Application Programming Interfaces (APIs) are the invisible glue powering modern digital services, from mobile apps to enterprise systems, and now AI‑driven workflows. APIs are foundational in software integration, cloud computing, and real‑time data exchange, profoundly impacting how businesses innovate and scale. Industries like finance and healthcare rely on APIs for secure data sharing, while AI platforms use them to deliver advanced capabilities across applications. Explore how the API landscape is shaping global tech and business outcomes.

Editor’s Choice

- 83% of businesses use APIs to maximize ROI on digital assets in 2026.

- Cloud deployment is expected to hold over 75% share of the API market by 2035.

- Network API segment may exceed $6B by 2030 at ~25.7% CAGR.

- North America holds the largest API management market share in 2025 (~39%).

- API management adoption is rising fastest in healthcare and BFSI sectors.

- API analytics can boost adoption rates by ~20% and reduce errors by ~30%.

Recent Developments

- Postman’s user base expanded from ~25M to 35M+ developers by 2026.

- AI APIs are increasingly used for text, vision, and predictive analytics.

- Adoption of APIs with built‑in AI capabilities doubled among enterprise app providers in 2025.

- Real‑time API monitoring tools now include cost attribution analytics for cloud and AI spend.

- API marketplaces are growing demand for pre‑built connectors across platforms.

- Major cloud vendors continue expanding API integration features within their ecosystems.

- Open API initiatives are increasing interoperability across public and private data systems.

- Developer tools emphasize version tracking and tagging standards for usage analytics.

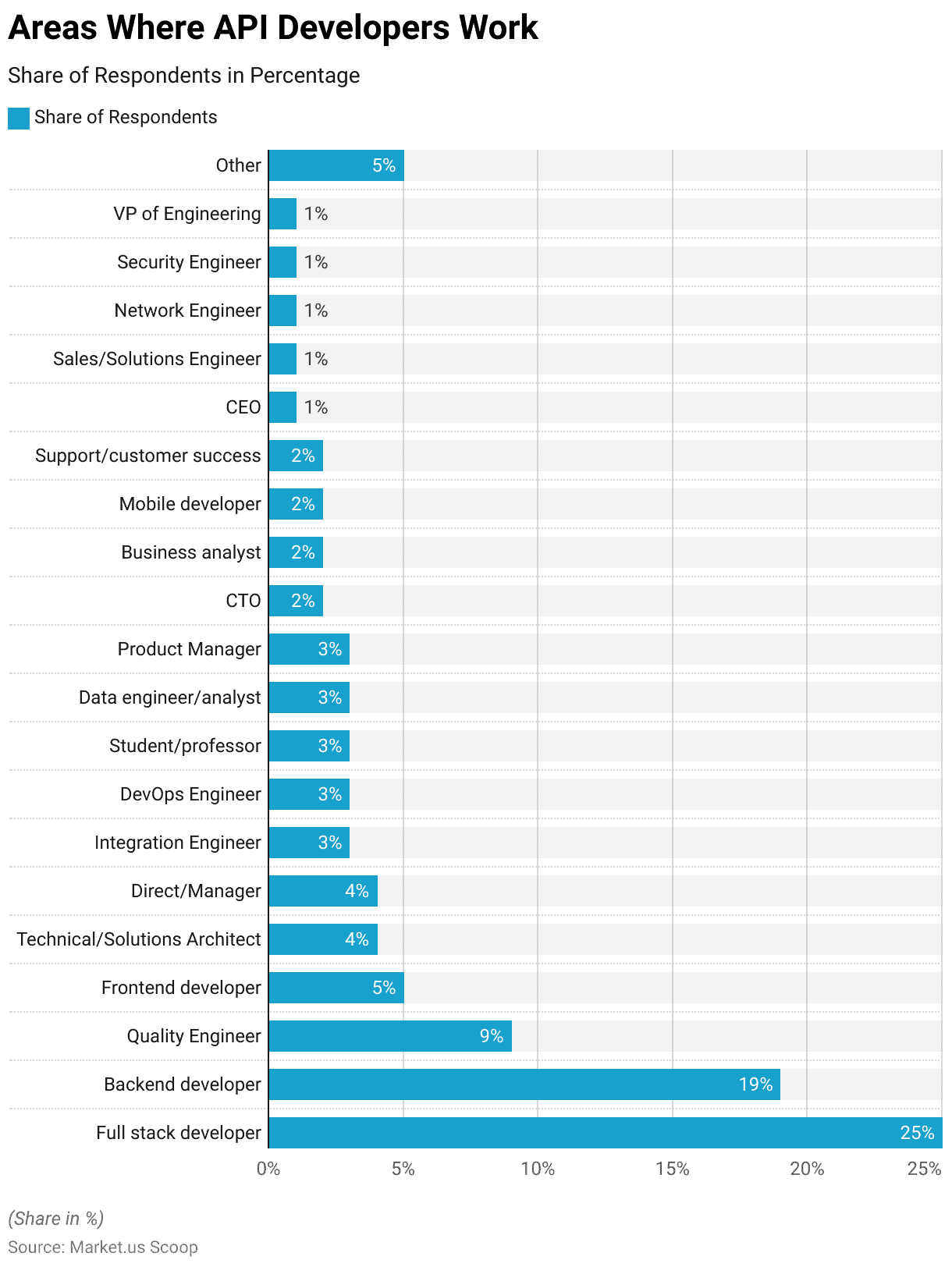

Areas Where API Developers Work

- Full stack developers lead the field, representing 25% of all API developers, highlighting strong demand for end-to-end development skills.

- Backend developers account for 19%, underscoring the critical role of server-side logic, databases, and API infrastructure.

- Quality Engineers make up 9%, reflecting increased focus on API testing, reliability, and performance assurance.

- Frontend developers represent 5%, showing continued reliance on APIs to power user-facing applications.

- Technical and Solutions Architects comprise 4%, emphasizing the need for API design, system integration, and scalability planning.

- Directors and managers account for 4%, indicating growing leadership oversight in API-driven initiatives.

- Integration Engineers, DevOps Engineers, Data Engineers/Analysts, Product Managers, and Students/Professors each represent 3%, demonstrating APIs’ reach across development, analytics, education, and product strategy.

- CTOs, Business Analysts, Mobile Developers, and Customer Support professionals each make up 2%, highlighting APIs’ strategic importance beyond pure engineering roles.

- CEOs, Sales/Solutions Engineers, Network Engineers, Security Engineers, and VPs of Engineering each account for 1%, showing executive and security involvement in API ecosystems.

- Other roles collectively represent 5%, reinforcing the broad, cross-functional adoption of APIs across modern organizations.

Global Market Size

- The total API ecosystem value is approaching $270 billion by 2025.

- API management segment reaches $11.71 billion.

- AI API market grows to $85.43 billion.

- Network APIs are valued at approximately $2 billion.

- API marketplace sector hits $25.17 billion.

- Cloud-centric API solutions grow at 4.6% CAGR.

- Data-driven applications drive the market past $270 billion.

- Developer tool ecosystems support 15-34% CAGR across segments.

Regional Adoption

- North America holds 39-42% of the API management market share.

- Asia Pacific exhibits the fastest growth at 17.2% CAGR.

- U.S. dominates the North American API market at a $90 billion projection.

- Europe advances open banking via PSD2 and FiDA frameworks.

- Latin America fintech market reaches $15.23 billion with API integrations.

- Canada drives API use in tech hubs and cloud applications.

- Australia leads APAC open API growth at 17% CAGR.

- Middle East grows public sector APIs in smart city initiatives.

- The global API management market. valued at $10.32 billion, led by North America.

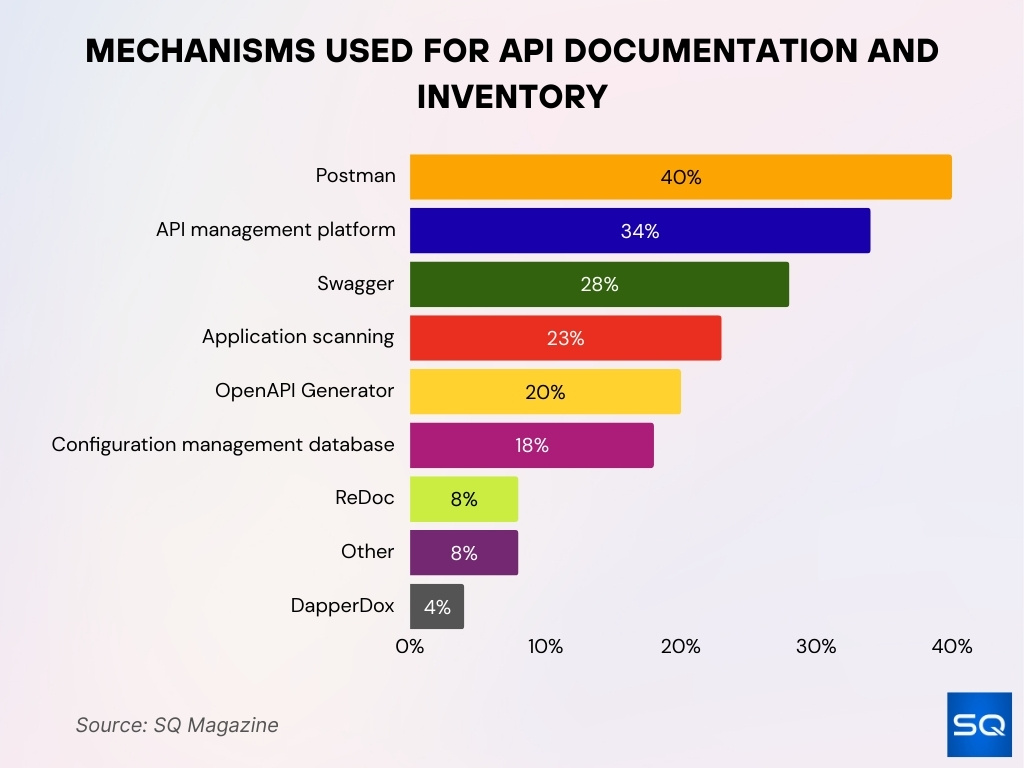

Mechanisms Used for API Documentation and Inventory

- Postman is the most widely used tool, with 40% of organizations relying on it for API documentation, testing, and inventory management.

- API management platforms are used by 34%, highlighting strong adoption of centralized governance, security, and lifecycle control for APIs.

- Swagger is adopted by 28%, reinforcing its role as a standard for API design, documentation, and developer collaboration.

- Application scanning tools account for 23%, reflecting growing emphasis on API discovery, security assessment, and compliance.

- OpenAPI Generator is used by 20%, showing increasing demand for automated API documentation and code generation.

- Configuration management databases support 18% of API documentation efforts, indicating integration with IT asset tracking and infrastructure visibility.

- ReDoc and other tools each account for 8%, demonstrating continued use of lightweight and alternative documentation solutions.

- DapperDox is used by 4%, suggesting a more niche adoption for specialized API documentation workflows.

API’s First Adoption

- 82% of organizations adopted an API-first approach.

- 25% operate as fully API-first organizations.

- 43% of fully API-first firms generate over 25% revenue from APIs.

- 74% of API-monetizing organizations derive at least 10% total revenue from APIs.

- API-first reduces integration time by 40%, speeding time-to-market.

- 70% of new applications leverage low-code/no-code enabled by API-first.

- 69% developers spend 10+ hours weekly on API tasks.

- 46% organizations plan increased API spending next year.

- Maintenance costs drop 30-40% with API-first unified codebases.

Usage Volume

- Stripe processes over 500 million API requests daily worldwide.

- Enterprises log millions of API calls per day in high-traffic services.

- Global API management market reaches $12.77 billion, driven by usage growth.

- API data flow service market is valued at $3.42 billion.

- 1 billion API requests analyzed, showing 53% latency reduction.

- Peak API requests hit 27,395 per second during high-demand periods.

- LLM API spending doubles to $8.4 billion, boosting usage volumes.

- 30% of API demand growth from AI tools.

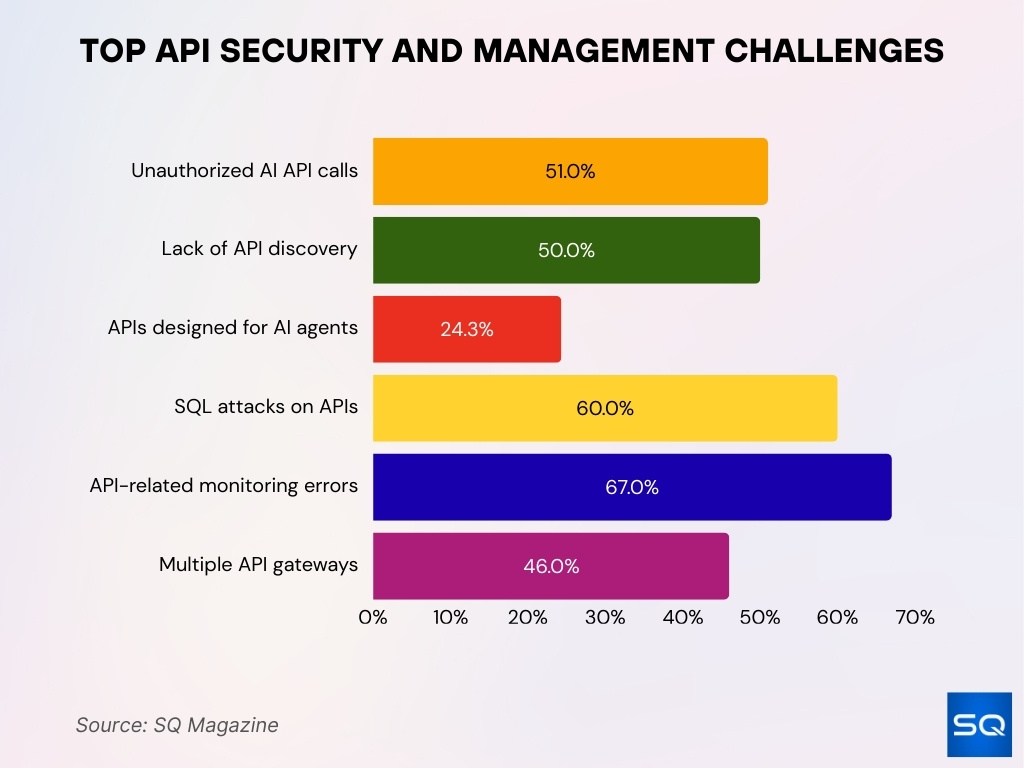

Key Challenges

- 51% developers worry about unauthorized API calls from AI agents.

- 50% organizations lack API discovery methods.

- 24.3% developers design APIs for AI agents.

- 60% increase in SQL attacks on APIs year-over-year.

- 67% of monitoring errors originate from APIs.

- 46% enterprises use multiple API gateways, complicating management.

Popular Endpoints

- 98% of API traffic from POST (53.4%) and GET requests.

- Authentication endpoints receive the highest traffic in enterprises.

- ChatGPT API leads in popularity for AI conversational integrations.

- Salesforce API tops usage charts, followed by Microsoft Graph.

- Banking APIs show the highest volumes in financial services.

- 613 average API endpoints per organization in production.

- Image info (1100 req/s) and pageimages (850 req/s) dominate queries.

- /users and /products endpoints are critical for onboarding and scale.

- Request volume spikes to 27,395 per second on peak endpoints.

Performance Metrics

- Average API uptime at 99.46%, down 0.20% year-over-year.

- Weekly API downtime rises to 55 minutes from 34 minutes.

- P95 response time targets under 200 ms for optimal performance.

- Error rates reach 2.52% backend during latency incidents.

- Throughput is measured as requests per second for capacity.

- AWS API Gateway steady-state 500 RPS per Region default.

- Average response time is 353 ms for the monitored AWS Asia API.

- 93% developers prioritize REST API performance metrics.

- 100% uptime achieved monthly for high-reliability APIs.

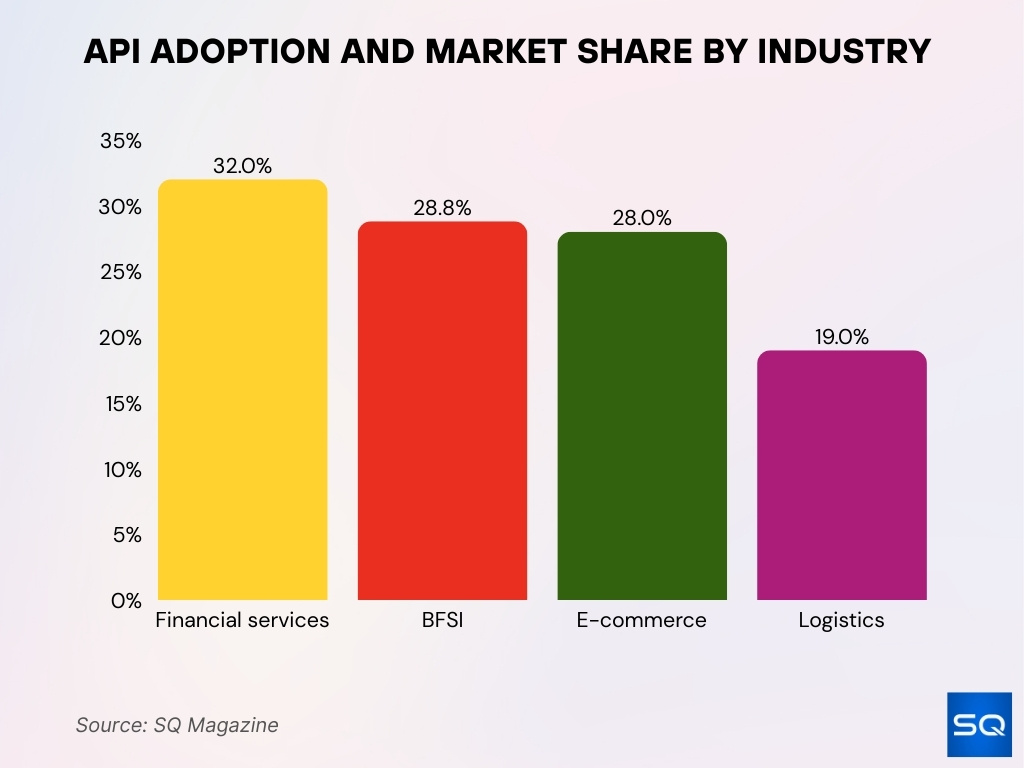

Top Industries

- BFSI holds 28.8% API management market share.

- Financial services account for 32% API data flow adoption.

- E-commerce captures 28% of API data flow services.

- Retail & e-commerce drives cloud API demand significantly.

- Logistics comprises 19% API data flow market share.

- IT & Telecom leads alongside BFSI in API usage.

- SaaS and fintech integrate APIs for ecosystem expansions.

- API banking market is valued at $31.73 billion for financial institutions.

Error Rates

- APIs trigger 67% of all monitoring errors.

- Average error rate targets below 0.5% for production APIs.

- 2.52% backend error rates during elevated incidents.

- 4xx client errors dominate authentication failures.

- 5xx server errors peak at 45% in regional outages.

- 0.11% overall error rate with 500 errors from 10,000 requests.

- 42% of errors are 500 Internal Server Error on report endpoints.

- 26% 503 Service Unavailable during search API failures.

- 70% API incidents are from unmonitored performance drift.

Uptime Statistics

- Global API uptime averages 99.46%, down from 99.66% year-over-year.

- Weekly API downtime increases 60% to 55 minutes.

- 99.95% uptime targeted for mission-critical APIs.

- 100% uptime achieved monthly for high-reliability services.

- Multi-region failover reduces downtime by 50% in top providers.

- 93% of organizations monitor uptime in real-time dashboards.

- API services maintain 99.4%-99.7% availability in mission-critical apps.

- 70% uptime anomalies resolved via automated failover.

Revenue Generation

- 65% of organizations monetize APIs, 10%+ total revenue average.

- API-first companies generate 25%+ revenue from APIs.

- The global API monetization platforms market is at $8.82 billion.

- API data flow service market reaches $3.42 billion.

- API monitoring tools are near $2 billion.

- Network API revenue hits $550 million globally.

- API management market is valued at $10.32 billion.

- API monetization platforms grow at 15.2% CAGR to $16.9 billion by 2033.

- Enterprise API revenue is $269.9 billion at the ecosystem scale.

AI Integration

- AI API market is valued at $85.43 billion.

- Global AI market reaches $244 billion.

- 82% enterprises use generative AI weekly.

- 71% organizations regularly employ AI in business functions.

- 92% companies plan to increase AI investments over the next three years.

- AI annual growth rate at 36.6% through 2030.

- 56% enterprise leaders champion AI adoption.

- 42% companies adopt AI in marketing and sales.

- The industrial AI market is projected at a $43.6 billion base, expanding strongly.

Frequently Asked Questions (FAQs)

The global API market is expected to reach around $12.54 billion in 2026 as part of ongoing growth in API services and infrastructure.

Businesses reported roughly a 60% increase in API calls year compared to the prior period, highlighting rising usage demand.

About 67% of organizations still leverage public APIs alongside internal systems.

Conclusion

APIs have evolved from technical utilities into strategic business assets that power digital ecosystems, drive innovation, and unlock new revenue channels. Across industries such as finance, healthcare, and SaaS, APIs support high‑volume interactions, AI integrations, and increasingly sophisticated service delivery.

As available data shows, growth prospects remain strong, yet enterprises must navigate performance, security, and governance challenges to sustain value. Understanding these trends can help business leaders make informed decisions and capitalize on API‑driven opportunities ahead.