Business loans and personal loans remain critical tools for financing goals in the U.S. economy. Business owners use loans to fund expansion, manage cash flow, or invest in equipment, while individuals increasingly turn to personal loans for debt consolidation or emergency expenses. The differences in loan size, interest costs, and approval criteria can shape borrower decisions and outcomes. In the following sections, we explore the latest statistics that reveal how these loan markets perform.

Editor’s Choice

- 24.6 million Americans held personal loans in Q1 2025, a 4.7% increase year-over-year.

- Total U.S. personal loan debt reached $253 billion in early 2025, up 3.3% from 2024.

- The average personal loan per borrower in Q1 2025 was $11,631.

- Unsecured personal loan originations rose 18% YoY to 5.4 million accounts in Q1 2025.

- Small business loan interest rates at banks ranged from 6.7% to 11.5% in mid‑2025.

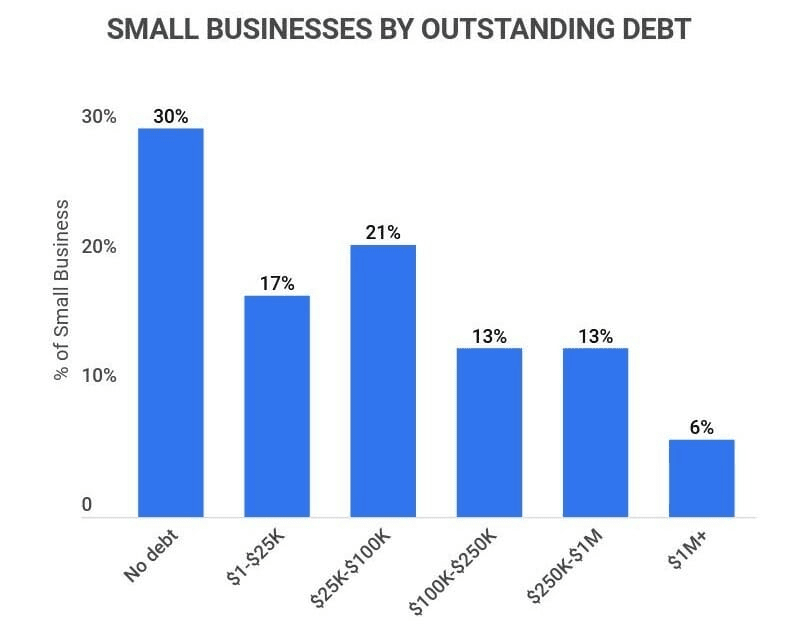

- Nearly 40% of small firms hold over $100,000 in business debt.

- Personal loan delinquency (60+ days) fell to 3.49% in 2025 from 3.75% the year before.

Recent Developments

- Unsecured personal loan originations grew 18% year-over-year through early 2025, signaling higher credit demand.

- Average personal loan debt per borrower increased slightly from 2024 to 2025, reaching about $11,724 in Q3 2025.

- Delinquency rates for personal loans (60+ days past due) hovered at ~3.5% in 2025, modestly elevated from the prior year.

- U.S. Federal Reserve surveys show fewer small businesses sought bank financing in 2024 compared to 2023, suggesting tighter credit access.

- Some lenders are facing higher concentration risk in small business portfolios, tied to large borrower exposures.

- Federal Reserve rate cuts late in 2025 seek to support borrowing demand and labor markets.

- SBA‑backed financing grew 7% in fiscal 2024, with small‑dollar loans gaining traction.

- The Fed’s Consumer & Community Context underscores the ongoing importance of business credit options for entrepreneurs.

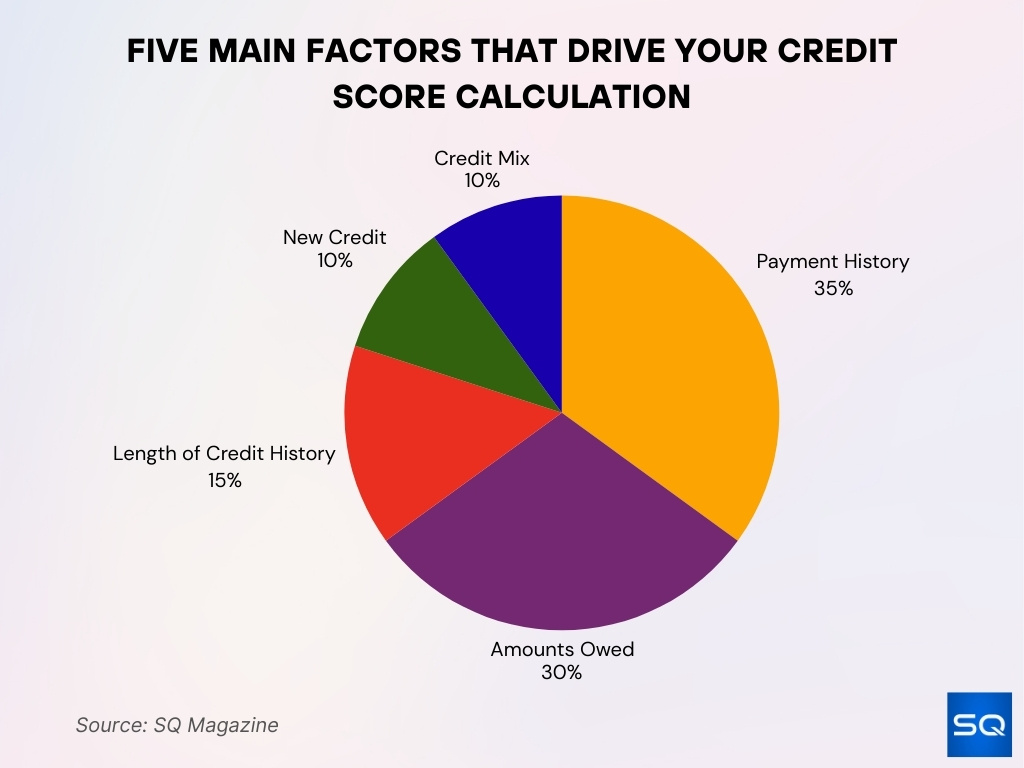

Top 5 Factors That Impact Your Credit Score

- 35% of your score comes from payment history, the most critical factor.

- 30% is based on the amounts owed across your credit accounts.

- 15% is influenced by the length of your credit history.

- 10% comes from the number of new credit accounts opened.

- 10% is shaped by your credit mix, or the variety of credit types used.

Borrower Profiles and Eligibility Trends

- The typical personal loan borrower in 2025 carries around $11,631–$11,724 in debt.

- Personal loans remain more prevalent among younger workers and renters, per broader lending patterns.

- Borrowers with credit scores above 680 often secure more favorable personal loan rates.

- Small business borrowers are less likely to apply at major banks than in prior years.

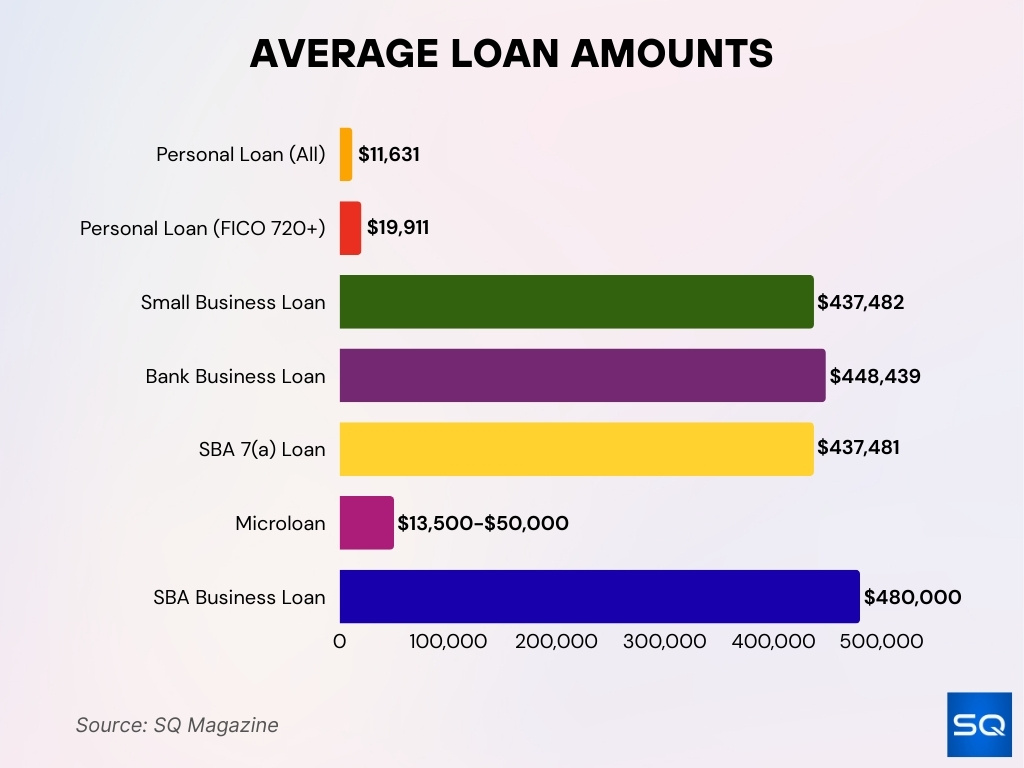

- A broad mix of business sizes seek credit, from microloans (~$13,500) to larger commercial debt (~$437,000).

- Increasing digital lending means more borrowers complete online applications, especially for personal credit.

- Underserved segments (minority or low‑income borrowers) often face stricter underwriting and limited access.

- Personal loan demand continues rising, indicating borrowers may prioritize flexible, unsecured options.

Average Interest Rates: Business vs. Personal Loans

- Business loan rates at banks averaged 6.7% to 11.5% in 2025, depending on lender and loan type.

- Online business loan APRs often exceed traditional banks, sometimes above 14%+.

- Average personal loan rates vary widely but are ~12.23% in 2025 on many platforms.

- Some reports cited personal loan rates up to ~26.5% on average across certain lenders through mid‑2025.

- Personal loan APR ranges typically span from the single digits to above 30%, influenced by credit score and loan size.

- Business loans with SBA backing often carry lower interest costs than unsecured business credit.

- Borrowers with excellent credit see more favorable personal and business loan pricing.

- Recent Fed policy cuts may ease borrowing costs modestly in 2026, affecting both loan categories.

Small Business Breakdown by Outstanding Debt

- 30% of small businesses have no outstanding debt.

- 17% hold debt between $1,000 and $25,000.

- 21% owe between $25,001 and $100,000.

- 13% carry debt ranging from $100,001 to $250,000.

- 13% have outstanding debt of $250,001 to $1,000,000.

- 6% operate with debt over $1,000,000.

Secured vs. Unsecured Loan Mix

- A majority of personal loans are unsecured, meaning no collateral is required.

- Business loans often mix secured options (equipment, real estate) with unsecured lines of credit.

- Microloans (~$13,500) are typically unsecured or lightly secured, appealing to startups.

- SBA 7(a) loans may require collateral for larger amounts, but often support underserved borrowers.

- Unsecured personal loan originations grew 18% in early 2025, showing a strong appetite for unsecured credit.

- Secured business financing remains common for asset purchases or working capital.

- Alternative lenders increasingly offer unsecured business lines and term loans online.

- Collateral requirements vary significantly across lender types, from strict banks to fintech providers.

Approval Rates and Underwriting Standards

- Only 13% of small business loan applications are approved by the largest banks.

- 16% of banks tightened lending standards for small business C&I loans in Q1.

- Nearly 20% of banks tightened standards for large/middle-market C&I loans in Q1.

- Small banks fully approve 52% of small business loan applications.

- Credit unions fully approve 51% of small business loan applications.

- Online lenders fully approve 31% of small business loan applications.

- 40% of SMEs denied financing due to low revenue and weak cash flow.

- Community banks issued 38% of total SME credit outstanding.

- 72% of loan denials cite borrower financials as the primary reason.

Average Loan Amounts Across Borrowers and Loan Types

- The average personal loan per borrower fell to $11,631 in Q1 2025.

- For borrowers with FICO 720+, average personal loans are $19,911.

- The average small business loan amount is approximately $437,482.

- Bank loans average $448,439, while SBA 7(a) loans average $437,481.

- Microloans average $13,500, with a cap of $50,000.

- SBA business loans average around $480,000.

- Equipment financing covers 80–100%, while invoice financing covers 70–90% of costs.

Application Process, Speed, and Funding Timelines

- Personal loans are funded in 1-3 business days for most online lenders.

- SBA Express loans are approved within 36 hours but funded in 30-60 days.

- SBA 7(a) loans take 60-90 days for full approval and the funding process.

- SBA 504 loans require 30-45 days for approval and up to 90 days for funding.

- Fintech lenders provide business loan funding in as little as 24 hours.

- Traditional banks average 3-5 weeks for small business loan decisions.

- Online lenders offer pre-approval in 5 minutes with funding in 3 days on average.

- SBA loans generally process in 60-90 days, depending on the lender and size.

- Automated fintech underwriting cuts processing from weeks to hours.

Repayment Terms and Schedules

- Personal loan terms average 2-7 years across most lenders.

- SBA 7(a) real estate loans extend up to 25 years maximum maturity.

- Business term loans commonly feature 10-year repayment periods.

- SBA working capital loans are limited to 10 years maximum term.

- Business lines of credit typically renew every 12-24 months.

- Short-term business loans require repayment within 3-36 months.

- Equipment financing SBA loans reach up to 10-15 years based on asset life.

- Personal loans allow fixed monthly payments over 1-7 year spans.

- SBA 504 loans offer 10-25 year terms for real estate projects.

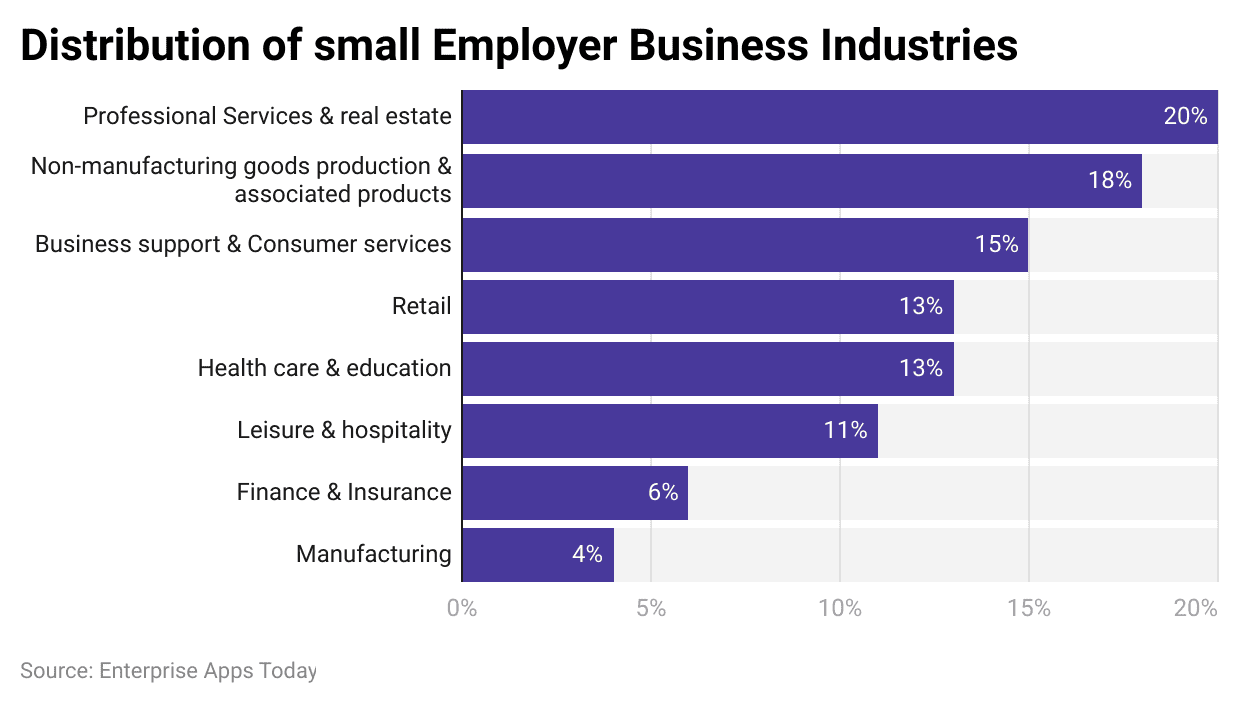

Industry Distribution of Small Employer Businesses

- 20% of small employer businesses are in professional services and real estate.

- 18% operate in non-manufacturing goods production and related products.

- 15% focus on business support and consumer services.

- 13% are engaged in the retail sector.

- 13% work in health care and education.

- 11% belong to the leisure and hospitality industry.

- 6% are part of finance and insurance.

- 4% operate in manufacturing.

Credit Score and Credit History Requirements

- Average FICO score reaches 715 among U.S. consumers.

- Personal loans require a minimum 580 FICO score from most lenders.

- Borrowers with 740+ FICO scores access the lowest personal loan rates.

- Banks demand a 680+ personal credit score for business loans.

- Business credit scores above 75 are considered strong by lenders.

- SBA 7(a) loans need a minimum 160 FICO SBSS score.

- Online lenders accept business loans from 500 FICO scores.

- 680-719 FICO range yields 23.27% average personal loan APR.

Business Revenue, Time‑in‑Business, and Financials Requirements

- Term loans require a minimum $96,000 annual revenue.

- Lines of credit need at least $50,000 annual revenue.

- SBA loans demand a minimum $96,000 annual revenue threshold.

- Many lenders seek $10,000 monthly revenue minimum.

- Banks typically require 2 years minimum time in business.

- Online lenders accept 6-12 months time in business.

- Invoice factoring needs $10,000 in monthly invoices outstanding.

- Revenue-based financing requires $10,000 monthly revenue.

- SBA 7(a) limits businesses to $7.5 million average annual revenue.

Debt‑to‑Income vs. Debt‑Service‑Coverage Metrics

- Personal loan lenders typically prefer DTI ratios at or below 36% for approval.

- Many unsecured personal loan providers cap maximum DTI between 35-40%.

- Some high‑DTI personal loan programs accept back‑end DTIs up to 50% for strong borrowers.

- Front‑end DTI comfort range for many lenders sits around 28-33% of income.

- Back‑end DTI comfort zone for many lenders falls between 36-43%.

- Commercial and small business lenders commonly target a DSCR of at least 1.25×.

- SBA lenders often look for a DSCR of 1.25× or higher on 7(a) loans.

- Many DSCR loan programs set minimum DSCR requirements in the 1.15-1.25× range.

- Stabilized commercial assets are typically underwritten to a DSCR of about 1.25× as a safe target.

Collateral, Guarantees, and Personal Liability

- About 76% of small business loans, lines of credit, and cash advances from nonbank lenders are secured by collateral.

- Unsecured personal loans account for 48% of the global personal loan market revenue, reflecting dominant non‑collateral lending.

- TransUnion reports $257 billion in outstanding unsecured personal loan balances in Q2, with an average balance of $11,676 per borrower.

- SBA requires personal guarantees from all owners with at least 20% equity in the business on guaranteed loans.

- SBA Express loans up to $50,000 do not require collateral, though larger Express loans may, based on lender policy.

- Among small firms, SBA loans or lines of credit represent 20% of credit sought, often paired with collateral to boost approval odds.

- Equipment and real‑estate small business loans show full approval rates of 73% and 54% respectively, reflecting strong collateral support.

Fees, Closing Costs, and Total Cost of Borrowing

- Most personal loan origination fees range from 1% to 10% of the loan amount, with 1% to 5% viewed as reasonable.

- Some online personal lenders charge origination fees up to 12%, significantly raising the effective APR.

- A 3% origination fee on a $10,000 personal loan can increase the total cost to about $13,347 over 5 years at 10% interest.

- Business loan closing costs commonly range from 1% to 6% of the total loan amount.

- Traditional bank business term loans typically carry 1-3% in closing costs, while SBA 7(a) loans run about 2-5% including guarantee fees.

- Commercial real estate business loans can see closing costs of 3-6%, often exceeding $25,000 on large deals.

- SBA 7(a) guarantee fees range from 0.00% to 3.75% of the guaranteed portion, depending on loan size and term.

- On loans over $1,000,000 with terms above 12 months, SBA guarantee fees can reach 3.50-3.75% of the guaranteed portion.

- Mortgage-style property loans for businesses typically add another 2-5% in closing costs, averaging about $4,661 for U.S. home purchases.

Default Rates and Delinquency Trends

- As of Q3 2025, the personal loan delinquency rate (60+ days) was about 3.52%, a slight increase from the prior year but lower than other unsecured credit delinquencies.

- Personal loan debt in the U.S. reached $269B by Q3 2025, reflecting broader credit growth and repayment risk.

- Although personal loan delinquency is elevated relative to some loan types, it remains below historical highs seen during major downturns.

- Corporate loan delinquencies climbed nearing the highest level since 2017, with small to mid‑sized firms showing more late payments.

- Some SBA loan segments saw delinquencies and defaults rise significantly after changes in program guarantees and borrower behavior.

- P2P and alternative lending channels report distinct risk patterns, where higher interest rates correlate with default probability.

- Delinquency and default trends vary widely by loan type, borrower credit profile, and economic conditions in 2025.

Online, Fintech, and Alternative Lender Penetration

- In 2025, digital lending platforms accounted for 63% of U.S. personal loan originations, showcasing tech‑driven market penetration.

- Fintech lenders now originate more unsecured personal loans than traditional banks in the U.S., indicating strong market shifts.

- The global fintech lending market size reached around $590 billion in 2025, including both personal and business digital loans.

- Online marketplaces such as Lendio have facilitated over $12 billion in business financing, simplifying access for small businesses.

- Biz2Credit and similar online platforms use analytics and automation to streamline business loan decisions.

- Peer‑to‑peer lenders like Prosper Marketplace have issued over $23 billion in personal loans, showing alternative channels’ reach.

- Digital platforms reduce application timelines and friction, attracting underserved borrowers with flexible credit profiles.

- Fintech penetration varies regionally, with North America and the Asia Pacific growing rapidly due to tech adoption.

Regional and Country‑Level Loan Market Breakdowns

- North America (especially the U.S.) dominates the global personal loans market, accounting for over 40% of the value in 2025.

- Personal loan market value was projected at roughly $429.78 billion in 2025, with global expansion continuing.

- Emerging markets in the Asia Pacific and Latin America show high growth rates due to expanding digital access and credit demand.

- The U.S. lending market overall (including business and consumer debt) reached an estimated $12.18 trillion in 2025, reflecting broad credit activity.

- Alternative lending markets are also expanding in Southeast Asia, with countries like the Philippines observing double‑digit annual growth.

- Regional economic conditions influence default and delinquency trends, with stronger digital economies supporting higher recovery rates.

- Europe and North America maintain significant shares of both personal and business loan origination volumes.

- Country‑level credit regulation and fintech adoption rates shape consumer and business access to loans.

Frequently Asked Questions (FAQs)

About 24.6 million Americans held personal loans in Q1 2025.

Total personal loan debt reached approximately $253 billion in Q1 2025.

Nearly 40% of small businesses reported holding more than $100,000 in business loan debt.

Conclusion

Both business loans and personal loans continue evolving amid technological change, rising digital lending, and shifting economic conditions. Personal credit markets show growth in borrower numbers, debt outstanding, and fintech penetration, while business lending grapples with underwriting complexity and tighter credit standards. Default and delinquency trends vary by loan type, with digital platforms reshaping access and risk patterns. Regional markets remain diverse, with North America leading overall size and emerging markets expanding rapidly. Understanding these dynamics helps borrowers and lenders make informed financing decisions in a complex credit landscape.