Cross-border e-commerce is transforming how consumers buy and how businesses sell beyond domestic borders. This trend is visible in retail and B2B channels alike, as companies tap international buyers for new revenue. For example, U.S. retailers increasingly export through global marketplaces, while brands in the Asia-Pacific leverage logistics hubs to reach Western markets, both scenarios showing real economic impact. Explore how these shifts shape revenues, platforms, and regional participation in the full article.

Editor’s Choice

- Global market growth: Cross-border e-commerce projected to rise from $551.23 billion in 2025 to $636.34 billion in 2026.

- CAGR outlook: Market forecast to expand at ~15.44% CAGR from 2025 to 2034.

- Long-term value: Some forecasts expect the market to reach $3.5 T by 2033.

- Cross-border share: Estimated to account for 22% of all e-commerce shipments by 2025.

- Digital wallet adoption: In broader e-commerce, digital wallets are accepted by ~73% of merchants.

- Payment diversity: Around 77% of consumers use multiple payment methods for cross-border transactions.

Recent Developments

- The Indian government removed value caps on courier exports to boost high-value cross-border sales.

- Revisions treat postal exports equally to cargo shipments to enhance e-commerce access to global markets.

- Global e-commerce logistics markets supporting cross-border delivery are expected to grow by over 18% from 2025 to 2026.

- Retailers increasingly face pressure to synchronize cross-border logistics and inventory planning in 2026.

- AI and data velocity are rising priorities for improving cross-border operational efficiency in e-commerce.

- Global payments innovations like real-time rails and stablecoins are shaping cross-border checkout experiences.

- Trade agreements and tariff considerations continue to drive strategic cross-border planning.

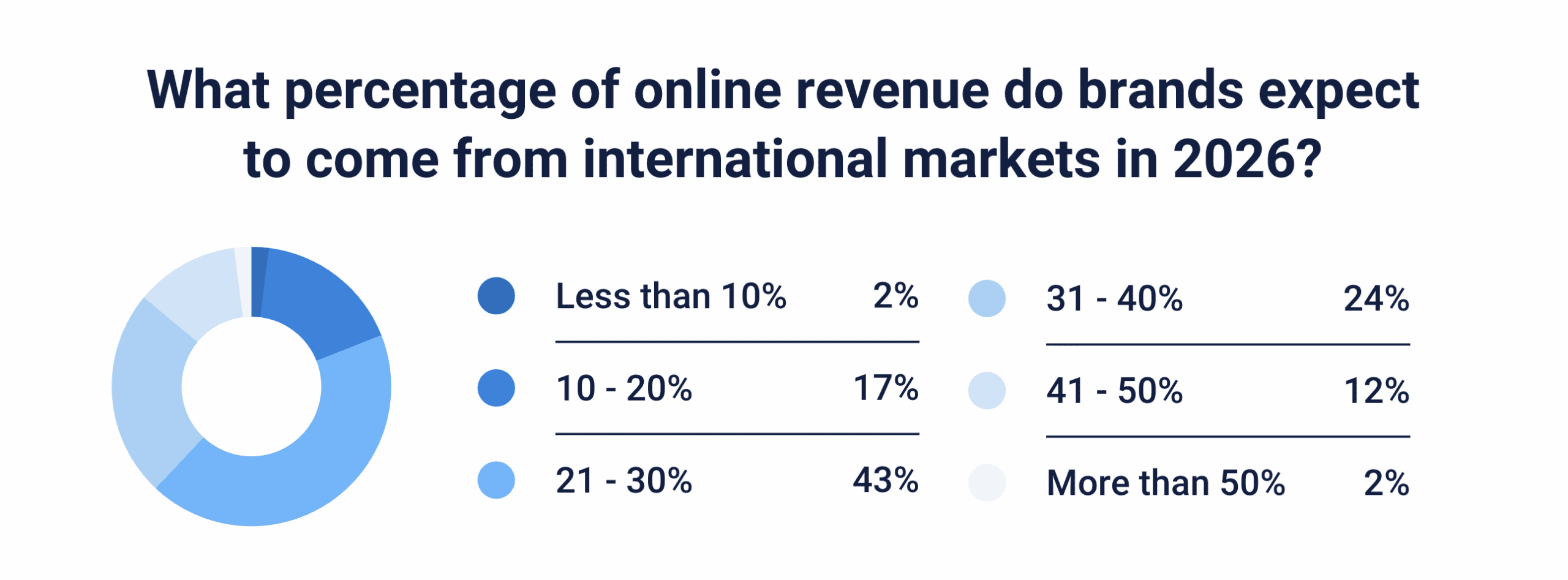

Expected Share of Online Revenue from International Markets

- The largest group of brands (43%) expects 21–30% of their online revenue to come from international markets in 2026.

- About 24% of brands anticipate 31–40% of revenue from global customers, indicating strong cross-border growth.

- Nearly 17% of companies project a more modest 10–20% contribution from international sales.

- A notable 12% of brands expect international markets to generate 41–50% of their online revenue.

- Only 2% of businesses foresee less than 10% of revenue coming from abroad, showing most brands rely on global demand.

- Likewise, just 2% expect more than 50% of revenue from international markets, suggesting few brands are predominantly global in sales.

Share of Total E-commerce

- In Europe, cross-border e-commerce grows at 29% CAGR through 2031.

- Brands expect 21-30% of 2026 sales from international markets.

- 42.5% of brands anticipate 21-30% cross-border revenue share.

- Global e-commerce totals $6.4 trillion, with cross-border ~22% of deliveries.

- Central/Eastern Europe e-commerce surges 59%.

Regional Market Analysis

- Asia-Pacific cross-border e-commerce grows at 27.5% CAGR through 2030.

- China’s cross-border market reaches $312.12 billion by 2034 at 14.7% CAGR.

- Latin America e-commerce surpasses $200 billion, and cross-border transactions double.

- Europe’s cross-border e-commerce is projected to reach €360 billion.

- North America cross-border B2C market shows robust growth from high digitalization.

- 67% APAC consumers engage in cross-border purchases.

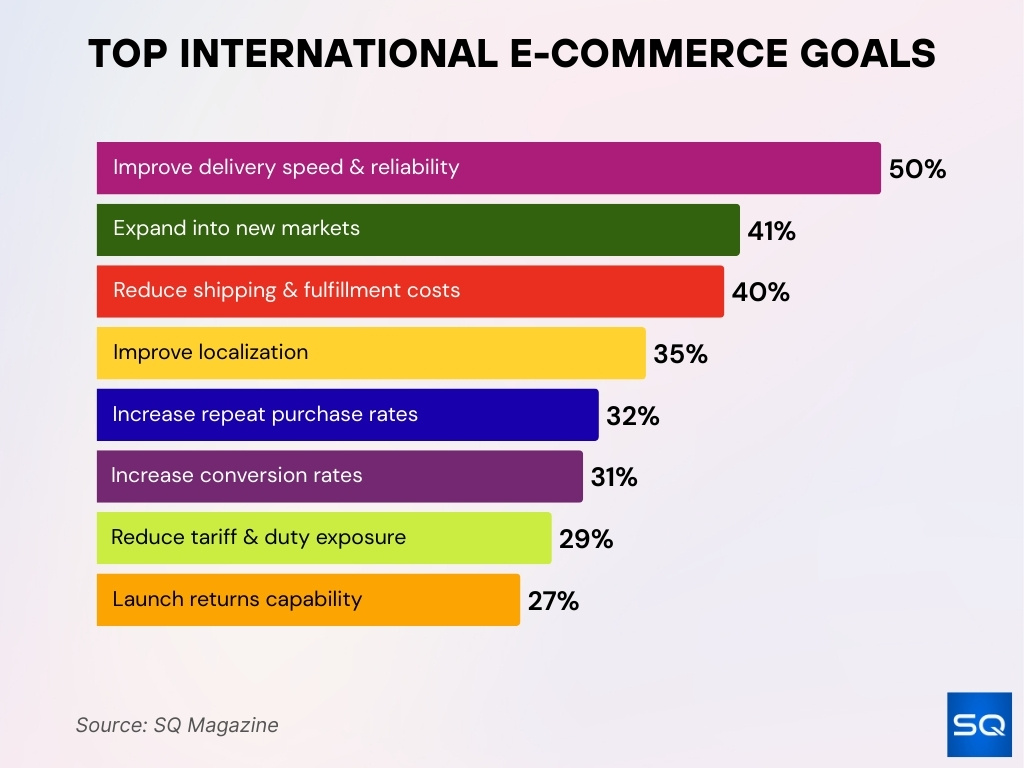

Top International E-commerce Goals

- The leading priority for global expansion is improving delivery speed and reliability, cited by 50% of brands.

- 41% of companies aim to expand into new markets, highlighting strong ambitions for international growth.

- Nearly 40% focus on reducing shipping and fulfillment costs, underscoring the expense challenges of cross-border commerce.

- About 35% of brands prioritize improving localization, adapting language, content, and user experience for regional audiences.

- 32% seek to increase repeat purchase rates, emphasizing long-term customer retention abroad.

- Close behind, 31% are working to boost conversion rates, improving the effectiveness of international sales funnels.

- Around 29% aim to reduce tariff and duty exposure, reflecting regulatory and cost pressures in global trade.

- Finally, 27% plan to launch or enhance returns capabilities, addressing a key friction point in cross-border ecommerce.

Top Platforms and Marketplaces

- Amazon leads with $362 billion GMV across domains.

- Alibaba and AliExpress dominate the B2C/B2B cross-border trade from China.

- Shopee reaches 50 million monthly users in Brazil.

- TikTok Shop GMV exceeds $54 billion, targeting 100 countries.

- Temu hits 120 million monthly users in the U.S.

- Lazada integrates the Alibaba ecosystem for a $50 average order value.

- Southeast Asia cross-border market is worth $50.37 billion.

- Shopee and Lazada control over 60% Indonesia/Vietnam GMV.

Payment Methods Breakdown

- Digital wallets reach 66% of global e-commerce payments.

- Digital wallets have grown to 5.4 billion users worldwide.

- Cards dominate with VISA at 97.1% in UK online shops.

- VISA leads France at 96.3% of online stores.

- Alternative payments exceed 60% in Asia-Pacific transactions.

- BNPL providers surpass 150 worldwide.

- Digital wallets are preferred by 26% of multi-country senders.

- Cross-border e-commerce grows 17% annually.

- Global payments market hits $3.12 trillion.

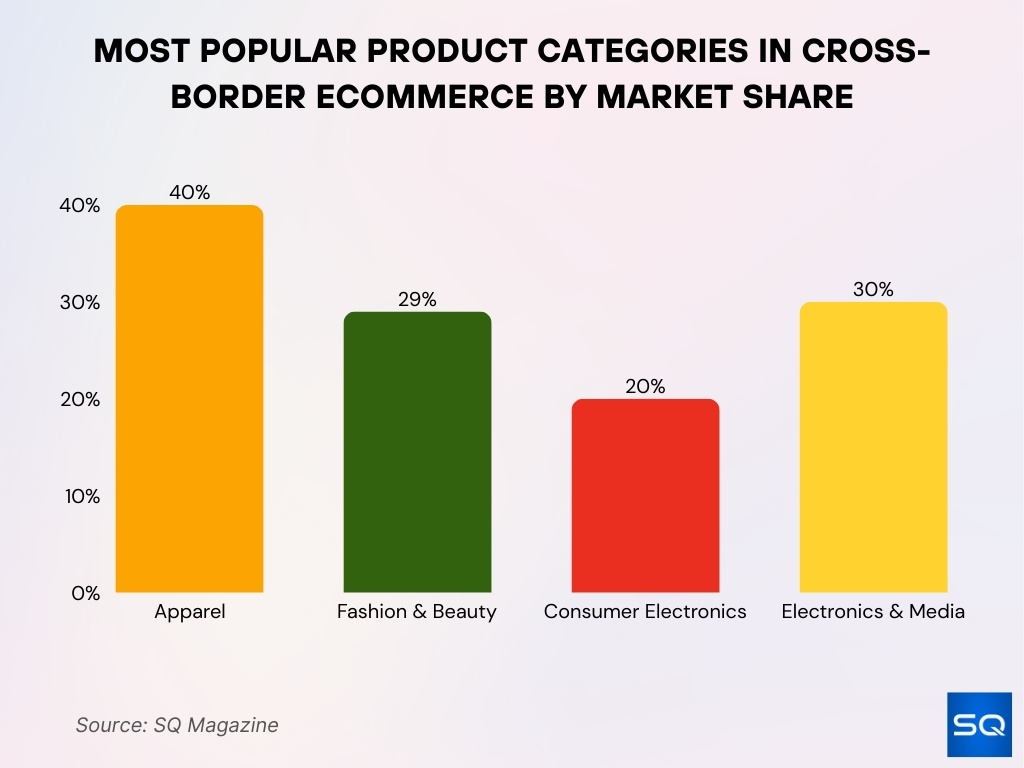

Popular Categories

- Apparel dominates with 40% of cross-border sales.

- Fashion and beauty account for 29% of market share.

- Consumer electronics represent 20% of cross-border spending.

- Electronics and media exceed 30% global cross-border share.

- Health and beauty products drive double-digit growth.

- Cross-border electronics sales total $282 billion.

- Hobby and leisure sales reach $233 billion.

- Personal care products hit $105 billion.

Shopper Penetration Rates

- 59% of global shoppers buy from retailers outside their country.

- 31.9% of U.S. online shoppers purchased cross-border.

- Canada shows 55.5% cross-border purchase rate among online shoppers.

- 51.6% of Spanish online shoppers bought from foreign sellers.

- 280 million cross-border buyers in China.

- 75% of subscription shoppers buy cross-border.

- 43% of Gen Z shoppers buy cross-border monthly.

- 55% of Singapore’s online purchases are cross-border.

- 42% of online shoppers purchase from foreign sellers.

Consumer Demographics

- Millennials comprise over 35% of cross-border spending.

- 52% of 25-34 year olds buy cross-border.

- Apparel top category for 62% of 16-24 year olds.

- 72% of Chinese and 65% UAE millennials shop cross-border.

- 37% of millennials make 11+ cross-border purchases yearly.

- 55% Gen Z use mobile for purchases.

- 56% Gen Z buy via social commerce.

- 85% Austria digital buyers purchase cross-border.

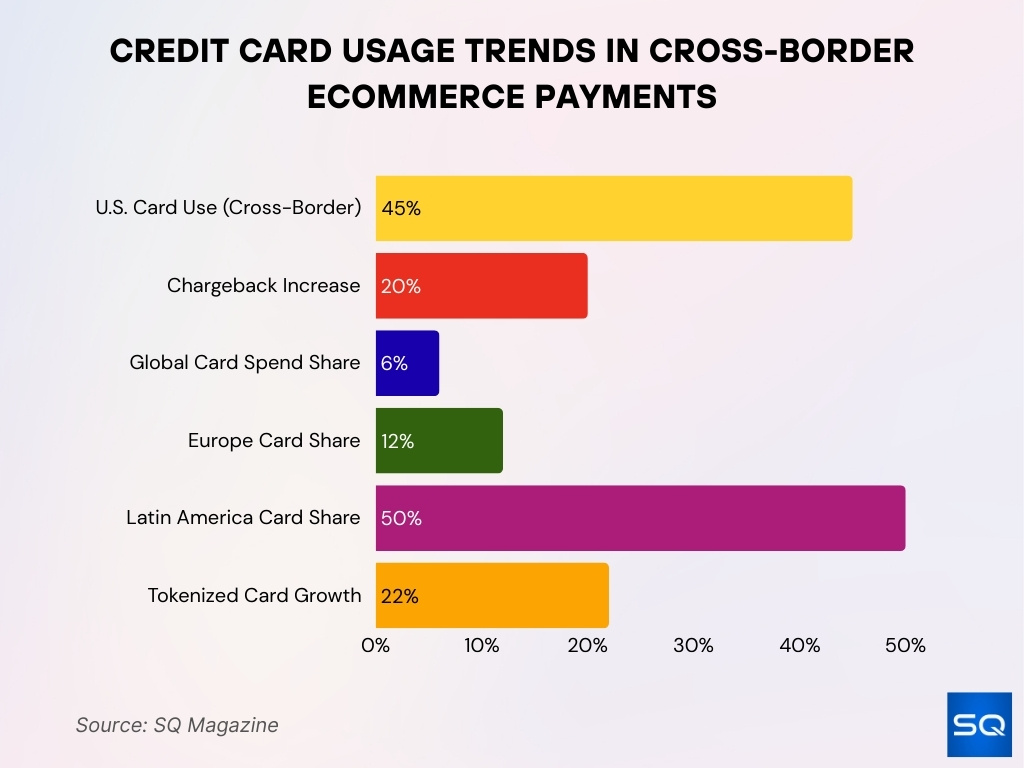

Credit Card Usage

- U.S. credit cards are used in over 45% of international online purchases.

- Chargeback rates 20% higher for cross-border vs domestic.

- Global cross-border card spending share reaches 6% of total.

- Europe card cross-border share hits 12% of payment volume.

- Latin America credit cards hold over 50% online retail payments.

- Asia-Pacific cards account for $1.13 trillion in cross-border transactions.

- Tokenized card payments grow 22% in cross-border.

Gen Z Preferences

- 73% of Gen Z consumers say they are comfortable purchasing from overseas retailers.

- Gen Z cross-border spending grew 21% year over year in 2025, outpacing older cohorts.

- Over 65% of Gen Z buyers prefer mobile-first checkout for cross-border transactions.

- Social commerce influences over 40% of Gen Z cross-border purchases, particularly through short-form video platforms.

- Gen Z shoppers are 2x more likely to use digital wallets instead of credit cards for international purchases.

- Nearly 60% of Gen Z consumers prioritize sustainable international brands, affecting cross-border buying decisions.

- Fast delivery expectations are high, with 68% of Gen Z expecting international orders within 7 days.

- Gen Z is 30% more likely than Gen X to try new overseas brands, reflecting lower brand loyalty barriers.

Incentives and Motivations

- Price advantage remains the top driver, with 68% of cross-border shoppers saying they buy internationally to find lower prices.

- Around 55% of global consumers purchase cross-border for product availability, especially items not sold domestically.

- Nearly 49% of U.S. cross-border buyers cite access to unique brands as a primary reason for shopping overseas.

- Free shipping incentives increase cross-border conversion rates by up to 35%, particularly in North America and Western Europe.

- Transparent duty and tax calculations at checkout reduce cart abandonment by over 20% in cross-border transactions.

- Approximately 62% of shoppers expect localized pricing in their currency, influencing purchase confidence.

- Loyalty programs boost repeat cross-border purchases by 18% year over year, particularly among Millennials.

- Seasonal sales events drive cross-border order volumes up by 40% to 60% during peak periods.

Logistics and Delivery Stats

- Cross-border shipping volumes increased 17% in 2025, reflecting continued global e-commerce expansion.

- Average international delivery times have dropped to 6 to 8 days in major trade corridors, down from 10 or more days in 2022.

- Nearly 48% of consumers abandon cross-border carts due to high shipping costs.

- Real-time shipment tracking improves customer satisfaction scores by up to 25% for international orders.

- Reverse logistics costs for cross-border returns are 2 to 3x higher than domestic returns, impacting profitability.

- Over 70% of shoppers expect clear delivery timeframes before checkout, especially for international purchases.

- Same-region fulfillment centers reduce cross-border delivery costs by 15% to 25%.

- Customs delays account for over 20% of late international deliveries, particularly in emerging markets.

Regulatory Impacts

- More than 130 countries updated digital tax or VAT rules between 2023 and 2025, directly affecting cross-border sellers.

- The European Union VAT e-commerce package increased compliance transparency but added reporting requirements for sellers.

- In the U.S., the de minimis threshold of $800 continues to shape import flows for low-value cross-border shipments.

- Data protection laws impact cross-border data handling for over 70% of global online retailers serving EU customers.

- Trade tensions and tariff shifts in 2025 affected cross-border product pricing by 5% to 15% in certain categories.

- Digital services taxes in several countries increased cross-border operational costs for marketplaces by 2% to 3% of revenue.

- Compliance automation software adoption among cross-border merchants rose 22% year over year in 2025.

- Regulatory fragmentation remains one of the top three challenges cited by over 50% of international e-commerce sellers.

Future Trends

- The global cross-border e-commerce market is projected to surpass $3 trillion by 2033, reflecting sustained double-digit growth.

- AI-powered localization tools are expected to improve cross-border conversion rates by up to 30% over the next five years.

- Cross-border B2B e-commerce is forecast to grow faster than B2C, with projected annual growth above 17% through 2030.

- Sustainable shipping options influence purchasing decisions for over 60% of Gen Z buyers, pushing retailers to adopt greener logistics.

- Digital wallet share of cross-border payments is projected to exceed 55% globally by 2027.

- Same-day cross-border delivery pilots in Europe and Asia could reduce delivery windows to under 48 hours in key corridors.

- Cross-border marketplace sales are projected to account for over 30% of total global online retail by 2030.

Frequently Asked Questions (FAQs)

Digital wallet transaction value is expected to grow from $7.5 trillion in 2022 to $12 trillion by 2026.

Cross-border sales are expected to grow about twice as fast as the wider e-commerce sector through 2030.

Global retail e-commerce sales, including cross-border, are estimated to reach over $8 trillion by 2026.

Conclusion

Cross-border e-commerce continues to reshape global retail and trade. Consumers increasingly shop beyond national borders to access better prices, broader selection, and global brands. Meanwhile, businesses invest in localized payments, faster logistics, and regulatory compliance to compete internationally.

With projected multi-trillion-dollar growth ahead, cross-border commerce is no longer a niche strategy; it is a core revenue channel for global brands and small businesses alike. Understanding incentives, operational challenges, and regional dynamics allows companies to position themselves for sustained international success.