One sentence summary: American Bitcoin Corp has expanded its strategic Bitcoin holdings to 4,783 BTC, marking a rapid growth phase just three months after going public.

Quick Summary – TLDR:

- American Bitcoin Corp added 416 BTC in the past week, raising its reserve to 4,783 BTC.

- The company’s Satoshis Per Share (SPS) metric jumped 17.3 percent, now at 507.

- Co-founder Eric Trump credited efficient strategy and cost structure for the sharp growth.

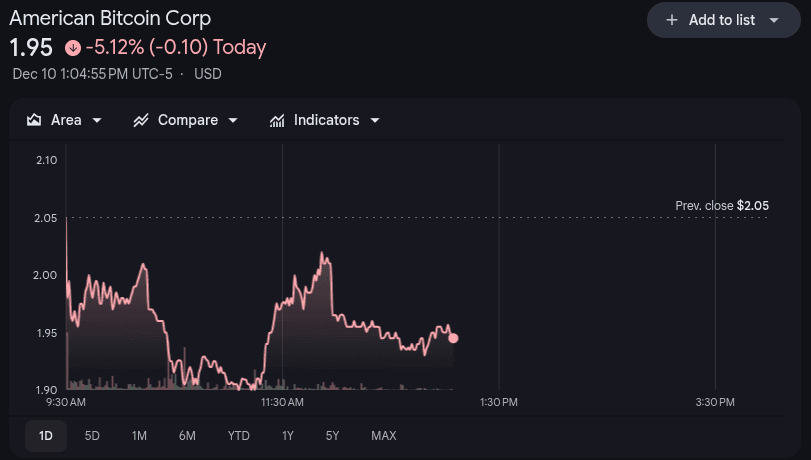

- ABTC stock saw a modest 2 percent gain after the announcement.

What Happened?

American Bitcoin Corp, a fast-growing Bitcoin accumulation platform, has significantly ramped up its BTC holdings, acquiring 416 Bitcoin in just one week. This move brings its total reserve to 4,783 BTC as of December 8, 2025, placing it among the top holders of Bitcoin among publicly traded US companies focused on digital asset accumulation.

The company also reported a sharp rise in its Satoshis Per Share (SPS) metric, which jumped more than 17 percent over the past month to reach 507. This metric gives shareholders a clear view of their indirect Bitcoin exposure through company equity.

ABTC Increases Strategic Reserve to 4,783 Bitcoin

— American Bitcoin (@ABTC) December 10, 2025

Read the full release here: https://t.co/2jCDTexfHJ pic.twitter.com/VMxhptwF0w

American Bitcoin’s Growth Momentum Continues

The new BTC purchases reflect American Bitcoin’s aggressive yet disciplined strategy to solidify its position as a leading corporate accumulator of Bitcoin. The company uses a combination of self-mining operations and strategic purchases to grow its treasury, while keeping an eye on operational efficiency and long-term profitability.

- The latest increase of 416 BTC took place between December 2 and December 8, 2025.

- Total reserves of 4,783 BTC include holdings in custody and Bitcoin pledged as collateral under a hardware supply agreement with Bitmain.

- The SPS metric, at 507 as of December 8, gives investors visibility into how much Bitcoin is tied to each share.

In a company statement, Eric Trump, co-founder and chief strategy officer, highlighted the growth pace and confidence in their long-term model.

Stock Recovery After Sell-Off

Shares of ABTC gained over 2 percent during pre-market trading on Wednesday, signaling a slight rebound after a turbulent early December. On December 2, the stock dropped roughly 50 percent when pre-merger private placement shares became freely tradable, significantly increasing selling pressure.

Despite the volatility, the company’s fundamentals appear strong. Its focus remains on growing shareholder value through BTC accumulation rather than reacting to short-term market swings.

SQ Magazine Takeaway

This story confirms what I’ve been seeing for a while now. American Bitcoin Corp is moving fast and executing on a clear strategy to become one of the top BTC holders in the public markets. The fact that they added over 400 BTC in a single week is a strong signal. And while their stock took a hit earlier this month, their continued growth in reserves and the rise in SPS shows they’re building long-term value. I like that they are being transparent with investors and not just relying on hype. This is a serious accumulation play, and it’s starting to show.