Imagine this: You’re walking through your neighborhood, earbuds in, the world tuned out as your favorite playlist flows seamlessly from one song to the next. This is not a rare moment, it’s an everyday ritual for millions around the globe. Music streaming has woven itself into our lives, whether during commutes, workouts, or wind-downs.

But behind the rhythm and melody lies a booming industry shaped by shifting user behavior, fierce platform competition, and an increasingly personalized listening experience. In 2025, the numbers reveal a market that’s matured, yet still accelerating in surprising ways.

Editor’s Choice

- The global music streaming market is projected to reach $62.3 billion in 2025, marking a year-over-year growth of 9.7%.

- Spotify continues to dominate the market, holding a 31.5% share of global music streamers as of Q1 2025.

- Apple Music has grown its subscriber base to 110 million users worldwide, a 12% increase from last year.

- In 2025, 72% of all music streaming revenue comes from paid subscriptions, showing a continued shift away from ad-supported models.

- Gen Z now accounts for 38% of all music streamers in the United States, highlighting a youthful dominance in the market.

- The average daily listening time on music streaming platforms reached 104 minutes per user in early 2025.

- The United States remains the largest market for music streaming, expected to generate $15.2 billion in revenue by the end of 2025.

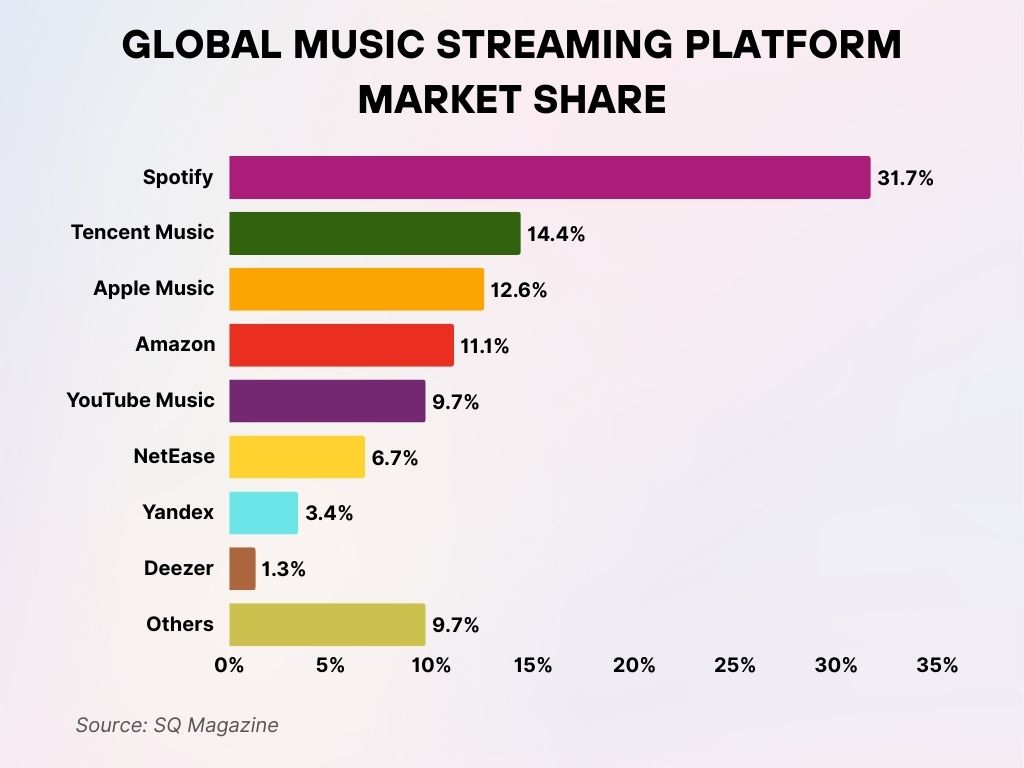

Global Music Streaming Platform Market Share

- Spotify leads the global music streaming market with a 31.7% share of total subscribers.

- Tencent Music holds the second spot with 14.4% of subscribers, primarily driven by the Chinese market.

- Apple Music accounts for 12.6%, making it the third-largest platform.

- Amazon Music follows closely with an 11.1% subscriber share.

- YouTube Music captures 9.7%, reflecting its growing popularity across younger audiences.

- NetEase has a 6.7% share, with a strong presence in China.

- Yandex controls 3.4%, mainly in the Russian market.

- Deezer contributes a smaller 1.3%, with a niche but loyal user base.

- Other platforms combined also make up 9.7%, showcasing a fragmented tail of smaller streaming services.

Global Market Size of Music Streaming

- In 2025, the global music streaming market is forecast to hit $62.3 billion, up from $56.8 billion the previous year.

- North America leads with a market value of $22.9 billion, representing over 36% of global revenue.

- Europe follows with an estimated $14.7 billion in music streaming revenue in 2025.

- The Asia-Pacific region has seen the fastest growth, expanding by 13.4% year-over-year to reach $11.1 billion.

- Latin America’s market size increased to $4.8 billion, showing notable growth driven by mobile streaming adoption.

- The Middle East and Africa now account for $3.2 billion, driven by rising smartphone penetration and localized music content.

- The global user base surpassed 815 million paid subscribers in 2025, with overall music streaming users (including free tiers) nearing 1.56 billion.

- Streaming revenue from emerging markets (India, Indonesia, Nigeria) grew by 17.8%, outperforming mature markets.

Top Music Streaming Platforms by User Base

- Spotify retains the top spot globally with 615 million monthly active users (MAUs) in Q1 2025, including 305 million premium subscribers.

- Apple Music reached 110 million users, with exclusive artist content fueling growth in North America and Europe.

- Amazon Music holds third place, boasting 90 million active users, with Prime integration driving retention.

- YouTube Music continues rapid expansion, hitting 92 million global users.

- Tencent Music platforms in China (QQ Music, Kugou, Kuwo) report a combined 589 million users, though monetization remains lower than Western counterparts.

- Deezer has grown its base to 23 million monthly active users, boosted by new AI-curated playlists.

- Boomplay, focused on African markets, reached 100 million installs with a 24% increase in active usage.

- JioSaavn and Gaana in India together serve around 110 million users, despite fierce competition from global players.

- Tidal reported a subscriber growth of 18%, now reaching 7.2 million users, with high-resolution audio and artist-first policies cited as key differentiators.

Total Song Counts by Music Streaming Services

- Apple Music, Deezer, and Amazon Music each offer the largest libraries with 90 million songs.

- Spotify follows closely with 82 million tracks in its catalog.

- YouTube Music provides access to 60 million songs.

- Yandex Music hosts around 40 million tracks.

- Tencent Music features a collection of 30 million songs.

- NetEase offers the smallest catalog with just 10 million songs.

Revenue Breakdown by Region

- The U.S. market will contribute approximately $15.2 billion to global music streaming revenue in 2025.

- Europe’s total revenue is projected at $14.7 billion, led by the UK, Germany, and France.

- China‘s music streaming industry is estimated to generate $6.4 billion this year, primarily through Tencent and NetEase platforms.

- India, while price-sensitive, is on track to contribute $1.1 billion in 2025 revenue, with freemium models prevailing.

- Brazil and Mexico lead Latin America, jointly accounting for $2.9 billion of the region’s total $4.8 billion revenue.

- The Middle East and North Africa (MENA) region crossed $1.5 billion, with localized streaming services like Anghami gaining traction.

- Australia generated $1.8 billion, a modest but steady figure driven by high per capita spending.

- In Sub-Saharan Africa, revenue growth reached $650 million, with Nigeria contributing over 35% of this amount.

Subscription vs. Ad-Supported Listening Trends

- 72% of global music streaming revenue now comes from subscription models.

- The number of premium subscribers reached 815 million, representing a 12.6% increase year-over-year.

- Ad-supported listeners still make up 43% of total users but contribute only 9.8% of global revenue.

- Average revenue per paid user (ARPU) is estimated at $5.64 per month globally in 2025.

- In the U.S., ad-supported revenue declined to $1.3 billion, while subscription revenue rose to $13.9 billion.

- Emerging markets like India and Indonesia show over 80% of users on free tiers, highlighting ongoing monetization challenges.

- Spotify’s freemium model maintains 310 million ad-supported users, but ARPU remains below $1.40 in most developing countries.

- YouTube Music ad-supported revenue grew by 11%, buoyed by video-first consumption trends.

- Pandora, though declining overall, still relies on ad-supported users for 84% of its total audience.

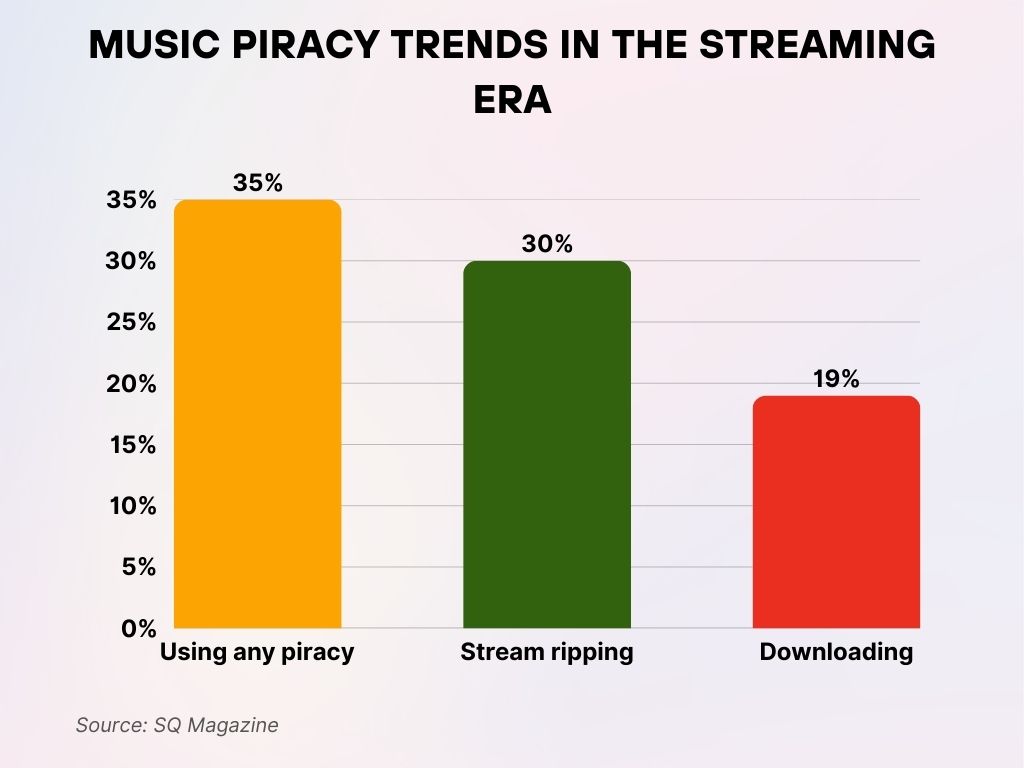

Music Piracy Trends in the Streaming Era

- 35% of internet users have accessed music through any form of piracy in the past 6 months.

- 30% used stream ripping, one of the most common modern piracy methods.

- 19% engaged in illegal downloading of music files.

- The data reflects persistent copyright infringement behaviors despite the growth of legal streaming platforms.

- Survey based on 12,610 internet users across 13 countries, highlighting a global trend.

Most Streamed Artists and Songs

- As of Q1 2025, Taylor Swift remains the most-streamed artist globally, crossing 48 billion cumulative streams on Spotify alone.

- The Weeknd’s “Blinding Lights” retained its title as the most-streamed song ever, now exceeding 4.4 billion streams across platforms.

- Bad Bunny leads the Latin charts with over 28 billion streams in total and maintains a top 3 global position for the third year in a row.

- Olivia Rodrigo’s 2025 album release generated 1.8 billion streams in its first two weeks, breaking Spotify’s debut-week record.

- On Apple Music, Drake surpassed 38 million monthly listeners, remaining the platform’s most followed artist.

- Billie Eilish saw a significant spike in Q1 2025, reaching 7.2 billion global streams, largely driven by Gen Z listeners.

- In the K-pop category, BTS collectively reached 38 billion streams, with solo acts like Jungkook and Jimin breaking into top global charts.

- Afrobeats artist Rema saw his global breakout continue, crossing 2.6 billion annual streams as of March 2025.

- TikTok-driven virality continues to influence charts, 65% of Spotify’s Viral 50 songs originated from TikTok trends in Q1 2025.

- YouTube Music’s most-watched music video in Q1 2025 was “Flowers” by Miley Cyrus, now surpassing 2.1 billion views.

Genre Popularity Across Platforms

- Pop music remains the most popular genre on Spotify and Apple Music, accounting for 31% of total streams.

- Hip-Hop holds second place, making up 22% of global streams, with the U.S. contributing nearly 60% of that total.

- Electronic and dance music (EDM) saw a resurgence in 2025, increasing by 9.3% year-over-year in total streams.

- Country music grew its global listenership by 14%, driven by increased adoption on Amazon Music and YouTube Music.

- Afrobeats exploded in popularity, especially in the UK and U.S., growing by 21% year-over-year on Spotify.

- Classical music streaming grew modestly at 5%, supported by dedicated apps like Apple Music Classical and IDAGIO.

- K-pop remains a global force, accounting for 7.5% of total streams in Asia-Pacific and 2.4% globally.

- On SoundCloud, independent and lo-fi genres now comprise 28% of trending tracks, with user-uploaded content fueling discovery.

- Latin music, especially reggaeton, grew by 18% globally, driven by Bad Bunny, Karol G, and Peso Pluma.

- Jazz and blues still represent under 2% of streams, though niche platforms report steady growth in dedicated fan bases.

Music Consumption by Source

- Paid music streaming leads with just under 25% of total music consumption.

- Video streaming (e.g., YouTube) follows closely behind, contributing nearly 23%.

- Radio remains relevant with about 17% of music consumption share.

- Short videos like TikTok account for roughly 12%.

- Ad-supported music streaming and purchased music (CDs/downloads) each contribute approximately 9–10%.

- Other sources, such as Netflix or music borrowing, represent around 6%.

- Social media and live shows contribute the least, with each making up less than 5% of overall music consumption.

Demographics of Music Streaming Users

- In the U.S., Gen Z (ages 13–27) accounts for 38% of all music streaming users, the highest share among age groups.

- Millennials (28–43) follow closely at 34%, while Gen X makes up around 15%.

- Streaming adoption among Baby Boomers (60+) has increased by 11% year-over-year, now representing 8% of users.

- 51% of global music streamers are male, while 48% are female, with 1% identifying as non-binary or other.

- Urban listeners represent 63% of the global streaming user base, while rural regions account for 37%.

- 80% of Gen Z music listeners discover new songs through short-form video platforms like TikTok and Instagram Reels.

- The average age of paid subscribers globally is 31, slightly younger than last year’s 32.5.

- In the U.S., Hispanic users represent 22% of streamers, while Black Americans make up 16% and Asian Americans 7%.

- Mobile streaming dominates among users aged 18–24, with 92% preferring smartphones over other devices.

- 71% of streaming users engage with playlists created by the platforms’ algorithms or editorial teams weekly.

Mobile vs. Desktop Streaming Usage

- In 2025, 89% of music streaming occurs via mobile devices.

- Smartphone usage continues to dominate with 1.42 billion global users, compared to 148 million desktop users.

- Tablet streaming rose modestly, now comprising 6.7% of all streams.

- In the U.S., 93% of Gen Z users prefer smartphones for listening, with desktop usage falling below 7%.

- Smart speaker streaming grew to represent 9.4% of home listening, led by Amazon Echo and Google Nest.

- Car-integrated music streaming now represents 15.3% of total U.S. listening time, boosted by services like Apple CarPlay and Android Auto.

- Desktop usage remains dominant among music producers and audio engineers, with 74% preferring desktop apps like TIDAL HiFi and SoundCloud Pro.

- Mobile apps are used more frequently for social sharing of music, with 54% of mobile users sharing tracks monthly.

- Data-saving modes on mobile apps have led to a 19% increase in app usage in developing markets.

- The average mobile user listens to 104 minutes of music per day, compared to 46 minutes on a desktop.

Music Engagement Based on Source

- Paid music streaming is the top source of engagement, accounting for 23% of music interactions.

- Video streaming follows closely with 22%, showing strong user preference for platforms like YouTube.

- Radio remains significant, contributing 16% to overall engagement.

- Short videos (e.g., TikTok) drive 11% of music consumption.

- Ad-supported music streaming and purchased music each represent 9% of engagement.

- Other sources, including borrowing and non-traditional platforms, make up 5%.

- Social media plays a smaller role at 3%.

- Live shows account for just 2%, highlighting the dominance of digital platforms.

Impact of Music Streaming on Physical and Digital Sales

- In 2025, music streaming accounts for 86.2% of total recorded music revenue in the U.S.

- Vinyl sales, however, rose by 11%, making it the only physical format showing consistent growth, reaching $1.6 billion in the U.S.

- CD sales declined further by 18.7%, now accounting for less than 2% of total music revenue.

- Digital downloads saw a 24% drop year-over-year, with major platforms like iTunes reporting record-low sales.

- Merchandise and concert bundle strategies are being used to compensate for falling download revenue.

- In the UK, physical sales make up only 9% of total music revenue.

- Japan remains the outlier, where physical media still accounts for 32% of music revenue in 2025.

- Bundled subscription models, such as those offered with telecom services, are encouraging migration from digital purchases to streaming.

- Bandcamp and similar platforms still support indie digital sales, but their share has shrunk to 1.2% of global revenue.

- Music streaming is now the primary revenue driver for 85% of independent labels, as per Q1 2025 data.

Growth of Podcast Consumption on Music Platforms

- In 2025, podcasts accounted for 17.6% of total audio content streamed on Spotify.

- Apple Podcasts saw a 12% increase in monthly listeners, reaching an estimated 44 million users in the U.S.

- YouTube Music officially integrated podcast functionality in Q1 2025, leading to a 22% spike in active listening hours.

- Gen Z and Millennials are the primary podcast audience, comprising 72% of total podcast consumption on music platforms.

- True crime and self-help podcasts top global genre charts, making up 28% of total podcast streams combined.

- In the U.S., weekly podcast listening reached 41% of the adult population, a record high for any year.

- Video podcasts have grown by 18.4% year-over-year, driven by creators repurposing content on Spotify and YouTube Music.

- Podcasts in non-English languages saw a 23% rise globally, with Latin America and Southeast Asia leading the charge.

- Platforms like Amazon Music have doubled down on exclusive shows, contributing to a 16% growth in podcast ad revenue.

- Podcast ad spend on music streaming platforms is projected to reach $3.1 billion globally by the end of 2025.

Top 10 Richest Musicians in 2025

- Jay-Z tops the list with an estimated net worth of $3.5 billion.

- Rihanna secures second place with about $2.1 billion.

- Sir Paul McCartney follows closely at $1.9 billion.

- Taylor Swift holds a strong position with around $1.8 billion.

- Bruce Springsteen is also among the elite with $1.7 billion.

- Madonna stands at approximately $1.3 billion.

- Herb Alpert matches close with $1.3 billion.

- Selena Gomez has accumulated roughly $1.2 billion.

- Beyoncé earns a spot with a fortune of about $1.1 billion.

- Bono rounds out the top 10 with $1 billion in estimated wealth.

Role of AI and Algorithms in User Engagement

- In 2025, AI-generated playlists will drive 34% of total user listening time on Spotify.

- Personalized daily mixes contribute to 65% of user engagement on Apple Music and Amazon Music combined.

- Platforms using machine learning to power discovery report a 19.2% higher user retention rate than non-personalized experiences.

- Spotify’s DJ AI feature, introduced in late 2024, saw a usage increase of 46% within Q1 2025.

- Mood-based and context-aware playlists now account for 27% of all new playlist subscriptions on major platforms.

- AI-powered voice assistants help users access personalized music instantly, especially on smart speakers, boosting music commands by 31% year-over-year.

- AI also powers content moderation, flagging over 1.8 million inappropriate uploads in Q1 2025 across streaming platforms.

- Platforms using behavioral analytics for curation reported an 8.5% increase in total listening time per user.

- TIDAL and Deezer now use AI for audio normalization and quality consistency, improving user satisfaction scores by 12%.

- AI-generated music remains niche but is growing, with over 2 million AI-created tracks streamed globally in Q1 2025.

Licensing and Royalty Distribution Trends

- In 2025, global music rights revenue from streaming is expected to exceed $28.4 billion, with 68% going to record labels and rights holders.

- Spotify reports that over $9 billion will be paid to artists and rights holders in 2025.

- Apple Music pays around $0.01 per stream, maintaining its position as the platform with one of the highest per-stream payouts.

- SoundCloud’s fan-powered royalties model paid out over $45 million directly to independent artists in 2025.

- Only 5% of artists receive more than 90% of total royalty payouts, highlighting the skewed income distribution.

- TikTok’s licensing deal renegotiations have impacted streaming residuals, prompting increased scrutiny from music publishers.

- The Mechanical Licensing Collective (MLC) in the U.S. reports a 31% increase in processed royalties compared to 2024.

- YouTube Music contributed $2.3 billion in royalty payouts in 2025, largely from user-generated content monetization.

- Royalty transparency remains a concern, with over 42% of independent artists claiming they don’t fully understand their earnings breakdown.

- Blockchain-based royalty platforms are gaining traction, now used by 7% of indie labels for smart contract distribution

Regional Trends in Music Streaming Consumption

- North America maintains the highest ARPU at $7.32, driven by premium subscription dominance.

- In India, over 83% of users stream through free tiers, but engagement is growing at 14% annually.

- Germany and France saw a combined 10% increase in subscription adoption, driven by improved family plan offerings.

- In Nigeria, music streaming penetration rose by 18%, with Afrobeats accounting for 75% of streamed content.

- Latin America’s mobile-first streaming habits continue to dominate, with Brazil leading with 72% mobile-only listeners.

- Japan, despite its physical media loyalty, saw streaming subscriptions grow by 11.8%, a national high.

- Middle Eastern platforms like Anghami report a 24% increase in localized Arabic content consumption.

- Russia’s music streaming ecosystem continues to face licensing issues, limiting access to major global catalogs.

- In Indonesia and the Philippines, regional pop dominates, with over 60% of the top-streamed tracks being in local languages.

- South Africa saw an impressive 19.6% year-over-year growth in music streamers, supported by affordable data packages.

Environmental Impact of Music Streaming

- Streaming generates 82,000 metric tons of CO₂ annually, with data centers and device usage as primary sources.

- In 2025, Spotify committed to being carbon neutral by 2030, focusing on data center efficiency and renewable energy.

- Apple Music reports 100% use of renewable energy for its streaming infrastructure as of Q1 2025.

- Deezer began displaying eco-badges on albums and tracks that were recorded in climate-conscious studios.

- Smart streaming settings, like lower bitrates and offline downloads, help reduce carbon emissions by up to 25% per user.

- Digital downloads have a lower carbon footprint than continuous streaming, but are declining in use.

- TIDAL partnered with sustainability organizations to plant 500,000 trees for every million subscribers milestone.

- The environmental cost of vinyl remains 16 times higher per unit than digital streaming, despite its resurgence.

- Industry-wide, 43% of platforms now publish annual sustainability reports.

- Listeners in Scandinavia lead in sustainable streaming practices, with 61% using offline mode regularly to save energy.

Recent Developments in the Music Streaming Industry

- Spotify acquired Podcastle, an AI audio startup, to enhance personalized podcast recommendations in early 2025.

- YouTube Music launched a new “Artist Connect” feature, allowing musicians to live chat during album releases.

- Amazon Music unveiled its immersive spatial audio experience exclusive to the Echo Studio, gaining traction in the U.S.

- Apple Music launched City Charts 2.0, tracking local music trends in over 150 cities worldwide.

- TikTok Music, now available in 22 countries, reported 48 million active users within six months of launch.

- Universal Music Group expanded its licensing partnerships with emerging platforms, such as Boomplay and Joox.

- AI-driven music production tools like Udio and Sunō have been integrated directly into SoundCloud’s creator tools.

- TIDAL launched Masterclass Live, offering virtual workshops with artists on music production and songwriting.

- Live-streamed music performances on streaming apps surged by 31%, led by partnerships with Twitch and Instagram Live.

- U.S. lawmakers proposed new regulations in April 2025 to mandate greater royalty transparency from all music platforms.

Conclusion

From personalized playlists to podcast power plays, 2025 has proven to be a landmark year for music streaming. The industry has matured but shows no signs of slowing. Growth is driven not just by the major players but by how platforms adapt to cultural nuances, regulatory landscapes, and technological shifts.

While convenience and access define the user experience, the rise of AI, regional diversity, and calls for fair royalty models point to a more complex, evolving ecosystem. And in this symphony of data, one thing rings clear: streaming isn’t just the future of music, it is music now.