. The company’s market cap shrank to $1.9 billion, down from a high of $8.6 billion just a few months ago.

ABTC is one of the top Bitcoin treasury holders with 4,002 BTC on its books, valued at over $363 million at current prices. Yet, despite this strong BTC backing, its stock continues to slide.

No Clear Catalyst, But Red Flags Abound

There was no single news item driving the sell-off, but analysts point to several warning signs:

- Panic selling by retail traders following heavy losses since the stock’s debut.

- Valuation concerns, with ABTC trading at a higher multiple than its treasury-focused peers.

- A bearish technical chart, featuring a double-top pattern and a recent death cross of its 50-day and 200-day moving averages.

Even as other crypto stocks like MicroStrategy and Trump Media rose 4 percent and 1 percent respectively, ABTC bucked the trend, suggesting a lack of confidence in the company’s fundamentals or future direction.

From $9.31 to $1.75 in Three Months

Since its September Nasdaq debut via a reverse merger with Gryphon Digital Mining, ABTC shares had surged to a high of $9.31. Tuesday’s plunge means the stock has now lost 78 percent of its value in under three months.

Despite generating $64 million in revenue and a $3.4 million net income in the third quarter, investors appear unconvinced. The company’s strategy of accumulating Bitcoin through mining rather than buying from markets seems not to be enough to instill confidence amid rising volatility.

SQ Magazine Takeaway

Honestly, this kind of plunge, especially when Bitcoin is rallying, shows just how risky and sentiment-driven some of these new crypto stocks can be. Even with solid BTC reserves and recent profits, ABTC got hammered because traders bailed and the technicals looked bad. I think this should be a wake-up call for anyone betting big on crypto-linked equities. Just because it has Bitcoin in the name doesn’t mean it’s going to follow Bitcoin’s price.