The subscription economy continues to reshape how people consume everything from software to streaming, meal kits, and wellness services. Today, this model has moved well past niche status, becoming a major revenue engine for businesses across industries, driven by predictable income and deepening customer relationships.

From SaaS platforms growing enterprise footprints to video services battling for viewer loyalty, subscriptions now underpin many business strategies. In healthcare tech and digital education, recurring revenue models help fund ongoing innovation and service upgrades. Read on to explore the most current data shaping the subscription economy.

Editor’s Choice

- The average consumer holds 5.6 active subscriptions across categories, including media, software, and lifestyle services.

- Failed subscription payments are expected to cost businesses $129 billion in lost revenue in 2025 due to involuntary churn.

- “Pause” functionalities, where customers can temporarily suspend, not cancel, subscriptions, saw usage rise by 337%, helping reduce churn.

- Monthly subscription churn rates vary widely, but top subscription businesses aim to maintain rates below 5% monthly as a benchmark of healthy retention.

- Reactivation strategies are gaining prominence; roughly 1 in 4 new sign-ups is a returning subscriber.

Recent Developments

- AI-driven personalization boosts retention by up to 30% and lifetime value by 25%.

- 50% of subscription churn is caused by failed card payments, costing $129 billion in 2025.

- B2C subscription retention rate stands at 72%, with a median lifetime of 2.8 years.

- 80.7 million U.S. households projected to cut the cord by the end of the year.

- Pause options see 337% year-over-year usage increase among flexible merchants.

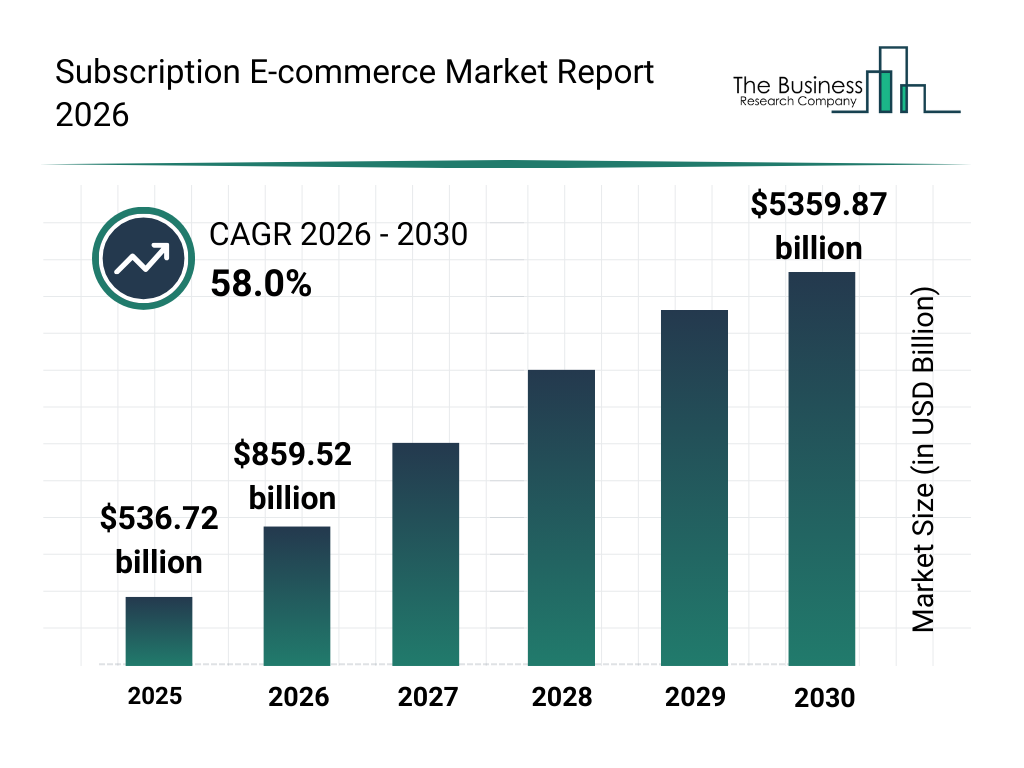

Subscription E-commerce Market Growth Outlook

- The global subscription e-commerce market is valued at $536.72 billion in 2025, marking a strong foundation for rapid expansion.

- Market size is projected to reach $859.52 billion in 2026, reflecting the accelerating adoption of recurring commerce models.

- The industry is expected to grow at an extraordinary 58.0% CAGR from 2026 to 2030, signaling one of the fastest-growing segments in digital retail.

- By 2030, the market is forecast to surge to $5,359.87 billion ($5.36 trillion), highlighting massive long-term revenue potential.

- The steep upward trajectory indicates widespread consumer shift toward subscription-based purchasing, including streaming, SaaS, meal kits, and direct-to-consumer services.

- Businesses are increasingly prioritizing subscriptions due to predictable recurring revenue and stronger customer lifetime value.

- The projected multi-trillion-dollar scale by 2030 underscores subscriptions as a core engine of future e-commerce growth.

Subscription Revenue Benchmarks

- Subscription economy to grow 67% from $722 billion in 2025 to $1.2 trillion by 2030.

- North America holds 38.2% share of the global subscription economy revenue.

- B2B segment accounts for 55.2% of subscription economy revenue.

- Fixed subscriptions represent 48.1% of the market revenue share.

- Subscription revenue growth at 13.3% CAGR outpaces the S&P 500’s 6.4% revenue growth.

- Software & Technology (SaaS) segment to grow at 15.8% CAGR.

- Digital video services to account for over 33% of global subscription spend by 2030.

Pricing Strategies

- 61% of SaaS companies adopt usage-based pricing, with 46% using hybrid models.

- Three out of five SaaS companies implement usage-based pricing.

- 46% of U.S. streaming subscribers choose ad-supported tiers.

- Ad-supported tiers drive 71% of premium SVOD net subscriber growth.

- Product bundling improves conversion rates by 15–25%.

- Freemium apps have a median 2.18% download-to-paid conversion rate.

- 59% of SaaS companies expect usage-based pricing to grow revenue share.

- Annual billing options generate 30% higher upfront cash flow.

- Tiered pricing contributes to 110%+ net revenue retention in top performers.

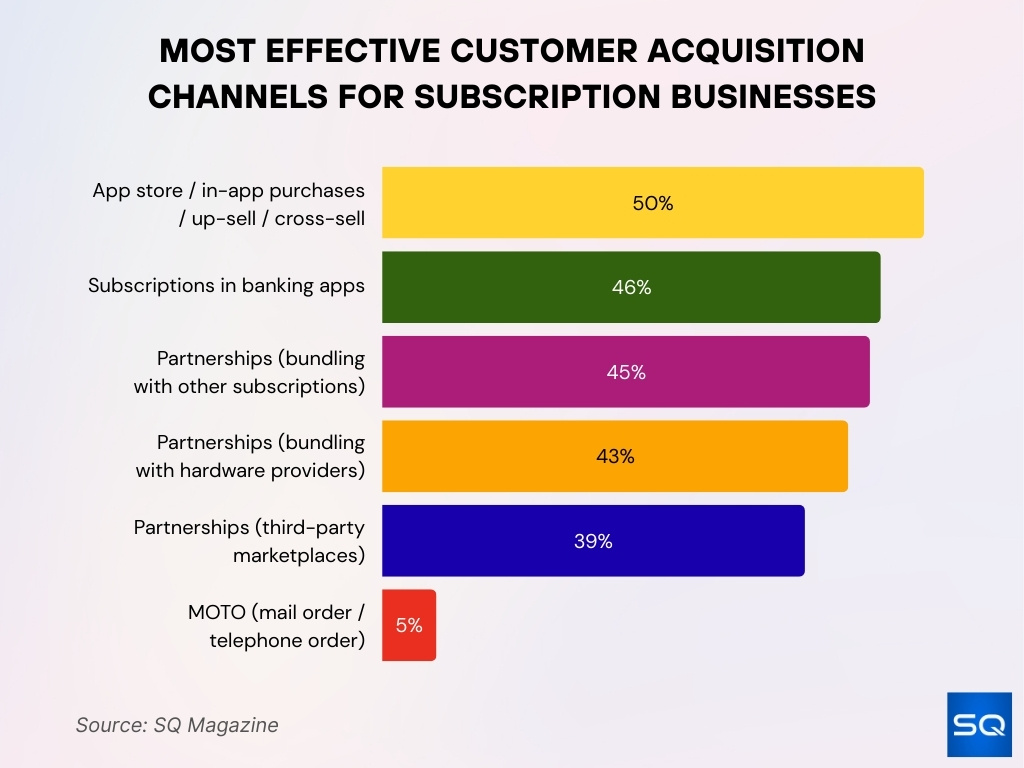

Most Effective Customer Acquisition Channels for Subscription Businesses

- App stores and in-app purchases rank as the most effective channel, with 50% of subscription businesses relying on up-sell and cross-sell opportunities within apps.

- Banking app subscriptions follow closely at 46%, showing the growing importance of financial platforms as distribution channels.

- Bundling with other subscriptions is highly effective at 45%, highlighting the power of ecosystem partnerships to expand reach.

- Hardware provider partnerships drive acquisition for 43% of companies, leveraging device ecosystems to onboard users.

- Third-party marketplaces remain a strong channel at 39%, enabling visibility through established platforms.

- Traditional MOTO (mail order or telephone order) methods are largely ineffective today, used by only 5% of businesses.

- Overall, the data shows a clear shift toward digital platforms, embedded services, and strategic partnerships as the primary engines of subscription growth.

Customer Lifetime Value

- Median B2B SaaS LTV $15K–$40K for SMB, $80K–$200K for mid-market, $300K–$1M+ for enterprise.

- Median LTV: CAC ratio across B2B SaaS segments is 3.2:1, healthy target 3:1 minimum.

- Enterprise NRR median 118%, mid-market 108%, SMB 97%.

- Top-quartile SaaS companies exceed 130% NRR across all segments.

- Increasing retention by 5% boosts profits 25%–95% in subscription models.

- Streaming first-time subscriber 12-month survival rate 45%.

- Top SaaS companies generate 50%+ new ARR from customer expansion.

- Healthy LTV: CAC benchmark 3–5x for sustainable SaaS growth.

- Existing customers are 60–70% more likely to buy again than new prospects.

Subscriber Retention & Churn Rates

- Average monthly churn for subscription businesses ranges between 5% and 7%, though SaaS often performs lower at 3% to 5%.

- Voluntary churn accounts for over 60% of total churn, while involuntary churn, failed payments, make up the remainder.

- Subscription e-commerce brands typically experience monthly churn rates between 6% and 8%, depending on the category.

- Failed payment recovery tools helped reduce involuntary churn by up to 20% in companies that deployed automated dunning strategies.

- Media and entertainment subscriptions see higher churn volatility, with some streaming platforms reporting churn spikes above 8% monthly following price increases.

- Nearly 47% of U.S. consumers canceled at least one paid streaming service in the past six months.

- Annual churn in B2B SaaS averages 10% to 14%, with enterprise-focused SaaS reporting lower rates than SMB-focused providers.

- Companies that implement annual billing reduce churn by up to 30% compared to monthly plans, due to stronger commitment cycles.

- Subscription companies with structured onboarding programs report 15% to 20% lower churn than those without formal onboarding.

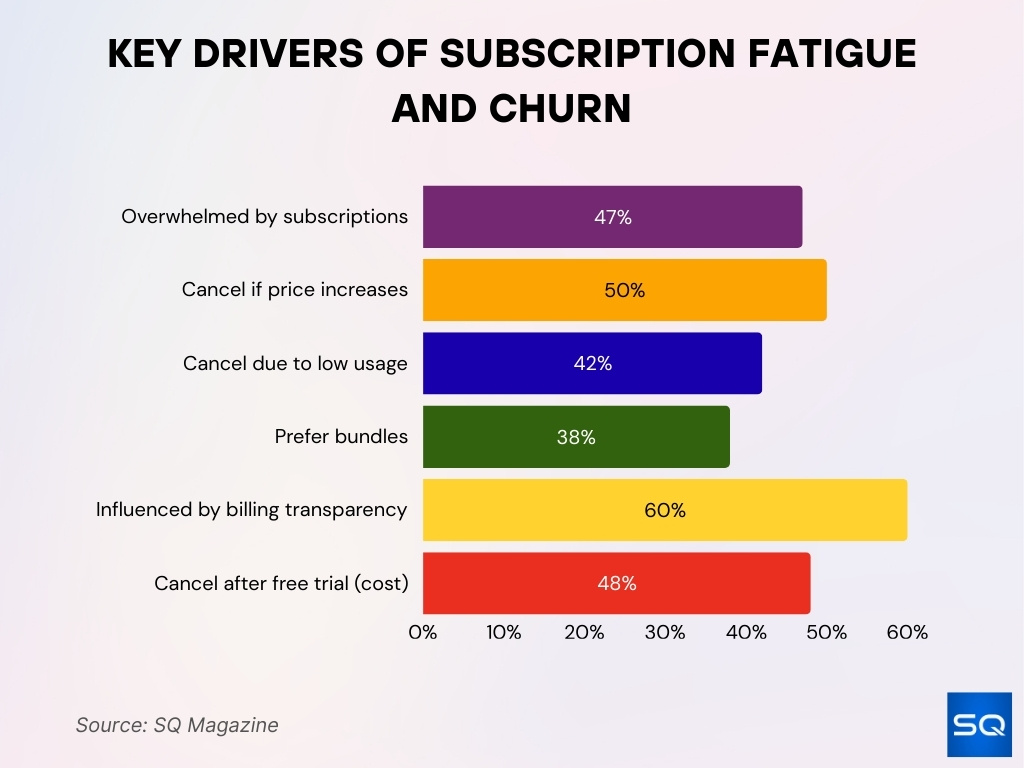

Subscription Fatigue & Consumer Selectivity

- 47% of U.S. consumers feel overwhelmed by the number of subscription services available.

- More than 50% of consumers say they would cancel a subscription if prices increase significantly without added value.

- Nearly 1 in 3 subscribers actively rotated streaming subscriptions to manage monthly costs.

- 42% of consumers canceled a subscription because they did not use it enough.

- Around 38% of consumers prefer bundled subscription offerings over multiple standalone subscriptions.

- Over 60% of users say clear billing transparency influences their decision to stay subscribed.

- Nearly 48% of users cancel before a free trial converts to paid due to cost concerns.

Consumer Behavior Trends

- 91% of U.S. internet households subscribe to at least one streaming service.

- The average U.S. household has 6.1 streaming subscriptions and spends $109 monthly on video services.

- Americans spend an average of $273 per month on all subscriptions, estimating only $111.

- 42% of consumers have forgotten at least one subscription they’re paying for.

- The average household subscribes to 8-12 different subscription services.

- 71% of Americans want to cut subscription spending amid rising costs.

- 83% of U.S. adults use streaming services regularly.

- Monthly subscription spending ranges from $200 to $500 for many U.S. households.

- 62% of streaming subscribers say there are too many services.

Impact of Pricing Changes & Price Hikes

- 1 in 3 consumers cut at least one subscription due to cost.

- 48% of streaming users would cancel after 20% price increase.

- 62% of U.S. streaming subscribers cite rising prices as the top frustration.

- 19% of users consider cancelling after 10% price hike.

- Median SaaS churn 6.73% monthly, 8.11% for B2C.

- 56% anticipate Netflix price increases.

- B2C churn improved 1.6 percentage points with AI retention tools.

- Bundles show 4% churn vs 9% for standalone streaming.

- Transparent price communication reduces churn impact by 20%.

Regional Market Insights

- North America holds 38.2% global subscription economy revenue share.

- U.S. leads the North American subscription market revenue.

- Europe generated $129.1 billion in revenue, 26.2% global share.

- Asia Pacific fastest growing, projected to reach $411.8 billion by 2033.

- China subscription CAGR 18.0%, India 16.6% through 2035.

- U.S. household streaming penetration 96%.

- Germany CAGR 15.3%, UK 12.6%, US 11.3%.

- Asia-Pacific fastest-growing subscription e-commerce region.

Frequently Asked Questions (FAQs)

Forecasts for the subscription economy by 2030 range between $1 trillion and $1.5 trillion globally, depending on methodology and sector inclusion.

The 2026 industry report highlights data behind 76 million subscribers shaping trends in the subscription economy.

About 77% of consumers maintained the same number of subscription services in 2026.

Broader global e-commerce is projected to surpass $6 trillion annually, while subscription e-commerce represents a smaller but rapidly growing segment within that total.

Conclusion

The subscription economy today reflects a shift from rapid expansion to disciplined optimization. Businesses now focus less on raw subscriber growth and more on lifetime value, pricing precision, and churn control. Meanwhile, consumers have become selective, balancing convenience with cost sensitivity.

Across SaaS, streaming, e-commerce, and fintech, companies that combine flexible pricing, transparent communication, and retention-first strategies outperform competitors. Regional growth remains uneven, yet global demand for recurring access models continues to rise.