The direct-to-consumer (DTC) business model has reshaped retail by allowing brands to sell straight to customers without traditional retailers or intermediaries. This shift has empowered companies to own customer data, tailor experiences, and respond rapidly to consumer trends. In the U.S. alone, DTC brands are carving out significant portions of retail spending via e-commerce and subscriptions, even as economic headwinds persist.

From subscription clothing boxes to digital skincare labels and wellness brands, this model now influences product innovation and consumer expectations across industries. Below, explore key data that illuminate the current state and future prospects of DTC commerce.

Editor’s Choice

- 72% of consumer products marketers say engaging customers meaningfully is harder than ever in 2026, underscoring competitive noise in DTC channels.

- 57% of consumers have switched to private label alternatives because they’re seen as more affordable than branded DTC products.

- 60% of consumers believe buying direct from a brand’s site should cost less than buying through marketplaces.

- Only 41% of consumers actively advocate for their favorite brands, reflecting loyalty challenges.

- 89% of marketers say AI is essential to attracting new DTC customers in 2026.

- 36% of consumers buy products via repeat subscriptions, showing the value of recurring revenue.

- Consumers belong to an average of 16.6 loyalty programs, though only 55% are active participants.

Recent Developments

- Global DTC sales continue growth momentum, with forecasted global revenue climbing from approximately $225.5 billion in 2024 to $880.1 billion by 2034, indicating long term expansion of the model.

- U.S. market estimations suggest DTC commerce will continue robust growth, potentially exceeding $250 billion by 2028, driven by digital engagement and tailored experiences.

- Resale channels are emerging within DTC, as brands build in-house second-hand marketplaces to capture eco-conscious shoppers and extend lifecycle value.

- Parachute Home’s closure of 19 retail stores and renewed focus on e-commerce underscores how some DTC brands are rebalancing strategies to improve profitability.

- Luxury brand Ferragamo saw wholesale revenue fall sharply in 2025, while its DTC sales grew 6.3% in Q4 alone, showing shifting priorities toward direct channels.

- DTC performance benchmarks like the Yotpo DTC Index now track approximately 40 influential brands’ revenue and growth trends to help industry players gauge performance.

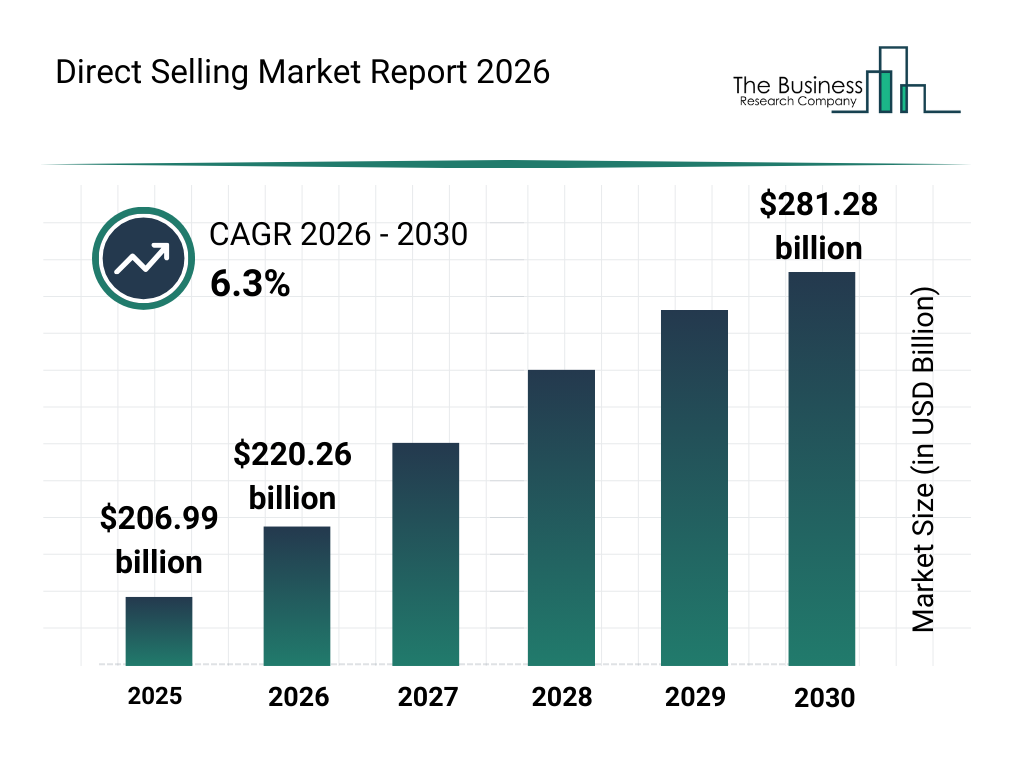

Direct Selling Market Growth Outlook

- The global direct selling market was valued at $206.99 billion in 2025, reflecting a substantial existing industry size.

- The market is projected to reach $220.26 billion in 2026, indicating steady year-over-year expansion.

- From 2026 to 2030, the industry is expected to grow at a CAGR of 6.3%, signaling sustained long-term momentum.

- By 2030, the market is forecast to climb to $281.28 billion, highlighting strong future demand.

- Overall, the sector is set to add more than $74 billion in new market value between 2025 and 2030, demonstrating significant expansion potential.

Sales Performance

- 36% of consumers purchase through repeat subscription models for predictable revenue.

- U.S. DTC e-commerce hit $239.75 billion in 2025, 19.2% of total retail e-commerce.

- 58% of supply chain leaders expect most sales to be DTC by 2026.

- 72% of marketers say engaging customers is harder, impacting sales.

- Loyal customers show 60-70% purchase conversion vs 5-20% new prospects.

- 81% of free-loyalty members shop more frequently with higher spending.

- Subscription industry grew 50% YOY in 2025, focusing on LTV.

- 89% of high-maturity brands report high customer retention rates.

- Email marketing drives top ROI for DTC sales alongside social and SEO.

Average Revenue per Brand

- The average revenue for established U.S. DTC brands ranges between $10 million and $50 million annually, depending on vertical and maturity.

- Emerging DTC startups often reach $1 to $5 million in annual revenue within their first three years if they achieve strong product-market fit.

- Beauty and personal care DTC brands average higher margins, often reporting gross margins above 60%, supporting stronger revenue scalability.

- Apparel DTC brands typically report gross margins between 45% and 55%, reflecting higher logistics and return costs.

- Subscription-driven DTC brands report 15% to 30% higher lifetime value than one-time purchase brands.

- The average annual revenue per Shopify merchant globally remains under $1 million, but top quartile DTC brands significantly exceed this threshold.

- Direct channel revenue now accounts for over 55% of total revenue for digitally native vertical brands, reflecting reduced wholesale dependency.

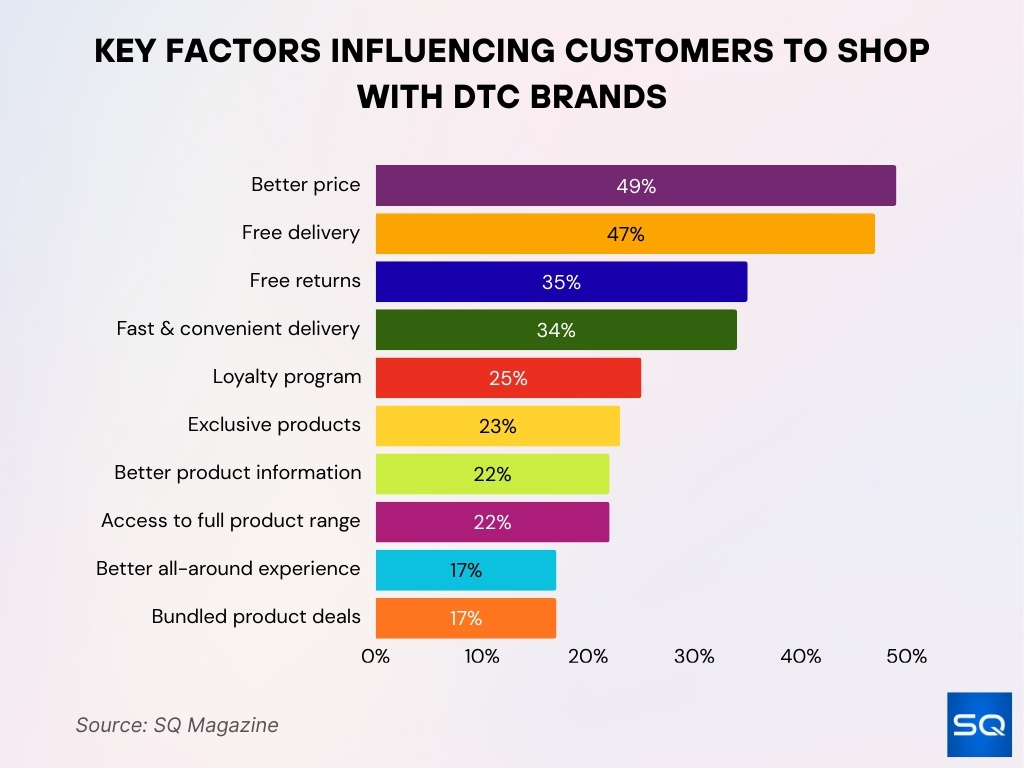

Key Factors Influencing Customers to Shop with DTC Brands

- Better price is the top motivator, cited by 49% of consumers, highlighting strong price sensitivity in DTC purchasing decisions.

- Free delivery ranks a close second at 47%, underscoring the importance of shipping incentives in online retail.

- Free returns influence 35% of shoppers, showing that risk-free purchasing significantly boosts conversion.

- Fast and convenient delivery motivates 34% of customers, emphasizing the growing demand for speed and convenience.

- A loyalty program appeals to 25% of buyers, indicating the value of rewards and repeat-purchase incentives.

- Exclusive products attract 23% of consumers, demonstrating interest in unique offerings unavailable elsewhere.

- Better product information is important for 22% of shoppers, reflecting the need for transparency and detailed descriptions.

- Access to the full product range also motivates 22%, suggesting customers value comprehensive brand catalogs.

- A better all-around experience influences 17% of consumers, highlighting the role of overall brand satisfaction.

- Bundled product deals motivate 17%, indicating moderate appeal for value packs and promotions.

Advertising Channels Performance

- U.S. digital ad spending reached $798.7 billion in 2025.

- Search advertising holds 40% of the digital ad market at $102.9 billion.

- Digital video revenue grew 19.2% to $62.1 billion, 24% of ad spend.

- Display advertising increased 12.4% year-over-year to $74.3 billion.

- 58% of DTC marketers allocate 41%+ budgets to digital channels.

- Email marketing generates a $36-$42 ROI per $1 spent.

- 64% of digital ad budgets are dedicated to mobile.

- Programmatic ad revenue hit $134.8 billion, up 18%.

- TikTok global ad revenue projected at $34.8 billion.

Subscription Statistics

- In the U.S., more than 40% of online shoppers report having at least one active product subscription.

- Roughly 28% of subscribers cancel within the first three months, making onboarding and early engagement critical.

- Brands that offer flexible subscription management reduce churn by up to 20%, according to industry benchmarks.

- Beauty and personal care represent one of the strongest verticals, with subscription penetration above 30% among millennial consumers.

- The average subscriber lifetime value is 2 to 3x higher than that of single purchase customers.

- More than 60% of subscription customers say convenience is the primary reason they enroll.

- Subscription commerce now accounts for nearly 20% of total DTC e-commerce revenue for digitally native brands.

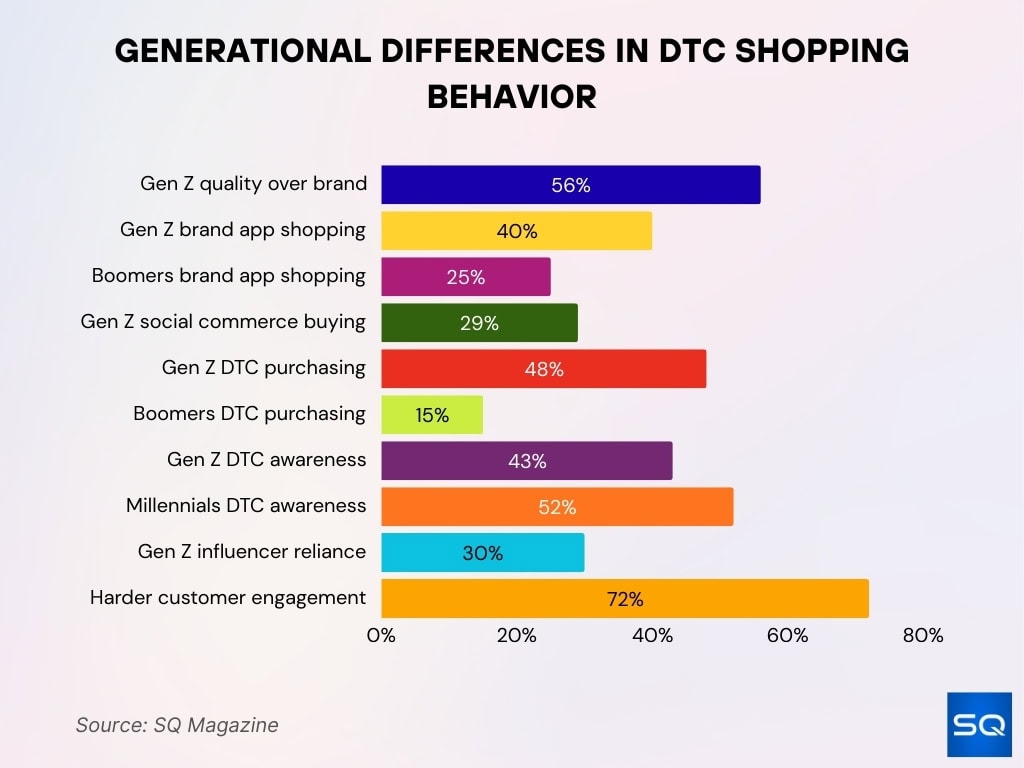

Age Distribution Statistics

- 56% of Gen Z say brand names matter less than product quality in purchasing decisions.

- 40% of Gen Z browse and shop directly from brand mobile apps vs 25% Boomers.

- 29% of Gen Z make purchases through social commerce like Instagram Shop.

- 48% of aware Gen Z have purchased from DTC brands vs 15% Boomers.

- 43% of Gen Z are aware of major DTC brands, lower than 52% Millennials.

- 30% of Gen Z rely on influencer reviews for buying decisions.

- 72% of consumer marketers say engaging customers is harder.

Top DTC Brands by Revenue

- Warby Parker FY2025 net revenue outlook $869–886 million, 13–15% growth.

- Allbirds focuses on sustainable growth amid market challenges.

- Glossier leverages 65% social engagement rate.

- Casper maintains 7% return rate vs industry 20%.

- Chewy autoship drives 73% of revenue.

- Peloton emphasizes subscription revenue share.

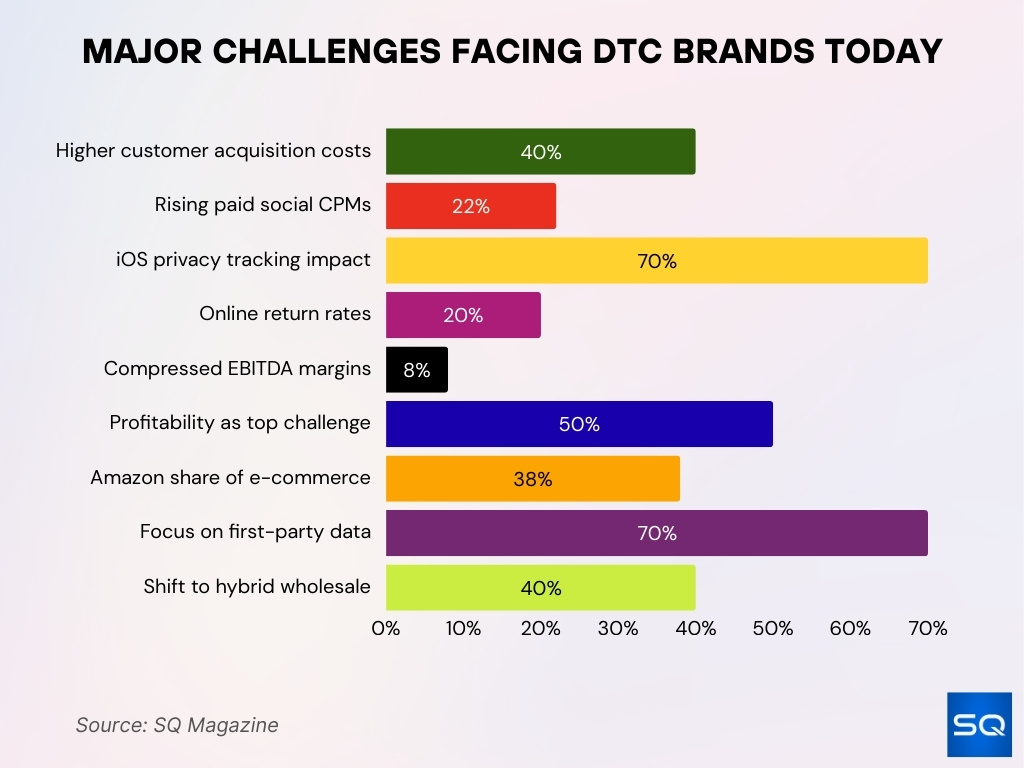

Industry Challenges in the DTC Landscape

- Customer acquisition costs increased 25–40% recently due to competition and privacy laws.

- Paid social CPMs rose 22% in recent years.

- iOS privacy changes impact tracking for over 70% of mobile users.

- U.S. online return rates average 17-20% across categories.

- Mid-market DTC EBITDA margins compressed to 7-8%.

- Nearly 50% of DTC founders cite profitability as the top challenge.

- Amazon accounts for 38% of U.S. e-commerce sales.

- Over 70% of digital marketers prioritize first-party data collection.

- Over 40% of DTC brands explore hybrid wholesale models.

Future Projections for DTC Brands

- U.S. DTC e-commerce sales are projected to exceed $213 billion by 2027, maintaining mid-single-digit annual growth.

- Global DTC market value could surpass $880 billion by 2034, driven by digital adoption and emerging markets.

- AI-powered personalization is expected to influence over 80% of digital commerce interactions by 2026.

- Social commerce in the U.S. is forecast to surpass $100 billion by 2026, benefiting mobile-first DTC brands.

- Subscription revenue growth is projected at 15% plus annually through 2027.

- Omnichannel DTC brands are forecast to outperform digital-only peers by 20% in revenue growth.

- Brands investing in first-party data ecosystems report up to 25% higher marketing efficiency.

- By 2026, mobile commerce is expected to represent nearly 45% of total U.S. e-commerce sales, reinforcing mobile-first DTC strategies.

Frequently Asked Questions (FAQs)

$212.9 billion.

10% growth to $2.4 billion.

37% market share.

25–40% higher CAC.

Conclusion

Direct-to-consumer brands have matured from venture-backed disruptors into established players reshaping retail economics. However, rising acquisition costs, tighter privacy regulations, and higher return rates continue to pressure margins. At the same time, subscription models, AI-driven personalization, and first-party data strategies offer measurable upside. Importantly, consumers increasingly expect transparency, value, and seamless digital experiences, expectations that DTC brands are uniquely positioned to meet.

Looking ahead, growth will likely favor brands that balance retention with acquisition, leverage omnichannel strategies, and build resilient customer relationships. Ultimately, the numbers underscore one clear point: DTC is no longer an emerging trend; rather, it has become a foundational pillar of modern commerce.